Good afternoon friends. A common mistake of beginning entrepreneurs is immaturity. At school they were supervised by teachers, at university and sometimes by teachers, but almost certainly by their parents. But in adult life this does not happen. If you become an entrepreneur, you yourself must find out what and when you should pay in taxes, what reports to submit, etc. On this page I have collected the most useful information about paying taxes for enterprises using the simplified tax system for this year. Pay your taxes and sleep peacefully.

Content

- We pay for ourselves to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund

- If the individual entrepreneur has employees

- Features of paying taxes according to the simplified tax system

- Features of paying taxes on UTII

- Payments under the patent taxation system

“Simplified”, “imputation” and patent are the three main taxation systems for individual entrepreneurs in Russia. Depending on the region and type of activity, the correct choice of tax calculation method allows you to save on them. If a company has opened more than one line of business, it can use several tax calculation systems at once.

The simplified tax system, UTII and PSN replace personal income tax, property tax and VAT (with the exception of customs VAT on imports) for an entrepreneur. Employee taxes and contributions still need to be paid.

What is an advance payment

Advance payment is an advance payment of tax, calculated based on the tax base for the reporting period. Advance payments are calculated based on the results of reporting periods, taking into account the amount for the previous reporting period, and pay them on time. The algorithm for calculating advances corresponds to the procedure for calculating tax.

The tax is calculated after the end of the calendar year. During the year, advances are paid - quarterly payments of the corresponding tax. If advances are transferred on time, then at the end of the year they pay the amount of tax from the tax base that arose in the fourth quarter.

It is necessary to correctly calculate and timely pay the advance payment according to the simplified tax system.

We pay for ourselves to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund

In addition to mandatory payments for each employee to the Pension Fund and the Compulsory Medical Insurance Fund, individual entrepreneurs pay the same contributions for themselves. Their amount is fixed, it is calculated from the minimum wage using the formula:

Pension contribution = minimum wage * 12 months * 26%.

Medical contribution = minimum wage * 12 months * 5.1%.

In 2021, the minimum wage reached 7,500 rubles, so the annual pension contribution was 23,400 rubles, and the medical contribution was 4,590 rubles per year. It is more profitable to pay for yourself not once a year, but quarterly. Because in this case, you can reduce the tax amount by the amount of the contribution. If you make a payment once a year or have a debt, you are not entitled to a deduction.

Important! You must pay your own contributions as long as the individual entrepreneur is open - even if the activity has actually ceased. Unpaid fees are collected through the court. If the individual entrepreneur is a woman on maternity leave, she needs to provide confirmation of her disability to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund.

How are penalties calculated and when should they be paid?

If advance payments are made later than the deadlines established by the legislation on taxes and fees, penalties will be charged on the amount of late advance payments.

Violation of the procedure for calculating and (or) paying advance payments cannot be considered as a basis for holding a person accountable for violating the legislation on taxes and fees.

clause 3 art. 58 Tax Code of the Russian Federation

Within the meaning of Article 75 of the Tax Code of the Russian Federation, penalties are amounts that are paid in case of late tax payment. Penalties are calculated for each calendar day of delay by multiplying the overdue amount by the number of days of delay and by the interest rate of the penalty, which is equal to one three hundredth of the refinancing rate of the Central Bank of the Russian Federation on the day of delay and are paid in addition to the amount of the tax payment due. According to the instructions of the Bank of Russia dated December 11, 2015 No. 3894-U, the value of the refinancing rate is equal to the value of the key rate.

Procedure for calculating penalties

Akvarel LLC has been applying the simplified tax system since the beginning of 2021. The advance payment for the first quarter in the amount of 25,437 rubles, the payment deadline for which was April 25, was transferred on May 5. Since the payment was made after the due date, you will have to pay a penalty for nine days of delay.

