Audio version of the article, listen

91 accounting accounts are closed depending on the period:

- the difference between credit and debit is reflected at 91.09;

- at the synthetic level monthly at 99;

- analytical levels of subaccounts are reset at the end of the year;

- in 1C, closing is automated;

- At the end of the year, the balance sheet is reformed.

Closing the month is, in essence, clearing the balances on some synthetic accounts. The law suggests that there should be no balance in the accounts responsible for collecting costs, income and expenses from core and other activities.

What are other expenses?

The concept of “other expenses” is spelled out in the same chapter of the PBU, but in section 10/99. Here is an open list of expenses - this means that the accountant can classify as other expenses whatever he deems necessary. However, this can be done if there are no contradictions with current legislation and the accounting policies of the enterprise.

Most often, this type of expense includes:

- losses from the sale of own funds;

- expenses related to the company’s bank account;

- a fund for doubtful debts, the formation of which is the responsibility of each organization, regardless of size;

- various fines imposed on the company.

Application of Dt 91 and Kt 01 when selling assets

When selling an OS, the seller creates accounts:

- Dt 62 Kt 91/1 - we record income from the sale of fixed assets;

- Dt 91 Kt 68 - reflect VAT;

- Dt 02 Kt 01 - write off accumulated depreciation charges;

- Dt 91/1 Kt 01/disposal - write off the residual value of fixed assets.

When closing the month, the financial result of the operation is revealed. Balances on subaccounts 91/1 and 91/2 are written off to subaccount 91/9. If the balance is debit, then a loss is recognized for the transaction; if it is a credit, a profit is recognized.

Subaccounts to account 91

In order to correctly carry out analytical accounting, additional sub-accounts can be opened to account 91:

- 91.1. The name of the subaccount is other income. The company receives such profit not from the main direction, but from additional activities.

- 91.2. The name of the subaccount is other expenses. In this case, all additional expenses that are in no way related to the main activity of the enterprise are taken into account.

- 91.9. The name of the subaccount is the balance of other income/expenses. This is the difference between profit and expenses on main account 91. This amount is written off to account 99. The procedure is performed every month.

The listed subaccounts in some accounting programs are designated 91.01, 91.02 and 91.09, respectively.

Features of annual closure

According to the accounting rules, every month it is necessary to close exclusively the synthetic level of the account, without taking into account subaccounts. They accumulate analytical data all year long:

- By type of income/expenses.

- By cost item.

- By department.

At the end of the year, the accounting department must reform the balance sheet. This means that when closing 91 accounts, transactions must reset all analytical subaccounts that are subject to such an operation:

- Dt 91.01 Kt 91.09 – the accumulated balance in the subaccount is reset to zero;

- Dt 91.09 Kt 91.2 – accumulated expenses are closed.

The resulting result as of September 91 closes at 99 “Profits and Losses”, depending on the financial result of the company.

Reflection of other profits and expenses in reports

Other profits and expenses must also be shown in reports as income and expenses from the main activities of the enterprise. They are indicated:

- In accounting reports . Other profit is indicated on line 2340 OFR. As for other expenses, they are indicated on line 2350 of the OFR. They are also displayed on the balance sheet. Profits and expenses are included in accounts receivable or credit, if such a debt was formed at the end of the reporting period.

- In tax reports . In this case, you need to focus on line 100 of Appendix 1 to sheet 02. Other profit is indicated here. They also focus on line 200 of Appendix 2 to sheet 02. Other expenses are shown here.

Often the figures given in the financial statements differ from the data in the tax return. This is due to interest charges. In accounting reports they are indicated separately, and in documents to the tax office they are included in the total amount.

In addition, a discrepancy appears if property tax was paid and the accountant included it in the line of other expenses. In the tax inspectorate report, this payment is included among indirect expenses.

