| In the first (electronic) issues of the magazine, we already introduced the reader to the procedure for calculating and paying insurance premiums in force in the Russian Federation [1]. But it’s 2015, which means policyholders need to take into account the amendments made by the legislator last year to the regulations governing this area. It should be noted that the rates of insurance premiums for most payers of insurance premiums remained the same, but the procedure for their calculation and the deadlines for submitting reports to extra-budgetary funds have changed. Details are in this article. |

Limit value of the taxable base for calculating insurance premiums

Starting from 2015, there will be no single maximum base for the calculation of all types of insurance premiums.

Limit for pension contributions

The maximum value of the taxable base for contributions to the Pension Fund will be approved by the Government of the Russian Federation, taking into account the size of the average salary, increased by 12 times, and the increasing coefficient (in 2015 - 1.7) (Part 5.1 of Article 8 of the Federal Law of July 24, 2009 N 212-FZ, hereinafter referred to as Law N 212-FZ).

In the future, from 2022, the maximum value of the base for calculating insurance contributions to the Pension Fund, established for the previous year, will be indexed (Part 5.2 of Article 8 of Law No. 212-FZ).

In 2015 it is equal to 711,000 rubles. (Clause 1 of the Decree of the Government of the Russian Federation of December 4, 2014 N 1316). Above this amount, insurance premiums will have to be paid, as before, at a rate of 10%.

Limit value of the base for contributions to the Social Insurance Fund of the Russian Federation

For 2015, the maximum value of the taxable base for insurance premiums in case of temporary disability and in connection with maternity was established by the Government of the Russian Federation in paragraph 1 of Resolution No. 1316 of December 4, 2014 (clauses 4 and 5 of Article 8 of Law No. 212-FZ ) in the amount of 670,000 rubles.

The limit on the base for medical contributions is canceled

In 2015, insurance contributions to the FFOMS will need to be paid from the entire amount of wages, and not within the limit, as was the case in 2014. This procedure is determined by the new part 1.1 of Art. 58.2 of Law No. 212-FZ (Article 5 of Federal Law dated December 1, 2014 No. 406-FZ). It does not indicate the maximum amount of the taxable base.

The change will not affect policyholders paying premiums at a reduced rate and listed in Art. Art. 58 and 58.1 of Law No. 212-FZ.

Fixed payments to the Pension Fund and the Federal Compulsory Medical Insurance Fund.

In accordance with Part 1 of Art. 14 of Law No. 212-FZ, payers of contributions who do not make payments and other remuneration to individuals (for example, entrepreneurs, lawyers, private notaries and other persons engaged in private practice) pay insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund in a fixed amount.

In 2015, the procedure for determining the fixed amount of insurance premiums established by Parts 1.1 and 1.2 of Art. 14 of Law No. 212-FZ. But since the size of this payment directly depends on the minimum wage (and the latter, by virtue of Article 1 of Federal Law No. 408-FZ of December 1, 2014, increased from 5,554 rubles to 5,965 rubles), the size of the fixed payment has increased compared to 2014.

Thus, the amount of a fixed payment to the Pension Fund in 2015 will be (Part 1.1 of Article 14 of Law No. 212-FZ):

- 18,610.8 rubles, – if the payer’s income does not exceed 300,000 rubles. This value is defined as the product of the minimum wage and the tariff of insurance contributions to the Pension Fund, established by clause 1, part 2, art. 12 of Law No. 212‑FZ (26%), increased by 12 times (RUB 5,965 x 26% x 12);

- RUB 18,610.8 plus 1% of the amount of income exceeding 300,000 rubles, but not more than 148,886.4 rubles - if income exceeds

300,000 rubles. The upper limit is determined as the product of eight times the minimum wage and the rate of insurance contributions to the Pension Fund, increased by 12 times (RUB 5,965 x 8 x 26% x 12).

The fixed payment to the FFOMS in 2015 will be 3,650.58 rubles. This value according to Part 1.2 of Art. 14 of Law No. 212-FZ is defined as the product of the minimum wage and the tariff of insurance contributions to the Federal Compulsory Medical Insurance Fund, increased by 12 times (5,965 rubles x 12 x 5.1%).

General insurance premium rates

The current aggregate general tariff of insurance premiums of 30% has been retained (Part 1.1, Article 58.2 of Law No. 212-FZ). It consists of the following tariffs:

- 22% - tariff for calculating pension contributions;

- 2.9% - tariff for calculating contributions in case of temporary disability and in connection with maternity;

- 5.1% is the tariff for calculating contributions for compulsory health insurance.

General tariffs must be applied by all insurers, with the exception of those companies for which reduced tariffs are provided (Articles 58 and 58.1 of Law No. 212-FZ).

Note. The amounts of insurance premiums no longer need to be rounded. From January 1, 2015, insurance premiums must be transferred in rubles and kopecks (Part 7, Article 15 of Law No. 212-FZ). This will make it possible to achieve identical indicators of accrued and paid insurance premiums in Form-4 of the FSS and Form RSV-1 of the Pension Fund of the Russian Federation.

What to do with a funded pension in 2015

Article 33.1 of Federal Law No. 167-FZ of December 15, 2001 (hereinafter referred to as Law No. 167-FZ) determines that the pension contribution rate is distributed among insurance and funded pensions. This norm remains relevant. However, in 2015 there is a special procedure for its application.

The right to choose a funded pension is preserved

Until December 31, 2015, insured persons born in 1967 and younger can choose one of two pension options - send 6% of contributions to finance a funded pension or send all 22% to an insurance pension (Clause 1, Article 33.3 of Law No. 167-FZ ).

If you choose the “savings” option, the employee himself must apply for the transfer, for example, to a non-state pension fund. The employer has nothing to do with this. Another point is important for him.

In 2015, there is a moratorium on accrual of contributions to funded pension

Regardless of the decision of the insured person to choose the “cumulative” option of pension insurance and his submission of the corresponding application, the entire amount of insurance pension contributions accrued for payments in favor of this person in 2015 is directed to the insurance pension.

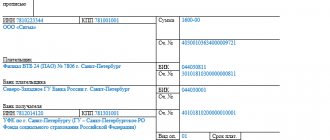

The accountant of a company that applies a general tariff calculates pension contributions at a single tariff of 22% and transfers them in one payment document to the KBK of the insurance pension (Article 22.2 of Law N 167-FZ).

In what cases can the contribution amount be reduced?

Mandatory payments to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund will be required for all individuals with individual entrepreneur status. It does not matter whether they conduct business and whether it generates income. However, there are still exceptions to this rule. Thus, there are cases when, during periods of absence of business activity and income, an individual entrepreneur has the right not to pay contributions. Such periods include, for example, the period of military service, caring for a child under 1.5 years old, caring for a disabled child (Part 6, Article 14 of the Federal Law of July 24, 2009 No. 212-FZ).

Also, quite often individuals register as entrepreneurs or “close” their individual entrepreneurs in the middle of the year. In this case, you will not need to pay contributions for the entire year. When calculating, you will need to take into account the number of calendar months of activity, as well as the number of days of the month in which the entrepreneur was registered or deregistered.

It should also be recalled here that individual entrepreneurs using the simplified tax system or UTII regime have the right to reduce the amount of the corresponding tax on insurance premiums payable (see “The Ministry of Finance reminded how individual entrepreneurs in 2014 can reduce the tax on insurance premiums paid “for themselves”).

Contribution rate in case of injury

Federal Law No. 401-FZ dated December 1, 2014 retains the current contribution rates for injuries in 2015 (from 0.2 to 8.5%) (Article 1 of Federal Law No. 179-FZ dated December 22, 2005). Therefore, as before:

- The amount of contributions depends on the main type of economic activity. To confirm it, you must, no later than April 15, 2015, submit an application and a confirmation certificate to your territorial branch of the Federal Social Insurance Fund of the Russian Federation in the forms approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55;

- There is no limit on the taxable base for them, so they are charged on all taxable payments.

