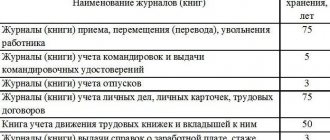

"Export" package of documents

VAT taxation of goods exported under the customs export procedure is carried out at a zero rate (subclause 1, clause 1, article 164 of the Tax Code of the Russian Federation).

Export is a customs procedure in which goods of the customs union are exported outside the customs territory of the customs union and are intended for permanent residence outside its borders (clause 1 of article 212 of the Customs Code of the Customs Union). Let us recall that in addition to Russia, the Customs Union includes Belarus, Kazakhstan, Armenia and Kyrgyzstan. However, subsequently the exporting company must confirm the legality of using the zero VAT rate. To do this, she needs to collect certain documents, which are listed in Article 165 of the Tax Code of the Russian Federation.

Firstly, this is a contract with a foreign buyer. Please note that the buyer must indicate a foreign person in the contract. Therefore, if the goods are exported outside the customs territory of the Customs Union, but the buyer in the contract is a Russian company, then the zero VAT rate cannot be applied (Letter of the Federal Tax Service dated October 17, 2013 No. ED-4-3 / [email protected] ).

Secondly, this is a customs declaration with marks from Russian customs. Officials note that the presence of a printed electronic customs declaration with the corresponding customs marks also confirms the validity of the application of the zero VAT rate (Letters of the Federal Tax Service dated 04/08/2015 No. GD-4-3/ [email protected] , Ministry of Finance of the Russian Federation dated 05/18/2015 No. 03-07- 08/28231). But a temporary declaration, according to officials, will not work. The Ministry of Finance of the Russian Federation in Letter No. 03-07-08/33977 dated August 20, 2013 notes that in order to confirm the validity of applying the 0 percent rate, the taxpayer is required to submit a complete customs declaration. Let us note that the department’s position is controversial. The courts express the opposite opinion on this matter: the validity of the application of the zero rate can be confirmed by a temporary customs declaration. The arbitrators explain their position by the fact that Article 165 of the Tax Code of the Russian Federation does not contain a clear indication of the type of customs declaration that confirms the application of the zero VAT rate. And if so, then it can be confirmed by a temporary customs declaration (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated 06.06.2011 in case No. A27-10918/2010, FAS North Caucasus District dated 03.29.10 No. A32-7360/2009, FAS Povolzhsky District dated January 22, 2008 No. A55-5396/2007-53).

Thirdly, these are transport (shipping) documents with the appropriate marks from customs officers. It happens that these documents are drawn up in a foreign language. For example, when exporting goods by air, the international air waybill may be drawn up in English. Officials note that the Tax Code of the Russian Federation does not require the submission of translations of transport documents drawn up in a foreign language (Letter of the Ministry of Finance of the Russian Federation dated March 25, 2008 No. 03-07-08/67). Meanwhile, in practice, tax authorities sometimes do not accept documents without translation into Russian. However, in court, exporters manage to defend their right to a zero VAT rate (Resolution of the Ninth Arbitration Court of Appeal dated 02.26.2010 No. 09AP-1071/2010-AK in case No. A40-110423/09-127-779, Third Arbitration Court of Appeal dated 05.08. 2009 in case No. A33-5989/2009, FAS East Siberian District dated July 10, 2009 in case No. A33-11586/08).

It may happen that a foreign buyer takes on the responsibility for removing goods from the Russian seller’s warehouse. And he uses his own transport or resorts to the services of a third-party carrier. Obviously, in this case, the exporter will not have transport documents with customs marks. Does this mean that he will have problems confirming the zero rate? This situation was reviewed by the financial department. Letter No. 03-07-08/12729 dated April 16, 2013 states that to confirm the zero VAT rate, the exporting organization can submit any document with marks from the customs authority of the place of departure confirming the departure of exported goods from the territory of the Russian Federation by the specified road transport.

