Author: Alena Donmezova – Specialist in RKO

Date of publication: 07/02/2019

Current for May 2021

Judging by surveys from independent agencies, banks are blocking accounts more and more often, and the consequences for small and medium-sized businesses are being felt more and more. If the account is blocked, the company cannot fully conduct administrative and economic activities, which leads to losses. At the same time, it is impossible to open another current account not only in your own bank, but also in another bank.

Of the 2,300 respondents, about 500 faced blocking, which is 20%. Half of them are due to the fault of entrepreneurs themselves, who did not pay taxes on time, made mistakes in paperwork and did not submit returns on time. The second half is the fault of regulatory authorities and banks. This may be a blocking with reference to 115-FZ or without explanation at all. The editors of the site pro-rko.com figured out all these reasons, and also collected recommendations on how to avoid blocking accounts.

Who can block?

As part of the exercise of its powers, the tax service has the right, along with issuing a ban on the alienation of the debtor’s property, to block his current account. This interim measure is enshrined in Art. 72 of the Tax Code of the Russian Federation. If this happens, the individual entrepreneur will not be able to use such a necessary tool for business as a current account for its intended purpose: pay contractors, withdraw cash from it.

In modern realities, when an increasing number of business entities are switching to non-cash payments, blocking can be very effective. It encourages the taxpayer to quickly repay the debt to the budget, since delay threatens losses and loss of trust of partners, and activities are completely paralyzed. At the same time, the entrepreneur will not be able to open a new account, and not a single bank will go against the tax authorities’ decision.

In addition to the Federal Tax Service, other government services can also issue a decision to suspend the movement of funds:

- Rosfinmonitoring;

- customs Service;

- Bailiffs Service.

Like tax authorities, customs have reasons to apply this measure. This applies to those businessmen who import imported goods into our country and must pay customs duties for them. This procedure is prescribed in Art. 155 of Law No. 311-FZ of November 27, 2010 “On Customs Regulation”.

If an individual entrepreneur has allowed the formation of a significant debt with penalties and fines, then these amounts will be collected through the court. Do not forget that an individual entrepreneur can also be liable for the debts of an individual. Like any person, he may have unpaid alimony or utility bills. As part of enforcement proceedings for collection, bailiffs may conduct an inspection of all the debtor’s property, and his accounts may be “frozen.”

Attention! Even if an individual entrepreneur has a large amount of debt to the extra-budgetary funds of the Pension Fund and the Social Insurance Fund, they do not have the right to contact credit institutions to block expenditure transactions on the accounts of their debtors. But this does not mean that the debt will be forgiven. Now the Federal Tax Service is in charge of administering insurance premiums, and this body has all the powers to apply such strict measures.

In addition to government agencies, the bank itself can prohibit transactions on an account.

Suspension of a specific financial transaction

If the bank has doubts about the purity of the transaction, then it has the right to demand additional documents and information. Clause 14 of Article 7 of Law No. 115-FZ establishes the obligation of clients to provide information necessary for banks to comply with legal requirements. Therefore, while receiving a response from the client and processing it, the bank suspends the transaction, which it considers doubtful, until the end of the next business day. At this time, you must have on hand all the documents necessary to confirm the operation:

- agreement

- check

- act/invoice or other supporting document.

The bank will either call or write a request through the client bank to provide documents confirming the operation. It is important to do this on time, otherwise the bank will not have time to verify the payment and process it before the end of the next business day. If the operation is still refused, then get ready for a more extensive check . In addition, the bank will add you to the “black list” No. 639-P. In the future, in order to prove the purity of the operation for which the refusal was received, you will have to go through a two-stage rehabilitation mechanism prescribed in Law No. 115-FZ.

I discussed in detail the mechanism for exiting the “Black Lists” in the article;

How to unblock an account under 115 Federal Law? How to get off the blacklist since March 2018?

What documents can banks request in connection with blocking an account under 115-FZ?

The bank may request any documents that it specifies in its internal control rules. As a rule, this is a closed list that can be replenished, but it should be understood that the rules arise from the recommendations of the Central Bank of the Russian Federation. The main list of regulatory information that banks use in their activities is given above.

What are the deadlines for submitting documents requested by the bank in connection with blocking an account under Federal Law 115?

When carrying out a large-scale audit of a client, the Central Bank recommends setting a time frame of 3 to 7 days. Most often, banks adhere to this procedure. But, the operational deadline for checking a specific financial transaction, as I wrote above, is the end of the next business day. We have to make it in time!

What happens if you do not provide the information requested by the bank?

If the bank does not provide documents on time, the transaction on the account will not be carried out. If a similar situation repeats, and the client again tries to carry out a dubious transaction, the bank has the right to terminate the agreement (paragraph 2, clause 5.2, article 7 of Law No. 115-FZ). If we are talking not just about carrying out a specific financial transaction, but about a larger-scale audit, then, based on the results of such an audit, the client may be “asked” to leave the bank on his own initiative. To follow or not to follow the bank's lead? Here, each situation is deeply individual.

It is no secret that some banks, when closing an account, may charge a “fee for non-submission (incomplete submission) of documents during verification.” Such a commission can reach 10-20% on the client’s account balance. Sometimes, it is better to stay and not lose money, try to prove that you are right by sending complaints to the Central Bank of the Russian Federation and the bank itself. But, unfortunately, this mechanism does not work with many banks. Therefore, sometimes it is possible to return the illegally withheld “fee for non-submission (incomplete submission) of documents during inspection” only through the court. But, fortunately, the courts, in such cases, very often side with the client, of course, if the latter has all the necessary evidence of fulfillment of obligations at the request of the bank.

Conclusion - we give the bank the full amount of required information, on time, with a detailed inventory with explanations for each item of the request. We don’t miss anything, even what you never had and shouldn’t have had!

Why is the tax office blocking?

The law clearly defines the list of reasons due to which transactions on the current account of an individual entrepreneur may be suspended. They can be found in Art. 76 of the Tax Code of the Russian Federation, and this list is closed. Based on the provisions of this article, we can identify situations that will entail this measure of compulsory enforcement:

- The individual entrepreneur has arrears of taxes or insurance premiums, the inspectorate sent him a demand for payment, but he ignored it. The interim measure of blocking is imposed only on the amount specified in the decision of the tax authority; the remaining funds can be freely used.

Attention! If a taxpayer receives a registered letter from the tax office, but he does not receive it, whether for a good reason or simply out of unwillingness, this will not relieve him of liability. The request is considered sent if it is sent by registered mail.

- The businessman did not report within the deadline established for filing a declaration or paying insurance premiums. 10 days after the deadline, a decision is made to block the account.

Important! If an individual entrepreneur is entrusted with the obligation to submit a declaration in accordance with the chosen taxation regime, then he must do this even if he has no income, or when he did not work. In this case, “zero” reporting is prepared. Errors or typos in the declaration will not in themselves lead to blocking of the account, but then you will need to submit corrective reports.

- The entrepreneur violates the rules of electronic circulation of documents with the tax authority and does not send receipts for receipt of documents via feedback via TKS. This applies to those individuals who use electronic communication channels to interact with the tax authorities. The individual entrepreneur must send confirmation of receipt of notifications within 6 days. If he does not do this, then the inspection’s response in the form of blocking operations occurs after 10 days.

- After an audit, the tax office made a decision against the individual entrepreneur to impose administrative liability, for example, in the form of a fine. For this decision to come into force, a certain time must pass, during which the taxpayer can sell or pledge his property and withdraw all money from his accounts. To avoid this, inspectors may impose a ban on the alienation of property or block the debtor's accounts.

In all of the above cases, the tax authorities’ actions are justified by law. As for banks, they are obliged to obey the decision of the state executive body and fulfill the collection order to write off the debt. The blocking of funds on the account may remain in effect until the debt is fully repaid.

What to do if your current account is blocked

The action plan includes only two steps, and you need to act quickly to unblock the account as quickly as possible.

Finding out the reason for the seizure of the current account

The easiest way is to check with your bank branch for the number and date of the tax inspector’s decision. Then you need to contact the tax office, the desk audit department, tell the specialist the number and date of the decision so that he can tell you the reason for blocking the account. This is necessary if the decision to block did not reach you by mail or through specialized communication channels.

Eliminating the cause of blocking

If you have not complied with the tax inspector's request to pay the tax, then you need to pay the tax. There is a practice of submitting to the tax inspectorate a copy of the payment order with the bank’s mark or sending this copy through specialized communication channels. After receiving the tax payment funds, the tax office will unblock the account within 24 hours.

The same scheme applies to the situation with submitting a declaration: to unblock an account, you need to submit a declaration, the most convenient way for this is the specialized operators Extern or Accounting. The current account will be unblocked within 24 hours.

To unblock an account in a situation where a receipt for acceptance of electronic documents has not been submitted to the inspection, you need to transfer the receipt to the inspection and submit the requested documents.

Previously, unblocking took a longer time because the decision of the tax inspectorate was delivered to the bank by couriers. Now this happens faster - through specialized communication channels, and the taxpayer does not need to take part in the relationship between the tax office and the bank.

How to avoid blocking your current account:

- Pay taxes from your current account and make sure that they are at least 0.9% of turnover.

- Withdraw cash as little as possible.

- Please indicate the detailed purpose of the payment. If you are paying for a service under a contract, please indicate its number and date. If you transfer money to a personal card, write: “transfer of personal funds.”

- Work according to OKVED. If the scope of your business has changed or expanded, change the OKVED codes or add new ones.

- Check your counterparties - request information from the bank, tax office or services such as Spark and Moedelo.Bureau.

- Do not ignore calls from the bank - remember that it is not profitable for the bank to block accounts, and bank employees want to help you.

Why is the bank blocking?

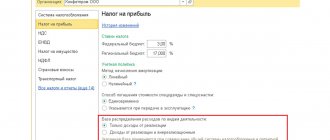

All banks in our country are subordinate to the Central Bank. They are required to comply with federal laws, orders and guidelines. One of the most recent legislative acts is the Central Bank Methodological Recommendations No. 4-MR dated 02/02/2017. They were created to identify and stop dubious transactions that are used by unscrupulous individuals for the purpose of:

- evasion of taxes and other obligatory payments;

- withdrawal of funds abroad;

- laundering (legalization) of funds earned by criminal means;

- providing financial support to terrorism.

Each bank has its own security service, which monitors all customer transactions, identifying dubious transactions among them. Particular attention is paid to transfers of amounts in large and especially large amounts (from 600 thousand rubles and 1.5 million rubles, respectively). To identify suspicious clients, bank employees focus on the following signs:

- if the share of taxes and other obligatory payments paid is less than 0.9% of all expenditure transactions, or the person artificially inflates this figure;

- if an individual entrepreneur has a staff of employees, but wages are not transferred from the current account to them, accordingly, personal income tax is not withheld and insurance premiums are not paid, or the wage fund is so small that it does not correspond to the number of employees, the minimum wage and the subsistence level;

- the cash turnover is very high, compared to the maximum stated when opening the account, and the money is constantly written off without a balance;

- funds are written off for purposes other than their intended purpose, transactions are not typical of the businessman’s activities (no payments for rent, for housing and communal services, etc.).

Important! The bank considers all these criteria in aggregate and on a systematic basis. If a client pays to the budget at a time for a certain tax period an amount that is less than 0.9% of the total turnover, then his current account will not be blocked.

Sometimes the blocking of transactions initiated by the bank in 2021 is due to a reason that the client cannot influence in any way: the revocation of the license by the Central Bank. Many people have faced this problem over the past three years, especially clients of small credit institutions. In this regard, only reliable banks, which value their reputation rather than the number of clients, can provide at least some bank guarantees to fund holders.

Suspension of account transactions (account blocking)

Legal blocking of an account by a bank is possible only in one single case:

If the account holder is included in the List of organizations and individuals in respect of which there is information about their involvement in extremist activities or terrorism.

The list is posted on the official Internet resource of Rosfinmonitoring and can be easily viewed. In all other cases, the decision to completely block the account can only be made by Rosfinmonitoring or the court.

Rosfinmonitoring has the right to “freeze” an account for up to 30 days and only if there is information about the account owner’s involvement in terrorist activities. For a longer period of time, the account can only be blocked by a court decision.

If the bank blocks the entire current account, and the company or individual entrepreneur is not on the list of Rosfinmonitoring, then such blocking is considered illegal.

Why is Rosfinmonitoring blocking?

There is a special authorized body for supervision in the financial sector - Rosfinmonitoring. This service operates in accordance with the provisions of Federal Law No. 115-FZ of August 7, 2001 “On Combating Income Laundering and the Financing of Terrorism.” The banks themselves must comply with this law; it is for violations discovered during an audit of their activities that many of these institutions have lost their license over the past few years.

As judicial practice 115-FZ shows, Rosfinmonitoring applies strict sanctions to those who arouse suspicion by their manner of doing business. What might attract the attention of this service? Such situations are when:

- the identity of the director is suspicious, his status may hint at a nominee if several companies are registered under him;

- Questionable payments are often made using inappropriate details and activity codes;

- it is not possible to establish the location of the organization due to the absence of a legal address, or this address falls under the criteria for mass registration;

- the company did not transmit information to the bank about changes in the constituent documentation;

- a businessman often withdraws money from his account, but does not pay taxes by non-cash payment, or the share of these payments is extremely small compared to the total turnover;

- there is no variety in the description of the purpose of operations if the same basis is present;

- the entrepreneur makes transfers to persons who are accomplices of terrorists.

All banks are afraid of the Rosfinmonitoring service, so it is easier for them to apply harsh sanctions against several of their clients who are suspicious than to take a risk and lose their licenses.

Refusal to carry out a specific financial transaction under 115-FZ.

The bank’s right to refuse to carry out an account transaction is provided for in paragraph 11 of Article 7 of Law No. 115-FZ. The operation may be refused in two cases:

- if the client, at the request of the bank, does not provide the requested documents relating to the financial transaction to be carried out;

- if bank employees, when performing control procedures, have suspicions that the operation is being carried out for the purpose of legalizing (laundering) proceeds from crime or financing terrorism.

By refusing clients from April 1, 2021, the bank has no prohibition on informing about the reasons for refusals to carry out transactions (Article 4 of Law No. 115-FZ). In accordance with the current version of Law No. 115 Federal Law, paragraph 13.4 of Art. 7 of Law No. 115 Federal Law states:

... a client who has received a refusal has the right to submit to the Bank documents and information confirming the absence of grounds for refusal of banking services. If the documents and information received from the client do not satisfy the Bank, then it is obliged to notify its clients not only about refusals to carry out transactions, about opening an account (deposit) or about termination of a service agreement, but also about the reasons for such measures.

I discussed in detail the mechanism for exiting the “Black Lists” in the article;

How to unblock an account under 115 Federal Law? How to get off the blacklist since March 2018?

What payments cannot be blocked?

Some types of transactions are possible even after the account is blocked. There is such a thing as the order of payments. In accordance with the Civil Code, the payment of taxes to the budget is preceded by:

- payments for compensation for personal injury;

- alimony payments;

- settlement of employees due to dismissal and payment of severance pay.

If funds allow, the individual entrepreneur can submit an order to the bank to pay such payments. In addition, the blocking only applies to expenses; no one prohibits replenishing the account.

How can a business survive in the current conditions and not become a victim of banks?

For conscientious businessmen who have fallen under the yoke of the anti-money laundering law, we have prepared some tips. It's up to you to decide whether to use them or not. Of course, it all depends on the specific situation.

1 tip:

Do as Law No. 115 - Federal Law says. Namely:

provide all documents and explanations that the bank asks for . This will help remove suspicion from you and prove your trustworthiness. If you provide the necessary evidence and the bank considers it, then the payment transactions you are trying to make will not be classified as suspicious in accordance with clause 2 of Art. 7 of Law No. 115-FZ. If the bank has accepted the documents, but does not consider them, as practice shows, this is a fairly common occurrence, then advice 2 and 4 are at your disposal.

Tip 2:

Is the situation familiar? Have you already provided, more than once, explanations and documents for similar payments, which the bank considers dubious every time? The list of documents in the request is growing and growing, creating insurmountable obstacles? Is every business payment put under a magnifying glass? Have you been turned off by your bank client and forced to personally bring each payment, give explanations and provide documents supporting it? Are you seriously advised to leave on your own and this is done verbally? Don't rush to close your current account and switch to another bank ! You can try to open in another bank, but it’s not a fact that problems won’t catch you there too. Let me explain why.

If your company or individual entrepreneur already has entries in the 639-P list, all banks see them. By transferring funds when closing an account to a new current account, the bank can make a “parting gift”, namely, make another entry in list 639-P when sending the last payment. It will sound like “Transfer of own funds in connection with the closure of an account under 115-FZ.”

Therefore, before you leave and close your checking account, understand the situation at your current bank.

Find out the reasons for blocking operations, find out if there are decisions to refuse operations. Provide the bank with documents and information explaining the economic meaning of the transactions for which you were refused. According to amendments to Federal Law 115 dated March 30, 2021, the bank is obliged to accept and consider such information within 10 days. If at the end of this period the bank does not change its decision, then it is necessary to contact the interdepartmental commission. For more details on how to do this, read the article:

How to unblock an account under 115 Federal Law? How to get off the blacklist since March 2018?

If during the proceedings with the bank it turns out that there are no official decisions on refusals to carry out transactions in relation to your company or individual entrepreneur, this indicates that you do not comply with the bank’s internal control rules and the bank does not want to see you as its client. Try to find out the parameters by which you “sank” and correct the situation. This way you will show the bank your integrity and, perhaps, the sanctions will soon end. If the bank does not change its attitude, leave, but take into account the lesson you learned so as not to find yourself in a similar situation again. Get ready, maybe they will give you the “parting gift” that I wrote about above.

Tip 3:

What to do if you are blocked from all transactions on an account on which large sums of money are stuck? There are 3 ways to withdraw money from your current account completely legally.

Your creditor is suing you.

This will take time for the trial, but when the creditor wins the trial and receives a writ of execution, he can present it to the bank, and the bank will be obliged to execute it.

Use the Judicial Order mechanism.

A court order is a court decision made by a single judge on the basis of an application for the collection of sums of money if the amount of money to be collected or the value of movable property to be claimed does not exceed 500 thousand rubles.

The deadline for issuing a court order is 5 days from the date of receipt of the Application for debt collection.

If the bank, say, has imposed a ban on the payment of wages, ask the employees to contact the magistrate and get a court order.

The same advice is valid for debt collection by suppliers. But, no more than 500 thousand rubles under one contract.

The bank will not be able not to process the document, but the disadvantage is the limited amount of collection.

Pay your taxes.

It is better to pay a tax that is not present at all in your activities. Then, you can contact the tax office to get a refund of the amount paid by mistake. Since this tax is not inherent in your activity, there will be no proceedings regarding it. Within 1 (and in practice, sometimes 2.3) months, you should receive money to the bank account that you indicated in the Tax Refund Application.

Tip 4:

What to do if the bank accepted the documents upon request, but, not wanting to understand the situation, illegally blocks the entire current account, and not a separate transaction? In this case, a complaint against the actions of the bank must be submitted to the Central Bank of the Russian Federation and the servicing bank. If you have the resources of time, money and desire, contact the Arbitration Court. Demand that the bank's actions be declared illegal. According to Art. 65 of the Arbitration Procedure Code of the Russian Federation, the bank is obliged to prove that it had grounds for suspending or refusing to carry out operations on behalf of the client. If your transactions are completely legal and you have provided all supporting documents, then most likely the court will side with you and oblige the bank to unfreeze your current account. There are precedents like this and they are not uncommon.

Don’t forget that you can recover losses, interest for using someone else’s money and legal costs from the bank (Articles 15, 395 and 856 of the Civil Code of the Russian Federation). It is extremely necessary to use this right, because This encourages the credit institution in its subsequent activities not to rush to conclusions and to consider all the arguments before making decisions.

Tip 5:

Banks do not favor the situation when a client has more than 3 current accounts, each of which carries out different transactions. For example, taxes are paid on one account, and settlements with counterparties are carried out in another way. The Central Bank's instructions recommend that banks analyze account turnover, wage payments, taxes and much more. Without information on your other current accounts, the bank will simply inundate you with questions and requests for information. Of course, blocking of account transactions is a very real event that can be expected in this situation.

If possible, use one account to conduct all transactions in your business, or use several accounts, but distribute the cash flows correctly.

Remember that for each current account you must undergo the following operations:

- Wage

- Taxes and insurance premiums are at least 0.9% of the account revenue (many banks require 1-2%)

- General business payments

How to check?

The official website of the Federal Tax Service has an expanded service, the capabilities of which allow you to check information about current decisions and suspensions. Its abbreviated name is “Bankinform”, the link to it is https://service.nalog.ru/bi.do. To get the result, just follow a few steps:

- Select the desired request type.

- Enter the details of the subject being checked: TIN and BIC of the bank.

- Pass the verification code and submit a request for processing.

- Receive a response in real time with the date of blocking and details of the Federal Tax Service that made such a decision.

Attention! The data in this database is freely available. Here you can find up-to-date information about all business entities: LLC, individual entrepreneur. Therefore, before concluding large transactions with counterparties, you can ask where to find information about blocking their current accounts. This measure will allow you to avoid the consequences of doing business with unreliable partners.

Eliminate the reason for blocking

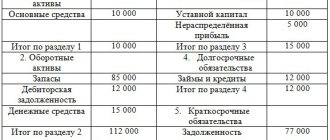

To freely use your account again, eliminate the reason for the blocking. The time frame for making a decision to lift the blocking is specified in paragraph 3.1 of Article 76 of the Tax Code of the Russian Federation. The tax office will make a decision and send it to the bank, after which the bank will remove the block. Our sign will help you understand how to please the tax authorities.

| Reason for blocking | What to do | When will the blocking be lifted? |

| Didn't submit the declaration. | Submit a declaration. | 2 business days after the tax office receives the declaration. |

| Did not pay tax, interest or fine upon request. | Pay tax, penalties or fines. | 2 business days after the money arrives in the tax account. Payment takes from 3 to 5 days, so to speed up the process, bring payments to the inspection. Then the blocking will be lifted 2 business days after receiving payments. |

| The receipt of the electronic demand was not sent. | — or send a receipt; — or provide documents or explanations upon request. | 2 business days after receipt of receipt/documents or clarification. |

Submit reports in three clicks

Elba - online accounting for small businesses. The service is easy to understand; it prepares reports and calculates taxes itself. There are integrations with banks and online cash registers.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

How to unlock?

Since this strict measure was applied to induce the payer to take some action, in order to cancel the blocking, this action must be completed. Therefore, before doing anything, it is important to know exactly the initiator of the sanction and its reason. Such information can be obtained from the bank's help desk.

Depending on who applied the blocking operation, you need to do the following:

- If the decision was made by the Federal Tax Service, then the deadline for unblocking the tax account is as follows: on the day the decision to cancel is made, if the measure was taken to ensure the collection of the debt at the expense of the debtor’s property; 1 business day after repayment of the debt, filing a declaration, and sending receipts for the receipt of electronic documents ;2 business days if the taxpayer replenishes the account with an amount suitable to pay the debt, or provides details of other accounts. In each of these cases, the tax office must notify the bank no later than the next day.

- If the bank has blocked it, and the reason for this does not depend on the client’s actions, then you need to get a written explanation. To do this, you need to submit a written request there and receive a response within two days. This document will be useful in the future to assert your rights.

- If the blocking was done by bailiffs, then you must first find out the amount of the debt and pay it off. This can be done on the department’s website, where you can pay by bank transfer and save the receipt. After submitting the check to the bailiffs, the unlocking process may take about a month.

- If the blocking occurred on the initiative of Rosfinmonitoring, then it will be necessary to collect many supporting documents justifying the legality of the operations performed.

Important! To avoid unnecessary questions related to compliance with 115-FZ, an entrepreneur must save all documents related to the business: lease agreements, supplies, receipts for the purchase of consumables, equipment repairs, etc.

What's going on in life?

In practice, it comes to the point that commercial banks block all transactions on a current account from the moment a request for documents and information is sent until the response is received and processed. Moreover, this often happens to completely conscientious clients who have nothing to do with terrorism or money laundering.

Sometimes the volume of documents requested by the bank is so large that it is physically impossible to provide the required amount of requested information within the specified time frame. Of course, I advise you not to violate the deadlines, but if you understand that the situation is hopeless and you don’t have time, don’t despair! Urgently write a letter to the bank and indicate the approximate volumes that you need to provide.

– If we are talking about a huge amount of information that needs to be copied on paper, describe the approximate number of pages or, perhaps, we are talking about volumes in bags and cars.

– If you are sending a response through a client bank, then write in the letter approximately how many containers of information you will have.

In any case, do not remain silent and start fulfilling the bank’s request immediately, this way you are more likely to respond in a timely manner.

According to Business Russia, almost half a million entrepreneurs had their bank accounts blocked. And not all of them were actually involved in money laundering and aiding terrorism. For those on the “black list”, even if they open a new current account, it is unlikely that they will be able to work normally. The situation for business is indeed very difficult. At the Eastern Economic Forum in September 2021, an entrepreneur complained about this to the head of Sberbank, German Gref, and heard in response that small businesses are “a profit laundering factory.”

This begs the question:

Illegal blocking

The procedure for applying this interim measure has many nuances. A businessman who finds himself in this unpleasant situation must not only know his rights well, but also have an idea of the work procedure of the body that blocked the account. Violations of these provisions make blocking illegal. Most often, this sanction is unlawful if:

- it was initiated by a body that does not have such powers, for example, the Pension Fund, Social Insurance Fund or Compulsory Medical Insurance Fund;

- the decision was made regarding the type of account to which this measure cannot apply, for example, loan, deposit, transit accounts;

- the taxpayer is already bankrupt;

- the decision to suspend was not sent in accordance with the form;

- the deadline for sending a tax demand for payment of the debt was violated, or the letter was sent by regular mail (not registered);

- the business entity violated the deadline for submitting financial statements, while submitting the tax return on time;

- the taxpayer made inaccuracies in the declaration, but submitted it on time;

- The deadline for filing tax reports was missed through no fault of the individual entrepreneur: it was delayed by the post office or the operator of electronic communication channels.

How to deal with illegal actions of the regulatory body, are there any levers of influence for them? You can defend your case in a higher authority, for the Federal Tax Service this is the Tax Service Department for the subject of the Federation. Usually it is located in the capital of the republic, or a large regional city. If this does not help, then you can complain directly to the Arbitration Court. As arbitration practice shows, it is quite possible to appeal an illegal decision, and the victim can receive interest from the inspectorate for each day of illegal blocking.

Thus, one of the important tools for doing business is a current account. The suspension of expenditure transactions on it greatly slows down activity. To avoid falling under this sanction, you need to pay taxes and other obligatory payments on time.

Why does the Federal Tax Service block a current account?

Let's start with the fact that it is necessary to distinguish between blocking under No. 115-FZ and the suspension of expense transactions by decision of the Federal Tax Service. In the first case, banks completely refuse service to a client if there is suspicion of him receiving illegal income. Such refusals are not always based on real grounds; in addition, banks are not required to provide a specific reason for blocking.

However, many large banks are loyal to small businesses. We recommend our users to study the offers of Sberbank, Alfa Bank and Tochka. These lending institutions were able to find the right balance between business interests and their own.

If you are in doubt about where to open a current account, take advantage of a free consultation on bank offers.

The blocking of a current account by the tax inspectorate occurs on the grounds listed in Article 76 of the Tax Code of the Russian Federation.

- Debt on taxes, contributions, fees, fines or penalties.

- Failure to submit a tax return or calculation of insurance premiums on time.

- Failure to fulfill the obligation to accept documents from the Federal Tax Service, sent via TKS through an electronic document management operator.

- Failure to comply with the requirements of the tax authority to provide explanations.

Another reason for blocking transactions on a current account is specified in Article 101 of the Tax Code of the Russian Federation - as an interim measure when brought to justice for a tax offense.

Thus, in order to avoid problems with blocking, it is necessary to fulfill the taxpayer’s duties on time: transfer payments to the budget, submit reports, respond to the inspection’s requests for explanations.

Your account is blocked! What to do if you are an individual entrepreneur?

Blocking of accounts by tax authorities and banks is a problem that has plagued small businesses since the end of last year. We have prepared for you a set of simple recommendations on what to do if this disaster happens to you

For the last six months, almost every second individual entrepreneur has been afraid of having their account blocked. Every day new posts appear on social networks that the bank has refused to carry out a transaction and blocked money, for example, for attempting to transfer to a relative or friend or even to your own card.

According to estimates from Business Russia, in 2021, banks blocked about 500 thousand current accounts of entrepreneurs. The thing is that banks today are overly actively complying with the requirements of the law on combating income laundering (No. 115-FZ), and sometimes indiscriminately block the accounts of entrepreneurs and individuals for suspicious transactions. Most often, however, the credit institution offers to unblock the account and/or transfer funds to an account in another bank for a certain commission. You can take advantage of this opportunity, or you can prove that you are right. Here's what we recommend doing.

First of all, find out from the bank the reason for the blocking

If your bank account is blocked, first of all, you need to find the reason. For example, an account may be blocked at the initiative of the tax authorities. The Federal Tax Service has this right if the entrepreneur has not paid taxes (clause 2 of Article 76 of the Tax Code of the Russian Federation). Then, not the entire account and the funds on it are blocked, but only the amount of debt to the tax authorities.

However, more often the bank itself initiates the blocking. By law, banks can block a client’s account if suspicious signs are detected (Federal Law No. 115-FZ of August 7, 2001 “On Combating Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” (hereinafter referred to as Law No. 115 -FZ). By the way, such blocking can happen both to an individual entrepreneur and to a private person. There is no clear list of operations that cannot be performed, but most often transit operations (transfers) and loans cause suspicion among a credit institution, especially if the amount is large .

In the case of individual entrepreneurs, sometimes the bank compares tax payments and cash flows, and if they do not seem adequate to the bank - for example, taxes are 3 thousand rubles, and 100 million rubles pass through the account, the bank blocks the account. Moreover, such “inadequacy” identified by the bank can be challenged in court. This cannot be the only reason for blocking an account, for example, as the arbitrators of the Far Eastern District dated August 29, 2016 No. F03-3838/2016 indicated in their ruling).

Eliminate the cause and request the bank to unblock the funds

If the account is blocked by the Federal Tax Service, everything is simple. You pay taxes, fines, penalties, and the account will be under your control again. In order for this to happen as quickly as possible, we recommend that you independently submit a bank tax statement confirming payment of the arrears. According to the Tax Code, the unblocking period is no later than one day following confirmation of tax payment.

If the bank has blocked the account on suspicion of money laundering, you must contact the bank branch with a request to explain the reason for the blocking. In some cases, it will be enough to provide an agreement, deed and other documents confirming the legality of the transaction. But sometimes the bank refuses to unblock the account without explanation. Even if you have provided all the necessary documents. In this case, proceed to action number 3.

Can't unlock it? Contact the Arbitration Court

File a claim with the Arbitration Court, and the bank will be forced to prove the legality of its actions in court. According to Art. 65 of the Arbitration Procedure Code of the Russian Federation, it is the bank that is obliged to prove that the grounds for blocking the account were sufficient! If you sue, win and receive a writ of execution, the bank is obligated to enforce the judgment in your favor. And there are a number of cases in which the courts sided with the client, for example, the resolution of the Arbitration Court of the Ural District dated September 25, 2015 No. F09-6389/15 in case No. A60-2597/2015, the resolution of the Arbitration Court of the Far Eastern District dated May 7, 2015 No. F03 -1619/2015.

In principle, each credit institution has its own list of suspicious signs, so from time to time we hear that this or that bank blocks more often than its “colleague”. In general, according to Art. 7 of Law No. 115-FZ, the bank may pay attention to your transfer if it discovers:

- the confusing or unusual nature of the transaction;

- the transaction has no clear economic meaning or obvious legal purpose;

- the transaction does not correspond to the activities of the entrepreneur;

- repeatedly making strange transactions.

He does not have to block the account right away, but will require additional documents justifying your operation. At the same time, the law practically “freezes” the hands of banks - they can refuse a client to perform a transaction, essentially, without explaining the reasons.

General rule: avoid transactions that could lead to account blocking

A more detailed list of transactions that the bank may consider suspicious is contained in the Methodological Recommendations of the Central Bank of the Russian Federation dated July 21, 2021 No. 18-MR and Methodological Recommendations of the Central Bank of the Russian Federation No. 19-MR dated July 21, 2021). According to the Central Bank, banks need to take a closer look at clients if:

- cash accounts for more than 30% of weekly turnover;

- less than 2 years have passed since the date of creation of the legal entity;

- activities within which operations are carried out to credit and debit funds from the account, but are not reflected in the corresponding increase in tax revenues to the budget;

- money comes to the account from counterparties with signs of transit or who simultaneously transfer funds further to other counterparties;

- funds are credited to the account in amounts not exceeding 600 thousand rubles, but often;

- Cash withdrawals are carried out regularly, daily or within 3-7 days from the date of receipt;

- amounts close to 600 thousand rubles are often withdrawn;

- money is withdrawn at the end of one trading day and again at the beginning of the next;

- The client has several corporate cards through which cash is withdrawn, but there are almost no other transactions.

The list is strange, to say the least. For example, a courier service or a delivery store will have revenue mainly in cash. Also interesting is the period of work less than 2 years, that is, every new entrepreneur is under suspicion...

But the bank usually selects several criteria, and if they match, they can block the account. Therefore, try to avoid at least most of these transactions.

Consequences of blocking

If the bank blocks your account on suspicion of laundering, then you will end up on the so-called “black” lists of the Central Bank, and in the future you will most likely encounter difficulties in opening a new account in another bank.

Some banks have a “whitewashing” procedure, when you can prove the legality of your transactions and move from a suspicious category to a normal one. But so far there are few such banks.

It is better to act proactively, if a controversial situation has already occurred, but was managed to be unblocked promptly, it is better to part with this credit institution in advance and withdraw funds to another account in another bank.