If an individual entrepreneur employs disabled people of group I, II or III, payments in their favor, as before, are subject to contributions in case of injury at a reduced rate - based on 60% of the established insurance rate (Article 2 of the Federal Law of December 1, 2014 N 401-FZ).

Additional insurance premium rates increased in 2015

Additional contributions to the Pension Fund are paid by companies that have jobs with harmful (dangerous) working conditions and the right to early retirement. Contributions are calculated regardless of the maximum value of the taxable base (Part 3, Article 58.3 of Law No. 212-FZ, Clause 3, Article 33.2 of Law No. 167-FZ).

The types of work that give the right to early retirement were listed in paragraphs. 1 - 18 p. 1 tbsp. 27 of the Federal Law of December 17, 2001 N 173-FZ (hereinafter referred to as Law N 173-FZ) (clauses 1 and 2 of Article 33.2 of Law N 167-FZ). However, from January 1, 2015, many provisions of Law N 173-FZ do not apply.

Note. Federal Law No. 173-FZ of December 17, 2001 was applied only to calculate the insurance part of the labor pension in the period before January 1, 2015.

Now you need to use two Federal laws:

- dated December 28, 2013 N 400-FZ “On Insurance Pensions” (hereinafter referred to as Law N 400-FZ);

- dated December 28, 2013 N 424-FZ “On funded pensions”.

The types of hazardous work that give the right to early retirement are now specified in Law No. 400-FZ.

The rates of additional contributions for such companies will depend on whether they have undergone a special assessment of working conditions or not.

Additional tariffs for companies that have not carried out a special assessment

If a special assessment has not been carried out, companies must pay additional contributions for employees engaged in hazardous work at the rates given in table. 1 below.

Table 1

Additional tariffs for contributions to the Pension Fund in 2015. No special assessment was carried out

| Tariff 6% | Tariff 9% | Tariff 4% | Tariff 6% |

| Until December 31, 2014 | From 01/01/2015 | Until December 31, 2014 | From 01/01/2015 |

| For the types of work listed in paragraphs. 1 clause 1 art. 27 Law No. 173-FZ | For the types of work listed in clause 1, part 1, art. 30 Law No. 400-FZ | For the types of work listed in paragraphs. 2 - 18 p. 1 tbsp. 27 Law No. 173-FZ | For the types of work listed in paragraphs. 2 - 18 p. 1 tbsp. 30 Law No. 400-FZ |

Additional tariffs based on the results of a special assessment

The size of additional tariffs may change if companies have carried out a special assessment of working conditions. Depending on the established subclass of working conditions in 2015, policyholders must pay premiums according to the additional tariffs given in table. 2 below (part 2.1 of article 58.3 of Law No. 212-FZ and paragraph 2.1 of article 33.2 of Law No. 167-FZ).

table 2

Additional tariffs for contributions to the Pension Fund in 2015. Special assessment completed

| Class of working conditions | Subclass of working conditions | Additional tariff, % |

| Dangerous | 4 | 8 |

| Harmful | 3.4 | 7 |

| 3.3 | 6 | |

| 3.2 | 4 | |

| 3.1 | 2 | |

| Acceptable | 2 | 0 |

| Optimal | 1 | 0 |

Payments not subject to insurance premiums.

The list of payments not subject to insurance premiums is determined by the provisions of Art. 9 of Law No. 212-FZ.

Since 2015, this list has been supplemented with a number of payments. So, according to paragraphs. “d” clause 2 part 1 of the said article from January 1, 2015 are not subject to inclusion in the taxable base:

- the amount of payments in the form of severance pay and average monthly earnings for the period of employment in a part not exceeding in general three times the average monthly earnings;

- compensation to the manager, deputy managers and chief accountant of the organization in a part not exceeding three times the average monthly salary.

Photo: www.ru.123rf.com

And further. In part 2 art. 9 of Law No. 212-FZ (as amended before January 1, 2015) stated that if documents confirming payment of expenses for renting residential premises were not provided, the amounts of such expenses were exempt from insurance premiums within the limits established by the legislation of the Russian Federation. Federal Law No. 188-FZ dated June 28, 2014 abolished this rule, and now the amounts reimbursed by the employer for expenses for renting accommodation on a business trip, which the employee did not document, are subject to inclusion in the base subject to insurance contributions.

