On October 1, 2011, paragraph 3 of Article 168 of the Tax Code on the issuance of an adjustment invoice came into force. And on December 26, 2011, Decree of the Government of the Russian Federation No. 1137 “On the forms and Rules for filling out (maintaining) documents used in calculations of value added tax” (hereinafter referred to as Resolution No. 1137) appeared. From this moment on, the previously applied procedure for maintaining documents on value added tax, which was approved in 2000 by Resolution No. 914, became invalid.

Resolution No. 1137 approved new forms of the journal for recording received and issued invoices, as well as purchase books and sales books.

There was confusion regarding the date of entry into force of the Decree. In fact, it came into force on January 30, 2012. Practicing accountants have a question: from when should the new rules be applied - from the new year or from the new tax period for VAT, that is, from the second quarter of 2012? Clarifications on this matter appeared immediately; on January 31, 2012, letter No. 03-07-15/11 was issued, which explained the procedure for applying the new resolution.

The Ministry of Finance allowed enterprises to fill out either new or old forms before the start of the next tax period, that is, until April 1, 2012. You can do everything as before, and this will not be an obstacle to receiving a deduction for value added tax.

The use of new forms is inevitable, so you still have to study them and get used to them in advance.

Who should lead

From January 1, 2015, only intermediaries who act in the interests of third parties (customers) on their own behalf must keep a log of received and issued invoices.

As a rule, these are commission agents or agents (clause 1 of Article 990, clause 1 of Article 1005 of the Civil Code of the Russian Federation). The following are also considered intermediaries:

- forwarders who organize the performance of services with the involvement of third parties, but do not themselves participate in transportation (clause 1 of Article 801, Article 805 of the Civil Code of the Russian Federation);

- developers who organize construction with the involvement of contractors, but do not participate in the execution of contract work themselves.

The obligation to keep accounting records does not depend on the taxation system that the intermediary applies, nor on whether he is a VAT payer or a VAT tax agent.

This procedure follows from the provisions of paragraphs 3 and 3.1 of Article 169, paragraphs 5 and 5.1 of Article 174 of the Tax Code of the Russian Federation, paragraph 22 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33.

Situation: should retail trade organizations that sell goods as commission agents (agents) under intermediary agreements keep an invoice journal?

No, they shouldn't.

Firstly, retail trade organizations do not issue invoices when selling goods to the public (Clause 7, Article 168 of the Tax Code of the Russian Federation). Instead, buyers are issued cash receipts or strict reporting documents. In the intermediary reports that retailers prepare for principals, they include copies of either cash register tapes or receipts issued. Because of these workflow features, the intermediary simply will not have invoices that he could record in the accounting journal.

Secondly, customers purchasing goods at retail do not claim VAT for deduction. This means that there is no point in tax inspectors monitoring the correspondence between the amounts of deductions and the amounts that the committents (principals) accrue to the budget for such operations.

Thirdly, paragraph 3.1 of Article 169 of the Tax Code of the Russian Federation, which establishes the responsibilities for maintaining an accounting journal, refers to intermediaries issuing (receiving) invoices, and not any other documents. Intermediaries who do not issue invoices are not subject to the provisions of this paragraph.

From the above we can conclude: if a retail trade organization on its own behalf sells goods of third parties under intermediary agreements, such transactions do not need to be registered in the invoice journal. In relation to other intermediary activities, such organizations are not exempt from the obligation to keep a journal of invoices.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated January 30, 2015 No. 03-07-11/3488.

Who is required to keep a log book?

From January 1, 2015, all entrepreneurs and intermediary organizations acquired the obligation to maintain and submit them to the tax authorities (Federal Law dated April 20, 2014 N 81-FZ and Federal Law dated July 21, 2014 N 238-FZ).

This should be done not only by VAT payers, but also by persons who are exempt from duties related to its calculation and payment and who are not taxpayers. The main feature is the implementation of entrepreneurial activity under a commission agreement or agency agreement in the interests of another person. In addition, this category includes persons who provide services under transport expedition contracts and developers. The signs of such persons are given in paragraph 1 of Article 990 of the Civil Code of the Russian Federation and paragraph 1 of Article 1005 of the Civil Code of the Russian Federation.

Which invoices to journalize

First, let's figure out why intermediaries, developers and forwarders keep logs of received and issued invoices. After all, they do not pay VAT and do not deduct VAT on these invoices.

