How are operations related to bottling motor oil purchased in tanks into cans reflected in the organization’s accounting records?

In March 2007, a trade organization purchased 20,000 liters of motor oil for carburetor engines from the manufacturer in tanks at a price of 588,844 rubles. (including excise tax 59,020 rubles, VAT 89,824 rubles). To bottle this oil, the organization purchased 4,000 5-liter canisters with a total cost of 180,000 rubles. (including VAT RUB 27,458). In the same month, the organization bottled oil into canisters; bottling costs amounted to 200,000 rubles. According to the accounting policy of the organization, these costs are included in selling expenses for accounting purposes.

Motor oil what kind of accounting account

In which account should Tosol be taken into account - 105 36 or 105 33?

In accordance with the dictionary of financial and legal terms, fuels and lubricants as a special type of inventory include:

- fuel (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas);

- lubricants (motor, transmission and special oils, greases);

- special fluids (brake and coolant).

The definition of fuels and lubricants in the dictionary is taken from the Guidelines for accounting of fuels and lubricants in agricultural organizations, approved. Ministry of Agriculture of Russia 05/16/2005. This is a departmental regulatory act that is applied only by agricultural organizations.

Antifreeze is a trade designation for non-freezing coolant; its main components are water and alcohol derivatives. The composition of coolants is regulated by the document “GOST 28084-89 (ST SEV 2130-80). State standard of the USSR. Low-freezing cooling liquids. General technical conditions", approved. and put into effect by Decree of the USSR State Standard of March 30, 1989 No. 913.

Strictly speaking, Antifreeze and other coolants (antifreeze) are not fuels and lubricants in their composition. If we turn to the data of the Unified Commodity Nomenclature for Foreign Economic Activity, approved. by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54, antifreezes belong to a different nomenclature group, different from fuels and lubricants.

In the All-Russian Classifier of Products by Type of Economic Activity OK 034-2014 (KPES 2008), approved. By order of Rosstandart dated January 31, 2014 No. 14-st, antifreezes were assigned code 20.59.43.120. They are included in group 20.59.4 “Lubricants; additives; antifreezes,” however, are not classified as lubricants and are accounted for under a separate code.

Therefore, Antifreeze can be classified as other inventory - products of the chemical industry and accounted for in account 105 06.

At the same time, many commercial organizations and state (municipal) institutions decide to take into account special fluids (brake and coolant) in the composition of fuels and lubricants. In particular, for planning purposes this was done by the Russian Ministry of Internal Affairs (letter of the Russian Ministry of Internal Affairs dated November 30, 2016 No. 1/12588 “On measures taken to implement the submission of the Accounts Chamber of the Russian Federation”).

By virtue of paragraphs. 117, 118 instructions, approved. By order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, account 105 03 is intended for accounting for fuel and lubricants, which accounts for all types of fuel, fuel and lubricants - firewood, coal, peat, gasoline, kerosene, fuel oil, autol, etc. This list is open.

In addition, according to section. III of Appendix 1 of the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r, the consumption of brake, coolant and other working fluids is controlled and calculated. This circumstance is an additional argument in favor of taking into account Antifreeze in account 105 03.

Due to the fact that there are no clear departmental recommendations or additional clarifications regarding special fluids (brake and coolant), in order to avoid claims from auditors, the institution has the right to fix in the accounting policy the most acceptable accounting account - 105 03 or 105 06.

In our opinion, both options are acceptable and not a mistake. The main thing is that the choice of account is documented. Taking into account current practice, we recommend taking into account special fluids (brake and coolant) on account 105 03 “Fuels and lubricants”.

Excise taxes

О Since 01/01/2007 this problem has been solved, since according to clause 3 of Art. 182 of the Tax Code of the Russian Federation for the purposes of Ch. 22 of the Tax Code of the Russian Federation, only the bottling of alcoholic beverages and beer, carried out as part of the general process of production of these goods, is equated to production.

Thus, when bottling motor oil into cans, the organization does not have obligations to charge excise duty, that is, the organization does not produce another excisable product and, accordingly, it does not have the right to deduct the amount of excise tax presented by the supplier of motor oil.

—————————————————————————T——————T——————T———————T— ———————————————¬ | Contents of transactions |Debit |Credit| Amount,| Primary | | | | | rub. | document | +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Shipping | |Motor capitalized | | | | documents | |oil4) | 41—1 | 60 |499 020| supplier | +—————————————————————————+——————+——————+———————+— ———————————————+ |The amount of VAT is reflected, | | | | | |presented by the supplier| | | | | |oils | 19 | 60 | 89 824| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Accepted for deduction | | | | | | presented amount of VAT | 68 | 19 | 89 824| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Paid to supplier for | | | |Bank statement by| |motor oil | 60 | 51 |588 844|current account| +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Shipping | |Canisters received | | | | documents | |(180,000 - 27,458) | 41—3 | 60 |152 542| supplier | +—————————————————————————+——————+——————+———————+— ———————————————+ |The amount of VAT is reflected, | | | | | |presented by the supplier| | | | | |canisters | 19 | 60 | 27 458| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Accepted for deduction | | | | | | presented amount of VAT | 68 | 19 | 27 458| Invoice | +—————————————————————————+——————+——————+———————+— ———————————————+ |Paid to supplier for | | | |Bank statement by| |canisters | 60 | 51 |180,000|current account| +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Invoice for | |Reflected release of canisters | | | | internal | | for filling them | | | | moving | |motor oil | 44 | 41—3 |152 542| goods, containers | +—————————————————————————+——————+——————+———————+— ———————————————+ | | | | | Settlement— | |Reflected expenses | | | | payment | |related to bottling | | 69, | | statement, | |motor oil in | | 70 | | Accounting | |canisters | 44 | etc.|200,000| help—calculation | L—————————————————————————+——————+——————+———————+— ---------------- -------------------------------- In this The scheme does not cover operations related to the sale of motor oil poured into cans, which are reflected in accounting in accordance with the generally established procedure. N.A. Yakimkina Consulting and Analytical Center for Accounting and Taxation 04/26/2007 ————

