The main goal of tax accounting in the 1C program is to correctly determine the amount of the tax base for determining income tax. Calculating the base is not very difficult, and is determined as the difference between the income received and the company's expenses incurred.

The main problem is the correct attribution of certain incomes (expenses) to the required types of accounting. The result is the appearance of constant and variable differences.

The relationship between accounting and tax accounting is expressed by the formula:

BU = NU + PR + VR , where

BU – tax accounting amount;

NU – tax accounting amount;

PR – constant difference;

TD – time difference.

Preliminary program setup

To calculate income tax, organizations use a special accounting provision - PBU 18/02. Despite all the apparent complexity, it is precisely this method that allows you to take into account the differences between accounting and tax accounting.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

In practice, it often happens that one amount is reflected in full in accounting, but only a part, or nothing at all, goes to the tax office. This provision exists for the connection of NU and BU.

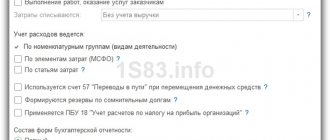

The 1C: Accounting program supports the use of PBU 18/02. You can enable its use directly in your organization’s accounting policy, as shown in the figure below.

From the user's point of view, nothing changes in terms of entering information. The accountant will not have to enter any additional data. It is enough to configure the program correctly.

From the point of view of reporting and internal calculations, the changes will be more significant. In this case, reporting, for example, turnover, will contain detailed information on the formation of the tax base. This includes, for example, data on the calculation of income tax (68.04.02), account 77, etc.

If you need to calculate income tax, it is strongly recommended to clarify in the program that PBU 18 will be applied.

Automation

In this article we do not provide accounting records to reflect the transactions considered. We are ready to consider them in more detail in our next publications.

But we propose to consider how accounting and tax accounting are automated in a specialized software product, a standard industry solution “Ortikon: Leasing. Accounting", which operates on the 1C: Enterprise 8.3 platform and is created on the basis of the standard configuration "1C: Accounting 8".

Since the basic configuration is created by 1C, this approach, on the one hand, allows the accountant to have full support for conducting standard operations, preparing and submitting regulated reports, on the other hand, to receive additional functionality that allows accounting and tax accounting of leasing transactions contracts.

Program “Ortikon: Leasing. Accounting" is registered in the Unified Register of Russian Programs for Electronic Computers and Databases and is published. Detailed information about the software product is presented on the 1C website in the section on industry and specialized solutions.

Tax accounting in 1C

As stated earlier, not all income and expenses need to be taken into account when calculating income taxes. This information is indicated in the chart of accounts. In the figure below you can see that account 90.04 does not have a checkbox in the NU column, while account 90.07.1 has the flag checked.

In this case, if the movement is carried out on DT 90.04, the debit will be recorded as zero in tax accounting. If the loan account has the NU flag set, then its amount will be reflected in the tax accounting for the loan accordingly.

Thus, both debit and credit amounts in tax accounting may differ or may be the same. There are also often cases when a certain amount is not reflected in tax accounting at all.

The figure below shows that the amounts in all three movements are reflected in both debit and credit. This follows from the fact that in accounts 90.08.1 and 26 the flags for reflection in tax accounting are set.

Please note that in the figure above, in addition to the NU fields, there are also the PR and VR fields. These vestries were discussed earlier. The sum of all lines of one movement (NU, PR, VR) must match the accounting amount, which is reflected in the “Amount” column.

The income tax calculation itself can be done automatically using month-end closing processing, which is located in the “Operations” section. The calculation is made by the regulatory operation of the same name, located in the fourth section.

Introduction to PBU 18/02 - permanent differences

Published 10/30/2018 11:09 Author: Administrator We offer you an immersion in the topic of PBU 18/02 “Accounting for corporate income tax calculations”, regardless of whether you apply it in your business or not. We will try to show the relationship between the concepts of this complex PBU and look at “how it works” with examples.

PBU 18/02 is called upon to use special postings to link the income tax calculated in accounting and tax accounting.

Previously, we already looked at the interweaving of the concepts of PBU 18/02 in the article Basics of accounting using PBU 18/02 in 1C: Enterprise Accounting 8

Let's talk about this in more detail. Pay attention to the key feature of the concepts of “assets and liabilities” according to PBU 18/02.

There are four in total:

- permanent tax liability,

- deferred tax liability,

- permanent tax asset,

— deferred tax asset.

The concept of “tax liability” (permanent and deferred)

In the case of a permanent tax liability, it is understood that the organization has a certain “constant (conditional overpayment) for income tax”, and it will always remain so (“Pay more in principle”).

In the case of a deferred tax liability, it is implied that in the current period the organization is postponing payment of tax, but will definitely pay it in the future (“Pay less now”).