Reduced insurance premium rates

Changes to the procedure for applying preferential tariffs in 2015 were introduced by Federal Law dated December 2, 2013 N 333-FZ.

Who will lose the right to a reduced tariff

In 2015, some companies that previously paid insurance premiums at reduced rates (Articles 58 and 58.1 of Law No. 212-FZ) will lose benefits (clause 1 of Article 1 of Federal Law dated December 2, 2013 No. 333-FZ):

- agricultural producers;

- companies using UTII;

- companies making payments to disabled people of groups I, II or III (clauses 1 - 3, part 1, article 58 of Law No. 212-FZ);

- Mass media (clause 7, part 1, article 58 of Law No. 212-FZ);

- engineering companies (clause 13, part 1, article 58 of Law No. 212-FZ).

Federal Law No. 333-FZ dated December 2, 2013 did not extend the effect of reduced tariffs for these policyholders to 2015.

Consequently, starting from 2015, they must charge insurance premiums at the general rates established by Part 2 of Art. 58.2 of Law No. 212-FZ. All other companies that had the right to apply reduced tariffs in 2014 will continue to apply them in 2015 (Table 3 on p. 22).

Table 3

Reduced insurance premium rates in 2015

| Policyholders | Norm Art. 58 Law No. 212-FZ | Extrabudgetary fund | ||

| Pension Fund | FSS RF | FFOMS | ||

| Business societies | Points 4 - 6 part 1 and part 3 | 8% | 2% | 4% |

| Companies in the field of technology development activities | ||||

| IT companies | ||||

| Companies making payments to crew members of ships registered in the Russian International Register of Ships | Clause 9 part 1 and part 3.3 | 0% | 0% | 0% |

| Companies on the simplified tax system, the main activity of which is specified in clause 8, part 1, art. 58 Law No. 212-FZ | Clause 8 part 1 and part 3.4 | 20% | 0% | 0% |

| Companies paying UTII | Clause 10 part 1 and part 3.4 | |||

| Organizations engaged in the field of social services, scientific research, etc. | Clause 11 part 1 and part 3.4 | |||

| Charitable organizations on the simplified tax system | Clause 12 part 1 and part 3.4 | |||

| Individual entrepreneurs on a patent | Clause 14 part 1 and part 3.4 | |||

Such companies pay insurance premiums until the employee’s payments exceed the maximum base for calculating contributions. Excess amounts are not subject to contributions.

Changes in the calculation of contributions at reduced rates

These changes apply to pharmacies and individual entrepreneurs on a patent.

Pharmacies . Since 2015, pharmacy organizations and individual entrepreneurs with a license for pharmaceutical activities can apply reduced tariffs only to payments to employees who have the right to engage in pharmaceutical activities or are allowed to carry out pharmaceutical activities (clause “a”, clause 29, article 5 of the Federal Law dated June 28, 2014 N 188-FZ).

Note. Persons who have the right to engage in pharmaceutical activities until January 1, 2021 are listed in paragraph 1 of Art. 100 of the Federal Law of November 21, 2011 N 323-FZ.

Thus, the question of whether preferential tariffs apply to all workers, including those who are not directly involved in pharmaceutical activities, is finally resolved.

Individual entrepreneurs on a patent . The majority of insurers will be able to apply a reduced tariff only for payments in favor of workers engaged in the type of economic activity specified in the patent (clause “b”, paragraph 29, article 5 of the Federal Law of June 28, 2014 N 188-FZ).

This restriction will not apply to individual entrepreneurs who carry out the types of activities listed in paragraphs. 19, 45 - 47 p. 2 art. 346.43 of the Tax Code:

- retail stationary trade in a sales area of no more than 50 sq. m;

- retail stationary trade without trading floors and through non-stationary retail chain facilities;

- catering services provided in a customer service hall with an area of no more than 50 square meters. m;

- leasing (hiring) of residential and non-residential premises, dachas, land plots owned by an individual entrepreneur by right of ownership.

Buh-Ved.RU

Useful articles » Insurance premium rates in 2015,

see rates for 2010, 2011, 2012, 2013, 2014, 2016 2017

Deadline for submitting individual information to the Pension Fund for 2015, KBK 2015

Main changes since January 1, 2015:

1. From January 1, 2015, insurance premiums are not charged for amounts of payments and other remuneration in favor of an individual (under employment or civil contracts (contracts, services)) exceeding 711,000 rubles , cumulatively from the beginning of the billing period ( Decree of the Government of the Russian Federation dated December 4, 2014 No. 1316 “On the maximum value of the base for calculating insurance contributions to state extra-budgetary funds from January 1, 2015”). Note: When calculating insurance premiums at an additional tariff for certain categories of employers who have jobs in hazardous and hazardous industries, the provision for limiting the base for calculating insurance premiums does not apply.

| Contributions | Base size limit |

| Compulsory pension insurance (PFR) | 711 000 |

| Compulsory social insurance (FSS) | 670 000 |

| Compulsory health insurance (FFOMS) | The maximum amount has been abolished, contributions are collected from the entire salary at the rate established for the organization |

2. Employers must determine the amount of insurance contributions to be transferred to the relevant state extra-budgetary funds accurately - in rubles and kopecks.

3. Since 2015, pension contributions are accrued from payments to foreign citizens and stateless persons (with the exception of highly qualified specialists) temporarily staying in the Russian Federation, regardless of the validity period of the concluded employment contracts.

Insurance premium rates in 2015

| Pension Fund of the Russian Federation | Social Insurance Fund of the Russian Federation | Federal Compulsory Medical Insurance Fund | |||

| Within the established limit of the base for calculating insurance premiums | Over established limit value of the base for calculating insurance premiums | ||||

| Organizations, individual entrepreneurs, individuals, not individual entrepreneurs under the general taxation regime ( Article 58.2 ) | |||||

| 22,0 | 10 | 2,9 | 5,1 | ||

| Part 1 of Article 58.3 Additional tariffs of insurance premiums for payers of insurance premiums specified in paragraph 1 of part 1 of Article 5 of this Federal Law in relation to payments and other remuneration in favor of individuals engaged in the types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law of December 17 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, the following additional tariffs for insurance contributions to the Pension Fund of the Russian Federation are applied from January 1, 2013, except for the cases established by part 2.1 of Article 58.3 (Commentary to Article 58.3 in the letter of the Pension Fund of December 30, 2013 No. NP-30-26/20622) | |||||

| 9,0 | |||||

| Part 2 of Article 58.3 Additional tariffs of insurance premiums for payers of insurance premiums specified in paragraph 1 of part 1 of article 5 of this Federal Law in relation to payments and other remuneration in favor of individuals engaged in the types of work specified in subparagraphs 2 - 18 of paragraph 1 of article 27 of the Federal Law dated December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, the following additional tariffs for insurance contributions to the Pension Fund of the Russian Federation apply from January 1, 2013, except for the cases established by part 2.1 of Article 58.3 (Commentary to Article 58.3 in the letter of the Pension Fund of December 30, 2013 No. NP-30-26/20622) | |||||

| 6,0 | |||||

| Part 2.1 Article 58.3 Instead of the additional tariffs established in parts 1 and 2 of Article 58.3, depending on the of working conditions established based on the results of a special assessment of working conditions , carried out in the manner established by the legislation of the Russian Federation, the following additional tariff is applied (Commentary to Article 58.3 in the letter of the Pension Fund of December 30, 2013 No. NP-30-26/20622) | |||||

| 8.0% (Score 4) 7.0% (Score 3.4) 6.0% (Score 3.3) 4.0% (Score 3.2) 2.0% (Score 3.1) 0.0% (Score 2) 0, 0% (Rating 1) | |||||

| Payers applying the simplified tax system and UTII (Organizations, individual entrepreneurs and individuals who are not individual entrepreneurs), with the exception of payers of insurance premiums specified in articles 58 and 58.1 | |||||

| 22,0 | 10,0 | 2,9 | 5,1 | ||

| Organizations with resident status of a technology innovation zone (Article 58, Part 1, Section 4-6) | |||||

| 8,0 | 2,0 | 4,0 | |||

| Organizations and individual entrepreneurs using the simplified tax system with the main type of activity listed in Article 58, Part 1, Clause 8 | |||||

| 20,0 | 0,0 | 0,0 | |||

| Vessel crew (Article 58 Part 1 Clause 9) | |||||

| 0,0 | 0,0 | 0,0 | |||

| For pharmacies, non-profit, charitable organizations ( Article 58, Part 1, Section 10-12) | |||||

| 20,0 | 0,0 | 0,0 | |||

| Individual entrepreneur on the Patent Taxation System (Article 58, Part 1, Clause 14) | |||||

| 20,0 | 0,0 | 0,0 | |||

| Participants of the Skolkovo project (Article 58.1) | |||||

| 14,0 | 0,0 | 0,0 | |||

| For insurance premium payers who have received the status of a participant in a free economic zone in accordance with the Federal Law “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol” (Article 58.4) | |||||

| 6,0 | 1,5 | 0,1 | |||

| For insurance premium payers who have received the status of resident of the territory of rapid socio-economic development in accordance with the Federal Law “On territories of rapid socio-economic development in the Russian Federation" (Article 58.5) (in the territories of the constituent entities of the Russian Federation that are part of the Far Eastern Federal District and single-industry towns (Federal Law of December 29, 2014 N 473-FZ) | |||||

| 6,0 | 1,5 | 0,1 | |||

4. On January 1, 2015, Federal Law No. 378-FZ comes into force, which amends certain legislative acts. In accordance with these changes, for insurance premium payers who have received the status of a free economic zone participant, reduced insurance premium rates are applied (in the Pension Fund of the Russian Federation - 6%, in the Federal Compulsory Medical Insurance Fund - 0.1%). They apply for 10 years from the date of receipt of the status of a participant in the economic zone, starting from the 1st day of the month following the month in which they received such status.

In addition, for legal entities and individual entrepreneurs who have received the status of a participant in a free economic zone, the calculation of the amount of insurance contributions for compulsory pension insurance to finance insurance and funded pensions is carried out by the Pension Fund on the basis of individual (personalized) accounting data and taking into account the option of choosing pension provision by the insured persons (0% or 6% for financing funded pension).

Insurance premium rates for free economic zone participants

| For persons born in 1966 and older | For persons born in 1967 and younger | |||

| pension option – 0% for funded pension financing | pension option – 6% to finance funded pension | |||

| to finance an insurance pension | to finance a funded pension | to finance an insurance pension | to finance a funded pension | |

| 6% to finance an insurance pension | 6% | 0% | 0% | 6% |

In the free economic zone on the territory of the Republic of Crimea and the city of Sevastopol, there is a special regime for carrying out business and other activities, and the customs procedure of the free customs zone is also applied. To obtain the status of a participant in a free economic zone, you must register in the territory of the Republic of Crimea or the city of Sevastopol, be registered with the tax authority, and also have an investment declaration that meets the requirements established by Article 13 of Federal Law No. 377-FZ.

5. Imposition of insurance premiums on payments in favor of persons recognized as refugees

Foreign citizens and stateless persons recognized as refugees, in accordance with paragraph 10 of part 1 of article 8 of the Federal Law of February 19, 1993 No. 4528-1 “On Refugees,” have the right to social security on an equal basis with citizens of the Russian Federation.

Thus, in accordance with Article 3 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation,” they are insured persons and have the right to a labor pension, except in cases established by federal law or an international treaty of the Russian Federation.

In this regard, insurance contributions for compulsory pension and health insurance are charged in accordance with the generally established procedure for payments in favor of persons recognized as refugees.

Imposition of insurance premiums on payments in favor of persons who have applied for recognition as refugees and persons who have received temporary asylum

Based on the provisions of Article 4 and paragraph 8 of Article 6 of Federal Law No. 4528-1, a person who has filed an application for refugee recognition is issued a certificate of consideration of the application for refugee recognition, which is a document proving his identity and the basis for the legal stay of this person on the territory of the Russian Federation. Federation, giving him the right to work, which allows us to assume that a person who has received a certificate of consideration of an application for refugee recognition is recognized as temporarily residing on the territory of the Russian Federation.

In accordance with paragraph 3 of part 1 of article 1 of Federal Law No. 4528-1, temporary asylum is the opportunity for a foreign citizen or stateless person to temporarily stay on the territory of the Russian Federation. Thus, a person who has received a certificate of temporary asylum receives the status of a foreign citizen or stateless person temporarily staying on the territory of the Russian Federation.

Consequently, payments in favor of a person who has received a certificate of consideration of an application for refugee recognition or a certificate of temporary asylum are subject to insurance contributions to the Pension Fund on the basis of paragraph 1 of Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”. Federation”, subject to the conclusion of an employment contract with him for an indefinite period or a fixed-term employment contract (fixed-term employment contracts) lasting at least six months in total during the calendar year.

In accordance with Article 10 of the Federal Law of November 29, 2010 No. 326-FZ “On Compulsory Medical Insurance in the Russian Federation,” insured persons are, in particular, persons entitled to medical care in accordance with Federal Law No. 4528-1.

In accordance with subparagraph 7 of paragraph 1 of Article 6 of Federal Law No. 4528-1, a person who has received a certificate of consideration of an application for recognition as a refugee has the right to medical care.

Also, persons who have been granted temporary asylum on the territory of the Russian Federation, in accordance with paragraph 13 of the Procedure for granting temporary asylum on the territory of the Russian Federation, approved by Decree of the Government of the Russian Federation of 04/09/2001 No. 274, issued in pursuance of Federal Law No. 4528-1, are subject to rights and obligations established by Article 6 of Federal Law No. 4528-1, including the right to medical care.

Thus, persons who have received a certificate of consideration of an application for recognition as a refugee, and persons who have been granted temporary asylum, are insured persons in the compulsory health insurance system in the Russian Federation.

Taking into account the provisions of Article 7 of Federal Law No. 212-FZ and Article 10 of Federal Law No. 326-FZ, payments and other remuneration in favor of persons who have received a certificate of consideration of an application for recognition as refugees, and persons who have been granted temporary asylum, are subject to insurance contributions for compulsory health insurance in accordance with the generally established procedure.

6. Memo for persons who arrived on the territory of Russia from Ukraine

7. Within three years from the date of entry into force of the Federal Law of December 29, 2014 N 473-FZ, territories of rapid socio-economic development can be created in the territories of the constituent entities of the Russian Federation that are part of the Far Eastern Federal District, as well as in the territories of single-industry towns with the most difficult socio-economic situation included in the list approved by the Government of the Russian Federation, in the manner prescribed by Chapter 9 of the Federal Law of December 29, 2014 N 473-FZ, after three years from the date of entry into force of this Federal Law - in the territories of the rest subjects of the Russian Federation. (to Article 58.5 of Federal Law 212)

The new Classifiers OKVED2 and OKPD2 will not be used in 2015

Types of economic activity that give companies and individual entrepreneurs the right to apply the simplified taxation system (STS) (clause 8, clause 1, article 58 of Law No. 212-FZ) are classified in accordance with the All-Russian Classifier of Types of Economic Activities.

From January 1, 2015, it was planned to switch to the use of new Classifiers, which were approved by Order of Rosstandart dated January 31, 2014 N 14-st - OKVED2 OK 029-2014 (NACE Rev. 2) and OKPD2 OK 034-2014 (KPES 2008).

But now, by Order of Rosstandart dated September 30, 2014 N 1261-st, this period has been extended until January 1, 2021. Accordingly, this year policyholders must use the old All-Russian classifiers: OKVED OK 029-2001 (NACE Rev. 1), OKVED OK 029-2007 (NACE Rev. 1.1), OKDP OK 004-93, OKPD OK 034-2007 (KPES 2002), OKUN OK 002-93 and OKP OK 005-93.