Accounting for business situations

Payments to staff

Salary

Salary to owners or managers of the organization

The powers of the head of the organization are limited for the duration of the bankruptcy, and part of the management functions is transferred to the arbitration manager appointed by the court (Article 45 of the Law of October 26, 2002 No. 127-FZ).

For performing the duties of an arbitration manager, he is entitled to a remuneration consisting of a fixed amount and a variable amount (interest).

The fixed part of the remuneration is assigned in the following amounts:

- administrative manager - 15,000 rubles per month;

- temporary and bankruptcy manager - 30,000 rubles per month;

- external manager - 45,000 rubles per month.

The court has the right, based on the decision of the meeting of creditors, to increase the fixed amount of remuneration (clauses 3 and 5 of Article 20.6 of the Law of October 26, 2002 No. 127-FZ).

The amount of interest on the arbitration manager's remuneration depends on the size of the book value of the organization's assets. In paragraphs 10-13 of Art. 20.6 of the Law of October 26, 2002 No. 127-FZ establishes the interest rates. The book value of the organization's assets should be determined as of the last reporting date preceding the start of the bankruptcy procedure (Clause 14, Article 20.6 of the Law of October 26, 2002 No. 127-FZ). Interest on remuneration to the arbitration manager should be paid within 10 calendar days from the date of completion of the bankruptcy procedure (clause 9, article 20.6 of the Law of October 26, 2002 No. 127-FZ).

The remuneration is paid at the expense of the organization’s property out of turn established to satisfy the claims of creditors (clause 2 of article 20.6, clause 1 of article 59 of the Law of October 26, 2002 No. 127-FZ).

The remuneration accrued to the arbitration manager is not wages, since he is not a full-time employee of the organization. When calculating remuneration, you should use account 76 Settlements with other debtors and creditors and write it off as expenses for ordinary activities. This operation is reflected by the following transaction:

- Debit 26 (44) Credit 76

- remuneration to the arbitration manager has been accrued.

An arbitration manager can only be a Russian citizen registered as an entrepreneur (Clause 1, Article 20 of Law No. 127-FZ of October 26, 2002), therefore he is obliged to independently pay personal income tax and insurance premiums from the income received. Contributions for insurance against accidents and preventive diseases are subject to only amounts paid to employees working under employment contracts (Clause 1, Article 5 of Law No. 125-FZ of July 24, 1998).

The procedure for calculating other taxes depends on what taxation system the organization uses.

The organization applies a general taxation system

When calculating income tax, the amount of remuneration should be included in other expenses related to the management of the company (clause 1.18 of Art. Tax Code of the Russian Federation, letter of the Ministry of Taxes of Russia dated May 7, 2004 No. 04-3-01/265).

Remuneration to the arbitration manager is classified as indirect expenses. Therefore, if an organization calculates income tax using the accrual method, the amount of remuneration must be fully attributed to the expenses of the current month (clause 1.1 of Article of the Tax Code of the Russian Federation). With the cash method, it should be taken into account on the day of payment (Clause 3 of Article of the Tax Code of the Russian Federation).

The organization applies the simplified tax system

Accounting for expenses occurs depending on the selected tax object:

- income minus expenses - remuneration to the arbitration manager is not included in the costs that reduce the tax base; expenses for external management of the organization are not included in the closed list of expenses (Clause 1 of Article of the Tax Code of the Russian Federation);

- income - payment of remuneration to the arbitration manager does not affect the amount of tax. Expenses for the payment of remuneration cannot be excluded from the tax amount, and the organization does not charge insurance premiums for it (clause 2 of Art.

The arbitration manager wants to recover his costs and remuneration from the applicant in the bankruptcy case

The financial manager wants to get paid

1. The arbitration manager has the right to remuneration in a bankruptcy case, as well as to compensation in full for expenses actually incurred by him in the performance of the duties assigned to him in a bankruptcy case.

2. Remuneration in a bankruptcy case is paid to the arbitration manager at the expense of the debtor, unless otherwise provided by this Federal Law.

3. The remuneration paid to the arbitration manager in a bankruptcy case consists of a fixed amount and an amount of interest.

The fixed amount of such remuneration is for:

temporary manager - thirty thousand rubles per month;

administrative manager - fifteen thousand rubles per month;

external manager - forty-five thousand rubles per month;

financial manager - twenty-five thousand rubles at a time for carrying out the procedure used in a bankruptcy case.

3.1. When calculating the amount of interest on the arbitration manager's remuneration provided for in paragraphs 12 of this article, the satisfaction of creditors' claims made at the expense of funds received as a result of bringing the persons controlling the debtor to subsidiary liability is not taken into account.

The amount of interest on the remuneration of the arbitration manager, established from the amount of creditors' claims satisfied from funds received as a result of bringing the persons controlling the debtor to subsidiary liability, is determined and paid in accordance with this paragraph.

The amount of interest determined in accordance with this paragraph is subject to withholding and payment from funds received by the bankruptcy estate in connection with the execution of a judicial act on bringing to subsidiary liability, in the amount of thirty percent, including the cost of paying remuneration to persons engaged by the arbitration manager for provision of services that contributed to bringing to subsidiary liability and (or) execution of a judicial act on bringing to subsidiary liability.

If, after the arbitration manager filed an application for bringing to subsidiary liability, the person controlling the debtor or another person satisfied the claims of the creditor (creditors) or provided the debtor with funds sufficient to satisfy the claims of the creditor (creditors) in accordance with the register of creditors’ claims in the manner and on the terms that are provided for, 85.1, 112.1, , , 129.1 of this Federal Law, or if, after the creditor uses the right provided for by this Federal Law, this creditor receives funds from the execution of a judicial act on bringing to subsidiary liability, the arbitration manager has the right to pay the amount of interest determined in accordance with this paragraph, if he proves that such satisfaction of the claims of the creditor (creditors) was caused by the filing of the specified application by the arbitration manager.

The amount of interest determined in accordance with this paragraph, subject to payment to the arbitration manager and persons engaged by the arbitration manager to provide services that contributed to bringing to subsidiary liability and (or) execution of a judicial act on bringing to subsidiary liability, at the request of persons participating in the case of bankruptcy, may be reduced by an arbitration court or payment may be refused if it is proven that the actions of other persons participating in the bankruptcy case contributed to the bringing to subsidiary liability of the persons controlling the debtor and (or) the execution of the judicial act on bringing to subsidiary liability.

The issue of establishing the amount of interest determined in accordance with this paragraph is considered according to the rules of this paragraph simultaneously with the consideration of the statement of intention to satisfy in full the claims of creditors against the debtor in the manner provided for, 85.1, 112.1, , 129.1 of this Federal Law, or according to the results of consideration of the claims of the arbitration manager to the creditor who received funds from the use of the right provided for in subparagraph 3 of paragraph 2 of Article 61.17 of this Federal Law.

If the arbitration manager submits an application to establish the amount of interest determined in accordance with this paragraph, after the completion of bankruptcy proceedings or termination of the bankruptcy case, this application is considered by the arbitration court that previously considered the bankruptcy case, according to the rules for resolving issues of reimbursement of legal expenses, provided for by the Arbitration Court. procedural code of the Russian Federation.

4. If an arbitration court releases or removes an arbitration manager from performing the duties assigned to him in a bankruptcy case, remuneration shall not be paid to him from the date of his release or removal.

5. The arbitration court considering a bankruptcy case, on the basis of a decision of a meeting of creditors or a reasoned petition of persons participating in a bankruptcy case, has the right to increase the amount of the fixed amount of remuneration paid to the bankruptcy manager, depending on the volume and complexity of the work performed by him.

The decision taken by the arbitration court to increase the fixed amount of such remuneration may be appealed.

6. If, in a bankruptcy case, powers are assigned to an arbitration manager due to the impossibility of approving another arbitration manager, the amount of remuneration paid to the arbitration manager during the period of performance of the duties assigned to him in the bankruptcy case is established by the arbitration court. In this case, the amount of the fixed amount of remuneration of the arbitration manager cannot be less than the size of the fixed amount of remuneration of the arbitration manager, determined for the corresponding procedure applied in the bankruptcy case, in accordance with this Federal Law.

7. The meeting of creditors may establish additional remuneration for the arbitration manager.

8. Additional remuneration is paid to the arbitration manager from the funds of creditors who decided to establish additional remuneration, or payments due to them to repay their claims.

9. Unless otherwise provided by this Federal Law, the amount of interest on the arbitration manager’s remuneration is paid to him within ten calendar days from the date of completion of the procedure that is applied in the bankruptcy case and for which the arbitration manager was approved.

10. The amount of interest on the temporary manager’s remuneration does not exceed sixty thousand rubles and is, based on the book value of the debtor’s assets:

(see text in the previous edition)

from two hundred and fifty thousand rubles to one million rubles - ten thousand rubles and two percent of the amount of excess of the book value of the debtor’s assets over two hundred and fifty thousand rubles;

from one million rubles to three million rubles - twenty-five thousand rubles and one percent of the amount of excess of the book value of the debtor’s assets over one million rubles;

more than three million rubles - forty-five thousand rubles and one-half percent of the amount of excess of the book value of the debtor's assets over three million rubles;

(see text in the previous edition)

(see text in the previous edition)

(see text in the previous edition)

11. The amount of interest on the administrative manager’s remuneration is based on the book value of the debtor’s assets:

up to two hundred and fifty thousand rubles - four percent of the book value of the debtor’s assets;

from two hundred and fifty thousand rubles to one million rubles - ten thousand rubles and one percent of the amount in which the book value of the debtor’s assets exceeds two hundred and fifty thousand rubles;

from one million rubles to three million rubles - seventeen thousand five hundred rubles and one-half percent of the amount of excess of the book value of the debtor’s assets over one million rubles;

from three million rubles to ten million rubles - twenty-seven thousand five hundred rubles and two tenths of a percent of the amount of excess of the book value of the debtor’s assets over three million rubles;

from ten million rubles to one hundred million rubles - forty-one thousand five hundred rubles and one tenth of one percent of the amount of excess of the book value of the debtor’s assets over ten million rubles;

from one hundred million rubles to three hundred million rubles - one hundred thirty-one thousand five hundred rubles and five hundredths of a percent of the amount of excess of the book value of the debtor’s assets over one hundred million rubles;

from three hundred million rubles to one billion rubles - two hundred thirty-one thousand five hundred rubles and one hundredth of one percent of the amount in excess of the book value of the debtor’s assets over three hundred million rubles;

more than one billion rubles - three hundred and one thousand five hundred rubles and one thousandth of one percent of the amount in which the book value of the debtor’s assets exceeds one billion rubles.

Remuneration to the arbitration manager. How to pay and reflect in accounting and taxation the remuneration of an arbitration manager. Remuneration to the arbitration manager is an indirect expense.

Question:

The joint stock company is at the stage of bankruptcy: an external management procedure has been introduced and an arbitration manager has been appointed. Is it legal for the Company to record expenses for remuneration to an external manager in Other (non-operating expenses) accounting account 91 or management operating expenses (accounting account 26.) Is accounting for bankruptcy management expenses similar or different? Accounting and tax accounting of these transactions.

Answer:

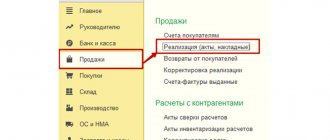

An external manager who performs part of the management functions during the bankruptcy procedure of an organization does not become a full-time employee of the organization, therefore the remuneration accrued to him is not a salary. When calculating remuneration, use account 76 “Settlements with other debtors and creditors”. The functions of the arbitration manager are related to management during the bankruptcy procedure. Therefore, in accounting, write off his remuneration as expenses for ordinary activities (clauses 5 and 7 of PBU 10/99). Do the following wiring:

Debit 26 (44) Credit 76 (remuneration accrued to the external manager).

When calculating income tax, include the amount of remuneration among other expenses associated with managing the organization (subclause 18, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Taxes of Russia dated May 7, 2004 No. 04?3?01/265).

Reflect the costs of the bankruptcy trustee's remuneration by analogy.

In accounting, remuneration is taken into account on account 26, 44 and in tax accounting is reflected as other expenses related to the management of the organization.

Rationale

Fixed amount

Remuneration in part of a fixed amount is accrued during the entire period of activity of the arbitration manager in the following amounts:

– administrative manager – 15,000 rubles. per month;

– temporary and bankruptcy manager – 30,000 rubles. per month;

– external manager – 45,000 rubles. per month.

Depending on the volume and complexity of the work performed by the bankruptcy manager, the arbitration court, based on the decision of the meeting of creditors (a reasoned petition of the persons participating in the bankruptcy case), may increase the fixed amount of remuneration.

Such rules are established by paragraphs 3 and 5 of Article 20.6 of the Law of October 26, 2002 No. 127-FZ.

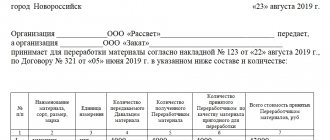

Features of accounting in case of bankruptcy of an enterprise

An enterprise that cannot fulfill its financial obligations is declared bankrupt by an arbitration court. There are no official documents defining the specifics of accounting during bankruptcy proceedings.

The composition of financial documentation during bankruptcy proceedings does not differ from the documentation of a functioning enterprise. Reporting is provided until the liquidation of the organization is completed.

This process is regulated by the Accounting Law.

Bankruptcy procedures

After accepting an application to declare an enterprise bankrupt, the arbitration court has the right to order a number of bankruptcy procedures - monitoring, financial recovery, external management, which imply the possibility of financial recovery of the company. If these procedures are successful, the company's insolvency proceedings may be terminated.

- Observation. The goal is to analyze the financial condition of the company and ensure the safety of its property. Management and management bodies retain their powers. For control, the court appoints a bankruptcy trustee. Coordination with it is necessary for transactions of obtaining and issuing loans, guarantees and guarantees, purchase or alienation of property worth more than 5% of the total balance of the company. Any types of reorganization, joining partnerships, distribution of profits and dividends, and withdrawal from the founders are prohibited.

- Financial recovery. The goal is to restore solvency and pay off debts. When the procedure is introduced, an administrative manager is appointed. The company continues to operate, the restrictions are the same as in the previous procedure. It is possible that a number of transactions in which restrictions were violated may be invalidated. The accounting department prepares primary documentation and puts accounting in order.

- External control. Introduced if previous procedures are unsuccessful. An external manager is appointed for management. Its actions are carried out with the consent of the creditors. The goal of all actions is to ensure the greatest efficiency in using assets to pay off debts. The chief accountant reports to the external manager and conducts tax and accounting.

The chief accountant should remember when carrying out the above procedures about the restrictions they impose. If the procedures are ineffective, then bankruptcy proceedings are opened.

Creditors' requirements

Creditors have the right to make claims 30 days after the announcement of the start of the monitoring procedure.

https://www.youtube.com/watch?v=7F4AOdR9oVA

The accounts of the debtor company are closed, and one main account remains or is opened again (the so-called bankruptcy account). Balances from all other accounts are transferred to it.

Payments to creditors are made from the main account. Current expenses are paid out of turn. The main payment queue looks like this:

- first priority – legal expenses, payments to the arbitration manager and the persons involved by him;

- the second is wages;

- third – utility and operating payments;

- fourth – remaining current payments.

The next stage is payments according to the register of creditors’ claims:

- first priority – compensation for harm to health and life, moral damage;

- the second – employment and copyright contracts, severance pay;

- third – other creditors.

A privileged position is occupied by creditors whose claims are secured by collateral. Payments to them are made after the sale of the collateral.

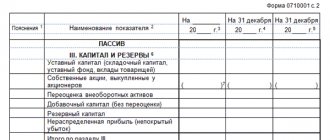

Liquidation balance

The liquidation balance sheet contains information about the composition of the debtor's property and the company's debts, and is also the basis for payments. After its preparation, the property is subject to inventory, and transactions on the alienation of assets are analyzed. Transactions that are contrary to the law are challenged in court.

This period is characterized by the initiation of many legal proceedings to recover assets, collect interest and penalties from legal entities on overdue receivables.

These measures can significantly increase the bankruptcy estate, which increases the chances of creditors receiving payments. The value of assets is determined by an independent assessment; quotes are taken into account when valuing securities.

Bankruptcy proceedings are completed when all assets are sold, written off or disposed of, and debts are repaid.

This fact is reflected in the asset of the liquidation balance sheet, which is compiled based on the results. The balance sheet liability reflects the remaining unpaid claims of creditors and losses of the owner of the enterprise.

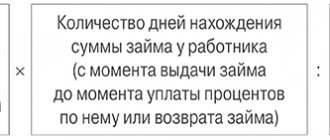

Interest amount

The amount of interest on the arbitration manager's remuneration depends on the size of the book value of the organization's assets or the size of the satisfied claims of creditors. The percentage amounts are given in paragraphs 10–13 of Article 20.6 of the Law of October 26, 2002 No. 127-FZ. For example, the amount of interest on the remuneration of a temporary manager when the book value of the organization’s assets is up to 250,000 rubles. is four percent of the book value of assets. The book value of the organization's assets is determined as of the last reporting date preceding the start of the bankruptcy procedure (Clause 14, Article 20.6 of the Law of October 26, 2002 No. 127-FZ).

Interest on remuneration is paid to the arbitration manager within 10 calendar days from the date of completion of the bankruptcy procedure (Clause 9, Article 20.6 of the Law of October 26, 2002 No. 127-FZ).

Accounting

An arbitration manager who performs part of the management functions during the bankruptcy procedure of an organization does not become a full-time employee of the organization, therefore the remuneration accrued to him is not a salary. When calculating remuneration, use account 76 “Settlements with other debtors and creditors”. The functions of the arbitration manager are related to management during the bankruptcy procedure. Therefore, in accounting, write off his remuneration as expenses for ordinary activities (clauses 5 and 7 of PBU 10/99). Do the following wiring:

Debit 26 (44) Credit 76

– remuneration was accrued to the arbitration manager.

Who is an arbitration manager?

An arbitration manager is a person in charge of the bankruptcy procedure. It is worth noting that the person who acts as a manager should not be interested in carrying out the procedure.

He may belong to one of three types of anti-crisis specialists:

- competition manager;

- temporary manager;

- external manager.

The person performing the role of the arbitration manager is key at all stages of the bankruptcy procedure. For each of them, special functions are provided at different stages of the bankruptcy procedure.

The person in charge of the bankruptcy procedure is appointed by the court. This person has a number of specific rights and obligations, among which we can separately highlight the right to remuneration for work.

Payment of personal income tax and insurance premiums

From income from private practice, the arbitration manager is obliged to independently pay:

– Personal income tax (subclause 2, clause 1, clause 2, article 227 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated June 10, 2011 No. ED-4-3/9304, Ministry of Finance of Russia dated October 8, 2010 No. 03-11- 11/261);

– contributions for compulsory pension (social, medical) insurance (clause 2, part 1, article 5 of the Law of July 24, 2009 No. 212-FZ).

Thus, when paying remuneration, the arbitration manager does not need to withhold personal income tax and charge insurance premiums. Do not charge premiums for insurance against accidents and occupational diseases. These contributions are subject to only those amounts that are paid to employees working under employment contracts (Clause 1, Article 5 of Law No. 125-FZ of July 24, 1998).

The procedure for calculating other taxes depends on what taxation system the organization uses.

BASIC

When calculating income tax, include the amount of remuneration among other expenses associated with managing the company (subclause 18, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Taxes of Russia dated May 7, 2004 No. 04-3-01/265).

Remuneration to the arbitration manager is an indirect expense. Therefore, if an organization calculates income tax using the accrual method, the amount of remuneration is fully attributed to the expenses of the current month (subclause 1, clause 1, article 318 of the Tax Code of the Russian Federation). When using the cash method, take it into account on the day of payment (clause 3 of Article 273 of the Tax Code of the Russian Federation).

An example of payment of remuneration to a temporary arbitration manager. The organization applies a general taxation system

In March, bankruptcy proceedings were initiated against Alfa CJSC. The organization is led by a temporary arbitration manager. The fixed remuneration of the arbitration manager is 30,000 rubles. per month. The reward is paid in cash from the cash register.

In March, Alpha’s accountant made the following accounting entries:

Debit 26 Credit 76 – 30,000 rub. – remuneration was accrued to the temporary arbitration manager;

Debit 76 Credit 50 – 30,000 rub. – remuneration was paid to the temporary arbitration manager.

When calculating income tax for March, the accountant included 30,000 rubles in other expenses.

Interest on the remuneration will be paid to the arbitration manager within 10 calendar days from the date of completion of the bankruptcy procedure.

How accounting is carried out in case of bankruptcy of an enterprise

Typically, the onset of a crisis in a company's activities leads to bankruptcy.

By such a phenomenon as a crisis we mean the state of the subject, which can be characterized as financial instability, which leads to the fact that the existence of the organization is, in principle, under threat. In addition, reduced competitiveness also plays a negative role in this situation. How should the company's accounting be kept during this period?

How should an accountant manage debt during bankruptcy?

During the period when a company is declared bankrupt, overdue debt begins to grow. This is how bankruptcy is characterized in microeconomics.

In extreme cases, the crisis usually manifests itself in the fact that the company completely loses its solvency. This leads to the complete insolvency of the company, which can no longer pay all existing debts in full.

At the same time, it will be important for the accountant to know how the company’s accounting should be kept during bankruptcy, how to correctly calculate the existing debt ratio, and how it differs from the short-term debt ratio. The calculation formula for the debt ratio is in a separate article, and the formula for the short-term debt ratio is here.

Therefore, it would be useful to study in advance what the rights and responsibilities of the chief accountant of a company declared bankrupt are.

It is interesting that such a phenomenon as the insolvency of one company can still lead to the fact that other organizations that are its partners will also lose their solvency. It turns out that financial insolvency has an avalanche-like character.

And if Russian legislation regulates the process of resolving disputes when debt arises between Russian companies, then controlled debt to a foreign organization requires the presence of one or more residents of this very organization.

But how are the relationships between the founders and owners of a bankrupt company and the creditor regulated? In this case, great attention is paid to financial obligations. The concept of receivables and payables is clearly stated in domestic legislation. Correct decoding of accounts receivable and accounts payable is also necessary. boo.

To regulate relations between organizations and debtors, a special bankruptcy institute has been created. Such an institution is understood as a whole system of legal frameworks that easily regulates all legal norms so that the organization still undergoes financial recovery. It also aims to protect the legitimate claims of creditors to repay debts.

The basis of such an institute was Federal Law 127. Who does this law apply to? In its effect, it can apply to absolutely all legal entities. persons other than:

- religious organizations;

- various political parties;

- government institutions.

The same law may apply to individual entrepreneurs. It regulates all available grounds for declaring a debtor bankrupt. Thus, within the framework of Federal Law 127, the procedure for taking measures that can be aimed at preventing possible bankruptcy is regulated.

In order to understand how a company’s accounting should be kept in the event of bankruptcy, it is necessary to consider each of the stages of conducting this procedure separately.

Observation

The monitoring procedure begins exactly from the moment the company is declared bankrupt by decision of the arbitration court.

It is needed in order to fully ensure the safety of the company’s property, as well as to compile a list of the creditor’s requirements and monitor the financial situation of the debtor.

It is the consequences of the observation procedure that influence accounting.

The observation procedure is reflected in the accounting department exactly to the extent that it affects the company itself. At the same time, there are no restrictions on the competence of the chief accountant. When signing any financial documents, the accountant must clearly know and comply with the requirement that any transactions must be approved by the temporary manager.

At this moment, the debt acquires the status of controlled; the correct calculation of controlled debt is here. If the requirements are not met, this will negatively affect, first of all, the company’s accounting department.

It is important for the accountant to draw the attention of the manager to compliance with all the conditions of the monitoring procedure, since if a criminal case is initiated against the head of the company, the accountant may also be brought into the process as a suspect or accomplice in a financial crime.

The essence of this procedure is the efforts made to restore the debtor's solvency. The process leads to the fact that the debtor will have the opportunity to pay off his debts without coercive measures. This procedure follows the observation procedure. At this stage, the arbitration court must appoint an arbitration manager.

In the process of financial recovery, the rights and responsibilities of the heads. accountants do not change in any way. At this time, it is possible to adjust the debt with its subsequent recalculation. However, some non-standard accounting transactions require careful consideration.

Accountants have many questions when certain transactions are declared invalid. But there is nothing complicated about it. It is enough just to take into account the following points:

- All primary accounting documents should be done in the same order as for an operating company that does not have problems with creditors.

- An accountant always needs to be prepared for the fact that the likelihood of transactions being recognized as invalid for a bankrupt company is much higher than for an ordinary functioning company.

External control

This procedure takes place when observation and financial recovery have not brought any successful results. In the process of external management, all powers are removed from the head of the company. In this case, the reins of government pass into the hands of an external manager, who was appointed by the arbitration court during the process of financial recovery.

An external manager can also manage such a process as writing off receivables and payables. This happens regardless of the type of debt and concerns the receivables and payables of the enterprise.

Separately, it is necessary to highlight the responsibilities of the external manager for maintaining accounting records, as well as reporting and statistical accounting. After all, it is at this stage that the manager is removed from all his responsibilities.

Moreover, if the manager was removed earlier (during the process of supervision or financial recovery), all responsibilities for maintaining accounting and static records are transferred to the temporary manager of the company.

From now on, all accounting reports and even the inventory of accounts payable and receivable can only be signed by an external manager, as well as the chief accountant of the company. The external manager has every right to initiate recognition of a concluded transaction with any interested parties as invalid.

It is important to take into account that the accountant may also be an interested party. Therefore, any of his personal transactions with the company must be under special control. The best option would be to exclude such situations so that various misunderstandings do not arise when concluding transactions.

The financial recovery procedure is the restoration of the company's solvency.

What are the powers of the external manager at this stage?

- An external manager when performing effective operations aimed at restoring solvency, art. 109-115) does everything to achieve maximum efficiency in using the debtor’s assets to pay off creditors’ claims. The accountant will not be an official and will not bear any responsibility for any actions of the enterprise.

- His powers do not include calculating the loan debt coverage ratio. This remains the responsibility of the chief accountant.

- All that is required of the external manager is to carry out any tax and accounting functions in accordance with all established norms of current legislation, as well as carry out the necessary entries of the debt transfer agreement. Such entries are clearly indicated in the accounting records.

Bankruptcy proceedings

When the measures taken do not lead to resuscitation of the financial condition of the company, it is declared bankrupt by decision of the arbitration court. At this time, the bankruptcy trustee begins to evaluate the debtor’s property.

After this, the manager is obliged to provide creditors with a plan for its sale. The funds received from this sale must be used to satisfy all claims from creditors.

The decision to end bankruptcy proceedings is also made in the arbitration court.

In the process of conducting bankruptcy proceedings, an accountant must take into account that in almost one hundred percent of cases the debtor organization undergoes a subsequent liquidation procedure. Therefore, he needs to begin preparing for the development and preparation of an interim liquidation balance sheet.

During this period, the chief accountant should begin to prepare for an inventory of the company's accounts. It is carried out as usual, as in cases with companies that continue to operate.

Once all creditors have been settled, the accountant also needs to draw up a liquidation balance sheet and pay all necessary taxes. At the same time, the preparation of an interim liquidation balance sheet must occur strictly after the register of claims presented by creditors has been fully disclosed.

In other words, it is necessary to draw up a balance sheet by the deadline indicated by the bankruptcy trustee for creditors to submit claims for the bankrupt organization. As soon as all the calculations have been made, the accountant can begin to draw up a liquidation balance sheet, as well as make settlements with the founders, if necessary.

Accounting report in bankruptcy

The fact that a company is in the process of being declared bankrupt does not in any way exclude the fact that the legal entity is also obliged to maintain tax and accounting records.

According to the legislation in force today, the basis for terminating the maintenance of this type of accounting is only the currently completed liquidation of the company.

In this case, a corresponding entry must be made in the Unified State Register of Legal Entities.

Maintaining accounting accounting during the bankruptcy procedure has its own characteristics.

The nuances are associated primarily with some procedural aspects of the process of declaring a debtor bankrupt, as well as the need and importance of payment in accounting for real expenses at the moment, and the satisfaction of all claims made by creditors.

At the same time, the priority process for satisfying creditors’ claims may differ from the sequence set out in the Civil Code of Russia. All these points must be taken into account during the process of liquidation of a legal entity. persons through bankruptcy.

simplified tax system

Simplified organizations that pay a single tax on the difference between income and expenses cannot include remuneration to the arbitration manager as part of the costs that reduce the tax base. Expenses for external management of an organization are not included in the closed list of expenses (clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

If an organization pays a single tax on income, then the payment of remuneration to the arbitration manager also does not affect the amount of tax. Expenses for the payment of remuneration cannot be excluded from the tax amount, and the organization does not charge insurance premiums for it (clause 2 of Article 346.32 of the Tax Code of the Russian Federation).