It's the beginning of March. In principle, we were ready to write this article and shoot a video a month ago, as most publications did. Surely, then we would have collected much more views than now. But we decided that before publishing our material, we need to make sure that our interpretations are correct, because we still have many questions regarding the reduction of the patent, even after publishing the notification form.

We hoped that by the end of February the tax office would issue official explanations in which it would tell us how inspectors would check notifications, or at least explain the most controversial issues. But things are still there.

Well, there’s nothing to do, we’ll get out on our own. In preparing this material, we broke a lot of spears in the dispute and, at least in our team, came to some conclusion. Of course, we cannot guarantee that it is absolutely correct, but at least it seems logical and more or less safe.

What can be deducted from a patent?

For those who have met with UTII or simplified tax system (6%) there is nothing new here. Insurance contributions for compulsory pension, medical and social insurance can be deducted from the patent. In addition, you can deduct the costs of temporary disability benefits, which are paid at the expense of the employer. And, of course, contributions for voluntary insurance of employees.

Tax Code of the Russian Federation, art. 346.51, paragraph 1.2 :

The amount of tax calculated for the tax period is reduced by the amount:

1) insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, paid (within the calculated amounts) in a given tax period in compliance with the legislation of the Russian Federation;

2) expenses for payment in accordance with the legislation of the Russian Federation of temporary disability benefits (except for industrial accidents and occupational diseases) for days of temporary disability of the employee, which are paid at the expense of the employer and the number of which is established by Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, in the part not covered by insurance payments made to employees by insurance organizations that have licenses issued in accordance with the legislation of the Russian Federation to carry out the relevant type of activity, according to agreements with employers in favor of employees in the event of their temporary disability (except for industrial accidents and occupational diseases) for days of temporary disability, which are paid at the expense of the employer and the number of which is established by Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”;

3) payments (contributions) under voluntary personal insurance contracts concluded with insurance organizations that have licenses issued in accordance with the legislation of the Russian Federation to carry out the relevant type of activity, in favor of employees in the event of their temporary disability (except for industrial accidents and occupational diseases) for days of temporary disability, which are paid at the expense of the employer and the number of which is established by Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.” The specified payments (contributions) reduce the amount of tax if the amount of insurance payment under such contracts does not exceed the amount of temporary disability benefits determined in accordance with the legislation of the Russian Federation (except for industrial accidents and occupational diseases) for days of temporary disability of the employee, which are paid for employer's funds account and the number of which is established by Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

The first and most obvious limitation is that only those payments made for employees engaged in activities transferred to the patent can be deducted from the patent.

Tax Code of the Russian Federation, art. 346.51, clause 1.2, para. 5

The insurance payments (contributions) and benefits specified in this paragraph reduce the amount of tax calculated for the tax period if they are paid in favor of employees employed in those areas of the taxpayer’s activity for which tax is paid in connection with the use of the patent tax system.

Those. if you work under a patent and the simplified tax system , but your employee is engaged only in activities that fall under the simplified tax system, and you handle the work under the patent yourself, then you cannot reduce the patent for insurance premiums for the employee.

Go ahead. To accept contributions for deduction, they must be paid within the tax period: “The amount of tax calculated for the tax period is reduced by the amount of insurance premiums paid (within the calculated amounts) in a given tax period.”

Article 346.49 states that the tax period for the patent system is considered to be a calendar year . If the patent was issued for less than a year, then the tax period is the validity period of the patent . And there is a special feature for 2021. In case of obtaining a patent for the entire 2021, the tax period is considered to be a month .

To ease your conscience, it’s worth saying a few words about the tax period in the form of a month. Quote from the Tax Code - “The amount of tax calculated for the tax period is reduced by the amount of insurance premiums paid (within the limits of the calculated amounts) in a given tax period.”

Because Since the tax is calculated for the tax period and you can deduct from it contributions that were paid in a given tax period, then some particularly impressionable entrepreneurs decided that in 2021, if you buy a patent for a year, then the contributions must be paid monthly, otherwise for some months The patent tax cannot be reduced.

We are sure that this is not the case. The monthly tax period rule was introduced primarily so that regions could make changes to their local patent laws during 2021 without having to wait until next year for them to come into force.

Tax Code of the Russian Federation, art. 5, paragraph 1

Acts of legislation on taxes come into force no earlier than one month from the date of their official publication and no earlier than the 1st day of the next tax period for the corresponding tax, except for the cases provided for in this article.

The legislator did not even think about forcing entrepreneurs to pay contributions monthly in 2021; moreover, the Tax Code does not contain any instructions on how to calculate tax for the tax period corresponding to the month. It says how to calculate the tax if the patent was purchased for a year, and how to calculate the tax if the patent was purchased for less than a year.

It is not clear what to do to calculate the tax for each month the patent is valid . Of course, a person with the most basic knowledge of mathematics will be able to guess without the hints in the Tax Code. But the law is a pretty strict thing. If it does not contain a description for some process, then it cannot be done.

We hope the issue with monthly insurance payments is closed. To reduce the patent on insurance premiums, they must be paid during the period of validity of this patent and no matter what month. By the way, this is also a very ambiguous thesis, but it’s too early to think about it; we’ll return to it towards the end of the article.

Now about another restriction that applies to entrepreneurs with employees. In the tax code it reads like this:

Tax Code of the Russian Federation, art. 346.51, clause 1.2, para. 6, 7

In this case, taxpayers (with the exception of taxpayers specified in paragraph seven of this paragraph) have the right to reduce the amount of tax by the amount of insurance payments (contributions) and benefits specified in this paragraph, but not more than 50 percent.

Taxpayers who do not make payments and other remuneration to individuals have the right to reduce the amount of tax on paid insurance contributions for compulsory pension insurance and compulsory medical insurance in the amount determined in accordance with paragraph 1 of Article 430 of this Code.

And this point also gives rise to many doubts. Our interpretation is this: if an entrepreneur, when conducting business under at least one patent, makes payments to individuals (under an employment contract or under a civil process agreement), then he can reduce all of his patents by no more than 50 percent.

We believe that the phrase “Taxpayers not making payments or other remuneration to individuals” defines the status of the entrepreneur in general, and not specifically for each patent.

There is another interpretation of this point. Some entrepreneurs believe that if their employees work under one patent, and under the second the entrepreneur operates on his own without outside help, then the 50% limit applies only to the first patent, and from the second, fixed contributions of the individual entrepreneur can be deducted down to zero. As confirmation of this position, we can give the example of UTII. In the chapter about UTII, this point was formulated in exactly the same way (almost letter for letter):

Tax Code of the Russian Federation, art. 346.32, clause 2.1 (as amended until 2021)

In this case, taxpayers (except for the taxpayers specified in paragraph three of this paragraph) have the right to reduce the amount of the single tax by the amount of expenses specified in paragraph 2 of this article by no more than 50 percent.

Individual entrepreneurs who do not make payments and other remuneration to individuals reduce the amount of the single tax on paid insurance contributions for compulsory pension insurance and compulsory medical insurance in the amount determined in accordance with paragraph 1 of Article 430 of this Code.

And with this formulation, the Ministry of Finance issued many letters in which it said that if an entrepreneur works on some type of activity himself, without involving employees, then he can reduce the tax for this type without applying the 50% limit.

Although we did not agree with these letters in everything, the position of the officials was quite clear, and it was in favor of the entrepreneur, so there was little point in arguing with this. Here, for example, is a letter dated November 20, 2019 No. 03-11-11/89475 .

But in these letters, tax officials referred to a clause of the Tax Code, according to which UTII payers, if they carried out several types of activities , were required to keep separate records of the indicators necessary to calculate the tax for each of these types of activities. But in the chapter on patents there is no such clause; accordingly, these explanations cannot be projected onto the patent system.

Of course, we can say that each patent is a separate tax period and they need to be considered separately, but until some inspector says this in his official explanation, or even better, a judge, all this is empty hot air. We strongly advise you to adhere to a more strict interpretation.

Notice of tax reduction under PSN

The Federal Tax Service of Russia has developed and sent for use a recommended form of notification of a reduction in the amount of tax when applying a patent.

The format of this notification, as well as the procedure for its submission to the tax authorities, is contained in the Letter of the Federal Tax Service dated January 26, 2021 No. SD-4-3/

From January 1, 2021, when applying the PSN, individual entrepreneurs have the right to reduce the amount of tax paid when applying the patent taxation system by the amount of insurance premiums paid both for “themselves” and for employees. Of course, these workers must work in the types of activities for which the patent is applied. Tax can also be reduced on sick leave for the first three days of an employee’s illness and on contributions for employees under voluntary personal insurance contracts. This right is enshrined in the Tax Code, paragraphs. 1.2 of Article 346.51.

To exercise this right, an individual entrepreneur must send a notification to the tax office about a reduction in the amount of tax calculated for the patent.

The recommended form of notification consists of:

- title page

- Sheet A

- Lista B

Title page

The title page indicates:

- code of the tax authority where the notification is sent

- Full name of the entrepreneur

- IP phone number

- date and signature

Sheet A

Sheet A contains information about those patents for which the individual entrepreneur wants to reduce the amount of tax. You must specify:

- patent number

- date of issue

- patent tax amount.

If an individual entrepreneur wants to reduce the tax on the amount of contributions paid for several patents, sheet A indicates the data for each such patent.

If one sheet is not enough to indicate the required number of patents, the required number of sheets A is filled in.

Sheet B

Sheet B indicates the amount of insurance premiums and benefits by which, according to the Tax Code, the amount of tax on a patent can be reduced.

The following information is entered on sheet B:

- payer attribute – whether the individual entrepreneur makes payments to employees (2) or not (1)

- total amount of tax payable on patents indicated on sheet A

- the amount of insurance premiums and benefits that reduces the amount of tax

We remind you that the insurance premiums indicated in the notification must be paid during the tax period of application of the patent and are accepted only within the calculated amounts. Overpayment of contributions does not reduce the tax amount!

Procedure for submitting notification

The notification can be sent to the tax office in paper or electronic form.

In paper form, the notification is submitted in person or by mail with a list of attachments. To send electronically, it is necessary to use an enhanced qualified electronic signature.

The notification is sent to the tax office to which the amount of tax on the patent is paid.

The form of notification, according to the Tax Code of the Russian Federation, must be approved by order of the Federal Tax Service of Russia. And while this order has not been issued or published, the Federal Tax Service has sent the recommended form of this notification. And this form will be valid until the notification form is approved by order of the Federal Tax Service.

Neither the Tax Code of the Russian Federation nor the letter from the Federal Tax Service indicate within what timeframe the notification must be sent. But judging from the provisions of Art. 346.51 of the Tax Code of the Russian Federation, there is one obligatory condition - at the time of sending the notification, the insurance premiums indicated in this notification must be paid.

If an individual entrepreneur first paid the tax and then filed a notification, a credit or refund of the overpaid amount of tax is made according to the rules of Art.

78 Tax Code of the Russian Federation. Please take a look at our article . In it we have collected a selection of the most basic questions from entrepreneurs:

- Is it possible to carry out international cargo transportation using a patent?

- Is it possible to sell beer or branded goods on a patent?

- Is it possible to switch from the simplified tax system to a patent within a year and what to do if you need to sell a product to a legal entity?

If you are not ready to deal with these issues yourself, then you can safely leave this routine to the specialists of our company.

For our clients, we offer favorable rates for keeping records of individual entrepreneurs’ income under the PSN and simplified tax system.

The cost of the full package of services is from 2,100 rubles. per month (keeping records for one settlement object).

What is included in our services:

- Maintaining daily records in KUDIR for cash receipts

- Maintaining daily records in KUDIR on receipt of funds from acquiring

- Sending a new form of notification to the Federal Tax Service on payment of insurance premiums

- Calculation of the total cost of the patent to be paid minus insurance premiums

- Monitoring the payment of taxes and contributions and preparing all documents for payment

- Monitoring the expiration of a patent and ordering a new patent

Or you can choose a tariff that will cost 500 rubles per month. It will include:

- Sending a new form of notification to the Federal Tax Service on payment of insurance premiums

- Calculation of the total cost of the patent to be paid minus insurance premiums

- Monitoring the payment of taxes and contributions and preparing all documents for payment

- Monitoring the expiration of a patent and ordering a new patent

And you will make entries about income yourself in our personal account. We will provide you with an income ledger upon request. We wrote in detail how this functionality works in this article.

Contact professionals right away so you can do what you love with peace of mind!

Which patent reduces employee fees?

Let's say an entrepreneur received two patents for the whole year. One costs 200 thousand and employs one person, whose contributions from their salary for the whole year amounted to 20 thousand, and the second patent costs 10 thousand, but five people work on it and contributions from their salaries amounted to 100 thousand. The question is: how much taxes should an entrepreneur pay?

Because Our task is to formulate the safest possible position for an entrepreneur on all controversial issues, then to answer this question, let’s choose the most unfavorable option and calculate the tax for each patent, taking for deduction only those contributions that were paid for employees working under this patent.

First patent. Its cost is 200 thousand rubles. Because If an entrepreneur has hired employees, he can reduce this patent by no more than 100 thousand . Contributions for an employee working under this patent amounted to 20 thousand. It turns out that we can reduce the patent by only 20 thousand. The total amount due is 180 thousand.

Second patent. Its cost is 20 thousand. It can only be reduced by 10 thousand (since the individual entrepreneur has employees). Contributions for employees working under this patent amounted to 100 thousand rubles. But we can only deduct 10. The total tax payable under this patent is 10 thousand rubles . And there are still 90 thousand “unused” contributions left.

And now, we look into the tax code and see an interesting point:

Tax Code of the Russian Federation, art. 346.51, clause 1.2, para. 8

If the taxpayer, in the calendar year in which he paid insurance payments (contributions) and benefits, received several patents exceeded the amount of this tax , taking into account the limitation established by paragraph six of this paragraph, then he has the right to reduce the amount of tax calculated for another patent (others) valid in the same calendar year by the amount of the specified excess.

It turns out that we can easily “transfer” these 90 thousand that we have left on the second patent to the first one. And it turns out that to those 20 thousand that we can definitely deduct from the first patent, another 90 thousand are added from the employees on the second patent. And from 200 thousand we can already deduct 110 thousand, taking into account the 50% limit, the final amount of tax payable will be 100 thousand.

In fact, the “magic norm” that we used in our example is not needed for this purpose; it was simply much easier to prove our position with its help. We believe that even without this rule, when calculating the tax on a patent, it is possible to collect all contributions in a pile, and not distribute them among patents. But that's a completely different story.

How the patent fee is reduced

Patent payments are reduced by the following amounts:

- The cost of paid contributions for pension, social and health insurance of employees (if any).

- Payment for the first three days of sick leave.

- Payments made for personal insurance of employees on a voluntary basis.

- Contributions to the Pension Fund for an individual entrepreneur (RUB 32,448).

- Compulsory medical insurance fee for individual entrepreneurs in the amount of 8,426 rubles.

- Contributions in the amount of one percent of income exceeding 300 thousand rubles.

So why do we need a “magic norm”?

And now we come to the main issue of this evening. Let's take another look at this point:

Tax Code of the Russian Federation, art. 346.51, clause 1.2, para. 8

If the taxpayer, in the calendar year in which he paid insurance payments (contributions) and benefits, received several patents and when calculating the tax on one of them, the amount of insurance payments (contributions) and benefits specified in this paragraph exceeded the amount of this tax, taking into account the limitation established by paragraph six of this paragraph, then he has the right to reduce the amount of tax calculated for another patent (others) valid in the same calendar year by the amount of the specified excess.

There is not a word in it that the fees that can be transferred from one patent to another must be paid during the validity period of both patents. This refers exclusively to the calendar year .

Thus, if an individual entrepreneur without employees received a patent for six months for 20 thousand rubles and during the validity period of this patent fully paid his fixed fees (40,874 rubles), then he does not have to pay for the patent, the fees completely covered it. And if, after the end of this patent, the entrepreneur immediately takes the next one (for another six months) for the same 20 thousand, then even though he will not pay any fees during its validity period, the tax can still be reduced, because Since the time of his first patent, he had 20,874 rubles left in insurance premiums, which he did not use to reduce taxes. He transfers them to his new patent, and thereby completely covers it.

Now, as they say, watch your hands. Let's try to find in this “magic clause” some words that in order to transfer unused insurance premiums, these premiums must be paid before the start of the patent to which the entrepreneur wants to transfer them. There are no such words, the paragraph is exclusively about the calendar year. And this gives us the opportunity to come up with the following example:

Let's say our entrepreneur received the same patent for six months for 20 thousand and completely forgot about his insurance premiums . It turns out that you have to pay the tax in full. He pays. But then he receives a patent for a month for 4 thousand, during this month he pays his fixed fees (40,874) and submits a tax notice in which he reports that he has reduced both his second patent (for a month) and his first (for six months ) for all your insurance premiums.

In total, he doesn’t owe anything to the tax authorities regarding patents, but since... He previously paid 20 thousand for his first patent, then he has an overpayment, which he can either return or offset to pay future taxes.

Let's condense everything that was said above into one phrase:

The amount of tax on all patents for the year can be reduced by the amount of all insurance premiums paid during the validity period of at least some patent within the calendar year.

Stop, wait, it’s the same thing...

How to give notice

A notification about reducing the amount of PSN tax by the amount of insurance payments (contributions) and benefits specified in paragraph 1.2 of Article 346.51 of the Tax Code of the Russian Federation can be sent to the tax office:

- personally;

- by mail with a description of the attachment;

- in electronic form via telecommunication channels, signed by UKEP.

The notification is submitted by the taxpayer himself or his representative to the tax office at the place of registration and to which the amount of tax subject to reduction was paid (must be paid).

A patent is a simplified tax system

...USN! Indeed, the methodology for working with insurance premiums is surprisingly similar to the Simplified Taxation System. Let's remember what the patent system was originally called? Simplified taxation system based on a patent . The rules for working under a patent were described in the chapter on the simplified tax system. And only then the patent was turned into an independent special regime, which was increasingly adjusted to the UTII.

It turns out that a patent was originally a special type of simplified tax system (by the way, read paragraph 10 of Article 346.25.1 of the Tax Code of the Russian Federation as amended in 2009; contributions could be deducted from a patent even then). It was later turned into a separate special regime. And finally, after the abolition of UTII, almost without looking at it, entire paragraphs from the chapter about UTII were transferred to it, adding a clause in which it again became similar to the simplified tax system. Only we think that this Frankenstein monster needs to be completely redone, and not patched up holes in it?..

Enough theory. How to reduce a patent?

It's time to talk in more detail about the Notice, which can be used to reduce the cost of a patent. It consists of three sheets:

- Title page. Here you need to introduce yourself and indicate which tax office the Notification is being submitted to.

- List of patents. This sheet indicates the details of the patents that you are going to reduce.

- Reduction amount sheet. This indicates the amount of payments by which we reduce patents.

We will not dwell on the title page in detail. Let’s just say that in the “Submitted to the tax authority” it is necessary to indicate the code of the tax office in which the patents listed in the Notification were received. If you have several patents in different tax authorities, then you need to submit your own Notification to each tax office, which will list only the patents received in this tax office.

Second sheet (Sheet A). Here, indicate the details of your patents that you plan to reduce:

- Patent number

- date of issue

- Patent tax amount

If all your patents do not fit on one sheet, then just take a second one.

Third sheet (Sheet B). Here you need to indicate whether you make payments to individuals or not (field “Taxpayer Attribute” ):

- Code 1. Individual entrepreneurs making payments to individuals.

- Code 2. Individual entrepreneurs who do not make payments to individuals.

Next, you need to summarize the value of all patents indicated on the previous sheet. In the “Total amount of tax payable” , write the amount of all patents listed on the second sheet.

And finally, we indicate the amount of payments by which we reduce our patents. Do not forget about the conditions that we discussed above:

- The fees (and other payments that reduce the patent) must actually be paid.

- These payments must be made within the assessed amounts. Those. you cannot pay your fixed contributions in advance for several years in advance and take the entire payment amount as a deduction.

- Payments that reduce a patent must be made during the period of validity of at least some patent.

- If payments for employees are accepted for deduction, then they must be made for those employees who are engaged in activities transferred to the patent.

- Individual entrepreneurs making payments to individuals (those who put code 1 in the first field) accept for deduction the amount of payments no more than half of the total tax on patents. Individual entrepreneurs who do not make payments to individuals (those who put code 2) accept for deduction an amount not exceeding the full cost of all their patents.

Important note. If in the field with payments that reduce patents you indicate an amount greater than the allowable amount, the tax office will refuse to accept the Notification.

Notification of the Federal Tax Service

The Federal Tax Service has not yet issued an order with a form to reduce the patent, but there is a letter dated January 26, 2021 No. SD-4-3 / [email protected] It published an application to reduce the amount of tax under PSN (KND 1112021), a description of the electronic format of the document, the procedure its presentation, as well as the form of notification of refusal to deduct contributions.

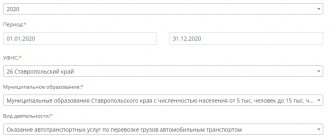

The deduction application consists of a title and two sheets. Let's figure out how to fill them out.

Title page

On the first sheet of form 1112021 for KND you need to indicate:

- Federal Tax Service number;

- last name, first name and patronymic of the entrepreneur;

- number of pages of the document and attachments to it, if any.

The lower left area of the title page confirms the accuracy of the information. Here you should enter:

- code 1, if the individual entrepreneur signs the document himself, or code 2, if this is done by a representative. In the second case, the full name of the applicant is reflected in the following lines, and the details of the power of attorney are reflected in the lower lines;

- date of completion of the document;

- signature.

At the very top of the title and remaining pages of the document, the entrepreneur’s TIN is written down, as well as the page number in the “001” format.

Sheet A

The sheet contains blocks of three lines:

- 010 - patent number;

- 020 - date of issue;

- 030 - cost of the patent before deduction.

If there are several patents, the cost of which will be reduced due to contributions and benefits, the required number of blocks is filled in.

Entrust reporting to specialists

Sheet B

On sheet B, the lines are filled in like this:

- 001 - payer code depending on whether the individual entrepreneur makes payments to employees (1 - makes, 2 - does not);

- 110 - the amount of tax payable on all patents without taking into account deductions (the sum of all lines 030 from sheet A);

- 120 - the amount of contributions/benefits accepted for deduction.

Sample of filling out the KND form 1112021

How can I submit multiple Notices within a year?

A situation may arise where it is necessary to submit multiple notifications. For example, you bought a patent for the whole year for 30,000 rubles, in the first quarter you paid a quarter of your insurance premiums (a little more than 10 thousand) and want to reduce your patent by this payment.

You fill out the Notification and submit it to the tax office. The tax office sees that you have reduced your patent by more than 10 thousand and is no longer waiting for the first third at the beginning of the year (it was covered by insurance premiums). But the Federal Tax Service understands that by the end of the year you still have to pay approximately 20 thousand.

Come December, you pay the last quarter of your insurance premiums, which now more than cover the cost of the patent, and are faced with the question of how to fill out the second notice of reduction? Should I indicate the full cost of the patent on the second sheet? Or taking into account the first reduction?

Because At the time of writing, there were no official clarifications from officials on the controversial issues of filling out the Notification, we suggest adhering to the following rule:

Each new Notification “nullifies” the previous one.

Those. When submitting a second notice, you need to pretend that you are doing this for the first time and, accordingly, indicate in it the full cost of the patent for the year and all your insurance premiums for the year that you are using to reduce it.

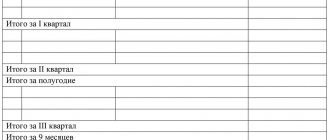

Here is an illustration of how, according to our theory, an entrepreneur who bought a patent for a year for 30 thousand had to fill out two of his notices.

First Notice reducing the patent by a quarter of the individual entrepreneur's contributions. Filed before April 1 to reduce the first payment on the patent (1/3 of the cost)

Second Notice reducing the patent entirely. Submitted at the end of the year

Bottom line

Basically, we said everything we wanted to say. It remains only to repeat that many of our statements voiced in this article cannot be called completely unambiguous. They seem logical and safe for use to us, but it may turn out that according to some of our theses (for example, that if an entrepreneur has at least one patent for which he attracts employees, then the restriction on a reduction of 50% applies according to all patents) the tax office will say otherwise, but while these clarifications are not available, you can use our interpretations. Let's repeat them.

- To reduce a patent, it is necessary to submit a corresponding Notification to the tax office. If patents were purchased at different tax offices, then to each tax office for patents that were received at this tax office.

- Notifications can be submitted at any time and in any quantity. But remember that each new notification resets the previous one .

- With the help of a notice, you can reduce the patent only by those fees that are actually paid . Simply put, you cannot file a patent reduction notice and then pay the fees later. As they say, money in the morning, chairs in the evening.

- If an entrepreneur makes payments to individuals, for example, under an employment contract or under a GPC agreement, then he can only reduce the tax by half . It doesn’t matter how many patents he has, if at least one of them has employees, the entire tax is reduced by only half.

- When filling out a notification about a decrease in the value of patents, you must indicate the details of all your patents, your status, in other words, whether you have employees, as well as the amount of tax on all patents and insurance premiums paid to date.

- of at least some patent can be reduced .