Read on the topic: How to refinance loans from other banks at MTS Bank - reduce the payment

Since January 2021, changes have been made to the legislation of the Russian Federation, according to which the refinancing rate was equated to the key one. The latter is a variable indicator. It is set by the Bank of Russia, depending on economic indicators, inflation levels and other factors. It is one of the main instruments for implementing the state’s monetary policy and directly affects the cost of loans issued by commercial banks to businesses and individuals, as well as interest on deposits.

A rate reduction has a positive effect on economic development. Cheap loans stimulate business development and consumer demand. But, as you know, development occurs in certain cycles. This means that the Central Bank has to change the rate from time to time, thereby implementing regulation. Thus, during a crisis, an increase in this indicator reduces the demand for loans. Reducing lending volumes, although it slows down the growth of economic development, allows us to avoid the processes of rising inflation and worsening the crisis.

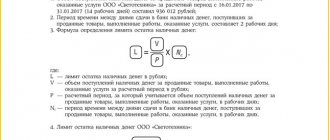

Knowing the exact value of the refinancing rate, the organization’s accountant can:

- check whether the regulatory authorities or contract partners have correctly assessed penalties;

- independently calculate the penalty for the contract, payment of wages, taxes or other payments.

To find out how much interest you need to pay in penalties, you must use the current value of the indicator at the time of delay. If the rate changed during this period, the calculation for the period of validity of each rate is carried out separately.

The table, which is located on the Central Bank website, contains the current value of the refinancing rate by year. It indicates the size of the indicator, the validity period and the document on the basis of which the changes came into force. It is recommended to use exclusively this table (which you also see on this page of our website), as it contains accurate and up-to-date data.

Refinancing rate of the Central Bank of the Russian Federation for April - June 2021

On April 23, 2021, the Board of Directors of the Bank of Russia decided to increase the key rate by 50.0 bp, to 5.00% per annum.

The refinancing rate (unofficial) will also be 5.00% per annum. The growth rate of consumer prices and inflation expectations of households and businesses remain elevated. The recovery in demand is becoming increasingly stable and in a number of sectors is outpacing the possibilities for increasing output. Under these conditions, the balance of risks is shifted towards pro-inflationary ones.

The Board of Directors raised the Bank of Russia's inflation forecast for 2021 to 4.7–5.2%. Under the current monetary policy, annual inflation will return to the Bank of Russia target in mid-2022 and will remain close to 4% thereafter.

When deciding to increase the key rate/refinancing rate to 5.00%, the Board of Directors of the Bank of Russia proceeded from the following:

Inflation dynamics.

Inflation continues to be higher than the Bank of Russia forecast. In March, the annual growth rate of consumer prices increased to 5.8% (after 5.7% in February). As of April 19, annual inflation was estimated to have slowed to 5.5%, which, however, is due to the high base effect of April 2021. Indicators reflecting the most stable processes of price dynamics, according to Bank of Russia estimates, increased in March and are significantly higher than 4% in annual terms.This is largely a reflection of the sustained nature of the recovery in domestic demand. Its influence on the rate of price growth is enhanced by restrictions on the supply side, as well as increased pressure on the costs of enterprises. Under the conditions of restrictions on foreign travel, household funds not spent for these purposes are partially redistributed to the consumption of goods and services within the country.

Inflation expectations of the population remain at elevated levels compared to the period before the pandemic. Enterprises' price expectations have increased. Professional analysts' expectations for the medium term are anchored around 4%.

The rapid recovery in demand and increased inflationary pressures create the need for an earlier return to neutral monetary policy. According to the forecast of the Bank of Russia, in the second quarter the annual growth rate of consumer prices will be close to the values of the first quarter. A steady slowdown in annual inflation is forecast for the second half of 2021. At the end of 2021, inflation will be 4.7–5.2%. Under the current monetary policy, annual inflation will return to the Bank of Russia target in mid-2022 and will remain close to 4% thereafter.

