Why does the tax office block a current account? What are the reasons and how to avoid it? The Tax Code defines the concept of account blocking as “Suspension of transactions on current accounts.” This means the bank stops all debit transactions on the current account. Everyone - but not everyone! Let's look at these questions below.

The tax office can block a current account only in 5 cases, described below, and clearly defined by the Tax Code:

Reason No. 1: Failure to comply with the tax requirement to pay tax (clause 2 of Article 76 of the Tax Code of the Russian Federation).

Each declaration and tax calculation undergoes a desk audit and, within 3 months, the Federal Tax Service can issue a tax payment requirement. The requirement is set:

- or via TCS (telecommunication channels)

- or by registered mail

Regardless of the method of sending, after 6 days the Request is considered received. Further, the Legislator gives us another 8 days to repay the debt (clause 4 of Article 69 of the Tax Code of the Russian Federation).

If the Requirement is not fulfilled, the head of the tax inspectorate or his deputy has the right to make a Decision to suspend transactions on the accounts. It should be understood and taken into account that the Federal Tax Service immediately blocks all current accounts of the organization, but within the amount of unpaid tax specified in the request.

For example , the amount of the tax claim is 10 thousand rubles, and the funds in each of the 3 available current accounts exceed the blocked amount. This means that the amount of 10 thousand rubles will be blocked on each of the 3 current accounts. The balance on current accounts exceeding 10 thousand rubles can be used by the organization to pay off any current obligations. But there is an obvious inconvenience - the amount of the Demand is 10 thousand rubles, and in total, 30 thousand rubles are blocked for three current accounts. What if we are talking about millions of blocked rubles? The company's activities may simply be paralyzed. In this case, the taxpayer can unblock excessively blocked accounts by writing an application to the Federal Tax Service with a corresponding request, proving that one (or more) of his current accounts has the required amount. The application must indicate account numbers, BIC and current account balances, as well as attach bank statements confirming these balances. This will speed up the unlocking process, because... The tax office will not need to request information from the bank.

Also, I would like to draw your attention to the fact that blocking an account due to non-payment of tax does not in itself mean immediate debiting of funds. Whether there is money or not, the bank will not write off the funds until it receives a collection order issued on the basis of the Decision to hold the taxpayer accountable. The decision is made by the head of the Federal Tax Service or his deputy, and only it and his “Collection Order” instrument provide grounds for writing off funds. The decision is made no later than 2 months from the date of issuance of the Request for Tax Payment.

Reasons for introducing account restrictions

The tax office may suspend account transactions in five cases. Three of them are related to “documentary” violations, and two are related to non-payment of taxes and other payments.

Let's start with the first group. The Federal Tax Service has the right to block an account if, within 10 working days after the end of the established period, a declaration based on the results of the tax period, calculation of insurance contributions or 6-personal income tax (subclause 1, clause 3 and clause 3.2 of Art. Tax Code of the Russian Federation) are not submitted.

Fill out, check and submit 6‑NDFL and RSV via the Internet Submit for free

IMPORTANT

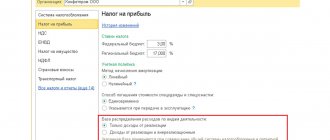

For failure to submit interim reporting, even if it is called a declaration (for example, for income tax), as well as financial statements, accounts are not blocked. This was repeatedly stated by officials of the Ministry of Finance (letters dated 04.07.13 No. 03-02-07/1/25590 and dated 19.08.16 No. 03-11-03/2/48777) and the Federal Tax Service (clause 20 of the appendix to the letter dated 17.04. 17 No. SA-4-7/ [email protected] ).

The next reason for “freezing” an account concerns persons who are required to submit reports in electronic form via telecommunication channels through an EDI (electronic document management) operator. If, within 10 working days from the date of occurrence of this obligation, the taxpayer has not concluded an agreement necessary for electronic document management with the Federal Tax Service, his account may be blocked (clause 5.1 of article 23 and subclause 1.1 of clause 3 of article 3 of the Tax Code of the Russian Federation).

REFERENCE

Persons required to report electronically include the largest taxpayers, as well as organizations and individual entrepreneurs whose average number of employees for the previous year exceeded 100 people. In addition, these are newly created organizations with an average number of employees of more than 100 people (clause 3 of Article of the Tax Code of the Russian Federation). Finally, these are almost all organizations and individual entrepreneurs that submit VAT returns (clause 5 of Article 174 of the Tax Code of the Russian Federation), as well as those who pay income to more than 10 individuals per year (clause 2 of Article 230 and clause 10 of Art. 431 Tax Code of the Russian Federation).

Submit information about the average number of employees via the Internet for free

Another “documentary” violation is related to non-compliance with the regulations on electronic document flow with the inspection. The account may be blocked if the taxpayer delays sending to the Federal Tax Service for more than 10 working days an electronic receipt for receipt of the TCS request for the submission of documents, explanations or a notice of summons to the inspectorate (subclause 2, clause 3, article 3 of the Tax Code of the Russian Federation).

Receive requirements and send requests to the Federal Tax Service via the Internet

The second group of grounds for “seizure” of an account includes two situations. The first is the inspection making a decision on the collection of taxes, fees, and contributions from money in bank accounts (Clause 2 of Article of the Tax Code of the Russian Federation). Let us remind you that the Federal Tax Service can make such a decision only after the deadline for voluntary payment, which is indicated in the requirement addressed to the taxpayer, has expired. The second situation is to ensure the recovery of the amounts specified in the decision based on the results of the audit. This is possible if the Federal Tax Service has already imposed a ban on the alienation (pledge) of other property, but its “accounting” value is less than the additional accrued arrears (subclause 2, clause 10, article 101 of the Tax Code of the Russian Federation).

IMPORTANT DURING THE CORONAVIRUS EPIDEMIC

The Federal Tax Service ordered the inspectorates to postpone the forced collection of tax debts and the application of interim measures until July 1, 2020. The ban on blocking does not apply if failure to take these measures may lead to the concealment of assets and (or) the possibility of committing other actions that impede collection (letter of the Federal Tax Service dated May 26, 2020 No. ED-20-8 / [email protected] , see “The Federal Tax Service has extended the ban to block accounts").

How to avoid blocking your account by the tax office

- You have the right to replace the blocking of account settlement with a bank guarantee (the bank must be listed in the list of the Ministry of Finance), a pledge of securities, or a third party guarantee.

- You can remove the blocking of a current account if the tax authorities committed violations when they made a decision to freeze the account. First, file a complaint with a higher tax authority. If the inspection does not satisfy the complaint, go to court.

- Monitor whether the accountant submits declarations, personal income tax calculations, and receipts on time.

If you eliminate all violations, your account will be unblocked. This will happen no later than one day after the tax authorities receive the required documents or amounts.

Illegal actions of the Federal Tax Service

The Tax Code of the Russian Federation specifies cases of account blocking. Despite this, tax services often commit violations and “freeze” money for other reasons:

- Late submission of accounting reports.

- Delay in the transfer of tax reports based on the results of a certain period.

- An error in the report or writing incorrect details for transferring money.

- Delay in the time of transfer of the declaration due to dishonest work of the operator or post office.

- Suspicion that the company is a fly-by-night company.

All the cases described above are not a reason to “freeze” funds. If the Federal Tax Service commits a violation, you can safely go to court.

Responsibility for illegal blocking of a current account.

If the deadline for unblocking the account was violated or if the decision to suspend transactions on the accounts was made unlawfully, the tax office is obliged to pay interest to the organization (if the organization makes a corresponding request). Interest is accrued at the refinancing rate for each calendar day of violation of the unblocking period or illegal suspension of account transactions.

The duration of the interest accrual period is determined from the day the bank receives the decision to suspend operations until the day the bank receives the decision to cancel the blocking. Moreover, for the day when the bank received a decision to suspend operations, the inspectorate must accrue interest even if during that day the organization used its current account.

What is 115-FZ

The Federal Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism” was adopted in 2001. Over the course of two decades, numerous amendments were made to the law: some norms were repealed, others were introduced into force. The service figured out what the essence of this federal law is and what goals it pursues.

The purpose of this law is to create and operate a legal mechanism to combat money laundering, the financing of terrorist and extremist activities, as well as the proliferation of weapons of mass destruction. The following are subject to the Federal Law:

- Citizens are individuals engaged and not engaged in private practice.

- Foreign citizens and stateless persons.

- Organizations working with funds and property.

- Legal entities.

- Individual entrepreneurs.

- Foreign organizations operating without forming a legal entity.

- State and municipal bodies.

Federal law obliges organizations working with funds to monitor the movement of funds, identifying suspicious and illegal transactions. The main regulator in the field of financial supervision is Rosfinmonitoring. Based on this, to the question of whether a bank can block an individual’s account, there is only one answer - maybe bank cards, deposits, and current accounts of individuals are subject to control.

The bank's financial department does not see normal transactions

A common transaction for a bank that tracks financial transfers of an individual entrepreneur or LLC is paying taxes, insurance premiums, rent, and issuing wages to employees. Such operations are natural and take place in any company. Therefore, their absence always leads to questions and checks.

Beginning businessmen face such violations. The most common mistake is that an entrepreneur, not wanting to withdraw money from the company’s turnover, acts as the founder of an LLC, director and sole employee, and does not pay wages. This system allows you not to pay insurance premiums. Having your own premises also eliminates the need to pay rent. For the enterprise, such a solution is in many ways advantageous, however, the bank does not think so and is trying in every possible way to prevent this.

The bank, tracking the receipt and debit of funds for the personal needs of the enterprise and not seeing tax payments, considers this situation suspicious. Therefore, all debit transactions carried out on the account are forcibly suspended until the circumstances are clarified.

What should you do if your current account is blocked? First, talk openly with the bank and provide the documentation they require. You will need to pay taxes and pay salaries to employees. This is necessary for the bank to see payment orders. If you have several current accounts that are located in different banks and taxes are calculated from the second, the first bank will not see this. In such a situation, to remove the blocking, it is enough to provide an extract. This can be a PDF file or a paper copy. Foma is chosen by the bank.

The bank doubts the legality of its transactions

Banks are required to regularly analyze clients' financial transactions. Otherwise, non-compliance may lead to sanctions or revocation of the Central Bank license. Therefore, a separate division is engaged in financial monitoring in banks - it monitors transactions and asks the client questions if employees have doubts about the transparency of transactions.

Avoiding account blocking in this case is not difficult. It is necessary to answer questions openly and provide upon request all documentation that relates to the transaction. If you do not do this on time or hide some of the transactions from the bank’s financial department, access to the online bank is limited. It can only be used to pay salaries to employees and make budget payments.

Total

It is a mistake to think that the procedure for unblocking an account is technical. There are no templates for how to resolve a controversial issue. As a rule, the chosen method for settlement is selected depending on the situation. You can achieve justice in any of the issues raised above on your own if you have experience, knowledge and free time. ready to offer professional help. We quickly solve the problem of blocking the accounts of individual entrepreneurs and LLCs, and also give recommendations on how you can protect yourself from possible sanctions from the tax service or bank.

The bank comes up with a problem out of the blue

The bank determines how the client can prove his reliability and the legality of financial transactions in the account. In practice, there are cases when the manager is first required to provide a document in electronic form, then they are asked to send passport data to confirm their identity, then a general photo, where the document, the unfolded passport and the client’s face will be visible in the frame. To ensure that the information is clearly readable and not upside down in the photo, you have to take pictures in the mirror.

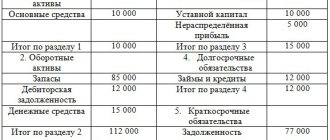

The situation becomes more complicated when the bank begins to demand documents that are not available. Thus, individual entrepreneurs may be asked for a balance sheet, which the manager does not have to maintain. In such a situation, you need to explain for a long time to bank employees why you do not have this or that document.

As a last resort, if explanations with the bank are delayed and you do not see positive changes, the illegality of the institution’s actions can be proven in court. During the trial, the bank is obliged to provide the court with evidence on what basis the account was blocked. However, this method takes a lot of time, which is critical for business development.