In accounting department

26 is needed to record expenses that are not related to production. It must be closed at the end of the reporting month. You can perform the operation in the 1C program. All you need to do is complete 7 simple steps. The principles of legal regulation are laid down in Orders of the Ministry of Finance: No. 94n dated October 31, 2000 and No. 57n dated April 6, 2015. The expense item, designed to reflect all costs incurred that are not related to production activities, must be canceled at the end of the reporting period. Close account 26 - reset operating balances to zero and transfer expenses accumulated during the month (make the balance equal to 0), since it does not have a separate reflection in the company’s balance sheet, but serves solely to collect information about general business expenses. The operation allows you to monitor the organization’s current expenses and make adjustments to management policies.

Account 26 according to accounting rules can be closed:

- writing off costs to the cost of production (debiting account 20 or distributing expenses between various productions on accounts 20, and);

- directly to the account 90, subaccount for management costs (direct costing method).

Note from the author. The chosen method of writing off general business costs must first be fixed in the accounting policy of the organization.

Scope of application

Every day, company management is faced with management costs that have nothing to do with production, sales or revenue-generating services. The question arises of how to take them into account correctly. Accounting 26 makes it easy to do this. First, all general business expenses are taken into account in this account, and then written off to the debit of accounts 90 “Sales”, 20 “Main production”, 29 “Service of production and economy” or 08 “Investment in non-current assets”, depending on the direction of the main activity of the enterprise.

Money is leaving

The most active users of account 26 are organizations related to the provision of services: dealers, brokers, forwarders, agents. It can include all expenses and be credited to sales accounting.

Trading companies rarely turn to account 26 in their activities. It is easier for them to assign account 44 “Sales expenses” for their business expenses. They attribute all costs to him.

Organizations engaged in agriculture distribute their general business expenses at the close of the reporting period once a month or quarterly by type of production. The exception is the cost of feed, seeds, raw materials for semi-finished products and materials. At the end of the year they are subject to adjustment to the level of actual costs. Also, if the company’s accounting policy allows this, they can be written off to the debit of account 90 “Sales”.

Construction companies, as well as house-building factories, mechanization departments, factories for the production of building materials 26 use accounting accounts to account for the costs of servicing workers, the costs of organizing work on construction sites, and maintaining administrative and economic personnel. General business expenses at the end of the month are written off to the debit of account 20.4 “Costs of construction and installation work.” Factories and house-building plants distribute them according to the types of services provided and products produced. And the mechanization departments are proportionally divided between the services provided to third parties and the construction and installation work performed.

Note! In budget accounting, the purpose of account 26 will be completely different. There it will be off-balance sheet. Budgetary institutions take into account property transferred for free use in accordance with Order of the Ministry of Finance of the Russian Federation No. 157N dated December 1, 2010.

Construction

Description and use of account 26

Account 26 “General business expenses” is used to collect information about costs for management needs not directly related to the production of products, performance of work, or provision of services.

Agents, brokers, dealers, forwarders, that is, organizations not related to production, use account 26 as the main one in conducting their activities, summarizing information on all their expenses on it and writing them off to the sales account.

Trading companies do not use account 26 in their activities and all expenses, without exception, are attributed directly to account 44 “Sales expenses”.

For information on the main components of costs accounted for in account 44 “Sales expenses”, read the article “Accounting entries for business expenses”.

Analytical accounting for account 26 is carried out directly by expense items and places of their occurrence.

Account characteristics

What activities can be classified as general business expenses:

- cash payments to employees of the administrative and economic apparatus who do not bring direct income to the company: directorate, accounting department, secretariat. Account 26 reflects wages, bonuses, vacation pay and other incentives paid by the company;

- insurance premiums paid by the company from the earnings of employees of the administrative and economic apparatus, subject to payment to the budget of the Russian Federation;

- depreciation of intangible assets and fixed assets acquired for the needs of the administrative and economic apparatus;

- rent, except for profit-generating premises: production workshops, retail premises, etc.;

- costs of repairing operating systems not related to production activities;

- expenses associated with the provision of consulting and information services;

- costs of materials that will be used for management needs;

- entertainment expenses;

- staff development;

- security of premises;

- recruitment;

- subscription to periodicals;

- software;

- telecommunications, communications, internet;

- business trips of administrative and economic staff.

To account for general business costs, enterprises use a full or partial journal-order form. They reflect information on payroll, consumption of materials, the total amount of wear and tear on the operating system, enter transcript sheets containing various financial expenses, etc.

Note! Payment for services rendered for the maintenance of general business personnel is all 26 accounts.

Education

Main components of general business expenses

The main general operating expenses include the following:

- Remuneration for management staff, directorate, accounting, office (including bonuses, vacation pay, benefits at the expense of the employer).

- Amounts of insurance payments to extra-budgetary funds related to the remuneration of employees of the administrative and economic apparatus of the organization.

Information about accounting entries when calculating and paying insurance premiums can be found in the material “Insurance premiums accrued (accounting entry)” .

- Accrued depreciation on fixed assets and intangible assets that were acquired to serve administrative and business personnel.

- Expenses for repairs of fixed assets not related to production.

- Expenses for renting premises used for management staff and other non-production purposes.

- Expenses for information and consulting services.

- Expenses for materials used for administrative needs.

- Entertainment expenses.

- Expenses for retraining of personnel.

- Expenses for paying for the services of security organizations.

- Recruitment costs.

- Expenses for subscription to periodicals.

- Software costs.

- Expenses for telephone calls and Internet services.

- Travel expenses.

ConsultantPlus experts explained in detail how to take into account administrative expenses when calculating taxable profit. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

You can familiarize yourself with all the nuances of documenting travel expenses in the article “Procedure for accounting for travel expenses in 2020-2021”.

Closing

To determine active or passive account 26, you need to pay attention to how costs are reflected on it. They are distributed as a debit and written off as a credit to the cost accounts for the main production. Thus, account 26 in the accounting department is active. It closes monthly. All balances are transferred to the cost of production. The balance at the end of the period should be zero.

There are two ways to form costs:

- At actual cost (full).

- Direct costing or at reduced cost.

An enterprise can use only one method in its activities, which must be fixed in its accounting policies. It will not be possible to change it. Closing the account 26 will depend on the chosen method.

If the organization uses the formation method at actual cost, then in this case general business expenses will be closed to account 20 “Main production”. If the company has service or auxiliary workshops that provide services to third parties, then the costs must be divided between accounts 23 “Auxiliary production” and 29 “Service production and facilities”. The procedure for writing off and distributing general business cost bases must also be reflected in the accounting policy. The accounting entry in this case will look like this:

Dt20 (23, 29) - Kt26

How to close the 26th account if the company has chosen the direct costing method. Everything is very simple. General business expenses when working at a reduced cost will be taken into account in account 90.2 “Cost of sales”. Wiring sample:

Dt90.2 - Kt26

In accounting, problems sometimes arise with writing off general business expenses. Why is account 26 not closed? Most likely he has an opening balance, which he shouldn't have. There are several reasons that, by eliminating them, can solve this impossible question:

- First of all, you need to check the accounting policy settings in the accounting program. It should indicate the method of cost formation at the enterprise, as well as information on how general business costs are distributed.

- The second possible reason may be incorrect analytical accounting for general business expenses. You should check the correctness of the distribution of costs by type of item, as well as by division of the company. Most likely, an error will be discovered in the details of the operations performed.

The accountant closes the month

. What to do if there was no revenue during the reporting month. There is also a way out. You need to create a sale for 1 kopeck and send it to a fake counterparty. After this, you can close general business expenses from account 26 to account 20 “Main production”. After this, all that remains is to manually reverse the extra penny at the end of the year.

An example of how to close account 26 manually by posting:

Dt26 - Kt02 - depreciation on fixed assets has been accrued.

Dt26 - Kt10 - inventories are written off.

Dt26 - Kt70 - wages accrued to the administrative and economic apparatus.

Dt26 - Kt68 (69) - insurance payments have been calculated.

Dt20 (21, 29, 90) - Kt26 - costs have been written off.

Important! If general business expenses are taken into account in tax accounting as indirect, then temporary differences invariably arise.

They must also be written off by postings.

Step-by-step instructions for closing in 1C

To close the account. 26 based on the results of the reporting month, you can make entries manually, but to correctly distribute costs and obtain the financial result of business activities, automatic closure is used in 1C software products.

Account 26 is used mainly by manufacturing companies, therefore, to display costs on it, you must first configure the accounting parameters (the instructions are based on the example of 1C “Enterprise Accounting”, edition 2.0):

- On the “Enterprise” tab, go to the accounting settings.

- When selecting types of activity, put a tick next to production (performing work and providing services). Without this mark, the program will consider the company trading using only accounts. 44 to display cash expenses incurred.

- Set up accounting policies in the “Enterprise” section.

- In the general information of the company, check the box “Product Manufacturing”.

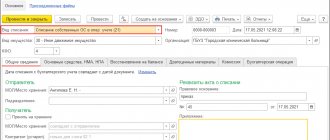

- On the “Production” tab, you can select the method for distributing the company’s costs (depending on wage indicators, production plans, etc.) and the method for including general business costs in the cost of finished products class=”aligncenter” width=”688″ height=”465 ″[/img]

- Setting up the distribution base.

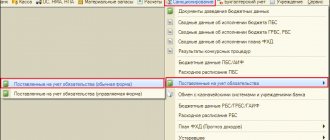

- In setting up the accounting policy parameters, allow monthly cancellation of account 26 in automatic mode (tab “Operations” – “Closing the month”). For the operation to be correct, you must first perform a group transfer of documents in the required sequence and close the previous items (payroll, depreciation, etc.).

After the end of the period, it is necessary to create a balance sheet for account 26 and analyze the ending balance (must be zero).

To the point. How to draw up a balance sheet (TCS) and check for errors.

The most common reasons for an account balance to be incorrect:

- filling out analytics for departments;

- generating statistics on cost items;

- choosing the sequence of documents.

How does account 26 correspond with other accounts?

It corresponds with other accounts in the chart of accounts, both in debit and credit. Basic debit entries:

Dt26

Dt26

Correspondence with loan accounting accounts:

Kt26

Postings

Which entries are most often used in accounting when writing off general business expenses:

- Calculation of depreciation of fixed assets for administrative and economic needs - Dt26 - Kt02.

- Costs associated with OS repairs by the organization itself or with the involvement of third-party specialists - Dt26 - Kt10 (60, 76).

- Depreciation was accrued for intangible assets (intangible assets) for administrative and economic needs - Dt26 - Kt05.

- The costs of renting premises that are not commercial or industrial are reflected - Dt26 - Kt76 (60).

- Costs for audit, information, consulting services - Dt26 - Kt76 (60).

- Expenses for training employees of the administrative and economic apparatus - Dt26 - Kt76 (60).

- Taxes written off - Dt26 - Kt68.

- Salary of administrative and economic personnel - Dt26 - Kt70.

- Insurance premiums - Dt26 - Kt69.

- Conducting official receptions, business meetings and negotiations, transport support - Dt26 - Kt71 (60, 76).

As can be seen from the example entries, all general business expenses are reflected on Dt26, and according to Kt26 they are written off to cost and sales.

A business meeting

How to close account 26 if there is no revenue

Is it possible and how to close account 26 if there is zero revenue from the sale of goods, products or services/work? According to accounting rules, this cannot be done, since indirect expenses need to be written off only if there is revenue, but also the final balance on the account. 26 should not accumulate. There is a way out - you need to carry out a minimum sale of 0.01 rubles. with a technical counterparty, after which account 26 will be automatically closed to account 20 (WIP), and at the end of the year the extra penny will be allocated through a manual operation.