Reserves for future expenses

Reserves for future expenses - information about reserved funds for expenses that are intended for use in future periods.

Please note: when working with reserves, accountants often do not separate two concepts: reserve for future expenses and deferred expenses. It should be noted that deferred expenses are amounts already accrued by the institution, where the amount and recognition for the period in accounting are determined. Reserves for upcoming expenses - there is no clear amount and time of execution.

Order of the Ministry of Finance of the Russian Federation dated May 30, 2018 No. 124 approved the GHS “Reserves. Disclosure of information about contingent liabilities and contingent assets" (hereinafter referred to as GHS "Reserves"). This standard regulates the work with reserves for future expenses of public sector institutions starting from 01/01/2020.

In order to correctly apply the “Reserves” standard, you should additionally be guided by the methodological recommendations to the GHS “Reserves”, set out in the letter of the Ministry of Finance of Russia dated 08/05/2019 No. 02-07-07/58716.

The “Reserves” standard defines the following types of reserves:

- For claims and lawsuits.

For example, the institution is one of the parties to the litigation. According to the assumption of our own legal service, there is a high degree of concern that the decision will most likely not be satisfactory. - On restructuring.

For example, an institution is planning to undergo restructuring. The formation of a reserve in terms of restructuring may include: costs of consulting services for organizing the restructuring process; termination of the premises rental agreement, and as a result - costs for the penalty; reduction of the workforce, which will lead to costs for retraining/relocating the remaining employees. - For warranty repairs.

For example, an institution is engaged in the production and sale of goods and provision of services. After the sale of a product or provision of a service, there may be cases of warranty obligations in terms of warranty repairs or warranty service. In order to evenly write off expenses for fulfilling warranty obligations, the institution creates an appropriate reserve. - For unprofitable contractual obligations.

For example, an institution rents premises, but uses it partially in its activities, thereby making a loss. - For dismantling and decommissioning of fixed assets.

For example, an institution creates an object that will later be dismantled and the area where it was located restored.

Please note: it is important to take into account that when reserves arise and form, the following criteria for their recognition must be observed (clause 9 of the “Reserves” standard):

- the institution has an obligation formed as a result of the facts of economic life that have occurred;

- to fulfill the formed obligation it will be necessary to dispose of assets;

- the amount of the obligation can be reasonably estimated and confirmed by calculation or documentation;

- The moment of presentation of the demand for fulfillment of the obligation and its size do not depend on the actions of the institution.

It is also worth noting that there are reserves that are defined by individual legal acts:

- reserve for reduction in the value of inventories (regulated by the GHS “Inventories”, approved by order of the Ministry of Finance of the Russian Federation dated December 7, 2018 No. 256n, valid from January 1, 2020);

For example, a public sector institution sells goods that over time have lost their original properties completely or partially, or market prices for similar goods have decreased. The sale of goods occurs at a price below book value or free of charge. - reserve for doubtful debts (regulated by the GHS “Revenues”, approved by order of the Ministry of Finance of the Russian Federation dated February 27, 2018 No. 32n, valid from January 1, 2019);

- reserve for payment of vacation of employees in the future period (in 2020 - Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n; starting from 01.01.2021 - GHS “Payments to Personnel”, approved by Order of the Ministry of Finance of the Russian Federation dated November 15, 2019 No. 184n).

For example, an institution creates a reserve in the current year for use in the future, which is used to pay accumulated vacations, compensation for unused vacations, and contributions to extra-budgetary funds.

The institution has the right to make changes or write off the amounts of reserves as of the current date, as of the date of reporting or reorganization. Changes in amounts are made on the basis of inventory approved by the accounting policy.

It is worth paying attention to the fact that expenses from the created reserve in accounting can only be for those purposes and obligations for which it was formed. Full or partial write-off of reserves is carried out upon recognition of expenses and (or) upon recognition of accounts payable for the fulfillment of the obligation for which the reserve was created (clause 28 of the GHS “Reserve”).

The reserve, if it has not been spent in the current year, is carried over to the next year taking into account the expense item.

Blog

Every accountant has heard about provisions for doubtful debts, but many are hesitant to apply this method of tax optimization in practice.

It is often scary that the rules for creating reserves in tax and accounting differ significantly and are quite difficult to understand.

We have systematized these differences for you according to the main criteria and, for clarity, divided them by type of accounting. In addition, the methodology for creating a reserve was reflected in a question-answer format and collected in a table.

Rules for creating reserves in tax and accounting

| Basic principles | Accounting | Tax accounting |

| Who has the right to create a reserve? | All companies are required to create reserves, there are no exceptions. | The taxpayer has no obligation to create a reserve. But it is worth remembering that in order to exercise the right to reserve, the organization must necessarily use the OSNO and the accrual method. Companies that use the cash method and the simplified tax system do not create reserves. |

| What documents regulate contributions to the reserve? | Clause 70, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n. | Tax Code of the Russian Federation. |

| Should information about the creation of a reserve be included in the accounting policy? | The enterprise should fix the main points of creation and the frequency of contributions to the reserve; there are no established standards. | If the organization has decided to create a reserve, then it is safer to indicate this in the accounting policy, otherwise there may be disputes. |

| What is doubtful debt? | Any unsecured receivables. | An unsecured debt arising in connection with the sale of services, goods and works. You can reserve the debt of buyers or customers, but not suppliers. Also, you should not include debt for loan amounts in the reserve. |

| How to identify doubtful debts? | Based on the results of the inventory. | Based on the results of the inventory. |

| How much debt can be reserved? | The company must independently determine the amount of the reserve based on the likelihood of the counterparty repaying the debt. |

|

| Is there a limit on the size of the reserve? | There are no restrictions on the formation of a reserve. | The reserve can be no more than 10% of sales revenue (excluding VAT). The amount of the reserve based on the results of the 1st quarter, 6 months, 9 months is the largest of the values:

or At the end of the year - no more than 10% of revenue for the current period. |

| How are the created reserves reflected in the reporting? | On the balance sheet, the reserve reduces the accounts receivable ratio. The provision is reflected in the income statement as other expenses. | In the income tax return - as non-operating expenses. |

| Why create a reserve? | Reserves ensure the reliability of financial statements. | The reserve allows you to take into account losses on doubtful debts in advance, without waiting for the moment when the debt is recognized as bad. In other words, the reserve allows you to reduce the tax base for income tax. |

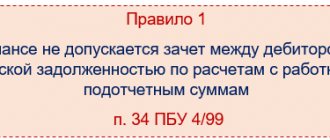

In addition to the popular questions about reserves discussed in the table, the topic of counter-obligation to the counterparty cannot be ignored. In this case, doubtful debt is the amount of accounts receivable that exceeds accounts payable.

Now, knowing all the nuances of creating reserves, let's see how this process is implemented in the 1C 8.3 program.

How to create a reserve in the 1C program? See our instructions.

GO TO INSTRUCTIONS

Accounting entries

In the accounting of a state institution, account 0 401 60 000 “Reserves for future expenses” is used to account for reserves (clause 302.1 of Instruction No. 157n).

An example of reflecting accounting transactions on reserves in a government institution:

Reserve formation:

Dt 0 401 20 200 (0 109 00 000) – Kt 0 401 60 000

The amount of the reserve during inventory/revaluation has been changed:

Dt 0 401 20 200 (0 109 00 000) – Kt 0 401 60 000 (red reversal method)

Accrual of settlements for obligations using reserve amounts:

Dt 0 401 60 000 – Kt 0 302 00 73Х (0 303 00 73Х)

How to create and use a reserve for doubtful debts in tax accounting

A reserve for doubtful debts must be formed every income tax reporting period. Thus, if a company calculates income tax quarterly, then the reserve should be formed once a quarter.

A company that uses the accrual method can create a reserve for doubtful debts not only in accounting, but also in tax accounting (clause 3 of Article 266 of the Tax Code of the Russian Federation).

Doubtful debt is the debt of the counterparty that arose in connection with the sale of goods (performance of work, provision of services), provided that it is not repaid within the time period established by the contract and is not secured in the form of a surety, pledge or bank guarantee (clause 1 of Art. 266 of the Tax Code of the Russian Federation).

If in accounting it is mandatory to create such a reserve, then in tax accounting the reserve is formed on a voluntary basis. Firms using the cash method do not create reserves at all. This is explained by the fact that such organizations can include expenses in the calculation of the tax base only after payment (clause 3 of Article 273 of the Tax Code of the Russian Federation).

It is necessary to establish the amount that should be included in the reserve by determining the period of overdue payment (clause 4 of Article 266 of the Tax Code of the Russian Federation).

- If the delay in payment is less than 45 days, then there is no need to create a reserve.

- If the period is from 45 to 90 calendar days, then 50% of the total debt must be included in the reserve.

- If the delay in payment is more than 90 days, then the full amount of the debt is included in the reserve.

However, it must be remembered that the law establishes restrictions on the maximum amount of the reserve for doubtful debts. Thus, the maximum reserve amount is 10% of revenue for the reporting or tax period, excluding VAT.

A reserve for doubtful debts must be formed every income tax reporting period. Thus, if a company calculates income tax quarterly, then the reserve should be formed once a quarter. If the reporting period is a month, then the reserve must be formed monthly (clause 3 of article 266, clause 2 of article 285 of the Tax Code of the Russian Federation).

Debts that are recognized as bad must be written off using the created reserve for doubtful debts (Clause 5 of Article 266 of the Tax Code of the Russian Federation).

By bad debt we need to understand (clause 2 of article 266 of the Tax Code of the Russian Federation):

- debt for which the statute of limitations has expired;

- a debt for which the obligation has been terminated due to its execution on the basis of an act of a government agency or liquidation of an organization;

- debt, the impossibility of collection of which is confirmed by a resolution of the bailiff - executor on the completion of enforcement proceedings.

The unused balance of the reserve must be compared with the newly created reserve.

- If the newly created reserve is greater than the unused balance, then the resulting difference should be included in non-operating expenses for income tax.

- If the unused balance of the reserve is greater than the newly created reserve, then the difference must be taken into account as part of non-operating income for income tax (clause 5 of Article 266 of the Tax Code of the Russian Federation).

We add that if the amount of bad debts exceeds the created reserve, then the difference should be taken into account as part of non-operating expenses (subclause 2, clause 2, p. 265 of the Tax Code of the Russian Federation).

Take advantage of all the possibilities of Kontur.Externa

Send a request

ANSWER:

Doubtful debt is a debt to the Organization, which with a high probability will not be repaid in full or in part.

This is evidenced, in particular:

- or violation by the debtor of the payment deadline;

- or information about the debtor’s financial problems.

The reserve for doubtful debts is created so that in the financial statements of the organization the data on its receivables are reliable.

DOUBTED DEBT FOR ACCOUNTING PURPOSES

Doubtful debt is recognized as receivables that meet the following criteria (clause 42 of the Instructions for accounting of income and expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated September 30, 2011 No. 102; hereinafter referred to as Instruction No. 102):

- arose as a result of the sale of products, goods, performance of work, provision of services;

- not repaid within the period established by the contract or legislation (if the period is not established - within 12 months from the date of occurrence of the receivables);

- is not provided with appropriate guarantees.

Provisions for doubtful debts are created at the end of the reporting period; the frequency and method of their creation are fixed in the accounting policies of the organization. The creation of reserves for doubtful debts at the end of the reporting year is mandatory provided that the organization has doubtful accounts receivable, to determine which the results of the organization’s mandatory inventory of assets are used before drawing up annual financial statements (clause 43 of Instruction No. 102).

Instruction No. 102 provides the following methods for creating reserves for doubtful debts:

1st method - for each debtor based on an analysis of the debtor’s solvency, the possibility of repaying the debt in full or in part and other factors;

2nd method - by groups of receivables based on their distribution by maturity;

3rd method - for the entire amount of receivables based on the indicator of revenue from sales of products, goods, performance of work, provision of services for the reporting period and the doubtful debt ratio.

Attention! The above approach applies for accounting purposes!

TAX ACCOUNTING FOR DOUBTED DEBT IN 2019

For tax accounting purposes, non-operating expenses in 2019 include: reserves for doubtful debts may be included based on the results of an inventory of accounts receivable carried out on the last day of the reporting (tax) period, not repaid on time, arising in connection with the sale of goods (work, services), property rights, intangible assets, but no more 5% of proceeds from the sale of goods (work, services), property rights, intangible assets, including VAT (subclause 3.48, clause 3, article 175 of the Tax Code), including value added tax, and calculated as follows:

- for doubtful debts with a maturity period of more than ninety calendar days - the amount of the created reserve includes the full amount of debt identified on the basis of the inventory;

- for doubtful debts with a period of occurrence from forty-five to ninety calendar days (inclusive) - the amount of the reserve includes fifty (50) percent of the amount identified on the basis of the debt inventory;

- for doubtful debts with a period of up to 45 calendar days - the amount of debt identified on the basis of an inventory does not increase the amount of the created reserve.

However, it is necessary to take into account some difficulties in the practical application of clause 3.48 of Art. 175:

- determining the types of obligations that are subject to clause 3.48 of Art. 175 NK;

- confirmation of the amounts of obligations (conducting an inventory of payments),

- recalculation of the amount of the reserve for doubtful debts included in non-operating expenses in each tax period.

In the event of a reduction or cancellation of deductions to the reserve for doubtful debts, the costs of the formation of which were taken into account as part of non-operating expenses in previous reporting periods, the corresponding amounts of the reduction in these deductions are subject to inclusion in non-operating income in the reporting period in which the specified cancellation or reduction is subject to reflected in accounting (subclause 3.22 of Article 174 of the Tax Code).

Clause 1 of Art. 186 of the Tax Code establishes that the amount of income tax at the end of the reporting period is calculated on an accrual basis from the beginning of the tax period. Accordingly, when calculating the tax based on the results of each reporting and tax period, the amount of the reserve for doubtful debts included in non-operating expenses must be recalculated and correspond to the limit established by sub. 3.48 clause 3 art. 175 NK.

Within the framework of the current legislation, for debts arising from non-operating income, it is not possible to take into account the created reserve as part of non-operating expenses in the amount of the established standard, for example:

- overdue debt on leasing interest;

- debt associated with the purchase of goods (work, services) (the goods were not received upon prepayment);

- debt with the rental of property.

Let us remind you!

In addition, non-operating expenses include losses from the write-off of accounts receivable that have expired (subclause 3.22 and clause 3.23, clause 3, Article 175 of the Tax Code):

- statute of limitations;

- statute of limitations for presenting writs of execution for execution;

These expenses are reflected on the date following the day of expiration of the limitation period, as well as on the date of drawing up documents about the impossibility of collecting debt in accordance with the law.

- losses from writing off receivables that are impossible (unrealistic) to collect (subclause 3.23, clause 3, Article 175 of the Tax Code).

Such expenses are reflected on the date of exclusion of the debtor from the Unified State Register of Legal Entities and Individual Entrepreneurs.

CREATION OF THE ORGANIZATION'S LEGAL REGULATIONS

Each organization determines the need to regulate work with accounts receivable independently.

In order to organize work with receivables, identify authorized and responsible persons, we propose to develop and enshrine in an order of the Head the “Procedure for organizing work with receivables”, which provides for:

- Unified approaches to taking measures aimed at reducing the amount of uncollectible receivables;

- Concept formulations: 1. current accounts receivable; 2. overdue accounts receivable. 3. unrecoverable accounts receivable.

- Determine the responsible persons authorized by the manager to carry out work with accounts receivable at each stage, provided for by the Regulations;

- The procedure for administering accounts receivable;

- The procedure for collecting receivables;

- Procedure for monitoring, inventory of calculations;

- The procedure for determining the ranking of debt, depending on the period of occurrence and repayment terms;

- The procedure for recognizing receivables as uncollectible;

- The procedure for writing off uncollectible debt.

- The procedure for using information on the status of settlements for accounting and tax accounting purposes in accordance with the requirements of the legislation of the Republic of Belarus.

- Monitoring the implementation of this Order.

| Best regards, Consulting |

17.06.2019