An individual entrepreneur without a current account can pay tax at a bank branch or via the Internet.

To pay, you must correctly fill out all tax payment details. You can generate a receipt in accounting systems or through a free service on the Federal Tax Service website.

If an individual entrepreneur has a current account with a bank, then taxes and contributions must be paid from it. Otherwise, the bank may block the individual entrepreneur’s account. The Central Bank's recommendations state that suspicious clients transfer less than 0.5% of turnover to the tax office. The bank does not check how you calculate taxes. He is guided by the recommendations of the Central Bank. Therefore, if there are no tax payments from the current account, then this is a reason for the bank to block the account.

How to fill out a receipt for paying tax according to the simplified tax system for individual entrepreneurs in 2019?

Good afternoon, dear individual entrepreneurs!

Let’s assume that a certain individual entrepreneur wants to pay an advance payment under the simplified tax system of 6% for any quarter of 2021 in cash, through SberBank.

Where can I get a receipt?

Of course, if you use an accounting program (for example, “1C”), then this is done by pressing two or three buttons. But what if there is no such program?

Then you can use the service for generating receipts from the Tax Service of the Russian Federation (FTS).

By the way, I recommend using it (if you don’t have an accounting program), since this is the official service of the Federal Tax Service.

But please note that if you have an individual entrepreneur account with a bank, it is strongly recommended to pay taxes (and contributions) only from it. The fact is that banks, starting in 2021, control this moment too. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

How to generate a receipt for advance payment under the simplified tax system?

We go to the official website of the Tax Russian Federation using this link:

We agree to the processing of personal data and click on the “Continue” button:

Select the payment method “Filling out all payment details of the document”

And we get to the following screen:

We indicate here that the individual entrepreneur pays using a payment document (that is, using a receipt). And click the “Next” button and go to the next screen.

Enter the code of your Federal Tax Service + OKTMO

In the “IFTS Code” field, enter the code of your tax office. Let our individual entrepreneur live in the mountains. Ivanovo, its tax office code is 3702, and its OKTMO code is 24701000 (see screenshot below).

Of course, you will enter your tax office code and your OKTMO. If you don’t know them, you can check with your tax office.

Or try to determine the code of your tax office + OKTMO using the “Determine by address” function.

Check the box next to “Locate by address” and enter your registered address. But, nevertheless, I recommend checking this data again with your tax office if you are not completely sure. Well, experienced individual entrepreneurs already know the code of their Federal Tax Service Inspectorate + OKTMO by heart =)

Moreover, pay attention to two switches:

- The Federal Tax Service and OKTMO are located in the same region

- The Federal Tax Service Inspectorate and OKTMO are located in different regions

In our example, let them be in the same region, so the following setting was chosen:

If you are in doubt about what to choose, it is better to check with your tax office. The fact is that, indeed, sometimes the tax office may be located in a different region than OKTMO. This happens when one tax office registers entrepreneurs from several regions of the Russian Federation. For example, from remote villages and small settlements.

It’s even better to use programs and services for maintaining accounting/tax records for individual entrepreneurs. These receipts are automatically generated in them in a few clicks.

And we press the “Next” button...

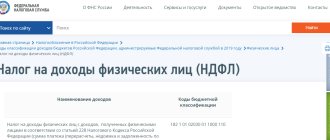

On the next screen you will have to indicate the so-called KBK. In short, this code indicates that tax is being paid according to the simplified tax system at 6% (“Income”).

We need to register this KBK: 18210501011011000110 (note that KBK must be entered in the service without spaces).

Click the “Next” button again

- We indicate that the payment is made by an individual entrepreneur (person status code “09”);

- Basis of TP (payments of the current year);

- QP (quarterly payments);

- We indicate the quarter you need and 2021. In our example, the payment is made for the first quarter of 2021;

- We indicate the payment amount. For example, I indicated 1000 rubles. It is clear that you may have a different amount.

And again click on the “Next” button

Next, enter your details:

- Full name

- TIN

- Registration address (since your tax office is “linked” to it)

Please note that you need to pay fees and taxes on your own behalf.

