Any individual entrepreneur (IP) who regularly carries out cash transactions - incoming and outgoing transactions with cash - must be well versed in the requirements of the legislation governing this area.

First of all, this will help avoid the imposition of fines for non-compliance with generally binding cash discipline standards.

However, for individual entrepreneurs, Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 provides for a simplified procedure for performing cash transactions, which provides them with some relaxations regarding setting a limit, drawing up documentation, carrying out accounting, and generating reports.

It is necessary to consider the procedure and features of cash discipline for individual entrepreneurs under different taxation regimes.

Cash desk for individual entrepreneurs - legal legislative nuances

Not so long ago, many were interested in whether a cash register is needed for individual entrepreneurs or whether it is possible to work “the old fashioned way,” that is, without a cash register? But in 2016, Law No. 290-FZ of 07/03/16 was adopted, which radically changed the previously existing procedure for using cash register equipment when making cash payments in the Russian Federation. The full-scale transition to new models of online cash registers, which began as an experiment, affected most businessmen as early as January 1, 2017. However, for some categories of individual entrepreneurs, the cash register still remains not a duty, but a right.

Requirements for floors and walls

All walls, partitions and ceilings of the cash register must be classified as capital. They can be built from:

- brick or stone (minimum thickness 50 cm)

- concrete stones (with double-layer masonry with a minimum thickness of 9 cm)

- concrete wall blocks (minimum thickness 20 cm)

- reinforced concrete panels (minimum thickness 18 cm)

Partitions must correspond to the main walls; during construction, it is allowed to use brick (with a minimum thickness of 12 cm), gypsum concrete panels (minimum thickness 8 cm), with the laying of metal gratings, the diameter of which cannot be less than 100 mm. One cell cannot exceed the size of 15 by 15 cm.

For walls and partitions that cannot be brought to the specified requirements (non-standard), it is allowed to strengthen the inside using metal gratings (reinforcement), 1 cm thick and a single cell size of 15 by 15 cm (no more). The reinforcement must have reliable welding (anchors (made of steel) with a diameter of 1.2 cm installed at a depth of 8 cm). The distance between welding points cannot exceed 50 cm.

Important! If the technical condition of the room does not allow the grilles to be attached from the inside, the fastening can be done from the outside.

All partitions (walls, floors) that border the premises of third-party enterprises are subject to reinforcement corresponding to non-standard floors (see above) throughout the entire area.

Who should switch to online cash registers and when?

Many sellers engaged in retail trade are required to work only using online cash registers from 2021. But, due to the fact that the introduction of improved models is gradual, the transition provides for flexible deadlines, and for some individual entrepreneurs even a time delay. When exactly and who may not yet use online technology is regulated by the updated Law No. 54-FZ of May 22, 2003.

The right to work without a cash register is for individual entrepreneurs who:

- Listed in paragraph 2 of the article. 2 of Law No. 54-FZ - these are entrepreneurs providing small household services to the population, as well as retailers. For example, providing services for repairing shoes, looking after sick people, receiving glassware; retail sales at fairs and exhibitions; retail sales of food or non-food products, etc.

- Apply PSN or UTII according to clauses 7-9 of the stat. 7 of Law No. 290-FZ - subject to the issuance of a BSO (strict reporting form) upon request of the buyer.

- Located in hard-to-reach areas according to clause 3 of Article 2 of Law No. 54-FZ - subject to the issuance, at the buyer’s request, of documentation confirming the fact of payment for the purchased product or service.

Thus, it is mandatory for those individual entrepreneurs who use OSNO, Unified Agricultural Tax or Simplified Tax System to work with the use of a new type of cash register. Other individual entrepreneurs have the right not to use online cash registers until 07/01/18 (clauses 8, 9 of Article 7 of Law No. 290-FZ) subject to the mandatory requirement for issuing BSO.