Intermediaries keep a log of received and issued invoices for one purpose - to inform the tax office. Intermediaries provide inspectors with a log of invoices, which they issue to buyers and receive from sellers as part of intermediary activities.

Based on these logs, inspections can monitor whether the amounts of VAT accrued, for example, by the principals when selling goods, correspond to the amounts of tax that buyers of these goods accept for deduction. And vice versa, do the amounts of deductions declared by the principals for the goods purchased for them correspond to the amounts of VAT that the sellers of these goods accrued for payment to the budget?

Therefore, intermediaries must record in the log book:

- invoices that intermediaries issue to customers on their own behalf when selling goods (work, services, property rights) belonging to customers. Based on such invoices, customers must charge VAT, and buyers have the right to deduct the tax;

- invoices that customers issue to buyers for goods (work, services, property rights) sold by intermediaries;

- invoices that sellers issue in the name of the intermediary when purchasing goods (works, services, property rights) for the customer. Based on such invoices, sellers must charge VAT, and customers have the right to deduct the tax;

- invoices that intermediaries issue to customers for goods (work, services, property rights) purchased from sellers.

Invoices that intermediaries issue to customers for the amount of their remuneration do not need to be registered in the accounting journal (letter of the Ministry of Finance of Russia dated January 22, 2015 No. 03-07-11/1698). The tax office will be able to check whether the amount of VAT accrued on the remuneration corresponds to the amount of VAT that the customer accepted for deduction without a journal. She will control this with the help of tax returns, in which the intermediary will have to reflect information from the sales book, and the customer - from the purchase book.

Such rules are established by paragraphs 5 and 5.1 of Article 174 of the Tax Code of the Russian Federation.

A complete list of invoices that intermediaries must record in the accounting journal is presented in the table.

Methods of management

You can keep a journal of invoices both on paper and in electronic form (clause 1 of Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). However, the journal can be submitted to the inspectorate as tax reporting only in electronic form via telecommunication channels (clause 5.2 of Article 174 of the Tax Code of the Russian Federation). Therefore, it is advisable for intermediaries who are not VAT payers and are not recognized as tax agents to immediately keep invoice logs in electronic format (approved by Order of the Federal Tax Service of Russia dated March 4, 2015 No. ММВ-7-6/93).

Other organizations (VAT payers or tax agents) can keep accounting journals on paper. But they will still have to transfer the data from these logs into VAT returns, which can be transmitted to the inspectorates only in electronic form through special operators (clauses 5–5.1 of Article 174 of the Tax Code of the Russian Federation).

Purchase book and sales book

From January 1, 2012, the form of the purchase book and sales book changed. The main changes are related to the appearance of the adjustment invoice.

An organization can prepare both books – both on paper and in electronic form. Additional sheets of the purchase books and sales books should also be compiled in one of these two ways, depending on how the book itself is maintained.

After the end of the quarter, before the 20th day of the next month, purchase and sales books compiled on paper must be certified with the personal signature of the head of the organization (an authorized person), laced, and their pages numbered and sealed with the organization’s seal.

The books compiled electronically for the quarter are certified by the electronic digital signature of the head of the organization or his authorized person. This only needs to be done when they are submitted to the tax authority.

Purchase books and sales books, as well as additional sheets to them, must be kept for at least four full years from the date of the last entry.

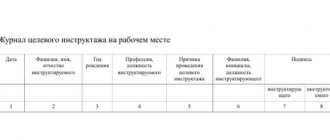

Filling out the log

The procedure for filling out the journal of received and issued invoices is explained in paragraphs 3–12 of Appendix 3 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Record all invoices in the journal: primary, corrected, adjustment. It doesn’t matter whether they are paper or electronic. Everything needs to be recorded in chronological order.

In Part 1 “Invoices Issued”:

- by date of issuance of electronic invoices;

- by date of preparation of paper invoices;

- by the date of preparation (correction) in cases where invoices are not transferred to counterparties.

In Part 2, Invoices Received, record invoices by the date they were received.

This follows from the provisions of paragraph 3, subparagraph “b” of paragraph 7 of Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 and the letter of the Ministry of Finance of Russia dated May 16, 2012 No. 03-07-09/57.

If you are registering primary invoices (including corrected ones), then do not fill out columns 16–19 of parts 1 and 2 of the accounting journal.

