When is INV-11 used?

Using the INV-11 form, an act is drawn up in which the inventory commission records information about expenses of future periods - those that are actually incurred one-time, but are expensed over several periods (months, years).

The form of the document in question was approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. It is filled out in 2 copies. The first is sent to the accounting department, and the second remains at the disposal of the commission, which conducts the inventory. Representatives of the relevant commission, as well as the financially responsible person, sign both copies.

To fill out the INV-11 form, accounting records for account 97 and information obtained when checking this data during the inventory are used.

For information on the document establishing the subject, time frame for conducting the inventory and the composition of the commission carrying it out, read the article.

Features of filling out the document

The act, which is drawn up in the INV-11 form, records:

- name of expenses of the future period;

- the total amount of relevant expenses;

- the date of occurrence of the relevant expenses and the period for their repayment;

- the amount of the estimated amount to be written off for each expense;

- the volume of write-offs already made and the balances of unwritten-off expenses as of the beginning of the inventory;

- the duration of the period between the inventory date and the moment expenses are incurred (in months);

- amounts to be written off as the cost of goods (per month or from the beginning of the year);

- the amount of the estimated balance of the relevant expenses, which is subject to repayment within the framework of a future period;

- amounts to be added or restored based on inventory results.

For information on the form used to reflect data on verification of settlements with counterparties, read the material “Unified Form No. INV-17 - Form and Sample”.

Inv-11 sample filling

The requirements for filling out an act according to this form is a mandatory norm when the inventory commission records documented verified information on BP expenses - already incurred virtually at a time, but related to expenses that will follow during one or more upcoming periods.

The act is filled out by members of the commission created for the inspection. One copy of the completed act must be transferred to the accounting department for subsequent processing, and the second copy must be registered in the accounting documents of the commission that conducted the inventory and filed in the Inventory Check Reports folder. In order to avoid mistakes, the members of the commission, who upon inspection will draw up INV-11, must be provided with a sample of completion and explanations on the BPR in advance.

The certificate's witnesses are the members of the commission who filled out the INV-11, as well as the person bearing financial responsibility.

The unified form INV-11 has four informative elements:

- title, containing information: about the installation data of the enterprise,

- about the order on the basis of which this inventory is carried out;

- containing information about the date and conduct of the inventory;

- reflects factual information about the types and amounts of expenses;

- containing the conclusions and signatures of the commission members, as well as responsible and officials.

It should be remembered that the Inventory Report can be drawn up in any form, but with the mandatory details of the approved document. Therefore, it is easier to use the approved form of the INV-11 form, which you can download below, so that the compiled document serves as the basis for entering information into the General Ledger.

When members of the commission fill out an act, only factual information obtained during the inspection, as well as accounting data according to Article 97, can be used.

The inspection report drawn up in the INV-11 form must include the following information:

- name or type of expenses, indicating the code;

- total amount - indicated for each (or specific) type of expense as of the starting date;

- indicator for the amount intended to be written off separately for each type of expense;

- the amount to be written off to the RBP at the time the inventory begins;

- the amount of amounts that are subject to write-off to the cost of products or goods (for the reporting period or the previous period from the beginning of the financial year);

- the actual volume of funds already written off, as well as the balances subject to write-off, at the time of the inventory check;

- date of occurrence and repayment terms of expenses;

- the duration of the period (in months) during which it is planned to repay the balance of the debt;

- the balance of the amount that, according to the inventory check, is subject to addition in subsequent periods (or restoration).

In order to avoid mistakes, before drawing up and signing an inventory report for deferred expenses, you can see a sample of filling out the document below.

Report “inventory of rbp (inv-11)”

Write-off of deferred expenses is carried out in three ways:

- monthly, within a certain date range;

- daily (meaning calendar days), within a certain date range;

- in an arbitrary (special) way. As a rule, this means a one-time write-off.

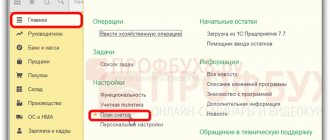

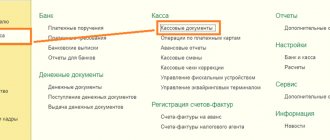

These settings are specified in the reference book of the same name “Future Expenses”. Let’s start our acquaintance with taking into account future expenses with this reference book and filling it out. Entering a new object and setting up the write-off of future expenses Let's go to the directory. Let's go to the "Directories" menu, then to the "Deferred expenses" submenu. In the list of directory elements, click the “Create” button. The setup form will open. Let's fill in the following details of Form 1C:

- Name. Let's say we purchased a domain in the “ru” zone.

OKPO, division, type of main activity according to OKVED;

Act of inventory of future expenses. Form INV-11 (filling sample)

The unified form INV-11 is a unified act form used to reflect the results of an inventory of future expenses. This procedure is carried out once a year as part of the annual traditional inventory of the property and liabilities of the enterprise.

Inventory of future expenses consists of reconciling the data of accounting account 97 (its turnover) with the indicators of primary documentation confirming the existence of expenses and their subsequent sequential assignment to expenses. This reconciliation allows you to track the correctness and timeliness of the write-off process.

How is an inventory of deferred expenses carried out?

The procedure is entrusted to the members of a specially created inventory commission, the composition of which is determined by the manager’s administrative document, for example, an order of the unified form INV-22.

Deferred expenses are those expenses that are not written off immediately in their entirety at the current moment, but are expensed gradually over a long period of time. This type of assets in the accounting records of an enterprise is reflected separately in account 97: the turnover on the debit of the account shows the total amount of expenses for future periods, and the turnover on the loan shows their share already allocated to expenses in the current period.

When inventorying such assets, the turnover in the debit and credit of account 97 is reconciled with the data reflected in the documents, on the basis of which costs are written off as expenses. Accounting and documentary indicators must coincide in the case of correct organization of accounting for future expenses.

The assets in question include those types of costs that are written off in the amount of a certain part of the total amount over a specified period (this can be months or years), this can include costs for:

- Licensed software;

- Upcoming construction work (for example, costs of materials transferred to the construction site);

- Other types of expenses for which there are no clear instructions in the PBU regarding their classification as expenses (for example, expenses for voluntary medical insurance, certification).

During the reconciliation, an inventory report is filled out in form INV-11 in two copies - for the accounting department and members of the commission. It is allowed to immediately fill out two copies with identical information or prepare one copy, then duplicate it using copying equipment and sign it.

This act is prepared for completion in advance, before the start of the inventory. It is possible that the members of the commission prepare it themselves, or this function is assigned, for example, to the accounting department, which issues a prepared form for the commission to fill out.

Modern companies, as a rule, keep records using special programs; in this case, the inventory report is prepared with their help. The columns in which information is entered on the basis of accounting are filled in immediately, after which the prepared act is printed for the members of the commission.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Inventory report form of the unified form INV-11

To reflect the results of the reconciliation, the standard form of inventory report INV-11, approved by the State Statistics Committee of Russia back in 1998 (Resolution No. 88), is usually used.

This form has a standard structure for similar inventory forms and consists of a title section with general information, a table with a list of the types of assets being inspected and their distinctive features, as well as the signatures of responsible persons and commission members.

Among the members of the commission there are usually employees of accounting, economic or technical departments, and a representative of the management team of the enterprise. It is not allowed to include in the commission financially responsible persons who are in charge of the assets being inspected.

The organization has the right not to use a unified form, but to prepare its own act form, which will reflect information about expenses for future periods. You can also take the existing INV-11 form as a basis and adjust it to suit your needs. In this case, the accounting policy must indicate which forms the organization will use to conduct inventory.

After filling out the INV-11 act, one copy must be submitted to the accounting department, whose employee will check the correctness of the inventory form.

The INV-11 form includes indicators characteristic of inventory lists (acts) and matching statements, that is, if inconsistencies are identified, they do not need to be transferred to matching statements. Discrepancies and conclusions from them are shown directly in the INV-11 form.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Rules for filling out the INV-11 act

There are certain requirements for drawing up an inventory report:

- Mandatory signatures of all participating persons;

- No blots are allowed;

- Information must be entered clearly and clearly;

- For each page, the number of serial numbers and the overall total are summarized.

Sample of filling out an inventory report for deferred expenses

At the top of the inventory report the following is filled in:

- information about the organization in which the reconciliation of documentary and accounting data for writing off deferred expenses is carried out - name, OKPO, division, type of main activity according to OKVED;

- information about the document establishing the procedure for conducting the inspection - name (the desired option is selected from those proposed, the rest are crossed out), number and date (copied from the document);

- information about the inventory - the timing (dates of the first and last day of the procedure) is taken from the administrative document defining the procedure for reconciliation ⊕ timing of the cash register inventory in 2020;

- details of the act - number and date (numbering is affixed in accordance with the rules established by the organization, may contain digital, alphabetic designations, as well as signs; the date corresponds to the actual day of registration).

To fill out the INV-11 act, the data from account 97 is used - its debit and credit turnover. Also, to reconcile accounting indicators, data is taken from documents confirming the existence of deferred expenses and their subsequent write-off.

The tabular part of the INV-11 form contains data from account 97 with details by type. Each individual row of the table reflects information about a separate type of expense that is subject to gradual write-off and reflected in account 97.

There are 15 columns in the inventory act table: in columns 1 to 9, data is entered on the basis of accounting, from 10 to 15 - filled in during the inventory process. When maintaining accounting in a special program, the INV-11 act is printed for members of the commission with the first nine columns completed. The remaining indicators are filled out by the commission members themselves.

Filling out the INV-11 table

| Column number | Information to be filled in |

| 1 | The sequence number of the table row. |

| 2 | Type of expenses related to future periods (this can include not only the costs of licensed software and construction, but also other expenses for which clear write-off rules are not established, and therefore, in the accountant’s opinion, they can be classified as expenses of future periods) . Typically, if expenses in tax accounting are written off gradually, then in accounting they are also included as expenses over a long period. |

| 3 | Expense type code, filled in if appropriate coding is available. |

| 4 | The amount of costs incurred in the current period and related to future periods, or costs incurred in previous periods and not completely written off in the current period. The column is filled in based on the account balance 97. |

| 5 | Cost incurrence date: |

- If they are one-time in nature - the actual date of the expenses;

- If they are associated with a long process (production, construction work, technology development) - the date of termination of such work.

The results of the table are summarized in the last row.

The reflected results of the inventory of future expenses are certified by the signatures of the commission members. The signatures of financially responsible persons are also affixed, who, by signing the act, confirm that the information contained in it corresponds to reality, these persons have no complaints or claims to the information presented.

After completing all the necessary manipulations with the inventory report INV-11, it is transferred to the accounting department for verification. It is not necessary to draw up an additional comparison statement if discrepancies are identified in the act, since it includes the functions of such a statement.

The employee, who has checked the data given in the inventory act, indicates his position, writes his last name, and signs. Such acts must be kept for at least 10 years.

Example of filling out form INV-11

Act of inventory of future expenses. First sheet (click to enlarge)

Act of inventory of future expenses. Second sheet (click to enlarge)

Programming and consulting services in 1C

First, let's remember what Deferred Expenses (hereinafter referred to as FPR) are. RBP are costs incurred by the organization in the previous and/or reporting period, but subject to inclusion in the cost of products (works, services) in subsequent periods of the organization's activities. To put it simply, without these expenses it is impossible to generate income in the future. Please note that BPOs only exist in accounting.

In tax accounting, expenses are recognized in the reporting period in which they arise according to the terms of the transaction. That is, according to the terms of the documents under which the transaction was executed.

In order to determine deferred expenses, it is necessary to distinguish between incurred costs of assets and expenses. Next, we highlight a separate independent object - RBP. The determining factor for an asset is the control of the organization and the possibility of obtaining economic benefits from it (receiving funds).

Costs can be deferred as an asset if:

- there is an opportunity to exchange for another asset;

- they can be used to pay off an obligation;

- they can be used between the owners of the organization;

- they are used in the process of producing products (works, services) for sale separately or in combination with other assets.

All this is determined by type of cost accounting, according to the specifics of the industry and is fixed in the accounting policy.

Accounting regulations recognize two types of costs related to BPO:

- Costs incurred in connection with upcoming construction work (materials transferred for construction).

- Licensed software.

Typically, expenses that are written off gradually in tax accounting are taken into account as RBP. These include costs for voluntary health insurance and costs for product certification. That is, if costs of a certain type need to be written off as expenses gradually, over several years, according to the accountant, then they can be classified as BPR.

The following expenses cannot be classified as deferred expenses:

- advances and subscription costs;

- expenses for payment of vacations (also a reserve for payment of vacations if the amount was not enough);

Debit 97 reflects the costs incurred, and credit reflects the gradual write-off of these costs as expenses.

In the balance sheet, RBP are reflected either as a separate item “Inventories”, or as a separate group of items in the section “Current assets”.

In the end, we have decided on the basic concepts and accounting; now we will look directly at the inventory of BPO.

In this case, inventory is needed to check the validity of attributing costs to future expenses, as well as to determine the period for attributing them to distribution and production costs.

The legality of attributing incurred costs to RBP is checked (according to clause 65 of Order No. 34n of the Ministry of Finance of the Russian Federation).

Each type of future expenses is analyzed. The initial amount specified in the administrative document is checked. All information on analytics, determination of balances on the date of inventory (reflected in the corresponding subaccount of account 97) is filled out in the INV-11 form.

For ease of use and automatic completion of INV-11, I offer a report (printed form). Using this external report, you can easily generate INV-11 for selected BPOs.

The archive includes: a file with an external report, instructions for connecting the report, instructions for working with the report. Also, in the report itself, if you click help “?”, you can also read the instructions for the report.

Additionally, you can watch the video below, in which I explain in detail and show this report in action.

How is the BPO inventory carried out?

To account for BPR, account 97 is used. Depending on the company’s accounting policy, this account may reflect, for example, the following costs:

- for the purchase of licensed software (software), if the purchased software is paid for one-time in one payment (expenses for using the program, which are made in periodic payments, should be taken into account as part of current expenses);

- for the acquisition of licenses and certificates;

- for contributions to self-regulatory organizations;

- for construction work.

An inventory of future expenses is carried out in order to reconcile the data on account 97 with the primary accounting documents. As a rule, such reconciliation is carried out before the preparation of annual financial statements during the annual inventory.

The rules for conducting inventory of BPO are regulated by orders of the Ministry of Finance. To carry out the inventory, a commission is created, which cannot include persons financially responsible for the property being inspected.

According to clause 3.35 of Order No. 49 of the Ministry of Finance of the Russian Federation dated June 13, 1995, the inventory commission, based on a documentary check, determines the amount that should be reflected in the RBP account in accordance with the accounting policy adopted by the company. The correctness of the write-off of costs in the reporting period is checked. Based on the results of the audit, the amounts to be written off or the amounts written off in excess are determined.

For example, if a company acquired licensing rights to software for a period of 1 year and took into account the costs of their acquisition as part of the BPR, then the costs should be written off within 12 months. In this case, the BPO inventory should show how correctly the accounting service wrote off costs.

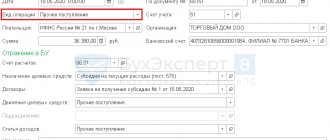

Deferred expenses in 1s 8.2 accounting

- Enter the item (RBP) using the "Add" button. Select the name of the expense from the “Nomenclature” directory (usually the Services group), indicate the quantity, price, VAT rate;

- In the Service Contents field, add. information, enter the full name of the RBP;

- In the Cost account (AC) and Cost account (CO) fields, specify the account in which future expenses will be accounted for;

- Subconto 1 select (add a new one if necessary) an element from the Deferred Expenses directory. In order for monthly expenses to be written off automatically when closing the month, you must correctly indicate the data in the directory (Fig. 323), for this:

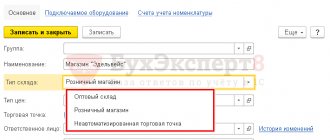

- In the Name field, enter the name of the BPO;

- In the BBP Type field, select the BBP type from the list;

- In the Expense recognition method field, indicate the frequency of write-off of the RBP.

We invite you to read: How sick leave is paid for an injury at work

It can be seen that when writing off deferred expenses, the debit balance by type of accounting BP decreased by the amount of write-off RBP: If you generate a report on account 26, you will see that the balance by type of accounting BP also decreased by the amount of write-off. The routine operation to write off the RBP must be performed monthly.

Upon expiration of the period for writing off the BPR, the entire amount of the expense will be written off and the temporary differences will disappear. If expenses for accounting purposes are written off at a time, but for tax purposes they are recognized as expenses of future periods, you need to do the opposite.

In the receipt document, it will be necessary to indicate the cost account according to accounting - the one to which expenses are written off, and the cost account according to NU - 97, indicating the sub-conto from the directory “Future expenses” (after having previously filled in the BPR parameters in this directory). Then carry out a monthly routine operation to write off the RBP.