Correct organization of accounting

For the most part, it is used motor oils that need to be taken into account. They are required to operate the car. Let's consider the main features of their accounting:

- Establishment of the hazard class of oils. In this case, the current waste classifier is used.

- Organization of temporary storage of oil. In this case, you need to take care of the availability of documentation.

- Timely inventory.

Used oil is considered waste if it does not meet the requirements of TR TS030/2012.

Vegetable oil accounting

Vegetable oil, unlike motor oil, may not be a waste. It can be sent for recycling. Used oil is processed, for example, into biofuel. For processing, the oil is sold to other organizations.

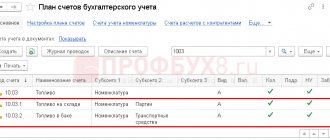

Purchase accounting

Oil accounting is carried out according to the Instructions for using the Chart of Accounts established by Order of the Ministry of Finance No. 94n dated November 30, 2000. These accounts are used for accounting:

- Account 10. Used to summarize information about the movement of raw materials.

- Account 41. Needed to summarize information about the availability of inventory items purchased as products for sale.

- Subcount 10-1. Serves to account for raw materials used in the manufacture of goods.

- Subaccount 41-1 “Products in warehouses”. Serves to record the availability or movement of inventories stored at bases.

Organization of motor oil accounting

Used motor oil must not be discharged into the environment. It is also prohibited to spray and burn it, pour it into water bodies, or pour it onto the soil. That is, you won’t be able to simply dispose of the oil. This is due to the threat to the environment. It is important to properly organize the collection of used oil. To do this, follow these steps:

- Appointment of those responsible for the collection and storage of raw materials.

- Organization of collection points that contain all the necessary containers.

- Search for opportunities for further use of the oil.

- Ensuring control, creating reporting.

- Providing safety training when interacting with waste.

Used oil must be recycled. An alternative option is regeneration to reuse raw materials.

Accounting Features

Accounting for used oil is the work of specially appointed persons with appropriate responsibility. For accounting, you need to create a waste movement log. It is managed by responsible persons. They must be appointed by order of the manager. These persons will be responsible for the truthfulness of all information entered into the journal. Accounting is carried out by accountants on the basis of invoices.

Used oils are secondary material resources. The cost of disposed waste based on clause 11 of PBU 10/99 is recorded as part of other expenses. These records are used for accounting:

- DT1060 KT20, 31. Receipt of returnable waste into the warehouse.

- DT62 KT91. Recognition of revenue from the sale of waste.

- DT91 KT68, subaccount “Calculations for VAT”. VAT accrual.

- DT91 KT1060. Write-off of the cost of sold returns.

Paragraph 5 of the Accounting Regulations PBU 5/98, established by Order of the Ministry of Finance No. 25n dated June 15, 1998, states that mining is accepted for accounting at actual cost. Actual cost is the total cost of the company associated with the purchase of raw materials. The following amounts can be included in the expenses:

- Customs duties.

- Amounts under the agreement.

- Consulting expenses.

- Expenses for the procurement of raw materials.

The legislative framework

We recommend that owners of organizations, their accountants and simply interested persons carefully familiarize themselves with the legal framework that exists in Russian legislation regarding leasing. Rental relations, which is what leasing means, began to develop in our country quite a long time ago. Accordingly, the experience gained in interaction with this form of relationship is reflected in regulatory documents.

In particular, we draw your attention to Article 607 of the Civil Code of the Russian Federation on the so-called “non-consumable things”. Next, be sure to read at least partially the Federal Law of October 29, 1998 No. 164-FZ “On financial rent (leasing)”. It describes in great detail on what basis the lessor and the lessee can cooperate, under what circumstances the lessee is obliged to return the leased item to its owner and under what conditions he can keep it. Also, 164-FZ very interestingly describes the legal aspects of the issue when the leased item is listed on the balance sheet of the lessee or remains with its original owner.

Motor oil what kind of accounting account

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

The program was developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

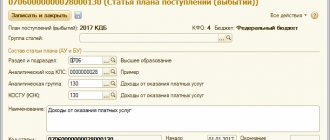

Which KOSGU should be used to reflect the purchase of windshield washer fluid for cars (the treasury authority rejected the payment indicating subarticle 346 of KOSGU with the remark to clarify the KOSGU of payment)? Is it possible in the current situation to pay under subsections 343 or 349 of KOSGU?

Having considered the issue, we came to the following conclusion: Since 2021, to determine KOSGU, the provisions of Order No. 209n have been applied, which contain a direct instruction: the assignment of material inventories to the relevant subarticles of Article 340 of KOSGU is carried out according to the intended (functional) purpose of the material stock. In other words, what is of fundamental importance is not what exactly we bought, but what we will use it for. Windshield washer fluid for cars is a liquid chemical used for household needs - for the purpose of caring for a vehicle (cleaning it of dirt), which means its purchase can be attributed to subarticle 346 “Increase in the cost of other working stocks (materials)” of KOSGU.

Rationale for the conclusion: From January 1, 2021, a new Procedure for applying the classification of operations of the general government sector, approved by Order of the Ministry of Finance of Russia dated November 29, 2017 N 209n (hereinafter referred to as Procedure N 209n), is in force. In this regard, by letter dated June 29, 2018 N 02-05-10/45153 (hereinafter referred to as the Methodological Recommendations) of the Russian Ministry of Finance, methodological recommendations for the application of the new procedure were communicated. According to clause 11.4 of Order No. 209n, Article 340 “Increase in the cost of inventories” of KOSGU is detailed by subarticles 341-349 of KOSGU, reflecting the increase in the cost of inventories for objects. At the same time, the attribution of the acquisition of individual objects of material reserves is carried out, among other things, in accordance with the All-Russian Classification of Products by Type of Economic Activities (OK 034-2014 (CPES 2008)), approved by Order of Rosstandart dated January 31, 2014 N 14-st (clause 3 of Section II of the Methodological Recommendations ). Windshield washer fluid is designed to remove dirt from the front (less often rear) window of a car, and in some cases, in modern cars, not only the glass, but also the headlights are washed. The composition of the windshield washer includes surfactants, dyes and fragrances; mixtures of technical ethyl alcohol and water are used. According to OK 034-2014 (CPES 2008), windshield washer fluid belongs to subcategory 20.41.32.112 “Car detergents” in section 20 “Chemical substances and chemical products”. Essentially, windshield washer fluid is a chemical substance in liquid form, used for household needs - to care for the vehicle (cleansing it of dirt). According to clause 11.4.6 of Order No. 209n, Information of the Ministry of Finance of Russia dated May 13, 2019 “Examples and features of attributing individual transactions to the relevant articles (subarticles) of the classification of operations of the general government sector (KOSGU)” to subarticle 346 “Increase in the cost of other inventories” of KOSGU Among other things, the following expenses include: - purchase of chemical reagents; — for the purchase of household goods; — for the purchase of care products and equipment for animals; - other similar expenses. The purchase of windshield washer fluid in its meaning corresponds to the concept of “similar expenses reflected using element 346 of KOSGU”. Subarticle 343 “Increase in the cost of fuels and lubricants” of KOSGU includes the costs of paying for contracts for the purchase (manufacturing) of fuels and lubricants (hereinafter referred to as fuels and lubricants), including all types of fuel, fuels and lubricants, additives, and other materials used as fuel and (or) lubricants to ensure the functioning of fuel systems (clause 11.4.3 of Order No. 209n). Specialists of the financial department, in a letter dated 01.08.2019 N 02-07-07/58075, include all types of fuel, fuel and lubricants as fuels and lubricants: firewood, coal, peat, gasoline, kerosene, fuel oil, autol. These fuel and fuel items are named in section 19 “Coke and petroleum products” of the OK 034-2014 classifier (KPES 2008). It is not possible to include windshield washer fluid among the indicated material reserves, which means that the reflection of the costs of paying for it under subsection 343 of KOSGU seems doubtful. The list of inventories classified under subarticle 349 “Increase in the cost of other disposable inventories” of KOSGU is closed, therefore this KOSGU code can only be used for inventories directly named in the description for it. Windshield washer fluid is not on this list. Considering that the institution also came to the conclusion that code 346 KOSGU was used when paying for the supply of windshield washer fluid, we recommend that you contact the treasury service authority for additional explanations about the reasons for refusing payment.

Accounting press and publications

“Budgetary healthcare institutions: accounting and taxation”, 2006, N 6

ACCOUNTING OF OPERATIONS FOR RECEIPTS AND EXPENDITURES

FUELS AND LUBRICANTS

In April 2006, the Ministry of Justice of the Russian Federation registered Order of the Ministry of Finance of Russia N 25n (hereinafter referred to as Order N 25n). Despite the fact that this Order comes into force from the moment of official publication, its effect extends to relations arising from January 1, 2006. Since almost all budgetary institutions, including medical ones, have on their balance sheet vehicles that use fuel - lubricants (fuels and lubricants): gasoline, oils, lubricants and special liquids; in accounting there is a need to reflect transactions on their receipt and write-off. This article highlights the procedure for reflecting these transactions in budget accounting in accordance with the requirements of Order No. 25n.

———————————————————————————————— Order of the Ministry of Finance of Russia dated February 10, 2006 N 25n “On approval of the Instructions on budget accounting.”

Capitalization of fuels and lubricants

Fuel and lubricants are classified as inventories and are accounted for in account 0 105 03 000 “Fuels and lubricants”. The posting of material inventories is reflected in the budget accounting registers on the basis of primary accounting documents (supplier invoices, etc.).

In case of discrepancies with the data of the supplier’s documents, a Materials Acceptance Certificate is drawn up (f. 0315004). The form is approved by Resolution No. 71a. The preparation of this document is necessary in the following cases:

— when accepting inventory from a supplier (especially when delivery is carried out at the expense or transport of the supplier), there may be a discrepancy between the supplied assortment, quantity or quality of materials and the data in the supplier’s accompanying documents;

— when accepting materials received without documents, the act is also necessary to file a claim with the supplier or sender;

— when materials are received by the responsible person by proxy, a situation may arise where the materials are not delivered in full or of inadequate quality.

———————————————————————————————— Resolution of the State Statistics Committee of Russia dated October 30, 1997 N 71a “On approval of unified forms of primary accounting documentation for accounting of labor and its payment, fixed assets and intangible assets, materials, low-value and wearable items, work in capital construction.”

Material inventories are accepted for budget accounting at their actual cost, formed upon acquisition, taking into account the amounts of value added tax presented to the institution by suppliers and contractors (except for their acquisition (manufacturing) within the framework of income-generating activities subject to VAT).

If oils, antifreeze and other special liquids for cars related to fuels and lubricants, as a rule, are purchased either by accountable persons or by non-cash payment of invoices to suppliers and contractors, then gasoline is purchased:

— on coupons for fuels and lubricants, giving the right to refuel vehicles at third-party gas stations;

— under an agreement for the provision of fuel and lubricants with a company that issues a special plastic card for each vehicle of the institution, which gives the right to refuel at gas stations subordinate to the company;

— at gas stations by accountable persons.

The procedure for reflecting operations to provide fuel and lubricants in budget accounting, depending on the method of their acquisition, has its own characteristics. Let's look at them with examples.

Purchasing fuel and lubricants using coupons

Gasoline coupons are purchased from the fuel company on the basis of a delivery note and invoice, which reflect the number of coupons and their cost, in accordance with the requirements of the government contract (agreement). The coupons are received by the responsible person by proxy. Reception of coupons at the cash desk is carried out according to a cash receipt order (f. 0310001) and is reflected in budget accounting on account 0 201 05 000 “Cash documents”. According to the cash receipt order (f. 0310002), drivers are issued coupons for reporting.

It should be noted that it is imperative to register incoming and outgoing cash orders for the acceptance and issuance of gasoline coupons in the Register of Incoming and Outgoing Cash Documents (f. 0310003), but separately from cash transactions. Analytical accounting of gasoline coupons is carried out by their types (by gasoline brand) in the Funds and Settlements Accounting Card. Transactions involving the receipt and withdrawal of coupons from the cash register are reflected in the Journal for Other Transactions.

Coupons are issued upon reporting to drivers, and fuel and lubricants received on them are accounted for on the basis of advance reports from drivers with attached coupon stubs. To avoid violations of budget accounting, when accepting advance reports from drivers, the accountant needs to pay attention to the documents attached to the report. As confirmation of refueling of vehicles using coupons, a coupon stub must be attached to the advance report, which indicates the brand of fuel and lubricants and the coupon number. The number on the tear-off spine confirms the fact that exactly those coupons that were received for the report were used.

Along with the advance report, waybills are submitted confirming the fact of refueling and consumption of fuel and lubricants. Based on these waybills, fuel and lubricants are written off.

From the editor. Read about the procedure for issuing waybills in the article by Yu. Nekrasova in this issue of the magazine on p. 46.

Let's look at an example of how the purchase of fuel and lubricants using coupons is reflected in accounting.

Example 1. In January 2006, a medical institution purchased 100 coupons for A-76 gasoline using budget funds. Each coupon is valid for 20 liters of gasoline. The price of one liter is 13.50 rubles. Gasoline coupons were credited to the institution’s cash desk and then issued for reporting to the drivers: Andreev A.V. - 12 coupons and V.V. Alekseev — 10 coupons.

The following entries will be made in accounting:

—————————————————————————————T————————————T——————— —————T—————————¬ | Contents of the operation | Debit | Credit | Amount, | | | | | rub. | +————————————————————————————+————————————+——————— —————+—————————+ |Coupons received |1 201 05 510|1 302 22 730| 27,000 | |for gasoline to the institution's cash desk| | | | +————————————————————————————+————————————+——————— —————+—————————+ |Payment made |1 302 22 830|1 304 05 340| 27,000 | | delivered to the institution | | | | | coupons | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Accepted corresponding |1 501 03 340|1 502 01 340| 33,750 | |budgetary obligations | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Coupons issued for reporting |1 208 22 560|1 201 05 510| 3 240 | | driver Andreev A.V. | | | | |(13.5 rub. x 12 tal. x 20 l)| | | | +————————————————————————————+————————————+——————— —————+—————————+ |Coupons issued for reporting |1 208 22 560|1 201 05 510| 2,700 | | driver Alekseev V.V. | | | | |(13.5 rub. x 10 tal. x 20 l)| | | | L————————————————————————————+————————————+——————— —————+——————————

Purchasing fuel and lubricants using plastic cards

Fuels and lubricants can be purchased using plastic cards. A budgetary institution enters into an agreement with a processing company. In this case, it transfers an advance to the company’s account, and the conditions and amount of the advance must be reflected in the contract.

In accordance with paragraph 37 of Resolution No. 101, budgetary institutions financed from the federal budget are allowed to pay an advance of 100% when purchasing fuel and lubricants. At the regional and local levels, the decision on the size and conditions of advances from regional and local budgets is made by the authorities of the constituent entities of the Russian Federation and local administrations, respectively. For example, in the Nizhny Novgorod region, according to Art. 26 of the Law of the Nizhny Novgorod Region dated December 29, 2005 N 210-Z, an advance payment for the purchase of fuel and lubricants is allowed to be made only in the amount of 30% of the contract amount.

———————————————————————————————— Resolution of the Government of the Russian Federation dated February 22, 2006 N 101 “On measures to implement the Federal Law “On federal budget for 2006."

Law of the Nizhny Novgorod Region dated December 29, 2005 N 210-Z “On the regional budget for 2006.”

Based on a letter from a budgetary institution, a certain amount is credited to each card, for which the driver has the right to refuel for a certain period, usually a month. Refueling with plastic cards is carried out only at those gas stations that accept them, until the advance payment on the card runs out. As a rule, the fuel company does not refuel using a “zero” plastic card.

Every month, the company submits an information report to the institution, which contains data on fuel and lubricants dispensed using cards, namely by plastic card numbers, as well as the quantity, nomenclature, and cost of gasoline dispensed. In addition, the report reflects the date, time, place of refueling and the balance on the plastic card.

At the end of the month, each driver submits waybills. Each waybill is accompanied by receipts from the gas station, confirming the quantity, type of fuel, cost of fuel filled according to a specific fuel card, as well as the date and time of refueling.

Based on the data of the fuel company and waybills for each vehicle, the institution’s accountant writes off the advance payment transferred to the company and, if necessary, makes an additional payment to its account.

Let's consider the reflection in budget accounting of transactions for the receipt of gasoline using plastic cards using an example.

Example 2. A medical institution entered into an agreement with a company to refuel 5 vehicles (used in authorized activities) using plastic cards. The agreement reflects that the institution transfers a monthly advance to the company’s account in the amount of 50,000 rubles. Using budget funds, the medical institution transferred an advance of 50,000 rubles. According to the letter from the institution, the company credited 10,000 rubles to each plastic card. Plastic cards are issued to drivers for reporting purposes. At the end of the month, an invoice was received confirming the refilling of each plastic card, for a total amount of 50,000 rubles.

In accounting, these transactions will be reflected in the following entries:

—————————————————————————————T————————————T——————— —————T—————————¬ | Contents of the operation | Debit | Credit | Amount, | | | | | rub. | +————————————————————————————+————————————+——————— —————+—————————+ |Advance payment transferred to the company |1 206 22 560|1 304 05 340| 50,000 | |for the purchase of fuels and lubricants | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Accepted corresponding |1 501 03 340|1 502 01 340| 50,000 | |budgetary obligations | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Report received from the company |1 105 03 340|1 302 22 730| 50,000 | |for refilled cards| | | | |cars | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Advance offset made |1 302 22 830|1 206 22 660| 50,000 | | based on invoice | | | | L————————————————————————————+————————————+——————— —————+——————————

Purchase of fuel and lubricants through accountable entities

A situation is possible when fuel and lubricants are purchased through accountable persons. As a rule, funds for the purchase of fuel and lubricants are issued on account at the beginning of the month (for a period equal to one month) or week (for a period equal to one week). Advance reports are submitted by drivers at the end of the month (week). Thus, the receipt and write-off of fuel and lubricants is carried out at the end of the month. The procedure for submitting advance reports is reflected in the accounting policies of the organization.

Example 3. A medical institution gave the driver, upon application, on account, funds for the purchase of A-76 gasoline in the amount of 1,300 rubles.

The following entries will be made in accounting:

—————————————————————————————T————————————T——————— —————T—————————¬ | Contents of the operation | Debit | Credit | Amount, | | | | | rub. | +————————————————————————————+————————————+——————— —————+—————————+ |Issued to the driver on report |1 208 22 560|1 201 04 610| 1300 | |cash | | | | |for the purchase of fuels and lubricants | | | | +————————————————————————————+————————————+——————— —————+—————————+ |A-76 gasoline has been credited |1 105 03 340|1 208 22 560| 1300 | | based on advance | | | | |driver's report - 100 l | | | | |at a price of 13 rubles. | | | | L————————————————————————————+————————————+——————— —————+——————————

The procedure for reflecting gasoline and other types of fuel and lubricants in budget accounting through an accountable person at the expense of funds received from income-generating activities has its own characteristics. Let's look at them.

Example 4. A medical institution purchased 10 cans of oil at a price of 236 rubles. per piece (including VAT 18% - 36 rubles) for use in business activities. The activities of a medical institution are not subject to VAT. The medical institution's account is maintained by a credit institution.

These transactions will be reflected in accounting as follows:

—————————————————————————————T————————————T——————— —————T—————————¬ | Contents of the operation | Debit | Credit | Amount, | | | | | rub. | +————————————————————————————+————————————+——————— —————+—————————+ |10 cans of oil received |2 106 04 340|2 302 22 730| 2360 | |at the expense of funds received | | | | |from entrepreneurial | | | | |activities | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Invoice payment made—|2 302 22 830|2 201 01 610| 2360 | | invoice for the supply of gasoline | | | | |at the expense of funds received | | | | |from entrepreneurial | | | | |activities | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Fuels and lubricants received |2 105 03 340|2 106 04 440| 2360 | L————————————————————————————+————————————+——————— —————+——————————

Write-off of fuels and lubricants

Write-off of fuel and lubricants is carried out on the basis of the Fuel and Lubricant Consumption Standards for Motor Transport (hereinafter referred to as the Fuel Consumption Standards).

———————————————————————————————— Guidance document R3112194-0366-03 “Fuel and lubricant consumption standards for road transport” approved by the Ministry of Transport of Russia on April 29, 2003.

Fuel consumption standards are intended for organizations operating automotive vehicles in the Russian Federation, regardless of their form of ownership.

The specified normative and methodological document provides the values of basic fuel consumption standards for all types of motor transport, lubricants, defines the procedure for applying the standards and methods for calculating normalized fuel consumption during operation.

The basic fuel consumption value is determined for each model, brand or modification of the car as a generally accepted norm. In addition, the Fuel Consumption Standards indicate the estimated standard value of fuel consumption, taking into account the transport work being performed and the operating conditions of the vehicle.

The write-off standards for fuel and lubricants are set in liters per 100 km.

To establish fuel consumption standards for each vehicle, they are established by order of the manager in accordance with the requirements of the Fuel Consumption Standards. This order must define the basic fuel consumption rate, as well as correction factors that increase or decrease the basic rate.

Fuel consumption rates may increase under the following conditions:

1. When operating vehicles in the winter season, depending on the climatic conditions of the country's regions - from 5 to 20%. For example, for the Nizhny Novgorod region, the winter premium is set at 10%, its validity period is from November 1 to March 31. It should be noted that in case of significant deviations (decrease or increase) in temperature from the average daily or average statistical values (temperature limit - -5 degrees C), the head of the institution may decide to clarify the beginning and end of the period for applying winter allowances, but only in agreement with regional (local) services of the Hydrometeorological Center of the Russian Federation.

2. When operating vehicles in cities with a population:

— over 3 million people — up to 25%;

— from 1 to 3 million people — up to 20%;

— from 250 thousand to 1 million people — up to 15%;

— from 100 to 250 thousand people — up to 10%;

- in cities and towns (with traffic lights and other traffic signs) with a population of up to 100 thousand people - up to 5%.

3. When operating vehicles that require frequent technological stops associated with loading and unloading, boarding and disembarking passengers, servicing pensioners, disabled people, sick people, etc. (in this case, stops at traffic lights, intersections and crossings are not taken into account) - up to 10%.

4. When driving the first thousand kilometers with new cars (break-in) and cars that have undergone major repairs, as well as during centralized transportation of such cars under their own power in a single state - up to 10%, when driving cars in a paired state - up to 15%, in a triple state - up to 20%.

5. For cars in operation for more than 5 years - up to 5%, for more than 8 years - up to 10%.

6. In winter or cold (with an average daily temperature below +5 degrees C) time of year when cars and buses are idle and warmed up, as well as when idle with the engine running while waiting for passengers (including sick, disabled people, etc.) Standard fuel consumption is established on the basis that one hour of inactivity corresponds to 10 km of vehicle mileage.

Please note: fuel consumption rates may be reduced by up to 15% when operating on public roads outside the suburban area on flat, slightly hilly terrain (altitude up to 300 m above sea level).

In the case of vehicle operation in a suburban area outside the city boundaries, correction (urban) coefficients are not applied.

Example 5. On the balance sheet of the institution there is a GAZ-3102 passenger car manufactured in 2000 with a ZMZ-4022.10 engine. According to the waybill dated April 15, 2006, the GAZ-3102 traveled 400 km, including: in a city with a population of 250 thousand to 1 million people. - 50 km, in a suburban area - 330 km and in an urban village (with traffic lights and other traffic signs) with a population of up to 100 thousand people. — 20 km.

According to the vehicle data, the basic fuel consumption rate per 100 km is 13 liters.

Let's determine the estimated standard value of fuel consumption:

— fuel consumption in a city with a population of 250 thousand to 1 million people — 50 km — can be increased by 15%:

50 km x 13 l x 115% / 100 km = 7.5 l;

- 330 km traveled in a suburban area - no increase in the basic rate is made:

330 km x 13 l / 100 km = 42.9 l;

— in an urban village (with traffic lights and other traffic signs) with a population of up to 100 thousand people, a car has traveled 20 km. In this case, the basic rate can be increased by 5%:

20 km x 13 l x 105% / 100 km = 2.7 l.

Total fuel consumed on April 15, 2006 was 53.1 liters (7.5 + 42.9 + 2.7).

In addition, this vehicle was produced in 2000, that is, the vehicle was in use for more than 5 years, therefore, by order of the head of the institution, an increase of 5% was determined, thus, the amount of fuel consumed will be 55.76 liters (53.1 liters x 105%).

If the Fuel Consumption Norms do not contain the basic fuel consumption norm for vehicles that are on the balance sheet of the institution based on the order of the head, the following is possible:

- for brands and modifications of cars that do not have significant design differences from the base model (same engine, gearbox, final drive, tires, wheel arrangement, body) and do not differ in curb weight from the base model, fuel consumption standards are applied in the same sizes, as for the base model;

— for brands and modifications of cars that do not have design differences, but differ from the base model in their weight (when installing vans, additional equipment, armor, etc.), the fuel consumption rate is determined on an individual application by the Ministry of Transport of Russia. To do this, the institution sends a letter with a request to determine the fuel write-off rate for a specific vehicle, for which the basic rate is not provided in the Guidance Document. During the period of establishing standards, the institution either must not operate this transport or must establish temporary standards. Temporary standards are established after a control measurement of fuel consumption.

If it is necessary to apply several surcharges simultaneously, the fuel consumption rate is set taking into account the sum or difference of these surcharges.

Regarding other lubricants, we note that their write-off is also carried out on the basis of an order from the head of the institution in accordance with the requirements of the Fuel Consumption Standards.

The operating consumption standards for lubricants are set per 100 liters of total fuel consumption, calculated according to the standards for a given vehicle. Thus, oil consumption rates are set in liters per 100 liters of fuel consumption, and lubricant consumption rates are set in kilograms per 100 liters of fuel consumption.

Oil consumption rates can be increased to 20% for vehicles after major repairs and in operation for more than five years.

The consumption of brake, coolant and other working fluids is determined in the quantity and volume of refills and refills per vehicle in accordance with the recommendations of manufacturers, operating instructions, etc.

Example 6. Using the conditions of the previous example, we calculate the write-off rate for motor and special oils.

The consumption rate of motor and special oils according to the Fuel Consumption Standards is:

— motor oils — 1.7 liters per 100 liters of fuel;

— special oils and liquids — 0.05 liters per 100 liters of fuel.

The write-off of engine oil in April 2006 should be in the amount of 6.8 liters (400 x 1.7 / 100).

Special oils and liquids were written off in the amount of 0.2 liters (400 x 0.05 / 100).

Regarding the reflection of transactions for the write-off of fuels and lubricants in budget accounting, we note that Order No. 25n made some changes to the procedure for reflecting these transactions. Previously, according to paragraph 56 of Instruction No. 70n, write-off and release of inventories were carried out at the average actual cost. In this case, inventories were assessed for each group of inventories by dividing the total actual cost of the group of inventories by their quantity, which is the sum of the average actual cost and the amount of balance at the beginning of the month and the inventory received during the given month.

———————————————————————————————— Instructions on budget accounting were approved by Order of the Ministry of Finance of Russia dated August 26, 2004 N 70n.

Since 2006, materials can be written off either at the actual cost of each unit, or at the average actual cost (at the discretion of the budgetary institution). The method of writing off materials is reflected in the accounting policy of the institution.

Note that the average actual cost is determined taking into account inventories received during the current (previously given) month as of the write-off date.

Please note: recording of operations for the movement of fuel and lubricants within an institution is carried out in the registers of analytical accounting of material inventories by changing the financially responsible person on the basis of the Statement of Issue of Material Assets for the Needs of the Institution (f. 0504210). In accounting, these transactions are reflected in the debit of account 0 105 03 340 “Increase in the cost of fuels and lubricants” and the credit of account 0 105 03 340 “Increase in the cost of fuels and lubricants”.

All types of fuel and lubricants are written off on the basis of the Statement of issue of material assets for the needs of the institution (f. 0504210) and the Waybill (f. 0340002, 0345001, 0345002, 0345004, 0345005, 0345007), as well as the Act on the write-off of inventories ( f. 0504230).

The write-off of spent inventories, including fuel and lubricants, on the basis of supporting documents is reflected in the debit of account 0 401 01 272 “Consumption of inventories” and the credit of account 0 105 03 440 “Decrease in the cost of fuels and lubricants”.

Let's look at transactions for writing off fuel and lubricants using an example.

Example 7. A medical institution, using funds received from budgetary activities, purchased 10 canisters of antifreeze in March 2006 for a total amount of 1,500 rubles. As of March 1, 2006, there were 3 canisters worth 360 rubles left in this group. During March 2006, 9 cans of antifreeze were written off for this group of material reserves. According to the accounting policy adopted by the medical institution for 2006, inventory is written off at the average actual cost. The personal account of a medical institution is maintained by the territorial body of the Federal Treasury.

The average actual cost of antifreeze will be 143.08 rubles. ((1500 + 360) rub. / (3 + 10) channels).

The average actual cost of the remainder of 1 canister of antifreeze as of 04/01/2006 is 143.07 rubles. ((1500 + 360) rub. / (3 + 10) channel - (9 channel x 143.08 rub.)).

Operations to write off fuel and lubricants in this case will be reflected in the budgetary accounting of the institution in the following order:

—————————————————————————————T————————————T——————— —————T—————————¬ | Contents of the operation | Debit | Credit | Amount, | | | | | rub. | +————————————————————————————+————————————+——————— —————+—————————+ |Supplied by supplier |1 105 03 340|1 302 22 730| 1500 | |10 cans of antifreeze | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Paid for medical antifreeze |1 302 22 830|1 304 05 340| 1500 | |institution | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Accepted corresponding |1 501 03 340|1 502 01 340| 1500 | |budgetary obligations | | | | +————————————————————————————+————————————+——————— —————+—————————+ |Written off antifreeze|1 401 01 272|1 105 03 440| 1287.72 | |(RUB 143.08 x 9 channels) | | | | L————————————————————————————+————————————+——————— —————+——————————

In conclusion, we note that inventory registers are defined by Instruction No. 25n, while the forms themselves and the procedure for filling them out are approved by Order of the Ministry of Finance of Russia dated September 23, 2005 No. 123n.

———————————————————————————————— Order of the Ministry of Finance of Russia dated September 23, 2005 N 123n “On approval of budget accounting register forms.”

Analytical accounting of fuels and lubricants is carried out on Cards for quantitative and total accounting of material assets. Financially responsible persons must keep records of material reserves in the Book (or Card) of accounting for material assets by their names, grades and quantities.

Accounting for transactions on the consumption of material reserves, their disposal from operation, and movement within the institution is carried out in the Journal of transactions on disposal and movement of non-financial assets.

M.Volchkova

Journal expert

“Budgetary healthcare institutions:

accounting and taxation"

Signed for seal

23.05.2006

—————————————————————————————————————————————————————————————————— ———————————————————— ——

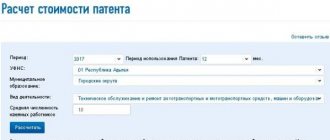

Accounting for fuel and lubricants in 1C 8.3: step-by-step instructions

From simple for individual companies to complex automation of large holdings.

Submission of regulated reporting in accordance with the legislation of the Russian Federation.

Institutions and organizations with vehicles are forced to buy gasoline, diesel fuel and other fuels and lubricants every day. The most common ways to purchase fuel and lubricants are in cash or with an advance report, as well as using fuel cards.

Let's look at how these methods of accounting for fuel and lubricants are implemented in 1C: Accounting 8.3.

Accounting by cards

The plastic fuel card payment system is the most convenient and profitable form of payment for fuel. The organization enters into an agreement with a fuel and lubricants supplier for the purchase of gasoline using a fuel card, which stores information about the established limits on the quantity and range of petroleum products and related services, as well as the amount of money within which petroleum products and related services can be obtained.

The posting of the cost of a fuel card (if there is one, since in most cases the card is used for free if it is returned) can be registered as a receipt - “Receipt (acts, invoices)” - create a receipt “Services (act)”).

In this case, the fuel card itself is taken into account as a strict reporting form on off-balance sheet account 006 and is reflected in accounting using a manual operation - menu “Operations” - “Operations entered manually”.

Please note that if a fuel card is produced free of charge, the card is also displayed on off-balance sheet account 006 “Strict reporting forms” at a conditional price - 1 card = 1 ruble.

At the end of the month, the fuel supplier provides documents reflecting the number of liters actually purchased, which is the basis for accounting in account 10.03.1 “Fuel” and is issued through “Receipt of goods (invoice)”, in the “Purchases” menu - “Receipt (acts, invoices."

We create a new document “Receipt of goods (invoice), fill in the organization, supplier, contract, warehouse and add rows to the tabular part “Goods” using the “Add” or “Selection” button. When creating an item, be sure to specify the type of item - fuels and lubricants.

Thus, we received fuel and lubricants from the supplier. The wiring has been formed - Dt. 10.3 - Kt. 60.

Regulatory regulation

Accounting and tax accounting

Like all materials, fuels and lubricants are taken into account in the amount of actual costs for their acquisition (clause 5, clause 6 of PBU 5/01). For profit tax purposes, the actual cost of inventories is determined based on purchase prices (excluding input VAT and excise taxes) and other costs of their acquisition (clause 2 of Article 254 of the Tax Code of the Russian Federation).

The purchase of fuel and lubricants can be carried out either in cash or by bank transfer.

In non-cash form there are:

- direct non-cash payment: by bank card or through a current account;

- indirect non-cash payment: using fuel cards, coupons, statements, and other documents that allow you to receive a certain amount of prepaid fuel.

The receipt of fuel and lubricants and its further accounting is carried out in the accounts (chart of accounts 1C):

- 10.03.1 “Fuel in warehouse”;

- 10.03.2 “Fuel in the tank.”

To control its movement, it is necessary to organize accounting at storage locations and materially responsible persons (MRP) in the context of various types of fuels and lubricants.

VAT

The issue of deducting VAT when purchasing fuel and lubricants is especially acute where there is a large fleet of vehicles and the costs of fuel and lubricants occupy a significant share in the structure of total costs.

When purchasing materials, VAT is deductible if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- the materials must be used in activities subject to VAT;

- a correctly executed SF (UPD) is available;

- materials were accepted for registration (clause 1 of article 172 of the Tax Code of the Russian Federation).

Moreover, if we talk about non-cash payment, then these three conditions are met when concluding any of the fuel supply contracts: to the buyer’s wholesale warehouse, using fuel cards, coupons, statements. For each of these contracts, the buyer receives a delivery note and an invoice from the supplier.

If you purchase fuel and lubricants for cash, deducting VAT can be problematic.

Is it possible to deduct VAT on cash receipts received at a gas station and attached to the advance report?

If fuels and lubricants were purchased at a gas station for cash without presenting an invoice, then VAT on it cannot be deducted (Letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 N 03-07-11/3094). The cash register receipt reflected in the purchase book will not find a “match” in the general database of invoices for Russia.

More information about VAT in the cash receipt

Fuel cards and coupons for fuel and lubricants - monetary documents or not?

Accounting for fuel cards and coupons is not regulated by accounting regulations. In the Instructions for using the Chart of Accounts, approved. By Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, fuel coupons and cards are not named as monetary documents, but the list of such documents is open.

Based on the analysis of the Instructions approved by Orders of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n and dated December 1, 2010 N 157n, several features of monetary documents can be identified:

- the document has a fixed cost;

- the product (service) according to the document has been paid for, but not received;

- As a rule, the receipt of an asset is of a one-time nature.

Based on this, we can conclude: quantity-amount and total coupons for fuel and lubricants can be considered monetary documents under contracts where ownership of the fuel passes at the time of refueling. Accounting for monetary documents is organized in 1C on account 50.03 “Cash Documents”.

The fuel card has no monetary value and can be used multiple times. In our opinion, it does not meet the characteristics of a monetary document and can be accounted for in an off-balance sheet account, for example, MTs.04 “Inventory and household supplies in operation.”

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.