Application of transactions when liquidating an operating system

During liquidation, on the day of signing the act on write-off of fixed assets, the following records are compiled:

- Dt 02 and Kt 01/disposal - write off accumulated depreciation;

- Dt 91 and Kt 01 (Dt 91/1 and Kt 01/disposal) - write off the residual value of fixed assets.

Read more about the write-off of fixed assets in the article “Unified Form No. OS-4 - Act on the write-off of an fixed asset.”

If the OS is liquidated before the expiration date, then it does not have time to fully depreciate. Thus, at the end of the month a debit balance is formed for this business operation, the amount of which is subsequently applied to reduce the financial result.

Account characteristics

To record information about the availability and movement of materials, account 10 is used in accounting.

This is an active account that has a debit balance characterizing the availability of materials on certain dates.

The receipt of materials is reflected in the debit of the account based on the primary documents received by the organization, and their disposal, including write-off to production, is reflected in the credit of the account. At the same time, the company prepares primary expenditure documents for disposal.

The final account balance is determined by adding the opening balance with the turnover on the debit of account 10, and subtracting from the resulting result on the credit of account 10.

Attention! In the balance sheet, information on account 10 is reflected in line 1210.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

What is account 10 used for in accounting “materials”

The chart of accounts establishes that account 10 takes into account objects that are defined in accounting in accordance with PBU 5 as materials.

Materials include material assets that are used in the form of inventory, raw materials for the production of finished products, provision of services, performance of work, for resale if necessary, for the implementation of the management process of a business entity.

If material assets are acquired for the purpose of resale on an ongoing basis, then they are goods and a different account is used to account for them.

Materials are accounted for on account 10 at the actual costs incurred for their acquisition or at accounting prices, depending on the methods chosen in the organization’s accounting policy.

Accounting can be maintained for each unit of materials, batch, or group. The company independently determines how to record them based on the characteristics of its activities, as well as in order to ensure control over their availability and movement.

Attention! Materials located in the company may not belong to it by right of ownership, then they are recorded on off-balance sheet accounts (002 and 003).

How to keep furniture records in accounting

Office furniture can be accounted for through account 01 “Fixed Assets” as part of fixed assets or as part of inventories (MPI) on account 10 “Materials”. It depends on the:

- The cost of the purchased piece of furniture.

- Its useful life (hereinafter - SPI).

The procedure for writing off furniture differs in different accounting options.

Currently, PBU 6/01 and PBU 5/01 are still used in accounting. But starting with reporting for 2021, in place of PBU 5/01 it is necessary to use FSBU 5/2019 “Reserves”. This standard can be started to be used earlier, as indicated in paragraph 2 of Order of the Ministry of Finance dated November 15, 2019 No. 180n.

Also see “How to apply the new accounting standard “Inventories” from 2020“.

Next, we will consider accounting for furniture as part of the operating system and inventory.

Which accounts does account 10 correspond to?

Account 10 can correspond with the following accounts:

From the debit of account 10 to the credit of accounts:

- Account 10 - when transferring materials between warehouses;

- Account 15 - when purchasing materials using accounts 15, 16 in accounting;

- Account 20 - when registering materials from the main production;

- Account 23 - when registering materials from auxiliary production;

- Account 25 - when recording materials that arose during the implementation of general production expenses;

- Account 26 - when recording materials that arose during the implementation of general business expenses;

- Cch. 28 – when registering irreparable defects as materials;

- sch. 29 - when receiving materials from service farms;

- sch. 40 - when adjusting the actual cost;

- sch. 41 - when converting goods purchased for resale into materials;

- sch. 43 - when converting finished products into materials;

- sch. 44 - when recording material that arose when incurring sales expenses;

- sch. 60 - upon receipt of materials from suppliers;

- sch. 66 - upon receipt of materials in the form of short-term trade credits or loans;

- sch. 67 - upon receipt of materials in the form of long-term trade credits or loans;

- sch. 68 - regarding fees or taxes attributable to the cost of materials;

- sch. 71 - upon receipt of materials from accountable persons;

- sch. 75 - when the founders contribute shares with materials;

- sch. 76 - upon receipt of materials from other suppliers, inclusion of the cost of services in the price of materials, etc.

- sch. 79 - upon receipt of materials from branches or head offices;

- sch. 80 - when making contributions from partnership participants in materials;

- sch. 86 - upon receipt of materials as targeted funding;

- sch. 91 - upon receipt of materials during the disassembly of OS objects;

- sch. 97 - adjustment of the cost of materials charged to deferred expenses;

- sch. 99 - when registering materials arising due to emergency circumstances.

You might be interested in:

Account 28 in accounting: how defects in production are taken into account, characteristics of the account, postings

According to the credit of the account, it corresponds with the debit of the following accounts:

- sch. 08 - when writing off materials for preparation for operation of non-current assets, capital construction, etc.;

- sch. 10 – when transferring materials between warehouses;

- sch. 20 - when releasing materials to main production;

- sch. 23 – when releasing materials to auxiliary production;

- sch. 25 – when releasing materials for general production needs;

- sch. 26 – when releasing materials for general business needs;

- sch. 28 - when releasing materials to correct defects;

- sch. 29 – when releasing materials to subsidiary farms;

- sch. 44 - when releasing materials for sales expenses;

- sch. 45 - for the amount of shipped materials, the revenue for which has not yet been recognized in accounting;

- sch. 76 - upon disposal of materials to another counterparty;

- sch. 79 - when transferring materials to branches or head offices;

- sch. 80 - when paying off a partner’s share with materials;

- sch. 91 - when writing off the cost of materials upon their disposal;

- sch. 94 - when a shortage of materials is detected;

- sch. 97 - when assigning the cost of materials to future expenses;

- sch. 99 - when writing off materials for emergency circumstances.

Examples of transactions and postings on account 14

Example 1. Markdown of goods

Let’s say Prim LLC purchased a group of goods worth 23,000 rubles. Based on the results of the 3rd quarter of 2021, they were marked down due to loss of presentation to 18,000 rubles. In March 2021, 8 units were sold. for 14,400 rub.

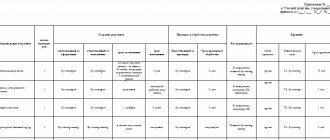

Table of entries for account 14 when marking down goods at Prim LLC:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 60 | 41.01 | 23 000 | Goods accepted for accounting | Packing list |

| 91.02 | 14.01 | 5 000 | A reserve for depreciation has been created | Manager's order, Accounting certificate |

| 99 | 68.04.2 | 1 000 | Permanent tax liability | Accounting information |

| 62.01 | 90.01.1 | 14 400 | Revenue from sales of goods is reflected | Packing list |

| 90.03 | 68 VAT | 2 197 | VAT accrual on sales | Invoice |

| 90.02.1 | 41.01 | 18 400 | Write-off of cost reflected | Packing list |

| 14 | 91.02 | 4 000 | Write-off of the reserve amount | Accounting information |

| 68.04.2 | 99 | 800 | Permanent tax asset | Accounting information |

Account 02 Depreciation of fixed assets

Depreciation of fixed assets can be calculated in the following ways:

- in a linear way;

- reducing balance method;

- the method of writing off the cost by the sum of the numbers of years of useful life;

- by writing off the cost in proportion to the volume of products (works).

The chosen method is fixed in the accounting policy. You can use different depreciation methods for different groups of homogeneous fixed assets.

Depreciation is accrued monthly starting from the month following the one in which the property was accepted for accounting as a fixed asset.

The amounts of accrued depreciation are written off as expenses for ordinary activities, these are:

Debit 20,23,25,26,29 - Credit 02.

Or included in other expenses (if the object is of a non-production nature or is intended for rental, if renting is not a regular type of activity):

Debit 91-2 - Credit 02.

If a fixed asset is used to create, modernize or reconstruct another non-current asset, then:

Debit 08 - Credit 02.