Legal advice › Road accident, traffic police

Send

- Statute of limitations for fines and conditions for paying traffic police debts

- Finding debt on fines and appealing the decision

Payment of a traffic fine is mandatory for all violators. Traffic rules are a set of laws that regulate legal relations within the boundaries of the road route. All participants in road traffic in 2021 are required to comply with requirements and standards. Sometimes drivers may not intentionally or deliberately violate traffic rules. Such actions are illegal and punishable by law. Most often, traffic police officers issue a protocol indicating the amount of the fine and the reasons why the penalty was applied.

All citizens are required to pay the accrued amount, because non-payment threatens with serious consequences, aggravation of the situation and consideration of the case in court. Rules of conduct on the road change and are supplemented quite often, so drivers may not have time to keep track of all the innovations.

To always act within the law and have the broadest possible understanding of your rights and responsibilities as a road user, you need to consult with an experienced traffic law lawyer.

Qualified expert assistance is available online today. Remote legal services via the network save citizens time, effort and money.

Statute of limitations for fines and conditions for paying traffic police debts

After the imposition of penalties, the driver has the opportunity to refute the accusation within 10 days. If no claim is received during this period, then the payment deadline begins from the 11th day. In 2021, citizens of the Russian Federation are required to pay administrative penalties within 60 days. How much money will need to be allocated to pay the fine depends on the degree of the offense and the driver’s further actions. The traffic police website has a table of fines in which you can check the amount and category of violation. Obtaining information via the Internet greatly simplifies the life of users.

If within two months the driver does not pay the traffic fine, then over the next two months a new resolution will come into force, according to which the amount of the fine will double. In addition to the penalty of doubling the amount of debt, refusal to pay in 2021 is punishable by administrative arrest for 15 days or 50 hours of forced labor.

Also, starting from 2021, a rule has come into force on the basis of which debtors of traffic police fines will not be able to leave the country. The travel ban is valid until the debt is repaid.

If the judge or commission dealing with the issue has information that the citizen is not paying the debt, he creates a second copy of the resolution and transfers it to the bailiff service. This government agency initiates enforcement proceedings and seeks to forcibly collect a fine from the debtor. One of the methods of SSP is the seizure or seizure of property as payment. If the driver does not voluntarily pay the fine after the ruling is issued within 5 days, then he will be charged a fee of 7% of the debt amount.

The statute of limitations for traffic police fines is two years. If during this period of time funds have not been collected from the driver to pay the debt, then the protocol will be cancelled. Any court document has a statute of limitations, but the waiting period can vary from six months to 10 years. A ban on leaving the country is used as a punitive measure against citizens whose debt amounts to more than 10 thousand rubles.

For more information about all penalties for overdue fines, and if you do not agree with the protocols issued or on other controversial issues, you can seek free legal advice by phone from professional auto lawyers.

Calculation and payment of traffic police fines at a discount in “1C:BGU 8” (Part 1)

Calculation and payment of traffic police fines at a discount using “1C:BGU 8” for budgetary and autonomous institutions

1. Accrual and acceptance of monetary obligations for a traffic police fine

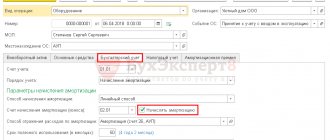

1.1. To calculate and accept monetary obligations for a traffic police fine, use the Transaction document from the Accounting -> Enter transaction manually menu.

1.2. Since the traffic police fine is calculated in the program by the Operation document, it is more convenient to enter correspondence regarding the acceptance of a monetary obligation in the same document in which the accrual was made.

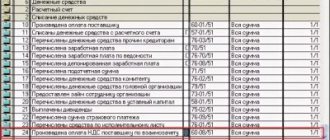

To correctly reflect transactions and generate primary accounting documents, it is necessary to take into account: Reflection of the transaction for calculating a traffic police fine (Debit account: 401.20, Credit account: 303.05) and Reflection of the transaction for accepting a monetary obligation to pay a traffic police fine (Debit account: 502.11, Credit account: 502.12 )

1.3. After posting the Transaction document, click the Print button or click the corresponding button to print the Accounting Certificate using f. 0504833.

2. Payment of a fine to the traffic police

2.1. To reflect the payment of a fine to the traffic police, use the document Application for cash expense from the Treasury/Bank menu.

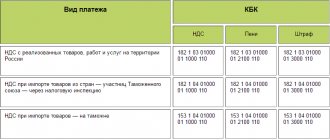

2.2. To correctly reflect transactions and generate primary accounting documents, it is necessary to take into account: Operation: Taxes and fees included in expenses, Loan account 201.11, Loan account: 18.01.

On the Application tab, fill in the data necessary to generate a printed form of the document. In the Tax, fee, other payment details, you should indicate the type of payment - select from the “Taxes and payments of the institution” directory, which opens by clicking the selection button. When selecting a payment, the payee and his account are filled in.

2.3. The Tax Payment tab is automatically filled in with the values from the tax card.

2.4. The Account tab is automatically filled in with the values from the account card selected in the document header; the values can be changed if necessary.

2.5. On the Explanation tab: the data given in the tabular section - KFO, Personal Account Section, KPS, KEC and Amount, are used to automatically fill in the details of the Accounting Records tab, generate a request for cash expenses for transfer to the treasury in electronic form, and generate transactions.

2.6. The Accounting entries tab is filled in automatically with the values specified in the document header, on the Application and Explanation tabs.

2.7. After receiving an extract from your personal account, on the Execution tab, you must enable the Paid checkbox and indicate the date of the extract.

2.8. After saving the document Request for cash expense, you can click the Print button to print the Request for cash expense.

2.9. After posting the document Request for Cash Expenses, you can click the Print button to print the Accounting Certificate using f. 0504833.

3. Adjustment of accrued expenses and cash liability by the discount amount

3.1. To adjust the accrued expenses for paying a traffic fine, use the Transaction document from the Accounting -> Enter transaction manually menu.

3.2. To correctly reflect the transaction and generate primary accounting documents, it is necessary to take into account: Reflection of the adjustment of accrued expenses for paying the traffic police fine (Debit account: 303.05, Credit account: 401.20, adjustment amount) and Reflection of the adjustment of the accepted monetary obligation (Debit account: 502.11, Credit account: 502.12 , the amount of adjustment of the monetary obligation by the discount amount with a “-“ sign).

3.3. After posting the Transaction document, click the Print button or click the corresponding button to print the Accounting Certificate using f. 0504833.

Calculation and payment of traffic police fines at a discount using “1C:BGU 8” for government agencies

1. Accrual and acceptance of monetary obligations for a traffic police fine

1.1. To calculate and accept monetary obligations for a traffic police fine, use the Transaction document from the Accounting -> Enter transaction manually menu.

1.2. Since the traffic police fine is calculated in the program by the Transaction (accounting) document, it is more convenient to enter correspondence regarding the acceptance of a monetary obligation in the same document in which the accrual is reflected.

To correctly reflect transactions and generate primary accounting documents, it is necessary to take into account the Reflection of the transaction for calculating a traffic police fine (Debit account: 401.20, Credit account: 303.05) and Reflection of the transaction for accepting a monetary obligation to pay a traffic fine (Debit account: 502.11, Credit account: 502.12)

1.3. After posting the Transaction document, click the Print button or click the corresponding button to print the Accounting Certificate using f. 0504833.

2. Payment of a fine to the traffic police

2.1. To reflect the payment of a fine to the traffic police, use the document Application for cash expense from the Treasury/Bank menu.

2.2. To correctly reflect transactions and generate primary accounting documents, it is necessary to take into account: Operation: Taxes and fees included in expenses and Loan account: 304.05.

On the Application tab, fill in the data necessary to generate a printed form of the document. In the Tax, fee, other payment details, you should indicate the type of payment - select from the “Taxes and payments of the institution” directory, which opens by clicking the selection button. When selecting a payment, the payee and his account are filled in.

2.3. The Tax Payment tab is automatically filled in with the values specified in the tax card.

2.4. The Account tab is automatically filled in with the values from the account card selected in the document header; the values can be changed if necessary.

2.5. On the Explanation tab: the data given in the tabular section - KFO, Personal Account Section, KPS, KEC and Amount, are used to automatically fill in the details of the Accounting Records tab, generate a request for cash expenses for transfer to the treasury in electronic form, and generate transactions.

2.6. The Accounting entries tab is filled in automatically with the values specified in the document header, on the Application and Explanation tabs.

2.7. After receiving an extract from your personal account, on the Execution tab, you must enable the Paid checkbox and indicate the date of the extract.

2.8. After saving the document Request for cash expense, you can click the Print button to print the Request for cash expense.

2.9. After posting the document Request for Cash Expenses, you can click the Print button to print the Accounting Certificate using f. 0504833.

3. Adjustment of accrued expenses and cash liability by the discount amount

3.1. To adjust the accrued expenses for paying the traffic police fine, use the Transaction (accounting) document from the Accounting -> Enter transaction manually menu.

3.2. To correctly reflect the transaction and generate primary accounting documents, it is necessary to take into account the Reflection of the adjustment of accrued expenses for paying the traffic police fine (Debit account: 303.05, Credit account: 401.20, adjustment amount) and Reflection of the adjustment of the accepted monetary obligation (Debit account: 502.11, Credit account: 502.12, the amount of adjustment of the monetary obligation by the discount amount with a “-“ sign).

3.3. After posting the Transaction document, click the Print button or click the corresponding button to print the Accounting Certificate using f. 0504833

Finding debt on fines and appealing the decision

In order to prepare in advance for a trip abroad and find out about the presence of debts on fines, you need to obtain reliable information.

This can be done in person at the traffic police department, as well as via the Internet. Online checking of fines in 2021 is carried out through the official portal of the State Service or on the electronic resource of the State Traffic Safety Inspectorate. In order to conduct an inspection, there is no need to create a special commission. It is important for the applicant to have information about the registration number of the driver's license and the license plate number of the car. You need to enter the specified parameters in a special electronic field and within a few seconds the system will process the request and also provide an answer.

Online methods of debt checking are in great demand and popularity in 2021. The methods have also proven their effectiveness, safety and reliability.

Also, through the State Services portal, you can find out about debts in other areas, apply for paperwork or the issuance of a new driver’s license. It is extremely convenient that today it is possible to pay fines and debts via the Internet. It is important to understand that the traffic police database is not updated immediately, so it is better to print out a payment receipt and carry it with you for a while.

In 2021, failure to pay fines received as a result of traffic violations will result in serious administrative liability. It is planned that penalties for drivers will be tightened.

If a citizen finds out about the debt online or in other ways, but does not agree with it, he can file a complaint with the court and insist on the creation of a commission that will familiarize itself with the situation and make a fair decision. To defend your rights in court, you need to enlist the support of a professional auto lawyer. Only a specialist will be able to competently build a case and argue your requirements based on the legal framework of the country. Experts will also undertake the preparation and maintenance of documentation and provide free legal advice over the phone.

Save

Save

Save

Similar articles

Traceological examination in case of an accident

Penalty for crossing the stop line

Payment of traffic fines

Parking in a disabled spot: fine amount

DO YOU NEED FREE LAWYER CONSULTATION?