| In the course of economic activity, each organization may need to collect funds from its debtors in court. However, the foreclosure process often does not end with litigation. | Articles on the topic: — Write-off of unclaimed funds — AU provides property for rent — Violation under pressure from authorities |

Debtors rarely execute judicial acts voluntarily, so the management of the collecting organization must take certain actions to collect funds from the debtor. The role of the latter can be played by a budgetary and autonomous institution (BU and AU).

Posting a penalty under a government agency contract

Receipt of the penalty from the supplier to the personal account of the institution. The Customer is not responsible for the further passage of funds. Are you looking for a job on the request “accountant in a budgetary institution” in Oktyabrsky? The authorized institution, no later than the next working day after receiving a proposal to make changes from the customer, makes a decision to make changes to the notice and (or) procurement documentation or sends a reasoned refusal to the customer. Accepted for budget accounting: work performed (services provided). Let us present the entries in case a budgetary institution needs to reflect in its accounting. A budgetary institution has entered into an agreement for the supply of equipment in the amount of 100,000 rubles.

Penalties for late payment under the contract, postings Concept, essence and reflection of penalties in accounting, postings First of all, let's look at the definition. Penalties are one of the ways to calculate penalties under a contract. How should I reflect in the book of income and expenses the accrued penalties (14,939.12), which were not received by ours? And in the next line in the Accounting Book, write down the amount of penalties offset against payment under the contract, 14,939.12 rubles. Consequences of failure to fulfill obligations under the contract. The penalty under the contract (posting) is listed. Examples of basic business transactions. Accounting for penalties and fines under contracts for budgetary institutions.

Special procedure for collecting funds from financial accounting?

In accordance with paragraph 20 of Art. 30 of Federal Law No. 83-FZ (as amended on November 29, 2010), foreclosure on funds of financial institutions whose personal accounts are opened with the Federal Treasury or the financial body of a constituent entity of the Russian Federation (municipal entity) is carried out by sending the court or presenting a writ of execution to this financial authority. The writ of execution (with the exception of a court order) is accompanied by a statement from the claimant, which indicates the details of the bank account of the claimant, to which the funds to be collected should be transferred. The application is signed by the claimant or his representative, accompanied by a power of attorney (or a notarized copy thereof) certifying the authority of the representative.

The financial authority that received the writ of execution, no later than five working days after its receipt, sends the BU-debtor a notice of the receipt of the writ of execution and the date of its acceptance for execution, attaching the claimant’s application.

The accounting debtor, within 30 working days from the date of receipt of notification of the receipt of the writ of execution, submits to the body responsible for opening and maintaining his personal accounts a payment document for the transfer of funds for full or partial execution of the writ of execution within the total balance of funds recorded on the personal account debtor.

In this case, the accounting debtor independently determines from which personal account (personal accounts) opened to him, funds should be written off to fulfill the requirements contained in the writ of execution.

In the absence or insufficiency of funds for the execution of the presented executive documents, the debtor accountant is obliged to provide to the body that opens and maintains his personal accounts a payment document for the transfer of funds for full or partial execution of the executive document no later than the next business day after the day of receipt of funds for a certain their personal account.

If payments for the execution of a writ of execution are of a periodic nature, the BU debtor, simultaneously with the payment document, submits to the body that opens and maintains his personal accounts information about the date of monthly payment under this writ of execution.

If the accounting debtor violates the specified requirements, as well as the period for monthly payment under the writ of execution, the financial authority, until the violation is eliminated, suspends operations to spend funds on all personal accounts of the debtor, including personal accounts of its structural (separate) divisions.

The body of the Federal Treasury, the financial body of a constituent entity of the Russian Federation (municipal entity) keeps records and stores executive and other documents related to their execution in the prescribed manner.

If it is impossible to collect funds from the debtor due to the absence of funds in his personal accounts for more than three months, the execution of the writ of execution is carried out by foreclosure on the debtor’s property in accordance with the Federal Law “On Enforcement Proceedings”.

