Why prepare a SZV-M report?

In accordance with Art. 3 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” the goals of individual (personalized) accounting are:

- creating conditions for the appointment of insurance and funded pensions in accordance with the labor results of each insured person;

- ensuring the reliability of information about length of service and earnings (income), which determine the size of insurance and funded pensions when they are assigned;

- creation of an information base for the implementation and improvement of the pension legislation of the Russian Federation, for the appointment of insurance and funded pensions based on the insurance length of the insured persons and their insurance contributions, as well as for the assessment of obligations to the insured persons for the payment of insurance and funded pensions, urgent pension payments, lump sum payments pension savings funds;

- developing the interest of insured persons in paying insurance contributions to the Pension Fund of the Russian Federation;

- creating conditions for monitoring the payment of insurance premiums by insured persons;

- information support for forecasting the costs of paying insurance and funded pensions, determining the tariff of insurance contributions to the Pension Fund of the Russian Federation, calculating macroeconomic indicators related to compulsory pension insurance;

- simplification of the procedure and acceleration of the procedure for assigning insurance and funded pensions to insured persons.

The SZV-M form was approved by Resolution of the Board of the Russian Pension Fund dated February 1, 2021 No. 83p “On approval of the form “Information about insured persons.” In the section “Information about insured persons”, information about insured persons is indicated - employees with whom employment contracts, civil law contracts, the subject of which is the performance of work, the provision of services, author's order contracts, contracts for alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements granting the right to use works of science, literature, art

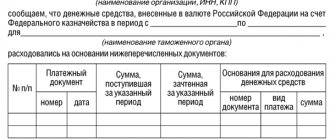

| № p/p | Last name, first name, patronymic (if any) of the insured person (filled out in the nominative case) | Insurance number of an individual personal account (required to be filled in) | TIN (filled in if the policyholder has data on the individual’s TIN) |

Thus, in the SZV-M it is necessary to indicate information about employees, about contractors with whom an employment contract has been concluded, a contract agreement that is currently in force or has ceased to be valid in the reporting period. In this matter, it is necessary to be guided solely by the duration of the contract.

With what errors will the report be fully or partially accepted?

If the inspectors send the policyholder a positive report, this does not mean that there are complete absence of errors in the submitted SZV-M. Errors with codes 30 and 20 are not critical; with them the report is considered submitted, but for those persons for whom errors were identified, the information may have to be supplemented.

Code 30 is usually assigned for errors in full name. or SNILS of employees. All this data must match what is stated in the insurance certificate. Although the controllers will accept such a report, information with identified errors will need to be submitted with a supplementary form.

Errors in the TIN of employees or the complete absence of this parameter are indicated by code 20. A supplementary form in the absence of a TIN will not be required; the inspectors will accept the report. But an incorrect indication can result in a fine, so it is better to correct such information.

How can I send SZV-M?

According to Art. 8 of the Federal Law of April 1, 1996 No. 27-FZ, information for individual (personalized) accounting submitted in accordance with this Federal Law to the bodies of the Pension Fund of the Russian Federation is presented in accordance with the procedure and instructions established by the Pension Fund of the Russian Federation.

This information may be presented as follows:

| Method of reporting | Conditions |

| In the form of written documents | Provided that the number of insured persons (including those who have entered into civil contracts for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) does not exceed 25 people |

| In electronic form (on magnetic media or using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services) with guarantees of their accuracy and protection from unauthorized access and distortion | The policyholder provides information on 25 or more insured persons working for him (including persons who have entered into civil contracts) for the previous reporting period in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation. |

When submitting information in electronic form, the relevant body of the Pension Fund of the Russian Federation sends to the policyholder confirmation of receipt of the specified information in the form of an electronic document.

Results

Submission of the SZV-M is accompanied by confirmation from the Pension Fund inspectors that the report has been accepted. In this case, a positive protocol is formed. If acceptance is refused, a negative protocol is generated. In the latter case, the policyholder will have to correct errors in the reporting form and resubmit it. To do this, he is given 5 working days from the date of receipt of the refusal to accept reports.

In addition to critical errors that lead to the formation of a negative protocol, there are errors with which the report will be partially accepted. In this case, you will need to send a supplementary form to the Pension Fund. There are also errors with which the report will be accepted in full and no additions will be required.

Sources:

- Federal Law No. 27-FZ dated 04/01/1996 (as amended on 04/01/2019) “On individual (personalized) accounting in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 No. 1077p “On approval of the format of information for maintaining individual (personalized) accounting (form SZV-M)”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How does the Pension Fund accept the SZV-M report?

When a report is received by the Pension Fund, it goes through several stages of control, at each of which it may not be accepted.

When checking the report, a number of parameters are assessed:

| Parameter | A comment |

| Format | Electronic file format |

| File name | For an electronic document |

| Policyholder details | Data correctness |

| Signature | There must be a valid signature both on paper and electronically. |

| SNILS | SNILS must correspond to the owner |

| Form type |

There must be one source form in one reporting period.

A supplementary form is provided after receiving a protocol with errors from the Pension Fund.

|

It is worth noting that if a report is submitted in electronic form, even if all fields are filled out correctly, but if the electronic format is incorrect, the report will not be accepted by the Pension Fund.

How the report is checked at the Pension Fund

Business entities acting as employers (organizations - all without exception, individual entrepreneurs - only with hired employees) have been submitting the SZV-M reporting form every month for almost 5 years.

It is sent before the 15th day of the month following the reporting month, in paper or electronic form - depending on the number of insured persons. A sample of SZV-M using the new form can be downloaded from ConsultantPlus. Trial access to the legal system is provided free of charge.

When submitted according to the TKS or when entered by an inspector from paper, the reporting information enters the fund’s automated system, where it is processed for errors. If detected, they are assigned a specific result code.

Error code 50 is critical. A report with it will not be accepted by inspectors. The reporting person learns about this from the negative protocol received from the controllers.

Common mistakes in SZV-M

When providing SZV-M in electronic form, in some cases the policyholder receives a negative inspection report. In this case, it is necessary to correct the errors and submit the report again.

Resolution of the Pension Fund of the Russian Federation (PFR) dated December 7, 2021 No. 1077P “On approval of the format of information for maintaining individual (personalized) accounting (form SZV-M)” provides error codes:

| Code | Error |

| 50 | The XML document is filled in incorrectly |

| XSD schema mismatch | |

| Incorrect electronic signature | |

| The “Registration number” element contains an incorrect number under which the policyholder is registered as a payer of insurance premiums, indicating the region and district codes according to the classification adopted by the Pension Fund of Russia | |

| Invalid Taxpayer Identification Number provided | |

| Previously, a form with the form type “original” was already presented. | |

| The reporting period for which the form is submitted is not less than or not equal to the month in which the audit is carried out | |

| 30 | SNILS not specified |

| The full name contained in the insurance certificate is not indicated | |

| The status of the ILS in the register of “Insured Persons” on the date of the document being checked is equal to the value of “UPRZ” | |

| At least one of the ′Last Name′ or ′First Name′ elements is not specified | |

| 20 | The TIN check digits of an individual are not the number calculated according to the algorithm for generating the TIN check number |

| The TIN element of the insured person is not filled in |

Failure when transmitting data via TCS

The organization submitted the electronic SZV-M on time.

But then I discovered that due to a technical failure when transmitting reports via TCS, the section “Information about insured persons” was not filled out. Therefore, it submitted a complementary form SZV-M. The Pension Fund of Russia fined the organization. In his opinion, the submission of information on the supplementary form SZV-M cannot be qualified as its clarification (correction), since no changes were made to the individual data of the insured person, the information was not supplemented, but was submitted for the first time and in violation of the deadline.

The Arbitration Court of the Volga District, in its resolution dated May 21, 2020 No. F06-61248/2020, canceled the fine and drew attention to the fact that the organization itself found the error and eliminated it before it was discovered by the Pension Fund.

Even despite the fact that a two-week deadline was set for submitting corrective information, and the information was sent later. But the current pension legislation does not provide for liability for organizations for violating the two-week deadline for submitting corrected data on insured persons.

More on the topic:

When will the supplementary SZV-M report be needed?

Why is there no protocol from the Pension Fund of Russia on the SZV-M report?

When sending the SZV-M report, it is advisable to pay attention to the following control points:

| Submission of the SZV-M report | A comment |

| Check errors | Before sending, correct any errors found during self-checking of the report. |

| Dispatch | Save the receipt confirming the shipment of the SZV-M. thanks to the receipt, the policyholder will have the opportunity to prove that he is right, indicating that the report was submitted on time. |

| Lack of protocol | Clarify with the Pension Fund the reason for the absence of the protocol (perhaps the reason for the absence of the protocol is a technical failure in the Pension Fund). |

If there is no protocol from the Pension Fund, you should not send the SZV-M report again.

Who is responsible for delivery?

Before clarifying the main issue - when there is no protocol from the Pension Fund for SZV-M - you need to understand the terminology.

What is "SZV-M"? This is a special form according to which a company or individual entrepreneur keeps a report to the Pension Fund of the Russian Federation. Stands for incoming information about the insured. That is, which the company submits to the fund. And the letter “M” indicates that this reporting is monthly (PFR Resolution No. 83p dated 02/01/2016).

Also see “New SZV-M report form from 2021”.

The head of the company appoints the person responsible for maintaining such documentation at his own discretion. But, as a rule, this is done by someone from the HR department (or an accountant): they have access to all personal affairs and contracts with employees.

Every month, SZV-M provides a list of all employees who worked for the organization during the reporting period (month). Even if a person worked for the company for only one day, information about this still needs to be reflected.

Also see “Instructions for filling out the SZV-M form in 2021.”

What are the consequences for not accepting the SZV-M report?

For violation of the submission of the SZV-M form, the insurer is held liable:

| Offense | Penalties | Normative act |

| SZV-M is not represented for individual contractors | Fine 500 rubles for each insured contractor | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

| Failure of the policyholder to comply with the procedure for submitting information in the form of electronic documents | Fine 1000 rubles | Art. 17 Federal Law dated April 1, 1996 No. 27-FZ |

Failure due to maintenance work

On the last day of the deadline, the organization tried to submit reports in the SZV-M form electronically. But an Internet failure prevented the report from being delivered to the transport server.

Therefore, the organization was able to submit information in the SZV-M form only the next morning - on the first working day after connecting to the Internet and restoring the operation of the software package for submitting electronic reports.

However, the Pension Fund decided to fine the organization.

Disagreeing with this, the policyholder went to court, which came to his defense. To support its arguments, the organization presented letters from the provider about the lack of Internet connection services or lack of access to the key media with an electronic signature certificate, as well as a response about the lack of Internet connection due to equipment maintenance.

Resolving this dispute, the Arbitration Court of the East Siberian District, in its resolution dated June 23, 2020 No. F02-2402/2020, came to the conclusion that the insured was not to blame for the incident. Therefore, the fine was canceled.