What is an investment tax deduction

An investment tax deduction is the amount with which some investors who are residents of the Russian Federation (those who spend more than 183 days a year in the country) are allowed not to pay personal income tax (NDFL). And if the money has already been paid to the budget, then return it. Most Russians' income is subject to personal income tax at 13%. But the state has a set of tax deductions to encourage citizens: it is ready to return the money if you do something that it approves of. For example, you buy real estate, study, have children. The investment tax deduction is intended to encourage citizens not to keep money in the closet, but to invest in the economy. If you file a tax deduction for a certain amount, you can get 13% of that amount back.

What to do if an OS object is sold?

If, before the expiration of the SPI, an object is sold or removed from the OS for another reason (other than liquidation), then the amount of income tax not paid in connection with the application of the INV in relation to this object is subject to restoration and payment to the budget with the payment of the corresponding amounts of penalties, which are accrued from the day the INV was applied.

| The property was sold after the expiration of the SPI | The object was sold before the expiration of the SPI |

| – | Restore the tax underpaid to the budget as a result of the use of INV |

| – | Pay penalties (accrued from the moment the INV is applied) |

| Income from sales cannot be reduced by the cost of purchasing the property | Income from sales can be reduced by the cost of purchasing the property |

What are investment tax deductions and when can you take advantage of them?

For those who invest, the law provides for three types of deductions. On income from the sale of securities Tax on income from the sale or redemption of securities may not be paid at all if several conditions are met: you have owned them for more than three years;

you bought them after January 1, 2014; the securities were not accounted for in the individual investment account. The tax deduction on income from the sale of securities applies to shares and bonds admitted to trading on Russian stock exchanges, or investment units of open-end mutual funds managed by Russian companies. In this case, income is the difference between the amount for which you sold the shares and the cost of acquiring them. Moreover, expenses mean not only expenses on the securities themselves, but also, for example, exchange fees. However, the amount of the deduction cannot exceed the number calculated using the formula: Amount of deduction = 3 million × Ktsb

The securities ratio depends on whether you owned the sold securities for an equal amount of time or not. If the securities were purchased in one year and sold in the same year, the securities are equal to the number of full years during which you owned them all. Let’s say, if you bought bonds in 2015 and repaid them in 2020, then the securities are equal to four, since the full years of ownership are from 2016 to 2019. Therefore, the maximum deduction will be:

Deduction amount = 3 million × 4 = 12 million

If you earned less on shares, you don’t have to pay tax. If you purchased shares or bonds in different years, the securities market is calculated using a complex formula that looks like this:

Vi is income from the sale of securities, i is their holding period in full years. When determining income, only stocks and bonds that you sold for more than you bought are taken into account. n is the number of securities holding periods in full years. If the holding period of two or more securities coincides, then n = 1. An example will make it a little clearer. Let's say you sold two shares in 2021. You owned the first one for three full years and earned 300 thousand on the sale. For the second, these parameters are 5 years and 500 thousand. Let's do the math:

Securities = 300 thousand × 3 years + 500 thousand × 5 years / 300 thousand + 500 thousand = 4.25

Accordingly, the maximum deduction amount will be as follows:

Deduction amount = 3 million × 4.25 = 12.75 million

However, if your income from the sale of securities is far from millions, you don’t have to bother with complex calculations. You will definitely not reach the maximum and can claim an investment tax deduction for the entire amount of earnings. For income from IIS An individual investment account (IIA) is a version of a brokerage account with special conditions. It was introduced to motivate citizens to invest money more actively and receive a little more from investments thanks to bonuses. Tax deduction is one of them. It is provided for income from an IIS upon its closure, if the account has existed for at least three years. Another condition is not to use other tax deductions available to IIS owners. You can only choose one of them. There is no upper limit for this investment tax deduction; personal income tax does not have to be paid on all income received from an individual investment account. For the amount deposited into the IIS. This is the second deduction option for the IIS.

It is provided in the amount deposited into the IIS, but not more than 400 thousand rubles per year, that is, you can return up to 52 thousand rubles. If you deposit less into the IIS, the deduction is less (13% of the amount deposited into the account). If you deposit more, you still get a deduction of 52 thousand rubles. Unlike the deduction for IIS income, which can be claimed when closing an account, the deduction for the deposited amount can be used every year. But the IIS itself must still exist for at least three years. Important: the previous two deductions related directly to income from transactions with securities. A deduction for the amount deposited into an IIS allows you to avoid paying or return personal income tax paid on basic income. For example, if you work officially and your employer pays taxes for you, then you can return the transferred money.

Other changes

Doubtful debt

Amendments are being made to paragraph 1 of Article 266 of the Tax Code of the Russian Federation, which determines the procedure for the formation of doubtful debts. The amendments will affect situations where an organization and its debtor have counter-debts.

The current version of this provision of the law states that the portion exceeding the counter-obligation of the taxpayer to the debtor is recognized as doubtful receivables. The amendments will affect situations where a debtor has several debts to the company at once, formed at different periods of time.

Now, in order to determine the doubtful debt, the company will have to reduce the earliest of these debts by the counter-obligation. The difference will be the amount of doubtful debt. For the first time, this rule will need to be applied when creating reserves for doubtful debts based on the results of the first reporting period of 2018.

The list of bad debts has been expanded

The list of debts that are considered unrealistic for collection has been supplemented. From January 1, 2021, these will include debts of an individual declared bankrupt that are considered repaid or those for which he is exempt from payments. For the most part, this category includes debts that the bankrupt was unable to pay due to the insufficiency of his property.

Let us remind you that doubtful debts are written off as non-operating expenses or repaid from appropriate reserves.

Many amendments have been made to tax legislation

For state unitary enterprises and municipal unitary enterprises the composition of taxable income has been increased

From January 1, 2021, a new version of subclause 26 of clause 1 of Article 251 of the Tax Code of the Russian Federation will be in effect. According to the amendments, funds that unitary enterprises will receive from the owner must be included in taxable income. According to the rules in force until the end of this year, funds transferred to state unitary enterprises and municipal unitary enterprises by their owners are not included in income.

The procedure for recognizing income and expenses when extracting hydrocarbons from a new offshore field has been determined

A number of articles of the Tax Code are being introduced in relation to activities related to the production of hydrocarbons in a new offshore field . All of them came into force on November 27 of this year and apply to legal relations that arose from the beginning of 2014. The Tax Code will be supplemented with four new norms at once: paragraph 1.1 of Article 271, paragraph 1.1 of Article 272, subparagraph 9 of paragraph 2 of Article 293.3, subparagraph 6 of paragraph 2 of Article 299.4.

In short, the essence of these changes is that there is a special procedure for recognizing income and expenses for production operations carried out at a new offshore field. A positive exchange rate difference will be attributed to income, and a negative difference will be attributed to expenses for this activity.

There is another innovation associated with new offshore deposits, or more precisely, with their search and evaluation. It does not introduce any rules of the Tax Code and does not change existing ones. Only the procedure for recognizing expenses for these activities is clarified. In accordance with Article 8 of Law No. 335-FZ, such expenses must be included in other expenses evenly over 36 months. The amendments apply to periods starting from January 1, 2014. There is also a four-year retention period for documents confirming such expenses.

Preferences for companies subject to sanctions

And the latest innovation in terms of income tax concerns companies that sold shares or shares and fell under sanctions and restrictions imposed by foreign states and international financial organizations. If several conditions are met, they should not classify the proceeds from the sale of shares (shares) as taxable income. The cost of sold shares or shares is not included in expenses. These rules follow from the norms of the new subclause 57 of clause 1 of Article 251, as well as from the amended subclause 48.22 of Article 270 of the Code.

Have questions about income taxes? We recommend that you familiarize yourself with the recent clarifications of the Federal Tax Service.

What documents are needed to receive an investment tax deduction?

