What tax benefits can labor veterans receive?

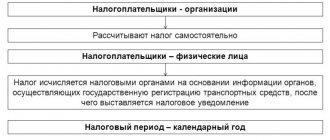

Tax benefits are established by federal and regional legislation and are provided to pensioners in accordance with their status.

Some categories of social assistance from the state are available to all citizens who have reached retirement age, others - only to a certain category: veterans of labor, combat or military service.

Tax benefits are provided through:

- Tax deductions;

- Significant reduction in the rate on tax obligations;

- Complete exemption from the obligation to pay tax;

- Reducing the final tax amount;

- Use of other forms of preferential assistance to veterans.

Benefits for veterans are provided on the basis of the Federal Law “On Veterans” No. 5-FZ, adopted on January 12, 1995.

Federal legislation does not establish transport tax benefits for combat veterans or other categories of veterans.

Federal legislation does not establish any benefits for veterans or labor in land taxes. Regional authorities retain the right to apply additional benefits to this category of citizens.

All-Russian laws establish the minimum cadastral value of a land plot at 10 thousand rubles, on which taxes are not paid at all.

If a veteran has a plot with a cadastral value of 10 thousand rubles or less, then he does not have to pay tax.

Regional authorities have the right to increase the preferential value of a land plot to allow citizens to avoid paying additional taxes, but they cannot reduce the tax-free value of a plot.

Moreover, the tax on a land plot is paid taking into account the deduction of a tax-free amount: if the cost of the land is 50 thousand rubles, then 40 thousand will be taxed, since a benefit is deducted from the total cadastral value.

Federal legislation establishes only general norms for the application of benefits to various categories of citizens; usually all provisions are spelled out in precise form in the legislative acts of the constituent entities.

In Moscow, veterans have the following benefits:

- The right to free travel on public transport within the city;

- Reimbursement of half the amount of expenses for mobile communications;

- A discount of 50% on utility bills, if the pensioner does not exceed the standards; if they are exceeded, the discount is applied only to the amount of the standards;

- The right to free travel on suburban railway transport;

- The right to receive a monthly payment in the amount of 247 rubles;

- Free treatment in a sanatorium if there are medical indications.

In the Moscow region, benefits for veterans are almost the same.

\n

\n Labor veteran certificates give:\n

\n

- \n

- men with working experience of 40 years or more, women - from 35, provided that they worked as children during the Great Patriotic War;

- recipients of orders and medals of the USSR and the Russian Federation, provided that their work experience is at least 25 years for men and 20 years for women.

\n

\n

\n

\nAlso, veteran status can be given at the regional level, but in this case it will only be valid in the territory of a specific region or region.\n

\n\n

\n

\nVeterans of labor pay land tax like other land owners. There are no exceptions for them in federal law. Regions can assign benefits, but they also have no concessions for veterans, but there are reliefs for pensioners.\n

\n

\nFederal benefit for pensioners.

A labor veteran is usually a pensioner. Therefore, starting from 2021, he may not pay tax on part of the plot - 600 sq. m. m. If the plot is exactly 6 acres or less, there will be no tax. If the land is, for example, 10 acres, you will only have to pay from 4.\n

\n

\nFull tax exemption - in certain regions.

Labor veterans are not mentioned in regional laws on land tax benefits. But, as a rule, WWII veterans, heroes and holders of orders can avoid paying the tax in full. In several regions, all pensioners are exempt from tax, for example, in the Sverdlovsk region and Krasnodar region.\n

\n\n

\n

\nThe tax office must make a decision within a month. After this, you will be sent a notification with a smaller amount; you do not need to ask for the benefit again next year.\n

\n\n\n

\n In this case, contact the higher authority. If you wrote to the interdistrict tax office, go and file a complaint with the city tax office.\n

\n

The procedure for exemption from land tax

- companies that are part of the penal system;

- control center, which is located in Skolkovo;

- institutions that are organizations of people with disabilities;

- public organizations that employ more than 80% of people with disabilities, and the land must be used to carry out activities provided for by the company’s charter;

- institutions that are engaged in the production and sale of traditional arts and crafts, the activity must be core for approval;

- an organization that is recognized as a resident of a special economic zone;

- a company on whose land plots roads are located;

- religious institutions, but only if the land is used for charitable purposes or exclusively for its intended purpose;

- enterprises engaged in legal proceedings and located within the special economic zone;

- entities performing management functions are also exempt from paying tax.

