Reasons for debt

As a result of mutual settlements with employees, both the organization’s debt to the employee may arise, and vice versa, the employee may become a debtor to the organization. The reasons for the occurrence of debts in the program can be either manual correction of amounts payable (usually the calculator can resort to manual correction of amounts in cases where he cannot receive the required amounts by calculation), and partial payment - for this purpose in the document “Salaries payable by organizations” you can indicate the percentage of payments (especially relevant at the current time, when the management of the organization may decide to pay part of the salary).

Accounts payable: line 1520 of the balance sheet (transcript)

Current as of: January 26, 2021.

The code of the accounting reporting lines must be provided in the forms submitted to the tax office or statistical authorities. The line code is indicated after the column “Name of the indicator” (clause 5 of Order of the Ministry of Finance dated July 2, 2010 No. 66n). The list of accounting reporting codes is given in Appendix No. 4 to Order of the Ministry of Finance dated July 2, 2010 No. 66n. So, for example, the line “Accounts payable” corresponds to code 1520. And accounts payable in the balance sheet is the balance of which accounts?

Accounts payable in the balance sheet: line 1520, which is included

Filling out a balance sheet is not the easiest task, especially for an inexperienced accountant. And to make your task easier, before registration you should find out the principles according to which data is entered into this type of accounting. So, for the convenience of accounting, this type of accounting is divided into sections and subsections, and in them there are lines in which, using debits and credits of accounts, the data that must be taken into account for further assessment of the financial condition of a legal entity is entered. This aspect is directly affected by various debts, which reduce the amount of the organization’s assets, and therefore require particularly careful calculation and error-free entry into documents. Further in the article about what accounts payable is in the balance sheet, its calculation and how it is noted.

Alignment of mutual settlements

To align mutual settlements with employees in the programs “1C: Salary and Personnel Management 8”, ed. 2.5 and 3.0, you need to analyze the data in the accumulation registers. “Mutual settlements with employees of the organization” and “Salary for the month of organizations”, where the lines with the value “Income +” are the amounts that the organization owes to the employee, the lines with the value “Expense –” are the amounts that the employee owes the organization;

To change these registers in “1C: Salary and Personnel Management 8”, ed. 3.0, you need to make a document “Data Transfer” (“Main Menu – All Functions – Documents”), and in ed. 2.5 you need to make a document “Adjusting entries in accumulation registers” (“Service – Service”).

Make it a rule to independently monitor any debts that arise after each salary payment. To do this, you can use the appropriate reports and processing. For example, the report “Structure of debt of organizations”, processing “Recalculation of salaries of an organization”.

More about accounts payable

Before talking about debt in accounting, it is worth recalling what these two definitions mean:

- Balance sheet is one of the main types of accounting. It contains information about the organization’s assets, its liabilities and capital status. It is expressed in two equal parts - an asset and a liability, the first of which reflects the value of all the organization’s property, and the second - how much money the company receives from outside thanks to its activities. Thus, using accounting, you can evaluate the financial and property status of a legal entity.

- Accounts payable on the balance sheet is a calculation of the organization’s debts to individuals and legal entities that must be covered within 1 year. It is included in liability, since it does not relate to the property of a legal entity, in section 5 “Short-term liabilities”.

The term accounts payable has several meanings, but they all say approximately the same thing - it is not long-term, and the calculation consists of:

- Debts to suppliers and contractors.

- Advances.

- Debts to subsidiaries and the country's budget.

- Amounts on bills.

- Debts to staff, etc.

Read more about which accounts include balance calculations below.

What documents are used

Information on remuneration is presented in the following documents:

- balance sheet (form No. 1) with annex (form No. 5);

- reports on income and expenses (form No. 2), on the flow of funds (form No. 4), on the intended use of money (form No. 6), etc.

How is the wage fund reflected on the balance sheet?

Salary accrual in accounting is displayed using the entry:

- Dt cch. (debit account) 20 “Main production” (25 “General production expenses”, 44 “Sales expenses”, etc.),

- K-t sch. (credit account) 70 “Settlements with personnel for wages.”

The total accrued but unpaid wages in the accounting report are reflected in the column “Debt to the organization’s personnel.”

Salaries accrued but not yet received by employees are reflected as deposited in account 76 “Settlements with various debtors and creditors.”