Click the “Next” button

Once again, carefully check everything and click on the “Pay” button.

Select “Generate receipt” and click on the “Generate payment document” button

An example of a receipt for paying tax under the simplified tax system in 2021:

That's it, our receipt for the advance payment under the simplified tax system for the first quarter is ready. Next, you should print out this receipt and pay in cash at SberBank.

Important: the receipt marked by the bank (and the check) for payment must be kept. The tax office may require it during a possible audit.

PS Let me remind you that the service can be found at this link: https://service.nalog.ru/tax.do

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

Innovations in the BCC from January 1, 2021

From 2021, the BCC must be taken from Appendix 1 to the Procedure approved by Order of the Ministry of Finance of Russia dated 06.06.2019 N 85n, Appendices 1, 2 to Order of the Ministry of Finance of Russia dated 06.06.2019 N 86n. This is new. In 2021, the codes were taken from Appendices 1, 2, 3 to the Procedure approved by Order of the Ministry of Finance of Russia dated June 8, 2018 N 132n;

We have, conditionally, summarized the new BCCs from January 1, 2021 into several groups of changes.

Change No. 1: New BCC for state duty

New BCCs from 2021 concern new payments that will be transferred. For example, starting from 2021, the Federal Tax Service will begin to maintain a unified accounting reporting resource. Tax authorities will provide data from balance sheets, but will require a fee for this. The money must be transferred according to KBK 182 1 1300 130 (Appendix 2.1 to Order No. 86n as amended by Order No. 149n).

We also added codes for the state fee for a comprehensive environmental permit (048 1 0800 110), payments for information from the Unified State Register of Real Estate (321 1 1301 130).

Change No. 2: new BCCs for fines for violations

In 2021, a specific BCC is provided for fines for each type of tax violation. Instead of two BCCs for fines from Chapter 16 of the Tax Code, you need to use 20 codes (details in the table below).

New codes have also been introduced for administrative fines for late returns, failure to provide information to the Federal Tax Service and other violations in the field of finance, taxes and fees (see below the KBK table on administrative tax fines).

Separate codes were also introduced for fines for violations of state registration legislation, illegal sale of goods, and non-use of cash registers (see the KBK table for fines for violations in business activities).

We also added codes for paying administrative fines for violating environmental protection rules, traffic rules for heavy trucks, etc.

Changes No. 3: new BCC for excise taxes

For excise taxes on ethyl alcohol from food and non-food raw materials, which was produced in Russia, one code was established: 182 1 03 02011 01 1000 110 instead of codes 182 1 0300 110 and 182 1 03 02012 01 1000 110. Codes for excise taxes on imported ethyl alcohol and wine, grape, fruit, cognac, Calvados, and whiskey distillates remain the same. See the table with the BCC of excise taxes on goods produced in Russia.

Why do you need tax receipts?

When paying bills, you should be sure to print individual entrepreneur tax receipts so that in case of problems, use it as a supporting document.

If the entrepreneur has not received written notification of the amount of tax due, he must generate a receipt himself by visiting the Federal Tax Service office or going to the tax office website.

Notice of tax amount

For your information! You can make receipts for payment of insurance premiums for individual entrepreneurs using the “Payment of Taxes” service by entering the Taxpayer Identification Number (TIN).

After filling out the form, the user has the opportunity to generate a payment document with a barcode. The most reliable way that saves a lot of time. You can access the tax service website through your Sberbank personal account or government service portal.

Despite the convenience of using new technologies, to pay such charges it is better to have on hand a payment document with the seal of the bank, postal worker or other organization that accepted the payment. When paying through a terminal, there will be no stamp on the receipts, and it is difficult to store them; it is better to scan them immediately. When paying through the website, you must also print a payment receipt, so that in case of controversial issues or correction of shortcomings, you must document your actions.

If for some reason the tax amount was not credited to the budget, Federal Tax Service employees may make a demand for repayment of the debt that has arisen.

Note! In the absence of payment, the tax office has the right to file a claim in court for forced collection of the tax and the fine accrued during the delay. The penalty is imposed on the funds available in the organization’s accounts, as well as its property.