You will need a 2‑NDFL certificate about income and withheld taxes for the year. You can take it from your employer or find it in your personal account on the tax website, where it will appear after March 1. Further, depending on the deduction, the list of documents will vary. For income from the sale of securities, you will need broker reports that will confirm: the duration of the securities in the account; correct calculation of the tax deduction (if you receive a refund through the tax office); that the securities sold were not taken into account on the IIS. The broker definitely understands what he is dealing with, so just contact him. And you will be given the necessary documents. For income from IIS In addition to the 2‑NDFL certificate on income and taxes, you will need: A document that confirms the right to deduction: an agreement on maintaining an IIS, or on brokerage services, or something similar. Broker reports on transactions on IIS. For the amount deposited into the IIS To apply for an investment tax deduction, in this case you will need: A document that confirms the right to the deduction, for example an agreement on maintaining an IIA or on brokerage services. Papers proving the fact of crediting funds, for example, a payment order or a cash receipt order. A certificate that you have not previously used a deduction for the amount deposited in the IIS. You will need it if you are applying for a deduction through a broker. You can get it from the tax office.

Project accounting analytics

To organize project-by-project accounting, an additional analytical axis “Investment Project Code” is entered into the accounting system when posting data on accounts No. 51, No. 60 and two analytical axes “Investment Project Code” and “Object Code” on accounts No. 08, No. 07 and No. 01. In the analytics axis “Investment Project Code” a list of investment projects and their codes that have passed the approval procedure is entered manually.

The responsibility for loading the list of investment projects and their codes from the company’s investment plan into the accounting system lies with the head of the relevant department - economic analysis of investments. In the analytics axis “Object code” the accounting operator enters the object code and its name.

Responsibility for the reliable entry of the object code and its name into the accounting system lies with the accountant (senior accountant) accounting for capital investments and accounting for fixed assets.

Working with financial documents and tax reporting is not an easy task as it may seem at first glance. An accountant has to keep track of all changes in legislation, study the composition and procedure for preparing tax reports, not miss deadlines for submitting reports for individual entrepreneurs, pay taxes correctly and on time, and not make mistakes in the details when transferring tax payments.

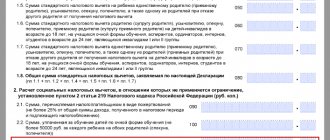

How to get an investment tax deduction through the tax office

With this method of receiving a tax deduction, you return previously paid tax. This option can be used to process all types of investment deductions. But you will have to do this a little differently. There are two ways. Through your personal account on the tax website. This option is suitable for filing a deduction for the amount deposited in the IIS. Lifehacker has detailed instructions on how to do this. Through a special “Declaration” program To process deductions for income from sold shares or income from an individual investment account, you will need a special “Declaration” program. You can download it on the tax website. Next, you need to fill out a declaration. Here are a few steps you'll need to take. Set the conditions From the drop-down list, select your inspection number and OKTMO. You can find out all this on the Federal Tax Service website. Please indicate the correction number. If you are filing a return for the first time, leave zero. Each time you send an updated document to the tax office, you will need to add one. Select your status. Immediately check the box “Generate a tax refund application”, because this is what everything is started for.

Provide information about the declarant. At this stage, you need to enter personal data. Everything here is intuitive.

Enter data on income received in the Russian Federation Income code. For most cases, code 13, indicated in yellow, is suitable. It includes salaries, fees and other standard income. If this code does not suit you, hover your cursor over each of the colored numbers - an explanation will pop up which type of profit is meant, and you can select the appropriate option.

Income information. To add it, you first need to click on the upper “+” sign, and then on the lower one. All information is in the 2‑NDFL certificates that you received from your employer or on the tax website. At this stage, among other things, it is necessary to declare income received from transactions with securities.

First, fill in the source of payments, then information about income

Information about the organization is in the 2-NDFL certificate. If the income is received from an individual, his full name must be indicated.

Enter your deduction information Let's get to the important stuff. On the “Deductions” tab, you must select “Investment and losses on securities”. Let's figure out what is what: The deduction amount provided for in subparagraph 1 of paragraph 1 of Article 219.1 of the Tax Code of the Russian Federation is a deduction for income from securities. If you are interested in it, enter in the top box the amount of your profit from the sale of stocks, bonds or shares, which you intend to exempt from taxes. The deduction provided for in subclause 3 of clause 1 of Article 219.1 of the Tax Code of the Russian Federation is a deduction for income from an individual investment account. Check the box if you need it.