To reflect this article, it is also necessary to record “D-c. 70 “Settlements with personnel for wages”.

The amount of wages lost by employees is also reflected in the balance sheet in the article “Other creditors” in section No. 5 “Short-term liabilities”.

In order for the wage fund to be reflected correctly in the balance sheet, the accountant can help with his work by drawing up established samples of the following documents:

- working forms for monthly payroll;

- payroll statements for each employee with the results of calculating the advance payment, with a breakdown by cost centers, by net salaries, with general results and types of accruals and deductions (T-51);

- summary reports on taxes and fees, including breakdowns by type of accrual, corresponding statements for each employee;

- time sheets;

- payment orders;

- employee pay slips;

- bank registers in banking format;

- memorial orders;

- calculations of sick leave and vacations;

- calculation notes upon dismissal (single form T-61).

Debt in accounting

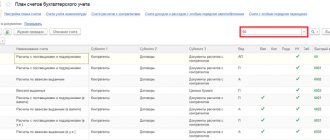

There is a special line in accounting - 1520, which should include all calculations of the company’s debts that must be repaid within 12 months. They are called short-term. According to the transcript, line 1520 of the balance sheet may contain calculations for the following accounts:

- Balance 60 - debts incurred during settlements with suppliers (15201).

- Credit balance 62 - debts with buyers or customers. (15202).

- Balance 68 concerns taxes and other fees (personal income tax, VAT, transport, property tax, etc.), but 69 concerns fees for social insurance. These are pages 15203 and 15204.

- Credit balance 70 relates to payments for employee salaries, so this is one of the most serious arrears - when employees do not receive wages on time (Line 15205).

- Balance 71 - debts to pay for the services of persons working for the organization, but not on staff - page 15206.

- Credit balance 73 - debt obligations to personnel for any payments other than wages. Also line 15206.

- Credit balance 75 - balances of debts for payments to the founders (15207).

- Balance 76 concerns creditors and debtors. The latter is disclosed in detail in the asset, and the first in the liability (15208).

Since line 1520 refers to short-term liabilities, it reflects the credit balance of the specified accounts for expansion, a simplified entry is not suitable here. Sections 5.3 and 5.4 of the explanations for this type of accounting will also be important here. And the list of all codes for it is noted in this Appendix to the Order of the Ministry of Finance.

Salary arrears on the balance sheet

The wage fund in the reporting includes the following subsections:

- monitoring labor productivity, ensuring its growth;

- control of labor discipline;

- monitoring the rational use of labor hours and compliance with production standards;

- finding ways to increase labor productivity;

- accurate calculation of the salary of each employee, its distribution among various cost areas;

- control of the correctness and timeliness of payments to company employees;

- control of payroll spending, etc.

The wage fund is the salary of employees, calculated taking into account:

- insurance contributions, including pension accruals - approximately 20%;

- personal income tax (NDFL) – 13%;

- contributions to health and social insurance funds – about 6%.

For example: an employee’s salary is 10 thousand rubles. It is necessary to add to this figure 20% for insurance premiums and pension contributions and 6% of the fund for health and social insurance.

Thus, you need to budget 12,600 rubles for this employee’s salary. At the same time, he will receive only 8,700 rubles in his hands, since 13% will be deducted from the 10 thousand due to him to pay personal income tax.

(The example does not take into account special tax regimes.)

The exact amounts of insurance contributions to state funds, monthly terms and liability for their violation are reflected in Federal Law No. 212 of July 24, 2009 (look for the edition with the latest changes and additions).

We talked in more detail about what is included in the payroll and wages.

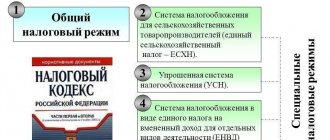

What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, the income received during the month and the expenses that the company incurred in the same period are recorded, and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no separate form for the health insurance fund.

Calculation by categories of this fund is also submitted to the Pension Fund.

If this month your individual entrepreneur suffered losses, for example, income was 10 thousand rubles, and expenses were 15 thousand, in the “difference” line, indicate 1% of the amount received, the minimum profit, or simply “zero”.

If your company operates under the general taxation system, reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method.

The only difference will be in the timing of reporting.

What documents are used

Information on remuneration is presented in the following documents:

How is the wage fund reflected on the balance sheet?

