Experts from TaxCoach have prepared a fresh analytical summary.

Often, to ensure the property security of a business and the efficient use of property in a Group of Companies, redistribution of assets is required. The economic meaning of the transfer of property in a holding structure is objectively different from the sale or other form of its transfer to third parties, because in essence we are transferring assets from one “our pocket” to another. Accordingly, the taxation of these transactions has its own characteristics: tax legislation provides for tax-free transfer of assets within holding structures.

The practice of applying these norms is almost established. Less and less often, tax authorities charge income tax, calling the transfer of property within a Group of companies a gift prohibited between legal entities. However, there are some fundamental nuances that affect the success of the entire procedure for transferring assets, including taking into account changes made to the Tax Code of the Russian Federation.

Let us remind you that tax-free transfer of assets between related companies can be different and includes, for example, such methods as contribution to the authorized capital, reorganization in the form of spin-off, etc.

Today we will focus on one of these methods - contributions to property without increasing the authorized capital of the organization , when a participant (shareholder) transfers certain benefits to his company (cash, shares (shares) in other legal entities, real estate, etc.) for improvement its financial and/or property status. At the same time, the authorized capital does not increase, and the nominal size of the participants’ shares does not change.

The civil law grounds for contributions to property are Article 66.1 of the Civil Code of the Russian Federation, Art. 27 of the Law “On LLC”, art. 32.2 of the Law “On JSC”.

If the charter of the receiving party is standard and does not contain detailed norms, then contribution to the property is possible only in money and only in proportion to all participants (shareholders). In an LLC, the decision on a contribution to property is made by no less than 2/3 of the votes. In a joint stock company, making a contribution is possible on the basis of an agreement approved by the Board of Directors, or by decision of the general meeting of shareholders.

At the same time, the Tax Code provides for two preferential mechanisms that make it possible to exempt inherently gratuitous deposits from taxation:

1. Gratuitous transfer of property on the basis of subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation.

It itself is possible in two forms:

- transfer of property from the “mother” or an individual participant (shareholder) in favor of an organization whose authorized capital consists of more than 50% of the contribution of the transferring party;

- "daughter's gift" This is a transfer from a subsidiary to the parent company, which owns more than 50% of the authorized capital of the subsidiary.

2. Contribution to the property of a business company or partnership from its participant or shareholder (clause 3.7, clause 1, article 251 of the Tax Code).

In other words, the Tax Code differentiated these grounds, including by the time of their appearance in the law, giving them some specific application features.

Gratuitous transfer of property under clause 11, clause 1 of Art. 251 Tax Code of the Russian Federation

Firstly, only property can be transferred . Money refers to property.

That is, this rule does not apply to property and non-property rights (assignment of claims, corporate rights, intellectual property rights, etc.). Violation of these conditions will result in additional amounts of income tax, penalties and fines.

Exemption from taxation in accordance with paragraphs. 11 clause 1 art. 251 of the Tax Code also applies to debt forgiveness.

Secondly, it is impossible to transfer it to third parties within one year from the date of receipt of property (except for cash).

In other words, significant restrictions are imposed on the use of property: it cannot be sold, leased or otherwise disposed of. The logic of the legislator is clear - some kind of assistance from a participant in his company is exempt from taxation, because he transferred the property for her own use, and not for renting out, for example.

As a result, the transfer of assets on the basis of clauses. 11 clause 1 art. 251 Tax Code in certain situations seems impossible. However, these restrictions do not apply to deposits in accordance with subparagraph. 3.7 clause 1 art. 251 NK.

Helping hand from the founder

The bank's refusal to carry out a transaction can be appealed

The Bank of Russia has developed requirements for an application that a bank client (organization, individual entrepreneur, individual) can send to an interdepartmental commission in the event that the bank refuses to make a payment or enter into a bank account (deposit) agreement. It is impossible to issue a copy of the SZV-M to a resigning employee.

According to the law on personal accounting, when dismissing an employee, the employer is obliged to provide him with copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. Dismissal of a parent of a disabled child: there are features

If an organization plans to reduce its staff and, among others, an employee who is the parent of a disabled child is affected by this reduction, the date of his dismissal may have to be postponed or his job may even have to be retained. What to do from April 16 to April 20

→ Accounting items

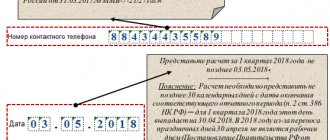

The article from the magazine “MAIN BOOK” is current as of November 22, 2013.

magazine No. 23, 2013

If the organization’s own resources are not enough for the organization’s current activities, participants can help fill the gap.

You can arrange for assistance in different ways: increase the authorized capital, make a contribution to the property of the LLC, or simply transfer assets free of charge. Each option has its pros and cons.

Increasing the authorized capital is a rather complicated procedure: you will need to hold a general meeting of participants twice, make changes to the charter and register them. From this point of view, free assistance is the simplest option.

But LLC participants can take a different route by obtaining assistance in the form of a contribution to property. In certain cases, from a tax perspective, this is more profitable than assistance received free of charge.

We'll tell you what you need to pay attention to so that you don't have to overpay taxes.

The tax code allows no income tax to be paid on any property received from participants, provided that the purpose of such transfer is to increase the net assets of the recipient company. Moreover, this rule applies regardless of the share of participation in the authorized capital of the organization, etc. 3.4 clause 1 art. 251 Tax Code of the Russian Federation;

If the contribution to the property is made in money, then no difficulties arise, VAT is not charged. But when transferring other assets (goods, materials, fixed assets, etc.), the participant must accrue and pay VAT to the budget on their market value, etc. 1 clause 1 art. 146, paragraph 2 of Art. 154 Tax Code of the Russian Federation. At least that’s what the Ministry of Finance thinks and Letters from the Ministry of Finance dated 21.08.

The transfer of fixed assets (intangible assets) as a contribution under a joint venture agreement is equivalent to their disposal (clause 29 of PBU 6/01, clause 34 of PBU 14/2007). The party to the agreement who made the contribution loses the exclusive right of ownership of these objects (Clause 1 of Article 1043 of the Civil Code of the Russian Federation). Therefore, such an operation falls under paragraph 14 of paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation.

When transferring fixed assets (intangible assets) to a joint activity before the expiration of the standard period of use of these objects, the organization is obliged to restore previously written off expenses in the form of their value.

The tax base can be reduced only by the amount of depreciation of retired assets accrued during their operation according to the rules of Chapter 25 of the Tax Code of the Russian Federation. For more information, see

The transfer of fixed assets (intangible assets) as a contribution under a joint venture agreement is equivalent to their disposal (clause 29 of PBU 6/01, clause 34 of PBU 14/2007). The party to the agreement who made the contribution loses the exclusive right of ownership of these objects (clause 1 of Art.

Contribution to property under clause. 3.7. clause 1 art. 251 Tax Code of the Russian Federation.

Subp. 3.7. clause 1 art. 251 of the Tax Code allows the investments of participants, both in the form of property and in the form of property or non-property rights, to be exempt from taxation. In this case, the size of the participant’s share does not matter.

The provisions of this paragraph apply to virtually any method of increasing property, including increasing the assets of the company in the form of transfer of things, cash, shares/shares in companies or securities, or, for example, rights of claim under an assignment agreement.

! Sub-clause 3.7, clause 1 of Article 251 is new and appeared in the Tax Code only in 2021. It replaced the famous sub-clause 3.4, which was popularly called “contribution to increase net assets”. Sub-clause 3.7 has a more concise content, referring to civil legislation - you can convey everything that is permitted by the Civil Code of the Russian Federation and special laws.

However, this method of tax-free transfer also has its limitations:

- Property, property or non-property rights can only be transferred from a participant (shareholder) to the relevant business company. That is, transfer in the opposite direction - from the subsidiary to the parent company - is impossible.

- Contributions to property are only possible in relation to business entities or partnerships . For example, such a contribution cannot be made to a production cooperative without tax consequences.

