What applies to deferred income?

Deferred income includes receipts that are specified in regulatory documents. For example, budget funds received to finance expenses, as well as unused funds at the end of the reporting period, accounted for in account 86 “Targeted financing”. Similarly, the amounts of received grants, technical assistance (assistance), etc. are taken into account. This is provided for in paragraphs 9 and 20 of PBU 13/2000 “Accounting for state assistance.”

In addition, as part of deferred income, lessor companies have the right to take into account the difference between the total amount of lease payments and the value of the leased property, which is listed on the balance sheet of the lessee (clause 4 of the Directives, approved by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15).

Another example is assets received free of charge - fixed assets, materials, goods (clause 29 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, Instructions for the chart of accounts).

Other income is reflected in current income or in accounts payable.

Subaccounts 98 accounts

- 98-1 “Income received for future periods.” On this sub-account, records are kept of the rent received, subscriber fees for communication and telecommunications services, utility services, passenger transport for subscriptions and travel documents (not one-time, but for a month, half a year, year, etc.).

Example.

Vostok LLC received rental payments several months in advance in the amount of 480,000 rubles.

The rental price per month is 120,000 rubles, including VAT 18%.

Postings:

Dt 51 Kt 98 The rental amount of 480,000 rubles was credited to the current account;

Dt 98 Kt 90.1 Revenue from receipt of rental payments for the month is reflected at 120,000 rubles;

Dt 90.3 Kt 68 VAT (value added tax) on the monthly rental amount is charged to the budget. 18,305 rubles.

Dt 76.AV Kt 68 VAT on the remaining amount of the rent, which acts as an advance, is accrued for payment to the budget. 54,915 rubles.

- 98-2 “Gratuitous receipts.” Movement, receipt, disposal of gratuitous fixed assets/funds, donated materials, etc. assets, as well as operations on budget financing from the budget for strictly defined purposes.

Regulatory documents - Order of the Ministry of Finance 91n dated October 13, 2003, 94n dated October 31, 2000, letter 07-02-06/223 dated September 19, 2012, Instructions PBU13/2000

Example 1.

Recipient LLC received free equipment worth 600,000 rubles (market value). The equipment has a useful life of 60 months. It is necessary to indicate income according to depreciation charges as other income (account 91.1).

Dt 08 Kt 98 Equipment was received that does not require installation. 600,000 rub.

Dt 01 Kt 08 The equipment was put into operation. 600,000 rub.

Dt 20 (44) Kt 02 Monthly depreciation. 10,000 rub.

Dt 98-2 Kt 91.1 Monthly income is reflected in the amount of depreciation charges. 10,000 rub.

Example 2.

Stroitel LLC received 50,000 kg of cement worth 150,000 rubles free of charge. Cement was capitalized at a price of 3,000 rubles per ton. In the next reporting month, 25,000 kg of cement is used.

Dt. 10 Kt 98 Cement was delivered to the receipt at market value. 150,000 rub.

Dt 20 Kt 10 25,000 kg released into production. 75,000 rub.

Dt 98-2 Kt 91.1 Material transferred to production is included in other income.

Example 3.

Regarding budget financing. Initially the amounts are taken into account:

Dt 86 Kt 98-2

In the future, as budget finances are used, the amounts of money spent are reflected in account 91.1 (other income)

- 98-3 “Future receipts from shortages discovered in the past.” If shortfalls are identified and receipt of financial/cash repayments is expected in the next month/quarter/year.

Example 1.

After an inventory of the unit was carried out on July 20 of the previous year, the inventory commission discovered a shortage of 20,000 rubles. The perpetrators have been identified and recorded in the internal investigation reports.

This amount is expected to be repaid in August of this year.

Dt 94 “Shortages” Kt 98-3 indicates the amount of the shortage. 20,000 rub.

Dt 73 “Settlements with personnel for other operations” Dt 98-3. 20,000 rub.

Dt 98-3 Kt 91.1 Accrue in other income after receiving money to repay the debt.

- 98-4 “Accounting for the difference between the value on the balance sheet of missing valuables and the amounts that must be paid by the guilty parties.” In the event that the amount from the culprit differs from the estimate on the balance sheet in a larger direction, the difference is taken into account in this sub-account and applied to other income in the process of repaying the debt.

Example 1.

The difference between the amount on the company’s balance sheet and the amount of recovery is taken into account:

Dt 73 “Settlements with personnel for other operations” Kt 98-4

Further, in the process of paying off the shortfall by those responsible, the funds are included in other income.

Dt 98-4 Kt 91.1

As for leasing, the regulatory document that defines the entire procedure for work in this area is Order of the Ministry of Finance 15 of February 17, 1997, Appendix No. 1. An enterprise that sells goods on lease - the lessor - carries out the following operations:

Dt 76 “Settlements with various debtors and creditors”

As soon as the funds arrive, the time comes to reflect in revenue:

Dt 98-1 Kt 90.1

Important! Analytical accounting is carried out for each object, case, material, etc.

Account 98 in accounting

This account is intended to accumulate information about:

- Income received that relates to future reporting periods;

- The debt for the shortfall for previous years, which is to be collected;

- The difference in case of shortages and damage between the amount of recovery and the value of the property.

The amounts of income for future periods are reflected on the credit of account 98, and on the debit - the amount of income transferred to the corresponding accounts upon the arrival of the expected date.

The subaccounts of account 98 “Deferred income” are presented below in the figure:

Analytical accounting of account 98 “Deferred income” is carried out for each:

- Type of income;

- Free receipt of valuables.

Correspondent accounts of subaccounts of account 98

Since shortages, subscription fees and gratuitous transfer of materials are radically different sources of finance in the accounting sense, then the correspondence of subaccounts will differ significantly.

Postings to subaccount 98.1

Subaccount 98.1 reflects the receipt of funds in the current period, but relating to future months or quarters. This is the receipt of utility bills, payment of monthly travel tickets, subscription fees for telephone services, rental payments, etc. The credit part of subaccount 98.1 corresponds with accounts reflecting the route of receipt of this income:

- – cash acceptance;

- – non-cash payment;

- – use of currency units, etc.

Accordingly, upon the arrival of the period for which income was received, posting Dt98.1 in correspondence with the account reflecting the use of these funds.

Analytical accounting for this sub-account is carried out for each type of income.

Postings to subaccount 98.2

Assets donated to the organization are reflected in subaccount 98.2. The credit part of the subaccount corresponds with accounts reflecting the purpose of the asset receipt:

- – when investing in non-current assets;

- – upon receipt of targeted funding for the implementation of the project.

The debiting of funds from this subaccount is reflected by posting Dt98.2 - Kt91 :

- when calculating depreciation on donated fixed assets;

- when writing off production costs based on donated materials.

Analytical accounting for this subaccount is carried out for each gratuitous receipt.

Postings to subaccount 98.3

Subaccount 98.3 takes into account upcoming receipts from the guilty parties to cover the shortfall. This can be either a voluntary admission of guilt and agreement to compensation, or by a court decision. The most commonly used wiring is:

- Dt94 – Kt98.3 – reflection of the amount of shortage identified in the previous reporting period;

- Dt73 – Kt94 – reflection of upcoming receipts from the guilty parties;

- Dt50 (51.52) – Kt73 – upon receipt of compensation;

- Dt98.3 - Kt91 - reflection of actual funds received to repay the previously identified shortage.

Why is account 08 needed?

08 account is used to account for the company’s expenses on property, which will subsequently be taken into account as a fixed asset or intangible asset. In agriculture, account 08 takes into account the costs of forming a herd of productive and working livestock.

Account 08 is active. An increase in the cost of commissioning the acquired property is charged to debit. For example, when purchasing a machine, debit 08 of the account will write off not only the cost of the asset, but also the costs of delivery, installation and commissioning. When an object is accepted for accounting, its value is written off against the loan.

The procedure for using account 08 is fixed in PBU 6/01 and PBU 17/20.

Let's summarize

- If you have received money for services that will be provided in the future, this account is used.

- A gift of fixed assets (fixed assets) or materials is indicated on account 98, the entire amount is written off as materials are released into production or fixed assets are depreciated into the account of other income.

- Shortages that are expected to be paid in the next reporting periods, interest on leasing, the difference between the value on the balance sheet and the amount of the shortfall - this account is used everywhere.

- In the balance sheet, information on account 98 (credit balance) falls on line 1530.

How to account for deferred income

Accountants take into account deferred income on the credit of account 98 “Deferred income”. Sub-accounts are opened to this account:

- subaccount 98-1 “Income received for future periods”;

- subaccount 98-2 “Gratuitous receipts”;

- subaccount 98-3 “Upcoming debt receipts for shortfalls identified in previous years”;

- subaccount 98-4 “The difference between the amount to be recovered from the guilty parties and the cost of shortages of valuables.”

Accounting for future income is carried out by type of income.

By budget financing

State aid funds aimed at financing capital expenditures are written off over the useful life of non-current assets. The entries for deferred income are as follows.

Debit 86 Credit 98-1

– state aid funds are reflected (during the commissioning of a fixed asset).

Debit 20 (23, 25, 26...) Credit 02

– depreciation has been accrued on fixed assets acquired through government assistance;

Debit 98-1 Credit 91-1

– depreciation on fixed assets acquired through government assistance is taken into account.

