In absolutely all economically developed countries, untimely submission of income tax reports is considered a serious violation of the law.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

In Russia, a fine is imposed for failure to provide a 2-NDFL certificate.

Tax legislation provides for not only fines for this, but also separate penalties for false data in certificates.

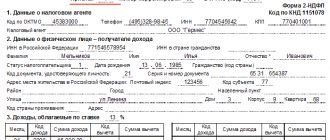

Signs in form 2-NDFL

Let’s assume that the company reporting personal income tax issued in 2021, i.e. in the reporting period, any non-cash prize to an individual. It is not possible to withhold tax in this case. How can this be reflected in the 2-NDFL certificate to avoid a fine? It is necessary no later than March 1, 2021 to submit to the Federal Tax Service and send to the individual a certificate in form 2-NDFL with sign 2 noted in it. It means that the tax agent organization failed to withhold the required amount from the payer. If tax is withheld, then indicator 1 is indicated.

Fine for 2-NDFL: you can avoid it!

Tax agents for personal income tax, including organizations and individual entrepreneurs, are obliged annually, no later than April 1 of the following year, to submit to the tax office at the place of their registration a certificate in form 2-NDFL, approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. MMV-7 -11/ [email protected] The certificate contains information about the income of individuals for the past calendar year and the amount of personal income tax calculated, withheld and transferred to the budget for this period for each individual.

For submitting false information in a tax agent certificate, you will be fined 500 rubles for each submitted document containing false information (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

What information is unreliable?

The Tax Code of the Russian Federation does not define the concept of “unreliable information”. According to the Federal Tax Service of Russia, expressed in letter No. GD-4-11/14515 dated 08/09/2016, this concept includes:

- any completed details of form 2-NDFL that do not correspond to reality;

- any errors made by the tax agent when filling out the details (for example, in the taxpayer’s personal data, income and deduction codes, amounts, etc.);

- arithmetic errors;

- distortion of total indicators;

- other errors leading to adverse consequences for the budget in the form of non-calculation or incomplete calculation, non-transfer of personal income tax, violation of the rights of individuals (for example, tax deductions);

- errors in indicators identifying taxpayers - individuals (TIN of an individual, last name, first name, patronymic, date of birth, passport data), which may also lead to the impossibility of fully exercising the rights of individuals, as well as the rights and obligations of tax authorities (in terms of tax administration).

Information needs to be updated

As you can see, it is safer to keep the personal data of individuals who receive income up to date. First of all, the data that is entered into the fields:

- "Full Name";

- “Series and number” (of the taxpayer’s identity document);

- “Residence address in the Russian Federation.”

This has been noted more than once by both the Ministry of Finance of Russia (letters dated 08/04/2015 No. 03-04-06/44917, dated 05/07/2015 No. 03-04-06/26534), and the Federal Tax Service of Russia (letter dated 12/18/2015 No. BS- 4-11/ [email protected] ).

The above fields must be filled in on the basis of an identity document of an individual or another document confirming the address of residence. In this case, in the absence of other violations of format-logical control, this information is considered to have passed format-logical control and is subject to acceptance in full.

In the commented letter, the tax service once again reminded: in order to submit reliable certificates in form 2-NDFL for 2021, before submitting the certificates, tax agents should:

- check the relevance of employees’ personal data;

- if necessary, update their personal data.

Please note: if an individual’s specified personal data has changed after submitting a certificate in Form 2-NDFL, then the updated Form 2-NDFL regarding the change in the personal data of the individual should not be submitted.

Extenuating circumstances

The Ministry of Finance of Russia in letter dated 04/21/2016 N 03-04-06/23193 explained: the qualification of the actions of a tax agent who made an error when filling out form 2-NDFL depends on the actual circumstances. The issue of bringing to responsibility must be considered taking into account all the circumstances, including those mitigating liability, excluding liability and excluding guilt. They can be established only when considering a specific case of a tax offense.

In a letter dated 08/09/2016 No. GD-4-11/14515, the Federal Tax Service of Russia clarified: the tax inspectorate must take into account the presence of mitigating circumstances in the case of providing false information that did not lead to non-calculation or incomplete calculation of personal income tax, adverse consequences for the budget, violation of rights individuals (clause 1 of article 112 of the Tax Code of the Russian Federation).

In addition, the tax agent can avoid liability if he independently identified errors and submitted updated documents to the tax authority before the tax authority discovered false information (Clause 2 of Article 126.1 of the Tax Code of the Russian Federation).

Deadline for bringing to justice

The Tax Code of the Russian Federation does not establish a deadline for identifying false information reflected in form 2-NDFL. According to the Federal Tax Service of Russia, a tax agent cannot be held accountable if three years have passed from the day the offense was committed or from the day after the end of the year during which the offense was committed until the decision to bring it to justice is made.

What is the penalty for failure to submit 2-NDFL?

According to the law, the report must be sent to the tax service within a certain time frame. According to paragraph 1 of Art. 126 of the Tax Code of Russia, the employer-taxpayer bears tax and administrative-criminal liability.

The amount of the fine for both the organization and the individual entrepreneur is 200 rubles. for each certificate not provided. That is, if an organization failed to withhold tax from 15 employees and did not notify about it, the fine will be equal to 3 thousand rubles. a fine may also be issued to the head of the organization. Its amount varies from 300 to 500 rubles.

Updating personal data

The 2-NDFL certificate contains the following data:

- The taxpayer's initials without abbreviations correspond to the passport.

- Taxpayer passport details.

- When filling out the address of the place of residence, the address of the taxpayer's place of residence is written based on the identity document.

Form 2-NDFL must be filled out by a tax agent based on the information in the document that identifies the taxpayer.

If the organization’s accountant fills out the documents in accordance with the order in accordance with the documents confirming the identity of the payers, such data will pass control and be accepted.

Before providing a certificate, tax agents must check the relevance of employee data.

If an organization submits certificates with incorrect employee data, this fact will be considered a submission of false data.

If the physical there has been a change in the person’s data after the certificate has been provided, there is no need to provide an updated form for it.

KBK upon payment

KBK is a digital budget classification code. It consists of 20 digits, which are divided into four parts and each of them means:

| First part | And these three characters determine the organization from which the data came |

| Second part | The third to thirteenth digit, inclusive, indicates the type of income. In this case, the first digit determines the income group, and the next two characters determine the subgroup. The seventh and eighth characters are the article, and the ninth and tenth are the subarticle. These data must be indicated from the payment documents in accordance with the values indicated in the classification of income of the Russian Federation. The next two signs determine the budget level |

| The third part | Fourteenth to seventeenth characters |

| Fourth part | The last three characters indicate the economic classification of taxes |

To pay the fine, you need to transfer the specified amount to the budget using the KBK, which is indicated in the notice of penalty.

Amount of penalty for untimely

In order for the taxpayer’s actions not to be considered an administrative-criminal violation, certificates must be submitted within the period established by law.

A fine in the form of a monetary penalty is imposed on the violator in this case:

- if data was not provided about all hired workers;

- if the certificates were not served at all for any reason.

If one of these violations is detected, a fine is imposed, the amount of which depends on all the circumstances.

This issue is regulated by the Code of the Russian Federation on Administrative Violations of Law. The amount of the penalty depends on the status of the citizens or organization:

| A fine is imposed on citizens | In the amount of 100 to 300 rubles. |

| Officials will be required | From 300 to 500 rubles |

| A fine is imposed on people who work in government agencies, diplomatic offices or consulates | In the amount of 500 to 1000 rubles. |

| Lawyers or attorneys must also pay | From 500 to 1000 rubles |

It is better to pay fines after submitting a certificate to the authorized bodies.

What data is considered unreliable?

For providing false information in any documents, the violator will receive a fine of 500 rubles for each false document.

Therefore, in order to correctly fill out the certificate, it is necessary to update the available information on employees, which will help to avoid unnecessary financial costs.

This information may be considered unreliable:

- any details specified in the certificate that do not correspond to reality;

- errors when filling out;

- distorted information about financial indicators;

- errors in calculating personal income tax;

In order not to receive a fine for providing false data, it is necessary to update information about existing employees, and also carefully fill out all the required fields.

Due dates

The Tax Code of the Russian Federation specifies a period of no later than 90 days before the end of the year for which you need to report to the tax service.

In some situations there are more specific dates, namely:

| The tax return is sent no later than April 1 | The year following the reporting year |

| If a certificate is sent to process a deduction on an application | Then it must also be sent no later than April 1 |

| If a deduction is needed in an organization | Then you can submit a certificate throughout the year |

Failure to comply with the established deadlines will result in a fine, so there is no point in postponing this issue.

What you need to know

For late submission of documents to the organization, a fine of 200 rubles is imposed. for each certificate.

This is described in Art. 126 Tax Code of Russia. And then administrative responsibility appears, which is determined by the following actions:

- Failure to provide or provision, but not on time, of data to the tax office.

- Refusal to provide such data to the tax service without good reason.

- The information provided is distorted or incomplete.

Required terms

The abbreviation personal income tax stands for personal income tax. persons That is, from a certificate issued in form 2-NDFL, you can find out all the information about the income of a certain individual. faces.

A standard certificate must contain the following sections:

- Information about the employer - tax agent.

- All information regarding the employee.

- Income that is taxed, the amount of which is equal to 13%.

- Miscellaneous deductions.

- The amount of income for which the certificate is written.

Who rents

Tax agents are required to submit 2-NDFL certificates. That is, those companies and private entrepreneurs who pay income to individuals. persons.

Usually these are employers. Moreover, it is necessary to register a certificate for each employee who receives income.

Must report accrued or deducted tax:

- All companies that are residents of Russia.

- Private notaries.

- Lawyers who open their offices.

- Foreign divisions of large companies.

- Foreign organizations.

If foreign organizations have the status of isolated units, then 2-NDFL certificates are sent to the Federal Tax Service at their address.

There is no need to submit data by physical address. persons who receive income in such situations:

| Payments are made to employees | Those who are obliged to pay personal income tax themselves |

| Phys. the person received income | From which tax is not withheld |

Otherwise, the employer must submit a 2-NDFL certificate within the period of time specified by law.

Otherwise, he will be charged a fine for incorrect 2-NDFL in the amount of 500 rubles. for each certificate that contains incorrect passport data.

According to the Tax Code of the Russian Federation, companies must send documents to the tax service no later than 90 days after the end of the year for which they need to report.

Normative base

Personal income tax is paid in accordance with current legislation. There is a large regulatory framework that prescribes the amount of this tax.

The main document, which is the basis for paying the tax, is the order of the Federal Tax Service SAE-3-04/706 dated October 13, 2006. This order fully complies with the provisions that are present in paragraphs 2 and 3 of Art. 230 Tax Code of Russia.

The main provisions include the 2-NDFL certificate form, a document in electronic form, and the assignment of tax agents to notify in a timely manner of the impossibility of making a tax withholding.