Monetary conditions

remain soft and have not changed significantly since the previous meeting of the Board of Directors of the Bank of Russia. Yields on medium- and long-term OFZs are close to the levels at the end of March, reflecting expectations of the Bank of Russia returning to a neutral monetary policy and the dynamics of interest rates in global financial markets. Lending continues to grow at a pace close to the highs of recent years. The decisions taken by the Bank of Russia to increase the key rate and the increase in OFZ yields that has occurred since the beginning of this year will determine the growth of loan and deposit rates in the future. This will increase the attractiveness of bank deposits for the population, protect the purchasing power of savings and ensure balanced lending growth.

Economic activity.

The recovery in economic activity is becoming increasingly sustainable. At the end of the first quarter, retail trade turnover approached the pre-pandemic level. The services sector for the population is being actively restored. This is facilitated by the consistent lifting of restrictive measures and gradual vaccination. According to Bank of Russia monitoring data, more than half of surveyed enterprises report that demand for their products has returned or exceeded pre-pandemic levels. Investment demand continues to grow. In some industries, the ability to increase output lags behind expanding demand, including due to a shortage of labor. There is a decrease in unemployment.

Economic recovery is also supported by external demand, which continues to grow despite the ongoing difficult epidemic situation in the world.

The Bank of Russia forecasts the growth of the Russian economy in 2021 by 3.0–4.0%. This means that the Russian economy will return to its pre-crisis level in the second half of 2021. In 2022–2023, GDP, according to the forecast of the Bank of Russia, will grow by 2.5–3.5 and 2.0–3.0%, respectively.

The medium-term trajectory of economic growth will be significantly influenced by factors from both internal and external conditions. The dynamics of domestic demand will be largely determined by the pace of further expansion of private demand. Consumer demand will be supported by a decrease in the propensity of households to save, along with growth in income and lending. The process of normalizing fiscal policy, taking into account the announced additional social and infrastructure measures, will also have an impact on domestic demand. The dynamics of external demand will largely depend on fiscal support measures in individual developed countries, as well as the pace of vaccination in the world.

Inflation risks.

The balance of risks is shifted towards pro-inflationary ones. The effect of pro-inflationary factors may be longer and more pronounced in conditions of faster growth in consumer demand compared to the possibilities for expanding output. Their impact may also be enhanced by elevated inflation expectations and accompanying spillovers.

Additional upward pressure on prices may continue to come from temporary difficulties in production and supply chains. Pro-inflationary risks are created by the price environment of world commodity markets, including under the influence of supply-side factors. This may affect the domestic prices of the goods concerned. At the same time, the further dynamics of food prices will largely depend on the prospects for agricultural harvests both within the country and abroad.

Short-term pro-inflationary risks are also associated with increased volatility in global markets, including under the influence of various geopolitical events, which may affect exchange rate and inflation expectations. In the context of a faster than previously expected recovery of the global economy and, accordingly, the exhaustion of the need for unprecedented stimulating policies in developed economies, an earlier start to the normalization of monetary policy by the central banks of these countries is possible. This may become an additional factor in increasing volatility in global financial markets.

Disinflationary risks for the baseline scenario remain moderate. Opening borders as restrictive measures are lifted can restore consumption of foreign services, as well as ease supply-side restrictions on the labor market through the influx of foreign labor. The slow pace of vaccination and the spread of new strains of the virus, as well as the associated tightening of restrictive measures, may slow down the recovery of economic activity.

Budget policy significantly influences the medium-term dynamics of inflation. In the base scenario, the Bank of Russia proceeds from the trajectory of normalization of fiscal policy laid down in the Main Directions of Budget, Tax and Customs Tariff Policy for 2021 and for the planning period of 2022 and 2023, which assumes a return to the parameters of the budget rule in 2022. The Bank of Russia will take into account the impact on the forecast of possible decisions on investing the liquid part of the National Welfare Fund above the threshold level of 7% of GDP.

According to Bank of Russia estimates, the implementation of additional social and infrastructure measures announced in April in the Address of the President of the Russian Federation to the Federal Assembly of the Russian Federation will not have a significant pro-inflationary impact.

