Budget classification codes are used by all entrepreneurs and organizations. BCCs for paying taxes consist of twenty digits. Thanks to them, payments go to the necessary branch of the state budget. All fines, taxes and duties are systematized using numerical values. They are always indicated on financial documentation to obtain data from government agencies.

The website lists the 2021 KBK

along with all the changes and the latest news. By federal order, changes were made to some of the codes on the territory of the Russian Federation. The resource provides a convenient form for viewing new values.

BCCs for 2021 were approved by order of the Ministry of Finance (order dated 06/08/2018 132n)

The structure of the codes is as follows:

- 1-3 categories determine the administrator of budget revenues,

- 4-13 digits determine the code of the type of income,

- Digits 14-20 indicate a subtype of budget income.

From 1 January 2021, the structure of each of these parts will be redefined. In a letter dated 08/10/2018 N 02-05-11/56735, officials of the Ministry of Finance noted that the new order dated 06/08/2018 132n preserved the continuity of the principles for the appointment of the BSC.

In 2021, 12 new codes were added to the list: for income tax, excise taxes, a new tax on additional income from the extraction of hydrocarbons, also for individuals. The Ministry of Finance also changed some budget classification codes for insurance premiums.

See the updated BCC for 2021 in our article.

Important changes to the BCC from April 14, 2019

Officials have made further adjustments to the new procedure for using budget classification codes (BCC).

In accordance with the innovations, it is now permissible to indicate income codes and CIF during planning. For example, when drawing up a plan for the financial and economic activities of a budgetary or autonomous institution. In the updated KBK order, officials expanded the list of programs, national projects, targeted activities and areas. All innovations are enshrined in Order of the Ministry of Finance of Russia dated March 6, 2019 No. 36n.

The income codes under Article 180 have been supplemented with new contents of income. From April 14, 2019, public sector employees can include the following income accrual transactions in this article:

- on taxes the object of taxation of which is the income of a budgetary or autonomous institution;

- according to VAT accrued on sales of a government agency;

- on income tax.

Innovations regarding CIF are presented as follows:

| CIF article | What changed |

| Article 510 | Receipts of budgetary and autonomous government agencies should be attributed to operations:

|

| Article 610 | We reflect returns in favor of government agencies of budgetary and autonomous types, for operations:

|

Codes for types of expenses have also been added. Now KVR 112, 122, 133, 134 may include payments of a monthly child care allowance due to non-working wives of military personnel under a contract outside the Russian Federation (the wives are at the spouse’s place of service). Also the amount of reimbursement of expenses for medical care for certain categories of citizens of the Russian Federation.

New KBK for 2021: which ones have changed

In 2021, twelve new budget classification codes were introduced in accordance with Order 459-FZ dated November 29, 2018. Below you can see them.

| Type of payment | KBK |

| Excise tax on marine dark fuel going to the Russian Federation | 153 1 0400 110 |

| Excise tax on crude oil intended for processing | 182 1 0300 110 |

| Excise tax on marine dark fuel produced in Russia | 182 1 0300 110 |

| Excise tax on marine dark fuel passing through the territory of the Russian Federation | 182 1 0400 110 |

| Tax on profits going to the regional budget and received from the development of Far Eastern oil and gas fields, in the presence of a production sharing agreement | 182 1 0100 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in paragraph 1 of paragraph 1 of Art. 333.45 Tax Code of the Russian Federation | 182 1 0700 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in paragraph 2 of paragraph 1 of Article 333.45 of the Tax Code of Russia | 182 1 0700 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in paragraph 3 of paragraph 1 of Article 333.45 of the Tax Code of Russia | 182 1 0700 110 |

| Tax on additional income from the extraction of hydrocarbons on subsoil plots located wholly or partially in the territories specified in paragraph 4 of paragraph 1 of Article 333.45 of the Tax Code of the Russian Federation | 182 1 0700 110 |

| State duty on excise stamps with a two-dimensional barcode with the EGAIS identifier | 153 1 0800 110 |

| State duty for federal special stamps with a barcode with the EGAIS identifier | 160 1 0800 110 |

| Single tax payment of an individual | 182 1 0600 110 |

The Ministry of Finance has changed some budget classification codes for insurance premiums for additional tariffs (Order No. 132-n dated 06/08/2018). The innovations affected fines and penalties. The replacement is due to the fact that the Ministry abolished the link between codes and the special assessment of working conditions.

Table of changes to the BCC for penalties and fines:

| What do we pay? | 2018 | 2019 |

| Additional contributions to the Pension Fund Tariff 1 (special assessment does not affect) | penalties 182 1 0210 160 fines 182 1 0210 160 | penalties 182 1 0210 160 fines 182 1 0210 160 |

| Additional contributions to the Pension Fund Tariff 1 (special assessment affects) | penalties 182 1 0200 160 fines 182 1 0200 160 | penalties 182 1 0210 160 fines 182 1 0210 160 |

| Additional contributions to the Pension Fund Tariff 2 (special assessment does not affect) | penalties 182 1 0210 160 fines 182 1 0210 160 | penalties 182 1 0210 160 fines 182 1 0210 160 |

| Additional contributions to the Pension Fund Tariff 2 (special assessment affects) | penalties 182 1 0200 160 fines 182 1 0200 160 | penalties 182 1 0210 160 fines 182 1 0210 160 |

New order

Order No. 65n, which established the key rules for the application of budget classification, ceases to be valid on December 31, 2018. From the new year 2021, updated standards will apply. Officials approved:

- Order No. 132n dated 06/08/2018, which contains a new procedure for the formation and application of BC codes.

- Order No. 209n dated November 29, 2017, which determines the procedure for applying KOSGU in accounting.

The innovations caused a flurry of questions and controversy. To resolve them, the Ministry of Finance issued additional clarifications on the procedure for applying new legal acts. The information is contained in Letters dated June 29, 2018 No. 02-05-10/45153 and dated August 10, 2018 No. 02-05-11/56735.

Now we will determine in detail what has changed in the codification of the income and expenditure parts of the bookkeeping system.

Budget classification code table for 2021 for taxes

The tables below show the codes for transferring taxes in 2019.

KBK 2021 – VAT

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Penalty | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Fine | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

KBK on corporate income tax in 2021

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| from income in the form of profits of controlled foreign companies | 182 1 0100 110 |

| Penalty | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| The corporate income tax on income in the form of profits of controlled foreign companies will have its own code. | 182 1 0100 110 |

| Fine | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations 182 1 0100 110 from interest on state and municipal securities | 182 1 0100 110 |

| The corporate income tax on income in the form of profits of controlled foreign companies will have its own code. | 182 1 0100 110 |

Budget classification codes in 2021 for personal income tax (NDFL)

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Penalty | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Fine | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners working on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

BCC for transport tax applied in 2021

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| from organizations | 182 1 0600 110 |

| from individuals | 182 1 0600 110 |

| Penalty | |

| from organizations | 182 1 0600 110 |

| from individuals | 182 1 0600 110 |

| Fine | |

| from organizations | 182 1 0600 110 |

| from individuals | 182 1 0600 110 |

KBK codes for corporate property tax in 2021

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Penalty | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Fine | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

KBK 2021 - Land tax for companies

| Where is the land plot located? | Payment type | Code |

| Moscow St. Petersburg Sevastopol | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Urban district without additional administrative entities | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Urban district if it contains intra-city administrative entities | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Intracity administrative entity | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Intersettlement territories | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| Rural settlement | Tax | 182 10600 110 |

| Penalty | 182 10600 110 | |

| Fine | 182 10600 110 | |

| urban settlement | Tax | 182 10600 110 |

| Penim 182 10600 110 | ||

| Fine | 182 10600 110 |

KBK 2021 - Water tax

| Purpose of payment | Code |

| Amount of tax (arrears) | 182 1 0700 110 |

| Penya | 182 1 0700 110 |

| Fine | 182 1 0700 110 |

Changes in income

Updated KBK 2021 - the compliance table in terms of income did not identify significant changes. In the new year, all budgetary revenues should be distributed into two key groups: 100 “Revenue” and 400 “Disposal of non-financial assets.” The updated procedure is similar to the 2021 rules. However, there are still innovations: certain articles of group 100 “Income” have changed.

Change No. 1. Article 120

Previously, Article 120 “Income from property” should have included income related to the use of state and municipal property. Rent, payments for the use of natural resources, as well as payments for the right to conclude government contracts (payment for winning procurement) were also included in Article 120.

Since 2021, the composition has been supplemented; now the following categories of income are included in Article 120:

- lease - operating and financial;

- payments for the use of natural resources;

- accrued interest on deposits, cash balances;

- accrued interest on loans issued and other financial instruments;

- dividends received from investing;

- shares in the profit received, loss from investment;

- granting non-exclusive rights (means of individualization, intellectual activity);

- payments for the right to conclude government contracts;

- concession fee;

- other options for income from the use of property.

Change No. 2. Article 130

This BC article has been supplemented with a new type of income. Now to Art. 130 “Income from the provision of paid services, compensation of costs” should include the receipt of payment for the provision of information from government sources (registers).

Change No. 3. Article 140

Art. 140 “Fines, penalties, penalties, compensation for damage” was also slightly adjusted. First of all, officials adjusted the wording of the type of income received in favor of public sector institutions as payment for violation of the terms of state and municipal contracts and agreements. New name:

Receipts as a result of the application of measures of civil, administrative, criminal liability, including fines, sanctions, confiscations, compensations, in accordance with the legislation of the Russian Federation, including fines, penalties and penalties for violation of the legislation of the Russian Federation on the contract system in the field of procurement of goods and works , services to meet state and municipal needs and violation of the terms of contracts (agreements).

But that's not all. From 2021 in Art. 140 include the institution's income from penalties on debt obligations.

Change No. 4. Article 150

Gratuitous cash receipts in 2021 should have been distributed among the subgroups of Article 150. There were three of them:

- 151 “Receipts from other budgets”;

- 152 “From supranational organizations and foreign states”;

- 153 “From international financial companies.”

This distribution has been eliminated in 2021. Now the BCC table for 2020, as amended, implies that any gratuitous payments should be reflected in Art. 150 without any detail.

In addition, keep in mind that legislators have expanded the list of income classified as gratuitous receipts with a new item. Now grants, donations and other gratuitous transfers from individuals and legal entities are included in Art. 150, and not at Art. 180, as previously prescribed by instruction 65n.

Change No. 5. Article 180

The adjustments also affected the list of “Other income”. Now, in this income item include all non-tax income that was not assigned to other items of group 100, namely:

- unknown receipts, for example, a payment with an incorrect BCC;

- income from the sale, sale of goods seized or detained;

- subsidies for other purposes and for capital investments;

- compensation for damages, with the exception of insurance compensation.

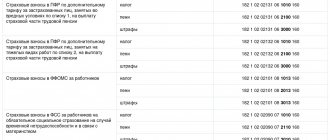

Table of budget classification codes for 2021 for insurance premiums

KBK 2021 - Insurance contributions for pension insurance (formerly in the Pension Fund of Russia)

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| for pension insurance for employees | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. | 182 1 0210 160 |

| Additional pension contributions according to the tariff | 1 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Additional pension contributions according to the tariff | 2 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Penalty | |

| for pension insurance for employees | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. | 182 1 0210 160 |

| Additional pension contributions according to the tariff | 1 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Additional pension contributions according to the tariff | 2 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Fine | |

| for pension insurance for employees | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0210 160 |

| for pension insurance of an individual entrepreneur for himself with income exceeding 300,000 rubles. | 182 1 0210 160 |

| Additional pension contributions according to the tariff | 1 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

| Additional pension contributions according to the tariff | 2 182 1 0210 160 – if the tariff does not depend on the special assessment; 182 1 0220 160 – if the tariff depends on the special assessment |

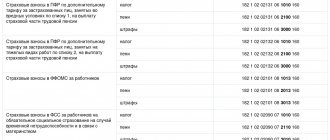

Social insurance contributions (formerly known as the Social Insurance Fund)

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

| Penya | |

| in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

| Fine | |

| in case of temporary disability and in connection with maternity | 182 1 0210 160 |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 |

KBC for payment of insurance premiums for compulsory medical insurance 2019

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| to the FFOMS budget for employees | 182 1 0213 160 |

| for medical insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0213 160 |

| Penalty | |

| to the FFOMS budget for employees | 182 1 0213 160 |

| for medical insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0213 160 |

| Fine | |

| to the FFOMS budget for employees | 182 1 0213 160 |

| for medical insurance of an individual entrepreneur for himself based on the minimum wage | 182 1 0213 160 |

KBK NDFL

There are no changes in 2021 regarding personal income tax codes. The choice of BCC depends on who remits the tax (taxpayer or tax agent): for example, for companies paying tax for employees, for individual entrepreneurs paying personal income tax for themselves, and for individuals who received income from the sale of property, different classification codes are used.

Here is the KBK for personal income tax 2021 (for individuals, the tax is transferred by the agent or the taxpayer himself):

| KBK | Decoding |

| 182 1 0100 110 | Personal income tax on income paid by the tax agent, including KBK dividends in 2021, personal income tax on which is transferred by the tax agent |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by individual entrepreneurs, private notaries, and other private practitioners (Article 227 of the Tax Code of the Russian Federation) |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by citizens not from tax agents, as well as from the sale of property, winnings, etc. (Article 228 of the Tax Code of the Russian Federation) |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | fixed advance payments from the income of non-residents working for citizens on the basis of a patent (Article 227.1 of the Tax Code of the Russian Federation) |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on the profits of a controlled foreign company received by controlling persons |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

KBK in 2021 for special modes

If you apply special tax regimes, see the KBK tables for paying taxes in 2021.

UTII

| Purpose of payment | Code |

| Amount of tax (arrears) | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

simplified tax system

| Purpose of payment | Code |

| Amount of tax (arrears) | from income (6%) -182 1 0500 110; from income minus expenses (15%), including minimum tax - 182 1 05 01021 01 1000 110 |

| Penalty | from income (6%) -182 1 0500 110; from income minus expenses (15%), including minimum tax - 182 1 05 01021 01 2100 110 |

| Fine | from income (6%) -182 1 0500 110; from income minus expenses (15%), including minimum tax - 182 1 05 01021 01 3000 110 |

Unified agricultural tax

| Purpose of payment | Code |

| Amount of tax (arrears) | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

Patent

| Purpose of payment | Code |

| Amount of tax (arrears) | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Penalty | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Fine | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

Selecting a section (subsection)

Let's consider the main provisions of the application of the KBR from 2021. According to the general principle of forming the budget expenditure code, the first 4 digits make up the section (subsection) of the KBR.

The section (subsection) code consists of 2 digits. A unique digital code, ranging from 0 to 9, is assigned to each section (subsection). According to the requirements of paragraph 17 of Order No. 132n, budget allocations are distributed to the relevant sections (subsections) of the KRB. The list of unified codes of sections and subsections for budgets of the budgetary system of the Russian Federation is provided in Appendix No. 5 to Order No. 132n. The choice of one or another section and subsection code is determined by the institution, taking into account the features set out in clause 2.2 of Letter No. 02-05-11/56735 of the Ministry of Finance of the Russian Federation, for example, these could be:

- expenses for the implementation by the main manager of centralized purchases of goods are included in order to meet the needs of the government agency, including ensuring the fulfillment of the functions assigned to it, taking into account territorial bodies and government agencies subordinate to it, as well as in order to meet the needs of the territory. bodies and (or) subordinate state. body of institutions;

- expenses for providing subsidies to a budgetary or autonomous institution for financial support for the fulfillment of a state task for the provision of public services (performance of work), etc.

KBK for state duty for 2021

| Purpose of payment | Code |

| on proceedings in arbitration courts | 182 1 0800 110 |

| on proceedings in the Constitutional Court of the Russian Federation | 182 1 0800 110 |

| on proceedings in constitutional (statutory) courts of constituent entities of the Russian Federation | 182 1 0800 110 |

| in proceedings in courts of general jurisdiction, magistrates. In addition to the Supreme Court of the Russian Federation | 182 1 0800 110 |

| on proceedings in the Supreme Court of the Russian Federation | 182 1 0800 110 |

| for state registration of: – organizations; – entrepreneurs; – changes made to the constituent documents; – liquidation of the organization and other legally significant actions | 182 1 0800 110 (if documents for state registration of an organization or entrepreneur are submitted not to the tax office, but to a multifunctional center, then the BCC must be indicated with the income subtype code “8000”, that is, 182 1 0800 110 (letter of the Federal Tax Service of Russia dated January 15, 2015 No. ZN-4-1/193)) |

| for state registration of rights, restrictions on rights to real estate and transactions with it - sale, lease and others | 321 1 0800 110 |

| for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of organizations | 182 1 0800 110 |

| for carrying out actions related to licensing, with certification provided for by the legislation of the Russian Federation, credited to the federal budget | 000 1 0800 110 |

| for registration of vehicles and other legally significant actions related to changes and issuance of documents for vehicles, registration plates, driver's licenses | 188 1 0800 110 |

| for carrying out state technical inspection, registration of tractors, self-propelled and other machines and for issuing tractor driver’s licenses | 000 1 0800 110 (in categories 1–3, the code is indicated depending on the competence of which chief administrator is in charge of administering a specific budget income (Appendix 7 to the instructions approved by order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n). Indicate in categories 1– 3 KBK administrator code “000” is not allowed.) |

| for consideration of applications for concluding or amending a pricing agreement | 182 1 0800 110 |

How are the new KBK deciphered?

A special indicator is not just a set of random numbers, it consists of groups of numbers that display encrypted values. The structure of the BCC for income is quite simple. It is used during refunds. The code consists of the following values:

- The initial 3 numbers are an administrative code that displays the final path of the cash payment. It indicates the recipient of the received money (for the tax authority - 182, Pension Fund - 392).

- The numbers from the fourth to the thirteenth show the type of profit - this sector includes groups, subgroups and articles that reflect goals, type of budget and article of legislation.

- From the fourteenth to the seventeenth digits, the tax is differentiated from other transfers.

- The last three numbers allow you to identify the economic type of the payment transaction.

Please note that the main code with twenty digits must be written down without a single mistake. It fits into the appropriate field in the financial documentation. In order to determine the CBC, subscribe to the newsletter of materials from the site. The resource helps to track all changes in the legislative framework. The site takes information about codes from the federal treasury and the official tax website.

KBC for fines in 2021

| Purpose of payment | Code |

| for violation of the legislation on taxes and fees provided for in Articles 116, 118, 119.1, paragraphs 1 and 2 of Article 120, Articles 125, 126, 128, 129, 129.1, 132, 133, 134, 135, 135.1, as well as the previously in force Article 117 Tax Code of the Russian Federation 182 1 16 03010 01 6000 140 for violations of the legislation on taxes and fees provided for in Articles 129.3 and 129.4 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| for violation of the procedure for registering gambling business objects, provided for in Article 129.2 of the Tax Code of the Russian Federation | 182 1 1600 140 |

| for administrative offenses in the field of taxes and fees provided for by the Code of the Russian Federation on Administrative Offenses | 182 1 1600 140 |

| for violation of the procedure for using CCP. For example, for violating the rules of technical maintenance of cash registers | 182 1 1600 140 |

| for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Pension Fund of the Russian Federation) | 392 1 1600 140 |

| issued by the Pension Fund of the Russian Federation in accordance with Articles 48−51 of the Law of July 24, 2009 No. 212-FZ | 392 1 1600 140 |

| for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Social Insurance Fund of Russia) | 393 1 1600 140 |

| for violation of the legislation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation (regarding the budget of the Federal Compulsory Medical Insurance Fund of Russia) | 394 1 1600 140 |

| for administrative offenses in the field of state regulation of the production and turnover of ethyl alcohol, alcohol, alcohol-containing and tobacco products | 141 1 1600 140 (if the payment administrator is Rospotrebnadzor) 160 1 1600 140 (if the payment administrator is Rosalkogolregulirovanie) 188 1 16 08000 01 6000 140 (if the payment administrator is the Ministry of Internal Affairs of Russia) (Chief administrators can delegate their powers to administer certain budget revenues to federal government institutions. In such situations, when transferring payments in categories 14–17 BCC, you must indicate the income subtype code “7000”) |

| for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | 182 1 1600 140 |

| for violation of the legislation on state registration of legal entities and individual entrepreneurs, provided for in Article 14.25 of the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

| for evasion of administrative punishment provided for in Article 20.25 of the Code of Administrative Offenses of the Russian Federation | 182 1 1600 140 |

Consequences of violation of the BCC

Since with the help of codes the state recognizes the purpose and direction of the money transfer. If at least one number is indicated incorrectly, then the money will not reach the final destination - this is comparable to a delay in payment or non-fulfillment. Subsequently, tax authorities are required to provide a fine or penalty amount. The penalty may increase daily at the key refinancing rate, and the taxpayer may not immediately know about it. As a result, even conscientious enterprises find themselves in unpleasant situations with debts.

Actions when errors are detected

The first step is for the organization to learn about the consequences of an error. The taxpayer is fully responsible for the failed transfer of the amount, so this is a mandatory step.

- First, submit a letter of application to the tax authorities. It must indicate a request to clarify the details of the transfer and the status of payments.

- Please also include instructions, receipts or checks for payments in the letter.

- After reviewing the application, the tax office will carefully check the transfers and draw up a tax report.

Usually the verification takes a couple of days, and its results come in the form of a letter to the organization. To prevent such a mistake, which can lead to unpleasant consequences, you need to adhere to the following rules:

- permanent accounting of payments made to the tax office;

- You must immediately submit a statement about the error;

- keep track of all changes in legislation.

The latest version of the KBK is on the website. With its help, all companies can not worry about the risk of mistakes with finances. Even if you receive a warning document from the fiscal service about unpaid tax, you should not worry. You just need to compare the calculations in the extra-budgetary fund or the tax office.

Transitional table of KBK codes for 2021

Since 2021, the administration of insurance premiums has been handled by Federal Tax Service inspectors. Budget classification codes for transferring insurance premiums have changed, now they begin with the numbers 182. An exception is contributions for injuries. They are still under the jurisdiction of the FSS and are transferred to the previous KBK.

To list arrears, penalties and fines for previous years, use transition codes. They are shown in the tables below.

Transition table KBK 2021 (contributions for employees)

| Payment | KBC in 2021 | Code in 2017-2019 | |

| For periods up to 2021 | For the periods 2017-2019. | ||

| Contributions to employee pension insurance at basic rates | |||

| Contributions | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Social insurance contributions | |||

| Contributions | 393 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Penalty | 393 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 393 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Employer contributions to health insurance | |||

| Contributions | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Penalty | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Fines | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

Transition table KBK 2021 (IP contributions)

| Payment | KBC in 2021 | KBC in 2017-2019 | |

| For periods up to 2021 | For the periods 2017-2019 | ||

| Entrepreneurs' contributions to pension insurance | |||

| Fixed contributions (minimum wage × 26%) | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Contributions from income over 300 thousand rubles. | 392 1 0200 160 | 182 1 0200 160 | |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fines | 392 1 0200 160 | 182 1 0200 160 | 182 1 0210 160 |

| Fixed contributions of entrepreneurs for health insurance | |||

| Contributions | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Penalty | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

| Fines | 392 1 0211 160 | 182 1 0211 160 | 182 1 0213 160 |

Transitional table of the KBK 2021 (pension contributions at additional tariffs)

| Payment | Code in 2021 | Code in 2017-2019 | |

| The tariff does not depend on the results of SOUT | The tariff depends on the results of the SOUT | ||

| For workers from List 1 | |||

| Contributions | 392 1 0200 160 | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | |

| Fines | 392 1 0200 160 | 182 1 0200 160 | |

| For workers from List 2 | |||

| Contributions | 392 1 0200 160 | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 392 1 0200 160 | 182 1 0200 160 | |

| Fines | 392 1 0200 160 | 182 1 0200 160 | |

News about changes

The website contains an up-to-date table of new KBKs for 2021. Thanks to the resource, users do not need to independently monitor changes and the relevance of codes. In the table you can find a complete list of numerical indicators updates. It complies with current legislation, because all information is taken from the official resource of the country’s Ministry of Finance.

Please note that if the code was entered incorrectly, the payment was still transferred to the state treasury. Therefore, after consideration of the case, legal entities are not obliged to pay penalties or interest on the debt. The Tax Code of the Russian Federation is regulated by 45 articles. Its points indicate the need to contact the tax authorities after discovering an error.

Not only large companies, but also entrepreneurs need to check the information on the website.

The coding applies to the owner and hired employees. The corresponding table also contains payment deadlines. Thanks to the convenient functionality of the site, the user will avoid mistakes in financial documents. The resource is convenient, because the data is divided into sections for penalties, fines and other payments. My Magnit personal account is available to everyone.

State duties

New BCCs for state duties were introduced on October 22, 2018 by order of the Ministry of Finance of the Russian Federation dated September 20, 2018 No. 198n. We present them in the table:

| KBK | Decoding |

| 153 1 0800 110 | State duty for the issuance of excise stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (USAIS) for labeling alcoholic products |

| 160 1 0800 110 | State duty for the issuance of federal special stamps with a two-dimensional bar code containing the identifier of the unified state automated information system for recording the volume of production and turnover of ethyl alcohol, alcoholic and alcohol-containing products (USAIS) for labeling alcoholic products |

| 182 1 0800 110 | State duty for re-issuance of a certificate of registration with the tax authority (when applying through multifunctional centers - MFC) |

KBK: trading fee 2021

The fee was introduced in the capital by Moscow Law No. dated December 17, 2014; it is not collected in other regions.

| KBK | Decoding |

| 182 1 0500 110 | Trade tax paid in the territories of federal cities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK for VAT

When paying VAT, the code is selected depending on which transactions were taxed - sales within the Russian Federation, or import of foreign goods into the Russian Federation. KBK VAT-2019 for legal entities and codes for individual entrepreneurs are the same.

The table shows the current VAT BCC (the tax agent in 2019 uses the same codes as VAT payers to pay tax):

| KBK | Decoding |

| 182 1 0300 110 | VAT on goods (work, services) sold on the territory of the Russian Federation |

| 182 1 0300 110 | KBK VAT penalties 2019 |

| 182 1 0300 110 | fines |

| 182 1 0400 110 | VAT on goods imported into the territory of the Russian Federation (from the republics of Belarus and Kazakhstan) |

| 182 1 0400 110 | penalties |

| 182 1 0400 110 | fines |

Site Map

- Pension contributions. Decoding codes for the budget classification of pension contributions for 2021.

- Contributions to compulsory social insurance. Decoding codes for the budget classification of contributions to compulsory social insurance for 2021.

- Contributions for compulsory health insurance. Decoding codes for the budget classification of contributions for compulsory health insurance for 2021.

- Personal income tax (NDFL). Deciphering the budget classification codes for personal income taxes (NDFL) 2021.

- Value added tax (VAT). Decoding the budget classification codes for value added tax (VAT) 2021.

- Income tax. Decoding the 2021 income tax budget classification codes.

- Excise taxes. Decoding the codes for the budget classification of excise taxes for 2021.

- Organizational property tax. Decoding the codes of the budget classification of property tax for organizations 2021.

- Land tax. Deciphering the codes for the budget classification of land tax for 2021.

- Transport tax. Deciphering the transport tax budget classification codes for 2021.

- Single tax with simplification. Decoding the codes of the budget classification of the single tax during simplification for 2021.

- Unified tax on imputed income (UTII). Decoding codes for the budget classification of the single tax on imputed income (UTII) 2021.

- Unified Agricultural Tax (USAT). Decoding the codes of the budget classification of the Unified Agricultural Tax (USAT) 2021.

- Mineral extraction tax (MET). Deciphering the budget classification codes for mineral extraction taxes (MET) 2021.

- Fee for the use of aquatic biological resources. Decoding the budget classification codes of the fee for the use of aquatic biological resources for 2021.

- Fee for the use of fauna objects. Deciphering the codes of the budget fee for the use of wildlife objects in 2021.

- Water tax. Decoding the codes of the budget classification of water tax for 2021.

- Payments for the use of subsoil. Decoding codes for the budget classification of payments for the use of subsoil for 2021.

- Payments for the use of natural resources. Decoding codes for the budget classification of payments for the use of natural resources for 2021.

- Gambling tax. Deciphering the budget classification codes for the gambling tax for 2021.

- Government duty. Decoding the codes of the budget classification of state duty for 2021.

- Income from the provision of paid services and compensation for state costs. Decoding codes for the budget classification of income from the provision of paid services and compensation for state expenses in 2021.

- Fines, sanctions, payments for damages. Decoding codes for the budget classification of fines, sanctions, payments for damages in 2021.

- Trade fee. Decoding the codes of the budget classification of trade tax for 2021.

- News. All news on changes in (KBK) budget classification codes for past and current years.

© 2019-2020 KBK Codes of the Russian Federation

KBK: UTII 2021

There have been no innovations in terms of imputed tax codes. As before, the KBK UTII 2021 for individual entrepreneurs will be the same as for “imposed” legal entities:

| KBK | Decoding |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK: property 2021 for legal entities

To which CSC to pay property tax depends on whether the company’s property belongs to the Unified Gas Supply System:

| KBK | Decoding |

| 182 1 0600 110 | Tax on property not included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Tax on property included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |