The procedure for calculating depreciation of fixed assets in accounting

Depreciation involves the gradual inclusion in expenses of the cost of fixed assets, which is a significant amount for any organization.

Fixed assets can participate in generating income for a long time and have a long service life. Depreciation of fixed assets must be calculated for all groups. But some of the property does not need to be depreciated:

- if the initial cost is within the limits of the maximum value not exceeding 40,000 rubles. (clause 5 of PBU 6/01) (if these objects are accepted for accounting as inventories);

- if the object is on the list of property for which depreciation is not accrued (clause 17 of PBU 6/01).

Read about non-depreciable fixed assets in the material “Rules for calculating depreciation of non-current assets”.

PBU 6/01 is the main document that establishes the rules for calculating depreciation of fixed assets in accounting. When accepting for accounting for each individual object, the organization determines the depreciation procedure based on PBU 6/01 and fixes the parameters: the method of calculating depreciation of fixed assets , and their useful life.

Read about the basic rules for calculating depreciation of fixed assets in the already familiar material “Rules for calculating depreciation of non-current assets.”

Is it possible to change the depreciation method?

You may not change the depreciation method during the calendar year. This is only possible if:

- reorganization of an enterprise (merger, division, accession);

- change of owners;

- changes in legislation;

- development of new accounting methods.

Example

Change in accounting policy as a result of reorganization

Enterprise “A” was joined by enterprise “B” in the middle of the year. Enterprise “A” operated in the service sector. The accounting policy states that the straight-line depreciation method is applied to all fixed assets. Enterprise “B” was engaged in production, had on its balance sheet working machines and equipment, to which the production method of depreciation was applied. After the reorganization, the company made changes to its accounting policy, according to which depreciation for working machines and equipment is calculated using the production method, and for other fixed assets - straight-line.

You can change the depreciation method from the beginning of the next calendar year if:

- there is a significant change in the expected economic benefit from using the OS;

- the prevailing circumstances justify a change in the depreciation method.

You can also review the useful life of the OS from the beginning of the next calendar year, taking into account:

- costs that improve the condition of the OS, and therefore extend their service life;

- technological changes that shorten this period.

Attention

A change in the norms for calculating depreciation in the Tax Code, which are used for the purpose of calculating income tax, is not the basis for an automatic change in the corresponding norms in accounting policies.

Situation

The need to reduce the applicable depreciation rates due to a reduction in depreciation rates in the Tax Code

The accounting policy of the enterprise establishes a depreciation rate for buildings and structures based on their expected useful life of 20 years in the amount of 5%. Starting from 2021, the Tax Code has reduced the depreciation rate for buildings and structures from 5 to 3%. This rule is used to determine the amount of deductible expenses for depreciation of fixed assets for the purpose of calculating income tax. Therefore, a change in the depreciation rate in the Tax Code is not the basis for an automatic change in depreciation rates in the accounting policy. The useful life of fixed assets can be revised in the accounting policy only taking into account costs incurred that extend their service life, or taking into account technological changes that shorten this life.

Example

Changing the depreciation method from the beginning of the calendar year

The company uses equipment for which depreciation is calculated using the straight-line method. Due to a significant decrease in equipment load, the cost of production per unit increases. Taking into account the current circumstances, the company decided to switch to the production method of calculating depreciation from the next calendar year, making changes to the accounting policy.

Example of calculating depreciation of fixed assets

Let's look at an example of how to calculate depreciation of fixed assets in practice.

Example

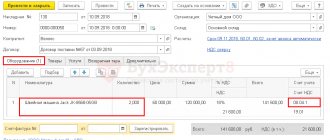

In January 2021, the organization accepted the facility into operation with an initial cost of 72,000 rubles. The fixed useful life is 3 years (36 months).

The linear depreciation method chosen by the organization provides for the following calculation of the annual depreciation amount: 72,000 × 1 / 3 = 24,000. Here 1/3 is the depreciation rate. It is calculated based on the specified number of years of operation. In fact, the annual amount can be obtained by simply dividing the cost by the number of years; in practice, this is how the calculation is made.

The monthly depreciation amount is equal to the result of dividing the annual amount by the number of months in the year: 24,000 / 12 = 2,000. Or, which is equivalent, the result of dividing the original cost by the number of months of use: 72,000 / 36.

What will the standard change?

To make it easier to apply the new standards in practice, the Ministry of Finance will develop recommendations and amend instructions No. 157 and No. 174. Thus, the grouping of fixed assets in the chart of accounts will change, and therefore it will be necessary to make adjustments to the institution’s accounting policies and the working chart of accounts.

In particular, new accounts will be introduced to account for non-exclusive rights to the results of intellectual activity and operating leases. Already now it is necessary to learn to look at the facts of economic activity in a new way, as well as at assets and liabilities that are already recorded. Therefore, before the annual financial statements for 2021, the following activities must be completed:

- analyze the fixed assets that are accounted for on the institution’s balance sheet, since some of them will have to be transferred to the off-balance sheet, and only the institution’s assets will remain on the balance sheet;

- allocate low-value property that can be combined to simplify accounting;

- determine which property should be divided into separate inventory items, which will allow better control of property and simplify the process of writing off fixed assets (for example, computers).

Depreciation of fixed assets has been accrued - how to reflect the entries in accounting?

Depreciation amounts are accumulated on the credit of account 02. The account in the debit of the entry depends on the characteristics of the activity in which the object is operated.

| Wiring | Object in use |

| Dt 20, 23, 25 Kt 02 | In the main production, auxiliary, general production workshops |

| Dt 26 Kt 02 | For management purposes |

| Dt 29 Kt 02 | In service farms |

| Dt 44 Kt 02 | In trading and procurement activities For the purpose of selling products in production activities |

| Dt 91 Kt 02 | In other activities |

Which OS are classified as assets?

The new standard provides criteria by which fixed assets should be classified as assets.

The asset must provide economic benefit (now or in the future) or have useful potential. The economic benefit that is contained in an asset implies that when it is used, the institution receives funds.

Useful potential is determined if the institution uses the asset for management needs or in activities to provide municipal (public) services. Also, an asset will have useful potential if it can be exchanged for other assets or repaid obligations assumed with it. That is, the OS must have such characteristics as consumer properties and profitability.

The asset must belong to the institution with the right of operational management or be in its use. The institution must control the asset as a result of the occurrence of business activities.

If these criteria are not met, the fixed asset should be transferred off balance sheet.

In November - December 2021, you should sort out the fixed assets that are listed on the institution’s balance sheet and leave only the assets.

Then it is necessary to understand for what purpose the assets entered the institution and how they are used: in other words, to determine whether the fixed asset has economic or useful potential.

Depreciation of fixed assets on the balance sheet

The balance sheet form does not provide a separate line for the amount of depreciation accrued as of the reporting date. But this amount participates in the formation of the line indicator 1150 as a regulating value. Namely, to reflect how the indicator in the net valuation is formed for the specified line: the original cost reduced by the amount of accumulated depreciation. The book value of the asset is equal to the difference between the balance of account 01 and the balance of account 02.

In this case, information on depreciation, including accrued, retired, accumulated as of the reporting date, is deciphered by groups of objects and provided to users of the statements in the notes to the balance sheet.

The following disclosure requirements in reporting are established:

- clause 35 of PBU 4/99 (order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n),

- clause 49 of the regulations on accounting (order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n),

- clause 32 of PBU 6/01 (order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n).

Depreciation of fixed assets in 2018-2019 in tax accounting

The procedure for accounting depreciation in 2018-2019 has not changed. However, in 2021, changes affected tax accounting. Thus, the Law of June 8, 2015 No. 150-FZ (clauses 7–8 of Article 5) introduced amendments to Art. 256, 257 Tax Code of the Russian Federation. They consist in increasing the value of property that is not classified as depreciable.

Previously, this figure was equal to 40,000 rubles. and corresponded to a similar limit in accounting. Now the amount in the Tax Code of the Russian Federation has been increased to 100,000 rubles. The new rules only apply to property put into operation on or after January 1, 2021. For other objects costing over 40,000 and up to 100,000 rubles, which were already in operation before this date, no adjustment is required in the form of writing off the remaining cost.

As we already know, in accounting the amount is 40,000 rubles. represents the upper limit on the cost of non-depreciable assets. In this case, in order to decide on classifying property as fixed assets, an organization can:

- select the maximum limit amount in the accounting policy;

- choose an amount less than this limit;

- take into account objects with a cost less than the limit as part of the inventory;

- do not set a limit by depreciating all objects of any value accounted for as fixed assets.

In tax accounting, the amount of 100,000 rubles is a cost limit that determines the recognition (or non-recognition) of an object as part of depreciable property. Items valued up to this limit are not considered depreciable property. Their full cost at the time the objects are accepted for accounting is written off as material expenses in accordance with subparagraph. 3 p. 1 art. 254 Tax Code of the Russian Federation.

At the same time, the legislator in the same sub-clause. 3 p. 1 art. 254 of the Tax Code of the Russian Federation provides the opportunity to include these amounts in expenses not at once in full, but by distributing the amount over a time interval greater than one reporting period. The period for progressive recognition of expenses is determined as the expected useful life. This is an action similar to accounting depreciation, which allows you to “stretch” the accounting of the cost of non-depreciable property in material expenses.

What transition actions should be taken?

The order of the Ministry of Finance and letters from the department contain preliminary work methods. Let us outline the most important transition activities:

1) Make adjustments to accounting policies.

2) Decide which OS objects will be transferred to different groups (after inventory), reflect all “postings” in the accounting. accounting

3) Find out which operating systems have not previously been assigned this status, and enter all these actions into the ledger. accounting

For fixed assets registered before 01/01/18, recalculation will not be required.

When do differences arise according to PBU 18/02?

A question that worries many accountants. But it is reasonable to approach it taking into account the benefits of taxation on property and profits.

For clarity, we have compiled the following table.

| Cost of objects | Expenses in accounting | Expenses in tax accounting | |

| Including the cost of property at one time in expenses | Gradual inclusion of property value in expenses | ||

| ≤ 40,000 rub. | Objects are not accounted for as inventories, but are depreciated as part of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 40,000 rub. ≤ 100,000 rub. | Depreciation of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 100,000 rub. | Depreciation of fixed assets | Impossible | There are no differences according to PBU 18/02 |

IMPORTANT! The choice in favor of not reflecting differences according to PBU 18/02 does not always entail a reduction in the complexity of accounting. From the point of view of tax reduction, it is often more profitable for an organization to use the right to a one-time attribution of the cost of objects to expenses in both accounting and tax accounting.

Results

When deciding how depreciation of fixed assets will be calculated in 2018-2019, the organization has the right to choose: reducing the labor intensity of accounting or the absence of differences according to PBU 18/02.

At the same time, it is reasonable to make a decision also from the point of view of reducing tax expenses. This, in particular, is facilitated by the use of the right to immediately attribute the cost of objects to expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.