Such rules are provided for in paragraph 9 of PBU 13/2000.

In practice, the question often arises: how to reduce future income from government support. The entries for reducing income are below.

When using government assistance to purchase materials:

Debit 10 Credit 60

– materials are capitalized;

Debit 86 Credit 98-2

– reflects the amount of state aid spent on the purchase of materials;

Debit 20 (23, 25, 44...) Credit 10

– materials are written off for production;

Debit 98-2 Credit 91-1

– the amount of state aid spent on the purchase of materials is taken into account as other income.

When calculating salaries (other expenses of a similar nature), the source of financing of which is government assistance:

Debit 86 Credit 98-2

– reflects the amount of state assistance - the source of financing payments in favor of employees (the source of payment of salary contributions);

Debit 20 (23, 26, 44…) Credit 70 (69, 73,…)

– accrued payments in favor of employees (salary contributions);

Debit 98-2 Credit 91-1

– the amount of government assistance, which is a source of financing payments to employees (salary contributions), is taken into account as part of other income.

This is stated in paragraph 2 of clause 9 of PBU 13/2000.

For fixed assets, goods, materials received free of charge

An example of reflecting future income when receiving fixed assets, goods and materials free of charge in accounting accounts is as follows.

Debit 08 (10, 41) Credit 98-2

– reflects the market value of assets received free of charge.

Debit 20 (08, 23, 25, 44, 91...) Credit 02

– depreciation has been accrued on the fixed asset received free of charge;

Debit 98 Credit 91-1

– other income is recognized in the amount of depreciation accrued on a fixed asset received free of charge.

When writing off materials received free of charge for production or other purposes, as well as when selling goods received free of charge, an entry is made:

Debit 98-2 Credit 91-1

– income from the use of materials received free of charge is recognized (income from the sale of goods received free of charge).

To compensate for the shortage

If the employee compensates for the damage caused by the shortage based on the market price of the missing property, posting:

Debit 73 Credit 94

– the shortage of property is attributed to the employee at book value;

Debit 73 Credit 98-4

– reflects the difference between the market and book value of the missing property;

As the employee repays the debt, the difference is written off in proportion to the share of the repaid debt:

Debit 98-4 Credit 91-1

– the difference between the market and book value of the missing property is included in income.

This procedure follows from paragraph 5.1 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49, and the Instructions for the chart of accounts.

If a shortage is identified in the reporting year, but relates to previous reporting periods, and the culprit is identified, it is taken into account as part of future income. At the same time, the amount of the shortage is attributed to the guilty person. In this case, make the following entries:

Debit 94 Credit 98-3

– reflects the shortage identified in the reporting year, but relating to previous reporting periods;

Debit 73 Credit 94

– the shortage of property is attributed to the employee.

As the employee repays the debt, an entry is made: Debit 98-3 Credit 91-1

– the shortfall repaid by the employee is included in income.

Subaccounts to account 98

Depending on the funds reflected on the balance sheet, the following additional sub-accounts are opened in the company’s accounting for account 98:

- 98.1 – for receipts for the provision of services in the future;

- 98.2 – to reflect inventory and materials donated to the company;

- 98.3 – to compensate for shortfalls identified in previous periods;

- 98.4 - to reflect the difference between the amount recovered and the book value of lost assets.

In which line of the balance sheet should deferred income be shown?

In the balance sheet, for deferred income there is a special line with the same name - 1530 “Deferred income”. The answer to the question - what is deferred income on the balance sheet is as follows. The balance line includes accounting data for account 98 “Deferred income” and account 86 “Targeted financing” (in terms of targeted revenues).

The next question is: is deferred income on the balance sheet an asset or a liability?

The item “Deferred income” is reflected in the liability side of the balance sheet (line 1530). This is due to the fact that the line is linked to another liability line - “Retained earnings (uncovered loss)”. An entry on this line means that the organization has profits that it owes to its owners.

However, in practice it also happens: there is already money, but there is no debt to the owners yet. Imagine that the current account of our Alpha LLC received free financial assistance from the state - 50,000 rubles. This amount increases the item “Cash and cash equivalents” in assets.

Now we need to balance this line. The balance sheet line “Retained earnings (uncovered loss)” is not suitable here. After all, budget financing is money that does not become profit immediately, but under one condition: the company spent it for its intended purpose.

But you haven’t written off even a ruble of these funds for expenses yet. Therefore, it turns out that help has not yet been provided. The state will provide it gradually throughout the year.

This means that 50,000 rubles that ended up in the current account cannot be considered profit. This is an advance from the state. That is, deferred income on the balance sheet is income that will become income in the future. The liability line “Deferred income” was invented just for such cases.

When you begin to recognize expenses, the money spent will be transferred from the Deferred Income liability to the Retained Earnings liability. And you will do this every time until you have mastered all the help.

