A taxpayer can return from the budget 13% of the amount spent on paying for medical services and purchasing medicines, provided that in the same period he paid personal income tax on his income at a rate of 13%, and treatment expenses meet the requirements of the Tax Code for such costs. To get back part of the money spent, the taxpayer needs to claim a social deduction for treatment by submitting a declaration to the Federal Tax Service (subclause 3, clause 1, clause 2, article 219 of the Tax Code of the Russian Federation). We will tell you how to draw up a document and provide a sample of filling out the 3-NDFL declaration for treatment.

How often and for what can I get a refund?

Russian citizens are allowed to apply for social benefits every year. You can receive a refund for the three years preceding the submission of the application, but for each year you must collect your own package of documents according to the dates when the expenses were incurred. Simply put, in 2021 you can file a return to recover funds spent on treatment in 2021, 2015 and 2014. Deductions are always issued based on annual results, and you can only receive reimbursement for expenses incurred in the current year in the next year.

Every year you can use social benefits for treatment

The list of services and goods, the costs of which require social compensation, is listed in detail in the Tax Code of the Russian Federation. In addition to the types of treatment and diagnostics that we talked about above, a refund is due to:

- For dental treatment, implantation, prosthetics and other services provided by dental clinics.

- As compensation for IVF (in vitro fertilization).

- During pregnancy management and paid obstetric care.

- When passing an extended list of paid tests.

The state allows you to return part of the funds for purchased pharmaceutical products and contributions to insurers for VHI. As for the list of medications, you can see them in the government decree of March 19, 2001.

Illustrative Examples

- Smirnov brought his wife with acute toothache to a private clinic. The tooth was not suitable for treatment; it was removed and prosthetics were made. The services cost 150 thousand. The man paid for the help. He works as a teacher, and his salary is 45 thousand per month. During the year he received 540 thousand, of which 70,200 went to income tax. Since the operations performed are considered expensive, the deduction is therefore not limited in amount. That is, 13% of 150 thousand. He will receive 19,500 rubles.

- Sobolev earns his living as an administrator at a local cafe-bar. His salary is 20 thousand per month. He transfers -31,200 to the state per year. Having visited a paid dentistry, the man decided to take advantage of the benefit by returning part of the expenses. But he was refused payment. The enamel and crowns of healthy teeth were whitened. These services are not essential and will not be reimbursed.

- The son paid for the diagnostics and the work on making prosthetics for his mother. As a result, he gave the clinic 250 thousand. The amount of compensation will be = (250000/100) * 13% = 32500.

- Before retiring, an officially employed person had his teeth completely treated. Next year he has the right to claim compensation for expenses, since contributions to the state treasury were made.

How to fill out the 3-NDFL declaration for treatment

In 2021, to reflect the deduction for treatment, the form from the Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

Tax refunds can be made only for the period in which the treatment was paid. If expenses for treatment are declared in 3-NDFL for previous years, the forms valid in the corresponding period are used. You cannot transfer the deduction (including its unused balance) to another year.

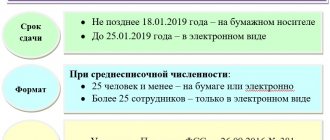

The Federal Tax Service will accept both paper and electronic versions of reporting. A declaration sent via the Internet (through special communication operators, the State portal) must be certified with an electronic digital signature.

There is no specific deadline for filing a 3-NDFL declaration for treatment. But the Federal Tax Service recalculates the tax and returns the overpayment only for the previous 3 years. For example, if a citizen reports a deduction in the 2020 tax return (3-NDFL) for the treatment of himself or a relative, the overpayment of tax for 2021 will be returned to him if he submits the return no later than December 31, 2023.

If the return only claims a deduction, it can be filed throughout the year. 3-NDFL, in which, in addition to deductions, the income of an individual is also declared, must be submitted no later than April 30 of the year following the reporting year.

Tax authorities have 3 months after receiving the declaration to verify the information, and another 1 month to transfer funds to the taxpayer.

Entering information about the declarant

The next tab “Information about the declarant” contains information about the taxpayer, his passport data, phone number.

Field "Full name" is filled in with the declarant’s TIN, date and place of birth.

The country code inside the citizenship line is set automatically.

After this, the lines indicating the series, number, and date of issue of the passport are filled in.

In the last line you need to enter your phone number.

3-NDFL for treatment: sample filling

You do not need to fill out all sheets of the deduction declaration. Only the necessary pages are used. For paper declarations, only one-sided printing is allowed.

If the taxpayer reports only a deduction for treatment, it is sufficient to include in the composition:

• title page;

• section 1 and its appendix – application for tax refund;

• section 2;

• Annex 1;

• Appendix 5.

The TIN of the individual is written at the top of each page of the declaration, the date and signature are placed at the bottom, empty fields are crossed out.

The tax in the declaration is indicated in whole rubles, the remaining cost indicators (income, expenses) are in rubles and kopecks.

Encoding used

Some data in the declaration is indicated in the form of special codes, some of which are given in the appendices to the Procedure for filling out the declaration, for example:

- The number of the Federal Tax Service Inspectorate and OKTMO is determined by the taxpayer’s place of residence; they can be clarified in your inspectorate or on the ]]>website]]> Federal Tax Service.