Salary accrual in accounting is displayed using the entry:

- Dt cch. (debit account) 20 “Main production” (25 “General production expenses”, 44 “Sales expenses”, etc.),

- K-t sch. (credit account) 70 “Settlements with personnel for wages.”

The total accrued but unpaid wages in the accounting report are reflected in the column “Debt to the organization’s personnel.”

Salaries accrued but not yet received by employees are reflected as deposited in account 76 “Settlements with various debtors and creditors.”

To reflect this article, it is also necessary to record “D-c. 70 “Settlements with personnel for wages”.

The amount of wages lost by employees is also reflected in the balance sheet in the article “Other creditors” in section No. 5 “Short-term liabilities”.

In order for the wage fund to be reflected correctly in the balance sheet, the accountant can help with his work by drawing up established samples of the following documents:

- working forms for monthly payroll;

- payroll statements for each employee with the results of calculating the advance payment, with a breakdown by cost centers, by net salaries, with general results and types of accruals and deductions (T-51);

- summary reports on taxes and fees, including breakdowns by type of accrual, corresponding statements for each employee;

- time sheets;

- payment orders;

- employee pay slips;

- bank registers in banking format;

- memorial orders;

- calculations of sick leave and vacations;

- calculation notes upon dismissal (single form T-61).

On our website you will find other publications by experts on the topic of payroll and wages. From them you can find out:

- How are funds calculated at enterprises, and how can you find out the size of the annual salary?

- What methods of payroll and wage planning are used, how are they optimized, and what does the efficiency of using funds mean?

- What types of payroll and personal wages are there, what taxes are they subject to and what deductions are made from them?

- How to wisely use and distribute funds?

Deadlines

The deadlines for submitting mandatory reporting on the wage fund are established by regulatory government bodies. Typically, reporting is submitted based on the following results:

- next quarter;

- calendar year.

Note:

When preparing reports on payroll, it is necessary to draw up a tax return for the Unified Social Tax no later than 30.03 of the year following the reporting period.

When preparing and submitting reports, the company goes through the following stages:

- The accountant sends regulatory documents establishing the form of the report and including instructions for generating reports in the automation department.

- Technicians update and customize reporting forms.

- The accountant prepares, consolidates and verifies data for reporting.

- The accountant generates reports for the current reporting period.

- The accountant checks the accuracy of the generated reports.

- The accountant prints a set number of copies of reports.

- Prepared reports undergo a second review cycle.

- The accountant submits reports signed by clients to regulatory authorities.

- The enterprise receives reports with a mark from the regulatory authority on delivery.

To summarize, we note that payroll is a fixed salary for employees.

The employer must pay 26% of the payroll, 13% (personal income tax) - the employee from his income.

Payroll reporting is almost the same for all small businesses, regardless of the form of organization.

Only the tax regimes differ, but this difference is insignificant.

Accounts payable: line 1520 of the balance sheet (transcript)

Current as of: January 26, 2021

Source: https://uspeh-163.ru/zadolzhennost-po-zarplate-v-balanse/

The principle of registration of debt obligations in the balance sheet

It is important to pay attention to what nuances there are when entering data on debts into accounting:

- Fines and penalties, as well as penalties, are included in debt obligations.

- The calculation of operations should be detailed, not simplified.

- Debts in foreign currency are converted into rubles according to the current exchange rate at the time of filling out the accounting records.

- All debts that will be paid for more than a year go into section 4 - “Long-term liabilities”. It is also possible to split them between sections, because debt often changes in structure and volume, and sometimes its elements need to be split between different accounting accounts.

- The loan arrears are added up in full; no amounts can be excluded from the calculation if there has been no repayment.

- The amount borrowed is entered into accounting with the interest accrued by the end of the reporting period.

- Debt becomes such only under certain conditions. For example, it appears to employees even without violating the terms of payment, existing constantly, and to extra-budgetary funds it appears only when they were not transferred on the reporting date. This point must be carefully monitored so as not to make mistakes when entering data.

- The arrears can be written off if the statute of limitations has expired - this is 3 years according to current legislation.

Although this type of accounting is not so easy to fill out, it is not difficult to enter information about debts. You just need to figure out which accounts it relates to, and the fact that accounts payable on the balance sheet is line 1520 is clear from this article. The main thing is to make the correct calculations, know which accounts are accounts payable on the balance sheet and their breakdown, and then there will definitely be no problems with registering the debts of a legal entity in accounting.

