An order on the right to sign primary documents is written in cases where the head of an enterprise needs to authorize one of his subordinates to endorse various documentation. As a rule, this practice is common in large and medium-sized organizations, where the director does not physically have the opportunity to get acquainted with and endorse all current papers.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What are primary documents

Primary documentation includes any accounting and tax accounting documents:

- invoices,

- money orders,

- acts,

- extracts,

- certificates,

- waybills, etc.

For the most part, these documents must be drawn up without a single mistake and at the same time endorsed by the signatures of responsible employees and/or the director of the company.

In what cases does this raise questions?

If there is a position of chief accountant in the staffing table and such an employee works in the organization. When the document contains two visas and the manager’s signature is on both positions, inspection agencies and partner companies have questions. Such documents include invoices and delivery notes.

If counterparties ask to redo the papers, then regulatory authorities in most cases will require evidence of the legality of such actions. To deduct VAT, you must send to the Federal Tax Service the original invoice signed by the chief accountant (clause 6 of Article 169 of the Tax Code, letter of the Ministry of Finance No. 03-07-09/42854 dated 08/27/2014). To confirm the right of one signature of the director for the accountant, it is necessary to submit a special order. Otherwise, you will have to go to court and prove that you are right.

If a managerial person performs the functions of a chief accountant, then a deduction on an invoice signed by the same person will be accepted (resolution of the Federal Antimonopoly Service of the North Caucasus District No. F08-6533/2008 in case No. A53-2656/2008-C5-14 dated 10.29. 2008, resolution of the Federal Antimonopoly Service of the North Caucasus District in case No. A53-17547/2008-C5-23 dated 06/03/2009).

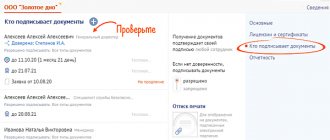

Procedure for granting signature rights

First of all, the management of the enterprise identifies employees who, due to their line of work, constantly encounter various types of documents. Then it is decided how to grant them the right to sign. This can be done in two ways:

- drawing up a special power of attorney,

- writing an order.

A power of attorney is appropriate in cases where documents are signed not only on the territory of the enterprise, but also in other places: for example, when a freight forwarder driver receives cargo from a warehouse of a partner organization or when an accountant receives a bank statement, etc. Another distinctive feature of a power of attorney is that it can be issued not only to a full-time employee of the enterprise, but also to an outside person. The order applies only to those employees who are registered in the company and receive the right to sign strictly internal corporate documents.

After drawing up the order, the head of the enterprise must verify the signatures of the subordinates mentioned in it with his autograph. The duration of the order is determined individually: it can be of an indefinite nature, or it can be drawn up for a period of one quarter, six months, a year, etc. depending on the situation within the company.

Responsible: necessity and order of appointment

To maintain, store, record and issue labor records in any organization, a special official must be appointed (clause 45 of the rules, approved by government decree No. 225 of April 16, 2003). This is not always a separate specialist; sometimes additional responsibilities are assigned to an employee by order. Requirements and responsibilities for the absence of a special order are given in the table.

| Sanctions for the absence of a person (clause 45 of the rules, approved by government decree No. 225 of April 16, 2003) | Design option | |

| Supervisor | Individual entrepreneur or legal entity | |

| Warning or fine from 1000 to 5000 rubles (Part 1 of Article 5.27 of the Administrative Code of the Russian Federation). In case of repeated violation - from 30,000 to 50,000 rubles or disqualification for up to 3 years (Part 23 of Article 19.5 of the Administrative Code). | Warning or fine from 30,000 to 50,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). In case of repeated violation of the IP - from 30,000 to 50,000 rubles (Part 23 of Article 19.5 of the Administrative Code). In case of repeated violation in an organization - from 100,000 to 200,000 rubles (Part 23 of Article 19.5 of the Administrative Code). | Main job. Part-time job. Combination. Assignment of responsibilities. |

IMPORTANT!

A separate authorized person is approved by the head (paragraph 2, clause 45 of government decree No. 225 as amended on March 25, 2013). The order on those responsible for maintaining work records is a mandatory document.

How to write an order: basic rules and sample

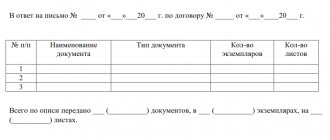

Today there is no single unified form for an order for the right to sign primary documents, so enterprises and organizations can write it in any form or according to a model approved in the accounting policy of the enterprise. However, some standards must still be adhered to. In particular, the order must indicate:

- order number,

- date of compilation,

- Company name,

- the locality in which the enterprise is registered.

In the main part, it is necessary to list everyone who is given the right to sign primary documents, indicating:

- positions,

- surname-name-patronymic,

- a list of documents that a particular employee has the right to sign.

It should be noted that the order may concern either one employee of the organization or an entire group of persons.

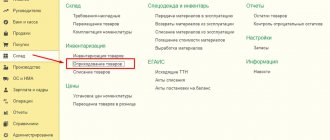

Electronic form of trade invoice

By virtue of the norms of Federal Law dated December 6, 2011 N 402-FZ “On Accounting,” all facts of an organization’s economic activities are subject to registration with primary accounting documents approved by the head of the organization upon the proposal of the official charged with maintaining accounting records.

In this case, the organization can use both independently developed documents and unified forms of primary documentation contained in special albums and approved by the State Statistics Committee of Russia.

Therefore, in practice, organizations use a consignment note in the TORG-12 form to register the sale (release) of inventory items to a third-party organization.

A consignment note can be generated and stored both in paper form and electronically.

The form and procedure for compiling an electronic invoice are no different from the form and procedure for compiling its paper counterpart, with the exception that the electronic document is compiled in one copy, which consists of two files.

One of them is formed on the seller’s side, and the second, when sending a document, on the buyer’s side.

To sign electronic invoices, instead of a handwritten signature, an electronic signature (ES) is used, and the electronic consignment note is signed with one electronic signature on the part of the seller and one on the part of the buyer. Total of two signatures.

At the same time, in the lines “Vacation authorized”, “Chief (senior) accountant”, “Cargo released”, “Cargo accepted” and “Cargo received by consignee” the full names and positions of the relevant persons are indicated, and in the line “By power of attorney No.” - information on the power of attorney of the authorized person.

How to place an order

The approach to drawing up orders can also be absolutely anything: companies have the right to use simple A4 or A5 sheets or their own letterhead to write these administrative documents. In this case, the order can be written by hand or printed on a computer - this does not play any role in determining the legality of the document.

However, with all this, the order must be certified by the signature of the head of the enterprise or any other employee authorized to endorse such papers.

In addition, everyone who is mentioned in it, as well as the employees appointed responsible for its execution, must be familiarized with the document for signature. Whether or not to put a seal on an order is the choice of the drafter, since it relates to the company’s internal document flow; moreover, as of 2021, the requirement for the mandatory use of seals and stamps in the activities of legal entities has been abolished by law.

The order is usually drawn up in a single original copy.

Why and when are they given the right to sign papers?

Documents are endorsed not only by the manager, but also by other employees - within the limits of their functionality.

Thus, accountants endorse balance sheets, accounts and reconciliation reports, economists – plans, reports and calculations, lawyers – contracts, specifications and claims, personnel officers – personnel orders, work books and memos. Who and what exactly is authorized to endorse fits into the sample order granting the right to sign or power of attorney. The right of first and second signature is distinguished. The first belongs to the leader. To grant such a right, a sample order on the right of first signature is used. The second is provided to an authorized representative - an employee of a budget organization. Such information is reflected in:

- order;

- job description;

- position;

- powers of attorney.

https://www.youtube.com/watch?v=upload

The first three relate to internal documentation. It is unacceptable to register them in the name of a person who is not in an employment relationship with the organization. But a power of attorney can be issued both to a regular person and to a third party.

Who has the right to stamp orders?

Those officials who issue these documents. That is, if the order is general for the organization, it is issued and certified by the signature of the head and the round seal of the organization.

If a document is issued by the head of a department, and the department uses its own internal seal, this is what is placed on the document. In this case, you cannot use the main seal of the organization. But, for example, an order for leave, hiring, appointment to a position or dismissal is signed by the head of the company. And accordingly, the main seal is placed. As with other personnel orders.

And the order to replace advertising stickers on the company’s branded cars comes from the head of the transport department, and is certified by him. If the transport department has its own seal, it is affixed.

The difference is in the scope of the document. Those that are certified by the signature of the head of the company and its main seal apply to everyone, without exception. Those that are certified by the signature of the head of the department concern only his subordinates or the designated executor. Whether a document should be certified by a seal or not is decided by the head of the department.

Thus, whether a seal is needed on the order is decided individually in each company. But according to the law, it is not at all mandatory.

Is a stamp required on the order?

Thus, from the point of view of the rules for preparing such documentation, a stamp on the order is not required. But in most organizations they still put an imprint. Why?

The first reason is that it adds weight to the document. Although in this case the need is rather purely psychological.

The second reason is to verify the authenticity of the official’s signature. This is not particularly necessary, but in the event of a conflict situation (violation of labor or legal standards in an order, violation of the order itself by subordinates), the presence of a seal on the internal orders of the organization is an additional argument in the dispute.

Content

The order for signing invoices must include the following information:

- The header of the document.

- Number and title, date of approval, and place of compilation.

- The “body” of the document (this point will be covered in more detail below).

- Applications.

- Signature of the head of the organization.

- List of persons who must read this document and sign.

We invite you to read other materials from our experts about invoices. Read about what a code in an invoice is, what a customs declaration or customs declaration number is, how to find out the values and units of measurement by code, how to correctly indicate transaction codes, how to correctly fill out the “address” and “country code” columns, and also what information about the recipient and sender of the cargo should be indicated in the document.