The advance payment date in the organization is the 20th.

After the 15th, but before the 20th, an employee was hired into the organization whose method of calculating the advance is set to a fixed amount. In this case, it is customary for the organization to pay the employee a certain amount in advance so that the condition of paying wages twice a month is met. Let's look at how you can pay an advance to such an employee in the program up to version ZUP 3.1.10 and starting with ZUP 3.1.10.The fact is that before ZUP 3.1.10, due to the fact that the employee did not have days worked in the first half of the month (from the 1st to the 15th), he was not included in the payroll for the advance payment. In addition, it was impossible to indicate the employee in the Statement for advance payment and manual selection.

Starting with ZUP 3.1.10, the behavior of the program has changed and has become more expected by the user. Despite the fact that the employee still does not have any days worked in the first half of the month (from the 1st to the 15th), he is automatically included in the Advance Statement

What is an advance payment as a method of payment when hiring?

An advance in labor relations involving new employees can be understood as:

- The first part of the employee’s monthly salary (the second, therefore, is called salary).

Salaries must be paid at least once every half month (Article 136 of the Labor Code of the Russian Federation). As a rule, Russian employers divide it into two parts:

- advance payment (usually paid from the 15th to the 30th of the billing month);

- salary (paid from the 1st to the 15th of the next month).

It is important that the advance and salary are approximately the same. In any case, the advance payment for half a month should not be less than the salary in proportion to the time worked (letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 No. 22-2-709). The same applies to salaries.

- Prepayment for work under an employment contract.

In general, a salary is given to an employee only upon completion of work. But it happens that the employer is forced to transfer an advance payment for labor before the end of the period for which it should be calculated. For example, this is possible if:

- It is accepted in the company that the advance for the reporting month is paid before the 25th day of a given month, salary - until the 10th day of the next;

- The reporting month is December, and in order for the salary to be accurately credited to employees, including newly hired ones, by January 10 - taking into account holidays and weekends, the accounting department transfers the salary in December as an advance payment.

- Vacation pay provided in advance.

Working full time, an employee has the right to paid leave of 28 days (excluding northern and regional benefits that increase leave) after 1 year of work. But after 6 months of work, the employee has the right to request a vacation, and, moreover, paid for all 28 days - in advance (Article 122 of the Labor Code of the Russian Federation).

The newcomer was not given an advance - what are the consequences?

There is no mention of salary advances for newcomers in labor legislation. At the same time, in Art. 136 of the Labor Code of the Russian Federation establishes the following requirements:

- salary payment - at least every six months;

- the specific date of payment is established in internal local acts, but no later than 15 calendar days from the end of the period for which it was accrued.

Find out how to reflect salary accruals in accounting in our publication.

Labor Code:

- calls all salary payments “salaries”, the term “advance” is not used;

- determines the minimum number of salary payments per month, each of which is not of an advance nature, but is calculated based on the time actually worked;

- establishes the maximum permissible calendar gap between the first and second parts of the salary;

- reserves the right for companies and individual entrepreneurs to determine the dates for issuing money and calculation algorithms.

Learn about employer rights from the article.

Determine the dates of the first and second salary payments yourself. For example, you can set the numbers 30 (31) and 15 (16) respectively - officials consider this option optimal (letter of the Ministry of Health and Social Development of Russia dated February 25, 2009 No. 22-2-709).

When formulating the text of the salary part of internal local acts, be guided by the following rules:

- The salary payment deadline is a specific day, not a calendar period (not a “fork” of dates). Rostrud insists on this.

Find out more here.

- Distribute the days for issuing the first and second parts of the salary so that every half month workers receive payment for their work. This is a requirement of Art. 136 Labor Code of the Russian Federation.

Choose convenient dates based on the specifics of the company’s work. This could be, for example, the 10th day (final payment for the previous month) and the 25th day (advance payment for the current month).

It should be taken into account that with this formulation, newcomers find themselves in a special position - persons who started work on one of the days of the billing month. It turns out that with salary payments on the 5th (calculation for the previous month) and on the 20th (advance for the current month), an employee who started work on the 1st needs to pay only the advance on the 20th.

There is no specific provision of law establishing liability for late payment of an advance to new employees or incorrect calculation of its amount.

| Type of violation of labor laws | Type of responsibility | Punishment |

| Late payment (non-payment) of advance payment, wages | Administrative (Article 5.27 of the Administrative Code) | Primary violation - a fine for officials and individual entrepreneurs from 1,000 to 5,000 rubles, for a company - from 30,000 to 50,000 rubles; Repeated violation - a fine for officials and individual entrepreneurs from 10,000 to 20,000 rubles. or disqualification for a period of 1 to 3 years, per company - from 50,000 to 70,000 rubles. |

| Disciplinary (Article 192 of the Labor Code of the Russian Federation) | If the salary is not paid due to the fault of the manager (or other authorized person), this may be considered as improper performance of their official duties and lead to the imposition of one of the provisions provided for in Art. 192 of the Labor Code of the Russian Federation of disciplinary sanctions | |

| Material (Article 236 of the Labor Code of the Russian Federation) | The employer is obliged to pay (except for delayed wages) interest - not less than 1/150 of the key rate of the Central Bank of the Russian Federation in force at that time on amounts not paid on time for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement | |

| Criminal (Article 145.1 of the Criminal Code of the Russian Federation) | Partial non-payment of wages for more than 3 months, committed out of selfish or other personal interest by the head of an organization, an employer - an individual, the head of a branch, representative office or other separate structural unit of an organization, is punishable by a fine in the amount of up to 120,000 rubles, the salary or other income of the convicted person for the period up to 1 year, or deprivation of the right to hold certain positions or engage in certain activities for up to 1 year, or forced labor for up to 2 years, or imprisonment for up to 1 year. Complete non-payment of wages for more than 2 months (or payment of wages for more than 2 months in an amount below the minimum wage established by federal law, committed out of selfish or other personal interest by the head of the organization, the employer - an individual, the head of a branch, representative office or other separate structural unit of the organization - punishable by a fine in the amount of 100,000 rubles to 500,000 rubles or in the amount of wages or other income of the convicted person for a period of up to 3 years, or by forced labor for a period of up to 3 years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years or without it, or imprisonment for up to 3 years with deprivation of the right to hold certain positions or engage in certain activities for up to 3 years or without it |

An employer cannot avoid punishment if an employee asks for a salary in one amount once a month and his request is not denied (letter of Rostrud dated November 30, 2009 No. 3528-6-1).

If your employee asks to pay him an advance payment several months in advance, and you meet him halfway, arrange such payment in the form of a loan with a minimum interest rate. Otherwise, you may have all sorts of problems: the advance may be considered an interest-free loan (the need to withhold personal income tax from the amount of the benefit from saving on interest), and you will have to immediately pay insurance premiums, etc., on the entire amount.

An employer who has not paid an employee (new or long-time) for the first half of the month will not be punished only if this employee did not work in the first half of the month (appeal ruling of the Moscow Regional Court dated 08/07/2012 in case No. 33-15891 /2012).

Find out whether employers' liability for delayed wages will be tightened in the near future.

Advance as the first part of a new employee’s salary

So, the first scenario is to pay the new employee an advance, represented by the first part of the salary.

If the employer’s local regulations state, for example, that the advance payment is paid before the 25th of the reporting month, and the basic salary - until the 10th day of the next month, then a new employee who comes to work must receive either an advance payment or a salary - on depending on the start date of work.

For example, if a person started working on the 1st, then he will receive the first salary payment only on the 25th. Consequently, the requirement of Art. 136 of the Labor Code of the Russian Federation regarding the payment of wages every half month will not be fulfilled.

It is quite acceptable to issue advances to newly hired employees as separate interim payments - albeit later than the salary, but earlier than the advance “for everyone”, in order to comply with the rule on transferring wages for half a month. But such a payment should not discriminate against other employees (Article 136 of the Labor Code of the Russian Federation), and therefore the rules for its provision must be enshrined in local regulations.

Example

- The procedure for paying wages (Section 3 of the Regulations on Remuneration).

3.1. Salaries at Trading-Consulting LLC are paid:

- 25th day of the current month - for the 1st half of the month;

- On the 10th of the next month - for the 2nd half of the previous month.

3.2. Newly hired employees are paid:

- when starting a job from the 1st to the 14th - on the 15th of the corresponding month;

- for admission from the 15th to the 24th - on the 25th of the corresponding month;

- for admission from the 25th to the end of the month - on the 10th of the next month.

At the end of the first month of work, the employee ceases to be considered newly hired and receives wages in accordance with clause 3.1 of the Regulations.

Results

Newcomers must receive their first salary payment no later than 2 weeks after starting work. All subsequent payments are made within the time limits set by the company for issuing wages (every half month, taking into account the actual days worked).

In order to comply with the salary requirements of the law for newcomers, it is necessary in the local act of the company to provide for special deadlines for the payment of the first salary. Otherwise, the employer may be subject to disciplinary, material, administrative or criminal liability.

Advance payment as a prepayment to a newly hired employee

Payment of an advance in the form of prepayment for labor - as a method of calculation when hiring a new employee - for many legal reasons does not correspond to wages, because:

- In accordance with Art. 132 of the Labor Code of the Russian Federation, wages are set based on the “quantity and quality of labor expended.”

Obviously, the “quantity and quality” of work can only be assessed by the fact of its completion. In the case of the advance in question, such an assessment cannot be made.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- In accordance with Art. 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to issue pay slips to employees, which reflect the data on the basis of which wages are calculated. For example:

- number of hours worked;

- level of plan implementation;

- volume of work performed.

If the payment method when hiring is an advance payment, then the employer will not have the specified information. They cannot be determined even approximately, in the absence of data on the previous performance of the new employee. Departments do not recommend calculating wages without taking into account data on actual time worked and volume of work (letter from the Ministry of Labor dated 08/10/2017 No. 14-1/B-725, Rostrud dated 09/26/2016 No. T3/5802-6-1).

Thus, it is legitimate to say that prepayment for labor is not a de jure salary. But we note that some courts take the opposite position. For example, the Saratov Regional Court, in a decision dated June 27, 2016 in case No. 21-396/2016, indicated that the employer has the right to pay employees earlier than the established deadlines. Moreover, according to the Saratov Regional Court, an advance payment is a privilege that improves the employee’s position in comparison with the provisions enshrined in the law and local regulations.

Advance as prepayment: what an employer needs to know

Taking into account the fact that an advance is still not a de jure salary, the employer should keep in mind that:

- Regardless of the amount of the advance payment, the employer will remain obligated to pay the wages themselves (advance or salary) within the time limits established by the employment contract.

If this is not done, then the Labor Inspectorate may initiate penalties against the employer in accordance with paragraphs. 6 and 7 art. 5.27 Code of Administrative Offenses of the Russian Federation.

- On the advance, which will not be considered as a type of salary de jure, personal income tax must nevertheless be paid.

- For large amounts or regular payments, advances may be assessed by the Federal Tax Service as interest-free loans to employees. Such loans generate material benefits from savings on interest, on which you need to pay personal income tax at a rate of 35%.

In this case, the Federal Tax Service and the court may not take into account the fact that the loan agreement is not drawn up by the parties. In this case, what matters, first of all, is the nature of the relationship between the employee and the employer, which may indicate their actual agreement on interest-free lending (ruling of the Fourth Arbitration Court of Appeal dated December 27, 2012 in case No. A58-4544/2012).

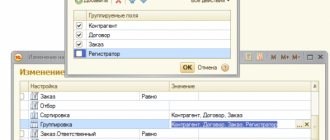

Solving the problem (starting from ZUP 3.1.10)

Let's consider solving the problem in versions starting with ZUP 3.1.10 using the following example.

On April 16, 2021, employee A.Yu. Fioletov was hired, whose method of calculating the advance payment is set to a fixed amount of 10,000 rubles. The organization's settings indicate that the advance is paid on the 20th of each month. According to the rules adopted by the organization, the employee is paid part of the advance - 2,000 rubles.

Since the employee’s method of paying an advance is set to a fixed amount, a preliminary calculation of the advance is not required; the Statement document is entered immediately...

When filling out the Statement... automatically, employee Fioletov A.Yu. appears in the document with the full amount of the advance - 10,000 rubles.

All that remains is to edit the advance amount manually for 2,000 rubles.

Vacation in advance for a new employee: nuances

Another interpretation of the concept of “advance” involves considering it as a type of vacation payment. It is assigned for the period that the employee has not worked by the time he goes on paid leave by agreement with the employer. For example, if an employee goes on vacation in the same month in which he comes to work.

When providing such a payment, the employer should keep in mind that he can recover vacation pay paid in advance only within 20% of subsequent labor payments to the employee (Article 138 of the Labor Code of the Russian Federation). Moreover, if an employee quits without paying the company for vacation pay, then the employer most likely will not be able to collect the debt from him (decision of the Supreme Court of the Russian Federation dated March 14, 2014 No. 19-KG13-18). The dismissal of an employee may also be due to reasons beyond his control. For example, conscription for military service.

In this scenario, the employer will only have to minimize financial losses by including the amount of the debt in non-operating expenses after recognizing it as hopeless (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation).