Depreciation in accounting

Depreciation of fixed assets (FPE) and intangible assets (IMA) is calculated on the credit of account 02 “Depreciation of fixed assets” and account 05 “Depreciation of intangible assets”, respectively (Order of the Ministry of Finance dated October 31, 2000 No. 94n). But the debited account depends on what type of activity the organization is engaged in, on its structure and features of the Accounting Policy for accounting purposes, as well as on where the depreciable property is used. Depending on this, accrued depreciation can be reflected in the debit of the following accounts:

- 08 “Investments in non-current assets”;

- 20 “Main production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 44 “Sales expenses”, etc.

Let us explain this with an example. Suppose a trade organization charges depreciation on a trademark: Debit account 44 - Credit account 05.

And if a manufacturing enterprise charges depreciation of equipment used in the manufacture of a certain type of product: Debit account 20 - Credit account 02.

If, for example, a truck is used exclusively during the construction of a building, depreciation on the vehicle will be included in the initial cost of such a building, which is formed on account 08: Debit account 08 – Credit account 02.

How the financial result is reflected - postings

A loss in accounting (hereinafter referred to as BU) is determined at the end of the reporting period by comparing the costs incurred and the revenue received. The financial result (profit or loss) is obtained from the sum of the results for the usual types of activity for the enterprise and other inflows and outflows. To record financial results, the chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) provides for account 99 “Profit and Loss”. During the financial year, the periods for which interim reporting is generated are closed, and the following entries are made:

| Dt | CT | Description |

| Profit from ordinary activities is shown (if the turnover according to Kt 90.1 is greater than the sum of turnover according to Dt 90.2, 90.3, etc.) | ||

| The loss for ordinary activities is shown (if the turnover according to Kt 90.1 is less than the sum of the turnover according to Dt 90.2, 90.3, etc.) | ||

| The profit for other activities is shown (if the turnover according to Kt 91.1 is greater than the turnover according to Dt 91.2) | ||

| The loss for other activities is shown (if the turnover according to Kt 91.1 is less than the turnover according to Dt 91.2) |

Note that the reflection of the facts of financial and economic activities for all subaccounts of accounts 90 and 91 is carried out continuously throughout the year, on an accrual basis. And only when the balance sheet is reformed at the end of the year, they are reset by postings Dt 90.1 Kt 90.9, Dt 90.9 Kt 90.2 (90.3). For count 91, the reformation is performed in a similar way. Accordingly, the accountant does nothing with the loss incurred at the end of interim reporting periods - the financial results are simply accumulated in account 99. But at the end of the year, the accumulated balance in account 99 is included in retained earnings or uncovered losses by postings:

| Dt | CT | Description |

| The uncovered loss of the reporting year is shown | ||

| The profit of the reporting year is shown as part of retained earnings |

Section I. Non-current assets

Intangible assets. The residual value of intangible assets is reflected on line 1110. Clause 3 of PBU 14/2007 “Accounting for intangible assets”, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n, allows you to find out what belongs to this group. Thus, in order to accept an object for accounting as an intangible asset, it is necessary that the following conditions be simultaneously met:

– the object is capable of generating economic benefits in the future, and the organization has the right to receive them;

– the object can be isolated or separated (identified) from other assets;

– the object is intended for use for a long time, that is, its useful life exceeds 12 months;

– it is possible to reliably determine the actual (initial) cost of the object;

– the object does not have a material form.

For example, if the specified conditions are met, intangible assets include works of science, literature and art, programs for electronic computers, inventions, utility models, selection achievements, production secrets (know-how), trademarks and service marks. Intangible assets also take into account business reputation arising in connection with the purchase of an enterprise as a property complex (in whole or part thereof).

Intangible assets do not include expenses associated with the formation of a legal entity (organizational expenses), intellectual and business qualities of the organization’s personnel, their qualifications and ability to work (clause 4 of PBU 14/2007).

Results of research and development. Research and development expenses recorded on account 04 “Intangible assets” are reflected on line 1120.

Intangible and tangible search assets. These two indicators are given in lines numbered 1130 and 1140. They are intended for organizations - users of subsoil to reflect information on the costs of developing natural resources (PBU 24/2011 “Accounting for the costs of developing natural resources”, approved by Order of the Ministry of Finance of Russia dated 10/06/2011 N 125n).

Fixed assets. For depreciable objects, the residual value of fixed assets is recorded in line 1150. If we are talking about non-depreciable property, then the line indicates its original cost.

Assets classified as fixed assets must comply with the conditions of clause 4 of PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n.

Objects must be owned by the organization or have the right of operational management or economic management. It is also allowed to include property received under a leasing agreement as fixed assets if it is taken into account on the balance sheet of the lessee.

Objects subject to mandatory state registration of property rights are considered fixed assets from the moment they are registered, that is, like all other objects. The fact that documents are submitted to the appropriate authority does not matter.

In Sect. Form I of the balance sheet does not have the line “Construction in progress”. The question arises: under what balance sheet item should expenses for the construction of real estate be reflected? The answer is on line 1150 “Fixed assets”. This is stated in paragraph 20 of PBU 4/99, approved by Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n. It’s best to add the decoding line “Construction in progress” to line 1150, using which to record the named expenses.

Profitable investments in material assets. Data on profitable investments in material assets corresponds to line indicator 1160. This is the residual value of property intended for rent (leasing) and accounted for on account 03. If the property was first used for production and management needs, but was later leased out, it must be reflected in a separate subaccount of account 01 as part of fixed assets. This is due to the fact that the transfer of the value of fixed assets into profitable investments and back is not provided for in accounting (Letter of the Federal Tax Service of Russia dated May 19, 2005 N GV-6-21 / [email protected] ).

Financial investments. For long-term financial investments, that is, with a circulation period of more than a year, line 1170 is allocated (for short-term ones - line 1240 of section II “Current assets”). Investments in subsidiaries, affiliates and other companies are also shown here. Financial investments are taken into account in the amount spent on their acquisition.

The cost of own shares purchased from shareholders for resale or cancellation, and interest-free loans issued to employees are not considered financial investments (clause 3 of PBU 19/02 “Accounting for financial investments”, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n). For the first indicator, line 1320 is provided. The second indicator is reflected as part of accounts receivable, namely, long-term loans are shown on line 1190, short-term loans - on line 1230.

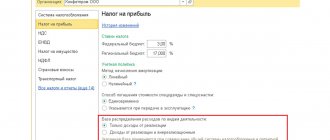

Deferred tax assets. Line 1180 “Deferred tax assets” is filled in by income tax payers. Since “simplified people” are not included in their number, it must be marked with a dash.

Other noncurrent assets. Here (line 1190) shows data on non-current assets that are not reflected in other lines of section. I balance sheet.

Accounting loss and tax loss - postings

When, according to accounting and tax accounting data (hereinafter - NU), a profit is obtained and both values are equal, then there are no difficulties in calculating and reflecting income tax (hereinafter - IR) in accounting. If in one of the accounting systems - BU or NU - one financial result was obtained, and in the other - another, then when closing the period, attention should be paid to PBU 18/02, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. In our article we will look at cases where discrepancies in losses arise in accounting and accounting records.

ConsultantPlus experts explained how to apply PBU 18/02 when receiving a loss in accounting and tax accounting:

Get trial access to the K+ system and upgrade to the Ready Solution for free.

Read about the obligation to apply PBU 18/02 in the article “PBU 18/02 - who should apply and who should not?”

According to Art. 283 of the Tax Code of the Russian Federation, an organization has the right to transfer losses received in the current tax period to the future, that is, to reduce the tax base by the amount of these losses in subsequent periods in full or in parts.

Read more about tax loss.

Therefore, even if in the current period the financial results according to accounting and accounting standards are equal, then in subsequent periods, other things being equal, accounting and tax profits will differ, thus, a deductible temporary difference will arise (clause 11 of PBU 18/02). Please note that the loss carry forward rule only works for the tax period (year); it does not apply to losses for the reporting period.

Let's consider 3 cases of losses and related transactions.

The same loss in accounting and financial accounting

According to clause 20 of PBU 18/02, after the accountant determines the financial result according to the accounting data, he must calculate and reflect in accounting the conditional income or expense for the NP. This must be done because the tax loss for the reporting period is reset to zero (clause 8 of Article 274 of the Tax Code of the Russian Federation), and the financial result according to the accounting system remains unchanged. The amount is calculated by multiplying the accounting loss by the IR rate and is reflected by posting:

- Dt 68 Kt 99 - for the amount of conditional income for income tax.

Further, in case of a loss, a deferred tax asset (DTA) for the same amount should be reflected:

- Dt 09 Kt 68 - SHE.

Thus, if a loss is recorded in NU and ACC, then account 68, subaccount “NP” will have a zero balance, and the declaration for payment will also reflect 0. In this case, the resulting difference between 0 in NU and the amount of loss in ACC should be reflected in accounting (form SHE).

Read about the accounting rules for IT in the article “Accounting for income tax calculations.”

Loss in NU, profit in accounting

If a loss was formed in the NU, and a profit in the accounting book, then in the NU the expenses were greater or the income was less, which means that in the current period deferred tax liabilities (DTL) should be reflected for taxable temporary differences or permanent tax income (PTI) for permanent differences . When closing the period, the accountant reflects the conditional expense for the IR, which is compensated by previously made entries for IT or PND, thereby bringing the current IR to 0.

Let's look at this situation with an example.

Example

In Kaleidoscope LLC, the profit according to the accounting book is equal to 250 thousand rubles, the loss according to the accounting book is 500 thousand rubles. The difference arose due to the write-off by Kaleidoscope of the depreciation premium on the new fixed asset - 350 thousand rubles. (IT). Also, Kaleidoscope LLC received equipment free of charge from the founder - an individual who has a share in the authorized capital equal to 70%. The cost of the equipment was 400 thousand rubles. In the accounting system, this income is reflected as other income; in the tax accounting system, it is not recognized as taxable income (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation). The following entries were made in the accounting of Kaleidoscope LLC:

| Dt | CT | Amount, thousand rubles | Description |

| 70 (350 × 20%) | Shown is IT for depreciation bonus | ||

| 80 (400 × 20%) | IPA shown for equipment received free of charge | ||

| 90.9 (91.9) | Profit determined according to accounting data | ||

| 50 (250 × 20%) | The conditional consumption for NP has been determined | ||

| 100 (500 × 20%) | ONA determined by tax loss |

On account 68 at the end of the period a zero balance is formed, which corresponds to the value of the NP according to the NU data, because there was a loss there. Accordingly, the tax is 0.

To find out whether an accountant should worry while awaiting tax inspections if a loss is shown in the tax return, read the article “What are the consequences of reflecting a loss in the income tax return?”

The following situation assumes that in BU the expenses were higher or income was lower than in NU, so this time the loss was formed in BU, and profit in NU.

Loss in accounting, profit in NU

In this situation, in the current period, there were deductible temporary differences, which led to the reflection of VTA, and/or permanent differences, as a result of which a permanent tax expense (PTR) was shown. Let's look at an example.

Example

In Karusel LLC, the profit according to accounting is equal to 150 thousand rubles, the loss according to accounting is 300 thousand rubles. Previously, the organization recognized ONA for a loss carried forward; the amount of the transferred loss is 400 thousand rubles. In the current tax period, Karusel LLC can repay part of the loss in the amount of 150 thousand rubles. at the expense of the profit received at NU. In addition, in the current year, a temporary difference arose in the accounting of Karusel LLC due to the excess of depreciation amounts according to the accounting book of the depreciation amounts according to the accounting book by 450 thousand rubles. The following entries were made in the accounting of Karusel LLC:

| Dt | CT | Amount, thousand rubles | Description |

| 90 (450 × 0,2) | SHE is shown for the difference in depreciation amounts | ||

| 30 (150 × 0,2) | ONA is written off for the repaid loss | ||

| 90.9 (91.9) | Loss determined according to accounting data | ||

| 60 (300 × 20%) | Conditional income for NP determined |

Thus, the turnover on the debit of account 68 is equal to 90 thousand rubles. and on the loan - 90 thousand rubles, that is, the current NP is 0 rubles. According to the tax return for the year, the tax amount for the year is also 0, since the tax profit was reset to zero by paying off the loss of previous years.

We don't miss anything!

Correctly reflected depreciation of fixed assets in the balance sheet allows you to accurately understand how large the organization’s profit is and how large amounts need to be included in the report. This determines what results the financial analysis will show, on the basis of which it will be possible to draw conclusions about the profitability of the enterprise. In addition, it is the depreciation of fixed assets in the balance sheet that is a significant factor. The financial leverage of the organization depends quite heavily on this.

Why is it so important how accurately depreciation is reflected on the balance sheet? The relationship is as follows: balance sheet information allows one to draw conclusions about how solvent the organization is. And it will be correct only if the depreciation in the balance sheet that accompanies the recapitalization of part of the company is correctly entered into the reporting.

Results

If a loss has occurred in accounting or tax accounting, you must remember that in this case you cannot do without the use of PBU 18/02. This provision regulates the accounting of permanent and temporary differences that lead to different financial results in accounting and accounting records. In addition, PBU 18/02 establishes that a carry-forward loss received in NU is also a temporary difference.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Line 1230 of the balance sheet (230, 240): decoding, principles of structure of line codes

Each line of the balance sheet has a code that allows you to identify the data contained in it. The main consumers of these codes are statistical and regulatory authorities, which can carry out analytical work on them.

Currently the codes are 4 digits long. For example, line 1230 of the balance sheet , former line 240, contains accounts receivable in the breakdown. This line shows the amount of debt that its partners, counterparties and other persons interacting with it have to the company in a certain period of time.

Line 230 also belonged to this category and reflected debts that could be repaid in no earlier than 12 months.

The balance sheet line codes contain very specific information:

- The first digit is that it belongs specifically to the balance sheet and not to another document.

- The second digit indicates belonging to a specific section of the asset.

- The third number shows the place of this asset in the liquid ranking. The higher the liquidity, the higher the number.

- The fourth digit is required for line detail. Thus, the requirements contained in PBU 4/99 are met.

Using a similar principle, we will selectively describe which codes correspond to the strings and provide a brief explanation of them. We will separately indicate in the table the new and old codes, since the balance must be drawn up for 3 years, and 2 years ago the previous code values were still in effect.

How does depreciation work?

You need to start accruing depreciation from the first day of the month following the day when the fixed asset was accepted for accounting. We accepted the OS in August - we calculate depreciation from September.

Until the useful life expires, accruals cannot be stopped. Suspension of work or cessation of use of equipment is not a reason to stop accrual. Suspension is permitted only for conservation for a period of more than 3 months or for a restoration period of more than 12 months.

Accrual must be stopped from the first day of the month following the one in which the object was written off or its cost was fully paid off. That is, depreciation does not need to be charged on any fully depreciated fixed assets with zero residual value, even if your company continues to use them.

Depreciation for recording is calculated monthly in accordance with the method approved in the accounting policy for individual groups or fixed assets:

- linear;

- reducing balance;

- by the sum of the numbers of years of useful life;

- proportional to production volume.

For any method, the useful life is important - this is the period during which the depreciable object generates income. The organization determines the period when it accepts the asset for accounting. When repairing or improving equipment, the useful life is increased.

Depreciation of fixed assets

The accounting policy of a business entity must necessarily fix the method of calculating depreciation used by it, choosing one of those named in this standard. Figure 1 gives a visual representation of possible options for calculating depreciation amounts in relation to fixed assets. Also in the presented figure you can see the formulas for the calculation.

In accordance with the principles of continuity and comparability, the calculation of depreciation of an organization's property is carried out using one method from one financial year to another. For the first time, depreciation on an object related to depreciable property is accrued in the next month after it is taken into account. Depreciation must be calculated over the entire time period while the asset is in use and allows the organization to derive a positive economic effect from its operation. The cost of an asset that is subject to transfer of its value into expenses in parts over a certain period of time must be fully depreciated, except in cases where it is disposed of before the end of this period.

If certain conditions are met by a business entity, depreciation can be calculated using simplified methods, for example, an organization can write off the depreciation amount once (at the end of the financial year) by making one accounting entry. In relation to production or household equipment, it is also possible to use a simplified accounting option in the form of a one-time attribution of their cost to the expense accounts provided for this.

The chart of accounts in the Russian Federation provides for a special account for accounting for depreciation of fixed assets with code 02 and the same name - “Depreciation of fixed assets”

Example 1

Shafran LLC has assets on its balance sheet that are subject to depreciation: equipment of the production workshop (main production). On January 31, 2021, the accountant, when performing the month-closing procedure, accrued depreciation of this property in the amount of 17,000 rubles. In the accounting program you can see the following posting:

Debit 20 Credit 02 in the amount of 17,000 rubles.

Depreciation: direct or indirect costs?

We discussed the difference between direct and indirect costs in our consultation. Let us recall that direct costs are those that are directly related to the production of a certain type of product, and therefore can be directly included in its cost. Otherwise, the costs are considered indirect. So is depreciation: if it relates to the production of a specific type of product, does not require distribution, but is directly included in the cost of production, it will be considered direct. If, for example, this is depreciation of general shop equipment that is used in the production of several types of products, then such depreciation will have to be distributed proportionally to some base (for example, the wages of production workers). This depreciation will be considered an indirect expense.

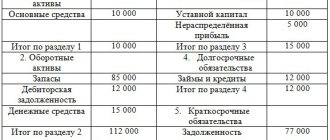

Balance Sheet Structure

The balance sheet is divided into two parts: assets and liabilities. Inside the parts there are sections, there are five of them, they are numbered consecutively. Inside the sections there are articles. Each item is a separate type of asset or liability. Items in an asset are arranged according to the degree of increasing liquidity: the lower the item is located, the faster the asset can be sold. In the liability, items are ordered by maturity: the lower the item, the faster the liability will need to be paid off.

I talked about the main articles, below you can click on the title and fall into the corresponding article.

ASSETS

I. Non-current assets

- Intangible assets

- Fixed assets

- Investments in non-current assets

- Profitable investments in material assets

- Long-term financial investments

II. Current assets

- Reserves

- Value added tax on purchased assets

- Accounts receivable

- Short-term financial investments

- Cash and cash equivalents

PASSIVE

III. Capital and reserves

- Authorized capital

- Extra capital

- Reserve capital

- retained earnings

IV. long term duties

- Long-term borrowed funds

- Long-term estimated liabilities

V. Current liabilities

- Short-term borrowed funds

- Accounts payable

- revenue of the future periods

- Short-term estimated liabilities

There may be more items in the real balance sheet - I have listed only the most common ones. Each item has a corresponding amount - this is the estimate of the corresponding asset or liability. The total for the section consists of the amounts for the items. Totals for assets and liabilities - from the amounts by sections. These totals are equal to each other and are called “balance sheet currency”.

Active and passive accounting accounts - table and explanations

Search Lectures

f) On March 30, a loan was received from a bank in the amount of 500 thousand rubles.

Draw up a balance sheet for the organization after each transaction.

The decision is reflected in the table: thousand rubles.

| Indicators | Fixed assets | Debt of the founders on contributions to the authorized capital | Cash | Balance | Authorized capital | Bank loans | Accounts payable | Balance |

| Bottom line | ||||||||

| 1 . | 560 | 560 | ||||||

| Bottom line | ||||||||

| 2. | -200 | -200 | ||||||

| Bottom line | ||||||||

| 3. | -170 | -170 | ||||||

| Bottom line | ||||||||

| 4. | 240 | 240 | ||||||

| Bottom line | ||||||||

| 5. | 220 | 220 | ||||||

| Bottom line | ||||||||

| 6. | 500 | 500 | ||||||

| Bottom line |

Grouping, combining all accounting and tax accounting objects according to their characteristics is used in every enterprise.

This classification is approved by law and is mandatory for all tax residents in the Russian Federation.

Order No. 94n of the Ministry of Finance of the Russian Federation approved a list of accounts and created instructions for their use.

In total, the list of accounts contains 99 synthetic accounting items; analytical transcripts can be opened for them, which give a more accurate picture of the work and functioning of the organization.

60 positions are used, the remaining 39 constitute a reserve that can be used when changing or optimizing accounting legislation.

1. Non-current assets (intangible, fixed assets).

https://www.youtube.com/watch?v=ytdevru

2. Current assets (raw materials, inventories, spare parts, materials, etc.).

3. Production costs (costing and distribution accounts). 4. Goods, finished products, sales (cost and sales).

5. Cash (cash and non-cash).

6. Settlements (with various counterparties, suppliers, buyers).

7. Economic, financial results (interim and final) and use of profits.

8. Reserves and funds of the enterprise.

9.Financing and loans.

10. Off-balance sheet accounts.

Correspondence of account 02 with other accounting accounts

| Account 02 by debit | Account 02 on loan |

| 01 Fixed assets 02 Depreciation 03 Profitable investments in material assets 79 On-farm calculations 83 Additional capital | 02 Depreciation 08 Investments in non-current assets 20 Main production 23 Auxiliary production 25 General production expenses 26 General business expenses 29 Servicing production and facilities 44 Selling expenses 79 On-farm settlements 83 Additional capital 91 Other income and expenses 97 Deferred expenses |

Amortization of intangible assets

Note 2

The main internal company document, which sets out the organization’s policy regarding the accounting of intangible assets, must prescribe an algorithm for calculating depreciation.

Figure 2 clearly shows all legally approved methods for calculating depreciation of property accounted for as intangible assets. The figure also shows that Russian accounting standards provide for depreciation of intangible assets only if the organization can reliably indicate until what point in the foreseeable future this asset can be used and have a positive economic effect from this.

To account for the depreciation of intangible assets, account 04 “Depreciation of intangible assets” of the Russian chart of accounts is intended. Depreciation on intangible assets is most often charged to general production, general business or selling expenses.

Example 2

Shafran LLC accrued depreciation on the trademark in the amount of 10,000 rubles. The accountant must reflect this fact of economic life on the basis of the calculation (accountant’s certificate):

Debit 26 Credit 05 in the amount of 10,000 rubles.

Example. Filling out the balance sheet

The LLC, registered in 2015, applies a simplified taxation system. The indicators of the accounting registers as of December 31, 2015 are shown in the table:

Table

Balances (Kt - credit, Dt - debit) on the accounting accounts as of December 31, 2015 of LLC

| Balance | Amount, rub. | Balance | Amount, rub. |

| Dt 01 | 600 000 | Dt 58 | 150 000 |

| Kt 02 | 20 040 | Kt 60 | 150 000 |

| Dt 04 | 100 000 | Kt 62 (sub-account “Advances”) | 505 620 |

| Kt 05 | 3340 | ||

| Dt 10 | 17 000 | Kt 69 | 89 000 |

| Dt 19 | 6000 | Kt 70 | 250 000 |

| Dt 43 | 90 000 | Kt 80 | 50 000 |

| Dt 50 | 15 000 | Kt 82 | 10 000 |

| Dt 51 | 250 000 | Kt 84 | 150 000 |

Based on the available data, the accountant compiled a balance sheet for 2015 in a general form:

Column 4 is the only one that requires filling out by the newly created organization. This column reflects data as of December 31 of the reporting year, that is, 2015.

Column 3 is also added to indicate line codes.

the indicator for line 1110 “Intangible assets” as follows: the credit balance of account 05 is subtracted from the debit balance of account 04.

In total we get 96,660 rubles. (RUB 100,000 – RUB 3,340). All values on the balance sheet are in whole thousands, so line 1110 shows 97.

The indicator of line 1150 “Fixed assets” is defined as follows: debit balance of account 01 – credit balance of account 02. Result – 579,960 rubles. (RUB 600,000 – RUB 20,040). 580 is recorded in the balance.

In line 1170 “Financial investments” the debit balance of the account is entered 58 - 150 thousand rubles. (that is, it is considered that all investments are long-term).

Total for summary line 1100: 827 thousand rubles. (97 thousand rubles (line 1110) + 580 thousand rubles (line 1150) + 150 thousand rubles (line 1170)).

Now it’s the turn of current assets. The value of line 1210 “Inventories” is defined as follows: debit balance of account 10 + debit balance of account 43. Total – 107 thousand rubles. (17 thousand rubles + 90 thousand rubles).

The indicator in line 1220 “Value added tax on acquired assets” is equal to the debit balance of account 19, therefore the accountant added 6 thousand rubles to the balance sheet.

The indicator for line 1250 “Cash and cash equivalents” was found by adding the debit balance of account 50 and the debit balance of account 51. The result is 265 thousand rubles. (15 thousand rubles + 250 thousand rubles). The line contains 265.

Total for summary line 1200 : 378 thousand rubles. (107 thousand rubles (line 1210) + 6 thousand rubles (line 1220) + 265 thousand rubles (line 1250)).

The final line 1600 shows the sum of the indicators of lines 1100 and 1200. That is, 1205 thousand rubles. (827 thousand rubles + 378 thousand rubles).

The remaining lines of column 4 are filled with dashes.

Let's move on to the balance sheet liability. The indicator on line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)” is equal to the credit balance of account 80, that is, the balance sheet costs 50 thousand rubles.

Line 1360 “Reserve capital” is the credit balance of account 82. In our case, this is 10 thousand rubles.

Line 1370 “Retained earnings (uncovered loss)” shows the balance of account 84. It is a credit balance. This means that the organization has a profit at the end of the year. Its value is 150 thousand rubles. There is no need to put the indicator in brackets.

The summary line indicator 1300 is equal to 210 thousand rubles. (50 thousand rubles (line 1310) + 10 thousand rubles (line 1360) + 150 thousand rubles (line 1370)).

The indicator for line 1520 “Accounts payable” (the accountant calculated that all debt is short-term) is determined as follows: credit balance of account 60 + credit balance of account 62 + credit balance of account 69 + credit balance of account 70. The result is 995 thousand rubles. (150 thousand rubles + 506 thousand rubles + 89 thousand rubles + 250 thousand rubles).

from 1520 to line 1500, since the other lines of section. V balance sheets were not filled out.

The total line indicator 1700 is equal to the sum of lines 1300 and 1500. The resulting value is 1205 thousand rubles. (210 thousand rubles + 995 thousand rubles).

The remaining liability lines are crossed out due to the lack of relevant data.

The indicators for the total lines 1600 and 1700 are equal. In both lines the value is 1205 thousand rubles. The balance is correct, which means that the form can be considered compiled correctly.

Active account scheme

| Debit | Credit |

| Opening balance - balance (availability) of economic assets at the beginning of the reporting period | |

| Debit turnover - the amount of business transactions that cause an increase in business assets during the reporting period | Loan turnover - the amount of business transactions causing a decrease in business assets during the reporting period |

| Final balance - the balance of business assets at the end of the reporting period |