Specialists can find the main forms of primary documents in albums of unified forms approved by the resolutions of the State Statistics Committee of the Russian Federation. Here are the most common ones.

The enterprise carries out dozens of operations every day. Accountants send money to counterparties, funds and founders, calculate salaries, receive computers and furniture, charge penalties, calculate depreciation, etc. For each such operation, it is necessary to draw up a primary document (Clause 1, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, hereinafter Law No. 402-FZ).

The primary document is created at the time of the transaction or upon its completion as confirmation of the fact of the transaction (Clause 3 of Article 9 of Law No. 402-FZ). Based on the primary data, accountants make entries.

An invoice, an act for the provision of services for creating a website, an accounting certificate - all these are primary documents that accountants use in their daily work. There are many types of primary products, and their diversity depends on the characteristics of the company’s activities. For example, in a transport company one of the main types of primary documentation will be a bill of lading, and in a library - an act of writing off literature.

Primary documents are supposed to be stored at the enterprise for at least five years, and the period begins to count after the reporting year (Clause 1, Article 29 of Law No. 402-FZ). That is, a document dated 07/03/2016 must be stored at least until 2021 inclusive. Separate storage periods for primary materials are established by the List approved by Order of the Ministry of Culture dated August 25, 2010 No. 558. To preserve accounting documents, enterprises often create special archives.

The primary document can be paper or electronic. In practice, more and more companies are using electronic document management (EDM). In particular, companies exchange contracts, invoices for payment, acts, delivery notes and invoices.

EDI significantly simplifies the procedure for processing primary documents from the moment they are created to the moment they are recorded, and speeds up work between counterparties. A big plus is that electronic documents do not need to be printed if this does not contradict the law or the terms of the contract (Clause 6, Article 9 of Law No. 402).

The electronic document is certified with a qualified electronic signature. If the parties make an appropriate decision, the primary document can be signed with a simple or unqualified signature (letter of the Department of Tax and Customs Policy of the Ministry of Finance of Russia dated September 12, 2021 No. 03-03-06/2/53176).

Send primary accounting documents via Diadoc!

Try it

The absence of primary documents in a company may entail a serious fine of 10,000 to 30,000 rubles (Article 120 of the Tax Code of the Russian Federation). Tax authorities will also issue a fine for errors in registration. In addition, persons responsible for processing documents may be fined under Article 15.11 of the Code of Administrative Offenses of the Russian Federation in the amount of 2,000 to 3,000 rubles. There is another danger: if during the audit the tax authorities do not find the required document, they may remove part of the expenses from the taxable base, therefore, the company will have to pay additional income tax.

Basic Concepts

Primary documentation in accounting – what is it? It is called evidence of the fact of a business transaction reflected on paper. Currently, many documents are compiled in the automated 1C system. Processing of primary documentation involves registration and recording of information about completed business transactions.

Primary accounting is the initial stage of recording events occurring in an enterprise. Business transactions are actions that involve changes in the state of the organization’s assets or capital.

Procedure for preparing financial statements

In order for the documents to meet the requirements, the procedure for drawing up financial statements provides for the display of absolutely all transactions carried out and the results of the inventory check for a specific period. The preparation of documentation is preceded by painstaking preparatory work, which is carried out in several stages:

- Preparation of primary accounting documents.

- Reconciliation of indicators for synthetic and analytical accounting, checking information in accounts.

- Carrying out an inventory with the formation of an inventory sheet.

- Correcting records if inaccurate data was found during verification.

- Closing accounts.

- Determination of interim financial results from the sale of goods or services and other operations that are not core to the enterprise.

- Calculation of net profit.

- Balance reform.

Finally, they begin the process of preparing documentation. It is important that the reporting procedure involves the use of only current accounting forms that are currently approved.

Processing of primary documentation in accounting: example of a diagram

As a rule, in enterprises the concept of “working with documentation” means:

- Obtaining primary data.

- Pre-processing of information.

- Preparation of documents.

- Approval by management or specialists authorized by order of the director.

- Re-processing of primary documentation.

- Performing actions necessary to conduct a business transaction.

Preparation of financial statements

If you are not ready to draw up documents yourself or are not sure that you can accurately follow the entire procedure for preparing and compiling reports, entrust this work to experienced specialists. Our employees are true professionals who have the necessary knowledge and skills to competently prepare documentation.

By using our service, you can avoid penalties for errors or late submission of documents, and also free up your personal time to solve more important tasks. All information that becomes available to our accountants is regarded as confidential and is not disclosed to third parties. Contact us - we will help you prepare reports inexpensively, quickly and efficiently!

Classification

There is one-time and cumulative primary documentation. The processing of information contained in such papers has a number of features.

One-time documentation is intended to confirm an event once. Accordingly, the procedure for processing it is significantly simplified. Cumulative documentation is used for a certain time. As a rule, it reflects an operation performed several times. In this case, when processing primary documentation, information from it is transferred to special registers.

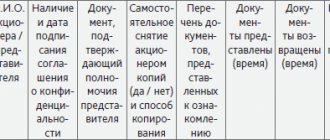

Features for individual entrepreneurs, LLC, JSC

The preparation and generation of documents may vary slightly depending on the legal form of the company. The main differences between individual entrepreneurs, joint-stock companies and LLCs can be found in the table below.

| Features for comparison | IP | OOO | JSC |

| Responsibility for obligations | own property | property of the company | JSC property |

| Tax system | TNS, simplified tax system, UTII, patent | everything except patent | All |

| Accounting | optional on simplified tax system | mandatory (simplified on simplified tax system) | mandatory, including on the simplified tax system |

| Formation of a reserve fund | No | No | Necessarily |

| Reflection in reports of funds withdrawn from the current account | No | Yes | Yes |

| Contributions to the pension fund | Always | only if there is activity | if there is activity |

| Cash discipline | No | yes (RKO, PKO and cashier's journal) | Yes |

Stages of processing primary accounting documentation

Each enterprise has an employee on staff responsible for working with primary information. This specialist must know the rules for processing primary documentation, strictly comply with legal requirements and the sequence of actions.

The stages of processing primary documentation are:

- Taxation. It represents an assessment of the transaction reflected on paper, an indication of the amounts associated with its implementation.

- Grouping. At this stage, documents are distributed depending on common features.

- Account assignment. It involves the designation of debit and credit.

- Extinguishing. To prevent repeated payments, the accountant puts o.

Types of primary documents

Specialists can find the main forms of primary documents in albums of unified forms approved by the resolutions of the State Statistics Committee of the Russian Federation. Here are the most common ones.

Documents for accounting of trade transactions

- TORG-12;

- Product label;

- Universal transfer document.

Documents for accounting of fixed assets

- OS-1 “Act on acceptance and transfer of fixed assets (except for buildings, structures)”;

- OS-4 “Act on write-off of fixed assets”;

- OS-6 “Inventory card for recording fixed assets”.

Errors in documents

They can occur for various reasons. Basically, their appearance is caused by the employee’s careless attitude towards the work he performs, the specialist’s illiteracy, and equipment malfunction.

Correction of documents is highly discouraged. However, in some cases it is impossible to do without error correction. The accountant must correct any deficiencies in the primary documentation as follows:

- Cross out the incorrect entry with a thin line so that it is clearly visible.

- Write the correct information above the crossed out line.

- Put o.

- Specify the date of adjustment.

- Put a signature.

The use of corrective agents is not permitted.

Requirements for preparing financial statements

Accounting forms are compiled according to recommendations adopted by the State Statistics Committee and the Ministry of Finance of the Russian Federation. Subsequently, the data in them can be used both for analysis within the company and for assessing the effectiveness of its work by third-party users. Therefore, reports must be accurate, timely and meet the following requirements:

- contain consistent, neutral and continuous information;

- the creation of hidden reserves is not allowed;

- Only fields and documentation forms directly related to the company’s work should be filled out;

- if there is insufficient data necessary to obtain an idea of the company’s activities, this is indicated in the reports in the form of additional explanations;

- it is important to comply with the reporting period;

- The documents must contain information that allows you to compare the presented data with the same indicators for previous periods.

In order to fully comply with the procedure for preparing financial statements, all significant indicators should be presented separately. In some cases, they can be indicated as a total amount, but disclosed in the explanations of the balance sheet and profit/loss.

Working with incoming documents

The process of processing incoming papers includes:

- Determining the document type. Accounting papers always contain information about completed business transactions. For example, these include an invoice, an order for receiving funds, etc.

- Checking the recipient's details. The document must be addressed to a specific enterprise or its employee. In practice, it happens that documents for the purchase of materials are specifically issued to the company, although no agreement has been concluded with the supplier.

- Checking signatures and seal impressions. The persons signing the document must have the authority to do so. If the endorsement of primary documents is not within the competence of the employee, then they are considered invalid. As for stamps, in practice, errors often occur in those enterprises that have several stamps. The information on the print must correspond to the type of document on which it appears.

- Checking the status of documents. If damage is detected on the papers or any sheets are missing, it is necessary to draw up a report, a copy of which is sent to the counterparty.

- Checking the validity of the event reflected in the document. Employees of the enterprise must confirm information about the fact of the transaction. Documents on acceptance of valuables are certified by the warehouse manager, and the terms of the contract are confirmed by the marketer. In practice, there are situations when a supplier receives an invoice for goods that the company did not receive.

- Determining the period to which the document relates. When processing primary papers, it is important not to take into account the same information twice.

- Definition of accounting section. When receiving primary documentation, it is necessary to establish for what purposes the supplied values will be used. They can act as fixed assets, materials, intangible assets, goods.

- Determining the register in which the document will be filed.

- Registration of paper. It is carried out after all checks.

Primary cash register

Cash transactions are executed exclusively in accordance with the Procedure for conducting cash transactions (Instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). You cannot, for example, design a “consumables” in free form or develop your own version.

The forms of primary cash documents are approved by Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88:

- KO-1 “Cash receipt order”;

- KO-2 “Cash expenditure order”;

- KO-3 “Journal of registration of incoming and outgoing cash documents”;

- KO-4 “Cash Book”;

- KO-5 “Book of accounting of funds accepted and issued by the cashier.”

Cash documents need to be checked very scrupulously, because such primary documents are directly related to the movement of cash and always attract the attention of the inspection authorities. For example, tax authorities will definitely pay attention to PKO, in which the amount exceeds 100,000 rubles. And all because you cannot pay in cash with one counterparty in an amount exceeding 100,000 rubles. The absence of signatures in cash documents will also be a reason for proceedings with the Federal Tax Service.

Let's summarize. So, primary documents are an integral part of accounting and tax accounting. Transactions cannot be carried out without supporting documents. Often accountants create accounting entries based on a copy or scan of the primary document. It is very important to replace copies with original documents in a timely manner, otherwise regulatory authorities may consider the operation or transaction fictitious. Only documents drawn up in accordance with the law are a guarantee of the security and reliability of accounting in the company.

Working with outgoing papers

The processing process for this type of documentation is somewhat different from the above.

First of all, an authorized employee of the enterprise creates a draft version of the outgoing document. Based on this, a draft paper is developed. It is sent to the manager for approval. However, another employee who has the appropriate authority can approve the draft document.

After certification, the project is drawn up according to the established rules and sent to the recipient.

Procedure and terms

According to the law, all enterprises, with the exception of budgetary ones, must provide annual reports to the tax authorities, the State Statistics Service, founders, owners and participants of the organization. Documentation is submitted to the tax office and State Statistics Service within 90 days after the end of the reporting year. In addition, BO is submitted quarterly (within 30 days after the end of the quarter), unless otherwise provided by law.

The annual reporting period is the period from January 1 to December 31. If the company was created in the middle of the year, then the reporting period is counted from the day it was entered into the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. The date of presentation of documents is considered to be the day of their actual delivery or the date of dispatch indicated on the registered letter - if they are sent by mail. In the event that the transfer is made on a weekend, the presentation period is considered to be the day following the non-working day. It should be taken into account that failure to comply with the deadlines for submitting reports to the Federal Tax Service may result in penalties.

If the enterprise owns affiliates or subsidiaries, in addition to the usual report, it is necessary to provide a consolidated BO illustrating the results of the activities of these divisions. For unitary enterprises and joint-stock companies, the shares of which are partially in federal ownership, the following deadlines for submitting annual summary documentation are provided:

- until 25.04 – for unitary organizations;

- until 1.08 – for JSC.

Certain types of companies, such as banking institutions, insurance organizations, stock exchanges, are required to publish BO in open sources of information no later than June 1 of the year that follows the reporting period. According to the reporting procedure provided for by Order of the Ministry of Finance No. 101, reports of joint-stock companies are published only after an audit and approval of documents at a meeting of shareholders.

Publicity of accounting data is a criterion that is relevant for many interested users, for example:

- sponsors;

- banks that provide credit to the company;

- investors;

- partners and other contractors with whom the organization closely cooperates;

- representatives of city or district administration.

Based on the published information, all of the above users can adequately assess the financial activity of the company, the feasibility of purchasing its assets, and also take into account possible risks that may arise when making investments.

Document flow planning

This stage is necessary to ensure prompt receipt, sending and processing of documentation. For proper organization of document flow, the enterprise develops special schedules. They indicate:

- Place and deadline for processing primary papers.

- Full name and position of the person who compiled and submitted the documents.

- Accounting records made on the basis of papers.

- Time and place of storage of documentation.

How to issue UPD

Instructions for filling out the unified form are given in Appendices No. 2 – 4 to the Federal Tax Service letter No. ММВ-20-3/96. The appendices also contain a list of operations for which the document can be used.

Before you start filling out the document, you need to determine its status:

- 1 – the transfer invoice replaces the tax invoice and the accounting transfer act (the organization uses VAT).

- 2 – the document is issued only as an invoice or primary transfer act (for transactions without VAT).

The UPD status is indicated in the upper left part of the form.

UPD 1. Filling out the form begins with the serial number (registration according to internal document flow) and the date of filling out the document. Next, enter the details of the seller/sender and buyer/recipient:

- Full name of the organization (for individual entrepreneurs - full name).

- Address (for individual entrepreneurs – registration address at the place of residence).

- TIN.

- Checkpoint (for legal entities).

The second part of the document contains information about the product, service, work performed or property rights:

- Name.

- Symbol of the unit of measurement (liters, pieces, meters).

- OKSM unit code.

- Customs declaration number (for imported goods).

- Total quantity by name.

- Price per unit by item excluding VAT.

- Total price excluding VAT.

- Excise tax amount (if any).

- VAT rate.

- Tax amount by name.

- The price includes VAT.

- Name of country of origin.

- OKSM country code.

Next, the totals for inventory items or services are calculated:

- Cost without VAT.

- Tax amount.

- Cost including VAT.

The line “Grounds for acceptance and transfer” indicates the number and date of registration of the contract or agreement on the basis of which the UTD was issued.

The transportation and shipment data shall indicate a bill of lading or other document confirming the fact of issue of inventory items.

Next, the document is signed (with a transcript):

- Manager and chief an accountant of an organization or an individual entrepreneur (indicating details of the state registration of an individual entrepreneur).

- Persons who participated in the shipment and receipt of goods and the preparation of a unified document form.

In the column “Other information about receipt, acceptance” you need to write “No claims.”

UPD 2. If a document is issued as an invoice or deed of transfer, without taking into account VAT, then dashes are placed in the columns “VAT rate” and “Tax amount by name”.

Features of document recovery

Currently, the regulations do not contain a clear procedure for the restoration of papers. In practice, this process includes the following activities:

- Appointment of a commission to investigate the reasons for the loss or destruction of documents. If necessary, the head of the enterprise can involve law enforcement agencies in the procedure.

- Contacting a banking organization or counterparties for copies of primary documents.

- Correction of income tax return. The need to submit an updated report is due to the fact that undocumented expenses are not recognized as expenses for tax purposes.

In case of loss of primary documentation, the Federal Tax Service will calculate the amounts of tax deductions based on the available papers. In this case, there is a possibility that the tax authority will apply penalties in the form of a fine.

Forms of primary documents

In your work, you can use unified and your own forms of primary documents (clause 4, article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). In this case, a homemade primary document must have all the required details. Many companies are forced to develop their own version of the materials write-off act, since there is no unified form of the document.

It is permissible to use a combined form of the primary document, when the unified form is taken as a basis and supplemented with the necessary columns or lines. In this case, all mandatory details must be preserved (Resolution of the State Statistics Committee of the Russian Federation dated March 24, 1999 No. 20).

The company's choice regarding the forms of primary accounting used must be specified in its accounting policies.

In the process of activity, the need for new primary documents may arise, then they can be developed and approved by the accounting policy.

Note! Since your counterparty can also use an independently developed primary document, your accounting policy must indicate that you also accept these documents for accounting.

For most documents, you have the right not to use unified forms, but cash transactions should be executed only according to approved document forms (information of the Ministry of Finance of the Russian Federation No. PZ-10/2012).

Common mistakes in the process of preparing primary papers

As a rule, those responsible for maintaining documentation commit the following violations:

- Fill out forms that are not unified or approved by the head of the enterprise.

- They do not indicate details or display them with errors.

- They do not endorse documents with their signature or allow employees who do not have the authority to sign documents.

Documentation confirming the facts of business transactions is extremely important for the enterprise. Its design must be approached very carefully. Any mistake can lead to negative consequences.

The procedure for preparing financial statements independently

The sequence of actions and requirements for preparing documentation yourself are no different from the process performed by an accountant. The entrepreneur must prepare an annual balance sheet and a report on the results of his activities, and then submit the papers to the relevant authorities.

Documents can be submitted electronically or in paper form. The first option involves the following sending methods:

- Through the Internet resource of the Federal Tax Service. To submit documentation through the tax service website, you must register and receive an electronic digital signature key, as well as install a special program on your computer for sending documents.

- By means of telecommunications. EDI channels are modern systems that allow you to send reports to the tax office without reflecting information on paper. As in the case of the Federal Tax Service, the entrepreneur will need to install software and obtain a digital signature. The system has a number of significant advantages. In particular, it controls the reporting procedure and reduces the likelihood of errors to zero. Also, TKS is promptly updated when new forms are introduced and is guaranteed to deliver BO to its destination.

As for submitting documents in paper form, this option involves sending them by registered mail via mail or submitting them to regulatory authorities through a personal visit to the Federal Tax Service and the State Statistics Service. In addition, an entrepreneur can always use the services of third-party organizations that will take care of all issues not only with sending documentation, but also with its preparation, taking into account the activities of the organization.

Payment order

A payment order is a primary document with the help of which the owner of a current account instructs the bank servicing him to carry out payment transactions to another specified account. Thus, you can pay taxes and fees, repay a loan, pay wages to employees, make an advance, pay for services, etc.

In order for the payment to reach its destination, the standard payment order form must be filled out in accordance with the procedure established by the Ministry of Finance (Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 N 107n). The form was developed by the Central Bank of the Russian Federation and approved by federal legislation. The numbers and names of its fields are given in Appendix 3 to Central Bank Regulation No. 383-P dated June 19, 2012, and the list and description of details are given in Appendix 1 to Central Bank Regulation No. 383-P dated June 19, 2012.

Step-by-step instructions for filling out a payment order

The list below provides a complete list of form fields with numbers and explanations.

1 - 0401060 - OKUD form number - these numbers must always be the same, no matter who the payment is intended for.

2 – Payment order – name of the bank document.

3 – No. – the payment number is entered by the payer according to the registration of internal document flow, the countdown begins from the new calendar year. Individuals can be assigned a serial number by the bank. The number must consist of a maximum of six digits in the format XXXXXXX.

4 – Date – date of execution of the payment order in DD format. MM. YYYY.

5 – Type of payment – the field is filled in only for urgent payments. The word "Urgent" is written. In all other cases, the field remains empty.

6 – Amount in words – indicate the full amount of the payment. The full amount of rubles is written in capital letters, kopecks are indicated in numbers. The words “rubles” and “kopecks” are written in full, without abbreviation. If the amount is round, then you don’t have to write 00 kopecks.

7 – Amount – indicate the transferred amount in numbers. Rubles and kopecks are separated by a sign. If the amount is round, then instead of 00 kopecks the sign = is placed. The amount of money in fields 6 and 7 must match.

8 – Payer – legal entity indicates the abbreviated name of the organization and address; individual – full name and registration address; those engaged in private practice - full name, registration address and, in brackets, type of activity; entrepreneurs – full name and “IP” in brackets and registration address. The name (name) must be separated from the address by the sign //.

9 – Count. No. – payer’s current account number.

10 – Payer’s bank – the name of the payer’s bank and the city in which it is located.

11 – BIC – identification code (BIC) of the payer’s bank.

12 – Count. No. – Correspondent account number of the payer’s bank (if the account is serviced by the Bank of Russia or its division, then the field does not need to be filled in).

13 – Recipient’s bank – the name of the recipient’s bank and the city in which it is located.

14 – BIC – identification code (BIC) of the recipient’s bank.

15 – Count. No. – Correspondent account number of the recipient’s bank (if the account is serviced by the Bank of Russia or its division, then the field does not need to be filled in).

16 – Recipient – if a legal entity, then indicate the abbreviated or full name of the organization (both options are possible); individual – full name; those engaged in private practice – full name and type of activity; entrepreneurs – full name and “IP” in brackets. If the recipient is a bank, then the information from field 13 is duplicated. When paying taxes and contributions, you must indicate the personal account of the territorial department of the Federal Treasury.

17 – Count. No. – recipient’s current account number.

18 – Type of op. – type of transaction – code established by the Central Bank of the Russian Federation (for a payment order you must always indicate 01).

19 – Payment deadline. – payment term – field is not filled in.

20 – Name Plat. - purpose of payment:

- Payments with restrictions on collection (Article 99 of the Federal Law of October 2, 2007 No. 229-FZ): wages, allowances, bonuses.

- Payments without penalties (Clause 1, Article 101 of Federal Law No. 229-FZ): travel allowances, travel compensation, etc.

- Payments without restrictions on collection (clause 2 of Article 101 of Federal Law No. 229-FZ): alimony payments, compensation for harm caused to health.

When listing other payments, the value is not indicated.

21 – Essay. plat. – the order of payment is indicated by a number from 1 to 6 (according to Article 855 of the Civil Code of the Russian Federation).

22 – Code – universal payment/accrual identifier UIP/UIN. If there is no code, then “0” is set.

23 – Res. The field is not filled in.

What are the consequences of the absence of mandatory details in the “primary”

During an audit, tax authorities may consider a primary document that lacks mandatory details to have been drawn up with gross violations. For example, the absence of a date in a document will not allow it to be attributed to a specific tax period, and the absence of a description of the operation does not give any idea of what fact of the enterprise’s economic activity we are talking about. As a result, such a “primary tax” will not be accepted for taxation, and the violator will be charged the amount of underestimated tax and penalties, or a fine (Articles 120, 122 of the Tax Code of the Russian Federation).