How to fill out Form 107 correctly?

Attention! The inventory form must be filled out in two copies! One form will be sent in an envelope along with the letter, and the second, with a date stamp, will be handed to the sender.

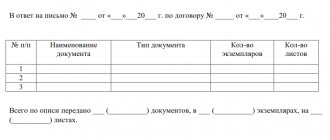

In form 107 the following lines are filled in:

- table attached documents:

- serial number,

- Name,

- amount,

- declared value (in rubles);

- the total total (in pieces) of items and the amount of declared value ;

- sender (full name or name of legal entity);

- signature .

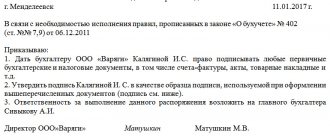

So, a sample of filling out an investment inventory will look like this:

If there are unfilled cells, it is allowed to put a dash. And if, on the contrary, there was not enough space to fill out, then you can continue on the second sheet of the form and make notes, for example, “Sheet 1 from N,” “Sheet 2 from N,” etc. The total quantity and amount must be given in total for all documents enclosed in the envelope. Again, this chain of forms must be filled out in duplicate.

Important! Corrections on the form for the description of attachments in a valuable letter are not allowed!

What does the list of documents for the 3-NDFL declaration for property deduction look like?

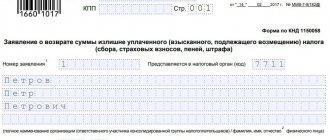

If the payer wants to take advantage of a property deduction, for example, for the costs of purchasing an apartment under an equity participation agreement (hereinafter referred to as the DDU), he lists in the inventory:

- 3-NDFL;

Find out how to fill out the 3-NDFL declaration for property deduction here.

- 2-NDFL;

- DDU;

- Act of Handover;

- payment documents;

- application for distribution of deductions (on joint or common property);

- application for personal income tax refund.

A sample of how to make an inventory of documents for the tax office will help you deal with this issue. Thus, an inventory of property deductions, combined with an application for a deduction, can be downloaded on our website using the link below:

For information on the property deduction and documents to support it, see the publication “Documents for obtaining a property tax deduction.”

What is declared value?

Since the inventory is needed as a fact of submitting reports, and according to the rules it is included in a valuable letter, our shipment needs to be assessed. Each embedded unit is assessed separately, and the assessment amount is assigned to the entire letter. You don’t have to assign a value, but just put a dash through it.

You should write on the envelope: “With inventory, value XX rubles.”

If suddenly the letter is lost, the post office must return the amount of declared value to the sender or recipient. For forwarding a letter, the mailroom operator will charge an additional +4% of the declared value.

Consequences of failure to provide

It is important to keep a list of documents for transfer to the tax office as evidence of their transfer. For failure to submit the requested papers by the taxpayer (fee payer, insurance premium payer, tax agent) within the prescribed period, fines will be collected:

- 200 rubles - from the organization for each document not submitted (clause 1 of article 126 of the Tax Code of the Russian Federation);

- from 300 to 500 rubles - from the head of the organization (note to Article 2.4, Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

How to send a letter with an attachment description?

You need to contact the Russian Post office operator with:

- unsealed envelope

- documents included in it,

- two completed inventory forms,

- the amount of money in your wallet for shipping.

The operator will check the entered data in the form with the attachment in the envelope, the correctness of filling out the inventory and the envelope, put a stamp on each sheet of the inventory with the date of acceptance, sign on each and give one copy to the sender along with the payment receipt.

By the way! For example, you can send a tax return in only one copy; your copy remains with you with an inventory form attached to it with the date the letter was sent.

Where is the list of documents for the tax office for the 3-NDFL declaration?

Ch. 23 of the Tax Code of the Russian Federation contains a list of deductions that allow you to reduce the tax base for personal income tax. The main ones are the following:

- standard;

- social;

- property;

- professional;

- investment.

Find out useful information about deductions in a special section.

When reflecting these deductions in the 3-NDFL report, in order to submit it to the Federal Tax Service, an individual must also draw up a list of documents justifying the expenses incurred by him.

However, the format of this inventory is not regulated. Some tax inspectorates independently choose its type, but this does not prevent the taxpayer from using his own version of the inventory. At the same time, the list of documents submitted to the tax office upon request (according to the sample presented below) must contain all documentation justifying the deduction.

You can download samples of inventories to the tax office on the submission of documents on the most popular deductions among taxpayers - property and social - on our website.

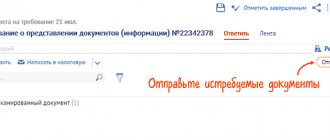

Option two: electronic

You can even divide it into two types: completely electronic document flow - EDI or combined - documents arrive at the organization in different ways, paper copies are scanned or recognized, and then loaded into the program and (or) electronic archive.

These are already advanced technologies:

Firstly , documents are accumulated in the form of files, which are much easier to store and find than cardboard “Case” folders;

Secondly , you can set up access rights for employees and you don’t have to contact the archivist or management every time - just log in to the system with your username and password. It is easier to control access to information representing commercial or state secrets or personal data of individuals;

Thirdly , it is economical - you do not need a separate room and a special employee.

Of the minuses: you will have to purchase a powerful server and set up a local network; when scanning paper documents, you need to save the originals (i.e., again, they need to be stored somewhere).

But preparing a selection of documents for verification is much faster. You can make a selection according to specified parameters in the system or copy the necessary files from folders. In this case, it is advisable to respond to the Federal Tax Service’s request electronically, otherwise what was the point of all the previous actions?

What are the advantages of sending by mail?

The most important thing is that the date that will appear on the stamp (put by the postal employee when he accepts it) will mean the date the declaration was accepted.

That is, when sending a letter by mail, you don’t have to worry that it will take a long time to get to the tax department. No matter how long it takes and no matter where it is delayed, you will still not be late in submitting your reports if you sent the letter on time.

This option is most suitable if there is one day left before the deadline for submitting the declaration. You simply send the report by mail and do not worry about deadlines. Because, let us remind you, for not submitting documents on time, the entrepreneur faces a fine and penalties.

Bottom line

We got acquainted with what the form 107 investment inventory form is, learned how it can be used and how to fill it out correctly. This is not required knowledge, but it can help if you want to use the option of sending a return to the tax office using Russian Post services. Such actions save a lot of time, although they cost a certain amount of money. Filling out the form is not difficult, the main thing is to be careful and attentive to avoid repeated filling, which can lead to errors.

Presentation on paper

The procedure for requesting and submitting documents within the framework of tax audits is established in Art.

93 of the Tax Code of the Russian Federation and fully describes the case of submitting documents in the form of paper copies. Thus, the tax authority transmits the request to the taxpayer “in person against receipt” under the TKS or by registered mail, and in the latter case it is considered received after six days. The taxpayer collects the necessary documents, makes and certifies copies. Moreover, if the taxpayer has electronic documents, to submit them on paper in accordance with repeated clarifications of the Ministry of Finance (Letter of the Ministry of Finance dated 07.07.2011 No. 03-03-06/1/409, Letter of the Ministry of Finance dated 26.08.2011 No. 03-03-06/1 /521), documents must be printed and also certified. After drawing up the covering letter, the taxpayer, along with all copies, sends it to the tax office - in person or by mail. According to Larisa Sivolobova, deputy head of the desk audit department of the Federal Tax Service of Russia Inspectorate No. 49, when submitting paper documents in large quantities, the taxpayer incurs quite significant time, labor and material costs, while with electronic document management the costs are minimal for the tax authority, and for the taxpayer.

Advantages of the “paper” presentation:

- You can submit any documents;

- proven practice of presenting in the form of paper copies.

Disadvantages of the “paper” presentation:

- an increase in the preparation time for a package of documents due to the need to search for documents in archives and certify each copy;

- complicating the verification of documents by the tax authority due to the need for manual processing;

- increasing the delivery time for documents (physical delivery takes from one to five days).

When is an inventory of the investment completed?

An attachment inventory is a documented list of the contents of a mail item. It is drawn up by the sender of the letter according to the unified template F 107, developed and approved by Order of the Federal State Unitary Enterprise “Russian Post” No. 114-p dated May 17, 2012.

Accordingly, this documentary form is used exclusively for valuable postal items sent by individuals or legal entities through Russian Post within the territory of the Russian Federation.

Form f 107 is filled out by the sender of the valuable letter according to certain rules in two equivalent copies.

As is known, a valuable item is considered to be a type of postal item in respect of which the sender indicates the so-called declared value, which is recorded in a separate column of the attachment inventory for each content item.

Valuable items sent through Russian Post include parcels, parcels, and valuable letters.

A valuable letter with a list of attachments attached is usually sent when it is necessary to send to the addressee any documents that are of particular importance and have a declared (named) value. For example, if tax reports or official papers certified by a notary are sent.

When accepting a valuable letter from the sender for its subsequent forwarding to the specified addressee, the Russian Post operational employee will perform the following actions:

- Checks the correspondence between the contents of the shipment and the submitted inventory (the sender gives the postal employee a letter with the attached inventory in open form).

- He will put a corresponding stamp on the form f 107 containing the current date (that is, the date of dispatch) and a personal signature. Its presence allows the sender to avoid sanctions imposed for late submission of certain documents. For example, when submitting tax reports sent by a valuable letter with an inventory of the attachment, the date of its acceptance by Russian Post will be considered the date of submission of tax reports to the Federal Tax Service.

- The first copy of the prepared inventory is inserted by the postal operations officer into the letter being sent, and the second copy is immediately returned to the sender with the appropriate postal stamp.

You should also know that the presence of a list of attachments in a valuable item allows the addressee - the recipient - to demand that a postal employee open the letter to check the contents before delivery. If it suddenly turns out that the contents did not reach the addressee in the required amount, the operations officer will draw up the necessary report and transfer it to a higher structure to investigate the situation and pay the sender (addressee) proper compensation.

As for the usual registered letter, it cannot be sent with an inventory attached, since it is attached only to valuable items.

The only difference between these two types of letters sent using Russian Post is that a valuable item requires the mandatory indication of the so-called declared value, while a registered item does not imply this need at all.

How to fill out form 107 when sending a letter by Russian Post?

The attachment inventory form, designed according to the F 107 template, can be obtained from any post office absolutely free of charge. Alternatively, the sender downloads this form online and then prints it out. Below is a link where you can download the current form f 107 in word format.

The form is filled out by the sender independently in two equal copies.

The attachment inventory template used when sending a valuable item via Russian Post requires the following information:

- Table with a list of contents. For each enclosed item, the serial number, name, quantity, as well as the declared value, which is calculated in rubles and determined at the discretion of the sender (for example, in accordance with the market price of the item), are indicated. The higher the declared (named) value, the more expensive it will cost to send it.

- The total number of items sent (in pieces) is the total in the column for the number of items (indicated in numbers).

- The total declared value (cost) of a letter in rubles is the total (entered in numbers)

- Full name of the individual sender (or name of the legal entity sender).

- Signature of the individual sender (or an authorized representative of the legal entity sender).

- The operational postal employee reflects information about the verification on this form, indicating his full name, position and signature. Here - in the required column - a postal stamp is affixed with the date of receipt and the postal office index.

You cannot edit the entered information.

If one form is not enough to indicate the contents, the sender can take additional ones, writing on each one its number in order and the total number of all forms taken (for example, “Sheet 1 of 3”).

It is allowed to put dashes in unfilled cells of the form.

and sample filling when sending documents

.

.

Example: