Reducing property taxes when using the accelerated depreciation mechanism

The basis for determining the tax base for property tax is the residual value of fixed assets. It is obvious that when using accelerated depreciation of fixed assets, their residual value will decrease much faster than when calculating depreciation using the usual method. In addition, the complete write-off of fixed assets when using accelerated depreciation with a coefficient, for example, 3, is carried out three times faster. All this allows you to significantly reduce the amount and period of payment of property tax when using the accelerated depreciation method.

conclusions

Accelerated depreciation helps enterprises write off fixed assets faster, as well as cover their own expenses at an increased rate.

Also, this measure allows you to reduce the amount of taxes paid, which has a beneficial effect on the amount of income and profit.

However, reckless use of this write-off method can lead to violations of tax legislation (Article 252 of the Tax Code of the Russian Federation).

This accrual method can also be applied to fixed assets that are leased, thereby reducing costs.

Redemption of the leased asset at the minimum residual value

Leasing transactions, as a rule, are concluded for a period that allows the leased asset to be completely written off using an accelerated depreciation mechanism. For example, if equipment is classified in the fifth depreciation group with a useful life of over 7 to 10 years (from 85 to 120 months), accelerated depreciation of equipment during leasing with a coefficient of 3 will allow it to be written off in 28 months, i.e. in less than 3 years. At the end of the leasing agreement, its residual and, accordingly, redemption price will be minimal (either zero or conditional, equal to, for example, 1,000 rubles). At this cost, the equipment will be reflected as part of the lessee's own fixed assets. A minimum or zero residual value may be beneficial to the lessee, for example, in the case of the sale of equipment or a car purchased under lease. The lessee can legally sell this property at a price of, for example, 1,000 rubles. This scheme is often used by managers of lessees who buy cars into ownership after leasing at a minimum price.

About depreciation using a specific example

Suppose a milling machine (aggregate mechanism) can operate without repair for 10 years. Gradually, over time, its price decreases, and annually 1/10 of the cost of this mechanism is transferred to the manufactured products. This transferable portion of the cost, which is evenly distributed over 10 years, is called depreciation.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Calculation of accelerated depreciation of fixed assets

In accordance with the Law “On Leasing” (Article 31) and the Tax Code (subparagraph 1 of paragraph 2 of Article 259.3), the balance holder of the leased asset has the right to apply accelerated depreciation to the leased property with a coefficient of up to 3. However, there is a limitation: the accelerated depreciation coefficient is not applied to property belonging to the first - third depreciation groups (i.e., with a useful life of more than 1 year to 5 years). When applying the accelerated depreciation coefficient, the current depreciation rate is multiplied by an increasing factor . In this case, the coefficient can be selected in the range from 1 to 3 and take not only integer values, but be equal, for example, 1.5, 1.63, 2, 3, etc.

The essence of the accrual method in accounting and tax accounting

The essence of the accelerated depreciation method is to apply the coefficient of increased wear and tear of products and transfer the increased cost to the price of the final product.

In accounting, this increased coefficient cannot be more than 3, and for small enterprises - more than 2.

In tax accounting, it can take the value 2 or 3 depending on the basis - Article 259.3 of the Tax Code of the Russian Federation indicates cases of application of this parameter by organizations.

The factor is added to the basic depreciation rate, increasing it.

An example of calculating accelerated depreciation of a leased asset

The accelerated depreciation formula is as follows: AMu = AM * AMC where: AMu is the accelerated depreciation rate; AM is the depreciation rate calculated in accordance with the useful life of the property; AMC is the accelerated depreciation coefficient from 1 to 3. Let's consider the mechanism for calculating accelerated depreciation on a specific example: Under a leasing agreement, equipment is purchased with an initial cost of 1,000,000 rubles (excluding VAT). The equipment belongs to the fourth depreciation group, the useful life of which is over 5 to 7 years. The term of the leasing agreement is 36 months (3 years). It would be optimal to determine the accelerated depreciation rate, at which the equipment will be completely written off during the leasing period. The balance holder of the equipment (which can be either the lessor or the lessee) determines the useful life of the equipment to be 72 months (6 years). In this case, the monthly equipment depreciation rate (without acceleration factor) will be 1.389%. The parties to the leasing agreement reached an agreement on the use of accelerated depreciation with a coefficient of 2. i.e. the monthly depreciation rate using an increasing factor will be 2.778%. The equipment will be fully depreciated over the leasing period of 36 months. In this example of calculating accelerated depreciation, you can also take the useful life of the equipment to be equal to, for example, 80 months. In this case, the monthly depreciation rate will be 1.25%, the depreciation rate using an increasing factor of 2.22 - 2.775%. The equipment will also be completely written off within 36 months.

| Next > |

Calculation formulas in accounting

The accelerated accrual method in accounting is called the reducing balance method, where the basis is the residual value of the fixed asset, the acceleration factor and the useful life.

First, annual depreciation is calculated, then it is divided into 12 months.

Formula:

Ar = St / SPI * K

- Ag – annual depreciation;

- St – residual value of the object (property) at the beginning of the year;

- SPI is the time of use of a fixed asset in a company. Defined in years;

- K – acceleration coefficient no higher than 3, which is set by the organization depending on the basis (small enterprises cannot set a coefficient higher than 2).

In addition, accounting also uses the non-linear accrual method - based on the sum of the numbers of years of the useful life.

In this case, the acceleration factor is not applied, but deductions are also made at an accelerated pace - more is written off in the first years than in subsequent years, and the amount of depreciation decreases every year.

Acceleration factor in tax accounting

The acceleration coefficient is a legally established indicator that is used to calculate accelerated depreciation of fixed assets if the enterprise has the appropriate basis.

Over the years, this parameter ranged from 2 to 3.

Using this coefficient, the manufacturer includes the cost of depreciation of its assets in the final cost of the product, taking into account multiplication by this indicator.

Ultimately, this affects the final cost of products upward, but helps offset equipment costs and reduce taxes.

The legislation provides several grounds for applying such a coefficient.

The acceleration coefficient with index 2 is obtained:

- Enterprises operating in special economic zones. In addition to tax benefits, such enterprises receive the right to calculate depreciation with a doubling of the usual rate.

- Enterprises operating on the basis of a special investment contract. A special tax regime is calculated for them. Also, these organizations must fall under the classification of sections 1-6 of depreciation groups in accordance with the Tax Code of the Russian Federation.

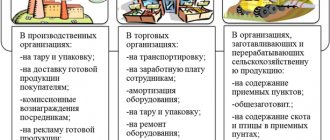

- Agricultural organizations of industrial type with a special status. These categories include state farms of various types, factories for the production of dairy and other food products. The accelerated depreciation method is used in this case if the enterprise has both its own equipment and fixed assets acquired on lease.

- Enterprises operating in unfavorable climate conditions. Such conditions include regions of the Far North, urban areas of heavy industry, arid areas and enterprises operating with hazardous, flammable and chemical substances.

It is important that these organizations are registered for tax purposes before January 1, 2014. Also, the enterprises owned, used and disposed of objects (property) for a period of at least 3 years.

Enterprises that have the right to apply an acceleration factor for depreciation of fixed assets equal to 3:

- In relation to items and objects subject to leasing agreements and used for 5 years or more.

- Organizations using facilities for the extraction of minerals, subsoil and hydrocarbons, provided that the facilities are used exclusively for production. Also, the enterprise must have a special license to carry out this type of activity.

- Fixed assets used exclusively for scientific purposes. This category includes objects of scientific institutes and organizations used for scientific research.

Accelerated depreciation allows the manufacturer to distribute the existing costs of equipment over the production period, as well as compensate for these costs by including the costs of equipment depreciation in the cost of the final product.

In the case of accelerated depreciation, this indicator will be correspondingly higher than the standard, since accelerated depreciation of the enterprise's fixed assets occurs.

Application cases

The use of an accelerated method for calculating and calculating depreciation of fixed assets of an enterprise is beneficial if it is necessary to speed up the process of writing off the cost of purchased equipment.

By reducing the tax base, the use of this coefficient can sufficiently compensate for the resulting costs (especially effective when using leasing).

At the same time, guided by Art. 252 of the Tax Code of the Russian Federation, the enterprise demonstrates the economic feasibility and justification for using this coefficient.

When leasing fixed assets

Accelerated depreciation and an increased coefficient are often applied to leased property. There are explanations for this. Accelerated write-off of value allows the person on whose balance sheet the leased property is listed to reduce income and property taxes.

Read more about calculating depreciation when leasing fixed assets.

In addition, if the fixed asset is listed on the lessor’s balance sheet, then the accelerated method allows you to quickly return the money invested in the object.

If the asset is on the balance sheet of the lessee, then this method allows you to quickly reduce the residual value of the asset for the purpose of its further repurchase from the lessor at a lower price.

The acceleration factor for leasing can be set to a value within three. In this case, the indicator can also be fractional, for example, 2.4 or 1.6.

In tax accounting, an accelerating indicator cannot be used for fixed assets whose useful life is less than five years (fixed assets belonging to depreciation groups 1-2).

The acceleration factor is added to the depreciation rate, which is then multiplied by the cost of the fixed asset.