The Bank of Russia will evaluate the feasibility of further increasing the key rate at its upcoming meetings.

Decisions on the key rate will be made taking into account the actual and expected dynamics of inflation relative to the target, economic development over the forecast horizon, as well as an assessment of risks from internal and external conditions and the reaction of financial markets to them. The next meeting of the Board of Directors of the Bank of Russia, at which the issue of the level of the key rate will be considered, is scheduled for June 11, 2021

.

The time for publishing a press release on the decision of the Board of Directors of the Bank of Russia is 13:30 Moscow time

.

The market decides, but there are other reasons

The regulator's key rate and the legal status of the depositor are not the only things that determine the size of rates on bank deposits. Not all banks can attract big money through transactions with the Central Bank of the Russian Federation - there are certain restrictions on the bank’s rating and other similar parameters. Accordingly, some banks have to turn to more expensive sources.

According to Albert Bikbov, it happens that deposit rates are higher than the key rate, but through this instrument it is possible to attract funds for issuing a loan:

— In general, rates on deposits of legal entities and individuals are determined by competition in the market, as are rates on loans issued. If a particular local market is highly competitive, this usually leads to an increase in deposit rates and a decrease in loan rates. In addition, different banks have different capabilities for attracting deposits - some have high ratings or low cost of funding (that is, many cheap sources of money - for example, in the form of balances in current and current accounts). This means that banks have different positions in the competition for clients, including through setting interest rates.

Mortgage, apparently, is almost the only type of lending where a steady decline is planned. Photo by Maxim Platonov

Dynamics of the Bank of Russia refinancing rate from 1992 to 2015. And further...

The material analyzes the dynamics of the refinancing rate over the past 20 years - starting from January 1, 1992. The highest refinancing rate, which was set by the Central Bank of the Russian Federation in the period from October 15, 1993 to April 28, 1994, was 210%. Over the course of 10 years, the rate of change in the Central Bank's refinancing rate slowed down, that is, the refinancing rate became more stable. In the period from 1993 to 2000, the refinancing rate changed mainly during the year from 5 to 9 times. In the period from 2002 to 2007, the refinancing rate stabilized and changed during the year from 1 to 3 times, and only downwards.

During 2008, the refinancing rate of the Central Bank of the Russian Federation constantly grew, and especially often after the start of the global financial crisis. In 2008, the refinancing rate changed 6 times, and this despite the fact that almost all central banks of the leading countries in the world revised rates downwards. But despite the difficult financial period, Russia ended 2008 with a refinancing rate of 13.00%. (Instruction of the Central Bank of the Russian Federation dated November 28, 2008 No. 2135-U “On the amount of the refinancing rate of the Bank of Russia”) and an inflation rate of 13.3%, i.e. The Central Bank of the Russian Federation kept the situation under control.

The refinancing rate of the Central Bank of the Russian Federation changed 10 times during 2009, all downward. Russia ended 2009 with a Central Bank refinancing rate of 8.75% and inflation of 8.8% (Rosstat data), and these were the lowest figures since 1991, that is, in the entire history of post-Soviet Russia. The low refinancing rate set by the regulator was aimed at stimulating the lending activity of banks, as well as curbing inflationary processes.

In 2010, the Central Bank's refinancing rate changed only 4 times, and only downward. In 2010, the lowest refinancing rate in the entire existence of the Russian Federation was also recorded at 7.75%, which was in effect from June 1, 2010 to February 27, 2011. Russia ended 2010 with a Central Bank refinancing rate of 7.75% and inflation of 8.8%.

Russia ended 2011 with a refinancing rate of 8.00%. This was the fourth value of the Bank of Russia refinancing rate for the year. During the year, the rate was revised three times. Inflation in the Russian Federation in 2011 was 6.1%, which is a historical minimum for the country.

2012 ended with a refinancing rate of 8.25% and inflation of 6.6%. During 2012, the refinancing rate was changed by the Bank of Russia only once - from September 14, upward by 0.25 points. During the previous eight months of 2012, the refinancing rate was 8.00%.