All about economics

This line shows the organization’s short-term accounts payable (clause 19 of PBU 4/99), the repayment period of which does not exceed 12 months after the reporting date.

What is included in short-term accounts payable?

According to line 1520 “Accounts payable” in section. V of the Balance Sheet provides information on the following types of short-term accounts payable.

- Accounts payable to suppliers and contractors, which are recorded on account 60 “Settlements with suppliers and contractors” in amounts recognized by the organization as correct (Instructions for using the Chart of Accounts, clause 73 of the Regulations on Accounting and Financial Reporting).

In particular, account 60 reflects the organization’s debt:

— for acquired material assets (including uninvoiced deliveries);

- for accepted work performed;

- for services consumed;

— on bills of exchange issued to suppliers and contractors;

- on commercial loans received from suppliers and contractors.

The amount of debt on commercial loans is formed by both the amount of the principal debt and the amount of interest due at the end of the reporting period in accordance with the terms of the agreements (clause 1 of PBU 15/2008, clause 73 of the Regulations on Accounting and Financial Reporting).

If the agreement for the acquisition of an asset (performance of work, provision of services) provides for a deferred (installment) payment and the fee for a commercial loan is not separately established, then its amount, taken into account in the price of the agreement, is determined by the organization independently. This amount, being the economic content of interest payable to the lender (creditor), is recognized in accounting evenly until the end of the deferment period (installment plan) in the manner prescribed by PBU 15/2008 (Appendix to the Letter of the Ministry of Finance of Russia dated 06.02.2015 N 07- 04-06/5027).

- Accounts payable to employees of the organization, which can be accounted for in the following accounting accounts:

- 70 “Settlements with personnel for wages” - in terms of accrued but not paid wages, bonuses, benefits, amounts of distributed income due to the founders - employees of the organization, etc.;

— 71 “Settlements with accountable persons” — regarding the amounts of overexpenditure on advance reports not reimbursed to employees;

- 73 “Settlements with personnel for other operations” - in terms of accrued but not paid compensation to employees for the use of personal property, amounts of financial assistance, moral damage, etc.;

- 76 “Settlements with various debtors and creditors”, subaccount 76-4 “Settlements on deposited amounts” - in terms of accrued but not paid due to the non-appearance of recipients of wages (Instructions for using the Chart of Accounts).

- Accounts payable for compulsory social insurance, including arrears of contributions, taking into account fines and penalties accrued for payment to state extra-budgetary funds. These types of debt are accounted for in account 69 “Calculations for social insurance and security” (Instructions for using the Chart of Accounts).

- Accounts payable for taxes and fees, which may include the following types of debt (Articles 13, 14, 15, 75, 114 of the Tax Code of the Russian Federation, paragraph 2, paragraph 23 of PBU 18/02):

— on payment of income tax;

- payment of property tax;

- payment of transport tax;

- on payment of land tax;

— on payment of other taxes and fees;

- for payment of penalties and fines accrued to the taxpayer.

These types of debt are accounted for on account 68 “Calculations for taxes and fees” (Instructions for using the Chart of Accounts).

- Accounts payable to buyers and customers, which arises in the event of receiving an advance (advance payment) for the supply of products, goods (performance of work, provision of services) and includes debt on commercial loans. The specified debt is reflected in the credit of account 62 “Settlements with buyers and customers”.

- Accounts payable for non-state pension provision for employees of the organization, recorded in account 69 “Calculations for social insurance and security”.

- Accounts payable to the founders (participants) for the payment of the actual value of the share (market value of the shares) upon leaving the company, as well as for the payment of income in the form of distributed profits, accounted for in account 75 “Settlements with founders”.

Debt to the founders for the payment of income arises on the date the general meeting of participants (founders, shareholders or the owner of the enterprise’s property) made a decision on the distribution of profits (clause 1, article 28 of Law No. 14-FZ, clauses 1, 3, article 42 of the Law N 208-FZ, paragraphs 1, 2 of Article 17 of Law N 161-FZ).

In accounting, the distribution of profit at the end of the year refers to the category of events after the reporting date, indicating the economic conditions in which the organization conducts its activities that arose after the reporting date. Such an event after the reporting date is disclosed in the Notes to the Balance Sheet and the Statement of Financial Results for the reporting year. At the same time, in the reporting period for which income is distributed, no entries are made in accounting (synthetic and analytical) accounting. When an event occurs after the reporting date in the accounting of the period following the reporting one, in general order an entry is made reflecting this event (clauses 3, 5, 10 of PBU 7/98).

In this regard, the debt to pay income in the form of distributed profit (both at the end of the year and when making interim payments) is shown in the accounting records as of the date the corresponding decision is made.

If, in connection with an increase in the authorized capital, funds and other property were received from shareholders (participants), but on the reporting date the corresponding changes in the constituent documents were not registered, then the value of this property reflected in the credit of account 75, subaccount 75-1 “Settlements on deposits in authorized (share) capital” is not included in the accounts payable indicator on line 1520 section. V of the Balance Sheet, but is reflected separately as a separate item in Section. III “Capital and reserves” (Appendix to the Letter of the Ministry of Finance of Russia dated 02/06/2015 N 07-04-06/5027).

- Other accounts payable for property and personal insurance, for claims, for amounts erroneously credited to the organization’s accounts, for rent, for license fees, for customs duties, for settlements with the principal and other types of debt not mentioned above. The specified types of accounts payable are reflected in the credit of account 76 “Settlements with various debtors and creditors.”

What accounting data is used when filling out line 1520 “Accounts payable”?

When filling out this line of the Balance Sheet, data on credit balances as of the reporting date is used (clauses 73, 74 of the Regulations on Accounting and Financial Reporting):

— on account 60 (in terms of short-term accounts payable);

- according to accounts 70, 71, 73;

— on account 69 (in terms of short-term accounts payable);

— on account 68 (in terms of short-term accounts payable);

— on account 62 (in terms of short-term accounts payable);

- according to the account 75, sub-account 75-2;

— on account 76 (in terms of short-term accounts payable).

According to the clarifications of the Ministry of Finance of Russia, when an organization receives payment, partial payment towards the organization's upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), accounts payable are reflected in the balance sheet as assessed minus the amount of VAT payable (paid) to the budget (Letter Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01).

Line 1520 “Accounts payable” = Credit balances in terms of short-term accounts payable on accounts 60.62. If an organization has accounts payable on accounts 62, 76 in the amount of the prepayment received, including VAT, then when determining the indicator of line 1520 it is necessary to reduce credit balances on these accounts for the corresponding VAT amounts (Letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01), 76,68,69,70,71,73, subaccount 75-2

Attention!

Attention!

Accounts payable expressed in foreign currency (including those payable in rubles), for reflection in the financial statements, are recalculated into rubles at the rate in effect on the reporting date (clauses 1, 5, 7, 8 PBU 3/2006).

The exception is accounts payable arising in connection with the receipt of an advance payment, prepayment or deposit. Such accounts payable are shown in the financial statements at the exchange rate on the date of receipt of funds (clauses 9, 10 of PBU 3/2006).

Organizations independently determine the detail of the indicator on line 1520 “Accounts payable”. For example, the balance sheet may separately contain information about the organization’s short-term accounts payable to suppliers and contractors, to buyers and customers for the amounts of advances received (prepayments), to the organization’s personnel, to the budget for the payment of taxes and fees, as well as to extra-budgetary funds, if such information is recognized by the organization as significant (paragraph 2 of clause 11 of PBU 4/99, clause 3 of Order of the Ministry of Finance of Russia N 66n, Letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01). The organization’s decision on whether an indicator is significant depends on the assessment of the indicator, its nature, and the specific circumstances of its occurrence. That is, when preparing financial statements, materiality is determined by a combination of qualitative and quantitative factors (Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01).

Indicators on line 1520 “Accounts payable” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year. If the indicator of line 1520 as of the reporting date is formed according to other rules, then the indicators as of December 31 of the previous year and as of December 31 of the year preceding the previous one must be adjusted as if they were determined according to the same rules as the indicator for reporting date. In other words, the comparability of comparative indicators must be ensured (paragraph 2, clause 10 of PBU 4/99).

The “Explanations” column provides an indication of the disclosure of this indicator. If an organization draws up Explanations to the Balance Sheet and the Statement of Financial Results according to the forms contained in the Example of Explanations given in Appendix No. 3 to Order of the Ministry of Finance of Russia No. 66n, then in the column “Explanations” on line 1520 “Accounts payable” tables 5.3 are indicated “ Availability and movement of accounts payable" and 5.4 "Overdue accounts payable", which disclose the indicators of line 1520 of the Balance Sheet.

Example of filling out line 1520 “Accounts payable”

Indicators for accounts 60, 70, 71, 76, 69, 68, 62, 75 (there is no credit balance for account 73): rub.

“1C: Salaries and personnel management 8”, ed. 3.0

To enter balances for mutual settlements with employees, in the “Payments” section, select the “Initial salary arrears” item. Balances should be entered at the end of the month preceding the start of the program. For example, if payroll calculation in “1C: Salary and Personnel Management 8”, ed. 3, has been maintained since January 2016, then in the “Month” attribute we select December 2015. To enter lines into the document, use the “Add” button. Select an employee in the line. In the “Amount” column, indicate the amount of debt at the beginning of the month. If at the beginning of the month there is an employee’s debt to the organization, then in the “Amount” column the debt is indicated with a minus. This amount will be displayed in red in the document.

What we reflect in line 1520 of the balance sheet: accounts payable

- Purpose of the article: reflection of information about accounts payable.

- Line number in the balance sheet: 1520.

- Account number according to the chart of accounts: Credit balance 60, 62, 68, 69, 70, 71, 73, 75, 76.

Accounts payable are the liabilities of an enterprise in the form of amounts reflected in the accounting accounts at the end of the reporting period. These may be advances received for which the company has not yet provided services or shipped goods. Or, on the contrary, the company was going to receive services, but did not pay the money.

What applies to the creditor

In addition, accounts payable may include:

- debts to suppliers for work, goods, services;

- advances received from buyers and customers;

- overpayment of taxes, insurance premiums, fees;

- unpaid wages to employees;

- duty to the accountable person;

- obligations to other creditors.

Accounts for accounting

To carry out payments to the creditor, the Chart of Accounts approved at the legislative level is used. In accounting, these types of debts accumulate in the following accounts:

How to write off accounts payable

When writing off overdue debts, non-operating income is used in tax accounting, since, in fact, the company made a profit without repaying its debts. Postings for write-off:

- Debit 60, 62, 70, 71, 76 Credit 91.1 “Other income” - the creditor for the counterparty is written off.

Note from the author! If the creditor sues the organization or signs a reconciliation report, the debt can be restored to the books.

The creditor may be written off after the expiration of the limitation period, which is determined by Art. 196 of the Civil Code of the Russian Federation, over 3 years. The onset of delay is considered to be the day of violation of the terms of the contract for payment or shipment of goods.

For example, Della LLC entered into an agreement with a contractor to perform repair work in the amount of 1,500,000 rubles. According to the terms of the agreement, the company must pay an advance of 40% of the cost of repairs, the balance must be paid within 5 working days after signing the certificate of completion of work.

The company paid an advance in the amount of:

- 1,500,000 * 40% = 600,000 rubles.

The unpaid balance was:

- 1,500,000 - 600,000 = 900,000 rubles.

The certificate of completion of work was signed on 01/30/2018, which means that the debt must be repaid by 02/07/2018. However, the company’s bank account did not have enough funds, so it paid only on February 16, 2018. The delay is calculated in calendar days. Payment to the creditor was delayed by 10 days.

Reflection of the creditor in the reporting

Drawing up a “Balance Sheet” report at the end of the financial year is the direct responsibility of each organization. The creditor in Form No. 1 is reflected in the liability side of the balance sheet in the following sections:

- "Short-term liabilities";

- "Long term duties".

How to take into account debt by maturity

The difference between the sections lies in the assessment of the timing of accounts payable. The company's debt for more than 12 months must arise in “Long-term liabilities”. Accordingly, if the creditor is less than or equal to 12 months, then it is shown in “Short-term liabilities”. Repayment periods are calculated according to the terms of agreements with creditors, with the exception of calculations:

- With a budget.

- With extra-budgetary funds.

- With staff.

Payment of taxes and insurance premiums is regulated by federal and regional legislation, depending on the type. Accumulation of tax liens can lead to bank account seizure and company bankruptcy.

As for settlements with staff, delays in wages entail financial and criminal liability. This is established by Federal Law No. 272-FZ and the Labor Code.

How to calculate the credit balance

Note from the author! Balances on credit accounts that are included in balance line 1520 can only be shown in detail. This balance meets the requirements of PBU 4/99 for reporting.

For example, at the end of the year a subject has debts on payments to the budget:

“1C: Salaries and personnel management 8”, ed. 2.5

In the “Setting up accounting parameters” form, on the “Salary payment” tab, there is a flag “Mutual settlements for salaries are carried out by month of accrual.” Mutual settlements are calculations of different types of payroll calculations. They are conducted in the context of months. This can be easily verified by analyzing the following accumulation registers:

- Accumulation register “Mutual settlements with employees of organizations.”

- Accumulation register “Salary per month of organizations”.

In them, each entry is tied to a specific month of accrual. That is, regardless of the state of the flag, the program always conducts mutual settlements in the context of salary calculation months.

The state of the flag determines the method of repaying the debts of the organization and employees.

If the flag is checked, then in order to retain the employee’s debts to the organization, it is necessary to use the “Debt Transfer” document to transfer all or part of the employee’s previously incurred debts to the month in which it is planned to repay this debt. To fill out the tabular part of the document, it is most convenient to use the “Fill in\By Debt” button. In this case, the program will automatically find all employees who have outstanding debts. In order to withhold arrears from an employee when paying a salary, it is necessary to accrue the salary for the month. Then it is necessary to generate a document “Salary payable to the organization”, which will pay off the employee’s debt to the organization.

In order to repay an organization’s debt to an employee, it is necessary to draw up the document “Salaries payable by organizations” in the current month, indicating in it the accrual month for which the debt is repaid (the month the debt was incurred).

If the flag is cleared, then in the current month the employee’s debt to the organization can be repaid only if he has received wages for that month. If the salary for the current month has been accrued, then the document “Salaries payable to the organization” with the “Salary” value set in the “Pay” attribute pays off both types of debt: the organization’s debt and the employee’s debt. If you set the value to “Debt”, then regardless of the presence of salary accrual for a given period, the document will only pay off the organization’s debt to the employee.

Decryption of line 1520

The line codes indicated in the financial statements are used when filling out documents that are sent for verification to the tax authorities. In this case, the numbers are indicated after the name of the line. In order to fill out the documents correctly and without violations, you need to know the decoding of line 1520 of the balance sheet. If you study the appendix to the order that regulates the completion of financial statements, you will see that under this code lies accounts payable. However, in addition to the name, it is also necessary to take into account which account balances are included in this column in order to fill it out correctly. Then it will be possible to prepare reports for sending to the relevant authorities.

How to fill line 1520

The group includes the following items that make up the meaning of this row. They relate to payments made, and debts can concern both organizations and individuals, for example, the company’s working personnel:

- All debts of contractors and suppliers cooperating with the organization.

- Available amounts on bills of exchange that must be paid.

- Debts to existing subsidiary organizations.

- Debts to employees regarding wages or other payments.

- Debts to extra-budgetary funds and budgetary organizations.

- Debts to the founders of this organization.

- Advances received by the company.

- Debts to other creditors not listed above.

When completed, balance line 1520 reflects the amount received from the following accounts, taking into account all payments that are due. The sum of all listed values must be indicated in the appropriate line when filling out the documentation:

- Settlements made with any contractors and suppliers cooperating with the organization.

- Settlements directly with customers or buyers in the process of providing services or selling certain goods.

- Payments of fees and taxes, in accordance with existing legislation that regulates the activities of the company.

- Calculations performed for insurance and social security.

- Payments to personnel - accrual for wages or other transactions.

- Transfer to accountable persons.

- Settlements with various founders of the organization.

- Payments to creditors providing borrowed funds to the organization.

If the organization has already received an advance payment as part of the performance of certain work or provision of services, then the accrued tax reduces the size of the credit balance reflected in line 1520. Also, the payable and receivable types of debt are indicated in detail and separately.

The first is in the liability, and the second is in the asset, so these debts are not balanced, even in a situation where a credit and debit balance arises for accounts with the same account. The procedure for drawing up specific debts to certain individuals or organizations may depend directly on the terms of the transaction. Usually it is equal to the specified contract price, but there may be other formation conditions.

Since the line relates to the section of short-term liabilities, when preparing documentation, only those balances that are considered short-term are taken into account, that is, they do not exceed one year in maturity immediately after the reporting date. If the account balance exceeds 12 months in total, then it is necessary to split it into two parts. One of them will be reflected directly in line 1520, and the second will go to line number 1450, which is known as long-term liabilities. This allows you to take into account all calculations when filling out accounting documentation.

Where are wages shown on the balance sheet?

Labor costs for production workers are a large category in the cost of manufacturing products, so special attention is paid to the issue of establishing the most rational form of payment, as well as maintaining or reducing the level of these costs. The issue of remuneration is important not only for management in terms of the costs of the enterprise, but also for its employees. For them, the level of wages received is of the highest interest.

In addition, when implementing an effectively working remuneration system, high motivation of employees is guaranteed to perform their functional tasks that meet both quantitative and qualitative indicators.

The amount of wages is determined depending on the position held, the category of the employee, his qualifications, type of unit, professional level and personal contribution of the employee to the accomplishment of assigned tasks.

Each enterprise has the right to apply its own remuneration system , that is, the procedure for calculating the amount of wages to be paid to employees in accordance with the work functions performed and the results of work, including the size of tariff rates, salaries (official salaries), additional payments and compensation allowances. In this case, the enterprise is obliged to record the time actually worked by each employee.

Labor legislation provides a number of guarantees to employees, including regarding wages.

For example, a minimum wage (minimum wage) is established, which cannot be lower than the subsistence level of the working population.

If an employee has fully worked the standard working hours during the period and fulfilled the labor standards, his monthly salary cannot be lower than the minimum wage.

Let us present the main blocks that are included in the remuneration of employees of an enterprise:

- tariff rate/official salary;

- compensation payments;

- incentive payments.

The tariff rate is a fixed amount of remuneration for an employee for fulfilling a standard of work of a certain complexity (qualification) per unit of time, without taking into account compensation, incentives and social payments (Article 129 of the Labor Code of the Russian Federation; hereinafter referred to as the Labor Code of the Russian Federation).

Salary is a fixed amount of remuneration.

What does the wage fund include?

The wage fund in the reporting includes the following subsections:

- monitoring labor productivity, ensuring its growth;

- control of labor discipline;

- monitoring the rational use of labor hours and compliance with production standards;

- finding ways to increase labor productivity;

- accurate calculation of the salary of each employee, its distribution among various cost areas;

- control of the correctness and timeliness of payments to company employees;

- control of payroll spending, etc.

The wage fund is the salary of employees, calculated taking into account:

- insurance premiums, including pension accruals - approximately 20%;

- personal income tax (NDFL) — 13%;

- contributions to health and social insurance funds - approx. 6%.

For example: an employee’s salary is 10 thousand rubles . It is necessary to add to this figure 20% for insurance premiums and pension contributions and 6% of the fund for health and social insurance. Thus, you need to budget 12,600 rubles .

8,700 rubles in his hands , since 13% will be deducted the 10 thousand to pay personal income tax . (The example does not take into account special tax regimes.

) The exact amounts of insurance contributions to state funds, monthly deadlines and responsibility for their violation are reflected in Federal Law No. 212 of July 24, 2009 (look for the edition with the latest changes and additions).

Basic forms of remuneration

There are two main forms of remuneration: time-based and piece-rate.

Time-based form of remuneration

Under this system, an employee’s wages are calculated based on the time actually worked and his tariff rate or official salary.

The time-based form of remuneration does not take into account the quantitative indicators of the activities of each employee.

Most often it is used to pay managers, administrative staff and specialists.

As for the main production workers, who have a direct influence on the quantity and quality of products produced, they are sometimes paid on a time-based basis.

This is due to three main reasons:

- ease of payroll calculation;

- it is impossible to determine time standards for remuneration or other quantitative measurement standards (part, product, specific operation or part of it, etc.);

- insufficiency of the quantitative standard for measuring labor.

For the main production workers, the time-based form of remuneration does not have the proper motivational component . After all, workers know that, regardless of the amount of work performed (products produced), they will receive their salary, prescribed in the staffing table (or the salary will be determined by multiplying the hours actually worked by the hourly tariff rate).

In this case, you need to motivate employees with other tools.

EXAMPLE 1

Source: https://bos-time.ru/buhgalteriya/zadolzhennost-po-zarplate-v-balanse-2.html