How can an NPO switch to the simplified tax system?

All organizations that plan to switch to the simplified tax system must comply with a number of conditions (Article 346.12 of the Tax Code of the Russian Federation):

- Restrictions on the type of activity (financial, sale of excisable goods, gambling). But, as a rule, NPOs do not engage in such types of business.

- Lack of branches. To avoid problems, you can register the unit as a representative office.

- The share of legal entities in the authorized capital should not exceed 25%. NPOs do not have an authorized capital, so this restriction does not apply to them.

- Annual revenue should not exceed 150 million rubles. NPOs should only count business income.

- The residual value of fixed assets should not exceed 150 million rubles. Here only depreciable property is taken into account, i.e. those objects that the NPO uses for commercial activities.

- The average number of employees should not exceed 100 people.

The choice between the simplified tax system “Income” and “Income minus expenses” options must be made by NPOs according to the same principles as commercial organizations. In general, the higher the share of business costs in income, the more profitable the second option will be.

The procedure for switching to the simplified tax system for non-commercial organizations also does not differ from the general one (Article 346.13 of the Tax Code of the Russian Federation). The new organization must submit an application to the Federal Tax Service within 30 days from the date of registration. An existing NPO can switch to the simplified tax system from the beginning of next year. To do this, you must submit an application before December 31.

Limitation on the share of participation of other companies

One of the criteria that limits the right to use the simplified tax system is related to the share of participation of legal entities in the authorized capital of the organization applying this special regime - no more than 25%. The limitation on the share of participation of other companies in the authorized capital of the company must be observed:

- on the date of commencement of work on the simplified tax system. Otherwise, the company will not acquire the right to use the simplified tax system;

- during the application of the simplified tax system. A company that violates this requirement during this period loses the right to use the simplified procedure.

Financiers note that when the composition of the organization's participants and their share of participation changes, the company submits documents to the registration authority to register the changes that were made to the constituent document (Clause 2 of Article 18 of the Federal Law of August 8, 2001 No. 129-FZ). In this case, registration is carried out within no more than 5 working days from the date of submission of documents to the registration authority, unless otherwise provided by the specified federal law. As a general rule, you can switch to a simplified system from January 1 of the new year. Tax authorities must be notified of the transition to “simplified taxation” from the beginning of the new year no later than December 31 of the previous year. To do this, you need to submit a notification to the tax office (clause 1 of Article 346.13 of the Tax Code of the Russian Federation).

In the commented letter, the Russian Ministry of Finance notes that this procedure also applies if a company switches to the simplified tax system after fulfilling the condition on the share of participation of other legal entities in its authorized capital. For example, if changes to the organization’s constituent documents were registered in the Unified State Register of Legal Entities before January 1, 2021, then it will be able to apply the simplified system from the beginning of 2021. By the way, if a company has a share of participation of other organizations in it of more than 25% and, despite this, applies the simplified tax system, the Federal Tax Service is not obliged to warn it about the tax consequences (letter of the Ministry of Finance of Russia dated January 22, 2018 No. 03-11-11/3052).

This is due to the fact that tax authorities are obliged to inform companies and individual entrepreneurs free of charge about their rights, about tax legislation, about the procedure for calculating taxes and fees, etc. (subclause 4, clause 1, article 32 of the Tax Code of the Russian Federation). The procedure for informing is prescribed in the administrative regulations of the Federal Tax Service (appendix to the order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n). But inspectorates are not obliged to warn about tax consequences to those organizations that, despite the share of participation of other companies in them exceeding 25%, use the simplified tax system. This is not stated either in the Tax Code or in the administrative regulations.

Features of tax accounting for NPOs using the simplified tax system

Non-profit organizations that, along with the main one, conduct commercial activities, usually switch to the “simplified” system.

Therefore, it is necessary to organize separate accounting. Targeted revenues for non-profit activities are not taxed. It is important that the purpose of the payment clearly indicates that this is not about revenue, but about targeted contributions.

If the object of the simplified tax system “Income minus expenses” is selected, then expenses that are directly related to business activities reduce the tax base. Those expenses that are associated with non-commercial activities do not affect the calculation of tax.

“Mixed” types of expenses that relate to both types must be distributed, reflecting the methodology in the accounting policies.

It is most convenient to divide expenses in proportion to revenue from commercial and non-commercial activities, by analogy with the situation when the simplified tax system is combined with other tax regimes (clause 8 of article 346.18 of the Tax Code of the Russian Federation).

Those who switched to the simplified tax system from the general tax system need to remember that with “simplified” income and expenses are recognized “on payment”, i.e. during the periods when money was received or debited from the account.

simplified tax system for transactions with shares

A person who leaves the LLC does not have income subject to a single tax within the limits of the contribution. In the case of the sale of a share, income from the sale arises, and the simplified taxation system is levied on the entire amount of the transaction. In this case, it does not matter which object of taxation - “income” or “income reduced by the amount of expenses” - the “simplified” works.

How to leave the founders

How to part with a company’s existing share in another company on a reimbursable basis is written in Federal Law No. 14-FZ of 02/08/1998 “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ).

If a company withdraws from the founders of the company, it draws up a corresponding statement (Part 6.1, Article 23 of Law No. 14-FZ). After this, the company holds a meeting of the remaining participants on the transfer of the share of the retired participant to the company and draws up minutes of the meeting of participants. The share of the retiring participant passes to the company on the date of receipt of the application (clause 2, part 7, article 23 of Law No. 14-FZ). If a participant leaves the company, he can sell his share both to the company itself and to a third party, if this is permitted by the charter of the LLC. When leaving an LLC, the share owned by the participant is alienated in favor of the company. The participant transfers his share to the company, and in return receives cash (or other property) that constitutes the value of this share.

When selling a share to a third party, we are talking about a purchase and sale transaction. For tax purposes, this means the exercise of property rights.

Tax consequences of selling a share

“Simplers” determine the object of taxation in the manner established by paragraphs 1 and 2 of Article 248 of the Tax Code of the Russian Federation (clause 1 of Article 346.15 of the Tax Code of the Russian Federation).

According to this norm, income includes income from the sale of goods (work, services) and property rights, as well as non-operating income.

Income from sales is determined in accordance with Article 249 of the Tax Code of the Russian Federation. In accordance with paragraph 1 of Article 249 of the Tax Code of the Russian Federation, income from sales is recognized as proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights.

Thus, income received from the sale of a share, in accordance with the provisions of paragraph 1 of Article 346.15 and paragraph 1 of Article 249 of the Tax Code of the Russian Federation, is taken into account for taxation as a single tax paid in connection with the application of the simplified taxation system.

Sales income includes everything that the company received from the buyer (customer) in payment for the contract, both in cash and in kind (clause 2 of Article 249 of the Tax Code of the Russian Federation).

Non-operating income is determined in accordance with Article 250 of the Tax Code of the Russian Federation. These include, in particular, income from equity participation in other organizations, accounts payable written off due to the expiration of the statute of limitations, fines, penalties and other sanctions received from partners for violating the terms of business contracts, property received free of charge, etc.

As for expenses (under the simplified tax system with an object, income minus expenses), it is impossible to reduce the income received from the sale of a share by the cost of the contribution to the authorized capital.

A contribution to the authorized capital of an LLC is not an expense for a participant who is a legal entity for single tax purposes, based on the provisions of Article 346.16 of the Tax Code of the Russian Federation. In addition, the transfer of property to the authorized capital is not a sale for tax purposes, since such a transfer is of an investment nature (subclause 4, clause 3, article 39 of the Tax Code of the Russian Federation).

Thus, the simplified tax system when selling a share to a third party at a price higher than its value is levied on the entire transaction amount.

Tax consequences of leaving an LLC

According to subclause 1 of clause 1.1 of Article 346.15 of the Tax Code of the Russian Federation, when determining the tax base under the simplified tax system, the income specified in Article 251 of the Tax Code of the Russian Federation is not taken into account. The general tax rule is established in subparagraph 4 of paragraph 1 of this article. It is said here that when determining the tax base, income in the form of property, property rights, which are received within the limits of the contribution (contribution) by a participant in a business company upon leaving (retirement) from the business company, is not taken into account. That is, if the amount received from the LLC upon leaving it is less than or equal to the contribution of the retiring participant applying the simplified tax system, then there is no need to pay tax.

Note that the tax base for the sale of a share at a cost equal to the contribution does not arise due to a direct norm of the Tax Code of the Russian Federation. And not because income and expenses in this case coincide. As we have already noted, there is no expense in the form of a contribution to the authorized capital of another organization under the simplified tax system.

Other obligatory payments of NPOs on the simplified tax system

Companies using the simplified tax system are generally exempt from VAT, income tax and property tax. However, there are situations when “simplified” people are obliged to pay these taxes (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

- VAT must be paid when importing imported goods, as well as if the organization conducts general affairs of the partnership or performs the functions of a tax agent.

- Income tax must be paid on dividends, profits of controlled foreign companies, as well as on transactions with securities.

- Property tax under the simplified tax system is levied on objects for which the base is determined as the cadastral value (for example, premises in office and shopping centers).

All these exceptions apply more to commercial companies, but sometimes NPOs can also fall under them.

For example, if an organization rents premises that are state or municipally owned, then it performs the functions of a tax agent for VAT (clause 3 of Article 161 of the Tax Code of the Russian Federation). Or an NPO owns an office in a business center - then the organization must pay property tax.

NPOs pay land and transport taxes under the simplified tax system in the same way as under OSNO - if the organization has the appropriate facilities.

If an NPO has full-time employees, then it must withhold personal income tax from salaries and charge insurance premiums. In general, the tax regime does not play a role here.

But for non-profit organizations on a simplified basis that are engaged in socially significant activities, a discount on insurance premiums has been established (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation). They only pay pension contributions at a rate of 20%, and for social and health insurance there is a zero rate. The benefit does not apply to contributions for injuries.

Preferential types of activities include the social sphere, education, healthcare, science, culture and mass sports.

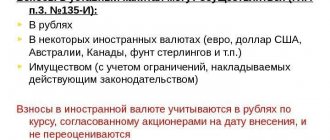

Contributions to the authorized capital of small organizations on the simplified tax system

| Authorized capital is necessary for the operation of any organization. This is both the limit of responsibility of the founders and, in some way, an emergency reserve of funds. The authorized capital is usually at the disposal of the organization even before the start of its work, but sometimes the authorized capital is increased during the operation of the organization, although this is often not profitable. In this article we will consider these and other issues related to authorized capital in more detail. |

When creating any company, one of the fundamental moments is the formation of its authorized capital (hereinafter referred to as the authorized capital).

These are funds initially invested by the owners to ensure the activities of the organization as provided for in its charter. It determines the minimum amount of property of a legal entity that guarantees the interests of its creditors, and is determined based on the basic amount of the minimum wage (minimum wage), currently equal to 100 rubles. and used for calculating: • taxes; • fees; • fines; • other payments, the amount of which in accordance with the legislation of the Russian Federation is determined depending on the minimum wage; • payments for civil obligations established depending on the minimum wage. The amount of the authorized capital, by decision of the founders, can increase or decrease in the process of financial and economic activities, with mandatory registration of changes in the constituent documents.

In addition, current legislation may provide for a minimum amount of authorized capital in a fixed amount of money, which is true specifically for limited liability companies. The minimum capital of such organizations should be 10 thousand rubles (Article 14 of Law No. 14-FZ).

In order to carry out state registration of a new company, it is necessary that at least 50 percent of the authorized capital be paid up. The remaining unpaid portion of the Criminal Code must be paid within one year from the date of state registration.

You can make a contribution to the authorized capital both in cash and securities, as well as various material assets or property rights that have a monetary value. If the amount of the contribution to the LLC's management company made by property is more than 20 thousand rubles, then an independent appraiser's opinion on the value of the transferred property is required. In cases of a property contribution in the amount of 20 thousand rubles or less, the monetary value of the property contributed to pay for shares in the authorized capital of the company is approved by a decision of the general meeting of the company's participants, adopted by all company participants unanimously. The procedure for conducting an independent assessment is regulated by Federal Law No. 135-FZ of July 29, 1998 “On appraisal activities in the Russian Federation.”

Clause 2 of Art. 34 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies” provides for payment of shares in the management company with property. In this case, the organization’s charter may establish types of property that cannot be contributed to pay for shares in the authorized capital of the company.

The difference between the value of the property contributed to the authorized capital and the nominal value of the share in this capital does not affect the tax base. “Thus, when making a contribution to the authorized capital, the excess of the estimated value of the contributed fixed asset over its residual value by the transferor is not taken into account for tax purposes” (Letter of the Ministry of Finance dated December 17, 2010 No. 03-07-11/491).

The movement of the authorized capital is accompanied by supporting documents, the correctness of which is taken into account by the accountant. Accounting for the authorized capital is carried out on account 80 “Authorized capital”.

On the date of the decision to create the company, an entry is made in the accounting records that forms the debt of the founders for the contribution to the authorized capital. This is done by posting Dt 75.1 Kt 80 (in case of departure of the founders and return of deposits - Dt 80 Kt 75.1).

When a debt is received from the founder in cash (to a current or foreign currency account) - Dt 51 (50, 52) Kt 75.

If the founder made a contribution to the organization’s current account in cash, then entries are made Dt 50 Kt 75, and then Dt 51 Kt 50. Note that such an operation still went through the cash desk. If the founder made a contribution by bank transfer, then Dt 51 Kt 75.

Also, the authorized capital can be formed through the contribution of materials, goods, fixed assets, etc. In all cases, the account to which the property is deposited is debited (08, 10, 41, 52, 58...) and account 75 is credited. For example, a contribution of office supplies Dt 10 Kt 75.

To make a contribution, you need constituent documents, an accounting certificate and some of the following: Act No. OS-14 “Act on acceptance (receipt) of equipment”, No. OS-1 “Act on acceptance and transfer of fixed assets (except buildings, structures)” , No. NMA-1 “Intangible Assets Accounting Card”, No. M-4 “Receipt Order”, Acceptance Certificate for completed work, contracts for the provision of services, bank statement on current account.

Contribution to the management company with property is carried out by a Russian company

Property received as a contribution to the authorized capital of an organization is accepted for profit tax purposes at the cost (residual value) of the property received. The cost (residual value) is determined according to the tax accounting data of the transferring party on the date of transfer of ownership of the specified property (property rights), taking into account additional expenses that, upon such payment, are made by the transferring party, provided that these expenses are defined as a contribution to the charter capital.

Depreciable property is accepted for tax accounting purposes (Letter of the Ministry of Finance dated 06/07/2011 No. 03-03-10/48): • based on the costs of the founder for its acquisition and bringing it to a usable state (if such property was not put into operation ) • either at the residual value, that is, the original value minus accrued depreciation.

It must be remembered that when determining the value (residual value) of the contributed property for tax accounting purposes, the amount agreed upon by the founders and/or the market value confirmed by an independent appraiser is not taken into account in any way. The market value of property cannot be accepted either for income tax on the sale of property or for calculating depreciation in tax accounting (Letter of the Ministry of Finance dated 05/07/2009 No. 03-03-06/1/304).

The value of the contributed property must be documented. If subsequently the organization that receives the property wants to sell it, then for the purposes of tax accounting for income tax it will be able to reduce income by the amount of expenses only if the value of the contributed property has been documented. If there is no documentary evidence of the value of the property, the company will have to pay income tax in full on the entire amount of revenue received.

Contribution to the management company with property is carried out by a foreign company or individuals

When contributing property by individuals and foreign organizations, its value is recognized as: documented expenses for its acquisition or creation, taking into account depreciation (wear and tear) accrued for profit tax purposes in the state of which the transferring party is a tax resident. However, the value of such property cannot be higher than the market value of this property, confirmed by an independent appraiser acting in accordance with the legislation of the specified state.

Thus, in the case of adding property to the Criminal Code by an individual or a foreign organization, the market value of the property, confirmed by an independent assessment, is taken into account for the purposes of tax accounting of such property as an “upper bar”, that is, it limits its maximum value.

If the property is contributed by an individual, the level of its depreciation can be agreed upon in the constituent agreement. At the same time, the cost of the contributed property (the cost of its acquisition) must be documented (Letter of the Ministry of Finance dated February 18, 2010 No. 03-03-06/1/82).

An organization that has received property as a contribution to the management company has the right to make expenses at the expense of such property, which will be taken into account for tax accounting purposes for income tax. So, if fixed assets were contributed to the management company, then the recipient organization will incur expenses in the form of depreciation of these fixed assets. In this case, depreciation on the received fixed assets will be calculated based on the residual value of this property according to the tax accounting data of the transferring party.

When determining the tax base for corporate property tax, companies that receive depreciable property as a contribution to the management company must remember that the value of such property is determined according to accounting data, not tax accounting. Thus, the cost of fixed assets will be different for income tax purposes and for property tax purposes (see Letter of the Ministry of Finance dated October 3, 2011 No. 03-05-05-01/80).

Under the simplified tax system, the contribution to the capital company is not included in the taxable base (Articles 346.15, 251 of the Tax Code of the Russian Federation), but such a company is obliged to make accounting entries, because Art. 6 of the new Federal Law of December 6, 2011 No. 402-FZ “On Accounting” does not provide for the exemption of organizations using the simplified tax system from accounting.

Accounting for a contribution to the property of a company that does not increase the authorized capital

Sometimes the financial situation requires the founders to make additional contributions to the organization’s management company. How to account for such a contribution?

Article 27 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” establishes the obligation of company participants to make contributions to the property of the company if this is provided for by its charter or a corresponding decision is made by the general meeting of company participants.

Contributions to the property of the company are made by all its participants in proportion to their shares in the authorized (share) capital of the company, unless a different procedure for determining the size of contributions to the property is provided for by the charter of the company (clause 2 of Article 27 of Law No. 14-FZ). Contributions are made in money, unless otherwise provided by the company's charter (Clause 3, Article 27 of Law No. 14-FZ). That is, the procedure for determining the size of the contribution, its composition, and the period for making the contribution are determined by the charter of the company.

Contributions to the property of an LLC do not change the size and nominal value of the shares of company participants in the authorized (share) capital (Clause 4, Article 27 of Law No. 14-FZ). Paragraph 14 of the Resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 9, 1999 No. 90/14 clarifies that these contributions are not contributions to the authorized capital. Contributions made become the property of the company.

The procedure for reflecting in accounting and reporting transactions on contributions to the property of the company is not regulated by regulatory legal acts on accounting. In this regard, there are two ways to account for funds received from the founders of the company as contributions to its property.

In accordance with the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 75 “Settlements with founders” is intended to summarize information on all types of settlements with the founders (participants) of the organization, therefore The receipt by an organization of funds as a contribution to the company’s property can be reflected using account 75.

Firstly, contributions to the company’s property should be considered as a gratuitous transfer of property and taken into account as part of other income in accordance with clause 8 of PBU 9/99 “Income of the organization”, since they do not change the size and nominal value of the shares of the company’s participants in the charter ( share capital, that is, they are not contributions to the authorized capital and are not subject to return. In this case, the amount of income is recognized on the date of receipt of funds in accordance with clause 16 of PBU 9/99.

According to the Chart of Accounts, gratuitous receipt of funds to the cash desk or to the current account of an organization is reflected in the debit of account 50 “Cash” or 51 “Cash Accounts” and the credit of account 98, subaccount “Gratuit Receipts,” respectively. At the same time, the amount of funds received free of charge is reflected in other income by entries in the debit of account 98 and the credit of account 91, subaccount “Other income”.

So, the following entries are made in the company’s accounting records:

Dt 75, subaccount “Settlements for contributions to the property of the company” Kt 98, subaccount “Gratuitous receipts” - the amount of the founder’s debt is reflected as gratuitous receipts (based on the decision of the general meeting of the company’s participants); Dt 50 (51) Kt 75, subaccount “Settlements for contributions to the company’s property” - funds were received from the founder into the company’s contribution; Dt 98, subaccount “Gratuitous receipts” Kt 91, subaccount “Other income” - other income is reflected in the amount received from the founders as contributions to the property of the LLC.

However, this method of accounting for participants’ contributions to the company’s property contradicts the requirements of PBU 9/99. According to clause 2 of PBU 9/99, the income of an organization is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of this organization, with the exception of contributions from participants (owners of property).

The Russian Ministry of Finance recommends that the contribution to the company’s property be reflected in the accounting records under account credit 83 “Additional capital” (see Letters of the Russian Ministry of Finance dated January 29, 2008 No. 07-05-06/18, dated April 13, 2005 No. 07-05-06/107 ). That is, when funds are received, the following entries are made in accounting:

Dt 75, subaccount “Settlements for contributions to the company’s property” Kt 83 - reflects the amount of the founder’s debt on contributions to the company’s property (based on the decision of the general meeting of the company’s participants); Dt 50 (51) Kt 75, subaccount “Settlements for contributions to the company’s property” - funds were received from the founder into the company’s contribution.

However, there is no direct instruction for recording such transactions using account 83 in the Chart of Accounts. Moreover, the list of transactions that can be reflected in additional capital is closed, and there are no transactions with contributions to the company’s property in it.

Thus, we believe that the organization should independently choose and fix the method of reflecting the contributions of the founders in the order on accounting policies in accordance with PBU 1/2008.

The contribution can also be in non-monetary form. We will show how to take such contributions into account using the example of a contribution in the form of a land plot.

In accounting, land plots can be classified as fixed assets in accordance with paragraph 2 of clause 5 of PBU 6/01 “Accounting for fixed assets” if they meet the requirements established in clause 4 of PBU 6/01, namely: a) use in production, when performing work or providing services or for the management needs of the organization; b) use for a long time, that is, a useful life of more than 12 months or a normal operating cycle if it exceeds 12 months; c) the organization does not intend to subsequently resell these assets; d) the ability to bring economic benefits (income) to the organization in the future.

The initial value of fixed assets received free of charge is recognized as their current market value on the date of acceptance for accounting as investments in non-current assets (clauses 7, 10 of PBU 6/01). According to paragraph 1 of Art. 66 of the Land Code, the market price of land is determined in accordance with the Federal Law of July 29, 1998 No. 135-FZ “On Valuation Activities in the Russian Federation”. In this case, as a result of the gratuitous receipt of an asset, the organization receives other income in the amount of the market value of this asset (clauses 7, 10.3 of PBU 9/99 “Income of the organization”).

Based on clause 11 of PBU 9/99 and clause 29 of the Methodological guidelines for the accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, the acceptance for accounting of fixed assets transferred free of charge is reflected in the debit of the account for accounting for investments in non-current assets in correspondence with the deferred income account with subsequent reflection in the debit of the fixed assets account in correspondence with the credit of the account for investments in non-current assets.

In Letters dated 02/17/2006 No. 03-03-04/1/126, dated 04/05/2005 No. 03-03-01-04/1/158, the Ministry of Finance of Russia explained: “The acceptance of land plots for accounting as part of fixed assets is carried out on the basis of a duly approved act of acceptance and transfer of fixed assets and documents confirming their state registration in the Unified State Register of Rights with the assignment of a cadastral number by the body carrying out the activities of maintaining the State Land Cadastre.”

Based on the decision of the general meeting of the company’s participants, an entry is made in the accounting records: Dt 75, subaccount “Settlements for contributions to the company’s property” Kt 98, subaccount “Gratuitous receipts” - reflects the amount of the founder’s debt on contributions to the company’s property. On the date of transfer of the land plot, the organization must make the following entries in the accounting records: Dt 08, subaccount “Transferred land plots” Kt 75, subaccount “Calculations for contributions to the property of the company” - the market value of the land plot is reflected; Dt 01 Kt 08, subaccount “Transferred Land Plots” - the land plot was accepted for accounting on the date of state registration of rights to it; Dt 98, subaccount “Gratuitous receipts” Kt 91, subaccount “Other income” - the cost of the land plot is recognized as other income.

But if an organization, in accordance with the recommendations of the Ministry of Finance of Russia adopted in the accounting policy, reflects contributions to the company’s property in its accounting under the credit of account 83 “Additional capital”, then it must make the following entries: Dt 75, subaccount “Calculations for contributions to the company’s property” » Kt 83 - reflects the amount of the founder’s debt on contributions to the company’s property (based on the decision of the general meeting of the company’s participants); Dt 08, subaccount “Transferred land plots” Kt 75, subaccount “Settlements for contributions to the company’s property” - on the date of transfer of the land plot its market value is reflected; Dt 01 Kt 08, subaccount “Transferred Land Plots” - the land plot was accepted for accounting on the date of state registration of rights to it.

Reasons, conditions and consequences of increasing the size of the authorized capital

The reasons for increasing the authorized capital may be different. For small businesses, the most common are the following: • an increase in the scale of the organization’s activities, which requires an increase in operating capital; • lack of working capital, if funds from the authorized capital are used for the consumer needs of the company; • increased needs for borrowed capital require an increase in the authorized capital to ensure creditors' confidence in the return of their funds even under unfavorable conditions; • introduction of a third party into the founders of the company; • other reasons.

Not every company can increase its authorized capital. At the time of making a decision to increase the authorized capital, the following conditions must be met: • the initial authorized capital has been fully formed, even if one year has not passed since state registration (in this case, the founders simply need to pay off their debt on contributions to the authorized capital); • at the end of the second and each subsequent financial year, the value of the company’s net assets should not be less than its authorized capital (otherwise the company is generally obliged to announce a reduction in its authorized capital to an amount not exceeding the value of its net assets and register such a decrease); • at the end of the second and each subsequent financial year, the value of the company's net assets must not be less than the minimum amount of the authorized capital established at the time of state registration of the company (otherwise the company is subject to liquidation).

Unfortunately, increasing the size of the authorized capital is not always profitable. Why?

Firstly, an increase in the authorized capital increases the limit of liability of the founders to creditors. Secondly, if a company buys, for example, a fixed asset in order to increase the authorized capital at its own expense, then the VAT paid on the purchase will not be included in the cost of the property. However, sometimes it is still necessary to increase the size of the authorized capital, so the consequences of such a step should be known in advance.

Additional benefits for NPOs on the simplified tax system due to the pandemic

Due to the coronavirus pandemic, the deadline for submitting declarations for all taxpayers has been postponed by 3 months. Thus, legal entities, including non-profit organizations, had to report under the simplified tax system for 2021 not until March 31, but until June 30, 2021.

It is important to understand that for NPOs we are only talking about a deferment in reporting. Only small and medium-sized enterprises (SMEs) operating in industries affected by the pandemic have the right to postpone the tax payment deadline for 2021.

Only commercial organizations can be classified as SMEs (Clause 1, Article 4 of Law No. 209-FZ dated July 24, 2007). Therefore, all NPOs had to pay a “simplified” tax for 2021 on a general basis:

- Until March 31, 2021, if the organization continued to operate during the special regime.

- Until May 12, 2021 – if activities have been suspended.

Even if there was no revenue from commercial activities in 2021, and the “simplified” tax was not paid, it is still necessary to submit a zero declaration under the simplified tax system.

In addition, certain categories of non-profit organizations can take advantage of tax write-offs for the 2nd quarter of 2021. This benefit applies to most taxes, including the simplified tax system.

Socially oriented NPOs, religious organizations, as well as NPOs recognized as the most affected by the pandemic are eligible for exemption from the “simplified” tax for the 2nd quarter

Conclusion

The transition of non-profit organizations to the simplified tax system is associated with a number of features - when determining limits, only revenue and fixed assets related to commercial activities need to be taken into account.

When calculating the “simplified” tax, it is necessary to organize separate accounting of income and expenses from two areas of work.

The remaining mandatory payments of NPOs to the simplified tax system must be transferred according to the same principles as other “simplified” ones. The exception is a discount on insurance premiums.

Socially oriented, religious and pandemic-affected NPOs do not have to pay a “simplified” tax for the 2nd quarter of 2020.