Payments to an employee upon dismissal by agreement of the parties are made in full on the day of resignation. This basis for terminating mutual obligations is peaceful in nature and allows, with minimal risks, to part with employees who dealt with information that constitutes a commercial secret, as well as with those with whom management has conflicting relationships.

This type of dismissal is difficult to challenge. But in order to reduce the risk of adverse consequences, the management of the enterprise needs to correctly draw up the documentation accompanying the process and act within the framework of the law. An important point in any dismissal is the calculation. For failure to timely pay a quitter the money he is due, the employer may be held liable, including financial liability for each day of delay. To avoid negative consequences, you should make a settlement with the employee upon termination of the contract by agreement of the parties, guided by the norms of labor legislation.

Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question

free of charge To solve your problem, call: You can also get a free consultation online.

Who pays severance pay upon dismissal?

An employer - a legal entity is obliged to guarantee the payment of severance pay to dismissed employees, except for the grounds for dismissal listed in the law.

Question: How to include a provision for severance pay upon dismissal in an employment contract, including by agreement of the parties? View answer

If the employer is a private entrepreneur , then the issue of payment of severance pay remains at his discretion. These points are discussed during hiring and must be reflected in the employment contract. If the main document, which is intended to regulate the concluded labor relations, does not address this issue, the dismissed person may be left without severance pay, and this will be legal.

Question: Is severance pay subject to personal income tax upon dismissal in connection with the liquidation of an organization, reduction in the number or staff of employees in the amount established by Art. 178 of the Labor Code of the Russian Federation (clause 3 of Article 217 of the Tax Code of the Russian Federation)? View answer

Holding a meeting of founders

If the party agrees to the dismissal proposal, negotiations are organized to determine the terms of termination of the contract. Since in this case the regulations do not establish notice periods, dismissal is often carried out on the same day.

Since hiring a general director is the prerogative of the company’s founders, the issue of dismissing the director is also within their competence.

It should be noted that if there are several participants in the LLC, then they will have to make the decision to dismiss the manager together, and draw up the appropriate protocol. If the organization has one founder, then the decision is simply drawn up by him alone.

Download a sample protocol of the general meeting of founders on the dismissal of a director by agreement of the parties

Dismissals with benefits

When a dismissal order is issued, it indicates the basis for releasing the employee from his position and the corresponding article of the Labor Code. Each reason has its own procedure for terminating employment agreements, which in many cases includes the accrual of “severance” benefits. It is based on the following grounds:

- liquidation of an enterprise, organization, firm;

- reduction in staff or numbers;

- professional unsuitability for medical reasons (if there is no other suitable vacancy or the employee’s desire to take it);

- complete loss of ability to work (according to a medical report);

- reluctance to continue working in changed working conditions;

- disagreement with transfer to another location following the employer;

- conscription into the army or substitute service;

- leaving maternity position;

- cancellation of an incorrectly drawn up employment contract;

- vacating a position for an employee who previously occupied it, who was wrongfully dismissed and reinstated by a court decision or labor inspectorate.

NOTE! Severance pay is available to almost any employee forced to leave their position, as long as they are in compliance with the law and the provisions of the employment contract.

Necessary conditions for dismissal by agreement of the parties

The legislator did not pay much attention to the termination of the employment agreement and the termination of mutual obligations for this reason, limiting itself to the wording of the grounds in part 1 of Article 77 and Article 78 of the Labor Code of the Russian Federation. However, the dismissal procedure and the actions of the parties should not go beyond the norms of labor legislation. An employee’s rights cannot be infringed, and the company’s management has no right to put pressure on a resigning employee.

The legislator regulates freedom of labor relations, and it is on this principle that termination of a contract by agreement is based. This type of dismissal can only be used by mutual agreement. This is the only mandatory condition for concluding an agreement. Otherwise, the parties act in accordance with established business customs in this area.

The agreement itself is characterized by written form. This is due to the fact that the termination of the contract must be carried out in the same way as its conclusion. The legislation does not establish requirements for the content of the document confirming dismissal for this reason, but the agreement must necessarily reflect aspects that will allow it to be characterized precisely as an act of termination of mutual obligations on the basis of Art. 78 Labor Code of the Russian Federation.

Other actions accompanying the dismissal process, whether agreed upon with or without payment of compensation, also need to be documented in order to avoid negative consequences for the participants. Thus, the management of the organization must:

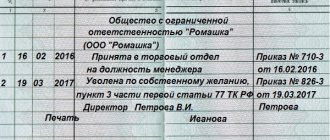

- Record the fact of resignation by the employee in the order.

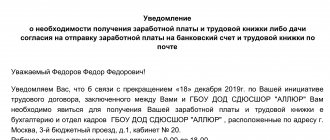

- Formalize the payment of funds using a calculation certificate.

- Make an entry in the work book in accordance with legal requirements.

- Fill out the employee's personal card.

It is also recommended to document negotiations, especially if the employee holds a serious position. The progress of the process of discussing the terms of resignation and its results are reflected in the minutes. All completed documentation will help to argue your position if litigation arises in the future.

Managers also quit

And, accordingly, they have the right to an honestly deserved severance pay, but only on the condition that there are no illegal actions on their account or they did not make decisions that negatively affected the finances of the enterprise. In what cases are labor benefits accrued to top managers:

- if they are removed from office by the decision of the founders without any guilt (clause 2 of Article 278 of the Labor Code of the Russian Federation);

- the boss, his deputy, the chief accountant, whom the new owner of the business decided to fire.

FOR YOUR INFORMATION! If, by a court decision, a person (whether a manager or an ordinary employee) has been prohibited from engaging in certain types of activities, then, upon leaving this position, he also has the right to a “severance” payment.

Is it possible to fire an employee without written consent?

The agreement to terminate the employment contract must be drawn up and signed under the condition of voluntariness.

The Labor Code of the Russian Federation does not establish in what form the agreement reached should be recorded. Therefore, an oral form of agreement between the employee and the employer is allowed, or it can be drawn up in writing.

In the first case, it is best for the parties to reach an agreement in the presence of witnesses in order to avoid further disputes and disagreements.

If the document is drawn up on paper, the employee’s signature must be present on it. This option is safer for management, as it allows you to prove the existence of this agreement.

Attention! Based on the above, an employee can be fired without his written consent, but only if a verbal agreement has been established with him.

Who will be left without benefits?

There are several reasons why those being laid off are not legally required to pay severance pay. In most cases, they imply the own will or the guilty actions of the dismissed employee. The exception is short-term contracts.

These grounds do not imply corresponding payments:

- care according to one’s own desire (clause 3. part 1 of article 77 of the Labor Code);

- the employee failed to complete the probationary period (Part 1 of Article 71 of the Labor Code);

- agreement of the parties;

- initiative of the employer, if the misconduct of the dismissed person provides for an extreme measure of administrative liability (Article 81 of the Labor Code);

- inconsistency with the position held by the employee;

- when a contract concluded for 2 months or less comes to an end.

What amounts can you expect?

The amount of accrued severance pay is calculated in accordance with the following factors:

- Average monthly earnings.

- The number of days in the compensated period, excluding weekends and holidays.

- Territorial location of the enterprise.

ATTENTION! Since the essence of this payment is support in the first two months of new employment, only working days are taken into account. The more weekends and holidays there are in the compensated month, the less the benefit will be.

Payment can be made for a period of 2 weeks, a month or 90 days after dismissal.

Salary for 14 days is due to the following categories of dismissed:

- upon dismissal due to medical reports;

- conscripted into the armed forces;

- if you refuse to move to a new location if the organization moves there;

- when a former employee is reinstated;

- if you are unwilling to work in changed conditions;

- “conscripts” during which the enterprise is liquidated or its staff is reduced.

Earnings for 1 month are based on:

- upon cancellation of employment contracts executed with certain violations;

- upon complete dismissal due to the cessation of the organization's existence.

3 monthly salaries will be received by:

- managers, their deputies and chief accountants who leave their positions by decision of business owners.

IMPORTANT! The employee will be paid the amount of average earnings for another 2 months after hour X, if during this time he fails to find a new job. In some situations, the Employment Service decides to extend the payment for another 1 month (if the dismissed person applied to this body within 14 days and did not find a job after 2 months).

Some regions of Russia are in special conditions, for example, the Far North and areas equivalent to this region. If the enterprise from which the employee leaves is located in a similar zone, then all payments are calculated differently, for example, the period for maintaining wages during the job search period can be increased to six months (Article 318 of the Labor Code of the Russian Federation).

To calculate labor benefits, it is enough to calculate the average daily salary and multiply it by the number of days subject to compensation.

Examples of calculating labor benefits

- The LLC where S.M. Galuzinsky worked is being liquidated. The employee earned 8,000 rubles. per month. We calculate the average earnings per day: the number of working days for the year was 220, multiply the salary by 12 months and divide by the number of days worked: 8000X12/220 = 436.36 rubles. The basis for dismissal involves the accrual of S.M. Galuzinsky. amounts equal to one average monthly salary. Next month there will be 20 working days (no holidays). Thus, Galuzinsky S.m receives 436.36X = 8727 rubles.

- Salary of Denisova V.A. – 10,000 rub. per month On January 11, 2016, she was fired due to staff reduction. For the previous accounting year, she had 249 working days, she earned 12x10,000 = 120,000 rubles, which means an average of 120,000/249 = 481.9 rubles per day. Next month (from January 12 to February 12, 2021) there will be 23 paid days. January 11 Denisova V.A. received severance pay in the amount of 23X481.9 = 11083 rubles. A week later, she contacted the Employment Center, but she was unable to get a job by February 12, and benefits were awarded to her again. From February 12 to March 12, 21 days without days off, minus March 8, so she is entitled to 20x481.9 = 9638 rubles for this period. If she had not involved the Employment Service or registered after January 24, this payment would have been her last. In the work book of Denisova V.A. There was no record of a new place of work for the next month either. Since she contacted the Employment Service on time, she is entitled to one more, final financial assistance. In the third billing month (from March 12 to May 12, 2016) there are 19 working days (except Saturdays and Sundays, May holidays are also excluded). Denisova V.A. will receive 19X481.9 = 9156 rubles. She is not entitled to any more payments.

IMPORTANT INFORMATION! The Labor Code of the Russian Federation provides a minimum of guaranteed financial support for those who have lost their jobs. The amount of the benefit may be revised upward if such a possibility is noted in the collective agreement or local regulations of a particular enterprise.

What about tax payments?

This payment, received on the last working day, constitutes the income of an individual, but such income, as Art. 217 of the Tax Code of the Russian Federation, is not subject to income tax if the amount is accrued in the amount established by law. Insurance and pension contributions for the amount of benefits specified in the Labor Code are also not made.

If an enterprise, by its own will, enshrined in the relevant documentation, increases the minimum payable prescribed by law, then the excess is subject to taxation. Insurance premiums and personal income tax will have to be paid on the amount that exceeds the usual payments.