In the period from April 26 to May 1 (6 days) the rate was 9.75%, from May 2 to May 4 (3 days) - 9.25%. The amount of penalties for the first six days of delay, from April 26 to May 1, was 49 rubles 60 kopecks (25,437 * 1 ÷ 300 * 9.75 ÷ 100 * 6), for the next 3 days of delay, from May 2 to 1, - 23 rubles 53 kopecks (25,437 * 1 ÷ 300 * 9.25 ÷ 100 * 3). In total, Akvarel LLC will have to pay 73.13 (49.60 + 23.53) for the late advance payment for the first quarter.

If the individual entrepreneur has employees

The following fee and tax payment schedules are relevant for all individual entrepreneurs - even those who do not have employees. And those who have them additionally need to submit the following payments and reports:

| Deadline | Payment type | Peculiarities |

| Every 15th of the month | Pass SZV-M for all employees | The report indicates the TIN and SNILS, it is submitted to the Pension Fund |

| Pay contributions to the Pension Fund, FFOMS, Social Insurance Fund for each employee | Pension Fund - 22%. FSS - 2.9%. Compulsory medical insurance - 5.1%. | |

| Every 16th of the month | Pay personal income tax on employee income | 13% of salary |

Individual entrepreneurs with employees submit the following types of reporting for all types of taxation:

- report on form 6-NDFL - quarterly;

- report on insurance premiums - quarterly;

- report on the average number of employees - once a year;

- report on employees who do not pay personal income tax - once a year;

- confirmation of the main activity of employees - once a year;

- employee experience report - once a year.

Features of paying taxes according to the simplified tax system

A simplified taxation system is applied if the company has no more than 100 employees, annual profits do not exceed 1.5 million rubles and there are no branches. There are two formulas for calculating the simplified tax system:

enterprise income * 6%;

(income - expenses) * 15%.

Important! Under the simplified tax system, taxes are paid every quarter, and not once a year. If an entrepreneur is late in paying the quarterly advance payment, penalties will be charged.

| Deadline | Payment name | Peculiarities |

| 31.12.2017 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | Last chance to pay your 2021 dues. If you paid quarterly, you only have to pay the amount for the fourth quarter. |

| 31.03.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | Pension Fund = minimum wage * 3 months. * 26%, FFOMS=minimum wage * 3 months. * 5.1% |

| 01.04.2018 | Additional contribution to the Pension Fund | Only with an income of more than 300 thousand rubles per year. Formula: income for 2021 * 1% . |

| 02.04.2018 | Declaration according to the simplified tax system | Rent even if there was no income |

| 25.04.2018 | Advance payment under the simplified tax system for the first quarter | If you pay tax on income, the tax amount is calculated using the formula: revenue for the first quarter * 6%. If you pay tax on the difference between income and expenses: (income - expenses for the first quarter) * 15%. |

| 30.04.2018 | simplified tax system for 2021 | Calculation formula: (income for 2021 * 6%) - advance payments for 2017 - insurance premiums for 2021 |

| 30.06.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | Pension Fund = minimum wage * 3 months. * 26%, FFOMS=minimum wage * 3 months. * 5.1% |

| 25.07.2018 | Advance payment under the simplified tax system for the first quarter | If you pay tax on income, the tax amount is calculated using the formula: revenue for the first half of the year * 6%. If you pay tax on the difference between income and expenses: (income - expenses for the first quarter)*15%. |

| 30.09.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | Pension Fund =minimum wage*3 months*26%, FFOMS=minimum wage*3 months*5.1% |

| 25.10.2018 | Advance payment according to the simplified tax system for 9 months | The calculation formulas are similar, but the amount of income and expenses for 9 months is used. |

| 31.12.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | Pension Fund = minimum wage * 3 months * 26%, FFOMS = minimum wage * 3 months * 5.1% |

Individual entrepreneur calendar for 2021 and deadlines for submitting reports to the simplified tax system

The deadlines for submitting reports in 2021 for individual entrepreneurs on the simplified tax system, working independently or with attracted employees accepted under an employment contract, are the same, but the volume of reporting documentation is different. Individual entrepreneurs without employees report on the results of the year, filling out the same reports, regardless of the tax rate, 6 or 15%. Reports of a businessman who uses hired labor, in addition to deductions under the simplified tax system, are supplemented with taxes to the Federal Tax Service related to the work of the team.

These include; tax on employee remuneration, accrual of payments to insurance funds and other mandatory taxes. Reporting periods vary from one month to one year.

General provisions for collecting taxes and fees for individual entrepreneurs when working on the simplified tax system

The applied mode of payments and requirements for documentary reporting makes it possible to reduce the fiscal and control burden, freeing up time for the businessman for targeted activities. The efficiency of individual entrepreneurs in timely contributions to the budget and submission of documentation to the Federal Tax Service depends on the correct orientation, in what period, what deductions and reporting need to be carried out.

The individual entrepreneur tax calendar for 2021, with specific reporting deadlines, helps the taxpayer solve this problem.

Information on reporting deadlines reflects the type of documentation and the sequence of reporting to the fiscal supervisory authority and social funds. Changes in tax collection are constantly recorded and entered into a journal; according to the information received, it is convenient for a businessman to control reporting periods and the time of payment of tax deductions.

Documentation to the fiscal service is classified into categories and recorded in the accountant’s calendar according to the time of submission.

The submitted materials take into account:

- constant tax and social payments of a businessman on the simplified tax system;

- information on hired personnel;

- information on documents processed through the cash register;

- data to the statistical service;

- tax information related to the specifics of the activity;

- declaration when work is stopped.

The use of a simplified tax collection option for individual entrepreneurs had a limit on annual turnover of 60 million rubles; if this amount was exceeded, the tax collection conditions changed to the OSNO regime, which made reporting and efficient business management difficult. From 2021, the amount of annual income for small businesses has been increased to 150 million rubles.

Also, a simplified tax collection regime can be used by an entrepreneur with hired employees of no more than 100 people.

Each individual entrepreneur reports to the Federal Tax Service according to his activities related to the type of business, number and tax rate. If there is no work, the entrepreneur is required to submit zero reports. For self-control and submission of documentation to the fiscal service on time, it is advisable for an entrepreneur to use the individual entrepreneur’s accountant’s calendar for 2021, which contains reporting deadlines and a table.

Summary information on the activities of individual entrepreneurs for submission to the Federal Tax Service in 2018 is reflected in legislative documents and represents:

- Data on the average number of employees per month who worked in 2017.

- 2NDFL – information on remuneration and taxes hired by employees under an employment contract.

- 6NDFL – data on employee salaries.

- Summary data on contributions to medical, pension and social insurance funds.

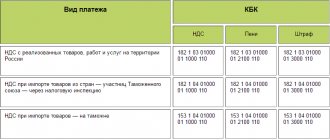

- VAT – An individual entrepreneur pays tax when he acts as an agent or issues an invoice with tax.

- A list of invoices when an individual entrepreneur acts as an agent or works under a commission agreement.

- Information on the activities of individual entrepreneurs with and without a team for 2017.

- UTII-IP pays tax when doing business on an imputed tax collection system.

- Unified agricultural tax is a tax for individual entrepreneurs and agricultural producers.

- A single simplified declaration when the activities of an individual entrepreneur are not regular.

- 3NDFL – when an entrepreneur acts as an individual.

The individual entrepreneur submits the listed information for the period of activity and within the time limits reflected in the accountant’s calendar.

For violation of reporting to the tax office, the entrepreneur is punished:

- a declaration submitted late under the simplified tax system is fined 1000 rubles if the report is zero;

- if the tax is paid on time under the simplified tax system, but the report is not submitted on time - a fine of 1000 rubles;

- if the declaration is submitted on time, but the contribution has not been paid - a fine of 5% of the amount of late paid tax, for each overdue month, but not more than 30%;

- non-payment of tax due to accounting violations is punishable by a fine of 20% of the amount of unpaid tax, but not less than 40 thousand rubles;

- for an unintentionally underestimated tax base - a fine of 20% of the amount of the unpaid contribution.

Report on individual entrepreneurs on the simplified tax system without employees

Self-employed entrepreneurs do not require financial statements.

Basic accounting comes down to monitoring income, with a tax rate of 6% of turnover, or income and expenses, with a rate of 15% of profit. Regional authorities have the right to individually lower the maximum deduction rates for businessmen working on the simplified tax system. You can check the tax percentage in your region at the Federal Tax Service at the place of registration of the entrepreneur.

A businessman who works without employees must be registered with the pension fund as an insurer.

When registering with the Pension Fund of Russia, an individual is assigned a registration number as an individual entrepreneur and from that moment on he pays contributions for himself. An individual entrepreneur without a team is registered with the social insurance fund only when it is necessary to receive benefits for temporary disability and maternity.

The individual entrepreneur’s reporting calendar for 2021 determined the type, timing of payments and documents provided, in which the entrepreneur shows:

- The reporting documents for 2021 reflect quarterly and annual income and show the applicable tax rate. Advance tax transfers are indicated, the calculated tax on income for the year is reflected, refundable deductions that reduce the payment of advances and annual withholding are reflected in total on an accrual basis quarterly and as a total for the annual period;

- flat tax on pensions. In 2018, individual entrepreneurs pay a mandatory annual tax in the amount of 26,545 rubles. In addition to this amount, an additional 1% is withheld from income exceeding 300 thousand rubles. Contributions are paid to the Federal Tax Service;

- compulsory contribution to health insurance. For individual entrepreneurs in 2018, it is 5,840 rubles and is transferred to the Federal Tax Service. Reporting to the Social Insurance Fund for this tax is not provided for individual entrepreneurs without a team;

- a book of accounting for incoming income and expenses, which reflects the transactions carried out by the entrepreneur during the tax period, is provided upon request of the Federal Tax Service. There is no need to certify KUDiR. For business-specific types of activities that use the simplified tax system, it is convenient to keep records and calculate the trading fee, for the subsequent reduction of the accrued payment;

A businessman who has chosen the simplified tax system has the opportunity to reduce the amount of tax paid to the Federal Tax Service, in the absence of employees, by a fixed deduction of social insurance contributions, but not more than 100% of the accrued tax. For an entrepreneur working under the simplified tax system, income minus expenses, constant taxes are taken into account in expenses.

Report on individual entrepreneurs on the simplified tax system with hired employees

The presence of an entrepreneur's workforce obliges him to additionally keep records, pay taxes and provide information about the work activities of employees hired under an employment contract. The accountant's calendar and the IP table will help you control the deadlines for submitting reports in 2021.

As an employer, an individual entrepreneur is obliged to register with the pension fund and social insurance fund, make payments to the Federal Tax Service for employees and report to the Pension Fund and the Social Insurance Fund.

In addition to the reporting of individual entrepreneurs without employees, an entrepreneur working with a team provides the following to the Federal Tax Service:

- information on the average number of employees per month working in 2021 is provided to the Federal Tax Service, taking into account those who have not worked for a full year;

- 2NDFL report, declaration of accrued remuneration and transferred taxes on the income of employees accepted under an employment contract, individually for each employee. The data is submitted to the Federal Tax Service on the basis of the deadlines specified in the accountant’s calendar;

- here is the 6NDFL report, general information about the salary of the team, employees hired under an employment contract, calculation and withholding of income tax. The amounts of tax deductions are also reflected. Reporting is submitted to the Federal Tax Service for 2021 and quarterly, increasing for 2021;

- To control the correct calculation of taxes, the individual entrepreneur keeps a book of incoming income and necessary expenses, which does not require certification from the Federal Tax Service. But for its absence the fine is 200 rubles.

- An individual entrepreneur, as an employer, transfers to the Federal Tax Service the accrued social insurance contributions for employees hired under an employment contract, including payments for himself. Reporting on the calculation and payment of taxes is provided to the Federal Tax Service:

If the individual entrepreneur’s team employs more than 25 hired employees, the report is sent electronically, with an electronic signature of UKEP;

- Value added tax reporting by a businessman using the simplified tax system is sent via the Internet in electronic form, only in the case of voluntary VAT calculation, when selling goods, and when the individual entrepreneur acts as a tax agent. Submission of documents to the Federal Tax Service on a quarterly basis;

- control over the issuance and receipt of invoices through the accounting journal. An individual entrepreneur must maintain documentation only in cases of concluding agency or commission agreements, as well as if he performed work for the benefit of third parties under an agency agreement. Information is sent electronically over the Internet quarterly;

- Documentary reporting on UTII is provided to individual entrepreneurs provided that they conduct business according to the prescribed taxation system and have a hired team of workers. The calculation of tax payments is carried out not on the turnover, but on the area of the retail space; it has a constant value, independent of income. Tax reporting is quarterly. Entrepreneurs using this taxation system can reduce the single tax on the cost of the purchased online cash register after registering it with the Federal Tax Service until July 2018. The deduction for the cost of the cash register is limited to 18 thousand rubles;

- Individual producers of agricultural products provide a report to the Unified Agricultural Tax at the end of 2021. Tax and accounting information is provided. The composition of the declaration depends on the number of employees, income received, and areas of activity. The document must be submitted to the Federal Tax Service by April 2, 2018. From January, individual agricultural producers will have to pay tax and report for property not used in the production and processing of marketable products;

- The 3NDFL declaration is submitted by the entrepreneur to the simplified tax system in the case when the income received is not related to his business, but is the profit of an individual.

In addition to reporting to the Federal Tax Service, the tax payment calendar for individual entrepreneurs under the simplified tax system 2018 provides for the submission of data on the work of a businessman, pension and insurance funds.

Reporting to the territorial pension fund:

- CMEA - M, the information in the document is provided to identify working pensioners. The entrepreneur provides a list of insured employees working under a civil contract and persons who performed contract work under an employment agreement. The report indicates accrued and paid insurance premiums for each employee. Information must be submitted monthly.

- The SEV-STAZH report is submitted once a year. The document provides information about hired employees who worked under an employment contract during the year, including those who quit or retired in 2017. Data on accrued and paid contributions for each employee for the subsequent assignment of insurance pensions is indicated. Individual entrepreneurs submit information about a retired employee separately within 3 days from the date of filing the application. Reporting documentation for activities from January to December 2021 must be submitted to the territorial pension fund no later than March 1, 2021;

- personalized reporting EDV-1 complements the information in the CMEA-STAZH documents. It reflects data on the policyholder and on contractual employees. Documents are submitted to the territorial pension fund. The deadline for the transfer of information for the period of individual entrepreneur activity from January to December 2021 is limited to March 1, 2021;

Information not provided to the Pension Fund on time and unpaid assessed contributions are punishable by penalties:

- for violation of the deadlines for registering an individual entrepreneur as an employer, for a period of up to 3 months - a fine of 5 thousand rubles, a longer period of failure to register with the Pension Fund of the Russian Federation - a fine of 10 thousand rubles;

- for untimely submission of reports for each employee hired under a contract - individual entrepreneur is fined 500 rubles;

- for an employee not included in the reporting form - a fine of 500 rubles;

- for incorrect information about an employee - a fine of 500 rubles;

- submitting a paper report instead of an electronic one is punishable by a fine of 1,000 rubles;

The calendar table for the accountant of the individual entrepreneur for 2021 takes into account the deadlines for submitting reports to the social insurance fund, which are provided by a businessman using the simplified tax system.

According to the paper calculation of 4-FSS, which indicates contributions for disability and maternity accrued and paid by the entrepreneur, and insurance payments accepted under an agreement with employees, documentation is provided to the social fund in 2018 in accordance with the reporting schedule in the accountant’s calendar.

