This article discusses the procedure for paying an employee for the time spent on the road, if it falls on a day off. It would seem that this issue is quite fully regulated by the current legislation, according to which being on the road on a business trip is equated to work. Nevertheless, in practice a large number of questions arise, the answers to which with specific examples with links to regulations and explanations we will try to consider in this article.

Before revealing the topic of the article, let’s define the basic concepts.

Key concepts and legislative framework

First, you need to understand what a business trip is and in what cases it applies.

So, a business trip is the sending of an employee for a certain period of time, agreed upon by the management of the company, to fulfill an assignment given by the company, away from the employee’s place of permanent work.

In addition, dispatch to another division of the same company, located in a different location, is also considered a business dispatch of an employee.

The main document regulating the planning and implementation of activities for the secondment of workers, Decree of the Government of the Russian Federation No. 749 as amended on July 29, 2015.

The trip begins its countdown from the moment of departure of the train, plane or other vehicle on which the employee departs. The day of arrival from a business trip is the day when the train or other transport arrives back. The number of days between these two dates is the actual time spent on work leave .

If travel documents have not been preserved, then the start date is usually considered to be the date of registration at the hotel or the date in the rental agreement. If these documents are not available, then the dates correspond to the dates on which the arrival and departure of the seconded employee at the temporary place of performance of official duties was noted.

All costs associated with renting accommodation and travel are reimbursed by the employer. At the same time, the employee retains his average salary for the duration of the trip.

If a business trip on a weekend takes place outside of Russia, then all payments (including daily allowances) are made in the currency of the country where the employee was sent.

Upon returning from a work trip, the employee is obliged to submit the following documents to the HR department or direct management within 3 working days :

- An advance report of all amounts spent.

- Documents for renting housing for living.

- Documents confirming travel expenses.

- Documents confirming other expenses related directly to the implementation of the tasks assigned to him.

How to pay for travel allowances when traveling abroad?

To answer this question, you should seek information from Letter No. 1037-IH of the Ministry of Labor, which summarizes the basic rules for such payments. To summarize the information contained in the letter, we learn that employees on short-term business trips in another country are paid for each day they are abroad, including the time spent on their trip. From the moment an employee travels outside the borders of Russia, he is accrued travel allowances in strict accordance with the rules established in the country where he will arrive.

Further, upon returning back, payment is calculated according to the rules that apply on the territory of the Russian Federation (also from the moment of entry into Russia and further movement around the country, to the point of work or to home). The same rule applies if an employee crosses the borders of several countries as part of his work. In this case, travel allowances are paid each time according to the standards established in the country where the specialist is sent.

What should I do if my departure date falls on a weekend?

Often there is a need to be present at a temporary workplace on Monday morning. That is, the posted employee will have to leave in advance: on Saturday or Sunday. How do I pay for a business trip on a day off?

Payment for days off on a business trip can be made in two ways:

- Double payment.

- Single payment if the employee has expressed in writing a desire to take time off for that day.

In this case, daily allowances are paid strictly for the number of days that the trip lasted.

The previous version of the Resolution specified the maximum period during which an employee could be on official absence - 40 days.

After these days, if necessary, one business trip was closed and a new one was immediately opened by order. There are no such restrictions in current legislation: the duration of the business trip is determined by the organization.

In addition to the first case, when the road takes up a day off, it also happens that an employee is forced to spend the weekend away without returning home .

Are these days payable? The situation is similar here, only one nuance differs: whether or not the employee performed his official duties on those days.

If an employee was involved in this on a day off (and there is an order about this), then double payment or time off and single payment occurs. If the employee did not work that day, then such day is not subject to payment.

Example 1. Calculation of payroll when taking into account travel days in the schedule

From 01.11.2020 employee Varezhkin A.V. transferred to a shift work method. The shift work schedule for 2021 includes:

- 1560 daily work hours;

- 156 full-time hours;

- 275 hours of travel to and from the shift.

Varezhkin has one planned accrual - payment at an hourly rate on shift in the amount of 200 rubles per hour. It is calculated only for day and night operating hours. Travel days are paid for as a separate accrual, which is not planned and is not included in the payroll .

It is necessary to calculate payroll .

Let's make sure that for Payment at the hourly rate on shift, the time type Days on the road . To do this, in the accrual settings, check that on the Time Accounting only working types of time are indicated: Shift and Night Shift .

We will assign a work schedule with travel days by personnel transfer

On the Remuneration , set Payment at an hourly rate on shift . The employee’s payroll will be calculated in the amount of RUB 33,183.33.

This value was obtained as follows:

- 200 <hourly tariff rate> * (1560 <day hours per year> + 156 <night hours per year> + 275 <hours per year>) / 12 <months> = 33,183.33 rubles.

Thus, if travel days are provided for in the employee’s work schedule , the payroll for hourly paid employees will be calculated taking them into account. It does not matter that this type of time is not established for Pay at an hourly rate on a shift .

How to calculate travel and daily allowances?

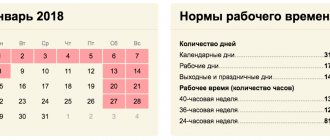

How are travel allowances calculated and paid on weekends? Calculating travel allowances is similar to calculating vacation pay. But, unlike the latter, it is not calendar days that are subject to recording, but working days. These payments are required, even if the employee leaves for one day. In case of a one-day trip, per diem is not paid.

To calculate travel allowances, you need to calculate the employee's average earnings for the previous year . To do this, all wages paid to the employee for the year are taken (excluding social benefits, other business trips and similar payments) and divided by the number of days worked.

This is how the employee’s average earnings per day are obtained. The result obtained must be multiplied by the number of working days that the employee will spend on a business trip.

For example:

Employee Pilkin Ivan goes on a business trip to another branch of the company for a period of five days. Management, accountants and personnel officers bring up reports and schedules of Pilkin’s visits for the previous year.

After deducting all weekends, vacations and time off, it turned out that Pilkin worked 200 working days. At the same time, he received 28,000 rubles a month.

Pilkin's average salary = 28,000*12/200 = 1,680 rubles per day.

Pilkin's travel allowance for five days will be:

K = 1,680*5 = 8,400 rubles.

The daily allowance on weekends on a business trip is calculated by the head of the company or an authorized person. The law establishes only their standard size when on a business trip :

In Russia – 700 rubles per day. In other countries – 2,500 rubles per day.

These amounts are not subject to income tax. Any excess is already considered by the Tax Code as income of an individual, and therefore the amount in excess of the standard daily allowance is subject to tax.

The question is also often asked: a business trip on a day off, how to issue an order? A sample order can be downloaded below. It is standard; a separate order is issued regarding employment on a day off due to production needs.

Order to go on a business trip

Order to hire someone to work on a day off

Setting the type of time and accrual

To reflect the days on the way to the shift and back, we will create a new type of time Days on the way (DP) . We will indicate Turnout as the Main Time .

The law does not require additional payment for night or evening travel. Therefore, one type of time to account for travel time will be sufficient.

In the Time Sheet (Salary - Payroll Reports - Time Sheet (T-13)), Travel Days will increase the total number of hours worked. If this is unacceptable, then before printing the Timesheet, you can temporarily change the settings for the time type Days in transit . Specify as the Main Time not Attendance , but, for example, Additional Weekends (Paid) . The solution is discussed in more detail in the article Setting up an allowance for a shift method. Method 1. Setting up a shift allowance using the “Weekends on shift” time type.

Let's create a new accrual for payment of travel days for shift workers . On the Main we indicate:

- Purpose of accrual - Other accruals and payments . Payment for travel time is the most ambiguous type of accrual for shift workers in terms of inclusion in the average and taxation of personal income tax and contributions. Therefore, it is better to immediately select the most flexible setting option so that, if necessary, it is easy to change the accrual parameters. Other accruals and payments category allows you to configure accruals with maximum flexibility;

- Execution method - Only if time tracking type is entered . The accrual will be calculated in the document Accrual of salaries and contributions if the employee in the month of calculation has hours by type of time Days on the road ;

- Formula. The procedure for calculating payment is clearly stated in the legislation - in the amount of no less than the daily rate per day of travel and delays in travel. The organization may provide for an increased amount of payment, but we will proceed from the established minimum. In our case, employees are given an hourly tariff rate, so it is necessary to calculate payment using the formula: Hourly tariff rate * Time in hours .

On the Time Tracking , note that this is an accrual for working a full shift within the normal time limits . This is required to correctly account for days and hours of travel in average earnings. During the time spent on the road, there is no additional payment for work at night, so among the types of time we will indicate only Days on the road .

At the legislative level, the procedure for including or excluding payment for travel days into average earnings is not strictly prescribed. Experts disagree. We made the adjustment based on what the payment would include in the average.

If you still need to exclude payment, as well as the days of travel themselves from the calculation of the average, then it is better to set up the accrual as planned (the execution method is Monthly ). It will need to be assigned to employees for each period of travel, and regular payment (based on salary, hourly rate, etc.) will be canceled during this time. Then payment for travel days and the days themselves will not be taken into account in calculating average earnings for vacations, business trips and other absences.

The procedure for taxing payment for travel days with personal income tax and contributions has also been controversial for a long time. Before 2012, several letters from the Ministry of Finance were published explaining that such payment need not be included in the base for personal income tax and contributions.

However, the Decision of the Supreme Court of the Russian Federation dated January 25, 2012 N GKPI11-2083 led to a change in the position of the regulatory authorities. The decision states that payment for travel time is still payment for the period when the employee does not fulfill his duties, and not compensation.

Moreover, the employee does not bear any expenses while on the road. Instead of daily allowance, he is paid another accrual - a shift allowance. Therefore, payment for travel days cannot be considered compensation in the sense of Art. 16 Labor Code of the Russian Federation. It is a guarantee of maintaining the employee’s earnings, similar to the average payment for the time of absence for valid reasons.

As an additional argument for the taxation of payment for travel days with personal income tax and contributions - in the Tax Code of the Russian Federation it is enshrined in the list of expenses for wages (clause 17 of Article 255 of the Tax Code of the Russian Federation). And compensation payments are usually recognized as other expenses (Article 264 of the Tax Code of the Russian Federation).

Therefore, on the Taxes, contributions, accounting tab for Payment of travel days for shift workers , we will indicate that it is subject to personal income tax with income code 2000 and refers to Income wholly subject to insurance contributions .

In the tax accounting of expenses for payment of travel days for shift workers, a separate clause is provided - clause 17 of Art. 255 Tax Code of the Russian Federation.

As stated above, payment for travel time cannot be classified as compensation payments. This means that it is not on the list of income that cannot be levied (Article 101 of Federal Law No. 229-FZ). Therefore, we will set the type of income of enforcement proceedings to 1 - Wages and other income with a limitation on collection .

Now let's look at ways to reflect Days in Transit in time tracking.

Filling out a time sheet

Even if an employee is on a business trip, the HR department is required to mark him on the report card.

How does this happen?

The days that fall on such absence are marked with one of two types of designations:

- letter – “K”; numeric – “06”;

If the trip falls on a weekend or holiday, then it is illegal to put one of these designations, since work on weekends on a business trip is paid at double the rate. In this case, the designation “РВ” or “03” is given. This is on the one hand.

On the other hand, you can put two marks on the report card at once to reflect that the employee is on a business trip on weekends and holidays . This will be more appropriate for the correct calculation of charges. Payment for business trips on weekends and holidays is made in the same order.

In addition, putting two marks at once is a guarantee that all payments will be received in the established amounts and the employee will retain all his rights during his absence from his main workplace.

Method 1. Reflection of travel days in the employee’s schedule

The simplest option for recording Travel Days is to indicate them immediately in the Employee Work Schedule (Settings - Employee Work Schedules). It is suitable when the shift work schedule and travel days are relatively stable. Otherwise, with any changes in the schedule you will have to:

- or adjust the employee work schedule ;

- or use Method 2 to record travel days.

In order for Travel Days to be taken into account in the Employee Work Schedule , in the Work Schedule Settings Types of Time table, select the Travel Days . We indicate the number of hours of travel time in the work schedule .

If in the form for setting up a work schedule there is no time type Travel days , then you should check the setting of the Use several types of time in the work schedule in Payroll settings (Settings - Payroll).

Also, when using the methodology for planning Travel Days in the Employee Work Schedule , you must take into account the following nuances:

- It will become more difficult to automate the calculation of the inter-shift rest hours allotted to employees. This nuance is discussed in the article Accounting and payment for inter-shift rest;

- this option is not suitable for salaried employees if the salary is paid without taking into account travel days . In this case, Travel Days will increase the standard working time, and the amount of Salary Payment will be underestimated;

- Payroll for hourly paid employees will be determined taking into account Travel Days .

Let's look at the last feature using an example.

Method 2. Reflection of travel days in separate documents

At first glance, this is a more labor-intensive option. It provides for the entry of Travel Days on a monthly basis using separate documents. However, if the work schedule is inconsistent and shift workers are often delayed on the road, then this option may be more convenient. It is also worth using:

- if you want to simplify the process of calculating overtime

- payroll should not take into account travel days.

To enter travel time data, you can use:

- Report card (Salary - Timesheets). Universal for work, but slows down the program. It also complicates recalculations. If possible, it is better to abandon its constant use;

For more details, see - Timekeeping with examples

- Individual schedule (Salary – Individual schedules). It is convenient and does not complicate recalculations, like Timesheet , but is not suitable for all employees. An individual schedule not only adjusts the actual time worked, but also makes changes to the standard time. Therefore, it cannot be used for part-time employees and salaried employees;

- Data for salary calculation (Salary - Data for salary calculation). At first glance, it seems that working with it is labor-intensive. the Data for calculating wages once , and then create new documents by copying and change the list of employees only if necessary. Let's look at this technique with an example.