You can submit an application to the judicial authority within six months from the last date of payment of the tax indicated in the request. In this case, the amount of arrears should not exceed 1,500 rubles*. When the amount of non-payment exceeds the limit, you can go to court within three years from the moment the debt arose.

Thus, you need to store payment documents for paying taxes and amounts to insurance funds for at least four years.

How to make and print a receipt

If an individual entrepreneur has not received a notification to pay tax, he can generate a receipt for the individual entrepreneur himself. This is the practice that the tax service will introduce in the future. But after it is formed, you must print it.

Tax office website with a splash screen for generating a receipt

In the future, it will be possible to pay the tax through a bank branch or post office. To generate and print a receipt from the tax office website, you need to perform the following steps:

- Go to the official website of the Federal Tax Service and find the section for paying debts by individuals (individual entrepreneurs belong to this category). Next, select payment information.

- A transition is made to the type of payment and the desired option is selected indicating the specific amount.

- The details of the payment recipient and their registration address are filled in. The Federal Tax Service code and digital data of the municipality (OKTMO) are entered automatically.

- Then enter the initials (last name, first name and patronymic without abbreviations) of the taxpayer and indicate his TIN. The data must be verified.

- After this, you need to select a payment method. It can be non-cash or cash (through the cash desk of a bank or post office).

- In any case, a receipt is generated and printed. Only for payments through a bank do you need receipts with a Federal Tax Service barcode for individual entrepreneurs.

Payment deadlines

Advances are transferred quarterly no later than the 25th day of the month following the expired reporting period: 1st quarter, half year, 9 months.

At the end of the fourth quarter, the advance payment is not transferred separately, since with the end of the quarter the calendar year ends and the tax on the simplified tax system must be calculated based on the results of the year.

Tax payment deadline:

- for organizations - no later than March 31 of the year following the previous year;

- for individual entrepreneurs - no later than April 30 of the year following the previous year.

If the last day of the payment deadline falls on a weekend, the payment is postponed to the next working day.

Receiving a receipt from the Federal Tax Service

The payment document can also be paid through a bank cash desk or mail. In addition, you can come to the Federal Tax Service office and pay individual entrepreneur taxes there.

Receiving receipts from the tax office

The taxpayer himself or another authorized person can pay the tax using payment documents.

To speed up the process and make it more convenient, you can do this in the following ways:

- pay through the taxpayer’s personal account on the tax website;

- make a payment through the online service of financial organizations of the Federal Tax Service partners;

- deposit cash through branches of banks and other credit institutions, certifying payment documents with their seal;

- make payments through the cash desks of local authorities and the post office;

- Finally, starting from 2021, with a special permit, it is allowed to issue tax payment receipts at the MFC.

Note! Owners of individual entrepreneurs receive tax notices with a bar code no later than December 1 following the expired period of the year for which taxes are paid. If this date is a holiday or weekend, it is moved to the next business day.

In other cases, if a paper receipt is not received on time, the taxpayer independently contacts the tax office or sends a request through the Personal Account.

Calculation of contributions for incomes over 300 thousand rubles

If the income of the payer of insurance premiums for the billing period exceeds 300,000 rubles, in addition to the fixed pension contributions indicated above (32,448 rubles), contributions are paid in the amount of 1% of the income exceeding 300,000 rubles. Note! Health insurance premiums for incomes over 300 thousand rubles are not paid

! Those. The amount of contributions to the FFOMS is fixed for all individual entrepreneurs, regardless of the amount of annual income.

Example:

The income of an individual entrepreneur in 2021 was: RUB 350,000. for activities subject to the simplified tax system and 100,000 rubles. for activities for which UTII is applied (how income is calculated is indicated above). Total 450,000 rub. The amount of contributions to the Pension Fund for 2021 will be 32,448 + (450,000 − 300,000) × 1% = 33,948 rubles. The amount of contributions to the FFOMS is 8,426 rubles.

The total amount of fixed insurance contributions to the Pension Fund for the year cannot be more than eight times the fixed amount of insurance contributions established for the year. Those. no more than 32,448×8 = 259,584 rubles.

