The simplified taxation system is a preferential regime for small businesses, allowing to significantly reduce the tax burden. You can switch to the simplified system within 30 days from the date of creation of the LLC or individual entrepreneur. In this article you will find a notification about the transition to the simplified tax system 2021 form 26.2-1 (sample filling) and the procedure for submitting it.

Free consultation on business registration

Notice deadline

Article 346.13 of the Tax Code of the Russian Federation allows a newly created organization and a registered individual entrepreneur to switch to a simplified system within 30 days after tax registration. In this case, the applicant is recognized as using the simplified form from the date of registration of the individual entrepreneur or LLC.

The clause was made specifically so as not to force taxpayers to report under the general taxation system several days before the transition to the simplified tax system. For example, an entrepreneur registered on January 15, 2021, but reported his choice only on February 10. He met the 30-day deadline, therefore he is considered to be applying the simplified taxation system from January 15, 2021. He is not required to report for the third quarter under OSNO.

You can submit an application to switch to the simplified tax system immediately along with other documents for state registration, however, if the tax inspectorates (registering and the one where the taxpayer will be registered) are different, then acceptance may be refused.

Just be prepared for such a situation; refusal to accept is not the arbitrariness of the tax authorities, but an unclear requirement of the Tax Code. In this case, you simply must submit Form 26.2-1 to the inspectorate where you were registered: at the registration of the individual entrepreneur or the legal address of the organization. The main thing is to do this within 30 days after registering the business.

If you do not immediately notify the Federal Tax Service about the transition, then the opportunity will appear only next year. So, if the individual entrepreneur from our example, registered on January 15, 2021, does not report this, he will work on the common system until the end of 2021. And from 2021, he will again receive the right to switch to a preferential regime, but this must be reported no later than December 31, 2021.

Read more: How to switch to the simplified tax system in 2021

Thus, you can notify the tax authorities of your choice either within 30 days from the date of registration of an individual entrepreneur/LLC or before December 31 in order to switch to the simplified tax system from the new year. An exception is made only for those working on UTII; they have the right to switch to simplified taxation during the middle of the year, but if they are deregistered as payers of the imputed tax.

For ease of doing business, paying taxes and insurance premiums, we recommend opening a bank account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

Project of a new form P14001

For several years now, the Federal Tax Service has been developing new registration application forms. Judging by the draft Order, the new form P14001 will be one and a half times larger - 74 pages instead of the current 51. The application, which includes requirements for filling out registration forms, is also impressive in its volume - 72 pages.

Discussions on new application forms have been ongoing for three years. Perhaps the Federal Tax Service will nevertheless reduce the number of pages in the forms and simplify the requirements for filling them out. In the meantime, you can get acquainted with what the new form P14001 will look like by downloading it from the link below.

Application on form P14001 (draft new form)

To which tax inspectorate should I report the transfer?

If you follow the letter of the law, then an application to switch to a simplified taxation system from the new year must be submitted to the inspectorate where the existing businessman is already registered with the tax authorities. This is indicated in paragraph 1 of Article 346.13 of the Tax Code of the Russian Federation.

But as to whether it is possible to submit a notification to the same Federal Tax Service where documents for state registration are submitted, it is not precisely stated. The fact is that in large cities and some regions special registration inspectorates have been created. So, in Moscow this is the 46th inspection, in St. Petersburg - the 15th. That is, documents for registration are submitted only to them, and are registered with the Federal Tax Service according to the registration of the individual entrepreneur or the legal address of the LLC.

In practice, tax authorities (the same 46th Moscow Federal Tax Service) accept applications for the simplified tax system without any problems when submitting documents for registration, but in some places, as we have already said, they require you to apply at the place of tax registration. In your particular case, it may well turn out that the inspectorate where you submit documents and which registers you for tax purposes will be the same. Then the question of choosing the Federal Tax Service simply does not arise. You can find out the inspection code on the tax service website.

45. Concept and procedure for submitting a tax returnTax return

is a written statement by the taxpayer about the objects of taxation, income received and expenses incurred, sources of income, tax base, tax benefits, calculated amount of tax and (or) other data serving as the basis for the calculation and payment of tax (clause 1 of article 80 of the Tax Code of the Russian Federation ).

The tax return is submitted

each taxpayer for each tax payable by this taxpayer, unless otherwise provided by the legislation on taxes and fees (paragraph 2, paragraph 1, article 80 of the Tax Code of the Russian Federation).

The calculation of the advance payment is a written statement by the taxpayer about the calculation base, the benefits used, the calculated amount of the advance payment and (or) other data serving as the basis for the calculation and payment of the advance payment. The calculation of the advance payment is presented in cases provided for by the Tax Code of the Russian Federation, in relation to a specific tax (paragraph 3, paragraph 1, article 80 of the Tax Code of the Russian Federation).

The calculation of the fee is a written statement by the payer of the fee about the objects of taxation, the taxable base, the benefits used, the calculated amount of the fee and (or) other data that serves as the basis for the calculation and payment of the fee, unless otherwise provided by the Tax Code of the Russian Federation. The calculation of the fee is presented in the cases provided for in Part 2 of the Tax Code of the Russian Federation, in relation to each fee (paragraph 4, clause 1, article 80 of the Tax Code of the Russian Federation).

The tax agent submits to the tax authorities the calculations provided for in Part 2 of the Tax Code of the Russian Federation. These calculations are presented in the manner established by Part 2 of the Tax Code of the Russian Federation, in relation to a specific tax (paragraph 5, paragraph 1, Article 80 of the Tax Code of the Russian Federation).

Tax returns are not subject to submission to the tax authorities.

(calculations), according to which taxpayers are exempted from the obligation to pay them due to the use of special tax regimes (clause 2 of Article 80 of the Tax Code of the Russian Federation).

In the absence of financial and economic activities, as well as in other cases provided for by the Tax Code of the Russian Federation, the taxpayer submits a tax return in a simplified form approved by the Ministry of Finance of the Russian Federation.

The tax return is submitted to the tax authority at the place of registration of the taxpayer (payer of the fee, tax agent) in the prescribed form on paper or electronically in accordance with the legislation of the Russian Federation. Taxpayers whose average number of employees as of January 1 of the current calendar year exceeds 100 people submit tax returns to the tax authority in electronic form, unless a different procedure for submitting information classified as state secret is provided for by the legislation of the Russian Federation. Tax return (calculation) forms are provided by tax authorities free of charge (Article 80 of the Tax Code of the Russian Federation).

Table of contents

How to fill out a notification

The form is one-page, easy to fill out, but certain points must be taken into account:

- If an application is submitted for the simplified tax system when registering an individual entrepreneur or organization, then the TIN and KPP fields are not filled in.

- Form 26.2-1 is signed personally by the entrepreneur or the head of the LLC. All other persons, including the founder, can sign the application only with a power of attorney, indicating its details. From experience, tax authorities accept the signature of the founder even without a power of attorney, but be prepared for disputes; it is still better to have the manager sign.

- Before choosing an object of taxation: “Income” or “Income minus expenses”, we advise you to get a free consultation or independently study the difference between these modes. It will be possible to change the object of taxation only from the new year

Free tax consultation

We provide a sample message about the transition to the simplified tax system when registering an individual entrepreneur; for an LLC it is filled out in the same way.

1. The first cells (TIN and KPP) are filled in by already existing organizations that are changing the tax regime. Newly created companies and individual entrepreneurs put dashes here.

2. Next, indicate the code of the tax authority and the identification of the taxpayer:

- 1 – when submitting form 26.2-1 along with documents for registration;

- 2 – if you report the choice of a simplified form in the first 30 days from the date of registration or deregistration under UTII;

- 3 – when working businessmen switch from other regimes.

3. Enter the full name of the individual entrepreneur or the name of the organization.

4. Indicate the code for the date of transition to the simplified tax system:

- 1 – when choosing a simplified system from the beginning of next year;

- 2 – from the date of registration of a new company or individual entrepreneur;

- 3 – from the beginning of the month of the year when the UTII payer is deregistered.

5. Select the tax object code:

- 1 – for “Income”;

- 2 – for “Income minus expenses”.

Please enter the year of notification below. Fields with the amounts of income for the previous 9 months and the cost of fixed assets are filled in only by operating organizations.

6. In the lower left field, enter the applicant’s data by selecting its characteristic:

- 1 – personally an entrepreneur or director of an LLC;

- 2 – representative submitting by proxy.

In the second case, you need to enter the name and details of the power of attorney. In addition, the full name of the director or representative is indicated; the full name of the entrepreneur in the lower left field is not duplicated.

7. All that remains is to enter the applicant’s phone number and filing date. The remaining free cells are filled with dashes.

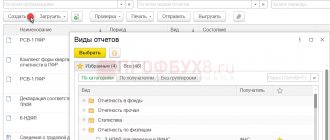

To simplify the preparation of the notification, you can fill it out in our service. Just follow the system prompts and you will receive an example document with your data, edit it if necessary. All you have to do is print out the entire package of documents and submit it to the Federal Tax Service.

Create documents

Usually two copies of the notification are enough, one remains with the inspector, the second is given with a mark of acceptance, it must be kept as confirmation of the choice of the simplified tax system. In practice, some of our users report that they are asked to provide three copies, so we recommend that you carry an additional copy of the notice with you.

How to make sure that you are really registered as a payer of the simplified system? The letter of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3/829 contains the form of an information letter (No. 26.2-7), which the tax inspectorate is obliged to send to the taxpayer upon his request. The letter confirms that the businessman submitted a notice of transition to the simplified tax system. There is no particular need for confirmation; a second copy of the application with an inspector’s mark is sufficient, but some counterparties may request such an official response when concluding transactions.

Tax Code of the Russian Federation. Chapter 13

1. A tax return is a written statement by the taxpayer about the objects of taxation, about income received and expenses incurred, about sources of income, about the tax base, tax benefits, about the calculated amount of tax and (or) about other data that serves as the basis for the calculation and payment of tax .

A tax return is submitted by each taxpayer for each tax payable by that taxpayer, unless otherwise provided by the legislation on taxes and fees.

The calculation of the advance payment is a written statement by the taxpayer about the calculation base, the benefits used, the calculated amount of the advance payment and (or) other data serving as the basis for the calculation and payment of the advance payment. The calculation of the advance payment is presented in the cases provided for by this Code in relation to a specific tax.

The calculation of the fee is a written statement by the payer of the fee about the objects of taxation, the taxable base, the benefits used, the calculated amount of the fee and (or) other data that serves as the basis for the calculation and payment of the fee, unless otherwise provided by this Code. The calculation of the fee is presented in the cases provided for in part two of this Code in relation to each fee.

The tax agent submits to the tax authorities the calculations provided for in Part Two of this Code. These calculations are presented in the manner established by part two of this Code in relation to a specific tax.

2. Tax returns (calculations) for those taxes for which taxpayers are exempt from the obligation to pay them due to the application of special tax regimes are not subject to submission to the tax authorities.

A person recognized as a taxpayer for one or more taxes, who does not carry out transactions that result in the movement of funds in his bank accounts (at the organization’s cash desk), and who does not have objects of taxation for these taxes, represents a single (simplified) tax assessment for these taxes. declaration.

The form of a single (simplified) tax return and the procedure for filling it out are approved by the Ministry of Finance of the Russian Federation.

A single (simplified) tax return is submitted to the tax authority at the location of the organization or place of residence of the individual no later than the 20th day of the month following the expired quarter, half-year, 9 months, or calendar year.

3. The tax return (calculation) is submitted to the tax authority at the place of registration of the taxpayer (fee payer, tax agent) in the established form on paper or in the established formats in electronic form along with documents that, in accordance with this Code, must be attached to the tax return (calculation). Taxpayers have the right to submit documents that, in accordance with this Code, must be attached to the tax return (calculation), in electronic form.

The provisions of paragraph two of paragraph 3 of Article 80 of this Code (as amended by Federal Law No. 268-FZ of December 30, 2006) apply until January 1, 2008 in relation to taxpayers whose average number of employees for 2006 exceeds 250 people

Taxpayers whose average number of employees for the previous calendar year exceeds 100 people, as well as newly created (including during reorganization) organizations whose number of employees exceeds the specified limit, submit tax returns (calculations) to the tax authority in established formats in electronic form, unless a different procedure for presenting information classified as state secret is provided for by the legislation of the Russian Federation.

Information on the average number of employees for the previous calendar year is submitted by the taxpayer to the tax authority no later than January 20 of the current year, and in the case of creation (reorganization) of an organization - no later than the 20th day of the month following the month in which the organization was created (reorganized) . The specified information is submitted in a form approved by the federal executive body authorized for control and supervision in the field of taxes and fees to the tax authority at the location of the organization (at the place of residence of the individual entrepreneur).

Paragraph four of paragraph 3 of Article 80 of this Code (regarding the provision of all tax returns (calculations) at the place of registration as the largest taxpayers) comes into force on January 1, 2008.

Taxpayers, in accordance with Article 83 of this Code, classified as the largest taxpayers, submit all tax returns (calculations) that they are required to submit in accordance with this Code to the tax authority at the place of registration as the largest taxpayers in the established formats in electronic form, if a different procedure for presenting information classified as state secret is not provided for by the legislation of the Russian Federation.

Tax declaration (calculation) forms are provided by tax authorities free of charge.

4. A tax return (calculation) can be submitted by a taxpayer (payer of a fee, tax agent) to the tax authority in person or through a representative, sent by mail with a list of the contents, or transmitted via telecommunication channels.

The tax authority does not have the right to refuse to accept a tax return (calculation) submitted by a taxpayer (fee payer, tax agent) in the established form (established format), and is obliged to mark, at the request of the taxpayer (fee payer, tax agent) on a copy of the tax return (copy of calculation ) a mark of acceptance and the date of its receipt upon receipt of a tax return (calculation) on paper, or transfer to the taxpayer (payer of the fee, tax agent) a receipt of acceptance in electronic form - upon receipt of a tax return (calculation) via telecommunication channels.

When sending a tax return (calculation) by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment. When transmitting a tax return (calculation) via telecommunication channels, the day of its submission is considered the date of its dispatch.

The procedure for submitting a tax return (calculation) and documents in electronic form is determined by the Ministry of Finance of the Russian Federation.

5. The tax return (calculation) is submitted indicating the taxpayer identification number, unless otherwise provided by this Code.

The taxpayer (fee payer, tax agent) or his representative signs the tax return (calculation), confirming the accuracy and completeness of the information specified in the tax return (calculation).

If the accuracy and completeness of the information specified in the tax return (calculation) is confirmed by an authorized representative of the taxpayer (fee payer, tax agent), the tax return (calculation) indicates the basis of the representation (the name of the document confirming the authority to sign the tax return (calculation). In this case, a copy of the document confirming the authority of the representative to sign the tax return (calculation) is attached to the tax return (calculation).

6. The tax return (calculation) is submitted within the time limits established by the legislation on taxes and fees.

7. Forms of tax declarations (calculations) and the procedure for filling them out are approved by the Ministry of Finance of the Russian Federation, unless otherwise provided by this Code.

Formats for submitting tax returns (calculations) in electronic form are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, based on the forms of tax returns (calculations) and the procedure for filling them out, approved by the Ministry of Finance of the Russian Federation.

The Ministry of Finance of the Russian Federation does not have the right to include in the tax return (calculation) form, and tax authorities do not have the right to require taxpayers (payers of fees, tax agents) to include in the tax return (calculation) information not related to the calculation and (or) payment of taxes and fees, except:

1) type of document: primary (corrective);

2) name of the tax authority;

3) location of the organization (its separate division) or place of residence of an individual;

4) last name, first name, patronymic of an individual or full name of the organization (its separate division);

5) contact telephone number of the taxpayer.

8. The rules provided for in this article do not apply to the declaration of goods transported across the customs border of the Russian Federation.

9. The specifics of submitting tax returns when implementing production sharing agreements are determined by Chapter 26.4 of this Code.

Federal Law No. 265-FZ of December 30, 2006 supplemented Article 80 of this Code with paragraph 10, which comes into force on March 1, 2007.

10. The specifics of fulfilling the obligation to submit tax returns by paying a declaration payment are determined by the federal law on the simplified procedure for declaring income by individuals.