Primary accounting documentation is the documents that are prepared for any business transaction. They serve as the basis for recording transactions in accounting accounts. Let's see what details the primary accounting documents must contain.

Primary accounting documents are prepared for each transaction, including to confirm its reality.

The list of primary accounting documents is not limited. The company can independently develop the forms of primary documents that it intends to use.

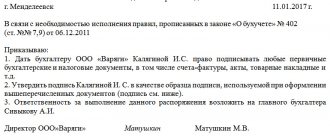

Signing primary documents by power of attorney

The founder of the company, shareholder, and other citizens are not the sole executive body of the company and do not have the right to act on behalf of the company. However, they can represent the interests of the company on the basis of a power of attorney issued to them. In addition, a power of attorney to sign primary documents (a sample text of the document is given below) can be issued to a citizen with whom the company does not have an employment relationship, that is, he is not an employee of the company.

Thus, if a company needs to give a citizen the right to sign primary documents, it is necessary:

- issue a power of attorney from the company (represented by its general director) for the right to sign primary documents for the relevant officials;

- indicate in a separate agency agreement the citizen’s obligation to timely submit documents for registration in accounting registers, as well as his responsibility for the accuracy of the transmitted data.

“Lyudmila LLC, represented by General Director D.V. Nazarov, acting on the basis of the charter, with this power of attorney grants the founder of the limited liability company “Lyudmila” Daria Vladimirovna Volnina (it is necessary to indicate full passport data and place of residence) the right to sign contracts (agreements, contracts).

The power of attorney was issued for the period from September 2, 2021 to September 2, 2017.”

Next comes a sample signature of the authorized representative and the signature of the general director.

Attention

That is, each primary document must contain the personal signature of the person responsible for the operation. According to Order of the Ministry of Finance of the Russian Federation No. 34n dated July 29, 1998, all documents accompanying the execution of business transactions with tangible assets must be signed by the head of the organization and the chief accountant or authorized persons.

According to the Instruction of the Central Bank of Russia No. 28-I dated September 14, 2006 (clause 7.5, clause 7.6), the primary right to sign primary accounting documents is granted to officials representing the sole executive power. Other persons may also be granted the right of first signature. The basis is a power of attorney issued in accordance with the legally established procedure. The right of the second signature is assigned to the accountant responsible for accounting.

It is appropriate in cases where papers are signed not only within the enterprise, but also in other places. For example, when a freight forwarder driver receives cargo from a partner organization’s warehouse or when an accountant receives a bank statement, etc.

The right to sign primary documents can be transferred to an authorized person. This is a fairly common practice in companies where there are a large number of sales and receipts of goods, and the director is busy with other matters, traveling and other activities related to the functioning of the organization. In order to entrust the signature of primary documentation to another person, a number of rules must be observed.

Thus, the employee who certifies the documentation must be officially employed by the company with an employment contract and an entry in the work book. The company must store all necessary employee data. Naturally, he must have a special education and understand the meaning and rules of document flow. Last and most important, a power of attorney must be properly issued for him.

A power of attorney is issued to a specific employee indicating his passport details, place of registration, actual place of residence and position in the organization. They write her out for a certain period of time. If the employment contract is fixed-term, for the period of its validity. If an employee works without a contract term, a power of attorney is issued for a year.

In the previous version, we considered an example with an accounting operator or an accountant whose responsibilities include signing the primary account during all working hours. There are situations when a power of attorney is issued to other officials - driver, forwarder, engineer, mechanic. An example of such a case is the driver’s self-pickup of purchased goods from the supplier’s territory.

To prepare documents and obtain the right to collect cargo and transport it, the organization issues a power of attorney. It consists of two parts - the document itself and its spine. The first part remains with the supplier, and the company takes the spine. Such a power of attorney is issued for a period of up to 10 days, indicating the company from which the employee should receive the goods and materials.

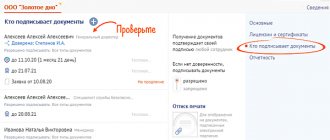

Who has the right to sign primary documents

FOR YOUR INFORMATION! If members of the commission sign, then it is necessary to indicate not their actual positions, but their role in the commission (“Chairman”, “Member of the commission”). But they need to be arranged in order of subordination.

Important

IOF or Full Name? The order of placement of initials - before or after the surname - is determined by Decree of the State Standard of the Russian Federation dated 03.03.2003 N 65-st and the Unified System of Organizational and Administrative Documentation “Requirements for the preparation of documents. GOST R 6.30-2003". According to these regulations, initials are placed after the surname in the following cases:

- when addressing a document to an individual (for example, A.P. Koroleva);

- when declaring or imposing a resolution when specifying the executor (for example, “The order is entrusted to I.I. Romanov”).

If the signature is a requisite, then the initials are placed before the surname.

It should be taken into account that the official position of the persons named in the order presupposes, by virtue of the requirements of the law and the charter of the enterprise, the preliminary receipt of an appropriate administrative act from the authorized body of the enterprise to perform certain actions (for example, to conclude a loan agreement).

The Order does not cover these aspects due to their regulation by other acts. Of all the presented options for fixing the division of powers of equally and differently authorized signatories, each enterprise has the right to choose any method convenient for it or to develop its own, not listed among the presented methods. June 2015

But why do you need to specify who exactly should sign what documents? This must be done so that the inspectors and your counterparties do not have questions about why, for example, during the director’s next vacation, documents are signed by his deputy or a person who does not work at this enterprise at all.

The order of the Ministry of Finance of Russia “On approval of the Regulations on accounting and financial reporting in the Russian Federation” dated July 29, 1998 No. 34n states that the list of people who have the right to sign primary documents by law is approved by the director of the enterprise, coordinating this with the chief accountant.

This right is reflected in one of the following documents:

- in accounting policies (AP);

- job description (JI);

- order;

- powers of attorney.

Why is primary reporting needed?

Primary documents are a mandatory element necessary for accounting; they are compiled in the process of conducting business transactions and are confirmation of their completion.

During the transaction process, a different number of primary documents may be involved. And the quantity depends on the specifics of the transaction. The package of necessary documents is prepared by the contractor or, in other words, the supplier.

List of mandatory operations when making a transaction:

- Concluding an agreement with the recipient (client). In the case where the client is a regular one, it is possible to sign one contract for several transactions at once, but in this case it is necessary to discuss in advance all the details, such as the sequence of payments, work execution, features of the provision of services, and the release of goods.

- Issuing an invoice for payment. The recipient gives it.

- Paying the bill. When the recipient pays, he receives a check from the contractor (can be cash or goods), in cases where the payment is in cash. If by non-cash means, the client transfers funds based on payments.

- Transfer of invoice. During the shipment of goods, the contractor must issue the customer a delivery note and an invoice.

- Issuance of a service provision certificate. After the services have been provided by the contractor, the client must issue him a certificate of provision of services and an invoice, if available.

Order

The order is issued by the manager to certain officials working in the company, and is valid as long as they are employees of the company. Thus, several differences between a power of attorney and an order can be identified:

- the power of attorney is issued to a specific individual, and not to an employee holding a certain position in the company;

- a power of attorney is usually issued for a specific period (for example, a year);

- a power of attorney can be issued to an individual who is not in an employment relationship with the company, while the order applies to employees of the company.

The form of the order for the right to sign primary documents is not approved by law; the company can draw up this document independently. It is advisable to include the following information in the order:

- Full names of employees;

- positions of employees who are given the right to sign documents;

- the order may contain a specific list of documents.

It applies only to those persons who work in the company and receive the right to certify strictly internal corporate documents.

After drawing up the decree, the director must certify the signatures of the employees indicated in it with his autograph. The duration of the order is determined on an individual basis: an order for the right to sign primary documents can be of an indefinite nature, or can be drawn up for a specific period, depending on the situation within the company.

We invite you to read: Replacement of risers at the expense of the owner

Regardless of whether an administrative act will be drawn up or the manager will give his preference to a power of attorney, the form must indicate:

- personal data of the authorized person;

- names of papers that it will be able to sign;

- If a power of attorney is issued, its validity period should be additionally indicated.

The order on the right to sign is drawn up on the official letterhead of the organization accepted for orders.

The mandatory points of the order are:

- Full names of employees;

- The position of the person who is trusted to sign documents;

- Deadline for granting signature rights;

- Sheet with sample signatures of principals and proxies.

If the head of an organization has concerns that employees may harm the company and sign “something wrong,” a list of documents is drawn up. In normal financial and economic activities of an organization, it is advisable to transfer the right of signature to the manager and chief accountant for the following series of documents:

- Certificate of completion;

- Consignment note for shipment or acceptance of goods and materials;

- Invoice;

- Cashier-operator's journal, cash documents;

- Standard supply contracts concluded with buyers;

- Power of attorney for receiving inventory items.

There is a common misconception that there is no need to create any orders, it is easier to order a stamp and put a facsimile everywhere, but a facsimile signature can be used if it is expressly provided for by law or by agreement of the parties to the transaction.

When preparing accounting and tax accounting documents, an organization requires “live” signatures of the manager and chief accountant. The tax services of the Russian Federation have a negative attitude towards primary documents in which a “facsimile” stamp is affixed instead of a signature. When issuing an invoice, the tax authorities generally deny the possibility of a facsimile signature. If you want to avoid disagreements with tax inspectors, you should not sign documents with a facsimile signature.

In the course of its activities, an organization draws up a wide variety of documents, each of which carries its own meaning. Correct filling, details, and completeness of the information provided are regulated by law. Small organizations receive significant concessions from the tax service in accounting and reporting.

An order for the right to sign the primary document should be drawn up on the company’s official letterhead. There is no special form for this document, so you can compose it in free form, indicating the following:

- list of persons who are entrusted with the right to sign (positions, full names);

- the period for which the right to sign the primary document is granted;

- sample signatures of authorized representatives;

- a list of documents that the specified persons have the right to sign (indicated if the manager fears that employees may exercise their right and cause harm to the company).

As a rule, the right to sign for the manager and chief accountant is transferred for the following documents:

- Certificate of completion;

- Packing list;

- Invoice;

- Cash documents and cashier's journal;

- Agreements concluded with buyers for the supply of goods;

- Powers of attorney for receiving inventory items.

The order is certified by the signature of the head of the company or another employee authorized to certify such documents. In addition, all persons responsible for its execution must sign to confirm familiarization with the document.

After the order is issued, the document must be stored together with other administrative documents of the company. If the order loses its relevance, it is transferred to the archive, where it is stored for at least 3 years (or a longer period in accordance with the company’s internal local documents). After this, the document can be disposed of.

Packing list

This document is used to formalize the sale (release) of inventory items to a third-party company. The invoice is issued in two copies. The first copy remains with the seller and allows you to record the release of goods to the third party, and the second copy is transferred to the buyer and allows you to capitalize the received inventory items. The data recorded in the invoice should not diverge from the data indicated in the invoice. Authorized persons who authorize the release of goods must personally sign the invoice. Signatures must be certified by the seal of the organization. Officials who accept the goods sign the consignment note and put a stamp.

Granting the right to sign on documents

In the absence of a responsible person, the right to sign documents is vested in the person performing his duties or the deputy responsible employee. In such a situation, it is necessary to indicate the actual position and surname of the individual who signed the document. The number of persons entitled to sign primary documentation should be minimal. Thus, documents accompanying the execution of financial transactions must be signed by the head of the organization and the chief accountant.

In the absence of these, secondary officials - deputies - sign the papers. Sample signatures of responsible persons and their deputies must be certified by a notary on a special card. This is presented to the bank servicing the organization.

Basic requirements for primary accounting documents

Note 1

The Ninth Federal Law “On Accounting” contains basic requirements regarding primary accounting documentation.

The essence of this law is as follows:

- Universal coverage. All business transactions must have documentary evidence, otherwise they cannot be reflected in the accounting account. In addition, documents that reflect a fact that does not take place in the economic activity of the organization are not accepted for accounting;

- Free form. Since the beginning of 2013, organizations have the right to independently choose the form of maintaining primary documentation for accounting. It is not necessary to use unified forms of primary documentation; an enterprise can either develop an independent form or adapt a unified one. The manager has the right to determine the form of primary accounting documentation in agreement with the chief accountant;

- Required details. Due to the fact that the use of a unified form is not a mandatory factor, a list of mandatory details that must be contained in the primary document was developed and approved at the legislative level. Such details include: the name of the organization and the date of preparation of the document, the name of the enterprise, the content of the business transaction and units of measurement, the signatures of the responsible persons and their positions (with a transcript);

- Timeliness. The legislation provides clear dates for the submission of primary documentation. This documentation must be drawn up either directly during the business transaction, or immediately upon completion of such a transaction. For example, when cash is issued from a cash register, this operation is immediately reflected in the cash book;

- Timely submission of documents to the accounting department. Responsible persons must submit documentation to the accounting department on time, which is reflected in the accounting registers. To do this, a schedule is drawn up in accordance with which the document flow is carried out, which has a positive effect on the process of document movement in the organization and controls the deadline for their submission to the accounting department;

- Display on paper. According to the law, primary accounting documentation can be compiled both on paper and electronic, with an electronic signature of an authorized person. But, as practice shows, it is better to have primary documentation on paper, because if it is necessary to provide it at the request of special authorities, it must be on paper;

- No corrections that are not agreed upon in advance. Certain corrections are permitted by law. If any are present in the document, then the dates of correction, signatures of authorized persons and their details must be indicated;

- Possibility of repetition. In cases provided for by law, primary documentation may be confiscated from the enterprise. But at the same time an organ. The person conducting the seizure must be given the opportunity to make a copy of these documents.

Did not you find what you were looking for?

Just write and we will help

Transfer of signature rights

Giving an employee these powers is formalized as follows.

All the necessary details are entered into the sample order for granting the right to sign:

- order number;

- Date of preparation;

- Company name;

- the locality in which the enterprise is registered.

In the main part, the sample order for the right to sign documents must contain the data of the employee (or employees, if the order concerns several persons):

- job title;

- FULL NAME.;

- a list of documents that an employee has the right to sign;

- executive visa;

- sample signature of an authorized person.

The employee should be made aware of this decision. He must sign as a sign of familiarization with it and express agreement with the responsibilities transferred to him. Since there is no unified order form for this case, you can develop the form yourself, based on our samples, and use it in your work.

The chief accountant and the head of the organization every day in their work are faced with the fact that they need to sign a large number of different documents: supply agreements, primary documentation, employment contracts or other financial documents. But what to do if an employee gets sick, goes on vacation or is on a long business trip? A sample order on the right to sign primary documents with an example of completion in this article will solve this problem.

In accordance with the legislative acts of the Russian Federation, there is a concept of the first and second signature. The first signature always belongs to the head of the organization, the second signature belongs to the financial director or chief accountant of the company. The situation becomes more complicated if the first and second signatures belong to the same person, when the manager has assigned himself the duties of an accountant, which often happens in small enterprises.

Reasons why a manager can delegate powers and issue an order on the right to sign primary documents:

- The person in charge of the organization is on vacation, on sick leave, or on a long business trip;

- The organization’s work schedule does not coincide with the work schedule of the company’s top officials, for example, a wholesale warehouse is open 24 hours a day, seven days a week, but the manager has a different work schedule;

- The organization's document flow has too large a volume of incoming and outgoing documents; it is unrealistic for one person to cope with such a quantity.

It is impossible to prepare documents without the signature of the organization's top officials. In such cases or under other circumstances, an order is issued on the right to sign primary documents indicating the full list of persons who have the right to sign for the head of the company or chief accountant.

The right of first signature cannot be transferred to the chief accountant or other person who has the right of second signature on financial and other documents.

The right to sign financial or other documents can only be transferred to an employee of the organization, and since the organization’s staffing may change, it is advisable to draw up an order annually.

It is worth noting that this order does not apply to bank documents, for example, a checkbook, since the right to sign is limited to the circle of persons specified in the bank card of the organization’s sample signatures and cannot be transferred to other persons.

The legislation of the Russian Federation provides for the right of first and second signature. The first signature belongs to the head of the company, and the second – to the financial director or chief accountant. However, often in small companies there is no chief accountant, and the manager has assigned his responsibilities to himself. In this case, the right to both the first and second signatures will belong to one person.

In certain cases, the manager delegates authority and issues an order on the right to sign the primary:

- when the company's responsible person is on vacation, a long business trip or on sick leave;

- if the work schedule of the head of the company and the departments does not coincide;

- The company has a large volume of documents, which makes it difficult for one person to cope with them.

We invite you to familiarize yourself with: What does establishing paternity provide and who can initiate the documents and stages of the procedure

Without the signature of documents by the company's top officials, their execution is impossible. In this case, an order is issued on the right to sign the primary office, which indicates the persons who have the right to put their signature on the document instead of the chief accountant or manager.

It is impossible to transfer the right of the first signature to a person who owns the right of the second signature (for example, when the chief accountant has the right of the second signature, the right of the first signature cannot be transferred to him). The right to sign is transferred to an employee of the organization through an order drawn up on the right to sign primary documents. Since the company may constantly change employees, it is advisable to draw up an order every year.

How to certify the right to sign primary documents - by order or power of attorney

The main criterion for distinguishing between an order for the right to sign primary documents and a power of attorney in this case is that the validity of a document of the first type applies only to employees of the business entity, while the second type applies to any persons specified in the document. The drawing up of orders and powers of attorney is regulated by different branches of law - labor and civil, respectively.

The procedure for issuing a power of attorney for the right to sign invoices was explained by ConsultantPlus experts. Get trial access to the system and upgrade to the Ready Solution for free.

The choice of an order as a normative act certifying the transfer of the right to sign the primary document will be optimal in cases where only internal documents are intended to be signed. At the same time, there is absolutely no need (primarily from the point of view of the security of the transfer of corporate information) to grant unnecessary powers to third parties.

In turn, if this or that documentation needs to be signed and then transferred to the third party (for example, accompanying documents for transported cargo or an invoice), then in this case a power of attorney may be needed.

Both in the power of attorney and in the order, it is important to reflect:

- personal data of the authorized person;

- a list of specific types of documents that an authorized person has the right to sign.

Also, in both cases, the head of the business entity certifies a sample signature of the authorized person, which is affixed by the person in a separate column of the order or power of attorney.

Signature right for the director

Responsibility for the right to sign The person authorized to sign must remember that he is personally responsible for signing documents. If he signs documents that indicate illegal actions, then various types of sanctions, including criminal ones, may be applied to him.

This should be understood when signing contracts for large sums of money. But the head of an organization also bears a risk when assigning powers to a particular person.

If he was absent for a month, and during this time many documents were signed. If difficulties arise in the future with the fulfillment of the obligations assumed, the manager himself will be responsible. If you have any difficulties with drawing up an order or power of attorney, our specialists will help you understand the current situation. They will select a solution that suits you and your company.

Who can sign primary documents

Considerable attention is paid to signing documents. It is very important that the persons who certify the primary document are authorized to perform this action. Another mandatory registration condition regarding signatures is that all persons who are in one way or another involved in the process of a business transaction and are responsible persons must put their signature on the document. So, who can sign primary documents:

- CEO of a company or individual entrepreneur;

- Chief Accountant;

- the storekeeper who released the goods;

- the driver who accepted the goods for transportation;

- the storekeeper who accepted the goods into the warehouse;

- the specialist who accepted the documentation for accounting;

- third-party carrier, if he was involved in the delivery process.

Deputy head for administrative and economic activities - management of the logistics and economic support department, organization of transport, operation of the building. 2. Deputy heads are given the right to conduct correspondence on agency letterhead on issues of their competence. 3.

During the period of temporary absence of deputy managers, issues of performance of their duties in each specific case are decided by the manager. Head V.V. Uyba Bibliographic list 1. GOST R 6.30-2003 “Unified documentation systems.

Unified system of organizational and administrative documentation. Documentation requirements." M.: IPK “Publishing Standards”, 2003.

2. Yankovaya V. F. Signature on the document // Secretary-referent. 2007. N 5. A.

The procedure for signing primary documents

Persons who have the right to sign the primary document are determined by the head of the enterprise together with the chief accountant.

The head of the organization, together with the chief accountant, as well as persons authorized by them for this purpose, sign primary documents that reflect the fact of a business transaction related to the flow of funds.

A primary document of a monetary or settlement nature without the signature of the chief accountant or an authorized person is considered invalid.

Is it difficult to figure it out on your own?

Try asking your teachers for help

Solving problems Tests Essays

Types of documents in an organization

Companies carry out business transactions every day, which must be immediately reflected in accounting, management and tax accounting. What are primary documents? This is precisely a reflection of these operations, also serving as proof that they took place. Then, for the purposes of analysis, systematization, control, forecasting and for the implementation of other economic procedures, all documents on transactions are registered in special directories and journals - accounting registers.

The essence of the primary document is to record the fact of the transaction performed. The document is issued at the time of its completion or immediately after it. It reflects a number of details necessary to confirm the reality of the operation, identify the persons involved in it, as well as its composition. The organization must comply with all requirements set by law and regulatory authorities regarding primary documentation.

Signing primary documents by power of attorney

There are several ways to resolve this situation:

- Provide in the constituent documents the possibility of signature for the deputy director or other official.

- Issue a power of attorney for signature by an authorized person (you can do this immediately for a long period, for example, for a year).

- Issue an order or instruction for the right to sign a specific document (one-time option).

- Use a facsimile version of the signature in cases where this does not contradict the law.

Signed by I.O. If the document is signed by the acting director or his deputy, the right to sign is delegated to him on the basis of the above documents.

Personnel officer. Personnel records management", 2011, N 4 THE RIGHT TO SIGN DOCUMENTS In the procedure for preparing a document, signing is of particular importance. In practice, when signing documents, situations often arise regarding the right to sign, delegation of this right to other officials, etc.

In most cases, a signature on a document gives it legal force (with the exception of documents that receive legal force after their approval - rules, regulations, instructions, regulations, staffing, some acts, etc.). The procedure for signing documents is established by GOST R 6.30-2003 “Unified documentation systems.

Unified system of organizational and administrative documentation. Requirements for the preparation of documents" [1]. The standard contains provisions addressing issues of external signature design.

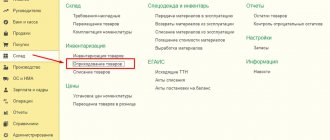

Examples of primary documentation

Every day the company performs certain actions: purchases goods, issues invoices, ships products, pays for purchases and taxes, receives and spends funds at the cash register. All these operations are documented with primary documents. To accurately reflect the listed actions in accounting, the following forms of documents are used:

- TORG-12 or waybill;

- invoice;

- incoming and outgoing cash orders;

- acts of completed work and services;

- acts of transfer of material assets;

- waybill;

- payment orders and bank statements;

- requirement for the issuance of material assets.

To this list you can add quite a lot of examples of primary documentation used in the company. Its main difference from accounting registers and reporting is the execution of the document during the operation or with a slight delay.

Payment documents

They confirm the fact of payment for goods, works or services. A payment document can be a payment order, payment request, cash and sales receipt, BSO (strict reporting form). The buyer receives the payment order at the bank, making a payment by bank transfer. The buyer receives a cash receipt, sales receipt or BSO from the seller at the time of payment in cash. All fields are filled in according to the rules approved by the Bank of Russia Regulation No. 383-P dated June 19, 2012, as last amended as of July 5, 2017.

Regulations

Samples of primary documents are approved by the State Statistics Committee, the Ministry of Finance and the law on accounting. Regional requirements and regulations are also being issued. The most important legislative act regulating the work of an accountant is 402-FZ. Art. 9 describes in detail the rules for maintaining documentation.

Legislative bodies almost quarterly issue regular amendments to existing provisions, new regulations, and publish changes in accounting and reporting. That is why accountants constantly improve their qualifications, subscribe to specialized thematic publications and try to keep abreast of all the news in tax and accounting. Failure to comply can result in large fines, extensive redactions of existing records, and other penalties.

We invite you to familiarize yourself with: What documents are needed for insurance in case of an accident under compulsory motor insurance, list of required ones

Check

An invoice is issued to the buyer, who pays the stated amount on the invoice. Accordingly, he accepts the terms of the agreement. There is no specific form for this document, so each company can develop its own form of invoice for payment. In addition, the invoice may contain additional information about the terms of the transaction. For example, the terms and procedure for payment and delivery, pickup of goods, notification of prepayment, etc. Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” states that the signature of the chief accountant, head of the company or authorized person are not mandatory details for this document. In addition, no printing is required either.

Document details

The legislation provides for mandatory details of primary documents that must be indicated by the organization. Their presence determines whether the documents will be taken into account in the final reporting when deducting amounts from the tax base, whether the fact of a business transaction will be accepted, and whether the Federal Tax Service will have any claims regarding the legality of the transactions.

Mandatory details of primary documents include the following information:

- names of the supplier, buyer, consignee and payer for transportation;

- bank details, TIN, physical and legal address of companies;

- document number and date;

- items that were moved, purchased or sold during the transaction;

- units of measurement, quantitative and cost expression of nomenclature;

- the total amount for all positions in the document;

- signatures, positions, transcripts of signatures of responsible persons;

- make, car number, driver’s details during transportation;

- number of seats, weight and category of cargo transported;

- the basis for issuing the document, the number and date of the contract, information about specifications, certificates, examinations, if any.

Electronic signature

The primary document can be signed in another way - electronically. The condition is the maintenance of electronic document management, the availability of appropriate software and hardware and an electronic signature certificate. A power of attorney must also be issued for the person whose name appears on the certificate.

In the process of work, both the head of the company and the chief accountant are faced with the need to sign a large number of documents. They put their signature on supply contracts, primary documentation, employment agreements and payment documents. Sometimes the indicated persons do not have the opportunity to sign all documents, which leads to the need to shift this responsibility to other persons. In the article we will look at how to draw up an order on the right to sign primary documents, and also provide a sample of it.

How can you transfer the right to sign primary documents?

After the head of the company decides on the persons who will have the right to sign the primary document, he decides on the method of transferring such right. This can be done in the following ways:

- draw up a power of attorney;

- issue an order.

The first method is appropriate if documents are signed not only within the company, but also outside it. For example, if a forwarding driver receives cargo from a counterparty’s warehouse, or an accountant receives documents from a bank. In addition, a power of attorney can be drawn up not only for an employee of the company, but also for a third party.

The order is drawn up for employees who work in the company. The period for which the right to sign can be transferred can be any. It can be unlimited or limited to one quarter, six months or a year. This is decided by the head of the company independently.

Why do you need an order for the right to sign?

The Ministry of Finance of the Russian Federation in information dated December 4, 2012 No. PZ-10/2012, commenting on the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, expressed the opinion that the head of an economic entity is obliged to approve lists of persons who are authorized to sign primary accounting documents.

The position of the department is based on the provisions of Art. 7 and 9 of Law No. 402-FZ and can be considered as defining a successive rule of law relative to the one established in paragraph 3 of Art. 9 of the Law “On Accounting” dated November 21, 1996 No. 129-FZ, which was previously in force. The previous legal acts regulating accounting contained a direct requirement for the manager to approve the list of persons who have the right to sign on the primary document.

The current legislation does not regulate how the relevant persons should acquire their powers. In practice, in Russian organizations it is common to consolidate these powers by issuing by management:

- an order for the right to sign the primary document by a specific person or a list of persons;

- power of attorney for the right to sign the primary document.

Let us consider the specifics of both methods of transferring rights to sign a primary document in more detail.