2013 in Russia ended with a refinancing rate of 8.25%, a key rate of 5.5%, and inflation of 6.5%. Throughout 2013, the Bank of Russia refinancing rate remained unchanged and amounted to 8.25%. And from September 13 of this year, the refinancing rate began to play a secondary role and is provided by the Bank of Russia for reference. According to the Bank of Russia project, by 2021 the refinancing rate will have to be equal in value to the key rate.

2014 ended with a refinancing rate of 8.25%, a key rate of 17% and inflation of 11.4%. During 2014, the policy of the Central Bank of the Russian Federation should have continued to adjust it to the level of the key rate. In fact, from January to December 2014, the refinancing rate did not change, and due to the sharp increase in the key rate at the end of the year, its change still looks unrealistic.

Throughout 2015, the refinancing rate did not change and the year ended with a refinancing rate of 8.25% and a key rate of 11.0%.

At the beginning of 2021, the refinancing rate was 11.00%, like the key rate, and subsequently the change in the refinancing rate occurred simultaneously with the change in the key rate of the Bank of Russia and by the same amount. From January 1, 2021, the independent value of the refinancing rate is not set and the dynamics are not recorded. The key rate changed twice during 2021 (to 10.5% and to 10.0%). At the end of 2021, the key rate was kept at 10.00%.

The key rate/refinancing rate for 2021 changed 6 times and all downward - from 10.11% to 7.75% (At the beginning of the year it was 10.0%, from March 27, 2017 it decreased to 9.75% , from 05/02/2017 decreased to 9.25%, from 06/19/2017 - 9.00%, from 09/18/2017 to 8.50%, from 10/30/2017 to 8.25%, and from 12/18. 2017 to 7.75%).

At the beginning of 2021, the Bank of Russia maintained the key rate at 7.75% per annum, from 02/12/2018 it was reduced to 7.50%, from 03/26/2018 it was reduced to 7.25%, and from 09/17/2018 it was increased to 7. 50% due to changes in external conditions. On December 17, 2018, the last rate change of that year was made to 7.75%, this is the 5th key rate /refinancing rate/ established during 2021.

In the period January - June 2021, the key rate of the Bank of Russia was 7.75% per annum, from June 17, 2021 it was reduced to - 7.50%, from July 29, 2021 it was reduced to 7.25%, from September 09 it was reduced to 7. 00%, from October 28, 2021 - 6.50%, and from December 16, 2021, reduced to 6.25%. This is the sixth rate cut in a year.

From the beginning of 2021, the key rate of the Bank of Russia was 6.25% per annum, from 02/10/2020 it was 6.00%, and from 04/27/2020 - 5.50%, from 06/22/2020 - 4.50%, and from 07/27/2020 - 4.25%. This is the fifth and final rate change for 2021.

From the beginning of 2021, the key rate of the Bank of Russia was 4.25%, and from March 22 - 4.50%, and from April 26 - 5.00%.

Below are all the refinancing rates of the Central Bank of the Russian Federation, starting from 1992 and up to the day of the abolition of its independent official establishment and key rates for subsequent years.

Rate for today

Now the key rate is minimal. It was lower last time in March 2014 (then its size dropped to 7 points). At the moment, the Central Bank's forecasts are optimistic. The regulator's management does not rule out another reduction in the near future, but does not rule out a pause. As long as favorable conditions remain, the current rate will most likely not be increased. The head of the Central Bank of the Russian Federation stated that this is not planned yet, even if economic sanctions against Russia increase.

You can also leave your feedback in the comments below or ask a question.

Calculate the benefits of refinancing a mortgage or loan Loan

refinancing calculator refinansirovanie.org

Refinancing rates of the Central Bank of the Russian Federation until the end of 2015

Refinancing rates of the Central Bank of the Russian Federation

| Period of validity of the refinancing rate | Refinancing rate (%) | Regulatory document |

| 01/01/2016* | From this date, the value of the refinancing rate corresponds to the value of the key rate of the Bank of Russia - as of the corresponding installation date | Directive of the Bank of Russia dated December 11, 2015 No. 3894-U “On the refinancing rate of the Bank of Russia and the key rate of the Bank of Russia” |

| September 14, 2012 – December 31, 2015 | 8,25 | Directive of the Bank of Russia dated September 13, 2012 No. 2873-U |

| December 26, 2011 – September 13, 2012 | 8,00 | Directive of the Bank of Russia dated December 23, 2011 No. 2758-U |

| May 3, 2011 - December 25, 2011 | 8,25 | Directive of the Bank of Russia dated April 29, 2011 No. 2618-U |

| February 28, 2011 - May 2, 2011 | 8,00 | Directive of the Bank of Russia dated February 25, 2011 No. 2583-U |

| June 01, 2010 - February 27, 2011 | 7,75 | Directive of the Bank of Russia dated May 31, 2010 No. 2450-U |

| April 30, 2010 - May 31, 2010 | 8,00 | Directive of the Bank of Russia dated April 29, 2010 No. 2439-U |

| March 29, 2010 - April 29, 2010 | 8,25 | Directive of the Bank of Russia dated March 26, 2010 No. 2415-U |

| February 24, 2010 – March 28, 2010 | 8,50 | Directive of the Bank of Russia dated February 19, 2010 No. 2399-U |

| December 28, 2009 – February 23, 2010 | 8,75 | Directive of the Bank of Russia dated December 25, 2009 No. 2369-U |

| November 25 - December 27, 2009 | 9,0 | Directive of the Bank of Russia dated November 24, 2009 No. 2336-U |

| October 30, 2009 - November 24, 2009 | 9,50 | Directive of the Bank of Russia dated October 29, 2009 No. 2313-U |

| September 30, 2009 – October 29, 2009 | 10,00 | Directive of the Bank of Russia dated September 29, 2009 No. 2299-U |

| September 15, 2009 – September 29, 2009 | 10,50 | Directive of the Bank of Russia dated September 14, 2009 No. 2287-U |

| August 10, 2009 – September 14, 2009 | 10,75 | Directive of the Central Bank of the Russian Federation dated August 7, 2009 No. 2270-U |

| July 13, 2009 – August 9, 2009 | 11,0 | Directive of the Central Bank of the Russian Federation dated July 10, 2009 No. 2259-U |

| June 5, 2009 – July 12, 2009 | 11,5 | Directive of the Central Bank of the Russian Federation dated June 4, 2009 No. 2247-U |

| May 14, 2009 – June 4, 2009 | 12,0 | Directive of the Central Bank of the Russian Federation dated May 13, 2009 No. 2230-U |

| April 24, 2009 - May 13, 2009 | 12,5 | Directive of the Central Bank of the Russian Federation dated April 23, 2009 No. 2222-U |

| December 1, 2008 – April 23, 2009 | 13,00 | Directive of the Central Bank of the Russian Federation dated November 28, 2008 No. 2135-U |

| November 12, 2008 – November 30, 2008 | 12,00 | Directive of the Central Bank of the Russian Federation dated November 11, 2008 No. 2123-U |

| July 14, 2008 - November 11, 2008 | 11,00 | Directive of the Central Bank of the Russian Federation dated July 11, 2008 No. 2037-U |

| June 10, 2008 – July 13, 2008 | 10,75 | Directive of the Central Bank of the Russian Federation dated 06/09/2008 No. 2022-U |

| April 29, 2008 – June 9, 2008 | 10,5 | Directive of the Central Bank of the Russian Federation dated April 28, 2008 No. 1997-U |

| February 4, 2008 – April 28, 2008 | 10,25 | Directive of the Central Bank of the Russian Federation dated February 1, 2008 No. 1975-U |

| June 19, 2007 – February 3, 2008 | 10,0 | Telegram of the Central Bank of the Russian Federation dated June 18, 2007 No. 1839-U |

| January 29, 2007 – June 18, 2007 | 10,5 | Telegram of the Central Bank of the Russian Federation dated January 26, 2007 No. 1788-U |

| October 23, 2006 – January 22, 2007 | 11 | Telegram of the Central Bank of the Russian Federation dated October 20, 2006 No. 1734-U |

| June 26, 2006 – October 22, 2006 | 11,5 | Telegram of the Central Bank of the Russian Federation dated June 23, 2006 No. 1696-U |

| December 26, 2005 – June 25, 2006 | 12 | Telegram of the Central Bank of the Russian Federation dated December 23, 2005 No. 1643-U |

| June 15, 2004 – December 25, 2005 | 13 | Telegram of the Central Bank of the Russian Federation dated June 11, 2004 No. 1443-U |

| January 15, 2004 – June 14, 2004 | 14 | Telegram of the Central Bank of the Russian Federation dated January 14, 2004 No. 1372-U |

| June 21, 2003 – January 14, 2004 | 16 | Telegram of the Central Bank of the Russian Federation dated June 20, 2003 No. 1296-U |

| February 17, 2003 – June 20, 2003 | 18 | Telegram of the Central Bank of the Russian Federation dated February 14, 2003 No. 1250-U |

| August 7, 2002 – February 16, 2003 | 21 | Telegram of the Central Bank of the Russian Federation dated 06.08.2002 No. 1185-U |

| April 9, 2002 – August 6, 2002 | 23 | Telegram of the Central Bank of the Russian Federation dated April 8, 2002 No. 1133-U |

| November 4, 2000 – April 8, 2002 | 25 | Telegram of the Central Bank of the Russian Federation dated November 3, 2000 No. 855-U |

| July 10, 2000 – November 3, 2000 | 28 | Telegram of the Central Bank of the Russian Federation dated July 7, 2000 No. 818-U |

| March 21, 2000 – July 9, 2000 | 33 | Telegram of the Central Bank of the Russian Federation dated March 20, 2000 No. 757-U |

| March 7, 2000 – March 20, 2000 | 38 | Telegram of the Central Bank of the Russian Federation dated March 6, 2000 No. 753-U |

| January 24, 2000 – March 6, 2000 | 45 | Telegram of the Central Bank of the Russian Federation dated January 21, 2000 No. 734-U |

| June 10, 1999 – January 23, 2000 | 55 | Telegram of the Central Bank of the Russian Federation dated 06/09/99 No. 574-U |

| July 24, 1998 – June 9, 1999 | 60 | Telegram of the Central Bank of the Russian Federation dated July 24, 1998 No. 298-U |

| June 29, 1998 – July 23, 1998 | 80 | Telegram of the Central Bank of the Russian Federation dated June 26, 1998 No. 268-U |

| June 5, 1998 – June 28, 1998 | 60 | Telegram of the Central Bank of the Russian Federation dated 06/04/98 No. 252-U |

| May 27, 1998 – June 4, 1998 | 150 | Telegram of the Central Bank of the Russian Federation dated May 27, 1998 No. 241-U |

| May 19, 1998 – May 26, 1998 | 50 | Telegram of the Central Bank of the Russian Federation dated May 18, 1998 No. 234-U |

| March 16, 1998 – May 18, 1998 | 30 | Telegram of the Central Bank of the Russian Federation dated March 13, 1998 No. 185-U |

| March 2, 1998 – March 15, 1998 | 36 | Telegram of the Central Bank of the Russian Federation dated February 27, 1998 No. 181-U |

| February 17, 1998 – March 1, 1998 | 39 | Telegram of the Central Bank of the Russian Federation dated February 16, 1998 No. 170-U |

| February 2, 1998 – February 16, 1998 | 42 | Telegram of the Central Bank of the Russian Federation dated January 30, 1998 No. 154-U |

| November 11, 1997 – February 1, 1998 | 28 | Telegram of the Central Bank of the Russian Federation dated November 10, 1997 No. 13-U |

| October 6, 1997 – November 10, 1997 | 21 | Telegram of the Central Bank of the Russian Federation dated 01.10.97 No. 83-97 |

| June 16, 1997 – October 5, 1997 | 24 | Telegram of the Central Bank of the Russian Federation dated June 13, 1997 No. 55-97 |

| April 28, 1997 – June 15, 1997 | 36 | Telegram of the Central Bank of the Russian Federation dated April 24, 1997 No. 38-97 |

| February 10, 1997 – April 27, 1997 | 42 | Telegram of the Central Bank of the Russian Federation dated 02/07/97 No. 9-97 |

| December 2, 1996 – February 9, 1997 | 48 | Telegram of the Central Bank of the Russian Federation dated November 29, 1996 No. 142-96 |

| October 21, 1996 – December 1, 1996 | 60 | Telegram of the Central Bank of the Russian Federation dated October 18, 1996 No. 129-96 |

| August 19, 1996 – October 20, 1996 | 80 | Telegram of the Central Bank of the Russian Federation dated August 16, 1996 No. 109-96 |

| July 24, 1996 – August 18, 1996 | 110 | Telegram of the Central Bank of the Russian Federation dated July 23, 1996 No. 107-96 |

| February 10, 1996 – July 23, 1996 | 120 | Telegram of the Central Bank of the Russian Federation dated 02/09/96 No. 18-96 |

| December 1, 1995 – February 9, 1996 | 160 | Telegram of the Central Bank of the Russian Federation dated November 29, 1995 No. 131-95 |

| October 24, 1995 – November 30, 1995 | 170 | Telegram of the Central Bank of the Russian Federation dated October 23, 1995 No. 111-95 |

| June 19, 1995 – October 23, 1995 | 180 | Telegram of the Central Bank of the Russian Federation dated June 16, 1995 No. 75-95 |

| May 16, 1995 – June 18, 1995 | 195 | Telegram of the Central Bank of the Russian Federation dated May 15, 1995 No. 64-95 |

| January 6, 1995 – May 15, 1995 | 200 | Telegram of the Central Bank of the Russian Federation dated 01/05/95 No. 3-95 |

| November 17, 1994 – January 5, 1995 | 180 | Telegram of the Central Bank of the Russian Federation dated November 16, 1994 No. 199-94 |

| October 12, 1994 – November 16, 1994 | 170 | Telegram of the Central Bank of the Russian Federation dated October 11, 1994 No. 192-94 |

| August 23, 1994 – October 11, 1994 | 130 | Telegram of the Central Bank of the Russian Federation dated August 22, 1994 No. 165-94 |

| August 1, 1994 – August 22, 1994 | 150 | Telegram of the Central Bank of the Russian Federation dated July 29, 1994 No. 156-94 |

| June 30, 1994 – July 31, 1994 | 155 | Telegram of the Central Bank of the Russian Federation dated June 29, 1994 No. 144-94 |

| June 22, 1994 – June 29, 1994 | 170 | Telegram of the Central Bank of the Russian Federation dated June 21, 1994 No. 137-94 |

| June 2, 1994 – June 21, 1994 | 185 | Telegram of the Central Bank of the Russian Federation dated 01.06.94 No. 128-94 |

| May 17, 1994 – June 1, 1994 | 200 | Telegram of the Central Bank of the Russian Federation dated May 16, 1994 No. 121-94 |

| April 29, 1994 – May 16, 1994 | 205 | Telegram of the Central Bank of the Russian Federation dated April 28, 1994 No. 115-94 |

| October 15, 1993 – April 28, 1994 | 210 | Telegram of the Central Bank of the Russian Federation dated October 14, 1993 No. 213-93 |

| September 23, 1993 – October 14, 1993 | 180 | Telegram of the Central Bank of the Russian Federation dated September 22, 1993 No. 200-93 |

| July 15, 1993 – September 22, 1993 | 170 | Telegram of the Central Bank of the Russian Federation dated July 14, 1993 No. 123-93 |

| June 29, 1993 – July 14, 1993 | 140 | Telegram of the Central Bank of the Russian Federation dated June 28, 1993 No. 111-93 |

| June 22, 1993 – June 28, 1993 | 120 | Telegram of the Central Bank of the Russian Federation dated June 21, 1993 No. 106-93 |

| June 2, 1993 – June 21, 1993 | 110 | Telegram of the Central Bank of the Russian Federation dated 01.06.93 No. 91-93 |