Selection with appendix

Within the framework of one reorganization, the law allows you to combine two procedures at once (Article 57 of the Civil Code of the Russian Federation): separation and merger, which can significantly save time and costs for reorganization. First there is separation, then attachment. The intermediate company resulting from the spin-off is virtual in nature, as it is used solely to transfer assets and liabilities to the acquiring company. The period of existence of this legal entity is not defined by law, but we can say that it tends to zero.

Documents are drawn up first for the separation of the company. According to the transfer deed, part of the assets and liabilities of the reorganized company is transferred to it, which are then added to the balance sheet of another legal entity (“Company 2” in the diagram above).

Of course, real life cannot always be “shoved” into the framework of the above-described methods of transferring property. There are a great many options for property consolidation; most often they are a combination of tax-free and low-tax methods of property redistribution, the set of which is always unique.

"Daughter's Gift"

The Tax Code allows tax-free transfer of property not only from the “mother”, but also in the opposite direction - from the “daughter” to. The exemption is provided under sub-clause 11, clause 1 of Article 251 of the Tax Code, subject to compliance with an important condition - the parent company’s share in the authorized capital of the subsidiary is more than 50%.

Important!

It will not be possible to transfer a “child gift” to an individual participant without taxes. Such payment will be equivalent to dividends.

At some point, the tax authorities had problems with “daughter gifts”: they persistently assessed income tax when transferring property to parent organizations, citing the fact that donations between legal entities are prohibited.

The Presidium of the Supreme Arbitration Court of the Russian Federation put an end to this matter, indicating in its Resolution:

“Economic relations between the main and subsidiary companies may involve not only investments of the main company in the property of the subsidiary at the stage of its establishment, but also at any stage of its activity. In addition, economic feasibility in relations between a subsidiary and the main company may necessitate the reverse transfer of property. At the same time, the absence of direct reciprocity is a feature of the relationship between the main and subsidiary companies, which from an economic point of view are a single economic entity.” Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 4, 2012 No. 8989/12.

After this, the Ministry of Finance of the Russian Federation supports the possibility of a “daughter gift” not subject to income tax.

A “subsidiary gift” in some cases is an alternative to paying dividends when the conditions for a tax-free transfer of profit from a subsidiary to the parent organization are not met, in particular:

- the holding period of 365 days has not been met;

- In addition to the majority participant with a share of more than 50%, there are minority shareholders in whose favor you do not want to “distribute profits”: dividends are distributed in most cases proportionally, and such a requirement is not imposed on a “child gift”.

Reorganization in the form of spin-off

Reorganization in the form of separation (Article 57 of the Civil Code; clause 8 of Article 50 of the Tax Code of the Russian Federation) is the most universal method of transferring property that does not have organizational and legal restrictions (applicable to both JSC, LLC, and partnerships).

During the spin-off, a second legal entity is formed, which is not the legal successor of the reorganized organization in terms of its tax obligations, except in cases where the tax authority proves that the sole purpose of the spin-off was to evade repayment of debt to the budget (clause 8 of Article 50 of the Tax Code).

Tax consequences

Income tax

A spin-off involves the “spinning off” of an old company into a new company. The property is transferred under a transfer deed and its value is not an expense for the old legal entity and is not income for the new company. That is, there are no income tax consequences.

VAT

The transfer of property within the framework of the allocation is not a sale; the company on the OSN does not have the obligation to charge VAT.

If the legal successor switches to UTII or the simplified tax system, then he is obliged to restore the VAT previously accepted for deduction by the reorganized organization in proportion to the residual (book) value. Clause 3.1 of Article 170 of the Tax Code of the Russian Federation This obligation has been in effect since 2020.

Who can become a participant in the spun-off company?

During the procedure of separation from an LLC, the participants of the new legal entity may become:

- reorganized company;

- participants of the reorganized company in the same composition and in the same proportions;

- part of the participants of the reorganized company (in other proportions) or other third parties.

The main condition is that this third party independently pays for the authorized capital, at least in the minimum amount of 10 thousand rubles.

In the case of a joint stock company, only the first two options are possible during the spin-off. Either the new company becomes a 100% subsidiary of the reorganized company, or the same shareholders in the same proportions become participants in the spun-off company.

In addition, mixed reorganizations in the form of spin-off are allowed, when it is possible to spin off an LLC from a JSC or vice versa.

Risks

The separation must be carried out in strict accordance with the principle of fair distribution of rights and obligations between the old and new legal entity. It means that:

- The assets of the spun-off company must be balanced by liabilities. In other words, it is impossible to transfer fixed assets without transferring the debt on the loans with which these fixed assets were acquired. If the old company has a large amount of accounts payable, then it is fair to transfer to the spun-off company part of such debt associated with the transferred property;

- the spin-off must meet the criteria of the business purpose concept (transfer of part of the assets to organize a new line of activity, business restructuring with the aim of creating several independent business units on the basis of former divisions, etc.).

When separating, the transfer of property and/or obligations to the new organization occurs under a transfer deed.

About debt forgiveness

As we have already mentioned, sub. 3.7. clause 1 art. 251 of the Tax Code of the Russian Federation replaced subclause 3.4, which directly provided for the possibility of contributing to property by forgiving a debt by a participant in his organization.

Currently there is no such clarification, although the possibility is still relevant.

Let's figure out whether it is now possible to forgive debt without taxes.

When the share of participation is more than 50%, then we can confidently refer to the clause already known to us. 11 clause 1 art. 251 Tax Code of the Russian Federation.

If the share of participation in a subsidiary is less than 50%, then we can only be guided by the new subclause 3.7, clause 1, article 251 of the Tax Code of the Russian Federation.

Neither the Ministry of Finance of the Russian Federation nor the courts have yet voiced their position.

We believe that you can get out of the situation in this way:

At the first stage, the participant (shareholder) or the general meeting, as before, decides to make a contribution to the property. But not in the form of debt forgiveness, but by transferring funds, the amount of which is exactly equal to the debt formed to him (for example, the amount of an unrepaid loan).

Makes a decision, but does not implement it.

At the second stage, the participant (shareholder) - creditor signs an agreement with the subsidiary to offset counterclaims (in our example with a loan - obligations to repay the loan and make a cash contribution).

As a result, the subsidiary's obligation to the participant is extinguished tax-free.

To be on the safe side, in the charter of a subsidiary company, as well as when applying subclause 3.4, which has become invalid, it is advisable to include a provision on the possibility of making contributions to property not only in money.

Formation and accounting of additional capital of an enterprise

This way you can finance your company free of charge.

Let’s take a closer look at the possibility of making such a contribution, its legislative justification, correct accounting procedures and tax consequences.

What do the laws say?

Federal legislation allows making gratuitous contributions to property assets, without affecting the amount of the authorized capital.

At first, this right applied only to LLCs: according to Art.

27 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”, the right of investors to contribute funds to the company’s fund is not limited.

Since mid-summer 2021, this possibility has been legally extended to joint-stock companies: Federal Law No. 339-FZ of July 3, 2021, which entered into force on July 15, introduced corresponding changes to the previously existing regulatory act.

Why should participants contribute funds to the company without increasing their share and authorized capital? Such financing is intended to solve several problems simultaneously:

- increase the organization's net assets;

- add additional working capital;

- acquire the necessary material or other property;

- improve reporting indicators on the balance sheet.

Unless otherwise provided in the Articles of Association, capital is contributed in cash. The law does not prohibit authorization to make a contribution in any form, such as:

- movable property;

- things;

- real estate objects;

- share in the authorized capital of another organization;

- shares of any other company;

- securities;

- intangible assets (exclusive rights, licenses, patents, etc.).

IMPORTANT! The obligatory nature of such contributions is regulated solely by the decision of the founders and is included in the statutory documents.

The founder, especially if he is also a legal entity, transferring property free of charge to the organization’s fund, must correctly reflect this operation in his accounting documents.

Such an act cannot be recognized as a donation procedure, since its size, as a rule, exceeds the limits allowed for donations between organizations. In order for the ban on donations between legal entities, justified in paragraph 1 of Art.

575 of the Civil Code of the Russian Federation was not violated, the contribution of participants to the LLC should be considered as:

- investment transaction;

- generally accepted implementation.

FOR YOUR INFORMATION! In both cases, the contribution of property is considered a gratuitous transfer, so these funds are neither an expense of the transferring party nor the income of the receiving party.

On the balance sheet, the procedure for gratuitous return and acceptance of property assets is carried out in accordance with clause 11 of PBU 10/99 “Organizational Expenses”, Instructions for the Application of the Chart of Accounts and Letter of the Ministry of Finance of Russia dated January 29, 2008 No. 07-05-06/18.

Sending side wiring:

- if a contribution is made in the form of cash: debit 91-2 “Other expenses”, credit 50 or 51 “Long-term loans” or 51 “Current accounts”, the content of the transaction indicates that a cash contribution is reflected;

- if materials, goods, etc. are transferred to the property: debit 91-2 “Other expenses”, credit 10 “Fixed assets”, 40 “Authorized capital” or 41 “Share capital”, the content of the transaction is a reflection of the transfer of non-cash contributions of funds;

- if any fixed asset is transferred to the property: debit 01 “Fixed assets” (disposal), 02 “Depreciation of fixed assets” or 91-2 “Other expenses”, credit 01 “Fixed assets” (operation), 01 “Retirement of fixed assets ", the reflected transaction is the write-off of the initial cost of a fixed asset, depreciation accrued on it, or the transfer of a non-cash contribution.

NOTE! If the contribution is made not in cash, but in property form, then the party receiving it will not be able to deduct VAT on this contribution.

As a result of gratuitous contributions made by the founders, the tax burden is slightly reduced if it is made to increase net assets. In all other cases, the contribution affects the tax accounting of the receiving party (changes the composition of the founders’ shares).

Profit tax will not be taken into account, since from a tax point of view, the transferred property is not profit, and therefore, expenses and costs associated with its transfer are not recognized (clause 16 of Article 270 of the Tax Code of the Russian Federation).

This allows you to finance a company without increasing its authorized capital and without changing the ratio of shares between owners and the nominal value of shares. Now it is enough to correctly register the deposit in accordance with the new requirements.

Contributions to the property of a joint-stock company are divided into voluntary and mandatory. The procedure and method of its execution depend on the type of deposit. The rules on donations and interested party transactions do not apply to the contribution agreement.

Shareholders can decide whether their contributions can be voluntary or mandatory. The type of contribution affects the order in which it is made.

Any shareholder, regardless of the type of joint stock company (public or non-public), can voluntarily contribute to the company’s property.

To do this, you need to obtain the approval of the board of directors and enter into an agreement with the company.

A contribution agreement is not considered a gift agreement. If the contribution is made by a shareholder - a commercial organization, this will not be a violation of the prohibition on donation (subclause 4, paragraph.

1 tbsp. 575 of the Civil Code of the Russian Federation). In addition, this agreement is not subject to the provisions on interested party transactions. And this fact greatly simplifies the procedure for registering a deposit.

As a voluntary contribution you can make:

- cash;

- things (movable and immovable property);

- shares in authorized capital and shares of other companies;

- state and municipal bonds;

- intellectual rights subject to monetary value (exclusive right, right to obtain a patent, etc.);

- rights under license agreements.

Mandatory deposits can only be made in non-public joint stock companies. The decision to make such contributions is made by the general meeting of shareholders, but for this it is first necessary to make changes to the charter.

As a mandatory contribution made on the basis of a decision of a meeting in a non-public company, only money can be made. Other options for making a contribution to the property of a joint-stock company may be provided for by the charter or a decision of the general meeting.

David Kapianidze, head of tax practice at BMS Law Firm

Income tax can reduce the attractiveness of contributions to the company's property for the company itself. In terms of income tax, contributions to property are not recognized as income, that is, there is no need to calculate tax on their value.

However, for this to happen several conditions must be met.

But the amendments also indicate that a decision of the general meeting of shareholders of a non-public company may establish the obligation to make property contributions in the form of cash.

This is where a conflict may arise, since if the shareholder owns less than 50 percent of the authorized capital or the property is transferred for subsequent sale, it will be necessary to reflect such an investment as income and pay tax. While no tax will be calculated on the financial investments of a shareholder owning more than 50 percent.

There is no way to avoid this. It will be the shareholder's responsibility to contribute in this case. Moreover, the company may file a claim for the fulfillment of this obligation. There are no changes to the value added tax. Contributions are not subject to VAT at the receiving party.

The right to make contributions to property is now provided for by law, so there is no need to additionally include provisions on this in the charter.

But if shareholders intend to introduce mandatory contributions to property, then it will be necessary to supplement the charter with new provisions.

True, the law provides for the opportunity to introduce mandatory deposits only for non-public joint stock companies.

Public societies

Public joint stock companies do not need to make changes to the charter. All the main provisions are already in the law.

The charter of a public company can only duplicate the provision on the right of participants of the joint-stock company to make contributions and detail the procedure for making contributions.

You can specify in the charter the acceptable form of contribution to the property and the procedure for making it.

The charter of a non-public joint stock company can provide for several important features of making contributions to property.

Feature one. It is possible to limit the maximum value and form of contribution for all or some shareholders. For example, establish that contributions to property are made only in cash, since accepting other property is burdensome for the company.

The limit on the size of the contribution can be not only in a certain amount of money, but also in percentage terms to the size of the authorized capital of the joint-stock company or to another value.

Feature two. It can be stated in the company's charter that the general meeting of shareholders has the right to make a decision on the mandatory making of contributions by all shareholders of the company.

In such a situation, making contributions will become not only the right of shareholders, but also an obligation in cases where the meeting decides on this.

Such conditions of the charter introduce additional powers for the general meeting of shareholders, which must also be indicated in the charter.

The law establishes that shareholders can only make a decision on mandatory contributions to property at a general meeting unanimously. The obligation to make contributions is borne by persons who had the status of shareholder on the date of the decision made by the general meeting.

If such a decision is made without introducing conditions on mandatory contributions into the charter, there is a possibility that the decision can be challenged. Similar situations were encountered in judicial practice in cases of making contributions to the property of an LLC.

Example 1

- money (foreign currency and Russian rubles). At the same time, in accounting documents, reporting on which is submitted to the Federal Tax Service, currency funds cannot be shown, therefore their monetary value is converted into rubles at the Central Bank exchange rate;

- shares (their par value is also indicated in the reporting);

- property (office equipment, furniture, cars, production equipment, etc.). The issue of property valuation is regulated in Art. 15 Federal Law “On LLC”. If, in the opinion of the founder, the estimated value of the property that is transferred to the management company of the new organization he creates does not exceed 20,000 rubles, then the assessment process is carried out independently.

- If it is immediately clear that the object of transfer is worth more than 20,000 rubles, the law obliges to hire a special independent appraiser, who will determine the real value of the transferred property.

A spoon of tar. VAT

But what will happen if a participant, for example a company on a special operating system, transfers not money, but property as a contribution? Is this transaction subject to VAT? Yes and no. In the sense that the transfer of property itself is not subject to VAT, but the transferring party (if it is on the general taxation system) must restore VAT on the residual value of the property. In this case, the restored value added tax can be included in expenses.

But the receiving party will not be able to deduct VAT, since it did not pay money for this property, because a contribution to property is a type of gratuitous transfer. So you can’t do without a fly in the ointment...

How to return a deposit to property

A contribution to property is irrevocable: unlike a loan, it cannot be demanded back.

Some kind of return on investments made is only possible in the form of dividends. The same as for investments in the form of a contribution to the authorized capital.

However, unlike contributions to the authorized capital, the amount of contributions made to property will not count towards the costs of acquiring a share (shares) upon subsequent sale of the share (shares), exit or liquidation of the company.

This injustice will probably soon be eliminated. The State Duma is considering a bill according to which the receipt by the parent organization from the subsidiary of funds within the limits of the previously made contribution to the property will not be subject to income tax.

If the bill is passed, there will be a tax-free way to “return” deposits, along with dividends, which in some cases are taxed at a rate of 13%.

Details

Line 1350 of the balance sheet displays information about the amount of additional capital of the organization. According to the current legislation, the main sources of its formation are identified:

- procedure for revaluation of non-current assets - increasing their initial value when bringing the value of property to market prices, for example, to attract additional financing for activities;

- the positive difference between the nominal value of a joint stock company's own securities and the price of their sale to shareholders is the organization's share premium.

Note from the author! According to the federal law on joint stock companies, the minimum size of the authorized capital of public companies is 100 thousand.

"Underwater rocks"

Any tax-free transactions traditionally attract the attention of regulatory authorities. Investing in property is no exception.

Tax authorities may attempt to deem a transfer of property and/or property/non-property rights between “related” entities to be economically unjustified if a reasonable “business purpose” is difficult to discern.

For example, a new member makes a generous contribution and immediately leaves the company. The tax authority will most likely say that the lender “investor” did not intend to participate in the company’s activities and receive profit from this activity, and his only goal in entering the business was the tax-free transfer of expensive property or funds.

Example taxCOACH®

Let's look at how this tool can work successfully using the example of a case study by experts from the taxCOACH Center for the retail sector. Let's imagine a business that is conducted within a Group of companies. Retail stores are independent legal entities (and the area of each store allows the use of UTII).

However, what about the profit of each operating point? You can use the investment in property that we already know! Retail companies establish a legal entity (let's designate it as an investment center) and make agreed funds received from the sale of products as contributions to property. There is no need to pay income tax, and the investment center can freely manage the participants’ money, for example, by investing it in new areas of activity.

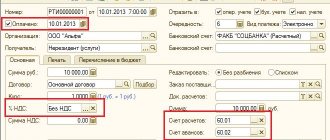

Accounting

In accounting, reflect the founder’s contribution to the company’s property as follows:

Debit 50, 51, 52 (08, 10, 41...) Credit 83

– money (fixed assets, materials, goods, etc.) was received from the founders as a contribution to the organization’s property.

This procedure is recommended in the letter of the Ministry of Finance of Russia dated April 13, 2005 No. 07-05-06/107.

If property was received as a contribution from the founder, then in accounting it must be valued at the current market value. This requirement is imposed by accounting legislation on objects received free of charge (clause 10.3 of PBU 9/99). To confirm the price, you can use the expert opinion of the appraiser.

Advice : to account for contributions to the organization’s property, use account 75 “Settlements with founders”.

This account is intended to summarize information on all settlements with the founders (Instructions for the chart of accounts). Accounting for this account is carried out in the context of settlements with each founder. This will allow you to control who has repaid their deposit debt and who has not.

When using account 75, reflect transactions for receiving a contribution to the organization’s property as follows:

Debit 75 Credit 83

– the founder’s debt for contribution to the organization’s property is reflected;

Debit 50, 51, 52 (08, 10, 41...) Credit 75

– the founder’s debt on contribution to the organization’s property has been repaid.

An example of how to reflect in accounting a participant’s monetary ruble contribution to the organization’s property

The authorized capital of Torgovaya LLC is 400,000 rubles. It is divided into shares between two participants: 60 percent of the authorized capital belongs to A.V. Lvov, and 40 percent - Alpha LLC.

The Hermes charter states that the founders are required to make contributions to the organization’s property. On April 16, the general meeting of founders decided to invest 50,000 rubles in the organization’s property within a month.

On April 20, the founders deposited their shares in the following amounts into the organization’s current account:

- Lviv – 30,000 rub. (RUB 50,000 × 60%);

- DDP – 20,000 rub. (RUB 50,000 × 40%).

The organization's accountant reflected these transactions as follows.

April 16 (formation of debt of participants on deposit):

Debit 75 Credit 83 – 30,000 rub. – reflects the amount of Lvov’s debt on contribution to the organization’s property;

Debit 75 Credit 83 – 20,000 rub. – reflects the amount of Alpha’s debt for its contribution to the organization’s property.

April 20 (contribution to the organization’s property):

Debit 51 Credit 75 – 30,000 rub. – money was contributed by Lvov as a contribution to the organization’s property;

Debit 51 Credit 75 – 20,000 rub. – money was contributed by Alpha as a contribution to the organization’s property.

An example of how to reflect in accounting the founder’s cash and foreign currency contribution to the organization’s property

The authorized capital of Torgovaya LLC is 400,000 rubles. It is divided into shares between two participants: 60 percent of the authorized capital belongs to A.V. Lvov, and 40 percent - to the foreign organization DDP.

The Hermes charter states that the founders are required to make contributions to the organization’s property. On April 16, the general meeting of founders decided to invest 225,000 euros in the organization’s property within a month.

On April 20, the founders deposited their shares in the following amounts into the organization’s current account:

- Lviv – 135,000 EUR (225,000 EUR × 60%);

- DDP – 90,000 EUR (225,000 EUR × 40%).

The conditional euro exchange rate was:

- on the date of the decision to make a contribution to the organization’s property – 60 rubles/EUR;

- on the date of payment of the deposit – 65 rubles/EUR.

The organization's accountant reflected these transactions as follows.

April 16 (formation of debt of participants on deposit):

Debit 75 Credit 83 – 8,100,000 rub. (135,000 EUR × 60 rubles/EUR) – reflects the amount of Lvov’s debt for contribution to the organization’s property;

Debit 75 Credit 83 – 5,400,000 rub. (90,000 EUR × 60 rubles/EUR) – reflects the amount of DDP debt for the contribution to the organization’s property.

April 20 (contribution to the organization’s property):

Debit 52 Credit 75 – 8,775,000 rub. (135,000 EUR × 65 rubles/EUR) – money contributed by Lvov as a contribution to the organization’s property;

Debit 52 Credit 75 – 5,850,000 rub. (90,000 EUR × 65 rubles/EUR) – money was contributed to DDP as a contribution to the organization’s property.

Since the exchange rate increased on the date of payment of the deposit, the accountant reflected the resulting exchange rate difference as follows:

Debit 75 Credit 83 – 675,000 rub. (135,000 EUR × (65 rubles/EUR – 60 rubles/EUR)) – reflects the positive exchange rate difference on Lvov’s contribution;

Debit 75 Credit 83 – 450,000 rub. (90,000 EUR × (65 rubles/EUR – 60 rubles/EUR)) reflects the positive exchange rate difference on the DDP deposit.

Further revaluation of the contribution to the organization’s property made in foreign currency is not provided, and therefore the accountant did not do it.

An example of how to reflect in accounting the non-monetary contribution of the founder to the organization’s property

The authorized capital of Torgovaya LLC is 400,000 rubles. It is divided into shares between two participants - A.V. Lvov (60%) and Alpha LLC (40%).

The Hermes Charter provides for the obligation of the founders to make contributions to the organization’s property. The general meeting of participants decided to submit materials. Lvov donates 2 tons of bricks to the organization, and Alpha - 5 tons of profile pipe.

An independent evaluator was hired to evaluate participants' non-monetary contributions. According to his conclusion, the market value of Lvov’s deposit is 30,000 rubles, and the value of Alpha’s deposit is 20,000 rubles. On March 14, this value of deposits was approved by the general meeting of the organization’s participants. On April 20, the founders transferred the materials to the society's warehouse.

The Hermes accountant reflected these transactions as follows.

March 14 (formation of debt of participants on deposit):

Debit 75 Credit 83 – 30,000 rub. – Lvov’s debt on contribution to the organization’s property is reflected;

Debit 75 Credit 83 – 20,000 rub. – Alpha’s debt on contribution to the organization’s property is reflected.

April 20 (contribution to the organization’s property):

Debit 10 Credit 75 – 30,000 rub. – Lvov contributed 2 tons of bricks as a contribution to the organization’s property;

Debit 10 Credit 75 – 20,000 rub. – Alpha contributed 5 tons of pipes as a contribution to the organization’s property.