The simplified tax system for individual entrepreneurs today is one of the most optimal tax regimes. A simplified taxation system greatly facilitates the life of individual entrepreneurs in the field of business. The use of this regime in most cases can significantly reduce the tax and administrative burden.

We wrote earlier what the simplified tax system for individual entrepreneurs is. In our material today we will talk in more detail about the reporting of individual entrepreneurs on the simplified tax system without employees in 2021. We will analyze different types of reporting, features of preparation and submission, deadlines.

Individual entrepreneur reporting on the simplified tax system in 2021

Declaration for 2021

Please note that advance payments must be made every quarter, and tax reporting, that is, the simplified taxation system (USN) declaration, must be submitted once a year (to the Federal Tax Service before April 30 at the place of residence of the individual entrepreneur).

Thus, individual entrepreneurs’ reporting on the simplified tax system without employees in 2021 is submitted for the past calendar year (2019).

An individual entrepreneur can submit a declaration in different ways:

- personally;

- through a representative (by notarized power of attorney).

- by mail;

- by email - through the Federal Tax Service website https://www.nalog.ru/rn50/service/pred_elv/ but to submit via the Federal Tax Service website you must purchase an enhanced electronic signature.

Please note that regardless of whether business activity was carried out or not, a declaration still needs to be filed (zero declaration).

Book of accounting of income and expenses (KUDIR)

In addition to the declaration, which is submitted once a year, individual entrepreneurs using the simplified tax system are required to maintain a Book of Income and Expenses (KUDIR) throughout the year. The book can be kept both in electronic form and on paper.

Starting from 2013, the book no longer needs to be certified by the tax service. In this case, the pages of KUDIR must be numbered and stitched. Please note that the absence of an individual entrepreneur’s book may result in a fine.

Filling out the Individual Entrepreneur Income and Expense Book on the simplified tax system is not at all difficult. The document contains transactions carried out by the entrepreneur (in chronological order). A new KUDIR is created for each tax period. The Federal Tax Service may require you to provide a Book of Income and Expenses.

Patent tax system

With PSN, the object of tax collection is not a certain income, but possible income based on a specific type of activity. The sizes are set by the state. And the options for types of activities for which the patent system is available are regulated by Article 346.43 of the Tax Code of the Russian Federation. It is also important that the list of these species is growing all the time.

The calculation of the price for a patent does not depend on the individual entrepreneur. The amount is set based on the rate for a specific type of commercial activity, as well as the period for which the patent is purchased (up to one year).

Individual entrepreneurs operating on a patent do not need to submit reports.

Taxes are paid within the cost of the patent itself.

Important changes from 2021

From the moment of registration of an individual entrepreneur, regardless of the presence or absence of entrepreneurial activity, there is a need to pay fixed payments for compulsory medical and pension insurance. Until 2021, these payments were transferred to:

- PFR (Pension Fund of Russia);

- FFOMS (Federal Compulsory Health Insurance Fund).

Starting from January 1, 2021, the administration of insurance contributions for pension and health insurance was transferred to the Federal Tax Service. In this regard, starting from 2021, individual entrepreneurs must transfer accrued insurance premiums to the Federal Tax Service at the place of their registration.

Due to the fact that from January 1, 2021, the administration of contributions for pension and health insurance is entrusted to the tax inspectorates, the budget classification codes for paying fixed contributions have changed.

Unified tax on imputed income (UTII)

In this regime, a tax is imposed on potential income from a specific type of activity. The regional coefficient is also taken into account, which can either increase or decrease the amount of payment according to the declaration on the “imputed” basis.

What affects the calculation of tax for UTII:

- Basic business profitability. Registered in the Tax Code of the Russian Federation.

- The value of the physical indicator. In its own way for each specific type of activity of entrepreneurs.

- Coefficients K1 and K2. K1 - the deflator coefficient has been equal to 1.798 since 2015. K2 - the correction factor varies depending on the regional setting.

The formula for calculating the UTII tax is: basic profitability* K1 * K2 * tax rate of 15 percent.

Time for filing reports and time for paying tax indicators:

- 1st quarter - until April 20 - reporting and until April 25 - tax.

- 2nd - until July 20 and July 25, respectively.

- 3rd - until October 20 and 25, respectively.

- 4th - until January 20 and 25, respectively.

Fixed payments for individual entrepreneurs on the simplified tax system

In 2021, the method for calculating fixed contributions of individual entrepreneurs for themselves was changed. This is due to the government’s final decision not to link the size of fixed contributions to the minimum wage.

Let us recall that the government considered that due to the fact that the minimum wage for 2018 increased compared to the minimum wage for 2021 by 1,989 rubles and amounted to 9,489 rubles, the amount of fixed contributions will increase significantly. The amount of fixed contributions in this case would be 35,412 rubles. Those. Individual entrepreneurs would have to pay 7,422 rubles more in 2021 than in 2021.

Therefore, the Government came up with a proposal to set the amount of fixed contributions in such a way that the annual amount of contributions would provide the entrepreneur with at least 1 point of the individual pension coefficient. After the adoption of the relevant law, the fixed part of insurance pension contributions for 2021 amounted to 26,545 rubles per year (i.e., it was calculated based on the amount of 8,508 rubles per month), for medical insurance the amount of contributions was 5,840 rubles.

Results of changes in legislation regarding the calculation of insurance premiums

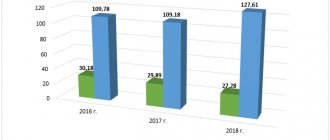

Federal Law No. 335-FZ of November 27, 2017 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation” introduced amendments to Article 430 of the Tax Code of the Russian Federation in terms of indicating a fixed amount of contributions for pension and health insurance :

In 2021:

- for pension insurance (if annual income does not exceed 300,000 rubles) – 26,545 rubles;

- for health insurance (regardless of income) – 5,840 rubles.

In 2021:

- for pension insurance (if annual income does not exceed 300,000 rubles) – 29,354 rubles;

- for health insurance (regardless of income) – 6,884 rubles.

In 2021:

- for pension insurance (if annual income does not exceed 300,000 rubles) – 32,448 rubles;

- for health insurance (regardless of income) – 8,426 rubles.

Reports on OSNO

Personal income tax

Personal income tax refers to the income that was received after the sale of property.

Personal income tax is calculated based on income for the tax period. From this amount, deductions must first be made. In the case of OSNO, the costs of commercial activities are subtracted from there. The tax rate is 13 percent. In cases where deductions are actually greater than profits, the tax is equal to zero.

The declaration document for this type of tax must be submitted to the main system before April 30th. The reporting form is filled out according to form 3-NDFL.

4-NDFL is used to calculate advance payments. Those who have just started work must be handed over within five days after the month in which the first profit was received. For those who have been working for a long time - together with 3-NDFL. Refers to those investors whose profits for the current year and the previous year differ by more than twice.

When to pay personal income tax:

- 1st payment – until July 15

- 2nd – until October 15

- 3rd – until January 15

The final one, which takes into account those paid earlier - until July 15

VAT

A lot of things apply to VAT. This includes the sale of goods and the provision of various types of services. This is simply a transfer of rights to property or goods (in the case where expenses on them are not included in profit). This is performing work for your own needs, and even importing. VAT is paid in cases where an individual entrepreneur generates an invoice in which this tax is allocated after a completed transaction is not recorded as taxable.

The tax rate is 18 percent. For some individual entrepreneurs - 10% (in certain categories of goods; details are specified in Decree of the Government of the Russian Federation No. 597 of June 18, 2012).

For those who export goods, the rate = zero.

The first step is to calculate “VAT for crediting”. To calculate this figure, the following calculation formulas are used:

In the case of a rate of 18 percent, the amount of income including VAT is divided by 118 and multiplied by 18.

In the case of a bet of 10 - on 110 and 10, respectively.

Then you need to get “VAT creditable” - from the received amount of expenses we find 18 or 10 percent.

Then we get “VAT payable to the budget.” This is the relationship between “VAT accrued” minus “VAT credited”. If the total amount is negative, then you are entitled to a refund from budget funds.

VAT reporting is submitted once every three months, but no later than the 25th day of the month following the reporting quarter. These are April 25, July, October and January.

Payment of VAT is calculated as follows: take the accrual figure for 3 months, divide by exactly three. Then, in the next three months of the next quarterly reporting period, we pay one amount each (also until the twenty-fifth).

Property tax for individuals

Will be superimposed on the price of inventory property owned by an individual. No reporting is required for this fee. And for those who own real estate, the FSN itself sends notification letters. Must be paid by December 1st.

KBK for insurance premiums of individual entrepreneurs “for themselves” in 2020

| Name of contribution | KBK |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves in a fixed amount | 18210202140061110160 |

| Insurance contributions for pension insurance of individual entrepreneurs for themselves with income exceeding 300,000 rubles | 18210202140061110160 |

| Insurance premiums for medical insurance for individual entrepreneurs for themselves in a fixed amount | 18210202103081013160 |

Additional pension fund tariffs

According to Federal Law 173 (“On labor pensions of the Russian Federation”), special tariffs apply to certain types of entrepreneur employees. This mainly applies to those who are employed in an enterprise with increased danger or harmfulness. In this case, the following will need to be added to the main calculation:

- With increased harmfulness of category 3.4 - a 7 percent tariff.

- With a harmfulness of 3.3 - 6 percent.

- At 3.2 - 4 percent.

- At 3.1 - 2 percent.

In case of increased danger, a tariff of four percent is applied.

An entrepreneur with hired employees submits a declaration to the pension fund using the RSV-1 form.

- For the first quarter - until May 16.

- For the first half of the year - until August 15.

- For the past three quarters - until November 15.

- For the whole year - until February 15.

Payment is due monthly by the 15th of the following month. If the day falls on a weekend - until the next working day.

This might also be useful:

- Changes in individual entrepreneur taxation in 2021

- What taxes does the individual entrepreneur pay?

- Tax system: what to choose?

- How much taxes does an individual entrepreneur pay in 2021?

- Fixed payments for individual entrepreneurs in 2021 for themselves

- Submitting reports electronically - using innovations

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payments to the Social Insurance Fund

The entrepreneur is required to submit a report in Form 4-FSS. The formula for calculation will look like this: amount to be accrued at the beginning of the year and until the end of the current month * 2.9 percent.

There are two ways to report to the Social Insurance Fund - paper and electronic. At the same time, if you employ more than 25 people, then the report is accepted only in electronic format.

The rules for reporting deadlines are:

- For the 1st quarter - until April 20 in paper form and until April 25 in electronic form.

- For the 1st and 2nd - until July 20 and 25, respectively.

- For 9 months of work - until October 20 and 25.

- For the whole year - until January 20 and 25.

Payments for reporting are transferred until the 15th of the next month.

Results

Despite the fact that a simplified procedure for cash discipline has been developed for individual entrepreneurs, when issuing money on account, they must comply with the same rules as legal entities.

However, individual entrepreneurs have the right not to draw up cash orders and not to maintain a cash book. The other side of the coin called “simplified cash discipline” can be poor control of cash, therefore, mainly those individual entrepreneurs who work alone avoid registering PKOs and cash settlements. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.