When a legal entity buys any vehicle and puts it on the balance sheet of the enterprise, it is obliged to pay taxes on it to the budget. Consequently, the question arises for the owner: how to correctly take into account, reflect on accounts, calculate the tax base and declare current expenses with the vehicle that are in addition to tax fees.

To avoid fines, penalties and arrears, the owner of the enterprise needs to know when it is necessary to pay the fee and at what discount rate, including in what cases it is possible to reduce the calculated income tax base due to paid contributions in order to save the organization money. Let's go into more detail later.

Transport tax for organizations from 2021

Transport tax for legal entities refers to regional types of tax payments and is regulated at the federal level (Chapter 28 of the Tax Code), as well as local (regulatory legal acts of the authorities of the constituent entities of the Russian Federation). In accordance with stat. 356 of the Tax Code, regions approve TN rates, terms of payment, benefits and legal grounds for their application. In this case, the restrictions provided for by the Tax Code must be taken into account.

Who exactly is recognized as the taxpayer of this tax? According to stat. 357 of the Tax Code, transport tax for organizations is obligatory for payment if they own vehicles registered in the generally established order. Objects subject to taxation are listed in stat. 358. In particular, these are cars and trucks, motorcycles, buses of various sizes, boats, airplanes and helicopters, and other self-propelled vehicles of land, air and water types (clause 1 of Article 358). The list of non-taxable objects is given in paragraph 2 of the statute. 358.

Timely calculation of transport tax for legal entities is carried out separately for each object registered in the name of the owner (clause 2 of Article 362). Enterprises, unlike individuals, accrue TN on their own, including advance amounts. If the regional authorities do not approve reporting periods in a particular subject of the Russian Federation, the car tax is transferred to the budget in a single amount at the end of the year. Moreover, in accordance with the Tax Code, the tax period is a year (calendar), and the reporting period is quarters (stat. 360).

Will the transport tax for legal entities change in 2021? At the moment, there are no global innovations observed. No one canceled the TN, and the replacement with another fee also did not take place. As before, regional authorities are in charge of administration, approving final rates and payment deadlines. However, some innovations were nevertheless adopted by officials. The changes will affect owners of prestigious expensive cars worth 3-5 million rubles. The size of the increasing coefficient for them is set at a minimum level of 1.1 (stat. 362 of the Tax Code as updated by Law No. 355-FZ of November 27, 2017). Currently, the coefficient is 1.1, 1.3, 1.5.

Another change applies to the tax return form for TN, which was approved by the Federal Tax Service in Order No. ММВ-7-21/668 dated 12/05/16. The document was adopted in 2021, but in practice all legal entities are required to submit a new form when submitting information for 2021. Sections about payments to Platon, lines about the year of manufacture of the vehicle, information about the registration of the object and/or deregistration from state registration have been added to the form.

The procedure for calculating the state fee

When calculating the tax, all formula variables and the resulting result are rounded to full rubles. This rule is the same for all business entities and is stated in Federal Law No. 248-FZ of July 23, 2013 (as amended on April 2, 2014) “On Amendments to Parts One and Two of the Tax Code.” Tax calculation for one unit of transport is carried out using the standard formula:

TN = MD x NS x (KMV / 12), where:

- TN - transport tax;

- MD - engine power;

- NS - tax rate;

- KMV - the number of months of vehicle ownership per calendar year.

Legal entities that own several vehicles pay tax on all units, and the amounts for each unit of transport are added up. For expensive units, a multiplying factor is applied, which is included in the formula when calculating through multiplication. Business entities pay transport tax in two stages: advance payment and main payment. At the regional level, deadlines for fulfilling obligations to pay transport tax are provided; for advance and main payments, deadlines are set independently. In this case, the advance payment is charged for the quarter, made before the end of the tax period, and the main payment is made after. Regional authorities can fix the payment of tax in a single payment, without an advance payment.

An example of calculating transport tax for a legal entity

The Promtorg enterprise in the Tula region owned a new car, purchased and registered in April 2021, which was alienated and deregistered in December of the same year.

The power of this transport was 200 hp, the regional rate, according to the Law of the Tula Region No. 343-ZTO dated November 28, 2002 “On Transport Tax,” was equal to 50 rubles. per unit of power. The cost of the car was 4.5 million rubles. Actual ownership of the car was 9 months. Thus, for the reporting period, a legal entity will have to pay a tax in the amount of 200 x 50 x (9 / 12) x 1.5 = 11,250 rubles, where 1.5 is the increasing factor. The advance payment required for this enterprise will be ¼ of the calculated amount and will be equal to 2812.5 rubles.

There are preferential categories among transport tax payers. The list of beneficiaries is determined in the Tax Code of the Russian Federation, and may additionally include categories specified by regional legislation. For example, in Moscow, preferential taxation is applied to business entities if they transport goods and passengers, but this benefit does not apply to taxis.

Transport tax - tariffs

The final tariff rates are adopted by regional authorities, taking into account the maximum/minimum restrictions under stat. 361. An increase in tariffs for certain types of vehicles in the Leningrad region has already been approved. and St. Petersburg, Ulyanovsk region, Arkhangelsk, Kirov and Kostroma. To know exactly how to calculate transport tax for legal entities, you need to clarify the interest rate for vehicles registered to the company. In this case, information is taken from the current version of the regional law.

Where to pay transport tax for legal entities

Transfer of TN based on the results of the year and quarters (in case of approval of reporting periods in a separate subject of the Russian Federation) is carried out to the regional budget at the address of the vehicle location (clause 1 of Article 363). The last address for all means of transportation, except for water ones, is the address of the location of the enterprise or OP (Article 83). If an organization is obligated to pay advances under the Taxpayer Agreement, such amounts reduce the total tax for the year.

The timing of the transfer of transport fees is regulated by the regions of the Russian Federation. In this case, the final payment date cannot be approved in the subject earlier than February 1 of the next year (clause 1 of Article 363). Here is a link to the stat. 363.1, which discusses the procedure for submitting a declaration. Accordingly, in the region, the deadline for transferring TN should not be set earlier than the date of filing the declaration, that is, earlier than February 1 (clause 3 of Article 363.1).

Bid

As already mentioned, transport tax is a regional tax, so the rate in each subject of the Russian Federation is different. But at the same time, the law sets a limit on the tax rate, in relation to which it can be either more or less, but not more than 10 times.

Each type of vehicle has its own specific rate, which, by decision of the constituent entities of the Russian Federation, can be changed no more than 10 times.

Also, differentiated rates may be applied to the vehicle, the amount of which depends on the type, age and economic class of the vehicle.

For example, for a passenger car over 3 years old the rate is 40 rubles per 1 hp, and for a passenger car less than 3 years old the rate will be 25 rubles per 1 hp. (example with fictitious numbers).

Transport tax for legal entities – payment deadlines in 2018

As a rule, the deadlines for transferring TN for reporting periods are approved before the last day of the next calendar month. For example, in the Rostov region. advances for the 1st, 2nd and 3rd quarters must be paid before 05/03/18, 07/31/18, 10/31/18. Moreover, if the last date of the month falls on a weekend or official holiday, the payment date is shifted to the first working day.

The final payment for TN for 2021 must be made by legal entities no earlier than 02/01/18. The deadlines adopted by the regional authorities are mandatory for all taxpayers. In case of violation, penalties are charged on the amount of arrears in accordance with the requirements of tax legislation for each day of delay. How is transport tax calculated for legal entities? More on this below.

Calculation of transport tax for legal entities

The procedure for calculating TN and advances is defined in stat. 362 NK. For the calculation, indicators of the tax base of the transport facility and the current rate in the region are taken. Additionally, the values of the increasing coefficient and the coefficient of actual vehicle ownership for the tax period are taken into account. The general calculation formula is as follows:

TN = NB x St in % x PovK x FactK, where:

TN - transport tax,

NB – facility power in liters. With. (for auto),

St. in % - the rate for the object in %, valid in the region,

PovK - increasing coefficient for premium cars according to clause 2 of the stat. 362,

FactK – coefficient of actual vehicle ownership for the tax period. Calculated according to the rules of clause 3 of stat. 362.

If an enterprise has several vehicles, the tax is determined separately for each. The results of the calculations are presented to the Federal Tax Service at the place of registration of the car owner in the form of a declaration for the tax period, that is, the calendar year.

How to calculate transport tax for legal entities and keep records?

Transport tax is calculated separately for each vehicle that is on the balance sheet, as follows:

- Tax rate*Tax base

Where, to calculate the tax base, engine power, jet thrust and other characteristics that affect the size of the contribution are taken into account.

With an advance payment system, this amount is divided by 4.

When registering or withdrawing during the reporting period (year - for “non-advance" and quarter - for the advance system), an adjustment factor is applied according to the formula, which reduces the amount of payment (must be subtracted from the first amount):

- Number of months of vehicle registration/Number of months of tax period

The resulting calculation must be reflected as a debit on the 68th account of the balance sheet, however, the correspondence will depend on many factors: participation of the vehicle in commercial activities, leasing, degree of participation in production and others. Accordingly, whether the vehicle will relate to the main activity or will be included in other expenses depends on what accounting entry will be made by the employee involved in economic and financial accounting. Or the owner will do it himself.

- Debit 20 – Credit 68 (accrual);

- Credit 68 – Debit 51 (payment).

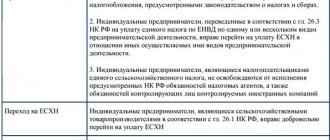

In order to take into account the accrued tax as expenses to receive a benefit when paying income tax, you must record all expenses on the vehicle using documents (certificates, checks, etc.) and prove that they were related to the receipt of commercial income. The benefit is provided for the tax period when the tax was actually accrued or paid to the state. This applies to organizations using a simplified taxation system of income minus expenses. For the single income tax and UTII, this rule does not work due to the peculiarities of the taxation systems.

Does the individual entrepreneur pay transport tax?

Often, in their business activities, businessmen use their own transport. In this case, who is obliged to pay the TN state – an entrepreneur or a citizen? To understand the issue, you need to carefully study the registration documents for the object. Since when registering a car, the certificate indicates an individual and not an individual entrepreneur, an ordinary person also becomes a taxpayer. Consequently, the entrepreneur pays property taxes, including transport and land taxes, on behalf of the citizen, without indicating the legal status of the individual entrepreneur.

Conclusion - we looked at how transport tax is paid by legal entities in accordance with legal requirements. To remain a bona fide taxpayer, an organization must independently calculate and pay the car tax according to the rates and deadlines accepted in the region. In case of violations of regulations, administrative and tax penalties may be applied to the enterprise.