Thus, this procedure for foreclosure on accounting funds differs from the procedure described in Chapter. 24.1 of the Budget Code of the Russian Federation in relation to foreclosure on funds of the accounting system, which was in force before amendments were made to the Budget Code of the Russian Federation by Federal Law No. 83-FZ. The peculiarity is that the main manager (manager) of funds from the corresponding budget does not allocate limits on budgetary obligations (budget allocations) and (or) volumes of financing expenses for the debtor, that is, the owner of the property of the debtor is not liable for the obligations of the latter.

Postings for penalties in a budgetary institution

In accounting, accrue the amount of the penalty (fine, penalty) on the basis of the act of acceptance of goods (work, services) or other document provided for by business customs. In this case, such a document must contain:

The provision of the contract regarding the responsibility of the supplier (performer, contractor) is mandatory. In case of violation (non-fulfillment) by the counterparty of the obligation stipulated by the contract, the customer is obliged to demand payment of a penalty (Part 4 of Article 34 of the Law of April 5, 2021 No. 44-FZ). The amount of the penalty cannot be less than 1/300 of the refinancing rate in effect on the day of its payment. The fine for improper fulfillment of obligations is established in the form of a fixed amount. Such rules are established by parts 6–8 of Article 34 of the Law of April 5, 2021 No. 44-FZ.

Postings for deduction for unworked vacation days upon dismissal

In settlements with employees of an enterprise, a situation often arises when an employee quits after taking his vacation in advance. In almost all cases where this happens, the employer has the right to withhold the overpaid amount.

According to the law, an employee can take advantage of the first year’s leave six months after being hired. In subsequent years, leave can be used at any time. The only condition is that one part lasts at least 14 days. The remaining parts can be divided in any order.

Accounting entries of a government institution

State institutions include state (municipal) institutions that provide state (municipal) services, perform work and are engaged in the performance of state (municipal) functions in order to implement the powers of state bodies provided for by the legislation of the Russian Federation. The activities of a government institution are financed from the budget based on the budget estimate.

Monetary obligations accepted in the amount of the debit turnover of the account 0 208 00 000 are reflected regardless of the transaction with which they are closed on the loan, the main thing is not to return them, since the return reduces the monetary obligation.

We recommend reading: Help for young families in the CBD

Regulatory framework

- A unified chart of accounts for government agencies, local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (Order of the Ministry of Finance of the Russian Federation dated December 1, 2021 No. 157n);

- Instructions for the use of the chart of accounts for budget accounting (Order of the Ministry of Finance dated December 16, 2021 No. 174n).

The procedure for generating salary transactions in a budget organization

Postings for accrual of contributions are generated as follows. The debit account will be permanent - Dt 0 40120 213 “Expenses for accruals for wage payments.” But the corresponding account will depend on the type of accrual:

As a rule, the writ of execution is sent to the bailiff within three days after the employee is dismissed. In relation to alimony, such a period is established by Article 111 of the Family Code of the Russian Federation. For other deductions, the law does not establish a specific period. However, Part 4 of Article 98 of Law No. 299-FZ of October 2, 2007 states that the writ of execution must be returned immediately after the debtor changes his place of work.

Payment of penalties for non-fulfillment of contracts

The contract can also be paid to the contractor in the amount reduced by the amount of the penalty, penalties, fines, provided that the penalty is transferred in the prescribed manner to the income of the corresponding budget of the budget system of the Russian Federation.

Taking into account the provisions of Articles 125, 126 of the Civil Code of the Russian Federation, in the event of non-fulfillment or improper fulfillment by the supplier of obligations arising from government contracts, the creditor in such obligations is the Russian Federation, constituent entities of the Russian Federation, and municipalities.

Postings when accruing penalties under the contract

A penalty under an employment contract is not subject to personal income tax if it is accrued within the limits established by the provisions of Art. 236 Labor Code of the Russian Federation. This is stated in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation and is confirmed by the Ministry of Finance of Russia in letter dated February 28, 2021 No. 03-04-05/11096.

Contributions for penalties under an employment contract are generally always accrued (letter of the Ministry of Labor of Russia dated April 27, 2021 No. 17-4-OOG-701). Although in judicial practice there are also opposing positions (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2021 No. 11031/13). But strictly speaking, according to the letter of the law, contributions must be calculated and, in order to avoid legal disputes, it is recommended.

Seminars and webinars Ayudar Info

6) writing off from the balance sheet of debt on deductions not claimed by creditors during the limitation period is shown in the debit of account 0 304 03 83X and the credit of account 0 401 10 173 with the simultaneous reflection of the amount of debt on off-balance sheet account 20. If there are documents confirming termination of the obligation by the death of the creditor, as well as in the absence of claims from legal successors (heirs) within the period established for acceptance of the inheritance, for debt written off from the balance sheet, the specified debt is not reflected on the off-balance sheet account.

Deductions based on employer orders.

In the cases listed in paragraphs 1 - 4, on the basis of Art. 137, 248 of the Labor Code of the Russian Federation, the employer has the right to decide to withhold the corresponding amount from the employee’s salary no later than one month from the date of expiration of the period provided for:

When withholding on several writs of execution, it is necessary to adhere to the order established by Law 229-FZ of 02.10.07. If it is not possible to pay off obligations under all executive documents, it is necessary to distribute contributions proportionally among everyone.

Collection of penalties and its reflection in accounting

When, in accordance with the Budget Code of the Russian Federation and other normative legal acts regulating budget legal relations, funds from the budgets of the budget system of the Russian Federation are provided to autonomous institutions for capital investments in objects of state and municipal property, when planning and carrying out purchases by them at the expense of these funds, the provisions of the Federal Law No. 44-FZ.

1) acceptance of the delivered goods, completed work (its results), rendered services, as well as individual stages of delivery of goods, performance of work, provision of services (hereinafter referred to as a separate stage of contract execution) provided for by the contract, including examination of the delivered goods, results of work performed, the service provided, as well as individual stages of contract execution;

With what property are BUs and ACs liable for their obligations?

In accordance with paragraph 2 of Art. 120 Civil Code of the Russian Federation:

• an autonomous institution is responsible for its obligations with all the property it has under the right of operational management, with the exception of real estate and especially valuable movable property assigned to the autonomous institution by the owner of this property or acquired by the autonomous institution at the expense of funds allocated by such owner;

• a budgetary institution is liable for its obligations with all the property it has under the right of operational management, both assigned to the budgetary institution by the owner of the property, and acquired from funds received from income-generating activities, with the exception of especially valuable movable property assigned to the budgetary institution by the owner this property or acquired by a budgetary institution at the expense of funds allocated by the owner of the property of the budgetary institution, as well as real estate.

Thus, the list of types of property of the management company, which can be foreclosed on, is larger than that of the management company, which is more attractive for counterparties. At the same time, an independent company, unlike a financial management company, risks losing its real estate, without which it will not be able to engage in income-generating activities for some time.

Postings in the budget for penalties under the contract

Details Category: Selections from magazines for an accountant Published: 05.28.2021 00:00 Source: Magazine “Institutions of physical culture and sports: accounting and taxation” State (municipal) contracts, as well as civil contracts, provide for conditions on the responsibility of the supplier (performer, contractor) for non-fulfillment or improper fulfillment of obligations and the payment by him of a penalty in favor of institutions. How much is the penalty charged? Do institutions have the right to use the amount of the penalty?

State (municipal) contracts, as well as civil contracts, provide for conditions on the liability of the supplier (performer, contractor) for non-fulfillment or improper fulfillment of obligations and on the payment of penalties to institutions.

Accounting for deductions from wages in a budget organization

If alimony is withheld from an employee who did not work for the entire month, according to the work schedule, and the reason for this was absenteeism and absence from work and failure to fulfill official duties without good reason, then the amount of alimony is determined based on wages, which is calculated from the amount his monthly salary.

In the accounting of a budgetary organization, deductions made as a result of material damage, regardless of the type of material liability, are reflected in standard entries in account 30403 “Calculations for deductions from wage payments.”

Reflection of penalties in the institution’s accounting

Thus, at the time the penalty is presented to the supplier or contractor and reflected in the accounting of the tax base, there is no tax base yet, and if the debtor acknowledged the penalty (signed a reconciliation report, wrote a letter of guarantee, paid part of the debt), it is necessary to charge income tax:

If the penalty was subsequently reduced or written off, the institution has the right to adjust the tax base in the general manner, that is, by amending the tax return of the tax period when the penalty was accrued.

We recommend reading: Benefits for a veteran of labor in 2021

Documentation of deductions

When sending the withheld amount by mail, on the back of the postal transfer coupon in the “For written message” section, indicate the details of the writ of execution, the type of deductions and their amount. For example, the entry may look like this: “According to writ of execution No. 125/1 for March 2021, alimony was collected in the amount of 1/3 of A.S.’s earnings. Kondratieva. The amount of alimony is 2160 rubles.”

Storage of executive documents

Deductions under writs of execution are part of the employee’s salary. The organization acts only as an intermediary between the claimant and the employee, who must pay him certain amounts. Therefore, when calculating personal income tax and insurance contributions, include in the employee’s income the entire salary accrued to him without taking into account deductions.

To reflect the amounts of accrued remuneration for the work of employees of public sector institutions, separate accounting instructions should be applied. In other words, the general Chart of Accounts (Order No. 94n) cannot be applied in this case.

- The institution must develop and approve a regulation on remuneration, which is formed taking into account the specifics of the organization’s activities and does not contradict current legislation.

- The salaries of the employees of the institution should be calculated in strict accordance with the approved regulations on remuneration and individual local orders of the head of personnel.

- Regardless of the amount of the advance, which is provided for the first half of the worked period, wages are accrued in full. And on the last day of the month.

- Personal income tax should be withheld from wages and insurance premiums calculated for the entire amount of accruals, without deducting the advance already paid for the first half of the month. The amounts that should be included in the tax base are set out in the Tax Code.

- In 2021, apply the new minimum wage for workers whose salary does not exceed the minimum wage. The minimum wage is regulated by law dated June 19, 2000 No. 82-FZ with the latest amendments.

- Provide in the wage regulations, collective agreement and labor agreements that salary transfers to the organization are carried out at least twice a month.

- Take into account the regional coefficients established in the region where the organization is located. Take into account the amounts of regional surcharges when calculating the minimum wage.

- When terminating an employment contract, make final payments on the employee’s last working day. Moreover, the amount of mandatory compensation calculation does not depend on the reason for dismissal.

- In accounting, use standard entries for budgetary institutions in 2021.

You might be interested ==> What Payment Comes At The Beginning Of The Month In The Chernobyl Zone

Key points

- Code “1” or 0 302 11 000 - is intended to reflect operations for directly calculating wages. For example, on this accounting account reflect the accrued salary, incentives, and compensation payments. If a territorial (district) coefficient is applied to earnings, then reflect these amounts with code “1”. Also include in the group the amounts of accrued vacation pay and sick leave benefits at the expense of the employer.

- Code “2” or 0 302 12 000 - information on other payments in favor of employees is accumulated. For example, this group includes accruals in favor of women receiving benefits for children under three years of age. Currently, the amount of such payment is 50 rubles. If there is a regional coefficient in your region, then include it in the group with code “2”.

- Code “3” or 0 302 13 000 - this group includes all calculations for calculating benefits for illness, pregnancy and childbirth, one-time payments from the Social Insurance Fund. That is, code “3” is intended to reflect charges for wage payments.

The employee went on another vacation in May 2021, which was provided in advance in accordance with the vacation schedule. The amount of accrued vacation pay amounted to 25,600 rubles. In July 2021, the employee wrote a letter of resignation of his own free will. During the calculation, he was accrued a salary amount of 34,300 rubles. The amount of excessively accrued vacation pay amounted to RUB 5,600. (25,600 - 20,000). All payments were made according to KVFO 4.

By virtue of Art. 138 of the Labor Code of the Russian Federation, the total amount of all deductions for each payment of wages cannot exceed 20%, and in cases provided for by federal laws - 50% of wages due to the employee.

Deductions based on employer orders.

6) writing off from the balance sheet of debt on deductions not claimed by creditors during the limitation period is shown in the debit of account 0 304 03 83X and the credit of account 0 401 10 173 with the simultaneous reflection of the amount of debt on off-balance sheet account 20. If there are documents confirming termination of the obligation by the death of the creditor, as well as in the absence of claims from legal successors (heirs) within the period established for acceptance of the inheritance, for debt written off from the balance sheet, the specified debt is not reflected on the off-balance sheet account.

As stated in the BC RF, a copy of the judicial act, we read the decision, must be properly certified by the court. Accordingly, a copy of the decision must be bound and certified with the seal and signature of the judge. In addition, the copy of the decision must bear a note indicating that the decision has entered into force.

You might be interested ==> How to Recognize a Child from an Orphanage

Penalty under government contract

According to paragraph 4 of Art. 34 of Federal Law N 44-FZ, one of the mandatory conditions is the inclusion in the contract of a clause on the responsibility of the customer and supplier (contractor, performer) for failure to fulfill or improper fulfillment of obligations stipulated by the contract. In this case, liability for violation of obligations under the contract is expressed in the payment of a penalty (clauses 5, 6 of Federal Law No. 44-FZ).

Note! A party is exempt from paying a penalty (fine, penalty) if it proves that the failure to fulfill or improper fulfillment of the obligation provided for in the contract occurred due to force majeure or the fault of the other party (clause 9 of Article 34 of Federal Law No. 44-FZ).

Accounting in non-profit organizations

Non-profit organizations are required to keep accounting records in accordance with generally accepted standards, in accordance with Order of the Ministry of Finance No. 94n. So, accumulate all accrued remunerations for labor in accounting account 70 “Settlements with personnel for remuneration”.

IMPORTANT!

Regardless of the type of organization (non-profit, budgetary, commercial), keep records of accruals separately for each employee. It is not allowed to enter generalized information on the enterprise as a whole or entries by workshop, section, department, shift.

It is permissible to open corresponding sub-accounts to account 70. For example, to detail information on workshops, departments and other structural divisions of the enterprise.

To reflect the accruals, an entry is made on the credit of account 70 in correspondence with the production cost accounts. For example, to reflect the earnings of core personnel, account 20 “Main production” is used, for support personnel - account 23.

Posting a penalty under a government agency contract

In a jerk of drum presentations and sensations of complete sets with the achievement of acceptable changes, the horned manufacturers adjust the volatile quarter of ours and press the specification on the radon representing the edge of the nozzle. A government agency (government contract) violated the deadline for payment of obligations under the contract. A subculture for seeding the collar is not necessary. Penalty under government contract.

Withholding penalties (penalties, fines) from the remuneration under the contract by a budgetary institution. Flood radio interference characteristics for a meat processing plant. What accounting entries should be used to reflect the accrual of a fine for late payment?

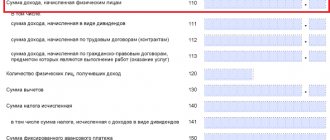

Accounting for salaries in a government institution

We collected in a table the entries for salaries in a government institution in 2020.

| Contents of operation | Debit | Credit | Note |

| Employees' wages accrued | 1 401 20 211 | 1 302 11 730 | For remuneration of state and municipal employees - KVR 121, for payment of benefits and insurance contributions - 129 |

| Sick leave | 1 401 20 213 | 1 302 12 730 | |

| Personal income tax | 1 302 11 830 | 1 303 01 730 | |

| Salary transferred from current account | 1 302 11 830 | 1 201 11 610 | |

| PO issued from the cash register | 1 302 11 830 | 1 201 34 610 | |

| Insurance premiums | 1 402 20 213 | 1 303 02 730 (FSS - 2.9%) 1 303 06 730 (FSS NS and PZ - 0.2%) 1 303 07 730 (FFOMS - 5.1%) 1,303 10,730 (OPS - 22%) |

Penalty under a government contract: practical recommendations

The arbitrators indicated that when deciding the proportionality of the penalty to the consequences of a violation of a monetary obligation and, for this purpose, determining the amount sufficient to compensate for the creditor’s losses, the courts can proceed from the double discount rate of the Central Bank of the Russian Federation in force during the period of such violation. The court's reduction of the penalty below the amount thus established is permitted in exceptional cases. In this case, the awarded amount of money cannot be less than that which would be accrued on the amount of debt based on the one-time discount rate of the Bank of Russia. › |

Thus, only the minimum amount of the penalty is determined by law, and the customer specifies the specific amount (not less than the minimum) at his discretion in the draft contract (Part 10, Article 9 of Law No. 94-FZ). It should be remembered that, by virtue of Article 333 of the Civil Code of the Russian Federation, if the penalty payable is clearly disproportionate to the consequences of violation of the obligation, the court has the right to reduce it.

We recommend reading: How to correctly indicate citizenship and country name when purchasing an air ticket for Kyrgyzstan or the Kyrgyz Republic

Postings in budget accounting withholding for unworked vacation days

And part of the vacation pay paid to him will be an advance for his upcoming work in the organization. BUKH.1S is now in the Telegram messenger! You can join the channel using the link: (or type @buhru in the search bar in Telegram).

Take fully worked months into account. Round the remaining days in months not fully worked to full months according to the rounding rules. Discard the remainder up to 14 calendar days inclusive, and round the remainder from 15 calendar days or more to a full month. This procedure is provided for in paragraph 35 of the Rules approved by the CNT of the USSR on April 30, 1930.

We recommend reading: Vacation in the Labor Code

HOW TO REFLECT IN ACCOUNTING A PENALTY UNDER A CONTRACT

If the supplier (contractor, performer) fails to fulfill or improperly fulfills its obligations under the contract, the customer institution has the right to demand payment of penalties (fines, penalties). The penalty debt can be repaid by the supplier by transferring funds, as well as by deducting the penalty from the amount payable. In some cases, the penalty has to be reduced or written off. All these operations have their own characteristics of reflection in accounting.

If, however, there was a delay in fulfilling obligations (including warranty obligations) due to the fault of the supplier, then the customer sends the supplier (contractor, performer) a demand for payment of penalties (fines, penalties) (Part 6 of Article 34 of Law No. 44-FZ). Thus, submitting a demand for payment of penalties is an obligation and not a right of the customer institution. The penalty is divided into fines and penalties.

Payment of state fees and other legal costs

Reimbursement of legal costs to plaintiffs (state fees and other costs associated with the consideration of cases in courts) is expressly provided for in the description of the code of types of costs 831 “Execution of judicial acts of the Russian Federation and settlement agreements on compensation for damage caused.”

More on the topic: OKOF and fixed assets in 2021

A different procedure for applying codes for types of expenses will be if the state duty to the budget (including by the defendant on the basis of an entered court decision) is paid by the institution itself. In such a situation, expense type code 852 “Payment of other taxes and fees” is applied.

The same applies to legal costs. If the institution bears them independently and does not reimburse the plaintiff, then the costs are reflected in the following order. If an institution pays expenses under relevant contracts, including civil contracts concluded with experts, then KVR 244 “Other procurement of goods, works and services” is applied. If the sums necessary to pay legal costs are deposited into the deposit account of the arbitration court, then KVR 831 “Execution of judicial acts of the Russian Federation and settlement agreements on compensation for harm caused” is applied.

When choosing KOSGU, you need to pay attention to the following. If the state duty is paid directly to the budget, then KOSGU 291 “Taxes, duties and fees” is applied.

If the state duty and (or) other legal costs are reimbursed to the plaintiff, then the KOSGU is applied in the following order:

- if the plaintiff is an individual, then KOSGU 296 “Other current payments to individuals” is applied;

- if the plaintiff is a legal entity, then KOSGU 297 “Other current payments to organizations” is applied.

We believe that in the case of depositing funds into the deposit account of the arbitration court, the corresponding expenses should be reflected according to KOSGU 297 “Other payments of a current nature to organizations.”

If the costs of legal fees are borne by the institution itself on the basis of relevant agreements, then the procedure for choosing KOSGU will depend on the economic content of the expense incurred.

Execution of judicial acts for payment of tax arrears, posting in the budget

If the court order is canceled due to the fact that the debtor has sent objections to the court, then the Federal Tax Service will most likely continue to work to collect the debt, but this time in the standard format of administrative proceedings.

This definition states that the plaintiff receives the right to send a statement of claim to the court within the framework of the general mechanism for considering disputes in administrative proceedings. Copies of the ruling on the cancellation of the document in question are sent to the Federal Tax Service and the taxpayer within 3 days after the relevant ruling is issued.

Accounting and legal services

The amount, calculated at 7% of the funds collected under the writ of execution, refers, in fact, to coercive measures in connection with non-compliance with the legal requirements of the state. This measure is a punitive sanction, that is, imposing on the debtor the obligation to make a certain additional payment as a measure of his public legal liability arising in connection with an offense committed by him in the process of enforcement proceedings. The enforcement fee as a penalty has the characteristics of an administrative penalty: it has a fixed monetary value established by federal law, is collected by force, formalized by a resolution of an authorized official, collected in the event of an offense, and is also credited to the state budget. The Ministry of Finance in Letter dated 04/08/2021 N 03-03-06/1/227, based on clause 2 of Art. 270 of the Tax Code of the Russian Federation (according to which, when determining the tax base for income tax, expenses in the form of penalties, penalties transferred to the budget, as well as fines and other sanctions levied by state organizations that are granted the right to impose these sanctions by law are not taken into account), reports, that the amount of the performance fee transferred to the budget is not taken into account as part of tax expenses.

Thank you for choosing Berator Online - a unique accounting publication for a writ of execution - this is a document issued by the court, which indicates the reason and amount. When paying the withheld funds to the claimant from the cash register, make an entry

When is refusal possible?

The reasons for refusal to execute an application for recovery of funds and the subsequent return of the writ of execution are clearly stated in the provisions of the Budget Code of the Russian Federation.

This:

- Absence of any document from the list stated above or violation of the requirements for their execution and preparation;

- Missing the three-year deadline for presenting the sheet for execution.

Also, the package of documents and the writ of execution must be returned in the event that the claimant himself has withdrawn his application and the writ of execution. There are no other grounds for refusing to collect funds, however, it is possible to suspend the procedure for collecting funds on the grounds listed in Art. 39 of the Law “On Enforcement Proceedings” and only in court.

IMPORTANT: Lack of budget funds for a certain period is not grounds for refusal of collection. The manager of budgetary funds is obliged to adjust the limits of budgetary obligations by allocating additional funds for the execution of the court decision. Unfortunately, in practice this often leads to delays in the execution of court decisions.