Do you record adjustment invoices (including corrected ones)? Then, in columns 8–19 of parts 1 and 2 of the accounting journal, indicate the updated data.

During the tax period, there may be no invoices issued or received at all, including adjustments and corrections. Or they prepared invoices for themselves, but did not transfer them to the buyer. In these cases, fill in only the lines of the relevant parts of the journal - name of the taxpayer, INN/KPP, etc. Leave the tabular parts of the journal empty.

This is stated in paragraphs 8 and 12 of Appendix 3 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The table will help you better understand the rules for registering invoices received and issued by intermediaries.

An example of filling out a log of received and issued invoices by an intermediary who is not a VAT payer

JSC Alfa (customer) entered into commission agreement No. 12 dated October 5 with Torgovaya LLC (an intermediary who is not a VAT payer). According to the agreement, Hermes sells a batch of toasters (100 pcs.), owned by Alpha. The price of the consignment is 118,000 rubles. (including VAT – 18,000 rubles).

The amount of remuneration paid to the intermediary for services rendered is 17,700 rubles.

On October 20, Hermes entered into a supply agreement with JSC Proizvodstvennaya for the supply of a batch of toasters (100 pcs.). On October 23, the goods were shipped to the buyer.

On the same day, Hermes issued an invoice dated October 23, No. 321, to Master and handed over a copy of it to Alpha. The Hermes accountant recorded this invoice in Part 1 of the invoice journal. The Hermes accountant did not register this document in the sales book.

Alpha issued an invoice dated October 23, No. 552, to Hermes for the amount of goods sold. The Hermes accountant registered the invoice received from Alpha in Part 2 of the invoice journal. The Hermes accountant did not register this document in the purchase book.

Since Hermes is not a VAT payer, it does not issue an invoice to the customer for the amount of its remuneration.

An example of filling out a log of received and issued invoices by an intermediary – a VAT payer

JSC Alfa (customer) entered into a commission agreement No. 12 dated October 5 with Torgovaya LLC (an intermediary who is a VAT payer). According to the agreement, Hermes sells a batch of toasters (100 pcs.), owned by Alpha. The price of the consignment is 118,000 rubles. (including VAT – 18,000 rubles).

The amount of remuneration paid to the intermediary for services rendered is 17,700 rubles. (including VAT - 2700 rubles).

On October 20, Hermes entered into a supply agreement with JSC Proizvodstvennaya for the supply of a batch of toasters (100 pcs.). On October 23, the goods were shipped to the buyer.

On the same day, Hermes issued an invoice dated October 23, No. 321, to Master and handed over a copy of it to Alpha. The Hermes accountant recorded this invoice in Part 1 of the invoice journal. The Hermes accountant did not register this document in the sales book.

Alpha issued an invoice dated October 23, No. 552, to Hermes for the amount of goods sold. The Hermes accountant registered the invoice received from Alpha in Part 2 of the invoice journal. The Hermes accountant did not register this document in the purchase book.

Since Hermes is a VAT payer, it issued an invoice to the customer dated October 23, No. 122, for the amount of its remuneration. This document is registered in the sales book, but is not registered in the invoice journal.

Situation: how to register in the invoice journal invoices drawn up by commission agents (agents) when purchasing goods (work, services) on their own behalf from several sellers or performers?

If the commission agent (agent) purchases goods (work, services) for the principal (principal) from several sellers or performers, he can combine the data of invoices received from them into a consolidated invoice. Such an invoice can include data from invoices that were issued to the intermediary by different sellers and performers, but on the same day. This follows from paragraph 6 of subparagraph “a” of paragraph 1 of section 2 of Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). In the same order, forwarders who purchase services for a client from third parties can draw up consolidated invoices (letters of the Ministry of Finance of Russia dated January 10, 2013 No. 03-07-09/01, dated December 29, 2012 No. 03-07- 15/161, Federal Tax Service of Russia dated February 18, 2013 No. ED-4-3/2650). In practice, developers can also prepare consolidated invoices and convey to investors the scope of work performed by contractors. Moreover, unlike intermediaries and forwarders, developers can combine invoices issued by contractors in different periods into consolidated invoices.

The intermediary must register invoices received from sellers (suppliers, performers) and consolidated invoices issued to the customer in the invoice journal.

When registering a consolidated invoice in part 1 of the invoice journal, the intermediary indicates:

- in column 1 – the serial number of the entry,

- in column 2 - the date of issuance of the consolidated invoice,

- in column 3 – code of the type of operation,

- in column 4 - the serial number and date of preparation of the consolidated invoice indicated in line 1 of the invoice,

- in column 8 – name of the customer (committee, principal),

- in column 9 – INN and KPP of the customer (principal, principal),

- in column 10 - the names of the sellers (performers) from whom the intermediary purchased goods (work, services) for the customer, through the sign “;”

- in column 11 - TIN and KPP of sellers (suppliers, performers). Specify them using the “;” sign.

- in column 12 – numbers and dates of invoices received from sellers (suppliers, performers),

- in column 14 – the cost of goods (work, services) including VAT according to the consolidated invoice,

- in column 15 – the amount of VAT on the consolidated invoice.

This follows from paragraph 7 of Section II of Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The intermediary (developer) registers the invoices themselves received from sellers (executors) in part 2 of the invoice register. This requirement also applies to intermediaries who are not VAT payers (clause 3.1 of Article 169 of the Tax Code of the Russian Federation).

Customers who submit a consolidated invoice to the investor indicate in the accounting journal:

- transaction type code (column 3) – “13”;

- transaction type code (column 12) – “1”.

This was stated in the letter of the Federal Tax Service of Russia dated July 20, 2015 No. ED-4-3/12764.

All transaction type codes are given in subparagraph “m” of paragraph 11 of section II of Appendix 3 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The intermediary does not register such a document in the purchase book. This follows from the provisions of paragraph 11 of Section II of Appendix 3 and paragraph 19 of Section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Customers (principals, principals) who received a “consolidated” invoice from an intermediary register it in part 2 of the invoice register in the general manner (subparagraph “a”, paragraph 11 of section II of Appendix 3 to the Decree of the Government of the Russian Federation of December 26 2011 No. 1137).

The customer specifies:

- in column 2 - the date indicated in the consolidated invoice,

- in column 3 – code of the type of operation,

- in column 4 - date and number of the consolidated invoice,

- in column 8 – names of sellers (suppliers, performers) indicated in line 2 of the consolidated invoice, separated by the sign “;”

- in column 9 - TIN and KPP of sellers (suppliers, performers), indicated in line 2b of the consolidated invoice, through the sign “;”

- in column 14 - the total amount payable including VAT, indicated in column 9 of the consolidated invoice,

- in column 15 - the total amount of VAT indicated in column 8 of the consolidated invoice.

Columns 10–12 do not need to be filled in, since they are filled out only by intermediaries.

This follows from paragraph 11 of Section II of Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

An example of compiling and recording a consolidated invoice in the invoice journal

JSC Alfa (customer) engages the developer Hermes LLC for the construction of the building. Hermes works with several contractors and suppliers and reissues invoices received from them to Alfa.

In the first quarter, Hermes received invoices:

- from the supplier JSC “Proizvodstvennaya” - No. 522 dated 02.02.2016;

- from the contractor JSC "Stroyfed" - No. 354 dated 02/02/2016.

Based on these invoices, Hermes prepared a consolidated invoice and issued it to Alpha on 20 February 2015. Hermes registered the consolidated invoice issued to the customer and the invoices received from the contractors in the invoice journal.

Alpha recorded the resulting consolidated invoice in Part 2 of the invoice journal.

Certification of the journal

The log of received and issued invoices must be certified no later than the 20th day of the month following the expired quarter.

If the journal is kept on paper, it must be signed by the head of the organization or another authorized person. In addition, the magazine must be laced, and its pages numbered and sealed.

Do you keep your journal electronically? Then do not forget to certify it with the electronic signature of the head of the organization (the person authorized by him) when you submit it to the tax office.

This procedure is provided for in paragraph 13 of Appendix 3 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

What is new about the forms?

New forms of books differ from old ones by the presence of three columns:

- number and date of correction of the seller's invoice;

- number and date of the seller's adjustment invoice;

- number and date of correction of the seller's adjustment invoice.

Some of the graphs have been renamed. In the purchase book, the names of columns 6–12 have changed. Only column 6 has changed significantly. Now from its name it follows that the country of origin must be indicated in the form of a digital code.

But in the sales book, the names of columns 4–9 have changed slightly.

Deadline for submitting the journal to the tax office

Intermediaries who are exempt from VAT and are not tax agents for this tax must submit invoice journals electronically to the tax office. This must be done no later than the 20th day of the month following the reporting quarter. This procedure is provided for in paragraph 5.2 of Article 174 of the Tax Code of the Russian Federation.

The electronic format of the journal was established by order of the Federal Tax Service of Russia dated March 4, 2015 No. ММВ-7-6/93.

Logs should be transferred to inspections via telecommunication channels through special operators. When sending, you must use the unified format approved by Order of the Federal Tax Service of Russia dated November 9, 2010 No. ММВ-7-6/535, and use the list of documents approved by Order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/465.

This is stated in the letter of the Federal Tax Service of Russia dated April 8, 2015 No. GD-4-3/5880 (the document is posted on the official website of the tax service in the section “Explanations of the Federal Tax Service, mandatory for application by tax authorities”).

Situation: what liability is provided for late submission to the tax office of a log of received and issued invoices?

A fine of 10,000 rubles.

From January 1, 2015, logs of received and issued invoices are included in tax reporting. The obligation to quarterly submit such journals to tax inspectorates is directly established for intermediaries who are exempt from paying VAT and are not tax agents for this tax (clause 3.1 of Article 169, clause 5.2 of Article 174 of the Tax Code of the Russian Federation).

Based on the accounting logs received from intermediaries, tax inspectorates monitor whether the amounts of VAT accrued, for example, by the principals when selling goods, correspond to the amounts of tax that buyers of these goods accept for deduction. And vice versa, do the amounts of deductions declared by the principals for the goods purchased for them correspond to the amounts of VAT that the sellers of these goods accrued for payment to the budget?

Invoice logs must be submitted no later than the 20th day of the month following the reporting quarter (clause 5.2 of Article 174 of the Tax Code of the Russian Federation). Failure to comply with this deadline is classified by inspectors as failure to provide information about taxpayers to the tax authority. That is, as an offense for which liability is provided for in paragraph 2 of Article 126 of the Tax Code of the Russian Federation. For organizations and entrepreneurs, this means a fine of 10,000 rubles.

How to fill out the Invoice Journal in 1C 8.3

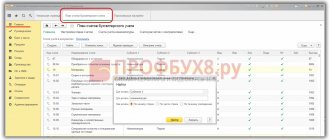

In the panel menu, select the Reports section, then go to VAT Reports and select the Invoice Journal subsection:

In the Invoice Journal, select the reporting period, then click the Generate button:

In this log you can also select settings and use additional settings. For example, create a journal specifically for any counterparty or group of counterparties.

Using the additional button, you can also change the shape of the table, that is, adjust it “to suit you” so that it is convenient to work in it:

Some instructions for the report are provided in the program. Using the same button, select the Help section:

Open this section and read the instructions for what the Invoice Journal report is intended for:

This is what the printed form of the journal looks like:

Codes for types of VAT transactions

Inspectorate of the Federal Tax Service of the Russian Federation from 07/01/2016 approved new transaction codes for value added tax. Order of the Federal Tax Service of Russia dated March 14, 2016. for No. ММВ-7-3/136. Thus, the following transactions must be reflected in the journal:

Features of the 1C 8.3 program for checking invoices

In order to automatically reconcile invoices submitted by suppliers, in the Reports section, select the VAT Reports subsection, then the Reconciliation of VAT accounting data section:

We select the Requests to Suppliers tab, request reconciliation, receive from him a register of issued invoices through the Supplier Responses tab and carry out (automatically) reconciliation with it through the Reconciliation tab:

Before performing automatic reconciliation with counterparties, a window with detailed reconciliation instructions automatically appears in the 1C 8.3 program:

In this instruction, immediately, without leaving the 1C 8.3 database, you can study in detail the article “Reconciliation of invoices: a new level of automation.”

Also, the 1C 8.3 program provides for checking the dossier on the counterparty. When entering the Contractors directory, select the Dossier button:

We select the counterparty (supplier) by tax identification number or name and click the generate button:

How to find and correct VAT errors in 1C, how to check VAT with counterparties in 1C 8.3, see our video:

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Storage of journal and documents

The storage period for the log of received and issued invoices is four full years from the date of the last entry (clause 13 of Appendix 3 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

The organization is also obliged to store and file in chronological order:

- the invoices themselves (including adjustment and corrected ones). At the same time, invoices issued electronically can be stored without printing (letter of the Federal Tax Service of Russia dated February 6, 2014 No. GD-4-3/1984);

- confirmation of electronic document management operators.