| March 30, 1993 – June 1, 1993 | 100 | Telegram of the Central Bank of the Russian Federation dated March 29, 1993 No. 52-93 |

| May 23, 1992 – March 29, 1993 | 80 | Telegram of the Central Bank of the Russian Federation dated May 22, 1992 No. 01-156 |

| April 10, 1992 – May 22, 1992 | 50 | Telegram of the Central Bank of the Russian Federation dated April 10, 1992 No. 84-92 |

| January 1, 1992 – April 9, 1992 | 20 | Telegram of the Central Bank of the Russian Federation dated December 29, 1991 No. 216-91 |

*The value of the Bank of Russia refinancing rate from January 1, 2016 is equal to the value of the Bank of Russia key rate on the corresponding date. From 01/01/2016, an independent value of the refinancing rate is not established.

Key rates of other world states and neighboring countries

Refinancing rates for major world economies

- USA - the key rate here is called the “Federal Funds Rate” and is equal to 0.75% as of March 2021

- Eurozone - in countries where the Euro is traded, as of the beginning of 2017, the key rate is 0% (zero percent) and is officially called “Main refinancing operations rate”

- Japan is one of the few countries where the refinancing rate is negative and equal to -0.1%. The official name of the indicator is “Target for the overnight call rate”

- China - in the Celestial Empire the refinancing rate is 4.35%

- Britain - in the UK the key rate is called “Bank Rate” and has a value of 0.25% at the beginning of 2021.

- Canada - the rate there is called “Target for the overnight rate” and is equal to 0.5% as of March 2021.

- Australia - the indicator is called “Cash Rate” and is equal to 1.5% as of March 2021.

Refinancing rates for neighboring countries:

- Ukraine - NBU discount rate is 14% as of March 2021

- Belarus - NBRB refinancing rate - 16% at the beginning of 2017

- Kazakhstan - The National Bank of Kazakhstan in February lowered its refinancing rate to 11%

- Türkiye - the figure is 11.27% as of February 2021

RECEIVE NOTIFICATIONS ABOUT NEW SITE MATERIALS TO YOUR E-MAIL!

Decisions made by the Bank of Russia on the refinancing rate

The Board of Directors of the Bank of Russia made the decision to improve the system of monetary policy instruments on September 13, 2013. Based on this decision, the key rate began to play the main role in the bank’s policy, and the refinancing rate played a secondary role and is given for reference. In addition, the Board of Directors of the Central Bank decided that in the period from September 13, 2013 to January 1, 2021, the refinancing rate will be adjusted to the level of the key rate.

Since 01/01/2016, the refinancing rate on the website of the Central Russia of the Russian Federation is no longer given for reference, since it now corresponds to the key rate.

The decision to adjust the refinancing rate was made on December 11, 2015

The Bank of Russia together with the Government, which provides for the following:

- from January 1, 2021, by decision of the Board of Directors of the Bank of Russia dated December 11, 2015, the value of the refinancing rate is equal to the value of the key rate of the Bank of Russia determined on the corresponding date and further its independent value is not established. In the future, changes in the refinancing rate will occur simultaneously with changes in the key rate of the Bank of Russia by the same amount.

- from January 1, 2021, the Government of the Russian Federation will also use the key rate of the Bank of Russia in all regulations instead of the refinancing rate (the order was signed by the Prime Minister of Russia D. Medvedev).

The material has been adjusted based on data from the Central Bank of the Russian Federation

dated April 23, 2021.

Bet value

Today, the regulator is gradually reducing the rate. This is due to the stabilization of the economy and low inflation. A decrease was observed in 2021, and for 2021 the forecast for improvement in macro and microeconomic indicators of the Russian Federation remains unchanged. The last decrease in the indicator occurred on March 26 of this year. According to the head of the Central Bank of the Russian Federation, the regulator plans to continue the gradual reduction if the economy continues to show growth signals. The next change is possible as early as April 2021. To find out exactly what the key rate is, you should use the latest information from the Central Bank website.