Repair of equipment and machinery is a fairly profitable and, at the same time, responsible type of activity. These services will be in demand at any time, because not a single economic or industrial enterprise can do without specialized equipment. When registering an organization with the tax service, the business owner must correctly indicate the OKVED encoding “Maintenance and repair of equipment”, only in this case the activity will be carried out legally.

In 2021, entrepreneurs should select the OKVED code from the special classifier OK 029-2014 (NACE Rev. 2), called OKVED2 (approved by Order of Rosstandart dated January 31, 2014 No. 14-st). The encodings from this directory have been used since 2014, all previous editions are no longer valid, and it is prohibited to take codes from them. If an entrepreneur unknowingly indicates an incorrect OKVED code during registration, the Federal Tax Service employees will refuse him registration. The classifier has a simple and understandable structure; there is nothing complicated in working with it.

How to find the right area

The page presents in the form of links types of activities according to OKVED with decoding. Select the area that matches the area you are looking for. The list is organized in a hierarchical structure. It is formed in accordance with the structure of OKVED numbers, so it will easily orient and direct you when searching for the required list in the most convenient way. By clicking on the appropriate link in the first list, you will be taken to the next page, where a clarifying list will be presented that allows you to narrow your search. Thus, you can easily and quickly find the entire list of organizations registered with the specified OKVED.

Also on the results page you can display organizations that have the required code listed as the main one, or those companies that simply included it in the list of codes, but as an additional one.

Decoding activities by code

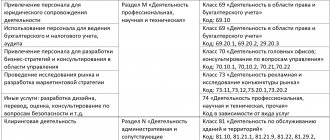

Merchants who have chosen the repair and maintenance of machines as their activity and indicated OKVED 33.12 in their application can provide the following services:

- Repair of machinery and equipment.

- Maintenance of production equipment. It is allowed to sharpen and install machines.

- Provide repair services for agricultural machinery.

- Refrigeration equipment repair and diagnostics.

- Maintenance of loading and unloading equipment.

- Repair and diagnostics of equipment for the mining industry, for the oil and gas industry.

All industrial enterprises directly depend on the equipment maintenance technician. After all, downtime of an enterprise due to the breakdown of some equipment can affect the financial side. It is cheaper to diagnose all equipment than to repair or purchase new equipment later.

Therefore, the demand in this area is very high. Professionals and craftsmen are needed everywhere. And, as a rule, if a specialist knows how to fix everything and understands machines and equipment, then he is unlikely to have competitors and will be constantly in demand.

Before registering your repair activity, it is worth checking the classification code and whether it is currently valid. OKVED 33.12, decoding for 2021 is valid in the new year. Although this code has just been changed since the middle of last year. Previously, entrepreneurs registered activities related to the repair of machinery and equipment using the code - .24.9.

How the OKVED code is formed

To make it easier to navigate the list and understand in which section of the given ones to look for certain types of activities according to OKVED, you need to understand how this numerical code is formed.

The OKVED code is a numeric identifier that has a hierarchical structure. In order from left to right, the numbers indicate groups and subgroups from the most general formulation to the most specific.

The first two numbers indicate the class, followed by a number indicating the subclass, the fourth position indicating the group, the fifth - the subgroup and the sixth - the types of activities. When registering a company, you only need to indicate the first four numbers, which is why the website provides this level of specificity.

This way you can find information about companies in any business field, even without knowing their names, easily and quickly.

How many digits should there be in the code?

The OKVED encoding for the repair of technical equipment must consist of at least 4 digits. The classifier has codes with a high degree of detail of activity, consisting of 6 digits. But since there are no such codes in class 33 of the OKVED2 reference book, it is enough to indicate the encoding consisting of 4 digits. For example, 33.14 or 33.17.

What happens if an entrepreneur operates under a different OKVED code than was declared? It should be noted right away that the current legislation does not provide for any liability for conducting activities not according to the code that is included in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities. But still, if the OKVED code for equipment repair was not declared, and the organization provides services in this particular area of activity, the business owner may be held administratively liable under Art. 14.25 Code of Administrative Offenses of the Russian Federation. This article provides for liability for failure to provide information about a legal entity or individual entrepreneur, and OKVED encodings specifically refer to such information.

Read also: Is it possible to carry out activities without OKVED

What OKVED codes are needed for trading in auto parts? Auto parts OKVED 2021

In order for the fact of purchase to be confirmed, the company must use a cash register. The exception is sales using vending machines or sales where cash registers cannot be used. A device used in retail must print 2 receipts at once. One of them is received by the buyer, and the second is kept by the seller.

45 group includes actions that are related to the sale and repair of cars or motorcycles. 46 and 47 include all activities that are related to sales. The main difference between 46 and 47 (wholesale and retail) is based on the predominance of a particular type of buyer in each group.

Which OKVED code can you choose as an individual entrepreneur for retail trade in 2021?

- non-specialized stores – 47.1;

- specialized - from 47.2 to 47.7;

- sale of goods outside adapted premises – 47.9;

- sale of used items – 47.79;

- activities organized through tents or markets – 47.8;

- trade by mail, from vending machines, home delivery – 47.9.

- fresh nuts, fruits and vegetables - 47.21.1 (canned - 47.21.2);

- meat and products made from it, including poultry – 47.22.1;

- the same and by-products - 47.22.2;

- canned food, meat and poultry products – 47.22.3;

- fish and seafood - 47.23.1 (canned food 47.23.2).

OKVED class 47

- retail sales in tents and markets: subclass OKVED 47.8;

- other retail sales not through department stores. For example: trade by mail, with door-to-door delivery of goods, through vending machines, etc. (subclass OKVED 47.9).

- resale (sale without conversion) of new and used goods for personal or household use, or use by shops, department stores, tents, postal trade enterprises, persons delivering goods on a door-to-door basis, traders, consumer cooperatives, etc. .;

- retail sale of goods such as personal computers, office supplies, paint or wood, although these products may not be suitable for personal or household use. Processing of goods traditionally used in trade does not affect the basic characteristics of goods and may include, for example, only their sorting, separating, mixing and packaging;

- retail trade through commission sales agents and the activities of retail auction houses.

OKVED code 45 - Wholesale and retail trade in motor vehicles and motorcycles and their repair

Whether or not the selected type of activity is subject to licensing.

If the main type of activity is subject to mandatory licensing, then it is prohibited to carry out such activities without an appropriate license. See the list of licensed activities.

- - all activities (except production and rental) associated with the trade, repair and maintenance of motor vehicles and motorcycles, including trucks and heavy-duty platforms (trucks), such as wholesale trade and retail trade of new and used named vehicles, their repair and maintenance, sale of spare parts for vehicles and motorcycles

- — activities of agents acting on the basis of commission agreements involved in the wholesale trade and sale of vehicles;

- — washing, polishing vehicles, etc.

We recommend reading: Payments to relatives of a deceased pensioner

Why is OKVED changed?

Tax authorities, at their discretion, can change the activity codes of entrepreneurs. And this is done very often. Based on the letter from the head, the Tax Service changes the classifier.

This is done in order to improve control over the activities of enterprises and to maintain statistical data. This makes it easier for government agencies to monitor the most popular activities in Russia and establish a tax regime for them.

Therefore, enterprises that have been operating in Russian markets for a long time are accustomed to frequent changes in OKVED, and new businessmen need to be careful not to be subject to sanctions from tax authorities. After all, this classification code is indicated when filling out tax returns and opening bank accounts.

OKVED codes for the provision of construction equipment services

- Pension reform: how the rules for assigning insurance, social and funded pensions will change

- Can an individual entrepreneur pay insurance premiums at the end of the year and reduce tax according to the simplified tax system (6%)?

- Rostrud will collect data on workers of pre-retirement age

- Supreme Court: An individual entrepreneur who does not receive income must still pay contributions “for himself”

- Is it necessary to issue a separate waybill for each day: the position of the Ministry of Transport

- New professional standard “Accountant”: what requirements for the profession does it introduce and who is obliged to apply it

- Six prohibitions for “simplified taxation”: the Supreme Court’s conclusions in favor of tax authorities

- How to pay for weekend work in May 2021?

- New income certificate for employees: when to issue, how to fill out, who should sign

- How to deduct VAT on an advance payment?

- Salaries for April 2021 are transferred on April 30th: what are the consequences?

- Adelia - 100,000 points!

- Deadlines for payment of salaries for April, error in the employment contract, additional payment for combinations: review of new clarifications from Rostrud

- How to calculate the date of dismissal during the May holidays?

- Employment contract: how to reflect the salary when working at 0.5 rates?

- In what case are “interest” income of individual entrepreneurs on the simplified tax system subject to a single tax?

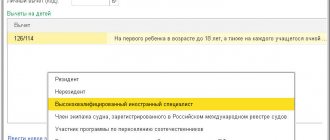

- 1C 3.0 does not take into account tax deductions for children when calculating personal income tax

- Is it possible to pay salaries for April on May 3rd?

- A law has been adopted replacing plastic cards with SNILS with another document

- What can be taken into account as inseparable improvements?

Choosing the correct economic activity code (OKVED) is important for every organization. Compliance of the coding with reality eliminates problematic issues that may arise with inspection authorities and even partners. If the tax office can impose a requirement to provide reporting on an actually unused code, then plans for cooperation may be disrupted. This happens because an audit of an organization always begins with official information - studying an extract from the unified state register of legal entities (entrepreneurs).

OKVED trade in auto parts

Showing OKPD search results by product/service name. They should be understood as follows: (a transcript is provided for the first result) Among all the Government contracts known to us, the product ( was assigned the OKPD code 34.30.20.990133 times. The remaining results should be interpreted by analogy.

34.30.20.990

Other parts and accessories for motor vehicles

50.30.22.111

Retail trade services of new other parts, assemblies and accessories of passenger cars

34.30.11.190

Other parts for internal combustion engines with spark ignition, not included in other groups

29.24.13.391

Coarse fuel filters for automobiles , tractors, agricultural machines and motorcycles

29.24.13.392

Fine fuel filters for cars, tractors, agricultural machines and motorcycles

34.30.20.110

Bumpers and their parts (including plastic bumpers)

34.30.20.970

Running parts, except gearboxes and axles

34.30.20.239

Linings other mounted brakes

25.13.40.311

Rubber driving V-belts for industry

31.10.61

Spare parts for electric motors and generators