Tax liability for unconfirmed exports

Companies carrying out export deliveries have the right to take advantage of the zero VAT rate (subclause 1, clause 1, article 164 of the Tax Code). True, such a privilege is granted to companies only subject to documentary confirmation of the fact of export of goods abroad. In this case, evidence will include, in particular:

- contract for the supply of products (or a copy thereof);

- bank statement (or a copy thereof);

- customs declaration (or a copy thereof);

- copies of transport and shipping documents (Article 165 of the Tax Code).

The company is given 180 days to collect the listed documents from the moment the exported goods are placed under the appropriate customs regime. If an organization meets this deadline, then the tax calculation should be reflected in section 5 of the VAT return “Calculation of the amount of tax on transactions for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented.” In this case, the tax base is determined on the last day of the quarter in which the full set of papers is collected (clause 9 of Article 167). At the same moment, the company receives the right to deduct “input” tax on goods purchased for this delivery of products abroad (paragraph 1, paragraph 3, article 172, paragraph 9, article 167 of the Tax Code). Thus, deductions for each confirmed export transaction are summed up with similar indicators for domestic transactions. The result obtained reduces the VAT payable to the budget at the end of the tax period, which is the date of collection of all necessary documents to confirm the fact of export of goods abroad. If the amount of tax deductions exceeds the tax accrued for the quarter and the exporter is due some compensation from the budget, then the rules of Article 176 of the Tax Code come into effect. However, we are more interested in the situation when, within 180 days, the company, as often happens, failed to collect the papers justifying the application of the zero VAT rate.

Beyond the deadline

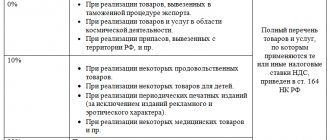

If a company misses the 180-day deadline for one reason or another, it will have to pay all VAT due at a rate of 10 or 18 percent, depending on the type of products sold. Moreover, according to paragraph 9 of Article 165 of the Tax Code, the moment of determining the tax base in this case is considered to be the day of shipment of goods for export. In other words, the company needs to submit an updated tax return for the period in which the products were sold abroad. The calculation of VAT in such a situation is reflected in section 7 “Calculation of the amount of tax on transactions for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is not documented.” It is assumed that the calculated amount of tax must be transferred to the budget on the 181st day from the moment the goods are placed under the customs export regime. If subsequently the company finally manages to collect evidence of its right to VAT benefits, then the tax paid will be returned to it (clause 9 of Article 165). Nevertheless, in practice, there are often situations when companies still delay until the last moment with such an obligation, hoping that all the documents confirming the zero rate will be ready soon. But, as you know, tax legislation provides for standard fines for non-payment or late payment.

Don't blame me, just put on the strap!

Having identified such a misconduct by a company, tax authorities will first of all demand payment of the tax itself, and will also charge penalties for late payment. Moreover, most likely, the auditors will proceed from the fact that the starting point for the application of these sanctions is the 21st day of the month following the tax period in which the export operation was carried out (letter of the Federal Tax Service dated August 22, 2006 No. ШТ-6-03 / [email protected] ). The final date for accrual of penalties will be either the day of payment of the due VAT, or the moment when the export is confirmed. Of course, one can argue with this position. A weighty argument in this case will be the conclusions of the Presidium of the Supreme Arbitration Court, presented in Resolution No. 15326/05. The senior arbitrators, in particular, indicated that penalties should be accrued no earlier than the 181st day counted from the date of shipment of goods for export, since it is at this moment that the organization becomes obligated to pay VAT. However, no matter how you look at it, you will have to pay a fine. Moreover, even if in the future the company collects all the documents justifying the application of the zero rate, it will only be able to obtain a refund of the amount of the transferred tax. The funds paid to pay off penalties will remain in the budget (letter of the Ministry of Finance dated September 4, 2004 No. 03-04-08/73).

Another penalty measure that tax authorities can apply in this situation is a fine provided for in paragraph 1 of Article 122 of the Tax Code in the amount of 20 percent of the unpaid tax amount. However, as arbitration practice shows, under certain circumstances judges may declare such prosecution illegal. An example of this is the resolution of the Federal Antimonopoly Service of the Volga District dated March 4, 2008 in case No. A06-3838/07.

Racing with inspection

So, based on the fact that the company submitted the full package of documents required by Article 165 of the Tax Code after the expiration of the 180-day period, the inspection held the company liable under Article 122 of the Code for non-payment of VAT. However, in court the company managed to “fight off” the fine.

The decisive argument in the case was the referee of the arbitrators to paragraph 42 of the resolution of the Plenum of the Supreme Arbitration Court of February 28, 2001 No. 5. In this provision, the senior arbitrators at one time indicated that when applying Article 122 of the Tax Code, one should take into account the fact that “non-payment or incomplete payment amounts of tax" implies that the taxpayer has a debt to the relevant budget. At the same time, the judges emphasized, within the meaning of paragraph 9 of Article 165 of the Tax Code, the taxpayer has the right to submit to the tax authorities documents justifying the application of the zero rate both within 180 days and after its expiration. Taken together, these norms mean that if, even at a later date, the fact of export is confirmed and, as a result, the legality of applying the zero rate is not disputed by auditors, then the late company has no debt to the treasury. And therefore, there are no grounds for bringing her to tax liability. Moreover, this is not the first time that the judges of the Volga District have expressed such a point of view, as evidenced by the resolution of September 8, 2005 in case No. A49-2598/2005-85A/11.

A similar situation was considered by the judges of the Federal Antimonopoly Service of the East Siberian District (resolution dated January 11, 2008 No. A19-5090/07-24-F02-9568/07). In this case, the arbitrators released the company from the fine, since they found that the documents confirming the export of goods were submitted by it to the inspectorate, again, albeit late, but before drawing up an on-site inspection report and making a decision on bringing to tax liability.

Thus, we can conclude that if a company failed to confirm the fact of export on time, but nevertheless submitted the necessary documents to the inspectorate before the tax authorities made a decision on the need to apply sanctions, then most likely they will not have to pay a fine. However, whether the game is worth the trouble in this situation is up to each individual company to decide, because it still won’t be possible to get rid of penalties like this.

M. Tushnov , expert at the Federal Financial Information Agency

| New generation berator PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT What every accountant needs. The full scope of always up-to-date accounting and taxation rules. Connect berator |

Order of presentation

The exporter must collect all the above documents and submit them to the Federal Tax Service within 180 calendar days from the date of placing the goods under customs export procedures.

This is stated in paragraph 9 of Article 165 of the Tax Code of the Russian Federation. At the same time, paragraph 10 of Article 165 of the Tax Code of the Russian Federation limits the fact of submitting documents to the deadline for submitting the VAT return, which, as is known, is submitted at the end of the quarter. For example, if a complete package of documents was collected, say, in November 2015, then it will need to be submitted along with the VAT return for the 4th quarter of 2015, that is, no later than January 25, 2021. This procedure applies even if by 25 January, the 180-day period has already expired. The main thing is that the documents are collected within 180 days and submitted to the Federal Tax Service on the nearest date established for filing a VAT return. Such actions should not lead to the accrual of VAT. This is confirmed by both judicial practice and the officials themselves (Letters of the Ministry of Finance of the Russian Federation dated February 15, 2013 No. 03-07-08/4169, dated February 16, 2012 No. 03-07-08/41, Federal Tax Service dated February 16, 2006 No. MM -6-03/171).

VAT refund when exporting from Russia

Collecting documents to confirm the zero rate is only the first step. Next, the regulatory authorities of the Federal Tax Service begin checking the authenticity of documents and reviewing compliance with all legal requirements, as well as checking whether the exporter has any debt to the budget.

The collected documents are submitted to the Federal Tax Service along with the VAT return for the period in which they were collected. Tax authorities conduct a desk audit within three months and, based on its results, make a decision on VAT refund or refusal to refund.

Postings for export VAT

If after 180 days the export is not confirmed, then the amounts of unconfirmed VAT are reflected using the following entries:

| Dt | CT | Operation description |

| 68(VAT refund) | 68 (VAT accrued) | Accrual for unconfirmed exports |

| 99 | 68 | Accrual of penalties |

| 68 | 51 | Transfer of penalties to the budget |

Postings for VAT refund upon confirmation of export:

| Dt | CT | Operation description |

| 51 | 68 | VAT refund |

The form of VAT refund can be selected from two options: return to the current account or offset against fines, arrears or future payments. The reimbursement option is chosen by the Federal Tax Service itself, or by the taxpayer in his application.

If a VAT refund is refused, the posting will look like this:

| Dt | CT | Operation description |

| 91 | 68 | The amount of VAT to be reimbursed is written off as expenses |

Despite the declared preferential benefits, the use of a zero rate can rather be considered an obligation of the organization rather than a right.

Export of goods by a foreign buyer

If the export goods are transported not by a third-party transport company, but by the buyer himself, the same list of documents is used to confirm the rate. Copies of the necessary documents are provided by the foreign partner; with these documents, the Russian exporter carries out the rate confirmation procedure in the usual manner.

Export to the EAEU

When exporting goods to the countries of the Eurasian Economic Union, which include Belarus, Kazakhstan, Armenia, and Kyrgyzstan, confirmation of the 0% rate is not required. To confirm the legality of applying this rate, it is necessary to request a certificate of payment of VAT by the buyer.

Special deduction

For export supplies, special rules apply for the deduction of “input” VAT.

If taxpayers can usually deduct amounts of “input” VAT as they accept goods, works, and services for accounting, then a special procedure applies for “input” VAT related to export supplies. It consists in the fact that, according to paragraph 3 of Article 172 of the Tax Code of the Russian Federation, the right to deduction arises at the time the tax base is determined. This is either as documents are collected (if the organization managed to collect all the necessary documents within 180 days), or as VAT is calculated (if the necessary documents were not collected within 180 days). This means that an organization exporting goods must separately account for the “input” VAT associated with export transactions. Moreover, the Tax Code of the Russian Federation does not provide for a clear procedure for the distribution of VAT on acquired material resources (works, services) used in further sales operations, taxed at different tax rates (as, for example, in the situation with non-VAT-taxable transactions). Paragraph 10 of Article 165 of the Tax Code of the Russian Federation only tells us that the organization determines this procedure independently and prescribes it in its accounting policies.

Therefore, the taxpayer has the right to independently choose a method for maintaining separate accounting for amounts of “input” VAT related to transactions taxed at different rates. And the Ministry of Finance of the Russian Federation in Letter dated July 14, 2015 No. 03-07-08/40366 confirms this conclusion. At the same time, the criteria for the distribution of “input” VAT amounts for export and “domestic” supplies may be the cost of goods sold, actual expenses or other indicators chosen by the taxpayer taking into account the specifics of its activities.

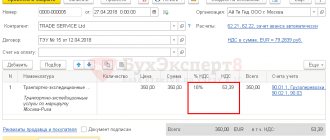

Sales book, purchase book

When shipping goods for export, the accountant will draw up an invoice and invoice in which the VAT amount will be absent and the VAT rate will be indicated as 0 percent.

In this case, the invoice should not be immediately included in the sales book due to the special order in which the moment of determining the tax base for VAT occurs. Indeed, for export deliveries, the moment of determining the tax base for the specified goods (works, services) is the last day of the quarter in which the full package of documents is collected, in the case when the documents are collected within the prescribed period (Clause 8 of Article 167 of the Tax Code of the Russian Federation). This means that you will need to register an invoice with a zero VAT rate on the last day of the quarter. Accordingly, the “export” shipment should not be reflected in the VAT return until the moment of determining the tax base arises. Advances received on account of upcoming export deliveries should not be reflected (clause 1 of Article 154 of the Tax Code of the Russian Federation). Since “input” VAT related to export supplies is deducted at the time the tax base is determined, the corresponding invoices must be registered in the purchase book on the last day of the quarter in which the necessary documents are collected.

VAT accrual on export proceeds

Regulatory regulation

If a package of documents to confirm the export of goods (finished products) that were purchased starting from July 1, 2016 (Article 165 of the Tax Code of the Russian Federation) is not collected and submitted to the Federal Tax Service within 180 days, then export sales are subject to VAT at the rate of 18 (10 )% (clause 5 of the EAEU Protocol). In this case, the taxpayer loses the right to a 0% VAT rate.

In this case, the tax base for additional VAT calculation is determined on the date of shipment (clause 1, article 167 of the Tax Code of the Russian Federation, paragraph 2, clause 5 of the EAEU Protocol). Thus, it is necessary to “go back” to the shipment period and charge additional VAT at the normal rate.

Payment of VAT on this sale is overdue. Therefore, it is necessary to calculate and pay VAT penalties, as well as pay additional tax to the budget (Article 75 of the Tax Code of the Russian Federation). Only after this do you submit an updated VAT return, then you can avoid a fine for incomplete payment of tax (Article 122 of the Tax Code of the Russian Federation).

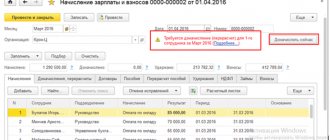

Accounting in 1C

If export sales are not confirmed within 180 days, you must register this event with the Confirmation of zero VAT rate document in the Operations section – Period closure – VAT routine transactions – Create button.

Let's look at the features of filling out the document Confirmation of the zero VAT rate using an example.

Document header

- from — the date on which the confirmation period for the zero VAT rate expires;

- Item of other expenses - Write-off of VAT on other expenses .

The expense item on which accrued VAT is taken into account is selected from the Other income and expenses directory. Type of article in NU - Taxes and fees (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation). The type of article in NU should be changed for a predefined article manually or a new article with this type in NU should be created.

Tabular part of the document

The tabular part can be filled automatically with export implementations by clicking the Fill .

- Event - 0% rate not confirmed .

Please note that the document is filled by default with all export sales for which the 0% VAT rate has not yet been confirmed. Therefore, unnecessary data must be deleted and only those for which the package of supporting documents has not been collected on time as of the date of the document must be left.

If export is not confirmed within 180 days, you must:

- additionally charge VAT at the rate of 18 (10)%;

- issue a new invoice with VAT in one copy (clause 22.1 of the Rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137). Such SF is not transferred to the buyer.

When posting the document Confirmation of the zero VAT rate with the Event 0% rate not confirmed, Invoice document is automatically created with the transaction code “” and with the amount of additional VAT charged.

Postings according to the document

The procedure for calculating VAT on unconfirmed export transactions is not regulated. In 1C, the position of the Ministry of Finance of the Russian Federation is implemented (Letter dated May 27, 2003 N 16-00-14/177):

- VAT is charged on unconfirmed export sales by posting Dt 68.22 “VAT on exports for reimbursement” Kt 68.02 “Value added tax”;

- accrued VAT is charged to other expenses - Dt 91.02 “Other expenses” Kt 68.22 “VAT on exports for reimbursement”.

If the export is not confirmed within 180 days, two situations are possible in the future:

- previously unconfirmed exports will not be confirmed later than 180 days;

- previously unconfirmed exports will be confirmed later than 180 days.

Let's consider each case in more detail.

Option No. 1. Export will not be confirmed later than 180 days

The document generates transactions:

- Dt 68.22 Kt 68.02 - VAT is charged on export proceeds;

- Dt 91.02 Kt 68.22 - VAT accrued on export proceeds is included in expenses.

Posting data is generated automatically when posting a document.

Reporting

If the zero VAT rate is not confirmed within 180 days and is not confirmed later, then VAT accrued on unconfirmed export sales is reflected in the income tax return as indirect expenses: PDF

Sheet 02 Appendix No. 2:

- p. 040 “Indirect expenses - total”: p. 041 including “amounts of taxes and fees...”.

Study in more detail What taxes should be reflected on page 041 of Appendix No. 2 to Sheet 02 in the income tax return

Option No. 2. Export will be confirmed later than 180 days

If the taxpayer is confident that supporting documents will be collected later, then posting Dt 91.02 Kt 68.22 must be removed from the document movements by checking the Manual adjustment . It is also necessary to remove movements from the VAT register for the sale of 0% .

This is done so that later, when confirming the VAT rate of 0% later than 180 days, the document Confirmation of the zero VAT rate .

To edit you should:

- DtKt button to go to the movements of the document Confirmation of the zero VAT rate ;

- enable Manual adjustment ;

- on the Accounting and Tax Accounting , delete the posting Dt 91.02 Kt 68.02.

After that, go to the VAT tab on sales of 0% and delete the movement in the register.

Additional sheet in the sales book

Unconfirmed export sales are reflected in an additional sheet of the Sales Book during the export shipment period. In our example - in the 1st quarter.

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

To display data from an additional sheet of the sales book, you need to configure the report using the Show settings . Let's consider the formation of an additional sheet of the sales book from the adjustment period.

In our example, export sales were in the 1st quarter, the confirmation period of 180 days expired in the 3rd quarter. We create an additional sheet of the sales book from the adjustment period, i.e. from the 3rd quarter.

- Period - 3rd quarter: the period in which the adjustment was made.

- Settings : checkbox Generate additional sheets and select analytics for the adjusted period from the drop-down list;

- For convenience, you can also check the box Display only additional sheets .

For non-commodity goods (finished products) purchased and sold starting from 07/01/2016, it is not required to restore the deduction of input VAT if export sales are not confirmed (clause 3 of Article 172 of the Tax Code of the Russian Federation).

Documenting

If the export is not confirmed within 180 days, then the invoice with the calculated VAT amount is issued in one copy. There is no need to hand over the document to the buyer.

The Invoice form was approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137. It can be printed by clicking the Invoices from the document Confirmation of the zero VAT rate . PDF

“Export” sections of the declaration

As for filling out the VAT return, sections 4 to 6 inclusive are provided for “export” supplies.

In a standard situation (when all documents are collected within 180 days), section 4 is filled out. The transaction code (line 010), the tax base (line 020) and the amount of tax deductions (line 030) are indicated there. As a rule, the parties set the cost of export goods in foreign currency. This cost must be converted into rubles and indicated in ruble amounts in section 4 of the VAT return. For the calculation, the exchange rate valid on the date of shipment of goods is used (clause 3 of Article 154 of the Tax Code of the Russian Federation).

VAT recovery

Sometimes a company may not know at the time of purchase that a particular product will be exported.

Or he plans to sell this product on the Russian market, and then changes his plans. In this case, “input” VAT is usually deducted on a general basis - at the time the goods are accepted for accounting. And at the moment when the goods are “exported”, is it necessary to cancel the previously applied deduction or restore VAT? Or do you need to do neither one nor the other?

Previously, the answer to this question was contained in subparagraph 5 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation, which required the restoration of VAT at the time of shipment of goods for export. However, as of January 1, 2015, this provision became invalid. In this regard, can we hope that there is no need to restore VAT now?

We don't think so. After all, the rule that “input” VAT is deducted in a special manner (at the time the tax base is determined) has not gone away. And if the company accepted VAT for deduction earlier than it should have, then it is obvious that it needs to be restored. Officials make the same conclusion (Letters of the Ministry of Finance of the Russian Federation dated February 27, 2015 No. 03-07-08/10143, dated February 13, 2015 No. 03-07-08/6693). However, the department does not specify when this needs to be done. We believe that it is most logical to restore VAT at the time of shipment of goods for export. After all, it is then that it becomes clear that the deduction was applied prematurely. We think that this is the position that local tax officials will be guided by.

Subsequently, the exporter will be able to deduct the restored VAT - in the quarter in which the company collects all the necessary documents confirming the right to apply the zero VAT rate.