Features of accounting and tax accounting for investors

Investor is a person who finances construction using his own or borrowed funds. For the purposes of this article, we will understand investors as legal entities - investors, shareholders and co-investors who do not themselves organize construction and do not perform work, that is, do not combine the functions of developers, customers or contractors.

As a rule, the main goals of an investor’s participation in construction are to increase their own capital investments (the corresponding share of the finished object will be included in fixed assets) or to obtain a share of the object for subsequent resale. At the same time, the investor can assign his rights to another person without waiting for the completion of construction (transfer of property rights). Therefore, depending on the pursued purpose of construction, accounting and tax accounting for investors may vary.

Investing in the construction of facilities for your own needs

The share of the completed construction facility will be used by the investor either in production activities, or for management needs, or for rental. It is known that in this case, the initial cost of the object formed in the debit of account 08 is written off to the debit of account 01 “Fixed assets” or 03 “Income-generating investments in material assets.”

The initial cost of a fixed asset item is formed according to the rules of PBU 6/01 “Accounting for fixed assets” [1]. If raised funds (credits and borrowings) were used to create it, the accountant must take into account the norms of PBU 15/2008 “Accounting for expenses on loans and credits” [2], in accordance with clause 7 of which interest is included in the cost of the investment asset, payments due to the lender (creditor), directly related to the acquisition, construction and (or) production of an investment asset.

Please note : By virtue of clause 8 of PBU 15/2008, additional loan costs can be included evenly as part of other expenses during the term of the loan (loan agreement).

When the construction of an investment asset is suspended for a long period (more than three months), interest payable to the lender (creditor) ceases to be included in the cost of construction from the first day of the month following the month of suspension of the acquisition, construction and (or) production of such an asset. During the specified period, interest is written off as part of the organization’s other expenses.

When construction is resumed, accrued interest is included in the cost of the investment asset from the first day of the month following the month of its construction resumption.

The period during which additional approval of technical and (or) organizational issues that arose during the construction of the facility is not considered a suspension period.

Interest on the use of borrowed funds ceases to be included in the cost of the investment asset from the first day of the month following the month of completion of construction.

If an organization begins to use an investment asset for the manufacture of products, performance of work, provision of services despite the incompleteness of its construction, interest ceases to be included in the cost of such an asset from the first day of the month following the month of the start of use of the object ( clause 13 of PBU 15/ 2008 ).

If funds from loans (credits) received for purposes unrelated to its construction are used to finance the construction of an investment asset, the amounts of accrued interest are included in the cost of this asset in proportion to the share of these funds in the total amount of loans (credits) payable to the lender ( creditor) received for purposes not related to the acquisition, construction and (or) production of this asset. An example of such a calculation is given in paragraph 14 of PBU 15/2008 .

The tax initial cost of a depreciable property is formed according to the rules of Art. 257 of the Tax Code of the Russian Federation and does not include interest accrued for the use of debt obligations (credits and borrowings). Interest amounts based on paragraphs. 2 p. 1 art. 265 of the Tax Code of the Russian Federation are taken into account as part of the investor’s non-operating expenses ( letters of the Ministry of Finance of Russia dated 02/03/2009 No. 03-03-06/1/37 , dated 12/19/2008 No. 03-03-06/1/699 , dated 12/05/2008 No. 03- 03‑06/1/667 , etc.).

If the investor plans to use the received share in the finished object in activities subject to VAT, then the amount of tax charged to him by the developer on the value of his share in the finished object can be deducted (clause 6 of Article 171 , clauses 1 and 5 of Article 172 Tax Code of the Russian Federation ). To do this, two conditions must be met: register the property and receive a consolidated invoice from the developer.

