A participant in an LLC may leave the organization for a number of reasons, and then there is a need to calculate his share at its actual value. The calculation base is the volume of net assets. The algorithm for its determination is fixed by order No. 84n dated 08/28/14 of the Ministry of Finance. However, when calculating the actual share value, questions may arise: what calculation period should be taken, how to correlate accounting indicators and the market value of assets, how to come to an agreement with the former participant on the calculations.

Question: How to determine the actual value of the share in the authorized capital paid to a participant upon leaving the LLC? View answer

Features of formation

The authorized capital (AC) is formed at the stage of creation of the organization. Information about its volume and the peculiarities of the distribution of founders' shares in it is subject to mandatory inclusion in the company's charter - this explains the origin of the term “authorized capital”.

The management company can be formed from the funds of one or several founders of the enterprise. The statutory payment period for the management company is 4 months from the date of establishment of the organization. For joint-stock companies (JSC), a separate procedure is provided for payment of the management capital, made up of shares distributed among the founders. At least 50% of the shares are paid for within three months after registration of the JSC, the remaining funds are paid over the next 9 months.

Any assets can be contributed as payment for the management company: cash, non-cash money, securities, property, property rights. If non-monetary assets are contributed to the fund, their value is preliminarily confirmed by an independent expert assessment, and the process of transferring them to the company is recorded in acceptance and transfer acts.

Meaning and functions

The authorized capital forms the basis necessary for the further functioning of the company. Moreover, this is not only a material basis, but also a legal one, since the Criminal Code is an integral condition for the creation and existence of a legal entity.

The authorized capital performs several functions at once:

- formative. The management fund is funds for the initial support of the created business; they are used to purchase equipment, inventory, goods, etc.;

- distribution The distribution of shares in the fund between the founders secures their right to a certain part of the enterprise’s profit;

- warranty The management capital is the minimum property of an organization, which in the event of its unprofitable activities and bankruptcy will ensure the payment of debts to investors and creditors;

- reputational The amount of capital of the company ensures its image and indicates stability. The larger it is, the more attractive the enterprise is to commercial partners.

On the legal essence of shares in the authorized capital after the reform of the first part of the Civil Code of the Russian Federation

In the journal “Laws of Russia: experience, analysis, practice”, 2021, No. 4, p. 42-47, my article “Share in the authorized capital as an object of trust management: from the legal essence to the solution of specific issues” was published.

Abstract of the article:

The article shows that a clear definition of the legal essence of shares in the authorized capital helps to solve practical problems of making transactions with them, which became even more aggravated after the reform of the first part of the Civil Code of the Russian Federation. As an example, we chose trust management, which raises a large number of questions in law enforcement.

Main conclusions:

- a share in the authorized capital as an object of civil circulation is the rights of the founder (participant) of a limited liability company, having a nominal value and determined through the proportion (share) of his participation in the formation of the authorized capital of this company, which is necessary to determine the scope of the rights and obligations of the founder ( participant) in relation to society;

— when we are talking about a share in the authorized capital as an object of civil circulation, we are talking about dividing into shares not the property of a limited liability company, but the rights of its founders (participants);

— a share in the authorized capital of a limited liability company is part of the obligatory right of claim of the founders (participants) to this company. It is this part of the rights of claim as property that acts as an object of civil circulation. The acquisition of a share in the authorized capital gives rise to the rights and obligations of a participant in a limited liability company;

— the institution of transfer of a share in the authorized capital to a limited liability company is a legally established exception to the rule that the obligation is terminated by the coincidence of the debtor and the creditor in one person, enshrined in Art. 413 Civil Code of the Russian Federation;

— the legislator and law enforcement authorities initially adhered to the point of view according to which a share in the authorized capital is a really existing right from the moment of its acquisition, but which can be realized under certain conditions;

- since the law does not contain special provisions regarding the trust management of shares in the authorized capital, then issues arising regarding the trust management of shares in the authorized capital should be resolved on the basis of general provisions on trust management, if this does not contradict the legal essence of shares in the authorized capital, and on the basis of general provisions on the assignment of claims;

— shares in the authorized capital may be the object of trust management, which is the provision of services;

— the main meaning of trust management of shares in the authorized capital is the trustee’s management of the part of the profit due to a participant in a limited liability company in his interests as the founder of trust management and concomitant participation in the management of this company, for which a power of attorney is additionally required.

The article is posted in the TRUST system (MSU): https://istina.msu.ru/profile/KurbatovAYA/, on the author’s personal page on the website zakon.ru

Types of authorized capital

There are several types of criminal codes. Depending on the organizational and legal form of the business entity, this may be:

- share capital. A type of management company created by general partnerships and limited partnerships - organizations that do not involve the development and signing of a charter. It is formed from contributions and shares of participants contributed in monetary or non-monetary equivalent;

- authorized capital. Typical for municipal and state enterprises. Includes intangible assets that ensure the functioning of the company;

- unit trust. Type of management company formed by cooperatives. Formed by combining shares of participants and profits earned in the course of business activity;

- authorized capital. Traditional type of management company created by LLC, OJSC, CJSC. Consists of founder's contributions, ensures the launch of a business and guarantees counterparties the security of cooperation with the company.

Minimum fund size

The decision on the size of the authorized capital is made by the owners of the company. However, the law defines a lower limit that should not be violated when establishing an enterprise and forming its funds. It depends on the legal form of the company.

The minimum size of the charter capital is:

- for LLC, JSC - 10 thousand rubles;

- for PJSC (public joint-stock company) - 100 thousand rubles;

- for a credit institution with a basic license - 300 million rubles, with a universal license - 1 billion rubles;

- for a microfinance organization - 90 million rubles;

- for a state enterprise - 5 thousand minimum wages (minimum wages);

- for a municipal unitary enterprise - 1 thousand minimum wages.

The minimum acceptable values for the size of the capital are periodically reviewed. In addition, in a number of regions, local laws impose additional conditions on the procedure for the formation and size of funds of established organizations.

Authorized capital, methods of formation

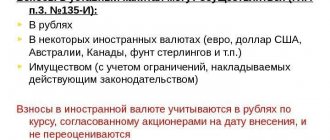

As we noted before, the minimum amount of authorized capital is transferred in cash. The rest can be transferred in any way subject to monetary value. In accordance with paragraph 1 of Art. 15 Federal Law "On LLC" No. 14 Federal Law such forms include the following:

- Cash.

- Things (including securities).

- Property rights.

- Other rights valued in monetary terms (including rights to trademarks and other intellectual property).

Money can be transferred to a current account, or transferred to the company's cash desk.

In the case of transfer of property to pay for a share, it is considered transferred and the share paid after the execution of the transfer deed. Property transferred to the management company must meet the following requirements:

- unlimited circulation

- has a cash equivalent.

The exception is a few cases specified in legislative acts (for example: land located in a special economic zone).

In payment for the share, various property can be transferred, which can be used by the company in its activities.

When contributing a share not in cash, there is a need to evaluate this property.

According to the Federal Law “On LLC”, the specific size of shares and the procedure for their contribution are established by the organization’s charter, a decision (with one founder) or a protocol on its creation and an agreement on establishment (with several founders).

The period must also be fixed in the charter, but it cannot exceed 4 months.

Currently, when opening a Company, there is no immediate requirement to contribute the authorized capital. The contribution of the share is made in compliance with the procedure and deadline established by the charter (no more than 4 months).

Use of the fund

The management fund is not an emergency reserve. These are the funds that support the company's activities. After the owners deposit their shares into the cash register or current account, the generated asset can be used for any corporate needs:

- acquisition of equipment, inventory, goods;

- rent;

- remuneration of employees;

- payment for services of contractors, etc.

The owners of the company have the right to dispose of their shares in the management company: sell them, donate them, etc., unless this is directly prohibited in the organization’s charter. If a participant leaves the founders, the company reimburses him for his share in the capital company no later than 6 months after the end of the financial year.

Return to list

Nominal and actual share of the founder

Good afternoon, When a participant leaves the Company, the share of the leaving participant passes to the Company from the date of receipt of the application for resignation. Within three months, the Company is obliged to pay the withdrawing participant the actual value of the share. If a participant refuses to receive the actual value of the share in favor of the Company, then in accordance with Art. 415 of the Civil Code of the Russian Federation, the refusal of the withdrawing participant from the right to receive the actual value of the share is debt forgiveness. Within one year from the date of transfer of a share in the authorized capital of the Company to the Company, it must be distributed among the remaining participants in proportion to their shares in the authorized capital (Article 24 Federal Law of 02/08/1998 N 14-FZ) or sold to third parties (new participants) . 1. On the date of receipt of the participant’s application for withdrawal, the actual share of the leaving participant passes to the Company: D 81 K 75 (Founder 1) - the amount of the actual value of the share transferred to the Company

On the date of signing the agreement on debt forgiveness, non-operating income was recognized: D 75 (Founder 1) K 91.1 - the amount of the actual value of the share of the withdrawing participant is included in non-operating income

2. When a share in the authorized capital of the company is sold by one participant (Founder 2) to a new participant (former Founder 1), the company does not have any income or expenses, since part of the share is sold not by the company itself, but by the founder, who is the owner of the share. All payments for the redemption of part of the share occur only between the participants. The amounts of payment that a participant receives for the sold part of the share are not reflected in the company’s accounting records due to the principle of property separation. The company undergoes a change in the composition of the founders, which is reflected only in the change in the analytics for account 80 “Authorized capital”: D 80 (Founder 2) K 80 (former Founder 1) - a change in the composition of participants is reflected at the nominal value of the sold part of the share. At the same time, the value of the authorized capital is not changes and does not depend on the contract price in the purchase and sale agreement concluded between the participants.

3. If the former Founder 1 decided to distribute the nominal share belonging to the company (reflected in the debit of account 81) in his favor without paying it to the company, then on the date of the decision to distribute the share: D 84 K 81 - the actual value is written off from retained earnings of the company At the same time, the former Founder 1 does not have a debt to the company to pay for the share distributed to him, since the distribution of the share is carried out at the expense of net profit. In the case under consideration, as a result of such distribution of shares, the nominal share of former Founder 1 increases. According to the official opinion of the Ministry of Finance of the Russian Federation, expressed in Letters dated 02/27/2012 N 03-04-05/3-226, dated 03/09/2010 N 03-04-06/2-26, dated 10/25/2007 N 03-04-06- 01/360, dated 08/22/2016 N 03-04-06/48973, when the size of the nominal share of participants increases due to distribution, income arises that is subject to personal income tax on a general basis. In this case, the organization must calculate personal income tax on income in the form of the value of the distributed share, withhold the amount of calculated personal income tax from any income paid to participants, and pay it to the budget. In the absence of paid income, she is obliged to submit information to the tax authority at the place of her registration about the amount of calculated tax and the impossibility of withholding tax (Article 226 of the Tax Code of the Russian Federation).

As of December 31, 2019, the balance sheet should not reflect the debt to pay the actual value of the share to Founder 1, since he refused to receive it.

Sincerely, A. Greshkina