Any independent financial transaction requires the need for an account opened in the name of the payer. In this regard, it is necessary to open an account with Sberbank not only for legal entities to organize settlements with clients and suppliers, but also for individuals when paying receipts or making payments at store checkouts, because plastic payment involves debiting from a card account. Each variety has its own characteristics and capabilities, which you need to know about before filling out the details.

Current account

This type of account is opened to an individual. It is needed in order to carry out transactions that are not related to business activities or private practice. To open a current account with a resident individual, you must provide:

- passport;

- certificate of registration with the tax authority (if available).

Foreign citizens or stateless persons who want to open an account will need to submit additional documents: a migration card and (or) a document confirming the right of a foreign citizen or stateless person to reside in the Russian Federation.

Account purpose

Adhering to the general rules, it became possible to open an invoice for both individual entrepreneurs and LLCs. A distinctive feature of the two registration forms is that in the first version only the entrepreneur himself is indicated for signature, and in the second - the owner of the business and the chief accountant.

It is necessary to correctly draw up an invoice from an individual entrepreneur, a sample document issued by the seller to the client.

Cooperation between the parties occurs according to the following algorithm:

- A potential consumer contacts a businessman and brings to his attention the need to purchase a product or service.

- The entrepreneur issues an invoice to the client and sends it in any way convenient for the other party: by e-mail, via Russian post, or in person.

- The buyer transfers funds to the current account of the business owner.

- After receiving payment, the businessman begins to fulfill his obligations to the consumer.

The issued invoice must include the seller’s contact information, information about the buyer, a list of goods and services with the exact quantity, cost per unit, total amount, and bank information for transferring funds.

If necessary, a template for correct filling can be downloaded from the Internet.

Checking account

Banks open current accounts to legal entities that are not credit companies, individual entrepreneurs and individuals who are engaged in private practice in accordance with the procedure established by the legislation of the Russian Federation, to make payments related to business activities or private practice. A current account is required to carry out transactions related to business activities or private practice.

List of profitable banks for opening an account

View list

In turn, a current account can also be divided into several types:

- depending on the owner: account for an individual entrepreneur, account for a legal entity;

- depending on the currency: a ruble account - it is suitable only for payments within the country, foreign currency accounts - are necessary to make payment transactions in dollars, euros, etc. with foreign partners. We wrote about how to open a foreign currency bank account here;

- depending on the country of registration of the taxpayer: accounts that are opened for a legal entity - a resident and accounts that are opened for a non-resident.

The standard package of documents for opening a current account looks like this: 1. For individual entrepreneurs:

- passport;

- card;

- documents that confirm the authority of the persons indicated on the card to manage the money in the account;

- licenses (if available).

2. For a legal entity:

- constituent documents;

- licenses (if available);

- card;

- documents that confirm the authority of the persons indicated on the card to manage the money in the account;

- documents that confirm the powers of the sole executive body of a legal entity.

We have identified several banks for settlement and cash services with the most favorable conditions:

| Bank | Opening an account | Service | Official site |

| Tinkoff | For free | 490 - 4990 rub. | tinkoff.ru |

| Alfa Bank | 0 — 9900 rub. | alfabank.ru | |

| Sovcombank | 0 — 1490 rub. | sovcombank.ru | |

| Loko-Bank | 0 — 4990 rub. | lockobank.ru | |

| Dot | 0 — 2500 rub. | tochka.com | |

| Modulbank | 0 — 4900 rub. | modulbank.ru |

You can open a current account in these banks remotely by leaving an online application directly on our website. All of the listed credit institutions, except Tinkoff, have free plans, which are popular among novice entrepreneurs. In addition, most banks give new clients gifts from partners in the form of bonuses for business development. For example, Tochka offers to receive up to 270 thousand rubles in bonuses.

How to send it

Any invoice to a legal entity or individual is always issued by an employee of the accounting department. When the document is completely and correctly filled out, taking into account all the required fields, it is handed over to the director of the company, who must put his signature on it. You can also add a seal, but this is not necessary, since since 2016 entrepreneurs and legal entities. persons may not use the seal if they wish.

Important! If there are erroneous data in a document, it is better not to correct them, but to issue a new one. This will help avoid confusion later, including accounting errors.

Such a document must be drawn up in two copies, one of them is sent to the person who paid for the service or product, the second must remain with the organization or entrepreneur who issued it. The invoice is filled out on a regular A4 sheet or letterhead from the organization, using the correct template. The second option is much better because it does not require constantly adding information about the company.

The template is not considered unified, so each individual entrepreneur and company can create their own individual form and use it as a personal sample. If a company or individual entrepreneur has been working in their field for a long time, they already have a standard form of such a form, in which only information about the recipients, as well as the names of services and goods, will change.

In most cases, the invoice is completed and sent to the client in electronic format. But every accountant should, just in case, print out the document in paper format and send the counterparty one copy signed by the director by regular mail. The second one will be kept in the folder where all other invoices should be.

Brokerage account

A brokerage account is a client’s personal account that is opened with a broker. All money, securities, transactions are reflected on it. You can open as many brokerage accounts as you like. Brokerage account features:

- has no restrictions on quantity, it is not prohibited to work with several brokers;

- the amount of money invested is not limited;

- unlimited validity period;

- You can store both money and securities in this account, but then another account is opened, a type of brokerage account - a depot;

- there are no restrictions on withdrawal of funds;

- you can trade through a brokerage account both in Russia and abroad;

- the brokerage account has access to Forex;

- Anyone can open an account;

- funds in the brokerage account are not insured;

- You must pay personal income tax on income from a brokerage account: 13% for residents, 30% for non-residents.

Brokerage accounts can be divided into several types depending on the number of owners, service methods, form of payment, cooperation and type of transaction. We wrote about this here. A brokerage account can be opened by both an individual and a legal entity. To do this, you need to contact a broker. To open a brokerage account, you need to collect approximately the following list of documents:

- Application and questionnaire;

- Passport;

- TIN.

How to issue an invoice for payment from an individual entrepreneur

Depositing personal funds into an individual entrepreneur's account - can this be done and why?

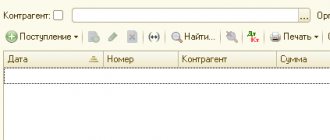

An invoice from an individual entrepreneur, a standard example of which is presented below, with all the necessary data is created in the 1C or Excel program. There are also special online services that allow you to prepare it using the Internet without installing additional software on your computer. This could be a program for issuing invoices and acts for individual entrepreneurs. During manufacturing, you will need to take into account all the parameters for documentation. To open a payment account, you need:

- Enter information about the individual entrepreneur in the first part of the template, including his full name, company name and address, Taxpayer Identification Number, and contact telephone number.

- Indicate the details of the banking organization in which the seller and the client are registered (if necessary).

- Assign a personal number to the account. Each of them can be included in the list of other documentation and taken into account in the main document flow system, and individual entrepreneurs can keep records separately and assign each a separate number.

- List in the form the entire list of ordered goods or services in a tabular format or in the form of a list, indicating for each quantity, price, VAT amount and the full amount to be paid.

- Additional important information, for example, fixed payment terms or the period during which the service will be provided or goods will be delivered.

- Signature and seal of the individual entrepreneur, if necessary; if the documentation is presented in electronic format, they will not be required.

Investment account

An individual investment account is a type of brokerage account, but is available only to individuals, citizens of the Russian Federation. It is intended for transactions with securities. Only one individual investment account can be opened. If you want to go to another broker and open a new account, the previous one will need to be closed. The main feature of such an account is the preferential tax treatment. The state provides the opportunity to receive a tax deduction. It enhances existing investment returns or provides additional fixed returns. Investment account characteristics:

- it can only be opened in the singular;

- there is an opportunity to receive a tax deduction;

- You can deposit funds only in rubles;

- maximum contribution - 1 million rubles;

- The account must be open for three years.

An investment account can be opened with a broker or manager. They conduct brokerage or securities management activities.

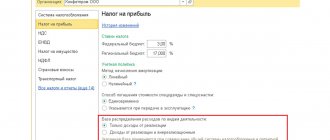

How to correctly reflect VAT

Entrepreneurs pay VAT only under the general taxation regime; under the simplified tax system and UTII all mandatory payments are replaced by a single tax. If an individual entrepreneur works with VAT, he must highlight its amount in the invoice. This can be done in two ways:

- Include tax in the final price. For example, if the cost of an operation including VAT is 200,000 rubles, you can designate it this way: “Transaction amount = 200,000 rubles, including 18% VAT = 36,000 rubles, total payable = 200,000 rubles. That is, the tax is already included in the price, but is still allocated separately.

- Indicate the cost without VAT and add it on top. Example of wording: “Cost of the operation = 200,000 rubles, including VAT 18% = 36,000 rubles, total payable = 236,000 rubles.

Budget account

A budget account is an account that is opened with a financial institution for businesses and organizations to record income and expenses. There are several types of budget accounts:

- profitable;

- consumables;

- current accounts of local budgets;

- current accounts of extrabudgetary funds.

To account for each type of income and expenses from a specific budget, different budget accounts are drawn up. A budget account is opened in a bank. Documents required for opening:

- Statement;

- State registration document;

- Charter of the enterprise;

- Minutes of the founding meeting;

- Minutes of the meeting No. 1, establishing the head and chief accountant - persons who have the right to sign bank documents;

- Card with sample signatures of authorized persons;

- Certificate of permission to open an account from the State Tax Inspectorate, Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund;

- Bank account agreement.

Common invoicing mistakes

Each sample invoice for payment of services without VAT from an individual entrepreneur may contain errors due to inattention, the presence of inappropriate forms or for other reasons. If an error was noticed by the organization’s specialists who compiled the invoice, they can correct it in the text. For this purpose, it is enough to cross out the incorrect data and enter the correct ones. Each change made must be certified by the manager’s signature and seal, if necessary, and also indicate the date. The list of main errors includes the following shortcomings:

- lack of decrypted signatures from one or the other party;

- issuing an invoice after five days have passed, when the goods have been unloaded and the service has already been provided;

- the client did not receive the document during the period when it was necessary to deduct VAT;

- errors in dates on copies of client or seller documents;

- errors made when forming the header of the form in the document.

Personal account

A personal account is designed to record settlements with individuals and legal entities, which reflect all information related to financial and credit transactions with a specific client. Personal accounts are maintained in financial and credit institutions, insurance organizations, tax inspectorates, utility companies and government agencies. A personal account is opened for individuals in a bank for personal use. It can be used to repay bank loans and pay interest to credit institutions; transfer of money to legal entities; storage of personal finances.

The personal account has its own number - a combination of 20 digits. It contains all information about the client: credit obligations, transactions performed, interest accrual, number of banking products, etc.

Legal entities and individual entrepreneurs can also open personal bank accounts, but they are not intended for settlements with partners. They are usually opened for transferring salaries to employees and when applying for a loan. A separate category consists of personal accounts of budgetary organizations. A personal account is opened for them with the Federal Treasury. There are no service fees for such accounts. The personal account displays the amount of federal budget funds available to the manager or recipient of these funds in the process of implementing procedures for authorizing and financing federal budget expenditures. Types of personal accounts of budgetary organizations:

- personal account for recording transactions carried out by participants in the budget process within the framework of their budgetary powers (divided into several types);

- to record operations carried out by a budgetary institution;

- to record transactions carried out by an autonomous institution;

- to record transactions carried out by the organization and other legal entities, peasant farms, individual entrepreneurs, the Federal Treasury body opens and maintains a personal account intended to record transactions with the funds of a legal entity, peasant farm, individual entrepreneurs that are not participants in the budget process.

When to exhibit

Sometimes, for cooperation between two parties, it is enough to conclude an agreement; this document specifies the volume of supplies, terms and amount to be paid. If the client orders goods from time to time and in different quantities, an invoice is issued for each individual transaction, which indicates the cost of a one-time purchase. You will still have to conclude an agreement, but it specifies only general provisions on cooperation.

An invoice is also issued in the following situations:

- The counterparties did not have time to conclude an agreement, and the delivery of goods must be carried out in a short time. The supplier can generate an invoice for payment, and a little later the parties will seal their relationship with an agreement.

- The buyer requires a one-time delivery, and it simply does not make sense to draw up a long-term contract.

If all the terms of cooperation inherent in the contract are reflected in the document, it will act as an offer. That is, the paid invoice will confirm the conclusion of a transaction between two counterparties, and it can be used in court. In this case, there is no need to conclude an agreement.

Special bank account

This type of account can be opened by individuals and legal entities to carry out certain types of payments. Types of special bank accounts depending on their purpose:

- collateral account;

- escrow account;

- nominal;

- debtor and so on.

Classification of special accounts based on placement modes and the possibility of spending money:

- letters of credit;

- check books;

- deposit accounts, etc.

A special account is opened in a bank, subject to the presence of a main current account.

Penalty and writs of execution during the moratorium period

One of the consequences of the introduction of a moratorium is the cessation of accrual of penalties (fines and penalties) and other financial sanctions for non-fulfillment or improper fulfillment by the debtor of monetary obligations and mandatory payments for claims that arose before the introduction of the moratorium.

In addition, the introduction of a moratorium against the debtor also means that it is impossible for the creditor to obtain compulsory execution by presenting the writ of execution directly to the bank. However, it is worth considering that the moratorium applies only to the most affected sectors of the economy

8-921-903-17-16

| A fine of five times the cost of goods for each month and other changes to the law “On the Protection of Consumer Rights” |

An entrepreneur has the right to use a personal account, but there are some peculiarities. Unlike a legal entity, an individual entrepreneur has the right to dispose of his property, including funds, at his own discretion. All money earned is considered his property, and he can withdraw it from the account at any time. We wrote more about this earlier

A legal entity cannot boast of such an advantage, even if you are the only member of the company and the general director in one person, all the funds you earned do not belong to you. This is the money of the society you created. You can pay yourself a salary from them or transfer them as dividends. Out of the blue, difficulties arise.

At the same time, the Central Bank of Russia obliges credit institutions to separate the accounts of individuals into those used for personal purposes and those where commercial payments occur. All this was done because the tax office cannot obtain data on account movements without a court decision. And for accounts that are opened for commercial needs - maybe.

But you shouldn’t think that there is a unanimous opinion on this matter among tax inspectors.

Deposit account

A deposit account or, in other words, a deposit account is opened in a banking organization for individuals and legal entities to receive income in the form of interest, which is accrued on the amount of money deposited into the account. Deposit accounts for individuals are divided into two types:

- urgent - issued for a specific period. The rate is higher than that of the second type of account. At the end of the term, you can withdraw the accumulated funds;

- on demand - issued for an unlimited period, money can be withdrawn at any time.

Legal entities open a deposit account for large amounts in order to receive passive income through interest accrual. Typically, banks offer legal entities to open a time deposit for a certain period with a fixed interest rate.

What is an invoice?

A standard payment template for payment is a document with payment details that can confirm that the client paid for a specific service or product. Invoices of this type are issued by entrepreneurs to those with whom they have entered into agreements for the sale of goods or provision of services, as well as to clients who have not entered into similar agreements with them. It allows you to confirm the fact of payment and prove it later.

Seal of an individual entrepreneur

The legislation does not provide for certain requirements for the form and content of such documentation. But there are special standards that need to be taken into account when issuing an invoice from an individual entrepreneur or organization. The document is drawn up using a special template, in which the necessary information must be indicated, and it must look appropriate:

- Full name IP;

- TIN;

- data of the banking organization with which the entrepreneur cooperates;

- a list of services or goods purchased by the buyer;

- the sum of all payments as a whole, where the amount for VAT should be allocated;

- numbers and dates.

Filling out an invoice for payment