Almost all costing instructions indicate the need for a monthly inventory of work in progress. Checking the actual reserves confirms the reporting calculations and production costs of the closing period. However, the inventory of work in progress, unlike other assets, is not properly covered in the methods. This is understandable: in controlling “work in progress”, specialists are guided by the company’s accounting policy and technological specifics. The question is important, so we will consider issues related to the inventory of work in progress, using the example of a machine-building enterprise.

COMPOSITION OF WORK IN PRODUCTION AND REGULATIVE DOCUMENTS FOR INVENTORY

According to clause 63 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (as amended on March 29, 2017), work in progress includes :

- products that have not gone through the full production cycle provided for by the technology;

- incomplete products that have not passed testing and technical acceptance.

To conduct an audit of work in progress within the framework of the law, specialists must know the general rules of inventory, the procedure for regulating inventory differences and recording the results. Let us present the regulatory documents that should be followed:

- Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 (as amended on November 8, 2010) “On approval of Methodological Guidelines for the Inventory of Property and Financial Liabilities” (hereinafter referred to as Guidelines No. 49);

- Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (as amended on May 3, 2000) “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results.”

OBJECTIVES OF WIP INVENTORY

The objectives of conducting an inventory of work in progress are as follows:

- check the actual presence of work in progress and assess its condition;

- compare the actual availability of work in progress with accounting data;

- check data on operational accounting of the movement of components and parts between departments and the total amount of costs in work in progress;

- control the completeness and timeliness of delivery of finished products to the warehouse and documentation of such delivery;

- check the completeness of the necessary technical documentation for finished products;

- check the correct distribution of costs by type of product and clarify the cost of manufactured products;

- determine the actual completeness of the backlog, the availability of assembly parts;

- prevent theft, concealment of marriage and other abuses;

- check the correctness of registration of output and calculation of piecework wages.

Accounting and evaluation of work in progress

Currently watching: 1323

Accounting and evaluation of work in progress is very important for analyzing the balances of unfinished products in the warehouse, as well as for determining the actual cost of finished products.

Work in progress is products that have not gone through all stages of the production process and have not yet been accepted into the finished goods warehouse.

It is recorded as a balance in the debit of account 20 “Main production”.

Let's see why?!

During the production process, all costs for the manufacture of products are taken into account in account 20 “Main production”, for example:

Dt 20 kt 10 – materials released into production;

Dt 20 kt 70 – wages accrued to production workers;

Dt 20 kt 60 – services provided by the supplier for the production process, etc.

That is, the debit of account 20 collects all costs for our future finished products.

Further, when the responsible person from the production workshop provides a report on the finished product, an entry is made:

Dt 43 kt 20 – capitalization of finished products.

And all costs recorded at this moment determine the actual cost of manufactured products. BUT! This is the case if there were no balances of work in progress at the beginning and there were no turnovers on the credit of account 20.

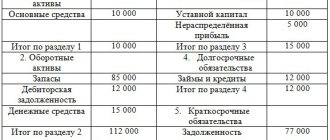

The actual cost of manufactured products is determined as follows: to the balances of work in progress at the beginning of the month (opening balance on account 20), costs for the month are added (turnovers on the debit of account 20), returned and written-off amounts are subtracted (losses from defects, returnable waste, downtime, etc. .d.) (turnover on the credit of account 20), and subtract the balance of work in progress at the end of the month (closing balance of account 20)

Since the production process is a continuous process, there is likely to be some amount of material and raw materials left in the workpieces that are transferred to the next reporting period. (We talked about materials accounting in this article). This is where the need to keep records of work in progress arises.

The amount of work in progress can only be identified during the inventory process, although it should be carried out by production service workers.

Let's look at an example:

Let's say a company makes jackets. During the month the costs were:

— materials – 200,000 rubles;

— wages of production workers were accrued - 100,000 rubles;

- depreciation written off - 20,000 rubles;

- general business expenses are distributed - 70,000 rubles.

In total, the costs collected amounted to 390,000.

The report of an economist from production provided data for this period on the production of 100 pieces of finished products, at a planned cost of 3,500 rubles per piece. In this case, you can determine the balance of work in progress: (390,000 – 350,000) = 40,000 rubles.

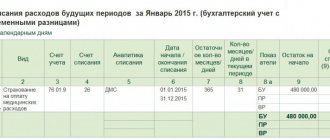

The assessment of work in progress balances can be carried out:

- in single production :

– based on actual costs incurred;

- in serial and mass production:

-at standard (planned) cost;

- according to direct cost items;

-at the cost of actually consumed raw materials, materials, semi-finished products.

In conclusion, I would like to say that accounting and evaluation of work in progress is a rather labor-intensive process and many companies refuse to define it. This approach is also acceptable in the production process if the organization’s management understands that work in progress is insignificant between reporting periods.

Our legislators define and establish rules for accounting for work in progress in this article.

PRODUCTION IN PROGRESS IN 1C PROGRAM.

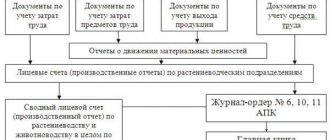

In the 1c program, the fact of receipt of finished products is reflected in the production report for the shift. This document makes the following entries:

Dt 43 kt 20 – arrival of finished products

Dt 20 kt 10 – writes off materials according to the specification for the production of a given finished product.

In order to take into account and reflect work in progress in the 1c program, it is necessary to enter inventory data (usually at the end of the month).

And what will happen in the 1c program? With one document - a production report for a shift - you write off the materials and capitalize the finished products according to the report data, which will be provided to you by the person in charge from the production workshop, and with another document - the result of the inventory - you again capitalize those materials that you count in the workshop (note, not on warehouse, but in the production process!), at the work in progress stage.

Thus, the 1c program will make entries for the capitalization of raw materials and by debiting account 20 you will have a balance at the end of the period (month). This will be considered work in progress in the 1c program.

If you need to thoroughly study production accounting at an enterprise, I invite you to take an online training course, where I will be your personal teacher and mentor in setting up correct production accounting, including in the 1c program. You can find out more about the course on this page.

Best wishes!

SELECT WIP FOR CHECKING

Inspections of work in progress depend on a number of factors:

- type of production;

- complexity and range of manufactured products;

- the procedure for operational accounting and storage of interoperational backlogs;

- other features of technology and production organization.

Notes

- Due to the scale of production, the busyness of accounting and control personnel and limited time, a complete inventory is not always possible or appropriate.

- You can control volumes and confirm accounting data using monthly or quarterly sample inventories of work in progress.

- It is optimal if the revisions are sudden. This will allow timely identification of problems and control of the accounting discipline of financially responsible persons in production.

It is advisable to carry out a selective inventory in the following cases:

- of materials and components from which products are made, surpluses and shortages have been identified, facts of theft have been confirmed (for example, during a warehouse inventory);

- shop officials have identified systemic problems with other objects and orders (for example, the problematic unit is a delivery shop or its share of costs in the work in progress exceeds 30%);

- overestimated or underestimated raw material consumption rates have been recorded, there is a need to confirm the standards;

- orders, work-in-process items have been in the workshop without movement for more than two months, there is no write-off of materials to order, no work is carried out on order, this type of product is not manufactured;

- the workshop's balance sheet includes obsolete and canceled designs, manufacturing defects (not put into storage; no decision has been made on what to do with such assets);

- significant deviations of the actual picking list from the planned one were discovered;

- the estimate of actual costs consistently exceeds the planned one by more than the permissible percentage of deviations (for example, 10% or more);

- it is necessary to control production times, completeness of products that are manufactured to order (as a rule, these are large objects, equipment with a large estimated cost, orders from customers important to the company);

- the deadline for delivery of finished products to the warehouse is overdue;

- additions to the output of workers who are paid piecework wages are recorded;

- after changes in document flow, “primary” and reporting of production departments, transition to automated workstations, after installation of weighing devices, automatic dispensers, counters.

Target selective inventories to the following WIP items, product groups, and orders:

- old orders and products, work on which began a year or more ago, mothballed WIP objects;

- work in progress balances from closed, canceled or suspended orders;

- products launched for the first time, experimental products, orders and products after design or technological changes;

- semi-finished products and assemblies that have not been assembled, have a high cost and are highly labor-intensive to manufacture;

- products, semi-finished products, components, the timely production of which determines the timing of other important orders;

- WIP facilities at the first and last sections of the technological chain;

- products and orders are under the control of top management or the owner.

IT IS IMPORTANT

Even if WIP inventories are selective, within a year it is necessary to cover with monitoring all groups of semi-finished products that the company produces, all types of technological operations and all production areas.

This is due to the following points:

- short production cycle;

- breakdown of raw materials by production stages;

- availability of internal semi-finished products;

- the use of different units of measurement at different stages of the production process.

Therefore, the process of summing up inventory and calculating raw materials as part of work in progress is a time-consuming procedure and requires special knowledge.

The consumption of raw materials in bakery production depends on the humidity of the flour roll and the yield of finished products. To obtain an accurate result, all this must be constantly taken into account. In practice, very often, with manual calculations, the problem is simplified, which results in data distortion, and the likelihood of mathematical errors is high. Calculations are often made by people who are not interested in the actual data.

This state of affairs cannot suit the business owner, who is interested in the inventory results being correct, generated quickly, and also able to be carried out by independent persons who are not responsible for the technological process.

Very often, programs that keep track of the production of bakeries are created in such a way that the raw material consumption specifications allow only the total amount of raw material consumption per output. The production cycle is short, intermediate stages are usually not taken into account, so this approach is justified for raw material consumption. However, for solving problems such as WIP inventory, this approach is unacceptable. Moreover, with an automated approach to removing residual raw materials using this method, we are able to carry out inventory much more often (even every shift), which allows us to increase control over the use of raw materials.

Thus, the most optimal method in automated accounting systems for a bakery can be considered a technique that takes as a basis the step-by-step establishment of norms for the consumption of raw materials for finished products in reference information. Each stage of product manufacturing has its own unit for removing residues, as well as a calculation method (for example, based on the number of bowls, flour added, dough weight or quantity of finished products). Since the technological process begins with the production of dough (dough, sourdough) in bowls, and ends with cooling, each subsequent stage includes the consumption of raw materials produced earlier.

PREPARATORY ACTIVITIES

Before carrying out an inventory of work in progress, it is necessary to carry out a number of preparatory procedures in order for the process to produce effective results.

1. Before starting the inventory, we check:

- availability and correctness of accounting in analytical accounting registers for each type of product, order, WIP object;

- availability of design and technological documentation, engineering survey results, design documentation, patents;

- whether semi-finished products can be used in production;

- provision of labor for hanging and moving large parts and assemblies, technically sound weighing equipment, measuring and control instruments, and measuring containers.

If the WIP inventory is planned, you need to organize preparatory work in the workshops , which will simplify the work of the commission. It is necessary to order that in workshops:

- parts and assembly units were placed in an order convenient for counting;

- signed, hung tags on racks, containers, parts;

- outdated designs and canceled orders were placed separately;

- removed defective parts and waste;

- delivered all unnecessary materials, purchased components and semi-finished products to warehouses;

- parts, components and assemblies, the processing of which was completed in the audited workshop, were transferred to the next technological stage.

2. We select a competent commission.

The inventory commission includes:

- technical specialists of general plant services (technologists, designers, controllers);

- employees of the financial and accounting service - an accountant of the production group, an economist or the head of the economic planning and production dispatch departments, an accountant-auditor;

- employees of the company's internal audit and security services;

- representatives of independent audit companies, competent experts.

An important point: limited time is allotted for inventory; errors are difficult to detect and correct, so it is necessary to provide a sufficient number of working commissions and performers. Inspectors must have a good knowledge of the technological process.

- We receive from financially responsible persons of production departments:

- the latest incoming and outgoing documents at the time of inventory, production reports for workshops;

- receipts stating that all documents on the movement of work in progress have been submitted to the accounting department or transferred to the commission.

- We instruct the members of the inventory commission about the purposes, volumes and procedure for conducting the inventory.