Accounting for deferred income is considered when the income de jure does not relate to the period in which it was actually received or accrued. That is, it refers to some future period. We talk about accounting for future income.

First, about deferred income and what applies to them. According to the order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, which approved the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its application, deferred income is:

- income received (accrued) in the reporting period, but relating to future reporting periods;

- upcoming receipts of debt for shortfalls identified in the reporting period for previous years;

- the difference between the amount to be recovered from the guilty parties and the value of the valuables accepted for accounting when shortages and damage are identified.

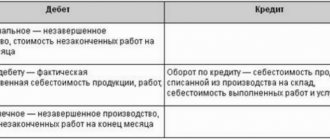

In relation to future income, postings are made using account 98 of the same name. It is passive (the balance is only on the loan) and synthetic.

Deferred income is reflected in detail, for example, in the following sub-accounts:

- 98-1 “Income received for future periods”;

- 98-2 “Gratuitous receipts”;

- 98-3 “Upcoming debt receipts for shortfalls identified in previous years”;

- 98-4 “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables”, etc.

In the balance sheet, the credit balance of account 98 as of the reporting date is reflected on line 1530.

The reflection of future income is especially relevant for:

- accounting for fixed assets and other property received free of charge;

- accounting of budgetary funds;

- expected revenues under the leasing agreement.

Difficulties in determining deferred income (DBP)

To a layman it may seem that determining future income is not difficult. For example, creditor organizations owe certain funds, the repayment deadline is already approaching, logic dictates that the money will come to the account. Does such profit relate to DBP? Or another example: an order has been received for a large batch of goods, which means they paid good money for it, is this DBP?

In fact, both of these examples do not illustrate deferred income in an accounting sense.

Accounting cannot count money that is still in prospect of being received; this contradicts the very meaning of accounting, which operates on already completed, and not at all possible, transactions.

In the first case, the income is only inferred; until the debt is paid, it cannot be entered into any accounting accounts. In the second example, ownership of the goods occurs at the moment of its transfer to the buyer (shipment), so that income will occur only after payment and transfer of ownership. There is no talk about future income. Such and similar situations do not fall under the purview of accounting, but within the sphere of planning.

Deferred income is the receipt of an asset or the reduction of a liability resulting from transactions in the current accounting period, but reflected in the statements of other periods that have not yet occurred.

What objects belong to the DBP

Profit received “in advance” can be attributed to several cases of receipt of income. The main feature by which this type of income can be classified as DBP is that it can, in full accordance with the law, be “stretched” over several accounting periods, that is, this asset will be used to generate profit not only now, but also in the future. .

NOTE! All incoming funds that are recommended by the DBP are specified in regulatory (methodological) documents. An accountant should not expand their list on his own.

Recommendations for DBP are presented in the following regulatory documentation:

- clause 9 of PBU 13/2000 “Accounting for state aid” – on accounting for targeted financing as a DBP;

- clause 29 of the Methodological Guidelines for the Accounting of Fixed Assets speaks of reflecting gratuitously received finances as a loan on the DBP account;

- clause 4 of the Instructions on the reflection of leasing operations in accounting - on the presentation of leasing differences as DBP;

- Chart of accounts for accounting financial and economic activities - about the presence of account 98, specifically designed to reflect DBP;

- Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 “On the forms of financial statements of organizations” - on the reflection of financial statements in the balance sheet in the section “Short-term liabilities”.

How do deferred income affect the calculation of net assets ?

- Rent. The lease agreement may provide for payment in advance for a certain time. A security deposit, which is paid at the beginning of the lease, but is offset for its last month, can also be recognized as deferred income.

- Advance payments are funds transferred under a contract for goods or services that have not yet been provided to the buyer (in advance) on account of subsequent payments. DBP will be recognized if the advance is made more than 1 accounting period in advance.

- Subscription (prepayment) to periodicals.

- Sale of tickets for various events, performances, performances.

- Revenue from subscriptions and long-term obligations , for example, income from the transportation of passengers who bought a “pass” for a quarter or a year, subscription fees for communication services, etc.

- Sponsorship "gifts". For a long time, gratuitous receipts provided for in the gift agreement were attributed to the period of receipt, and tax was also reflected and paid on this profit. But if we consider this asset as a long-term asset that will “work” for the company for several years, then it can quite legitimately be considered as deferred profit. This also includes grants received.

- Funds from the budget received to cover costs.

- Funds allocated for specific purposes that are not fully used (fund balances in account 86 “Targeted financing”).

- When leasing, the difference between the amount of lease payments and the cost of the property leased (it must be on the balance sheet of the recipient of the property).

- Probable return of previous shortages . If a loss has been incurred, it can be irrecoverable (when the guilty party has not been identified) or it can be attributed to accounts receivable (when the amount is planned to be collected from the financially responsible person). In the second case, payment of such a shortfall may also be considered DBP.

- Leasing difference. If the company is a lessor, then the difference between the value of the property leased and the total amount of lease payments is also recognized as DBP. In this case, it does not matter that the property is already on the balance sheet of the lessee.

FOR YOUR INFORMATION! If fixed assets are received as a gift in this way, then depreciation in future periods will not be charged for them (otherwise it would level out the “profit” from deferring profits for the future), but the transfer of part of the DBP to current expenses is recorded. Thus, the cost will not include depreciation, which in this case will act as a transfer of expenses incurred earlier.

Question: When they talk about future income in tax accounting, as a rule, they mean income that needs to be recognized (distributed) over several reporting (tax) periods. In what cases should income be distributed? View answer

Enter the site

RSS Print Category : Accounting Replies : 36

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (4) »

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 |

| on debt 98 the whole year hangs every month (=36703) from loan 92 in an equal amount ?? What could it be? and what should be attributed to the D 98 account? and what are the loan amounts 98?? |

| I want to draw the moderator's attention to this message because: A notification is being sent... |

| You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know. |

| AZA [e-mail hidden] Belarus, Minsk Wrote 17483 messages Write a private message Reputation: 1511 | #2[102087] March 17, 2010, 15:46 |

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise. I want to draw the moderator's attention to this message because:

Notification is being sent...

Life is not a test. If you made a mistake, live with the mistake.

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 | #3[102092] March 17, 2010, 15:51 |

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

so this is for 2009. I don’t know what the former accountant was up to here? but the situation is this: Balance according to Kt 98 as of 01/01/2009 = 1017362. so Then every month D98-Kt92 =36703 What to do??

I want to draw the moderator's attention to this message because:

Notification is being sent...

You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know.

| MiniBushka Belarus, Minsk Wrote 86 messages Write a private message Reputation: | #4[102094] March 17, 2010, 15:54 |

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

I don’t agree about the end of the year and the balance is equal to 0 on January 1, 2010 as of 01/01/2010 there may be a balance on account 98, it will be debited to account 92 monthly starting from January 2010 according to the procedure and deadlines established by the accounting of the enterprise

I want to draw the moderator's attention to this message because:

Notification is being sent...

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 | #5[102097] March 17, 2010, 15:56 |

PEOPLE HELP I want to draw the moderator's attention to this message because:

Notification is being sent...

You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know.

| AZA [e-mail hidden] Belarus, Minsk Wrote 17483 messages Write a private message Reputation: 1511 | #6[102099] March 17, 2010, 15:58 |

Minibushka, I agree that the balance at 98 can hang until 2014 and be written off in equal shares over 5 years according to Presidential Decree No. 1. I want to draw the moderator’s attention to this message because:

Notification is being sent...

Life is not a test. If you made a mistake, live with the mistake.

| nagelin Belarus, Minsk Wrote 110 messages Write a private message Reputation: | #7[102100] March 17, 2010, 15:59 |

This, for example, could be a posting to attribute to income the cost of freely received fixed assets in the amount of monthly depreciation.... I want to draw the moderator's attention to this message because:

Notification is being sent...

| MiniBushka Belarus, Minsk Wrote 86 messages Write a private message Reputation: | #8[102102] March 17, 2010, 16:00 |

Tatyana-M wrote:

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

so this is for 2009. I don’t know what the former accountant was up to here? but the situation is this: Balance according to Kt 98 as of 01/01/2009 = 1017362. so Then every month D98-Kt92 =36703 What to do?? As I understand it, these are exchange rate differences hanging on D 98. That's right, they are written off in Finnish. results monthly in the amount of at least 10% of the actual. s-s, but not more than the amount of exchange rate differences included in deferred income

I want to draw the moderator's attention to this message because:

Notification is being sent...

| MiniBushka Belarus, Minsk Wrote 86 messages Write a private message Reputation: | #9[102104] March 17, 2010, 16:02 |

Valentina wrote:

Minibushka, I agree that the balance at 98 can hang until 2014 and be written off in equal installments over 5 years according to Presidential Decree No. 1.

yeah, and you’re right, but you can’t write off all five years - here the accounting variation will be any specified there

I want to draw the moderator's attention to this message because:

Notification is being sent...

| Tatyana-M Belarus, * Wrote 3658 messages Write a private message Reputation: 233 | #10[102105] March 17, 2010, 16:03 |

MiniBushka wrote:

Tatyana-M wrote:

Valentina wrote:

At the end of the year, 98 had to be closed, the balance should have become 0. From January 1, 2010, according to Presidential Decree No. 1 - 98, the account does not participate in the revaluation of accounts receivable in foreign currency and currency in the accounts of the enterprise.

so this is for 2009. I don’t know what the former accountant was up to here? but the situation is this: Balance according to Kt 98 as of 01/01/2009 = 1017362. so Then every month D98-Kt92 =36703 What to do?? As I understand it, these are exchange rate differences hanging on D 98. That's right, they are written off in Finnish. results monthly in the amount of at least 10% of the actual. ss, but no more than the amount of exchange rate differences taken into account as part of deferred income, we cannot have exchange rate differences! oh woe is me..!!

I want to draw the moderator's attention to this message because:

Notification is being sent...

You must either have the intelligence to understand, or the rope to hang yourself!!! ******** If a person reproaches you for ingratitude, find out how much his service costs, pay him off and no longer have any relationship with him ********************* ******** Education does not lie in the amount of knowledge, but in the full understanding and skillful application of everything that you know.

« First ← Prev.1 Next → Last (4) »

In order to reply to this topic, you must log in or register.

Why allocate DBP

The matching principle that guides accounting states that income must be consistent with the expenses that generated the income. Sometimes a business receives assets, that is, income that is not specifically related to the current accounting period, because the expense is spread over a longer time. Theoretically, the funds could have been received over a long period, but they all arrived at once. In such situations, accountants prefer to report profit in an amount not exceeding the income of the current period, and transfer funds received that are not related to it to the DBP subaccounts.

Why do this, because you can immediately write down the entire asset received as profit? Yes, it is possible, but we should not forget that the amount of profit is directly proportional to the tax base. And if there is a legal opportunity to reduce it this year, why increase it by income that will only be used in the future?

EXAMPLE. The organization rents out real estate. She was paid rent for three years at once. The asset is there. If you record all of it in this year’s income, the amount of the income tax base will be increased. If you take into account only the payment for the current year as profit, then the remaining funds must be taken into account as DBP, reflecting them in the balance sheet of profit in the next two years, thus proportionally distributing the tax base.

Receiving fixed assets free of charge

Example

Astra LLC received a machine worth 500,000 rubles under a donation agreement. Such inventory items cannot be included in income immediately; income is recognized as they are used.

The useful life of the machine is set at 50 months.

Postings

| Dt | CT | Operation description | Sum | Document |

| 08 | 98 | Received a machine free of charge | 500000 | Transfer certificate |

| 01 | 08 | The machine is registered as OS | 500000 | Act OS-1 |

| 20 | 02 | Depreciation calculated for the month | 10000 | Accounting information |

| 98 | 91.1 | Income is recognized in the amount of monthly depreciation | 10000 | Accounting information |

Where are deferred income reflected?

Special account 98, which is called “Deferred Income,” is designed to reflect all types of deferred profits. The instructions for the Chart of Accounts allow you to open a number of sub-accounts for this account, specified by DBP objects:

- “income that will be received in future accounting periods”;

- “gratuitous receipts” – gifts, sponsorship, etc.;

- “future receipts for past shortfalls identified in earlier periods”;

- “the difference between the cost of recovery according to the balance sheet and the amount payable by the guilty party”, etc.

In the balance sheet, a special line 1530 is intended to account for this type of profit.

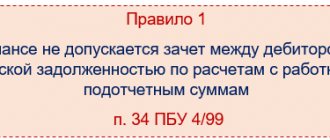

ATTENTION! It can reflect only those incomes that are recognized by the DBP in the regulatory documents of this organization.

What accounting data is used when filling out line 1530 “Deferred income” ?

Active or passive?

Are deferred receipts an asset or a liability when reflected on the balance sheet? Line 1530 reflects the item “DBP” as a balance sheet liability, despite the fact that it takes into account income.

The reason is that this line has a direct connection with another line, also related to the liability “Retained earnings (uncovered loss)”. It records the profit that the organization “owes” to its owners. But in practice, there are often situations when the debt to the owners has not yet arisen, but the money has already arrived on the balance sheet. For example, money was received as funding from the budget. They should be classified as “cash” assets. How to balance a liability? These are not retained earnings, because the organization has not yet done anything of what they were intended for, which means they have not yet become a profit. The profit from them is only in the future, so it is appropriate to include them in the liability line “Future income”. As this money is spent, that is, expenses are recognized, the amounts from the DBP liability will be transferred in parts to the Retained Earnings liability.

We carry out accounting

To reflect the DBP, the credit of account 98 “Deferred Income” and correspondent accounts are intended for accounting for finances and settlements with counterparties.

To write off amounts of income from future periods when this very “future” occurs, the debit of this account (98) is used, as well as the correspondence of the account in which the income was recorded (90 or 91, this determines the type of receipt).

Subaccounts that define a specific DBP object also provide for the corresponding correspondence:

- “Gratuitous receipts” – 08 “Investments in non-current assets”, 86 “Targeted financing” (loan 91 “Other income and expenses”);

- “Forthcoming receipts of debt for shortfalls for past periods” - 94 “Shortfalls from loss and damage to valuables”, 73 “Settlements with personnel for other operations”, subaccount “Reimbursement of material damage” (credit 91 “Other expenses”);

- “The difference in the amount of recovery from the perpetrator and the book value” - 73 “Settlements with personnel for other operations” (credit 91 “Other expenses”).

Expert opinion

Numerous experts and auditors note that in the event of controversial situations, the company should not have any problems. Thus, arbitration courts in most cases believe that the norms of Chapter 21 of the Tax Code of the Russian Federation do not determine the inclusion of expenses as expenses as a condition for the right to deduct VAT. That is why indicating costs in account 97 in the balance sheet does not create any obstacles to tax deductions. This is evidenced by the relevant arbitration practice - just read the numerous decisions of the FAS.

DBP inventory

IMPORTANT! A sample of filling out an inventory report for deferred income from ConsultantPlus is available here

For the adequacy of accounting for deferred profits, it is necessary to regularly inventory (check) this part of the balance sheet. The inventory includes:

- the correctness of attributing this type of profit specifically to future income;

- reconciliation of the correspondence of the amounts according to the “primary” (that is, whether they are reflected correctly in the documentation);

- clarification of how correct the reflection of funds is in relation to the accounting policies of this organization.