Home • Blog • Online cash registers and 54-FZ • Online cash register for a hairdresser and beauty salon in 2018-2019

An online cash register for a hairdresser - whether it is needed or not, when to switch, and whether there is a deferment - all these questions concern small business owners and individual entrepreneurs in connection with the sensational 54 Federal Law “On the use of cash register equipment.” As a rule, beauty salons do not issue receipts for their services, or rather, they did not issue them. What does it mean? 54 of the Federal Law obliges the purchase of online cash registers for transmitting data through the OFD to the tax service. Why is this necessary? Of course, with the aim of controlling the “poor, unfortunate” businessmen, who are being squeezed into a vice more and more, and the extortions are only multiplying. In connection with the release of legislative updates, let's figure out what awaits hairdressers and beauty salons in 2018-2019, and whether online cash registers for hairdressers are needed in 2021.

Special offers for online cash registers

Large selection of equipment according to 54 Federal Laws. All cash desks are at manufacturer prices with an official guarantee. It has become even more profitable to purchase a cash register in our store - there are special offers.

GET AN OFFER IN THE ONLINE CASH CATALOG

Transition deadlines

- From July 1, 2021, online checkout for beauty salons and hairdressers became mandatory if, in addition to services, the salon sold cosmetics, personal care products and other goods.

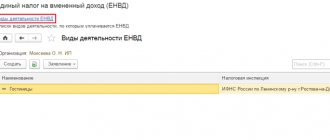

- In 2021, the rest of the individual entrepreneurs with employees and all legal entities switched to online cash registers. Individual entrepreneurs on UTII, PSN and STS have the opportunity until February 1, 2021 to issue a check with a single amount, without the name and quantity of paid services and goods.

- From July 1, 2021, cash registers should appear for individual entrepreneurs who work without employees under an employment contract and sell only goods of their own production, for example, masks and soap prepared in a beauty salon. Until this point, entrepreneurs may not issue the client a check, BSO or any other confirmation of payment.

Mobile cash registers MSPOS-K and MSPOS-E-F

Who is it suitable for:

- Masters for field service at home, office, hospital, hotel.

- Small salons with limited space at the reception desk.

- Salons that experience interruptions in the Internet or electricity.

- Large salons with several halls, where the client pays at the place of receiving the service, and not at the reception.

Cheaper than stationary cash registers. The optimal solution for small businesses and startups. See prices for MSPOS-K and MSPOS-E-F with acquiring

- Compact, lightweight, fits into your tool bag.

- Touch color screen.

- Autonomous battery operation for 24 hours.

- You can insert a SIM card to connect to the mobile Internet.

- Built-in camera for reading barcodes (needed if you sell goods).

- The MSPOS-E-F model has a built-in terminal for paying with bank cards.

- The check must be torn off manually.

- The 5.5" screen is comparable to a smartphone screen, but may not be large enough for some employees.

Which hairdressing salons may not use online cash registers?

A cash register for a beauty salon or hairdresser is not allowed to be used in hard-to-reach and remote areas that do not have regular transport links. The list of such areas is compiled by regional authorities. You can find out whether your locality belongs to such areas at the regional tax office. If your hairdresser or salon is exempt from using a cash register, at the client’s request you need to issue documents confirming payment receipt (Clause 3, Article 2 of Law 54‑FZ).

There is another category that may not use an online cash register. These are self-employed citizens, payers of professional income tax (PIT). These include participants in the experiment for Moscow and the Moscow region, Kaluga region and Tatarstan, with an income of no more than 2.4 million rubles. per year or related to the sale of excisable goods (Article 4 of Law No. 425-FZ dated November 27, 2018). Self-employed people submit information to the Federal Tax Service about settlements with clients not through the cash register and OFD, but through a mobile application.

Monoblocks Kontur.Sigma and MSPOS T-F

Who is it suitable for:

- Salons with little free space at the reception desk.

- Large salons with several halls, where the client pays at the reception

- For salons with medium and large flow of clients

- For hairdressing salons with a wide range of services and products

The optimal solution for a mature business in terms of price and capabilities. See prices for Kontur.Sigma and MSPOS T-F.

- The screen and receipt printer form a single compact device.

- On the table it takes up space comparable to a lying sheet of A4 paper.

- The check is cut automatically.

- Large color touch screen: Kontur.Sigma has 10”, MSPOS T-F 11.6”.

- Kontur.Sigma's screen can be tilted.

- There are connectors for connecting a scanner, acquiring terminal, and cash drawer.

- With MSPOS T-F you cannot change the angle of the screen, only with Kontur.Sigma.

- If you need to print long names of services and goods on a receipt, the width of the Kontur.Sigma receipt (57 mm) may seem insufficient, then it is better to use MSPOS T-F (80 mm).

Advantages of online cash registers for beauty salons

By connecting online cash registers for a beauty salon to a computer or laptop with an installed accounting program, for example, VLSI, you will receive a simple solution for automating the salon, and therefore the following advantages:

- Maintaining an electronic journal and managing employee schedules.

- Formation of a customer base: collection of contact information, visit history and completed procedures.

- Distribution of personal offers and development of loyalty programs: bonus cards, individual discounts and promotions.

- Facilitation of accounting.

- Reports for the owner in real time and from any device.

Cash register for hairdressing salons - the main types, how not to “get money”

Now cash registers are presented in three main types: fiscal registrar, POS system and autonomous online cash register. Each cash register model is presented in the tax service cash register register. The most important thing when buying a cash register is to buy it from reliable sources. Each model must be presented and registered in the tax register, just as the fiscal registrar must not be counterfeit. You should not buy a cash register secondhand or in China; it will not be able to be registered and you will not be able to work with it. Trying to save a lot on buying a cash register is not worth it. It’s not for nothing that the saying goes: “the miser pays twice.”

Fiscal recorder – works only with a computer or tablet. DF does not work on its own. To carry out its functions, the device requires a nomenclature database and a special program. The fiscal registrar resembles a simple receipt printer in appearance, but combines not only a printing device, but also the now necessary fiscal storage device. The fiscal registrar receives data and writes it to the fiscal drive. Fiscal data is also sent to the OFD, and then through the OFD to the Federal Tax Service.

POS system – the basis is a POS terminal (a special computer with special software and many interfaces for convenient operation and connecting additional devices). The system operates in conjunction with the fiscal registrar. View the catalog of POS systems.

An autonomous online cash register is a regular cash register in the usual sense.

An autonomous cash register is purchased together with a fiscal drive, and does not need to be connected to a computer. view the catalog of offline online cash registers.

What will change in working with cash registers?

In accordance with the law, a check for a cash register must be punched now even upon receipt of an advance payment. In the case of hairdressers or beauty salons - when selling gift certificates. To properly complete the sale, you will need to print two receipts:

- The first is when selling a gift certificate to a client. A check is generated to confirm the prepayment.

- The second is after the provision of services to the bearer of the certificate. The receipt reflects the full list of services provided for the amount of the certificate. The type of payment is indicated as “Advance payment”.

The second document can be used for a larger amount than that indicated in the gift certificate. Both knocked-out checks are sent to the Federal Tax Service, but only the second one records the direct sale of services or goods.

Who are “self-employed citizens”?

Self-employment is understood as a form of employment in which an individual receives income from activities related to the sale of work, goods or services produced by him, in the implementation of which he does not have an employer or hired employees.

Read the review article by portal experts about self-employment and the features of doing business as a self-employed citizen at the link.

Which cash register to buy for a hairdresser

Three main solutions may be suitable for hairdressing and beauty salons: stand-alone cash registers, POS terminals, and fiscal storage devices. We tell you how to choose a cash register for your business.

Autonomous online cash registers

When choosing such devices for hairdressing salons, it is worth deciding on the tasks that the cash register must solve. To comply with the requirements of the law and not spend a lot of money on it, “autonomy” is an ideal option. It runs on a built-in battery and looks like a large calculator with buttons. The cashier enters the price manually, receives payment, and the cash register prints a receipt.

Advantages of autonomous cash registers:

- - low cost,

- - compactness,

- — high mobility, battery powered,

- - cheap spare parts.

Flaws:

- - small screen,

- - low print speed,

- — it’s difficult to add new products/services.

Recommended models: Mercury-185F, ATOL 91F, Kassa F

POS terminals

POS terminals are compact modern devices, easy to use and easy to configure. Such cash register equipment will fit seamlessly into even a premium-class beauty salon.

Advantages:

- — the ability to select services or goods from the catalog on a large touch screen,

- — it’s easy to make changes to the assortment during a shift,

- - modern technological equipment.

Flaws:

- — The POS terminal combines several devices; if any one breaks down, the entire monoblock must be replaced,

- — the touch screen gets dirty easily,

- - high cost of spare parts.

Recommended models: Evotor 7.2, Evotor 10, Vicki Mini F

Fiscal registrars

The fiscal registrar only works in conjunction with a computer. Therefore, purchasing it for a hairdresser is advisable if you already have a computer or have a place to install it.

Advantages:

- - ability to connect to a computer,

- - unlimited number of goods and services,

- — you can make changes to the assortment during a shift,

- — no additional software or integration with a commodity accounting system is required.

Flaws:

- - work only in conjunction with a computer.

Recommended models: Vicki Print 57F, SHTRIH-ONLINE, ATOL 20F

For a complete catalog of cash registers, see the Online cash register section. If you are in doubt about your choice, we recommend that you seek advice from our managers. They will help you navigate the assortment.

Who to entrust settlement with the client

While there was no cash register in the salon, any employee could accept payment from a client. For example, an administrator or a master who provided a service.

With the appearance of a cash register, you need to determine in advance who will work at it and add their names to the list of cashiers when setting up the cash register. This is necessary to comply with the legal requirement to indicate on the check the name of the employee making the payment.

And the names of the cashiers are needed to know who performed what operations at the checkout: how much revenue they brought in, what discounts they provided. The cash register sends this information to the service with which it works in conjunction: it receives from it the items to be printed on the receipt and sends back sales information for generating reports.

Tax deduction of 18,000 rubles for online cash registers

The law guarantees individual entrepreneurs on UTII and PSN without employees a tax deduction of up to 18,000 rubles. for each purchased online cash register. The deduction amount can include expenses for the cash register itself, the fiscal drive, services for connecting and setting up the cash register, as well as the cost of the software. The deduction is provided when registering a cash register before July 1, 2019.

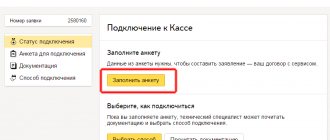

If you don’t have time to deal with issues of connecting and registering an online cash register, fill out an application on our website! We will do everything quickly and on a turnkey basis.

The final stage is an agreement with the fiscal data operator

After the cash register is registered with the tax office, you need to select the OFD and enter into a service agreement with it . There are many operators, you can choose any one, especially since they all have the same prices. Theoretically, you can come to the office and sign an agreement there, but in practice no one does this. The entire procedure takes place online through your personal account.

Annual maintenance costs 3,000 rubles. After the conclusion of the contract, an invoice is issued that must be paid. You can also top up your balance through your personal account using a bank card.

As is the case with tax authorities, the procedure can be entrusted to a specialized organization . As a rule, they offer a ready-made solution - registration with the tax office and OFD. By the way, you can generally order a turnkey package solution. It includes a cash register, its delivery and all connection and registration work, as well as settings and staff training. The cost of a package with an Evotor 7.2 smart terminal and technical support for 3 months is an average of 46,000 rubles .

Attention! As in the case of a cash register, check whether the fiscal data operator is authorized to conduct tax service activities. You can check this on the tax website - there is a complete list of such organizations. If the OFD loses its accreditation, it will not be able to work and will be excluded from the register.

This concludes the connection and registration of the online cash register for the hairdressing salon of individual entrepreneurs and LLCs. Finally, we will give some useful tips.

- replenish your balance in your personal account on the OFD website on time. If the balance is negative, sending documents is suspended. They are stored on the fiscal drive for up to 30 days - during this time the problem must be resolved. Most operators have a daily payment - you can pay for, say, a month of service, if necessary;

- connect acquiring. Payment by plastic card is almost ahead of the classic method of cash payment, especially in large cities. Often, customers leave an establishment that does not accept cards, and you don’t want to lose customers. Banks lease equipment for free, taking a percentage of each payment. It depends on your turnover and averages 2%;

- Close your shift every day and train the staff working at the cash register to do the same. Make sure that all fiscal documents are sent to the cloud - the device itself will inform you about this with the inscription “All documents have been sent”;

- check your device after updates. The software is automatically updated. Some menu items may look different after this, which is better to find out about right away rather than during settlements with the client.

Renting premises for a beauty salon

To open a beauty salon with the best profitability, it is important to choose the right future location. In the service industry, location selection can be a critical factor in business profitability. Pay attention to:

- building density in residential areas;

- traffic in shopping and business centers;

- number of employees in the business part of the city (at least 1,000 people);

- convenience of transport or walking accessibility;

- absence of direct competitors.

Until January 27, 2014, Appendix No. 1 to sanitary requirements for premises areas SanPiN 2.1.2.2631‑10 dated May 18, 2010 No. 59 was in force

| Room | Square |

| Waiting hall | not less than 6 m2 |

| one hairdresser workplace | from 4.5 to 8.0 m2, but not less than 15 m2 per hairdressing salon |

| laundry | from 9.0 m2 |

| room for staff to rest and eat | from 6.0 m2 |

Now Appendix No. 1 has been excluded from SanPiN 2.1.2.2631‑10 No. 59, but a number of requirements remain:

- a separate room or place for disinfection, pre-sterilization cleaning and sterilization of instruments, equipped with a sink with hot and cold water supply;

- cabinets (cosmetic, pedicure, massage, solarium, piercing, tattoo) should be located in different rooms;

- it is allowed to combine manicure and pedicure services in one office if one workplace for a manicure-pedicure specialist is organized;

- hairdressing salons must have utility, auxiliary and household premises;

- It is allowed to combine a lobby with a cloakroom for visitors and a waiting room, as well as a meal room with a dressing room for staff, if there are less than 10 workers per shift.

Therefore, to accommodate an economy class cabin, you need a room of at least 50 m2, for premium establishments - at least 100 m2.

If you find a suitable premises, do not rush to sign a lease right away! First, you need to obtain permission to start work, that is, coordinate your activities with the local administration, SES and Fire Inspectorate, otherwise your expenses for renting premises that are “not suitable” will be in vain. The local administration issues permission or refusal to locate a service enterprise based on an application and documents confirming the right to use the premises. You will have to contact the SES and Rospozhnadzor several times. Initially, obtain a sanitary and epidemiological conclusion on the design documentation. Another tip: don’t agree to short-term rentals, it’s a huge risk. If the owner of the premises finds a more profitable tenant, you will have to move out, which implies expenses that a young business is unlikely to be able to bear. In addition, for a salon to generate real profit, it must be in one place for at least three years.

Fines in case of violations of 54-FZ

Fines for providing services without an online cash register:

| Type of offense | Fine for officials and legal entities |

| Cash register equipment is not available in the organization or is not used when it is available. | Official: from ¼ of the settlement amount (but not less than 10,000 rubles) to ½ of the settlement amount (but not less than 10,000 rubles); Legal entity: from ¾ of the settlement amount (but not less than 30,000 rubles) to 1 of the settlement amount (but not less than 30,000 rubles). |

| Repeat violation (if a previous violation was recorded) | Official: disqualification for a period of 1 to two years; Legal entity: administrative suspension of activities for up to 90 days. |

| The total amount of transactions performed without the participation of cash register equipment was from 1,000,000 and above | Official: disqualification for a period of 1 to two years; Legal entity: administrative suspension of activities for up to 90 days. |

| The purchased and used cash register equipment does not comply with the requirements of the legislation of the Russian Federation | Official: up to 3,000 rubles; Legal entity: up to 10,000 rubles. |

| The entrepreneur did not provide (untimely provided) data to the Federal Tax Service | Official: up to 3,000 rubles; Legal entity: up to 10,000 rubles. |

| The electronic version of the cash receipt was not sent to the buyer (or the paper version of the receipt was not issued) | Official: 2,000 rubles; Legal entity: 10,000 rubles. |

UPD: description updated 09/22/2019

How much does it cost to open a beauty salon from scratch?

How much money does it take to open a beauty salon? Costs depend on the class of establishment, locality and conditions for the provision of premises. If you rent in a small city, you can get by with the following expenses:

- economy class salons - about 1 million rubles;

- business class salons - from 1 to 3 million rubles;

- premium class salons - from 3 to 10 million rubles and above.

If you are not yet ready to incur large expenses to maintain the image and prestige of your establishment, we advise you not to immediately think about how to open a premium-level beauty salon. In our book, we provide a ready-made example with calculations for an economy class establishment as a business plan for a beauty salon. The cost calculation for the purchase of equipment for 7 workplaces was based on the catalog of a specialized website offering the selection of furniture and equipment using 3D modeling. The income part is presented in the form of an example of calculations of the profitability of various services, using the algorithm of which you can preliminary estimate the payback in your specific case.

The profit of a beauty salon will be 20-30% higher if you organize the sale of professional cosmetics and related products. We also talked about how to do this in the book.