The same calculation is submitted to the Social Insurance Fund in electronic form.

Detailed information personalized for each employee is not required in reporting. The total amounts in the documents are reflected on an increasing basis.

From the site: https://tvoeip.ru/buhgalteriya/otchetnost/sroki-sdachi-na-usn

Features of paying taxes on UTII

A single tax on imputed income is applied to certain areas of business. They are listed in Chapter 26.3 of the Tax Code of the Russian Federation:

- car repair;

- catering industry;

- household services (minor repairs, decoration, dry cleaning, cleaning);

- outdoor advertising;

- traveling trade;

- provision of parking spaces and retail space for rent;

- veterinary services and other activities.

To switch to UTII, you need not only to engage in a certain type of activity, but also to have no more than 100 employees.

Formula for calculating UTII

The tax is calculated not on profit, but on a fixed amount established by the state for each line of business. For example, for household services it is 7,500 per individual entrepreneur. This fixed amount is the basic return. A physical indicator is also used - room area, number of employees and other data.

To calculate, you need a deflator coefficient (K1), unique for each type of business. For example, in 2021 for all companies that deal with household appliances, K1 = 1.798. Another necessary figure is the regional coefficient K2, which is established in each constituent entity of the Russian Federation for all types of activities. For example, for household services in St. Petersburg K2=0. Formula for calculating UTII:

Basic profitability (BD) * Physical indicator (FP) * K1 * K2

UTII for household services (1 employee) = 7500 * 1 * 1.798 = 13,485.

If the entrepreneur did not hire employees, he can deduct insurance premiums paid for himself from the tax amount. If you have employees, you can deduct pension and medical contributions paid for them, but not more than 50% of the tax amount.

| Deadline | Payment name | Peculiarities |

| 31.12.2017 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | Calculated and paid as in the simplified tax system |

| 22.01.2018 | UTII declaration for the fourth quarter of 2021 | Can be submitted electronically |

| 25.01.2018 | Payment of tax for the fourth quarter of 2021 | Formula: (BD*FP*K1*K2) - (PFR contributions + FFOMS for 2021) |

| 31.03.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | see simplified tax system |

| 01.04.2018 | Additional contribution to the Pension Fund | Only with an income of more than 300 thousand rubles per year. Formula: income for 2021 * 1%. |

| 20.04.2018 | UTII declaration for the first quarter of 2021 | — |

| 25.05.2018 | Tax payment for the first quarter of 2021 | Calculated similarly |

| 30.06.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | see simplified tax system |

| 20.07.2018 | Declaration of UTII for the second quarter of 2021 | — |

| 25.07.2018 | Payment of tax for the second quarter of 2021 | Calculated similarly |

| 30.09.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | see simplified tax system |

| 22.10.2018 | Declaration of UTII for the third quarter of 2021 | — |

| 25.10.2018 | Tax payment for the third quarter of 2021 | Calculated similarly |

| 31.12.2018 | Contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund | — |

When to make payments

The reporting periods for the single tax on the simplified tax system are quarter, six months and nine months. Advance payments for “simplified” tax must be transferred no later than the 25th day of the first month following the reporting period (that is, quarter, half-year and nine months). Accordingly, as a general rule, the tax must be transferred to the budget no later than April 25, July 25 and October 25, 2021. Such deadlines follow from Article 346.19 and paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation. At the end of the year - the tax period for a single “simplified” tax - organizations and individual entrepreneurs use the simplified tax system to summarize and determine the total amount of the single tax; for the object “income minus expenses” - a single or minimum tax. Organizations transfer these payments to the budget no later than March 31 of the following year, individual entrepreneurs - no later than April 30 of the next year.

It is possible that the “simplified” payment deadline will fall on a weekend or non-working holiday. In this case, a single tax or advance payment according to the simplified tax system can be sent to the budget no later than on the next working day after the last (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).