Example of reflecting deferred income

Alpha LLC received government assistance to finance current expenses. RUB 50,000 was transferred to the company’s current account from the budget as part of the small business support program. An entry is required on the balance sheet.

Show an increase in the asset “Cash” by 50 thousand rubles. And also reflect the new liability in the line “Deferred income” in the amount of 50 thousand rubles. As a result, in section I of the asset

“Non-current assets” line

“Cash” will increase by 50 thousand rubles.

In section V of the liability “Short-term liabilities”: “Future income” will also increase by 50 thousand rubles. As a result, both assets and liabilities will increase by 50 thousand rubles and the balance will converge.

DBP accounting: account 98

Accounting for DBP is reflected in account 98 , which is passive. The opening account balance shows the total amount of income at the beginning of the analyzed period of time. The loan shows those types of income that should be attributed to future periods. The debit account turnover reflects exactly what amount was written off to other accounting accounts for a given period.

The ending balance shows the amount of unwritten off income at the end of the established interval.

In addition to advance receipts from clients, it is advisable to reflect on this account such types of income as:

- payment for rent stipulated by the contract, received in advance ahead of the deadline specified in the contract;

- subscription fee for the operation of telephone landline and mobile communications and the Internet, paid by counterparties before the onset of the periods specified in the contracts;

- property and assets that the organization has capitalized under donation documents;

- planned receipts for shortages that occurred in previous periods, but are documented in the current period.

Account 98 in the standard chart of accounts has 4 subaccounts , and accounting for all regulated subaccounts must be kept in strict analytics of a certain type of acquired benefit.

So, subaccount 1 shows payment of rent, monthly utilities, subscription fees for communications services and revenue for the transportation of goods.

Subaccount 2 shows the amounts of assets that were received by the enterprise under gift agreements. Accounting is carried out for each type of such assets and shows their market value reflected by the date of actual acceptance for accounting.

Subaccount 3 takes into account future receipts of those amounts of shortages of materials and funds that were identified in past intervals. This subaccount also shows amounts recovered during legal proceedings.

Subaccount 4 displays the amounts of the actual cost of missing or damaged goods and materials, the residual value of missing or broken fixed assets and the amount of established losses of partially damaged materials.

If a commercial enterprise on a state-targeted basis was provided with financing in the form of material assistance, grants or subsidies during the reporting period, its accounting must be reflected in subaccount 2 of account 98.

This account subsequently corresponds with account 86 “Targeted financing” . This aspect is important for subsequent reporting.

Examples of transactions with transactions on account 98

Example 1. Renting property

On February 1, 2021, a lease agreement for office space was concluded between Spide LLC and Left LLC and payment was made for 6 months in advance. On February 3, 2021, funds in the amount of 354,000 rubles were received into the account of Spide LLC, incl. VAT — 54,000 rub. According to the lease agreement, payment for the premises is made monthly, or for several months at once - the amount is reflected immediately, but is written off monthly.

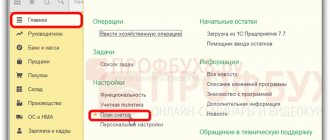

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

Table of entries for account 98 - Accounting for future income from rental:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 98.01 | 354 000 | Reflects the actual receipt of rent (six months) - advance | Bank statement |

| 98 | 90.01 | 59 000 | Monthly rent reflected (February) | Lease agreement, accounting certificate |

| 90.03 | 68 | 9 000 | VAT has been charged on rent for February 2021. | Invoice, lease agreement |

| 76.AB | 68 | 54 000 | VAT charged on advance payment | Invoice, sales book, payment order |

| 68 | 76.AB | 9 000 | VAT deducted from rent (February) | Invoice, sales book |

Example 2. Recovery from the guilty party

Based on the results of the inventory, Knan LLC revealed a shortage (theft) by the seller of 8 kilograms of butter in the amount of 6,100 rubles, the market value of 7,100 rubles. The rate of natural loss is 500 grams. The shortfall is fully withheld after three months.

Table of entries for account 98 when recovering from the guilty party:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 94 | 41.01 | 6 100,00 | Write-off of shortage | Inventory act and inventory |

| 44 | 94 | 381,25 | Write-off of shortages according to the natural loss rate | Accounting information |

| 73 | 94 | 5 718,75 | The shortage is transferred to the guilty party | Accounting certificate, Manager's order |

| 73 | 98.04 | 618,75 | The difference between the amount of recovery and the cost in accounting is reflected | Accounting information |

| 70 | 73 | 1 906,25 | Withholding 1/3 of the shortfall from the seller’s salary | Payroll |

| 98 | 91.01 | 206,25 | The difference after collection is taken into account | Accounting information |

Example 3. Gratuitous receipts

Kokhev LLC received equipment under a donation agreement with a useful life of 45 months, worth 400,000 rubles. Inventory and fixed assets cannot be included in gratuitously received income immediately; it is recognized as it is used.

Table of transactions for account 98 with free receipt of inventory and fixed assets:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 08 | 98.02 | 450 000 | Receipt of equipment reflected | OS transfer act |

| 01 | 08 | 450 000 | The equipment has been accepted for registration | OS commissioning certificate |

| 20 | 02 | 10 000 | Calculation of depreciation per month | Accounting information |

| 98 | 91.01 | 10 000 | Income recognition in accounting |

Accounting for fixed assets using account 98

To reflect the acquisition and acceptance for accounting of fixed assets, the Karuna accountant makes the following entries in April: Dr Kt Description of transaction Amount, rub Document 08 60 Reflection of receipt of fixed assets 110,000 Invoice 08 60 Reflection of delivery cost 10,000 Invoice 01 08 Acceptance of fixed assets for accounting (110,000 + 10,000) 120,000 Accounting certificate The monthly depreciation amount will be: 120,000 / 36 = 3,333 rubles) Accrual of depreciation in May: Dr Kt Description of the transaction Amount Document 20 02 Monthly depreciation 3,333 Accounting certificate Example 2. Modernization of OS Fortuna LLC in September 2014 put into operation an operating system worth RUB 960,000, SPI is set for 5 years, depreciation is calculated using the straight-line method. In December 2021, the organization is modernizing the facility in the amount of 96,000 rubles. As a result of modernization, the SPI increased by 1 year.

Account 98 “deferred income”

Accounting account 01 is the active account “Fixed Assets” and reflects information about the organization’s fixed assets (Fixed Assets), their value and movement. The account belongs to the non-current assets section of the approved Chart of Accounts. Table of contents

- 1 Definition of fixed assets 1.1 Items of fixed assets

- 1.2 Conditions for recognizing an object as a fixed asset

- 2.1 Main correspondence of account 01

- 3.1 Example 1. Acceptance of fixed assets for accounting

Postings to account 98 - deferred income

Account 98 “Deferred income” is intended for such situations. Subaccounts 98 accounts:

- 1 Standard correspondence account 98

- 2 Types of deferred income

- 3 Receiving fixed assets free of charge

- 4 Receiving free materials

- 5 Deferred income from the lessor

- 6 Reflection in the balance sheet

Standard correspondence accounts 98 Types of deferred income

- Income from utility bills;

- from subscription fees for the provision of telecommunications services;

- from rent for the use of premises;

- from cargo transportation using road, air and rail transport;

- etc.

The account is passive.

OS groups usually include:

- building;

- equipment;

- transport;

- IT equipment;

- capital investments in leased operating systems;

- environmental management facilities.

When deciding whether to account for property as part of fixed assets, in addition to the useful life criterion, the cost indicator should also be taken into account. Non-production objects and land plots whose accounting value exceeds 40,000 rubles.

, should also be taken into account as part of fixed assets.

-lesson: “Accounting for fixed assets: correspondent accounts, examples and typical situations” In this video lesson, the expert of the site “Accounting for Dummies” Natalya Vasilyevna Gandeva explains in detail what is included and taken into account on account 01, which subaccounts and correspondent accounts.

Account 01. accounting of fixed assets, example, postings

In the absence of the culprit, the amount of the shortage of fixed assets is written off in accounting by the following entries: Debit Credit Description Document 94 01 The residual value of the shortage of fixed assets is taken into account Inventory sheet, commission act 91.

2 94 The loss from the shortage of fixed assets is reflected (the culprit has not been identified) Inventory sheet, act of the commission Transactions on the revaluation of fixed assets carried out in accordance with the procedure established by law are reflected in accounting by the following entries: Debit Credit Description Document 01 91.

1 Revaluation of fixed assets is recognized as part of income Revaluation certificate 83 01 Depreciation of fixed assets was made at the expense of additional capital Revaluation certificate 84 01 Reflection of depreciation of fixed assets Revaluation certificate 91.

2 01 Depreciation of fixed assets is reflected in losses Act of revaluation An item of fixed assets can be liquidated as a result of sale, write-off due to physical wear and tear, in case of gratuitous transfer, etc.

Accounting for receipt of fixed assets

Conditions for recognizing an object as a fixed asset To recognize an OS object, the following conditions must be present simultaneously:

- purpose - use in the production activities of the organization;

- expected SPI over 12 months;

- promising economic benefits;

- not intended for resale.

OS costing less than 40,000 rubles. can be taken into account as part of inventories and immediately written off as costs.