Please note : If these conditions are met, the right to deduction does not depend on whether the investor has turnover under the credit of account 68-VAT in a particular tax period. If the inspectorate refused to deduct only due to the failure to carry out taxable transactions in a given quarter, the investor will be able to prove the validity of presenting VAT for deduction in court ( Resolution of the Federal Antimonopoly Service of the Moscow Region dated March 17, 2009 No. KA-A41/1603-09 , etc.).

According to the Ministry of Finance ( 03‑07‑10/11 dated November 21, 2008 ), VAT amounts presented by the contractor are accepted for deduction from the taxpayer-investor according to the customer’s invoices issued on the basis of the contractor’s invoices for work performed, subject to the acceptance of these works for accounting, including on account 08 “Investments in non-current assets”. However, in practice, tax inspectors often take a different position - the right to deduction arises after the object is included in fixed assets (reflected in the debit of account 01 or 03). In this case, the investor can defend his point of view in court ( decrees of the Federal Antimonopoly Service of the Moscow Region No. KA-A40/2579-09 , No. A55-9765/2008 , etc.).

However, presenting VAT for deduction before the object is reflected in the debit of account 01 (or 03) is not the only basis for disputes with inspectors. Practice shows that inspectorates deny investors a deduction for a variety of reasons. For example, because the invoice was drawn up by the developer in violation of the five-day period established by clause 3 of Art. 168 Tax Code of the Russian Federation . However, the courts have repeatedly indicated that violation of the deadline for drawing up an invoice is not included in the list of requirements for an invoice established by paragraphs 5 and 6 of Art. 169 of the Tax Code of the Russian Federation , and cannot be a basis for refusing to accept tax amounts for deduction ( resolutions of the Federal Antimonopoly Service dated May 19, 2009 No. A55-12068/2008 , FAS VSO dated September 5, 2007 No. A19-2735/07-43‑F02-4551 /07 , etc.).

Let us consider the reflection of transactions in accounting using an example.

Example 1.

Investor LLC entered into an investment agreement with a developer for the construction of an office center intended for rental. The contribution of Investor LLC is equal to 59,000,000 rubles. (including VAT – RUB 9,000,000). Construction financing is carried out in three tranches:

– in August 2008 – 17,700,000 rubles;

– in February 2009 – 14,160,000 rubles;

– in May 2009 – 27,140,000 rubles.

The share in the constructed building was accepted in July 2009. In August, Investor LLC carried out state registration and put the facility into operation.

Transactions are reflected in accounting as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| In August 200 8 | |||

| Funds were transferred to the developer (I tranche) | 76 | 51 | 17 700 000 |

| In February 2009 _ | |||

| Funds were transferred to the developer (2nd tranche) | 76 | 51 | 14 160 000 |

| In May 2009 _ _ _ | |||

| Funds were transferred to the developer (III tranche) | 76 | 51 | 27 140 000 |

| Jul 20 09 _ _ _ | |||

| Accepted from the developer a share in the office center (59,000,000 - 9,000,000) rubles. | 08-3 | 76 | 50 000 000 |

| The presented VAT is reflected | 19 | 76 | 9 000 000 |

| Accepted for VAT deduction | 68 | 19 | 9 000 000 |

| The state fee for registering ownership of a share in the building has been transferred | 76 | 51 | 7 500 |

| In August 200 9 g . | |||

| The initial cost of the building's share has been increased by the amount of the state fee for registering ownership rights | 08-3 | 76 | 7 500 |

| Share in the office center put into operation | 03 | 08-3 | 50 007 500 |

The actual construction costs attributable to the investor may differ from the amount of his investment contribution.

Therefore, the contract should establish a procedure for covering the negative difference (if costs exceed the investment contribution) or distributing the positive difference (if construction costs are less than the investment contribution, the resulting difference is either returned to the investor or remains at the disposal of the developer as his income). If the property is for sale

The accounting procedure for investing in construction for the purpose of subsequent sale differs little from investing for one’s own consumption. To account for the relationship with the developer under the investment agreement, the investor also uses account 76, subaccount “Settlements with the developer.” Having received a share in the finished property from the developer, the investor reflects its value on account 41 “Goods”. Accordingly, the formation of the actual cost is carried out according to the rules of PBU 5/01 “Accounting for inventories” [3] (the costs of state registration of property rights are included in the actual cost of the share). It is not correct to use accounts 01 and 03 in this case, since the investor’s property does not meet the requirements of clause 4 of PBU 6/01 , since it was originally intended for resale. Thus, the investor does not have the obligation to pay property tax on its value. (In accordance with Article 374 of the Tax Code of the Russian Federation, the object of taxation is property recorded on the balance sheet of an organization as fixed assets.) The validity of this conclusion is confirmed by resolutions of the Federal Antimonopoly Service VSO dated January 13, 2009 No. A33-2017/08‑F02-6774/08 , FAS TsO dated 04/03/2007 No. A14-3166-200677/28 , etc. At the same time, if inspectors establish the fact that an object is used in economic activity (for example, leasing), it will not be possible to avoid additional assessment of property tax ( resolution of the Federal Antimonopoly Service of the North-West District dated 06.03 .2009 No. A56-19655/2008 and FAS PO dated May 30, 2008 No. A12-12669/07 ).

Please note : Interest on loans and borrowings, as well as additional costs associated with raising debt obligations, are not included in the actual cost of the share received from the developer, since this asset is not an investment for the purposes of applying PBU 15/2008 .

If the further sale of a share of the finished object is subject to VAT, then the investor can deduct the amount of tax received from the developer. Otherwise, VAT is taken into account in the cost of the share.

Investing in the construction of facilities intended for assignment of rights

In this section we will consider the situation when an investor finances construction in order to receive income from the further assignment of his property rights to the developer. Note that when transferring a share in construction, we are not talking about monetary claims, but about the transfer of property rights arising from agreements for participation in shared construction or investment contracts. The fact is that the shareholder (investor) transfers the right to demand that the developer fulfill his obligations to create a property and transfer it to the investor-shareholder.

Value added tax

The transfer of property rights is recognized as subject to VAT ( clause 1, clause 1, article 146 of the Tax Code of the Russian Federation ). At the same time, paragraph 2 of Art. 146 and art. 149 of the Tax Code of the Russian Federation establishes lists of transactions exempt from taxation. Since these lists do not include transactions for the transfer of property rights to residential buildings or residential premises, as well as shares in them, the transfer by taxpayers of the right to claim (property rights) for the construction of such objects paid for by them is subject to taxation. According to paragraph 1 of Art. 153 of the Tax Code of the Russian Federation , when transferring property rights, the tax base for VAT is determined taking into account the features established by Art. 155 Tax Code of the Russian Federation .

Based on clause 3 of Art. 155 of the Tax Code of the Russian Federation , when transferring property rights to residential buildings or residential premises, shares in residential buildings or residential premises, garages or parking spaces, the tax base is determined as the difference between the cost at which property rights are transferred, taking into account tax, and the costs of acquiring these rights . This position is reflected in the Letter of the Ministry of Finance of Russia dated April 16, 2008 No. 03‑07‑11/149 . Arbitration courts also agree with this point of view ( resolutions of the FAS ZSO dated November 10, 2008 No. F04-6806/2008(15526‑A46-42) , FAS VVO dated August 7, 2008 No. A28-370/2008-10/21 , etc.) .

The moment of determining the tax base is the date of state registration of the assignment transaction ( clause 8 of Article 167 of the Tax Code of the Russian Federation , Letter of the Federal Tax Service for Moscow dated March 28, 2008 No. 19-11/30092 ).

Note: Ch. 21 of the Tax Code of the Russian Federation does not define what costs are recognized as expenses for the acquisition of an assigned property right. In this regard, the arbitrators of the FAS Eastern Military District, in A28-370/2008-10/21 dated 08/07/2008 , indicated that in order to determine the costs of acquiring these rights, by which the VAT tax base can be reduced, one should be guided by paragraphs. 2.1 clause 1 art. 268 of the Tax Code of the Russian Federation , that is, take into account not only the acquisition price of these property rights, but also the costs associated with their acquisition and sale.

The amount of VAT payable to the budget upon assignment of property rights is determined at the calculated rate of 18/118 ( clause 4 of Article 164 of the Tax Code of the Russian Federation ).

Example 2.

Before the completion of construction and commissioning of the residential building, the shareholder in August 2009 entered into an agreement on the assignment of claims, according to which he assigned his property rights to apartments and parking spaces in houses under construction to another organization. As a result, the taxpayer received income in the total amount of RUB 23,600,000. The total amount of expenses associated with the acquisition of property rights is 20,650,000 rubles.

The tax base will be 2,950,000 rubles. (23,600,000 - 20,650,000). The amount of VAT accrued on the transaction is RUB 450,000. (RUB 2,950,000 x 18/118).

When transferring shares in the construction of non-residential buildings, the procedure for determining the tax base for VAT is neither Art. 155 , nor other norms of Ch. 21 of the Tax Code of the Russian Federation has not been established. In this regard, the financial and tax departments believe that the accountant should be guided by clause 2 of Art. 153 of the Tax Code of the Russian Federation , according to which, when determining the tax base, proceeds from the transfer of property rights are formed on the basis of all taxpayer income associated with settlements for payment of these property rights ( letter of the Ministry of Finance of Russia dated July 14, 2008 No. 03-07-11/254 , Federal Tax Service for the city Moscow dated March 28, 2008 No. 19-11/30092 ). Moreover, in this case, the moment of determining the tax base is established according to the general rule - on the basis of clause 1 of Art. 167 of the Tax Code of the Russian Federation , that is, VAT must be calculated on the earliest of the following dates:

1) the day of transfer of property rights;

2) the day of payment, partial payment towards the upcoming transfer of property rights.

Example 3.

A participant in the shared construction of a business center invested funds in the amount of 70,000,000 rubles. Subsequently, the right to space in a building under construction was assigned to another organization for RUB 86,140,000.

The tax base for VAT will be 86,140,000 rubles, and the tax amount will be 13,140,000 rubles. (RUB 86,140,000 x 18/118).

To be fair, we note that some experts consider it possible not to charge VAT when assigning property rights to shares in non-residential buildings. This position is based on the fact that in this case there is an object of taxation (transfer of property rights), but Ch. 21 of the Tax Code of the Russian Federation does not establish the procedure for determining the tax base. Obviously, the investor (shareholder) will have to prove the legality of tax savings in court. Unfortunately, it cannot be said that the arbitrators will side with the taxpayer, since the positive court decisions available in the legal reference databases date back to the period before 2006, when Art. 155 of the Tax Code of the Russian Federation did not regulate the assignment of rights to shares in buildings under construction at all. At the same time, since the new edition of this article, as noted above, does not establish rules for determining the tax base for “non-residential” concessions, it is possible that the courts will continue to be on the side of taxpayers.

And one more nuance regarding the deduction of VAT . The Federal Tax Service for Moscow, in Letter No. 19-11/30092 , rightly noted that the specifics of applying the deduction of the amount of VAT paid by the taxpayer upon the acquisition of property rights, Art. 171 and 172 of the Tax Code of the Russian Federation has not been established. This means that the right to deduction arises upon the existence of an invoice. At the same time, the developer issues this document after completion of construction and transfer of a share of the finished facility to the investor. Therefore, during the period of assignment of rights, deduction of VAT from the cost of the share (the amount of funds transferred to the developer) is not possible. After completion of construction, this investor is no longer an investor, since he has transferred his rights to another person. This means that the developer will not issue him a consolidated invoice, that is, deduction of VAT is not possible at a later period.

Since the problem of taxation and the application of deductions in relation to the assignment of rights to shares in non-residential buildings has not been resolved by law, we can recommend that investors (shareholders) avoid making such transactions if possible. An alternative is the purchase and sale of a share in a completed building (VAT is charged on the contract price, but the tax presented by the developer is deducted in the generally established manner).

Income tax

The determination of the tax base upon assignment of a claim does not depend on the type of real estate: residential or non-residential. The tax base is calculated on the date of state registration of the assignment agreement as the difference between the income received from the assignment of the right, excluding VAT ( clause 1, clause 1, article 248 , clause 1, article 249 of the Tax Code of the Russian Federation ) and the costs of acquiring and implementing the assigned right ( clause 1, clause 1, article 253 , clause 2.1, clause 1, article 268 of the Tax Code of the Russian Federation ). An investor may include, for example, the costs of paying for services under concluded agency agreements to search for buyers of property rights ( Letter of the Federal Tax Service for Moscow dated December 6, 2007 No. 20-12/116732 ).

Please note: The assignment of rights by the investor (shareholder) is not subject to clause 1 of Art. 279 of the Tax Code of the Russian Federation , since this article applies only to agreements for the assignment of monetary claims. On this basis, we believe that when assigning a share in construction at a loss, one must be guided by the general rules set out in Art. 268 Tax Code of the Russian Federation .

Accounting

Since it is initially planned to assign the right to a share in a facility under construction, the property right that has arisen for the investor should be qualified as a financial investment ( clauses 2 and 3 of PBU 19/02 “Accounting for Financial Investments” [4]) and reflected in the account of the same name 58. Sales (assignment ) property rights are reflected through sales accounts.

Example 4.

Start-Stroy LLC ceded the rights to space in an office center building under construction to Comfort LLC for RUB 86,140,000. (including VAT – RUB 13,140,000). According to the assignment agreement, funds were transferred to the current account of Start-Stroy LLC in the following order:

– prepayment of 70% of the contract price (RUB 60,298,000);

– 30% (RUB 25,842,000) after state registration of the transaction.

The actual costs of Start-Stroy LLC for the acquisition of this property right amounted to 70,000,000 rubles.

The following entries must be made in accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| On the date of receipt of partial advance payment | |||

| Received funds in exchange for assignment of rights | 51 | 76 | 60 298 000 |

| VAT charged on prepayment (RUB 60,298,000 / 118 x 18) | 76‑VAT | 68 | 9 198 000 |

| On the date of state registration of the assignment | |||

| Income under the assignment agreement is reflected | 76 | 91-1 | 86 140 000 |

| VAT charged | 91-2 | 68 | 13 140 000 |

| Accepted for deduction of VAT on prepayment | 68 | 76‑VAT | 9 198 000 |

| The amount of expenses associated with the acquisition of the transferred property right has been written off | 91-2 | 58 | 70 000 000 |

| Cash received as final payment for the transaction | 51 | 76 | 25 842 000 |

If the investor (investor) applies the “simplified tax”

, the funds received under an agreement for the assignment of claims to a third party to participate in the construction of real estate are income from the sale of property rights and are subject to a single tax in the period of their actual receipt at the cash desk or to the current account ( Letter from the Ministry of Finance Russia dated May 12, 2008 No. 03‑11‑04/2/83 ). At the same time (if the object of taxation is income minus expenses), the costs of acquiring the right of the “simplified” organization do not have the right to be included in expenses, since this type of expense is not provided for in paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation ( Letter of the Ministry of Finance of Russia dated July 31, 2007 No. 03‑11‑04/2/191 ).

[1] Approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

[2] Approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n.

[3] Approved by Order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n.

[4] Approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n.

Save or print the declaration

After you have entered the information, use the “Check” button to make sure that you have filled out everything. If you plan to submit the document to the tax office in person, send it for printing. Or save as a file with the .xml extension.

Send the declaration The declaration can be uploaded to the tax office website in your personal account in the form of an xml file. To do this, you need to follow this path: home → “Life situations” → “Submit a 3‑NDFL declaration” → “Download”.

How quickly will the money come?

If you are filing a tax refund and filled out everything correctly the first time, then prepare to wait up to four months. The tax office has a month to check the declaration, but the department can conduct a desk audit, which will lengthen the process to three months. If the tax office has questions, depending on the inspector’s requirements, you will need to provide additional documents or submit an adjusted return, which, naturally, will also affect the waiting time. After the inspector approves the deduction, another month is given to pay the money.