Documentation preparation

Individuals who are subjects of entrepreneurial activity are exempted by current legislation from the following obligations related to documenting cash transactions:

- Establishing a restriction (limit) on the amount of cash remaining in the cash register of a business entity at the end of the operating day. An individual entrepreneur has the right not to limit the cash balance in his own cash register. You can legally keep as much cash as you need.

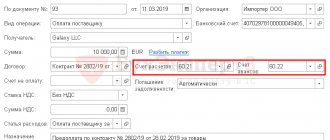

- Drawing up cash orders. Cash receipts do not need to be registered with a receipt order (PKO). The expenditure of cash does not need to be certified by filling out an expense order (RKO).

- Entering information about the receipt and expenditure of cash in the cash book. The individual entrepreneur has the right to refuse to fill out this document.

How to register a cash register for an individual entrepreneur

What should the cash register of an individual entrepreneur be in 2021? The old-style cash register provided for the fiscalization of information through EKLZ by collecting data from the seller. New online models are equipped with an improved device - a fiscal information storage device and have Internet access. At the same time, to transfer data to the Federal Tax Service, there is a special organization between the tax inspectorate and the seller - OFD (fiscal data operator), with the help of which all information about cash payments with clients is promptly received by the control authorities.

We figured out whether an individual entrepreneur should have a cash register. How to register the device with the tax office if an online cash register is a necessity?

Buying an online cash register

Before you buy new equipment, make sure that you cannot upgrade the old one. For clarification, you can contact the cash register supplier directly with a question about the possibility of improving the cash register. When modernization is permissible, the device must be deregistered with the Federal Tax Service and transferred to the manufacturer to perform a set of works. The cost of such a service will certainly be cheaper for the individual entrepreneur than purchasing a new electronic cash register. The approximate average price of modernization work ranges from 5 to 10,000 rubles. At the same time, the cost of purchasing a new cash register will be 15,000-30,000 rubles.

Note! You need to purchase new online cash registers only from the list approved by the Federal Tax Service, posted on the tax service website. If the selling company is not on the official list, you should not enter into an agreement with such a company due to violation of legal requirements.

Selecting OFD

After the individual entrepreneur has purchased an online cash register, you should select the OFD through which information about sales will be transmitted to the Federal Tax Service. Like cash register suppliers, you should choose an operator exclusively from the official list. The main guideline when choosing is the cost of service, as well as the availability of additional services, for example, online registration of changes, including deregistration of cash registers. The average service price for the first year is 3,000 rubles, in subsequent years - about 12,000 rubles. annually. Additionally, you will need an Internet connection, the cost of which will be about another 6,000 rubles. in year.

Registration of cash register with the tax office

Does an individual entrepreneur need to register a cash register with the Federal Tax Service? Of course, such registration of cash register is necessary. This can be done through your OFD or independently. In the first case, you will need to pay for an additional service - about 2000-3000 rubles. In the second, you can act independently through the official website of the Federal Tax Service; the necessary condition is the presence of an enhanced digital signature (electronic digital signature). If the signature is not completed, you will not be able to register an online cash register via the Internet yourself.

What does the process of registering an online cash register with the Federal Tax Service include:

- An application of the established form is submitted - through the website of the Federal Tax Service or your OFD, with which an agreement for the provision of services has been previously concluded. Additionally, a registration certificate, copies of conclusions and other documents at the request of the tax inspectorate are attached confirming the KKM’s compliance with regulatory requirements.

- Within one working day, the Federal Tax Service informs the applicant of the registration number of the cash register: the data is entered into the Federal Tax Service (fiscal drive) along with the name of the individual entrepreneur.

- Registration of the cash register is carried out by an inspector of the Federal Tax Service within 5 days from the date of filing the application - after which the data on the cash register is entered into the cash register registration card, which is redirected to the entrepreneur and serves as official confirmation of the registration of the cash register for tax purposes.

Requirements for the premises of cash registers of enterprises

The requirements for cash register premises are complex. They concern all aspects of the room.

Walls and ceilings

The following requirements apply to walls and ceilings:

- Walls and ceilings must be at least 500 mm thick, concrete blocks - at least 200 mm thick, reinforced concrete panels - at least 180 mm thick.

- Partitions should be similar to external walls. They are constructed from 80 mm thick plasterboard panels. A metal grid with a diameter of at least 10 mm is laid between the panels. The cell dimensions are no more than 150 x 150 mm.

- If the walls and ceilings do not meet the listed requirements, their internal surfaces are reinforced with metal gratings. Their diameter is at least 10 mm. If it is not possible to install gratings from the inside, they are installed from the outside. However, this decision must be agreed upon with security units.

- If the cash register premises are located next to other premises (boiler rooms, entrances, etc.), the walls and ceilings on the inside are also strengthened.

Walls and ceilings are the basis for the security of a room.

Doors

The following requirements apply to doors:

- Doors must meet the standards of GOST 6629-88, GOST 24698-81, GOST 24584-81. They must be durable and withstand hacking attempts: both physical (shoulder hits) and those involving the use of tools (crowbar, ax, etc.).

- The requirement for entrance doors is serviceability. Their thickness is at least 40 mm. Doors are equipped with at least two mortise locks. They are mounted at a distance of at least 300 mm.

- Entrance doors are covered with sheet steel. On the inside they are equipped with a metal chain and a peephole.

- The strength of doors can be increased. For this purpose, special linings, corner lock strips, and reliable door hinges are used. You can strengthen the door leaf.

- Shaped grilles can be used to provide increased protection.

- The doorway is framed with a steel profile.

Doors are also the basis of security. It is through them that criminal entry is usually carried out.

Window

Windows must meet these requirements:

- The outer door or wall has a door through which cash transactions are carried out. Its size is no less than 200 x 300 mm. If the window size is larger than the standard size, it is reinforced on the outside with a “rising sun” grille.

- Windows and vents are glazed and equipped with reliable locks. The glass is fastened in the grooves with high quality.

- The openings of the cash register area are equipped with metal bars. They are made from steel rods. Their diameter is at least 16 mm.

- It is possible to use decorative grilles. However, their strength must be sufficient to ensure safety. That is, gratings cannot play only a decorative function.

- Grilles can be mounted both from the inside and between the frames. In the latter case, the window opens outward.

- If bars are placed on windows, one of them should be sliding. A padlock is installed on this grille.

- If the room belongs to group A, protective shields must be used in addition to the grilles.

Windows can be internal or external. The first ones are used to issue funds.

Ventilation shafts and chimneys

You can also enter the room through the ventilation shaft. Therefore, it is also equipped with structures for protection:

- Shafts and chimneys with access to other rooms and to the roof are equipped with metal gratings.

- For protection, you can use false grilles, which are made of metal tubes with a diameter of at least 6 mm.

The gratings must be durable. They provide a barrier to penetration.

Locking devices

Locking devices are locks. If they are equipped in rooms of group “A”, the devices must be highly reliable. Let's consider the requirements for locking devices:

- Mortise locks without an automatic latching function, padlocks and padlocks, bolts and latches are used as locking devices.

- High security locks of the “Abloy” type are installed.

- The degree of protection is considered high if there are five locking pins on the locking cylinder.

- Padlocks are usually a tool for added security.

- Door hooks are made of metal rods with a diameter of at least 12 mm.

The security qualities are influenced by the method of fastening the safety linings and other parts. Fastening in locks is carried out using screws.

Door hinges

Door hinges are made of steel. The latter provides the necessary strength. Fastening is done using screws. If the doors open outward, end hooks are installed.

Individual entrepreneur - cash discipline 2021

Should an individual entrepreneur keep a cash register ? A detailed response from the Bank of Russia is contained in Instructions No. 3210-U dated March 11, 2014. It defines the regulations for registering cash discipline of legal entities and entrepreneurs. According to clause 4.6 of the document, individual entrepreneurs may not maintain a cash book, subject to accounting for income transactions, as well as expense transactions, by reflecting information in the KUDiR. Or, in the absence of the need to maintain KUDiR on UTII, subject to tracking the physical indicators used in the calculations of the imputed tax.

In practice, this norm means the following - regardless of the current field of activity, the scale of the business and the tax regime used, entrepreneurs may legally not maintain a cash book. KO-4. And each businessman makes the decision on the advisability of full accounting of cash flows independently. Drawing up incoming and outgoing orders and a cash book helps to obtain reliable data on cash inflows/outflows and balances in the company's cash register. Cash discipline cannot be avoided for those individual entrepreneurs who have a large number of staff, have subordinates, pay salaries and benefits in cash, etc.

If an entrepreneur has decided on the need to draw up a cash book, he should adhere to the general regulations for cash accounting. That is, maintain primary documents daily (on cash days), stitch and certify KO-4, issue payment and payroll statements, appoint responsible persons for the timely generation of these documents. In the absence of KO-4, no sanctions are provided for the individual entrepreneur.

Level of protection required for the cash register

The cash register is an object of the highest degree of protection, which is ensured by installing additional grilles, hinged locks (made of hardened steel), mortise locks, overhead locks, latches, hooks, high-security locks (with five or more corkscrew pins), lever locks (with 6 levers). Locks must be installed in accordance with established requirements (use of safety linings, shields, etc.).

Accounting for cash transactions: accounting aspect

The accounting department of a legal entity is responsible for recording all cash transactions, which includes:

- Use of accounting registers, correctness of data entered into them

- Maintaining primary documentation

- Accurate reflection of digital indicators in financial statements

- Entering into the reporting documentation data only about real (actually carried out) economic activities

- Application of accounting register accounts

- Maintaining reports based on indicators entered into accounting registers

In order for the tax service to have a reason to hold the guilty person accountable, the violation of the requirements for maintaining accounting of cash transactions must be recognized as significant (gross).

Conducting a cash audit

In order to monitor compliance with the legality of the economic activities of the enterprise, as well as the normative implementation of cash transactions, an audit is carried out at the cash desk of a business entity.

The presented checks can be carried out:

- Company management or auditor specialists

- Authorized tax officials

- Officials of the Ministry of Finance

The legislator establishes the possibility of conducting voluntary audits (at the discretion and at the request of the management of the enterprise), and also provides for cases in which such an audit is mandatory:

- When recording offenses in the organization in the area of financial flows (for example, theft)

- When preparing the annual report

- Upon termination of an employment contract with a cashier or upon appointment of another employee to temporarily perform the duties of a cashier

The audit must be accompanied by the preparation of documentation (an order to conduct it with a set deadline, reports on the progress of the audit, conclusions, etc.) provided for at the legislator level, as well as compliance with the regulatory legal acts of the procedure:

- Preparatory stage

- Recalculation of financial assets held at the cash desk in cash

Analysis of the objectivity of exceeding established cash limits (if detected)- Carrying out control measures to ensure compliance with measures aimed at the safety of valuables stored in the cash register

- Checking the compliance of the cash register with the established requirements of cash discipline

- Identification of misuse of financial resources

- Drawing up reporting documentation based on the audit performed

Important! Upon completion of the audit, an act is issued, in the preparation of which the INV-15 form established by the legislator must be used.

To ensure an adequate level of protection for the cash register premises, entrepreneurs and heads of legal entities are required to comply with the requirements established by the legislator for organizing work and conducting cash transactions. The totality of such conditions constitutes cash discipline, non-compliance with which is the basis for bringing the perpetrators to administrative and criminal sanctions.

Top

Write your question in the form below

Limiting cash balance

Today, the legislator gives the management of legal entities the right to independently establish a limit on the cash balance by enshrining the corresponding provision in the local acts of the organization.

This limit should be understood as the maximum permissible amount of funds expressed in cash and stored in the cash register premises. The practical purpose of the limit is the delivery of financial assets exceeding its amount (without objective reasons) to a financial institution.

When making calculations to determine the limit, specialists are guided by indications of the amount of incoming or outgoing funds during the established billing period, taking into account collection.