Account 01 in accounting The fixed assets accounting account is active, its structure is displayed in the form of a table: In the standard version, the synthetic account 01 includes subaccounts for breakdown by types of fixed assets.

To reflect disposals, a sub-account for the disposal of fixed assets is also often opened, into which the initial and written-off costs are collected, and the write-off is carried out from this account. If the disposal account is not used, then transactions Dt 02 - Kt 01 arise.

Gratuitous receipts98-3 - Upcoming receipts of debt for shortfalls identified in previous years98-4 - The difference between the amount to be recovered from the guilty parties and the cost of shortages of valuables99 - Profit and loss Kt 001 - Leased fixed assets002 - Inventory accepted for safekeeping003 - Materials accepted for processing004 - Goods accepted for commission005 - Equipment accepted for installation006 - Strict reporting forms007 - Debt of insolvent debtors written off at a loss008 - Security for obligations and payments received009 - Security for obligations and payments issued01 - Fixed assets001-11 - Disposal of fixed assets010 - Depreciation of fixed assets011 - Fixed assets leased012 - Intangible assets received for use013 - Inventory and business.

Source: //dolgoteh.ru/buhuchet-osnovnyh-sredstv-s-ispolzovaniem-scheta-98/

Which accounts does account 08 correspond to?

Account 08 corresponds with most of the accounts by debit. The list of accounts with which he corresponds on the loan is much smaller. For convenience, we have collected all the accounts in a table.

| Account 08 corresponds by debit with | Account 08 corresponds for the loan with |

| 02 “Depreciation of fixed assets” 05 “Depreciation of intangible assets” 07 “Equipment for installation” 10 “Materials” 11 “Animals for growing and fattening” 16 “Deviation in the cost of material assets” 19 “VAT on acquired assets” 23 “Auxiliary production” 26 “General business expenses” 60 “Settlements with suppliers and contractors” 66 “Settlements for short-term loans and borrowings” 67 “Settlements for long-term loans and borrowings” 68 “Settlements for taxes and fees” 69 “Settlements for social insurance and security” 70 “ Settlements with personnel for wages" 71 "Settlements with accountable persons" 75 "Settlements with founders" 76 "Settlements with various debtors and creditors" 79 "Intra-business settlements" 80 "Authorized capital" 86 "Targeted financing" 91 "Other income and expenses » 94 “Shortages and losses from damage to valuables” 96 “Reserves for future expenses” 97 “Deferred expenses” 98 “Deferred income” | 01 “Fixed assets” 03 “Income-earning investments in tangible assets” 04 “Intangible assets” 76 “Settlements with various debtors and creditors” 79 “Intra-business settlements” 80 “Authorized capital” 91 “Other income and expenses” 94 “Shortages and losses from damage to valuables" 99 "Profits and losses" |

Reflection in the balance sheet of the enterprise

When compiling the final balance sheet, DBP are displayed on line 1530 of the Liabilities of the balance sheet in the “Short-term liabilities” (see figure).

It shows the value of funds received free of charge, receipts for identified thefts and shortages of past periods and the amount of targeted funding received by the organization over the past calendar year.

When filling out the balance sheet, it is necessary to remember that for the purpose of drawing up correct financial statements, advances received must be reflected separately from the DBP.

Therefore, payments transferred as an advance payment are subject to accounting on line 1520 and are one of the components of accounts payable.

In fact, line 1530 ultimately needs to show the amounts of the credit balance of account 98 and the credit balance of account 86 in the target financing provided analytics.

But in the case when the amount of unused targeted funding is large and significant in the overall indicators of the organization’s turnover, then it is advisable to show it separately. A special line in the “Short-term liabilities” section can be used for display.

Basic postings with account 08

The table contains the main typical transactions with account 08 that every accountant encounters.

| Debit | Credit | The essence of wiring |

| 08 | 02 | We charged depreciation on equipment involved in the creation of a new non-current asset. |

| 08 | 05 | We calculated depreciation of intangible assets involved in the creation of a new asset. |

| 08 | 10 | The cost of materials used to create a non-current asset was written off. |

| 08 | 23 | The cost of auxiliary production services was written off to the cost of the asset. |

| 08 | 26 | We wrote off part of the general business expenses associated with the creation of the asset. |

| 08 | 60 | Purchased OS or intangible assets. |

| 08 | 66 / 67 | Interest on the loan was included in the value of the asset. |

| 08 | 70 | We paid wages to employees involved in the creation of the asset. |

| 08 | 69 | Insurance premiums were calculated from the salaries of employees involved in the creation of a non-current asset. |

| 08 | 75 | We received intangible assets as a contribution to the authorized capital. |

| 08 | 98 | Received a non-current asset free of charge. |

| 01 | 08 | The non-current asset was taken into account as fixed assets. |

| 03 | 08 | The non-current asset was taken into account as fixed assets for subsequent rental on a reimbursable basis. |

| 04 | 08 | The non-current asset was taken into account as an intangible asset. |

| 91 | 08 | The cost of a non-current asset sold or disposed of for another reason was written off. |

We recommend you the cloud service Kontur.Accounting. In our program, you will easily master the accounting of non-current assets and set up all the necessary analytics. You will also be able to keep records, calculate salaries, submit reports and use other accounting tools. We give all newbies a free trial period of 14 days.

Regulatory regulation of business transactions on account 98

When determining the procedure for reflecting business transactions related to the accounting of deferred income in the accounting accounts, one should be guided by the following regulations:

1. Instruction No. 50.

2. Instruction No. 41.

Document:

Instructions for accounting for value added tax, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 30, 2012 No. 41 (hereinafter referred to as Instruction No. 41).

>> Full text is available to subscribers. Get access. >>

Typical transactions for account 98

For account 98, the postings are described in the chart of accounts. Using subaccounts, the main transactions look like this:

- Dt 08 Kt 98.02 - fixed assets received free of charge at market value are accepted for accounting;

- Dt 98.02 Kt 91.01 - income is recognized in the amount of monthly depreciation;

- Dt 86 Kt 98.02 - budget funds have been received that are aimed at financing expenses;

- Dt 94 Kt 98.03 - the amount of the shortage confirmed in the court decision is reflected in the accounting;

- Dt 98.03 Kt 91 - the amount of the shortfall has been repaid;

- Dt 73 Kt 98.04 - reflects the amount of the difference between the amount of recovery of the shortage from the guilty employee and the real price of the lost property;

- Dt 51 Kt 98.01 - advance payment of rent was received for six months in advance;

- Kt 98.01 Kt 90.01 - reflects the monthly rent payment;

- Dt 10 Kt 98.02 - free material was received for production, reflected in accounting at market value;

- Dt 08 Kt 98.02 - equipment was transferred to the balance sheet as a charity;

- Dt 62 Kt 98.05 - transport leased;

- Dt 98.05 Kt 90.01 - regular lease payment accrued;

- Dt 51 Kt 98.02 - a grant was received with targeted use for landscaping;

- Dt 98.02 Kt 91.01 - plants were planted on the territory purchased through the grant.

Receiving free materials

Example

Alina LLC, a confectionery factory, received 800 kg of granulated sugar free of charge. The goods are capitalized at a cost of 20 rubles/kg, the total amount is 16,000 rubles. The next month, 400 kg of granulated sugar were written off for production, and in the next two months - 200 kg per month.

Assets received free of charge are included in non-operating income. In accounting they are reflected at market value determined as of the date of acceptance for accounting. Market value is determined on the basis of prices prevailing for a given type of asset as of the current date, or on the basis of an examination.

Postings

| Dt | CT | Operation description | Sum | Document |

| 10 | 98 | Sugar is capitalized at market value | 16000 | Transfer and acceptance certificate, Receipt order |

| 20 | 10 | 400 kg of sugar written off for production | 8000 | Withdrawal slip |

| 98 | 91.1 | Used sugar is written off as income for the current period | 8000 | Accounting information |

Enter the site

RSS Print Category : Accounting Replies : 36

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (4) »

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 |

| on debt 98 the whole year hangs every month (=36703) from loan 92 in an equal amount ?? What could it be? and what should be attributed to the D 98 account? and what are the loan amounts 98?? |

| I want to draw the moderator's attention to this message because: A notification is being sent... |

| You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know. |

| AZA [e-mail hidden] Belarus, Minsk Wrote 17483 messages Write a private message Reputation: 1511 | #2[102087] March 17, 2010, 15:46 |

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise. I want to draw the moderator's attention to this message because:

Notification is being sent...

Life is not a test. If you made a mistake, live with the mistake.

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 | #3[102092] March 17, 2010, 15:51 |

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

so this is for 2009. I don’t know what the former accountant was up to here? but the situation is this: Balance according to Kt 98 as of 01/01/2009 = 1017362. so Then every month D98-Kt92 =36703 What to do??

I want to draw the moderator's attention to this message because:

Notification is being sent...

You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know.

| MiniBushka Belarus, Minsk Wrote 86 messages Write a private message Reputation: | #4[102094] March 17, 2010, 15:54 |

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

I don’t agree about the end of the year and the balance is equal to 0 on January 1, 2010 as of 01/01/2010 there may be a balance on account 98, it will be debited to account 92 monthly starting from January 2010 according to the procedure and deadlines established by the accounting of the enterprise

I want to draw the moderator's attention to this message because:

Notification is being sent...

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 | #5[102097] March 17, 2010, 15:56 |

PEOPLE HELP I want to draw the moderator's attention to this message because:

Notification is being sent...

You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know.

| AZA [e-mail hidden] Belarus, Minsk Wrote 17483 messages Write a private message Reputation: 1511 | #6[102099] March 17, 2010, 15:58 |

Minibushka, I agree that the balance at 98 can hang until 2014 and be written off in equal shares over 5 years according to Presidential Decree No. 1. I want to draw the moderator’s attention to this message because:

Notification is being sent...

Life is not a test. If you made a mistake, live with the mistake.

| nagelin Belarus, Minsk Wrote 110 messages Write a private message Reputation: | #7[102100] March 17, 2010, 15:59 |

This, for example, could be a posting to attribute to income the cost of freely received fixed assets in the amount of monthly depreciation.... I want to draw the moderator's attention to this message because:

Notification is being sent...

| MiniBushka Belarus, Minsk Wrote 86 messages Write a private message Reputation: | #8[102102] March 17, 2010, 16:00 |

Tatyana-M wrote:

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

so this is for 2009. I don’t know what the former accountant was up to here? but the situation is this: Balance according to Kt 98 as of 01/01/2009 = 1017362. so Then every month D98-Kt92 =36703 What to do?? As I understand it, these are exchange rate differences hanging on D 98. That's right, they are written off in Finnish. results monthly in the amount of at least 10% of the actual. s-s, but not more than the amount of exchange rate differences included in deferred income

I want to draw the moderator's attention to this message because:

Notification is being sent...

| MiniBushka Belarus, Minsk Wrote 86 messages Write a private message Reputation: | #9[102104] March 17, 2010, 16:02 |

Valentina wrote:

Minibushka, I agree that the balance at 98 can hang until 2014 and be written off in equal installments over 5 years according to Presidential Decree No. 1.

yeah, and you’re right, but you can’t write off all five years - here the accounting variation will be any specified there

I want to draw the moderator's attention to this message because:

Notification is being sent...

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 | #10[102105] March 17, 2010, 16:03 |

MiniBushka wrote:

Tatyana-M wrote:

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

so this is for 2009. I don’t know what the former accountant was up to here? but the situation is this: Balance according to Kt 98 as of 01/01/2009 = 1017362. so Then every month D98-Kt92 =36703 What to do?? As I understand it, these are exchange rate differences hanging on D 98. That's right, they are written off in Finnish. results monthly in the amount of at least 10% of the actual. ss, but no more than the amount of exchange rate differences taken into account as part of deferred income, we cannot have exchange rate differences! oh woe is me..!!

I want to draw the moderator's attention to this message because:

Notification is being sent...

You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know.

« First ← Prev.1 Next → Last (4) »

In order to reply to this topic, you must log in or register.

Accounting for deferred expenses: account 97

Account 97 records expenses incurred in a given month, but not related to sales of that month, that is, this account is used when incurred expenses need to be deferred until the next month.

For example, an organization insures its property for six months. The insurance company submits an invoice for a certain amount; this invoice reflects the insured amount for the entire insurance period; the organization must pay it in full at the time of receipt of the insurance policy. In this case, the organization can terminate the contract with the insurance company at any time and return the remaining money.

In this case, it is impossible to completely write off the entire amount as expenses, so the insured amount is evenly distributed over six months, that is, divided by 6, and every month 1/6 of the amount is written off as expenses for the current month.

How to reflect this in accounting?

Postings for accounting for deferred expenses on account 97

| date | Debit | Credit | Operation name |

| 01.11.2012 | 76 | 51 | Insurance premium paid to the insurance company |

| 01.11.2012 | 97 | 76 | An insurance policy for 6 months has been accepted for registration |

| 30.11.2012 | 44 (20) | 97 | Insurance costs reflected (1/6 of the amount) |

| 31.12.2012 | 44 (20) | 97 | |

| 31.01.2013 | 44 (20) | 97 | |

| 28.02.2013 | 44 (20) | 97 | |

| 31.03.2013 | 44 (20) | 97 | |

| 30.04.2013 | 44 (20) | 97 |

| Buy ★ bestselling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

At the end of the insurance period, the entire amount from account 97 will be completely written off as expenses, and the balance will be zero.

Thus, in order to reflect future expenses on account 97, you need to know the amount and period for recognizing expenses; during this period, the amount is gradually written off (depreciation of fixed assets is written off in a similar way).

What other expenses can be reflected on account 97? Newly created organizations can use this account and reflect their initial expenses (preparatory) when there are no sales yet, not on account 44 (for trading organizations), but on account 97. When sales appear, expenses from account 97 are written off to account 44 or general amount, or gradually, at the request of the management of the enterprise.