The concept of “tax asset” (permanent and deferred)

In the case of a permanent tax asset, it is implied that the organization has some “constant (conditional savings) on income tax”, and it will always remain so (“Pay less in principle”).

In the case of a deferred tax asset, it is implied that in the current period the organization “conditionally overpaid” the tax, but in the future it will necessarily compensate for this “overpayment” (“Will pay less in the future”).

Constant differences

Important Features:

1. Permanent differences affect the company’s net profit and are accrued from net profit through account 99.

2. Permanent differences are not reflected in the balance sheet because have no account balances at the end of the current period.

3. We do not accept permanent differences and will never accept them in the future for the purposes of calculating income tax with the budget.

When do permanent differences occur?

1. Permanent tax liability is the most common case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of expenses not accepted in tax accounting (394-354=40). We equalize the income tax in accounting by posting:

D-t 99.02.3 K-t 68.04.2 (40*20%=8).

When using PBU 18/02, account 68.04.2 appears, which is key because It is on this basis that the income tax payable to the budget is formed. This tax amount will be indicated in the income tax return. In this case, postings are generated for a specific analytical accounting object.

Principles of tax accounting in 1C

1. Accounting and tax accounting are carried out in parallel, i.e. One operation generates data from both accounts;

2. Accounting and tax accounting data can be compared using a control number because The rule BU=NU+PR+BP applies. In other words, accounting data always corresponds to tax accounting data with permanent and temporary differences. In this case, the differences can be both with a sign (+) and with a sign (-).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8 edition 3.0.

The organization paid tax penalties (VAT) for late payment. This type of expense is not accepted for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation)

We compare the data according to the rule BU=NU+PR+VR {2705.00 (BU)=2705.00 (PR)}. A permanent difference has been formed.

The operation “Closing the month” creates a permanent tax liability. The formula for calculation (PNO=PR*20%) and accounting entries (D-t 99.02.3-K-t 68.04) are indicated for reference in column 7 of the calculation certificate.

We generate a report on financial results (form No. 2). The permanent tax liability is reflected in line 2421 with a minus sign.

2. A permanent tax asset is a pleasant but rare case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of income not accepted into the NU (300+35=335). We equalize (reduce) the income tax in accounting by posting:

D-t 68.04.2 K-t 99.02.3 (335*20%=67).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8.3.

The organization received free assistance from the founder with a 100% share in the authorized capital. This type of income is not accepted for tax purposes (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

We compare the data according to the rule BU=NU+PR+VR {300,000.00 (BU)=300,000.00 (PR)}. A permanent difference has been formed.

With the operation “Closing the month” we create a permanent tax asset.

We generate a report on financial results (form No. 2). The permanent tax asset is reflected in line 2421 with a plus sign.

If in the current period an organization has both permanent tax liabilities (PNO) and permanent tax assets (PNA), they are reflected separately by type of liability.

In Form No. 2 (Report on financial results) PNO and PNA are shown as a total amount with a transcript attached.

Analytical accounting of permanent differences

If an organization has only permanent differences in its accounting, then analytical accounting for accounting accounts can be carried out by dividing income and expenses into “accepted for tax accounting purposes” and “not accepted for tax accounting purposes.”

“Meaningful achievements require significant effort.”

Author of the article: Irina Kazmirchuk

Introduction to PBU 18/02 - permanent differences

We offer you an immersion in the topic of PBU 18/02 “Accounting for corporate income tax calculations”, regardless of whether you use it in your business or not. We will try to show the relationship between the concepts of this complex PBU and look at “how it works” with examples.

PBU 18/02 is called upon to use special postings to link the income tax calculated in accounting and tax accounting.

Previously, we already looked at the interweaving of the concepts of PBU 18/02 in the article Basics of accounting using PBU 18/02 in 1C: Enterprise Accounting 8.

Let's talk about this in more detail. Pay attention to the key feature of the concepts of “assets and liabilities” according to PBU 18/02.

There are four in total:

- permanent tax liability,

- deferred tax liability,

- permanent tax asset,

— deferred tax asset.

The concept of “tax liability” (permanent and deferred)

In case of permanent tax liability

it is implied that the organization has a certain “constant (conditional overpayment) for income tax”, and it will always remain so (“Pay more in principle”).

In case of deferred tax liability

it is implied that in the current period the organization is postponing payment of tax, but in the future it will definitely pay it (“Pay less now”).

The concept of “tax asset” (permanent and deferred)

In the case of a permanent tax asset

it is implied that the organization has a certain “constant (conditional savings) on income tax”, and it will always remain that way (“Pay less in principle”).

In case of a deferred tax asset

it is implied that in the current period the organization “conditionally overpaid” the tax, but in the future it will definitely compensate for this “overpayment” (“Will pay less in the future”).

Constant differences

Important Features:

1. Permanent differences affect the company’s net profit and are accrued from net profit through account 99.

2. Permanent differences are not reflected in the balance sheet because have no account balances at the end of the current period.

3. We do not accept permanent differences and will never accept them in the future for the purposes of calculating income tax with the budget.

When permanent differences occur?

- Permanent tax liability

– This is the most common case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of expenses not accepted in tax accounting (394-354=40). We equalize the income tax in accounting by posting:

D-t 99.02.3 K-t 68.04.2 (40*20%=8).

When using PBU 18/02, account 68.04.2 appears, which is key because It is on this basis that the income tax payable to the budget is formed. This tax amount will be indicated in the income tax return. In this case, postings are generated for a specific analytical accounting object.

Principles of tax accounting in 1C

1. Accounting and tax accounting are carried out in parallel, i.e. One operation generates data from both accounts;

2. Accounting and tax accounting data can be compared using a control number because The rule BU=NU+PR+BP applies. In other words, accounting data always corresponds to tax accounting data with permanent and temporary differences. In this case, the differences can be both with a sign (+) and with a sign (-).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8 edition 3.0.

The organization paid tax penalties (VAT) for late payment. This type of expense is not accepted for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation)

We compare the data according to the rule BU=NU+PR+VR {2705.00 (BU)=2705.00 (PR)}. A permanent difference has been formed.

The operation “Closing the month” creates a permanent tax liability. The formula for calculation (PNO=PR*20%) and accounting entries (D-t 99.02.3-K-t 68.04) are indicated for reference in column 7 of the calculation certificate.

We generate a report on financial results (form No. 2). The permanent tax liability is reflected in line 2421 with a minus sign.

- Permanent tax asset

– a pleasant, but rarely encountered case of permanent differences.

As can be seen in the example, accounting and tax profits differ by the amount of income not accepted into the NU (300+35=335). We equalize (reduce) the income tax in accounting by posting:

D-t 68.04.2 K-t 99.02.3 (335*20%=67).

How it works in 1C

Let's consider an example of reflection in 1C: Enterprise Accounting 8.3.

The organization received free assistance from the founder with a 100% share in the authorized capital. This type of income is not accepted for tax purposes (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

We compare the data according to the rule BU=NU+PR+VR {300,000.00 (BU)=300,000.00 (PR)}. A permanent difference has been formed.

With the operation “Closing the month” we create a permanent tax asset.

We generate a report on financial results (form No. 2). The permanent tax asset is reflected in line 2421 with a plus sign.

If in the current period an organization has both permanent tax liabilities (PNO) and permanent tax assets (PNA), they are reflected separately by type of liability.

In Form No. 2 (Report on financial results) PNO and PNA are shown as a total amount with a transcript attached.

Analytical accounting of permanent differences

If an organization has only permanent differences in its accounting, then analytical accounting for accounting accounts can be carried out by dividing income and expenses into “accepted for tax accounting purposes”

and

“not accepted for tax accounting purposes.”

“Meaningful achievements require significant effort.”

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+1 Elena 03/15/2020 19:53 Very useful article! Thank you!

Quote

-1 Marina Serebryakova 11/08/2018 01:43 I liked it very much! I'm waiting for the next materials.

Quote

0 Marina Serebryakova 08.11.2018 01:42

Quote

0 Goncharova Alina 10/31/2018 03:02 Thank you for the article! I'm looking forward to the next article

Quote

Update list of comments

JComments

Analysis of the state of income tax regulations

Of course, most of the calculations that affect the correctness of income tax calculations are made automatically by the program, but there are cases of erroneous situations. A special report that analyzes accounting will help you deal with them.

The main form of the report indicates the period for which we want to analyze the data and organization. The report layout shows the different sections in which the data is grouped. You can go to any of them by left-clicking.

The figure below shows that we have entered the "Expenses for ordinary activities" section. The block with depreciation is highlighted in red, which means failure to comply with the rule BU = NU + PR + VR.

Having moved to the subsection with depreciation, we received a report that shows in which document and by what amount the error in equality occurred.

Pay attention to the checkbox in the “By Documents” add-on. This is what allows you to see in the report links to documents in which the program found erroneous data.

Comparison of BU and NU data

To compare NU and BU, as well as identify accounting errors in 1C 8.3, you can use standard reports from the Reports item, depending on the specific data of interest to the accountant:

Let's compare the data of NU and BU in 1C 8.3 using the example of the Turnover Balance Sheet.

To reflect NU, BP, PR data in the report, as well as control the equality BU=NU+BP+PR, you need to check similar boxes in the report settings, using the Show settings button, on the Indicators tab.

After checking the boxes, additional lines will appear in the report: