Chart of accounts for accounting in budgetary organizations: important provisions, explanations and analysis of the latest amendments.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

About the concept

The chart of accounts acts as an ordered list of accounts accepted in accounting and combined depending on the purpose of accounting.

The Unified Chart of Accounts and its Instructions, approved by Decree of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n, regulate accounting in state organizations.

Such formations are divided into:

- autonomous;

- budgetary;

- state-owned.

Science, education, healthcare and other government-important sectors are the areas of activity of budgetary organizations . State funds to support scientific and innovative activities can also be established in the form of budgetary institutions. (clause 1, article 15.1 of the Law of August 23, 1996 No. 127-FZ).

The Chart of Accounts for budgetary organizations and the Instructions for its use were approved by Order No. 174n dated December 16, 2010.

The PS has been used by institutions since 2011. Based on it, organizations create their own working document based on the Chart of Accounts. It reflects exclusively those synthetic accounts that are characteristic of the recipient of budget money.

A budgetary institution has the authority, based on the theses of the Instructions for using the Chart of Accounts for government organizations, to involve auxiliary analytical account codes that ensure the creation in accounting of additional data required by various users of the financial statements of these institutions.

Structure and table

An account, as an accounting unit, helps to organize the property, debts of the institution and the financial institution. In accounting for budgetary organizations, accounts can be active or passive , in contrast to commercial organizations, where there are active-passive accounts:

- Active for the organization's property and resources.

- Sources of financing are reflected in passive

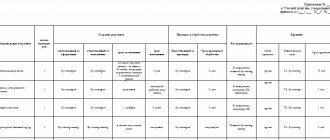

The account number contains 26 digits. The following is part of the table given in Order No. 174n. With its help you can easily decipher the composition of the invoice.

Let's look at it in more detail, taking into account the changes that need to be taken into account in 2021:

- In the working Chart of Accounts of an institution, during synthetic accounting, it is customary to display zeros in the first seventeen digits, and when establishing postings, show zero values in the first fourteen, unless otherwise specified in the accounting policy.

- Next are the codes for the type of inflows or outflows, corresponding to the code for the type of expenses and other groups. They are indicated in the next three digits.

It should be noted that for budgetary institutions the list of types of expenses has been trimmed. They can apply codes to

- employee salaries;

- insurance premiums;

- purchase of goods;

- payment of taxes and fees, etc.

These are only partial elements of entire groups of types of expenses. In more detail, you can find the list of acceptable CWR in the letter of the Ministry of Finance dated March 15, 2021 No. 02-05-11/14269.

Note! From January 1, 2021, in digits 1-4, the code of the type of function of the institution is entered instead of zeros. (See paragraph two of the decree of the Ministry of Finance of the Russian Federation dated December 31, 2015 No. 227n).

The 18th bit indicates the financial security code. Below are the main codes listed in Order No. 157n:

1 - at the expense of budget revenues; 2 - at the expense of funds earned independently; 3 - funds on a temporary basis; 4 - payments for the execution of orders from the state; 5 — payments for other tasks; 6 - payments for the implementation of capital investments; 7 - cash receipts from compulsory medical insurance.

Find out what employers face in 2021 for failure to pay wage advances. Law of the Russian Federation on trade secrets 98-FZ: how can organizations join the confidentiality regime? Find out from the article.

The synthetic account code is shown from 19 to 21 digits, and in 22 and 23 digits the serial number or analytical account is reflected.

Worth considering! From 2021, the name of the corresponding analytical accounting account must include the name of the suitable account and the designation of the codification indicator of the type of inflows or outflows in brackets.

chart of accounts for accounting in budgetary organizations

Budget accounting chart of accounts. Account number structure

Fifth level.

Working documents of budgetary institutions, the development and approval of which are legally required and necessary for financial and economic activities. For example, these are orders from the head of a budgetary institution on accounting policies, inventory of property and liabilities, document flow schedules, etc.

A budget accounting chart of accounts is a systematic list of accounts numbered in a certain order; it is unified and combines accounting by the bodies organizing the execution of budgets - the financial bodies of public legal entities; bodies carrying out cash execution of the budget - treasury bodies; main managers of budget funds; budgetary institutions. The budget accounting chart of accounts consists of five sections and a list of off-balance sheet accounts:

—section 1 — “Non-financial assets”;

—section 2 — “Financial assets”;

—section 3 — “Obligations”;

—section 4 — “Financial result”;

— Section 5 — “Authorization of budget expenditures.” Each section brings together a corresponding group

homogeneous accounts, which are divided into synthetic and analytical accounts, which allow the objects of budget accounting to be detailed.

Accounts are a way of grouping the current reflection of property and liabilities according to qualitatively homogeneous characteristics, due to the method of double entry. Accounts in budget accounting can be only active or only passive. Active accounts are budget accounts that record the funds of institutions and their assets. Passive accounts are institutional accounts that reflect the sources of funds. The main principle of the formation of a separate account is the homogeneity of the objects taken into account. Double entry provides the ability to monitor the correctness of recording business transactions.

Synthetic accounting is recording of generalized accounting data on types of property, liabilities and business transactions according to certain economic characteristics, which is maintained on synthetic accounting accounts. For more detailed accounting, analytical accounts are used, which are opened as a development of the synthetic account. Analytical accounting data must correspond to the turnover and balances of synthetic accounting accounts.

The structure of the budget accounting account number is built according to the catalog principle (the principle of nested modules) and includes 26 digits.

Table 1 shows the structure expense account .

Table 1

Compound

The chart of accounts has five sections of balance sheet accounts and off-balance sheet accounts . Each section combines information about different groups of assets and liabilities:

- The first section is devoted to non-financial assets. These include fixed assets, intangible assets, non-produced assets, investments in leased items, etc.

- The second section characterizes financial assets. These accounts are designed to reflect the presence and movement of liquid funds, cash investments, advances issued and other settlements with debtors of budgetary institutions.

- The third section, “Liabilities,” reveals what debts the organization has to creditors and the budget.

- The fourth section is devoted to the financial result. The accounts of this section are specialized for presenting the results of financial activities.

- The accounts of the fifth section “Authorization of expenses” are necessary to combine data on the process of implementation by a budget institution of instructions, including the acceptance and (or) implementation by the institution of responsibilities for a given financial year.

In addition to balance sheet accounts, the PS also covers accounts taken into account off the balance sheet. They are encrypted with two numbers. Off-balance sheet accounts reflect:

- property accepted for use;

- strict reporting forms;

- obligations of insolvent debtors;

- shares in management companies, etc.

Taxes and Law

Adopted changes to the working chart of accounts of institutions taking into account the requirements introduced by Orders of the Ministry of Finance of Russia dated March 31, 2018 No. 64n - to Instruction 157n, 65n - to Instruction 162n, 66n - to Instruction 174n, 67n - to Instruction 183n.

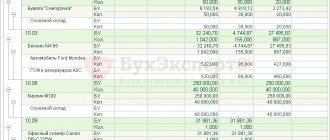

Accounts

| Account number | Old name | Account number | New name |

| 101 40 | Fixed assets – leased items | 101 90 | Fixed assets – property in concession* |

| 101 02 | Non-residential premises | 101 02 | Non-residential premises (buildings and structures) |

| 101 03 | Facilities | 101 03 | Investment property** |

| 101 06 | Industrial and household equipment | 101 06 | Industrial and household equipment |

| 101 07 | Library fund | 101 07 | Biological resources |

| 205 21 | Settlements with payers of property income | 205 21 | Calculations of income from operating leases |

| 205 30 | Calculations of income from the provision of paid work and services | 205 30 | Calculations of income from the provision of paid services (works), compensation of costs |

| 205 31 | Settlements with payers of income from the provision of paid work and services | 205 31 | Calculations of income from the provision of paid services (works) |

| 205 40 | Calculations of forced seizure amounts | 205 40 | Calculations of fines, penalties, penalties, damages |

New contractual relationships

* Concession is a system of relations between the state or municipal entity (concessor) on the one hand and a legal or individual person (concessionaire) on the other hand, arising as a result of the concessionaire granting the concessionaire the rights to own, use, and, under certain conditions, to dispose of state property under a contract, for a fee and on a return basis, as well as the rights to carry out activities that are the exclusive right of the state or municipality.

Accounting for advances received

In connection with the detailing of analytical accounts 205 00, 209 00 in accordance with the detailing of KOSGU articles 120, 130, 140, 180 in the configuration, the method of accounting for advances received has been changed. Instead of predefined accounts for recording advances received.

205.2A “(Advances) Settlements with payers of property income”;

205.3A “(Advances) Settlements with payers of income from the provision of paid work and services”;

205.7A “(Advances) Payments on income from transactions with assets”;

205.8A “(Advances) Settlements with payers of other income”;

209.7A “(Advances) Payments for damage to non-financial assets”;

209.8A “(Advances) Payments for other income.”

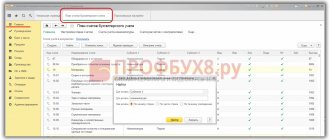

From January 1, 2021, accounting for settlements on advances received is kept on the off-balance sheet accounts of the group AP “Advances received” AP5.XX, AP9.XX, the analytical accounts of which correspond to the subaccounts of accounts 205 00, 209 00. The start date of the accounts is 01/01/2018.

Accounting on the off-balance sheet accounts of the AP “Advances received” group is carried out in the context of the subconto “Counterparties”, “Agreements and other grounds for the occurrence of obligations”. The receipt of the advance is reflected in the credit of the accounts, the offset (return) of the advance is reflected in the debit of the accounts of the AP “Advances received”.

Cash flow documents

When receiving advances from customers, instead of outdated accounts 205.xA and 209.xA, you should check the “This is an advance” checkbox and indicate the corresponding income settlement account, for example, 205.21 “Calculations for income from operating leases”, 205.31 “Calculations for income from the provision of paid services (works)”, etc. in the tabular part of the documents:

“Receipt cash order” with the operations “Receipt of income from buyers (205 20-30,70-80; 209 70)”, “Receipt of funds for compensation of damage (209)” (if the sale of excess property is reflected in account 209.7x and an advance payment is reflected );

“Cash receipt” with the operation “Receipt of income from sales (205 20, 30, 70, 80; 209 70)”;

“Cash receipt in foreign currency” with the operation “Receipt of income from sales (205 20, 30, 70, 80; 209 70)”.

When returning advances to customers, instead of outdated accounts 205.xA and 209.xA, you should check the “This is a return of advance payment” checkbox and indicate the corresponding income settlement account, for example, 205.21 “Calculations for income from operating leases”, 205.31 “Calculations for income from the provision of paid services (works)”, etc. in the tabular part of the documents:

“Expense cash order” with the operation “Return of income to customers (205 20-30,70-80; 209 70)”;

“Request for return” with the operation “Return (reimbursement) of excess income from sales (205 20, 30, 70, 80; 209 70)”;

“Cash disposal” with the operation “Return (reimbursement) of excess income from sales (205 20, 30, 70, 80; 209 70)”;

“Payment order” with the operation “Return (reimbursement) of excess income received from sales (205 20, 30, 70, 80; 209 70).”

Transfer of revolutions

When you select the Transfer of turnover , the date of the document is automatically set to the date preceding the date of transition to the use of new accounts established in the institution’s card, for example, 05/31/2018.

The transfer of turnover is carried out for the period specified in the details Transfer of turnover for the period from... to ....

If there are a large number of operations that require data transfer, the period for which records will be processed by the document can be reduced, up to one day. This allows you to transfer data to new KOSGU in parts - in separate documents.

When posting the document, accounting records for 2021 for old KECs are reversed, and new records are created instead for new KECs.

Error correction

Correction of errors identified in the period before the transition date

Errors identified in the period from January 1, 2021 to the transition date should only be corrected using the “Red Reversal” method after the transition date.

Late documents relating to the period from January 1, 2021 to the transition date should be entered according to the new rules after the transition date.

Instructions for use of PS

Appendix 2 of Law No. 174n provides instructions for using the Chart of Accounts. It defines a system for displaying property, debts and events in the economic life of an institution. Budgetary organizations are guided by the Instructions for the use of the Unified Chart of Accounts and these Instructions.

The Instructions classify in more detail:

- accounts;

- divided into synthetic and analytical;

- the correspondence of accounts on the main events is commented on.

In the absence of a suitable entry in the current Instructions, the organization has every reason to develop its own, subject to an agreement not to violate the law.

PS with explanations and postings

For clarity, we will give an example of how to create an active debit account for such a fact of economic life as taking newly built buildings onto the balance sheet . Documentation of this operation is carried out through an act of acceptance and transfer of objects or a receipt order.

The resulting debit account 0.101.11.130 corresponds with the credit account 0.106.11.310, which means an increase in investments in fixed assets - the institution’s real estate.

Let's consider another typical operation: withholding personal income tax by the institution as a tax authority from the accrued salaries of employees . In this case, there will be an increase in debt on payments to the budget. This operation is documented using a payroll slip.

For most accounts, the KOSGU code is uniquely determined by whether it is a debit or credit of the account.

Find out what the procedure for registering dismissal is in the process of transferring an employee to another organization. How to calculate vacation pay upon dismissal? Details here.

Law FZ-131 in the new edition with amendments is possible.

Review of recent changes

Let's consider some of the latest changes by order of the Ministry of Finance of the Russian Federation dated November 16, 2021 No. 209n , issued by the Ministry of Justice. The full list of amendments can be found in the original source.

- In the Chart of Accounts, changes affected the names of the accounts themselves (for example, the previously named account “Estimated (planned) assignments” began to include, among others, the definition of “forecast”).

- Also, new analytical accounts have been added to some accounts. For example, the “Income of an economic entity” account previously included eleven analytical accounts, and with the new rules, another analytical account 040110174 “Lost income” appeared.

- There have been significantly more changes in the Instructions to the Chart of Accounts. Only in 2021 it was clarified what is meant by the 24-26 digits of the account number. The regulations for the formation of some accounts were more precisely defined (for example, 020400000 “Financial investments” from 1 to 17 categories includes zero values).

- To organize management accounting, now, at the request of the founder, you can specify analytical codes of inflows and outflows from 1 to 17 digits instead of zeros. This possibility must be specified in the accounting policy.

- The changes affected the correspondence of some accounts (not all cases were considered):

- We excluded the correspondence of accounts 040120272 for Debit and 010537440 for Credit when transferring the cost of sold GP to the costs of this financial year.

- We created correspondence accounts 021013.560 for Debit and 021012660 for Credit, characterizing the recalculation of the total value added tax on advances taken for withholding.

- The posting was changed: Debit 050209000 Credit 050201000 to Debit 050299000 Credit 050201000 for the operation of obtaining liabilities by using the reserve for future expenses.

Review of changes in accounting for government agencies in 2021

Published 07/31/2018 22:59 After the signing of new orders that significantly change the rules of accounting for public sector institutions in general, and make changes to the Instructions for the Unified Chart of Accounts in particular, I would like to dwell separately on general, conceptual innovations. In this article I will tell you what accounting rules existed previously, and what changes came into force after the signing of Order 64n. I would like to divide the article into accounting blocks familiar to every accountant and summarize as much as possible all the significant changes.

GENERAL ACCOUNTING RULES:

1. The most important thing I would like to say is: in connection with the release of a number of new GHS, it is necessary to remember that accounting is now carried out not only in accordance with the Budget Code, Law No. 402 “On Accounting”, Instruction No. 157, but also with taking into account the provisions of the GHS “Conceptual Framework for Accounting and Reporting”. This means that the list of desktop regulatory documents increases by one unit.

2. A number of clarifications were also introduced regarding accounting: a) accounting is carried out on the assumption of continuity of activity; b) the institution must use the most conservative estimates - do not overstate assets and income, and do not understate liabilities and expenses.

3. Features of accounting for leasing objects are excluded from budget accounting.

ACCOUNTING POLICIES:

1. An important change in terms of the working chart of accounts: if previously it contained the accounts that the institution uses, now it can contain OR a list of accounts (as before), OR simply codes of accounting accounts and rules for generating account numbers from them. Please pay attention to this when developing the institution's accounting policies.

2. A major change can also be called the fact that the accounting policy must now contain inventory rules not only for property and liabilities (as before), but also for assets, property on off-balance sheet accounts and other accounting items.

3. Also, now the institution is required to specify in its accounting policies the rules of document flow and technologies for processing accounting information. Previously, the institution's accounting policies did not contain this kind of data at all. The choice must be indicated in the accounting policy: a) the procedure and timing for transferring documents to the accounting department; b) the procedure for interaction between structural units regarding the transfer of documents to the accounting department. This also includes the requirement to store accounting policies for at least five years after they were last used.

4. It is also now necessary in the accounting policy to indicate the rules for the transfer of documents when changing any responsible person conducting accounting, including the chief accountant.

ACCOUNTING RULES FOR NON-FINANCIAL ASSETS:

1. One of the most important changes, which has already been discussed in an article on our website, is changes in accounting for the lease of non-fiscal assets. The main idea of the new GHS “Lease” is the accounting of financial lease objects on balance sheet accounts. More details can be found in the article Federal standard “Lease” - accounting from 2021 in 1C: BSU 8 Financial lease objects are reflected in the accounts of a new group - 111 “Rights to use assets”.

2. Change in cost criteria for accounting for intangible assets: instead of 3,000 rubles. – now 10,000 rubles. (for example, accounting on off-balance sheet accounts worth less than 10,000 rubles), instead of 40,000 rubles. – now 100,000 rubles. (for example, depreciation for intangible assets worth up to 100,000 rubles in the amount of 100 percent upon commissioning).

3. Changes in terms of depreciation: a) now depreciation is not suspended under any conditions (previously depreciation was suspended for a conservation period of more than 3 months or a restoration period of more than 12 months); b) depreciation on fixed assets is regulated by the GHS “Fixed Assets”, and depreciation on the right to use assets is regulated by the GHS “Rent” (previously, the rules for accrual for the right to use assets were not established at all).

4. In terms of accounting for non-fiscal assets received under exchange agreements, it is now necessary to determine the value of non-fiscal assets at fair value based on its price, for example, upon purchase. If, under any circumstances, it is impossible to determine the fair value, then such NFA can be taken into account at the residual (book) value of the NFA that your institution gives in exchange under the exchange agreement. But even if the residual value of the exchanged NFA is unknown, it should be taken into account at a conditional valuation - a ruble for each NFA. Here I would also like to say that you need to be as careful as possible, because during the audit it will be necessary to prove that fair value was not available.

5. In terms of accounting for non-refundable assets received free of charge, determine the estimated value using the market price method. And following the example of accounting for non-fiscal assets received under exchange agreements: if the market price of non-fiscal assets is not available, then we accept accounting at a conditional valuation. But there is a clarification at this point - at the moment when data on market prices becomes known, it is necessary to revise the book value.

6. Another case of change in the initial (book) value of NFA has been added - depreciation of NFA objects. There is also an article about this: Revaluation of fixed assets in 1C: Accounting departments of a state institution 8 Indicators of decrease in value are now reflected in the new group of accounts 114.

7. The behavior when transferring property to commercial organizations has been determined: it is also necessary to reflect it at fair value.

8. As part of NFA accounting, a group of accounts “Biological resources” appears (which replaces the group of accounts “Library collection”). Animals and perennial plantings must now be included here. It is also now necessary to fully reflect the growth and restoration of biological resources in the institution’s records.

9. Regarding inventory numbers, you can not assign an inventory number to those objects that have some kind of unique number: cadastral number of a building, state number of a car. There are also now rules for numbering within a complex of OS objects - it is necessary to assign a serial number within this complex, which contains: the inventory number of the complex + the serial number of the object.

RULES FOR CORRECTING PAST PERIOD ERRORS:

1. Rules have been defined that will make it possible to clarify the uncleared receipts of all previous years. Specialized accounts have been introduced into the Chart of Accounts: 210.82. and 210.92.

2. Rules have also been defined that will make it possible to correct errors of previous years based on consolidated calculations. New accounts have been introduced: 304.84 and 304.94.

3. And in general, to correct the mistakes of past years, rules have been defined and described, and special accounts have been introduced - 304.86 and 304.96.

4. Also for the income and expense accounts of the current year (401.10 and 401.20), rules for correcting errors of previous years are defined. New accounts have been introduced to reflect such situations (401.18, 401.19; 401.28, 401.29).

5. In addition to the usual accounts, which at the end of the financial year are closed to account 401.30 “Financial result of an economic entity,” all of the above added accounts are also closed to this account.

OFF BALANCE ACCOUNTS:

It has been clarified that disposal of fixed assets to off-balance sheet account 02 can now be carried out before the decision to write off is approved. This is due to the fact that legislative changes provide for a clarification that disposal before the decision to write off is approved is prohibited only from off-balance sheet account 02.

Author of the article: Svetlana Batomunkueva

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 DENIS 08/30/2019 16:11 “4. Regarding the accounting of non-fiscal assets received under barter agreements???

Quote

Update list of comments

JComments