We recommend reading: Amount of compensation for a disabled child for not attending kindergarten

All land owners are required to pay land tax. It does not matter what status the payer has. Individuals and legal entities who own a plot of land on the basis of lifelong ownership or perpetual exploitation rights are required to contribute funds to the local budget. The tax must be paid annually.

Tax benefits for labor and combat veterans in 2021

Labor veteran certificates give:

- men with working experience of 40 years or more, women - from 35, provided that they worked as children during the Great Patriotic War;

- recipients of orders and medals of the USSR and the Russian Federation, provided that their work experience is at least 25 years for men and 20 years for women.

Also, veteran status can be given at the regional level, but in this case it will only be valid in the territory of a specific region or region.

Veterans of labor pay land tax like other land owners. There are no exceptions for them in federal law. Regions can assign benefits, but they also have no concessions for veterans, but there are reliefs for pensioners.

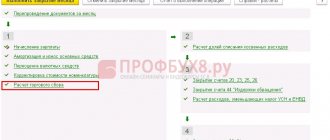

Federal benefit for pensioners.

A labor veteran is usually a pensioner. Therefore, starting from 2021, he may not pay tax on part of the plot - 600 sq. m. m. If the plot is exactly 6 acres or less, there will be no tax. If the land is, for example, 10 acres, you will only have to pay from 4.

Full tax exemption in certain regions.

Labor veterans are not mentioned in regional laws on land tax benefits. But, as a rule, WWII veterans, heroes and holders of orders can avoid paying the tax in full. In several regions, all pensioners are exempt from tax, for example, in the Sverdlovsk region and Krasnodar region.

The tax office must make a decision within a month. After this, you will be sent a notification with a smaller amount; you do not need to ask for the benefit again next year.

In this case, contact the higher authority. If you wrote to the interdistrict tax office, go to the city tax office with a complaint.

Some other categories of persons of retirement age may receive the right to deduct 1 million rubles from the total amount to be paid. However, the law mentioned above does not say anything about persons who are directly labor veterans. This situation often leads to misunderstandings and conflicting precedents in the fiscal and administrative legal fields.

Benefits in land tax - who can avoid paying for land

Since the land tax is local (the funds received from citizens go to the maintenance of the municipal economy and property), the benefits for it are established by the local legislative authorities. That is why a person who wants to find out about his right not to pay the fee in full, or to reduce its size, should read not only the Tax Code of the Russian Federation, but also local regulations.

- religious institutions, and their land is occupied by churches, cathedrals and other buildings of this nature;

- public organizations of disabled people and their unions, if the share of disabled people in them is at least 80%, and the land is used by them to achieve the goals of creating such organizations.

Land tax for labor veterans

The general conditions for issuance are determined by the municipal authorities. The list of necessary documents that will need to be provided should be clarified in advance. Each region has its own requirements. A certain part of the discounts is provided at the state level, and part - at the regional level.

ATTENTION . The specifics of obtaining tax benefits are determined by the local municipality, but the procedure for issuing a certificate is as follows: a person, before November 1, comes to the Federal Tax Service with papers for the selected taxable object, the relevant documents for the property. After 10 working days, the application is reviewed by the Federal Tax Service and a decision is made to issue it.

- Benefits now apply to only one unit of real estate (house or apartment), regardless of their total number.

- The veteran undertakes to submit an application to the local branch of the Federal Tax Service, where he will indicate which object the tax discount will apply to. This must be done before the grace period begins.

- If a pensioner owns several units of real estate and has not indicated which one should not be taxed, then the Federal Tax Service selects the unit that is subject to the largest tax.