Example:

The income of an individual entrepreneur using the simplified tax system in 2021 was: 30,000,000 rubles. The amount of contributions for 2021 would be 32,448 + (30,000,000 − 300,000) × 1% = 329,448 rubles, however, since it is greater than the maximum possible contributions of 259,584 rubles, 259,584 rubles are paid. contributions to the Pension Fund and contributions to the Federal Compulsory Medical Insurance Fund in the amount of 8,426 rubles.

What information should be included

A receipt for payment of tax or insurance premiums is a type of payment document that passes through the bank’s cash desk and confirms the fact that funds have been transferred.

Such a receipt indicates the mandatory details of the sender and recipient of the payment:

- name of the sender or his individual tax identification number (TIN);

- purpose of the payment document;

- bank details (BIC, correspondent current account);

- budget qualification code (KBK);

- amount of payment.

In addition, optional details are indicated:

- OKTMO (territory code according to the all-Russian classification directory);

- payer's initials and home address;

- signature of the owner of the IP.

The receipt is divided into two parts:

Their content is the same: the notice is torn off and stored in the bank’s archives, and the receipt is transferred to the payer as a document confirming the receipt of funds.

Tax payment receipt

In addition, the printed receipt has a special barcode with encrypted payment information. It reduces the time required to enter information, since using a scanner it can be read in a few seconds.

Important! When registering an individual entrepreneur on the government services website, the Federal Tax Service has the right not to send him a notice of accrued tax by mail. He can generate a payment document and print it himself.

Registration on this government portal provides many advantages. Through it you can receive not only a notification of debt, but also order the necessary certificate. For business people this is a significant time saver. Registration will take about a week, and this should be taken into account when planning to pay tax through this portal.

Filling example

To make it clear how to fill out a receipt through the online service, you can try to calculate the tax and generate a receipt for an individual entrepreneur for a certain Ivan Ivanovich Ivanov, who has his own individual entrepreneur. Being on the UTII system, an enterprise can pay them quarterly in order to evenly distribute the load throughout the year.

It should be understood that the deduction for individual entrepreneurs on the simplified tax system is 6%. This must be taken into account when calculating.

If a company has a bank account, then it is better to pay taxes and fees from it. This issue is strictly controlled by banks.

Once consent to the processing of personal data is given, you can begin to draw up the document.

In the table, the type of taxpayer and the type of payment document are “Settlement document - Payment document”.

Further, the BCC is indicated. To pay mandatory contributions to pension insurance, enter the code 18210202140061110160. The transfer of the contribution to health insurance is entered at KBK 18210202103081013160. The codes were valid for 2021, so it is necessary to clarify their current period.

Estimated amount for the year:

- contributions to pension insurance - 36,144 rubles;

- contributions to the Federal Compulsory Compulsory Medical Insurance Fund (for health insurance) - 6940 rubles.

To pay quarterly, you need to divide each of them into four equal parts:

- Contributions to the Pension Fund - 9036.0 rubles;

- Contributions to the FFOMS - 1,735 rubles.

if the individual entrepreneur did not work for a full year, contributions are adjusted according to the time worked in each quarter.

In the “IFTS Code” column, enter the code of your district tax office. It is found in the column on the right, where there is a list of departments.

Next, the payer status is selected. In this case, this code is 09 (IP taxpayer).

A check mark is placed in the TP column (payments for the current year).

The reporting period is indicated.

Enter the payment amount.

Then the payer details are indicated

After entering, all data is verified and adjusted if necessary. If everything is in order, press the “Pay” button.

Note! If it is a cash payment, you need to click on the “Generate payment document” button. The receipt is downloaded to your computer. You can print it and pay at any convenient place.

Thus, an entrepreneur can independently generate a tax receipt for an individual entrepreneur and pay it without leaving the office. Modern taxation is gradually moving away from sending paper payment receipts and is seeking to use electronic systems to inform citizens about accrued taxes and the means of payment.

*Prices are as of July 2021.

Fixed Contribution Tariffs

IN 2020

The following tariffs apply

for payments to individual entrepreneurs “for themselves”

:

| Payers | Pension Fund, insurance part | FFOMS |

| Individual entrepreneurs (regardless of the taxation system), notaries, lawyers and other persons obligated to pay fixed fees | 22.0% (of which 6% is the joint part of the tariff, 16% is individual) | 5.1% |

Why do we need contribution rates if they are not calculated as a percentage of income for individual entrepreneurs? And how many pension points you will be awarded depends on the Pension Fund’s contribution rate.

How to generate receipts for paying taxes on the Federal Tax Service website

Online payments have become a part of our lives. This is a quick and convenient way to pay taxes, fees, fines, rent, purchases or other services. The inspectorate provides users with the opportunity to generate payment documents and pay debts on the Federal Tax Service website.

On the main page of the portal www.nalog.ru there is a publicly accessible “Pay taxes” service.

The section consists of three subsections:

- individuals;

- individual entrepreneurs;

- legal entities.

The service allows you to generate a tax receipt, print it, or make an online payment.

Individuals

The section for individuals consists of four subsections:

- Personal Area;

- payment of taxes;

- state duty;

- filling out a payment order.

Each section is intended for generating bank documents for various types of fees.

Paying taxes

In the subsection “payment of taxes, insurance contributions of individuals”, payment orders for the listed types of fees are filled out:

- property;

- land;

- transport;

- on the income of individuals;

- insurance premiums;

- fines for late submission of the 3-NDFL declaration.

Attention: Debt repayment is carried out according to the UIN notice or by filling out a payment order manually.

If the citizen does not have a notification about the need to transfer the fee, then he should select “proceed to filling out the payment document.” On the page that opens, you need to provide payment information:

After this, click “next”. The next step specifies:

- registration address;

- Federal Tax Service code;

- municipality.

Important to know: When transferring personal income tax or a contribution for transport, you must indicate the address of the citizen’s place of residence, and when paying for land or real estate, the location of the object.

At the next stage, information about the payer is filled in:

Personal Area

Users can create a receipt for paying taxes on the tax website through the taxpayer’s personal account. When logging in, the amount to be paid is immediately displayed on the screen.

The following actions are available to the user:

- view details;

- pay now.

If you click on the “details” button, a decryption of the debt will appear on the screen.

When you select a specific charge, a page will open with a description of the object and a formula for calculating the amount of the charge.

If a citizen discovers an error in the charges, he needs to report this to the inspectorate. This can be done online by clicking on the appropriate button.

Help: To confirm the changes made, you must attach supporting documents.

If there are benefits for paying mandatory contributions, you should inform the Federal Tax Service about this.

If all charges are correct, then you need to click “pay” to go to the page with available methods of transferring funds. There are two options available in your personal account:

- online payment;

- generating a receipt.

When paying with a receipt, you need to click “Generate payment documents”, after which they will be automatically saved on your PC in PDF format. They can then be printed for presentation to the bank.

Useful: The debt will disappear from the website page 10 days after the funds are transferred.

New in 2021

Before challenging charges, you should find out what changes in calculations have been adopted in 2021:

- the property fee is calculated from the cadastral value of the property;

- the list of vehicles to which the increasing factor is applied has been expanded;

- a law was passed on the deduction of six acres of land.

Rates and benefits vary depending on where the taxpayer lives, so it's also worth checking out changes in local government regulations.

Deadlines for filing reports and paying taxes

How to make a payment under the simplified tax system without employees? The tax is paid not on the profit received after all deductions, but on the total income. This applies to an interest rate of 6%. If an individual entrepreneur works on the simplified tax system for income minus expenses, then 15% is taken from net profit.

Deadlines in 2021:

- Tax for 2021 is due by May 3, 2018.

- Advance payments are made by the 25th day of the month following each quarter.

- The declaration for 2021 is due by 04/30/2018.

In the “income minus expenses” mode, all stages are carried out similarly to the previous ones until the tax is calculated - expenses are subtracted from the amount of income and multiplied by a fixed interest rate, which ranges from 5 to 15%. In other situations, the step-by-step instructions remain unchanged.

If there are hired employees, the amount of reporting increases; in this case, accounting is practically no different from legal entities.

Alternative option

Debt verification is available on the government services portal. To do this, you need to log in and go to the “services” section, and then select “Tax debt”.

To obtain information, you need to provide payer information and TIN.

Data on accrued but not paid fees will be displayed on the screen. On the portal you can immediately transfer funds using a bank card. When the money is credited to the Federal Tax Service, the user will receive a notification in their personal account.

Online methods for generating payment documents for the payment of taxes and government duties - a convenient service. Using the Federal Tax Service website, you can easily pay any fees, without commission, which allows you to save money and time on visiting a bank or post office. If you are unable to receive notifications, you can fill them out yourself.

What taxes can I pay?

Russian taxpayers individuals. individuals pay income tax (NDFL), as well as various types of property taxes. In most cases, personal income tax is paid by the employer. It must be paid independently if income was received from leasing property, transactions with securities and in some other situations.

The situation with property tax payments is different. In most cases, the person himself will have to take care of paying them. For the convenience of taxpayers, the tax service annually sends out notifications and receipts for making payments.

The following types of tax levies include property taxes:

- transport (for a car, motorcycle, boat, etc.);

- for real estate (apartments, houses, etc.);

- to the ground.

Tax amounts depend on the type of property, category of taxpayer and other factors. For example, land taxes are set at the municipal level and may have different rates in different cities.

Important. Beneficiaries are exempt from paying certain types of tax payments, but for this they must submit the relevant documents to the inspectorate.

In some cases, a person must pay other tax payments on his own. But they are quite rare.

For the convenience of the population, the ability to obtain data on tax accruals is implemented on the official website of the Federal Tax Service in the “Personal Account” section. You can also contact the inspectorate at your place of registration for this information.

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from March 6 to March 23, 2020. His vacation pay was paid on March 2. In this case, the date of receipt of income and the date of withholding personal income tax is March 2, and the last date when personal income tax should be transferred to the budget is March 31, 2021 ( postponed to 05/06/2020 due to coronavirus, quarantine and non-working days).

In general, pay the withheld personal income tax in 2021 to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation). Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence. However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

After the budget receives personal income tax transferred by tax agents, these funds are distributed between the budget of the constituent entity of the Russian Federation and the budgets of municipalities (settlements, municipal districts, urban districts) according to the standards established by budget legislation.

Federal Law No. 172-FZ of June 8, 2020 exempted individual entrepreneurs, notaries, lawyers, and other private practice specialists affected by the coronavirus from paying personal income tax for the 2nd quarter of 2021. This is an advance payment for the first half of 2021 minus the advance for 1 quarter. 2021.

Payment methods

Initially, the state offered to pay taxes only in cash at the cash desk of any bank or by issuing a payment order on paper and transferring the funds to the account of the Federal Tax Service. But technology development does not stand still and many modern payment methods have appeared.

More and more people prefer to pay taxes online. You can do this in one of the following ways:

- on the Federal Tax Service website from a card via personal account;

- in online banking systems and banking applications;

- from an online wallet account of one of the Russian payment systems.

Payment on the Federal Tax Service website

The most convenient option to pay taxes online without visiting the Federal Tax Service is to use your personal account. In this case, you can view the current debt, accruals, and even pre-deposit any amount into the account of a single advance wallet.

Instructions on how to pay all taxes via LC include only 5 steps:

- Go to the Federal Tax Service website and log in to your account. For authorization, you can use the login and password issued by the Federal Tax Service, your Unified Information and Logistics Account (Government Services) or a qualified electronic signature.

- Get acquainted with information about debts and accruals. Here you can view the balance of funds in a single advance wallet.

- Select the required charges and/or debt to pay. If desired, the advance wallet can be topped up with any amount by indicating it on the screen.

- Select the payment method - bank card and agree to the terms of data processing. You must carefully study all the information on the page.

- Enter your card details and confirm the payment. Depending on the issuing bank, a code from SMS may be required.

General concepts about the simplified tax system

An individual entrepreneur can choose the most suitable tax regime. A special place is occupied by the simplified system, which amounts to 6% of income or 15% of income minus expenses.

This is the maximum percentage established by the Tax Code of the Russian Federation. It may decline at the local government level in different regions. There are limitations to working on such a tax system.

For entrepreneurs to work on the simplified tax system, the following limits were established:

- annual income up to 150 million rubles;

- number of hired employees up to 100 people.

The simplified tax system (STS) is a common option that entrepreneurs use in their activities.

It is characterized by ease of accounting and a minimal reporting package. How much will individual entrepreneur taxes be under the simplified tax system this year? The exact figure is unknown, but the fixed fee is 6% of income or 15% of the difference in income and expenses. This figure may vary depending on regional odds. But at the same time, it cannot be less than 1% of the income received. If an individual entrepreneur pays for himself and for his employees, then he must additionally pay personal income tax. In addition, payment to the pension fund and Social Insurance Fund is mandatory.

According to current legislation, tax payment under the simplified tax system without employees is carried out until the end of April. In this case, it is necessary to submit a report for the past year.

How to pay taxes for individual entrepreneurs on the tax website

One of the problems entrepreneurs have when transferring taxes is errors when filling out a payment order. It would seem nothing complicated: dial 20 numbers in a row, enter it in the required field and transfer the money. However, an error in even one figure threatens that the money will go to the wrong place. How can an individual entrepreneur pay taxes via the Internet and be sure of writing KBC, OKTMO and other details? The Federal Tax Service will help - pay the tax.

Purpose of payment under the simplified tax system “income”

Identification of tax according to the taxable object used by the payer is carried out not only by the “purpose of payment” field, but also by the budget classification code, therefore, in field 104 of the payment order, the corresponding BCC should be indicated.

The purpose of payment for this object corresponds to KBK 182 1 05 01011 01 1000 110.

In the “purpose of payment” field when paying the simplified tax system for 2021, the following entry should be reflected: “Tax paid in connection with the application of the simplified taxation system (USN, income) for 2016.”

How to pay taxes as an individual entrepreneur

An entrepreneur pays taxes and fees either once a quarter - these are current or advance payments, or once a year - based on the results of the past 12 months. He can use the following methods:

Useful documents to download

1. Issue a paper receipt

To do this, take a receipt form from the Federal Tax Service in advance or fill it out manually, go to a branch of any bank and pay the tax. Most often, Sberbank is used to pay taxes and fees. The disadvantage of this method is that there are queues at banks and you will have to pay an additional commission.

Entrepreneurs without a current account often pay through receipts. This is convenient, because a receipt is an analogue of a payment order.

2. Through the entrepreneur’s personal account or from a card

This is convenient because the entrepreneur can pay via the Internet or mobile application. But you will have to fill out the payment yourself and the possibility of error remains.

3. Through the taxpayer’s personal account on the Federal Tax Service website

The taxpayer’s personal account is a channel of communication and data transfer between the taxpayer and the state.

Using a taxpayer's personal account (TPA) simplifies life and helps:

- Find out about the presence of debts and overpayments for taxes - personal income tax (personal income tax), property tax for individuals, transport and land taxes.

- Send any documents through your account. Everything related to notifications, messages, statements. This is especially convenient when you urgently need to submit an application for benefits or confirm the availability of tax deductions. In addition to the official document, attach scanned copies of real documents.

- Pay taxes using TIN for free

- without visiting the tax office

- Fill out and send reports on form 3-NDFL

- Create a payment order and pay taxes yourself

4. Through specialized services.

For example, this one.

Purpose of payment of the simplified tax system “income minus expenses”

As mentioned above, to correctly identify the payment, the payment order must reflect the BCC. The purpose of payment under the simplified tax system “income minus expenses” in 2021 corresponds to KBK 182 1 05 01021 01 1000 110.

As for the field of the payment invoice “purpose of payment”, it should indicate: “Tax paid in connection with the application of the simplified taxation system (USN, income minus expenses), for 2021.”

More on the topic:

- Order of the Ministry of Transport 50 of 2014 Order of the Ministry of Transport of the Russian Federation of November 28, 2014 N 325 “On amendments to the order of the Ministry of Transport of the Russian Federation of April 22, 2002 N 50” Order of the Ministry of Transport of the Russian Federation of November 28, 2014 N 325 ″O amendments to the order of the Ministry of Transport […]

- Calculation of MTPL insurance VSK MTPL calculator 2021 VSK The Military Insurance Company of Russia, being a member of the RSA, provides MTPL as a licensed product sold at legally established tariffs. You can calculate the cost of the policy using the OSAGO 2021 VSK calculator. And the rules […]

- Moscow court website Employees of MOS OTIS will stand trial for the death of a child in an elevator cabin Two employees, electrician Alexey Goncharenko and senior workman Alexey Titov, have been charged in the final version in connection with the death of a child in an elevator on the street […]

- Work in banks in Moscow as a lawyer Work in banks in Moscow as a lawyer White Bridge Consulting • Moscow Lawyer Personnel holding PROFILE • Moscow Lawyer in a manufacturing company B&T Company • Moscow Lawyer (bankruptcy) Government organization • Moscow Part-time lawyer White Bridge Consulting • […]

- What is the single tax for individual entrepreneurs? The single tax rate for individual entrepreneurs. It is not always convenient for taxpayers who are individual entrepreneurs to apply the OSNO: it is necessary to pay each tax separately, keep in mind the numerous dates and deadlines for submitting tax reports, remember the procedure for calculating […]

- Property tax rate for 2021 Moscow Property tax in 2021. What bet should I use? Another change came into force on January 1, 2021. According to the innovation, movable property registered as a fixed asset (FPE) from January 1, 2013, except for property received as a result of […]

- LLC USN 6 tax reduction on the amount of contributions How the simplified tax system base for an LLC can be reduced by the amount of insurance premiums in 2021 Every year, an increasing number of representatives of small and medium-sized businesses choose the simplified tax system as a simpler and more understandable system for transferring contributions to the state treasury. It compares favorably with other modes [...]

- DSAGO is separate from MTPL All about the DSAGO insurance policy Introduced in Russia in 2003, compulsory civil liability insurance for owners of a personal vehicle implies guaranteed receipt of financial support by participants in an accident. In this regard, the MTPL policy received the status of a document [...]

How to create a personal account on the tax website

1. Using the login and password in the registration card.

The password can be complex and consists of several characters taken at random by the machine. It is difficult to repeat it and it is advisable to change it to your password within the first month. You will receive a registration card at any Federal Tax Service by presenting an identification document.

You enter the password from the registration card, and the login is your TIN. With their help, you register on the tax office website.

2. Using an electronic digital signature (EDS).

EDS is a person’s “live” signature translated into electronic format. It is issued for one person and virtually confirms all actions performed using an electronic signature. It helps you quickly pay taxes for individual entrepreneurs through the taxpayer’s personal account.

A key certificate is “embedded” into each digital signature, which is issued by a Certification Center authorized by the Ministry of Telecom and Mass Communications of Russia. Therefore, obtaining an electronic signature is a paid service. The price starts from 2,700 rubles and above. You can get a free electronic signature here. Such a signature can be used not only on the Federal Tax Service website, but also to participate in electronic auctions and tenders, file complaints and submit financial statements, participate in bankruptcy auctions and establish electronic document flow with clients.

To obtain an electronic signature, you need to prepare documents: passport, SNILS, INN, OGRN individual entrepreneur.

How to pay taxes for individual entrepreneurs on the tax website for free. Step-by-step instruction

When paying via the Internet, it is most convenient to use the service of the Federal Tax Service - pay the tax. On the service, the entrepreneur pays taxes online for free without commissions or additional payments.

To do this, go to the website and select the “Individual Entrepreneurs” section. Then click the “Fill out payment order” button, then go down and click the “Skip and proceed to fill out the payment document” button.

In the “Taxpayer” field, indicate “Individual entrepreneur”. In the “Payment document” field, put a dot on “Payment document” and click “next”.