- The title page indicates period codes “34”, country (RF) “643”, taxpayer category for individuals (not individual entrepreneurs) – “760” (Appendix No. 1 to the Procedure), status “1” (residents - persons who were in territory of the Russian Federation more than 183 days a year).

- In section 1 on page 010, the code “2” is placed, indicating that the tax is subject to refund; below is the BCC of the tax - 18210102030011000110.

- In section 2 the tax rate is 13%, on page 002 “Type of income” the code “3” is indicated - other.

- The codes of types of income indicated in Appendix 1 are selected from Appendixes No. 3, 4 to the Filling Out Procedure.

The rest of the information is taken from the taxpayer's documents.

Recommended filling algorithm

The following procedure for filling out 3-NDFL for treatment is recommended:

• Start with the title page.

• Then reflect data on income received in Appendix 1 (in the general case - according to information from 2-NDFL certificates).

• Then go to deductions in Appendix 5. The amount of costs for expensive treatment is indicated on page 110, for regular treatment - on page 140, the purchase of medicines is reflected on page 141, contributions under voluntary health insurance contracts - on page 150. The final indicators are displayed ( pp. 120, 180, 190, 200).

• The results obtained must be sequentially transferred to section 2, then the refund amount is indicated in section 1 of the declaration.

• To receive a refund, you must fill out an application (Appendix 1 to Section 1), which indicates the bank details of the taxpayer - the tax authorities will use them to transfer the money.

All completed sheets must be numbered; their total number is indicated on the title page. The total number of sheets with copies of supporting documents is also calculated, the result obtained is recorded in the corresponding cell of the title page.

To make the information clearer, we will give an example of filling out 3-NDFL for treatment - a sample of filling out 2021.

Example

In 2021, Svetlana Aleksandrovna Novikova applied for services at a private dental clinic. In 2021, Novikova decided to return part of the funds paid, reflecting the deduction in 3-NDFL for dental treatment. A sample will be given below.

Data required to prepare the declaration:

- Salary at the place of work for 2021, according to certificate 2-NDFL for 2021, amounted to 384,200.10 rubles.

- When paying income, the employer withheld tax of 13% - 49,946 rubles. No tax deductions were applied.

- The cost of paying for dental services according to the contract and a certificate from the medical clinic amounted to 38,700 rubles.

As a result of the calculations, it turned out that Novikova is due 13% of the paid medical services - 5,031 rubles - as a refund from the budget. (38,700 x 13%).

In April 2021, Novikova sent to the Federal Tax Service a completed copy of the 3-NDFL declaration for treatment, a sample of which looked like this:

What documents should I attach to 3-NDFL for a tax deduction for treatment?

In addition to the 3-NDFL declaration itself, inspectors are presented with documents confirming treatment expenses for verification. What you will need:

- a copy of the agreement with the medical institution;

- a copy of the license of the medical organization (not needed if its number is indicated in the text of the contract);

- a certificate of payment for services issued by the medical institution for the tax authorities (original if a paper copy of the declaration is sent to the Federal Tax Service);

- a copy of the prescription for medications issued by the attending physician;

- copies of payment documents for the purchase of medicines (cash receipts, sales receipts, receipts, etc.);

- certificate of income and withheld tax from the employer (2-NDFL).

When applying in the 3-NDFL declaration for a refund for the treatment of relatives (spouses, children under 18 years of age, including adopted children, parents, adoptive parents), an additional copy of a document confirming a close relationship, for example, a birth or marriage certificate, is attached.

Insurance premiums paid under a VHI agreement can also be deducted. For verification, copies of the policy or agreement, licenses, documents on payment of amounts under the agreement are attached.

Instead of an afterword

We offered you detailed step-by-step instructions for filling out the declaration and told you about all the features of returning funds spent on treatment. After reading the text carefully, you will easily prepare the necessary package of documents and can fully count on successful and full reimbursement of expenses aimed at your health or the health of your loved ones.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

8-804-333-11-40 (We work throughout Russia)

It's fast and free!

Download the program Declaration 2021

To start filling out form 3-NDFL in the program, you first need to download it from the tax service website, then put it on your computer and open it.

To download, it is best to go to the source website - the Federal Tax Service, it is important to pay attention to the release date of the downloaded file - for 2021 it should be 01/13/2021.

.

After downloading the program file to your computer, you need to install it. The procedure is simple, however, if there are difficulties, then you need to additionally download the installation instructions from the link above, where this process is clearly explained in pictures.

The installed file opens by double clicking. The program has seven tabs, which you can navigate between in the menu on the left. In the top menu, you can save the entered data, view the declaration at any time, print the 3-NDFL form, and also save it in xml format, which can then be transferred to the Federal Tax Service through the taxpayer’s personal account.

conclusions

Having treated your teeth and paid a certain amount of money for it, you should carefully preserve all accompanying documentation - payment documents, checks, contracts.

These papers will help you reduce your expenses on dentistry by refunding your income tax due to the use of a tax deduction.

To return 13 percent, it is enough to fill out 3-NDFL and submit it along with other papers to the Federal Tax Service.

Refunds will be made upon completion of the inspection, which usually takes up to three months.