But besides land tax benefits (which will be indicated later in the article), what other benefits are available to persons of retirement age who are, moreover, labor veterans? There are two main points to note here:

The possibility of establishing land tax benefits in the Moscow region is regulated by the law of the Russian Federation, No. 74 . This law provides for citizens who have the opportunity to use preferential conditions for paying a fee for a plot of land. According to the federal legislation of the Russian Federation, benefits such as complete exemption from payment are provided only to sparsely populated areas, for example, in the Far North.

If by local law a citizen is completely exempt from paying tax, then the previously paid amount can either be returned to the taxpayer’s account or re-credited for other types of tax. For this you also need to write an application.

The envisaged compensation for land tax has been drawn up and adopted in 2021. This category of pensioners may not pay the land tax, provided that at the time of employment the subject paid 10 thousand rubles in tax deductions. The privilege is provided to veterans who registered their status before 2021.

Land tax for beneficiaries-veterans of labor. This article provides information about the benefits due for the payment of land tax for taxpayers from the “Veteran of Labor” category. Legislative framework for the purpose of benefits, categories of subjects and methods of obtaining tax breaks.

The tax authority is obliged to review the application and documents and make a decision to refuse or change the tax amount. The refusal must be reasoned and issued in writing. If you persist in your position, go to court.

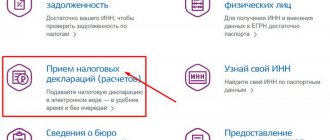

If necessary, a person can send an application remotely, for example, through the Federal Tax Service website. To do this, you will have to register, fill out the form online and attach copies of documents converted into electronic format. All that remains is to wait for a positive decision on exemption from payments or provision of a discount. After this, you will be able to personally evaluate the benefits of preferential conditions.

Land tax has been paid by land owners since 1999 - since the advent of the updated Tax Code. Revenues from it go to the local budget. The only exceptions are urban and agricultural lands.

- 0.3% of the cadastral value of the land. Used when calculating tax for land occupied by individual buildings or subsidiary plots. This includes land for livestock farming or horticulture.

- 0.7 - 1.5% - for other objects. Their list is specified in the regulatory legal acts of municipalities.

The calculation and payment of the tax burden are established by local legislation. It is this that determines who is entitled to land tax benefits, guided by federal regulations.

The legislation establishes categories of persons who have the right to partially pay or not pay land tax at all. This includes:

- disabled children;

- disabled people;

- WWII participants;

- labor veterans;

- Participants are liquidators of the Chernobyl nuclear power plant consequences.

- heroes of the USSR and Russia.

It is worth noting that this list is not exhaustive. Each region has its own. Let's look at the most common categories of people applying for benefits and find out whether they are entitled to them.

In the early 90s. This category of the population was exempt from paying land taxes. With the update of the Tax Code in 2005, this privilege was abolished. Now pensioners pay land taxes in full on an equal basis with the working population.

Tax benefits are possible at the municipal level. Thus, tax privileges depend on the location of the land plot. You can find out whether benefits are available and what their size is from the regulations governing taxation at the local level. It can be downloaded from the official website of the municipality.

In addition to benefits, authorized bodies have the right to establish requirements, upon fulfillment of which an individual can take advantage of the opportunity to reduce tax or not pay it at all. Most often, these are: permanent registration in the territory of the municipality, lack of official employment, etc.

The procedure for obtaining tax benefits and the scheme for their payment can be found at the territorial tax office.

- pensioner's ID;

- land documents confirming ownership;

- passport;

- work book (if necessary).

Thus, land tax benefits for pensioners are the exclusive prerogative of the local government level. Mainly used as a measure of social support for low-income groups of the population.

Not a single article of the Tax Code contains information about the complete exemption of disabled people of group 2 from paying land tax.

Article 391 of the Tax Code of the Russian Federation reveals the procedure for reducing the tax base and categories of taxpayers who have the right to take advantage of such privileges. Among them there are also disabled people of group 2, provided that it was issued before 01.01. 2004.

A disabled person is an individual who is limited in life activity as a result of illness, injury or defect from birth. Group 3 disability is established for 1 year or for life. A certificate is issued to an individual. It is this document that serves as the basis for obtaining a tax benefit.

Federal legislation does not exempt this category of citizens from paying full taxes. Municipalities are vested with this power. In accordance with Article 391 of the Tax Code of the Russian Federation, disabled people have the right to reduce the taxable cadastral value by 10 thousand rubles.

An individual applying for this benefit is required to provide documents confirming his right to the inspectorate at the location of the land plot.

Land tax benefits for disabled people of group 3 are associated with a reduction in the amount for calculating the tax.

- Calculated from the cadastral value of the site. If it is revalued, the amount may increase up to 1.5 times.

- In most regions of Russia, the amount of cadastre value far exceeds the market value of a plot of land.

- Tenants of the site are exempt from the tax.

- The cadastral value may be reduced by court decision. To do this, the applicant must prove that it exceeds the market price of the land. An independent assessment will be required.

- Preferential categories of persons are mainly established at the local level. So in Yekaterinburg, pensioners, including working people, are exempt from tax.

- The tax must be paid by 1.10. Failure to pay will result in fines and penalties.

- In the future, land and property taxes will be combined.

As stated, pensioners in the 90s were completely exempt from the obligation to pay taxes. In 2005, amendments were made to the legislation, according to which this type of benefit was abolished. To date, legislative norms do not provide for separate provisions regarding retired citizens.

In 2021, the obligations for pensioners regarding the collection of land plots have not been cancelled.

People of retirement age are classified as low-income, since the amount of benefits is low. Preferential conditions are provided for most tax payments for pensioners.

The main provisions relating to the scope of taxation are enshrined in tax legislation. The rules that are in force today came into force at the beginning of 1999. Until this point, citizens on pensions were fully exempt from tax obligations.

Despite the fact that pensioners are currently not exempt from paying taxes, the legislator provides benefits for this type of payment. Benefits for pensioners are subject to establishment at the local level.

Who is exempt from paying land tax: categories of beneficiaries

As the name implies, this collection of funds for the country’s budget is associated with land territories owned by individuals. It is local in nature and is obligatory for payment in the Russian Federation by organizations and ordinary citizens. In the article we discuss the characteristics of the levy, who is exempt from paying land tax and its benefits.

The determination of the cadastral value is made in accordance with the land legislation of our country. Price information can also be obtained by requesting a local office of the city territorial office of the Federal Service for State Registration of Cadastre and Cartography.

Land tax benefits for pensioners and labor veterans

According to legally established standards, the fee cannot be reduced by more than 10 thousand rubles. In this case, it is worth mentioning that such benefits are provided to disabled people belonging to groups 1 and 2, as well as:

- veterans and persons who became disabled during the Second World War;

- citizens recognized as disabled in childhood;

- Knights of the Order of Glory (provided that it is full);

- veterans or disabled persons of combat activities;

- heroes of Russia or the USSR;

- who became disabled during nuclear testing and their radiation;

- testing nuclear weapons;

- exposed to nuclear radiation.

As already stated, preferential benefits are prescribed in acts adopted at the regional level. To receive benefits, persons receiving pensions must take the following actions:

- contact the tax authority or the municipal administration and find out about the availability of benefits;

- when it becomes known that benefits are provided, it is necessary to collect the required documentation and contact the tax office.

It is worth keeping in mind that the situation regarding benefits is unstable. If benefits were not established last year, it is not guaranteed that they are not currently available.

Local authorities set the amount, period and validity period of preferential tax payments. Lands that are not included in cadastral registers are not subject to taxes. Payment is made after the corresponding notification arrives at the registration address of the owner of the plot.

This document contains all the necessary details for depositing funds. It is also possible to pay taxes online, for this you can choose any convenient method. You can pay through your personal account created in the tax system, through Internet banking, etc.

If not provided for by regional acts, then the pensioner is not provided with preferential conditions for paying land taxes. Payment of tax payments depends on where the land plot on which the garage is located is located.

When the garage is located in a cooperative, the tax amount comes in relation to this association. Next, taxes are divided between the owners. This action is carried out by accountants.

At the federal level, no benefits have been established for pensioners who own summer cottages. For plots where summer cottages and gardening are located, the collection rate is 0.3 percent. The calculation is made relative to the cadastral value.

Regions are establishing preferential conditions for paying taxes by pensioners; for example, the Odintsovo district of the Moscow Region has established that non-working pensioners do not pay taxes; similar measures have been taken in the Pavlo-Posad district regarding single persons.

Who establishes tax benefits?

The conditions for providing benefits and the full list of citizens entitled to receive them are stated directly in the Tax Code of the Russian Federation, Chapter 32 . Taxation benefits are established by the current code of the Russian Federation and normative representative acts of local government bodies.

The Tax Code provides benefits for land tax

The Tax Code provides for the deduction of a mandatory payment for each plot of land that is in common shared ownership and involves the provision of benefits for a limited number of persons prescribed in the Tax Code of the Russian Federation.

Land plots are not recognized as objects of taxation:

- land property that was seized in connection with a decision of the legislation of the Russian Federation;

- which contain valuable monuments of the country's cultural heritage that are on the World Heritage List, as well as large nature reserves of the Russian Federation, historical museums and reserves, and the archaeological heritage of the Russian Federation;

- which have become invalid;

- which are part of the forest fund;

- where there are water bodies that belong to the Russian Federation and are included in the country’s water fund;

- which are included in the common property of apartment buildings.

Land tax in 2021 - which persons and organizations are exempt from payment, how to get the benefit

Land is treated as part of real estate, so the tax calculation will be identical. The category of payers includes owners and users of plots. The tax rate varies between 0.1–2.5% of the cadastral registry assessment. The definition of the circle of payers is enshrined in the Tax Code in Article 389.

Public disabled organizations may also be included in these categories. A condition for receiving benefits has been established for them - the number of persons with disabilities must be at least 80%. If such companies create enterprises, they will be partially exempt from this type of taxation. To qualify for the benefit, they will need to have more than half the number of people with disabilities on their staff, and the payroll of these people must be more than 25%. The benefit does not apply to such organizations if they produce a certain list of goods, works and services approved in a special list.

Labor veterans are exempt from the following payments in 2021

Only a certain group of the population enjoys land tax benefits, namely:

- elderly people (pensioners);

- disabled people who have 2nd and 3rd disability groups;

- individuals who have the right to receive social support from the state due to a difficult life situation;

- families who have lost their breadwinner who served in the military defense of the Russian Federation;

- military personnel who were removed from military defense service due to health conditions or at the end of their service period;

- land tax benefits can be provided to large families and low-income families;

- single-parent families (in the absence of one of the parents or guardians).

The listed population group also has a tax break for a summer cottage.

Residents of the northern regions of Russia and the Far East do not pay mandatory state land contributions. As well as the category of citizens exempt from paying land tax:

- heroes of the Soviet Union and the Russian Federation;

- veterans of the Great Patriotic War and other combat veterans;

- disabled children and people with disabilities since childhood;

- disabled people of 1st and 2nd disability groups;

- people who are registered with the Russian healthcare system due to radiation burns received during the disaster at the Chernobyl nuclear power plant (Chernobyl victims);

- people who were directly involved in the development, testing, and exercises of any nuclear installations and as a result suffered health complications (participants in nuclear tests).

Many pensioners often wonder whether land up to 6 acres in size is taxed. According to federal law, starting from 2021, pensioners are exempt from paying state payments for land plots of less than 6 acres of land.

Land tax benefits are available to old-age pensioners: older people in Russia have the right to receive tax benefits on the land issue. More than 15 million pensioners use the proposed “discounts” every year, because such tax discounts for pensioners on land make life much easier and allow them to save money.

If the land plot is less than 6 acres, then pensioners do not need to pay a mandatory payment for it.

If the plot size is larger, then the cost of this payment is calculated from the remaining area of land.

The pensioner also needs to pay land tax if he has more than several properties at his disposal. In this case, he must select one object from each category to which the benefit will apply (apartments, houses, garages, and so on).

Are military pensioners exempt from making mandatory payments on land property?

Military pensioners also pay a mandatory state contribution for land, taking into account the fact that they can receive benefits in the form of partial or complete tax exemption.

For veterans and disabled combatants, as well as for several other groups of the population, a reduction in the tax base of 10 thousand rubles is provided.

Labor veterans are not exempt from paying land taxes. Only a few categories of people have the right not to pay land tax, which does not include labor veterans:

- heroes of the USSR and the Russian Federation;

- disabled people of the first and second groups;

- disabled children;

- war veterans;

- people affected by the Chernobyl accident.

To apply for the benefits specified in the article, you must:

- contact the tax office yourself;

- send an application by mail;

- fill out an application through your personal account on the website of the Federal Tax Service;

- register an application through the MFC (multifunctional center).

If registration takes place in person, through a visit to the tax office, then you need to take documents confirming your rights to benefits. If online, then send documents electronically.

The application form for land tax benefits can be found here:

- take it from the tax office itself;

- download from the tax service website;

- download from the link below on our website.

Reducing land taxes can be quite difficult, since the tax depends on the cadastral value of the land and experts rarely make mistakes in the assessment characteristics of a land plot. However, this can be done in several ways:

- if you go to court and try to appeal the assessment of the land plot. In this case, the correctness of the calculations of the cadastral value of the land will be disputed, in which an examination will necessarily be carried out and the land will be assessed by experts in the event of an automatic error, it will be brought in accordance with the calculation standards;

- A reduction in land tax is also possible when renting out a plot. In this case, the owner may not pay the full cost of the tax, since it will be reduced;

- You can reduce the payment using benefits for certain groups of the population (listed above).

It is worth keeping in mind that going to court does not guarantee a positive outcome of the case and it often happens that, on the contrary, the cadastral value is added to the land plot after the trial, due to the fact that the expert gave an incorrect assessment.

Who can be exempt from paying land tax in the Russian Federation in 2021

- single citizens who have an income of less than 0.5 times the subsistence level;

- orphans, children and guardians who live together;

- single-parent families;

- rehabilitated persons who are subject to political repression;

- large families, if the children have not reached the age of majority;

- families that have a child with a disability.

- Hero of the USSR and Russia.

- Knight of the Order of Glory.

- A person who has 1st or 2nd group disability.

- A person who has been disabled since childhood.

- Veteran and disabled person of the Second World War and combatant.

- A person who has suffered from radiation.

- A person who participated in nuclear tests and eliminated nuclear accidents.

- A person who has radiation sickness.

Medical support

Veterans of labor have the right to free medical care under the compulsory medical insurance policy in state and municipal clinics.

Also, a labor veteran can undergo dental prosthetics at dental clinics for free. Free procedures do not include the manufacture of prostheses made of metal-ceramic material or using precious metals;

If there are medical indications, a labor veteran can receive a trip to a sanatorium or boarding house. Round trip travel will also be compensated (if the veteran gets to the place of treatment by train).

In Russia, they provide four types of tax breaks for a normal quality of life for people.

In 2021, the following types of benefits are provided:

- property tax is not paid;

- transport tax discounts;

- land tax discounts;

- Some financial rewards are not taxable.

Those who receive the title do not pay property tax: any real estate and shares. In 2021, the state provided a choice for which apartment or house not to pay tax. First of all, this is aimed at citizens involved in re-registering apartments for close relatives who have veteran status.

If you own several properties, you need to inform the relevant services about which property will be exempt from paying fees. If this is not done, the inspection will forcibly select housing. In most cases, fees are levied on properties that have the highest tax rate. The property tax situation is regulated by Article 407 of the Tax Code of the Russian Federation.

In 2021, benefits related to transport have the same principle as those for property. Tax reductions are provided per car. Discounts apply if the car's power is no more than one hundred horsepower.

ATTENTION !!! Car tax benefits are determined at the regional level. The authorities independently create a list of categories of citizens who have the opportunity to receive benefits. Conditions, requirements and payment terms are determined. In some regions, transport tax is paid in full, and some provide a good discount.

The amount of funds paid depends on the power of the car and is 200 hp. excluding water and air transport, as well as all-terrain vehicles and snowmobiles.

The law does not exempt labor veterans from paying land taxes completely. In a number of regions, minor relaxations are provided. The total tax amount depends on local authorities and economic development. The rate is determined based on the cadastral value of the land. Federal law provides for a small amount of 10,000 rubles, which is not taxed. The tax deduction cannot be reduced. The categories of citizens who are entitled to benefits are determined by the municipal authorities.

First of all, you need to find out whether land benefits are issued at all in a particular region. If yes, then you need to contact the tax office with an application for a discount.

Fully exempt categories of labor veterans:

- people holding office in the local municipality;

- organizations of disabled people;

- HOA;

- NPO;

- Heroes of Labor Glory of the USSR and the Russian Federation.

List of citizens for whom a reduction of the tax base by 1,000,000 rubles is applied:

- disabled people of groups 1 and 2;

- WWII veterans;

- people involved in the elimination of man-made disasters;

- large families.

Who is exempt from paying land tax from individuals in 2018-2019

There are also local incentives that are set for specific areas.

They are approved by regional and municipal executive authorities. For example, in some regions large families, orphans under 18, and relatives of military personnel who have lost their breadwinner may not pay for land. Now some people can reduce their tax base by 10,000 rubles. If the price of the plot is this minimum, then no payment will be charged. The calculation is carried out by tax officials and if this factor is detected, the person will not be notified of payment.

Land tax for pensioners in 2021: what benefits are provided?

- Buying an apartment How much does it cost to register an apartment when purchasing?

- How to save money when buying an apartment in a new building?

- How to avoid being deceived when buying an apartment on the secondary market

- How does a foreigner buy an apartment in Russia?

- How to buy the last room in a communal apartment?

- Buying an apartment in a new building: step-by-step instructions, difficulties, legal advice

- Drawing up a deposit agreement when purchasing an apartment between individuals

- Social payments for the purchase of housing for a young family in 2021

- The nuances and risks of buying an apartment from a contractor

- Risks of the seller and buyer when buying an apartment by proxy

- Family law

- Inheritance law

- Land law

- Labor law

- Automobile law

- Criminal law

- Real estate

- Finance

- Taxes

- Privileges

- Mortgage

Citizens of the country who, due to various circumstances, are entitled to pensions can also count on other support measures.

In fact, this category of citizens receives various benefits. Benefits for pensioners are provided if certain conditions and rules are met.

The older generation can count on both federal and regional benefits.

Today, it is possible to create a conditional list of basic privileges for persons receiving a pension. Conditional list of benefits typical for all regions of the country:

- compensation for using a landline telephone;

- reduction of electricity payments;

- various payments and compensation for transport;

- reduction of payments for housing and communal services;

- reduction in utility bills.

To receive benefits that are provided at both the federal and regional levels, a person must contact the territorial offices of the PRF or social protection units. It is necessary to understand that preferences are of a declared nature and are not assigned automatically.

Thus, in order to receive what is due, you need to collect and submit the necessary package of documents on time for consideration and assignment of benefits. For convenience, you can send your documents through the government services portal, as well as use the services of the multifunctional center.

In order not to get confused about how to apply for benefits, you can consult with specialists.

List of persons exempt from paying land tax

In addition, there is a certain list of benefits for legal entities that are provided only in a specific local territory. A complete list of such benefits will have to be found separately on the website of the current local legislation.

Enterprises that do not own any land may be fully or in part exempt from the current payment of the established land tax. To receive such a benefit, they will have to contact their local municipal authority.

What is the land tax and its benefits in St. Petersburg and the region

The tax base for land collection is the cadastral value of the taxable land plot. You can find out its value by the cadastral number, which is located in the title documents for the land or an extract from the EDGP. In addition, you can use the Rosreestr website through a form indicating the address, as well as a publicly available cadastral map, where in addition to the number the value of the cost is indicated.

The formula may contain additional factors, for example, a coefficient as the ratio of the number of months of use of the plot to the number of calendar months. Accordingly, if the site is used for a whole year, the coefficient will be equal to one, which means there is no need to take it for calculations.