Features of bills of exchange as securities

Being an unconditional debt document, a bill of exchange can be:

- Simple, i.e. drawn up between two persons and having the nature of a promissory note of the direct debtor;

- Transferable – a document, the preparation of which takes place with the participation of a third party (used to formalize the transfer of receivables).

Both a simple and a bill of exchange can be:

- Someone else's or your own;

- Discount – interest rate, i.e. providing for an interest rate at which interest will be calculated on the amount of the bill, or interest-free.

Both types of bills of exchange can be commodity, i.e., confirm the debt under a contract for the supply of goods and materials, or financial. In this case, the subject of the transaction is the bill itself. The difference in the purpose of using bills of exchange affects the accounting accounts that will be used to account for bills of exchange.

Features of organizing accounting and document flow

Operations with bills of exchange at OJSC Steklonit are quite diverse. First of all, the company accepts bank bills as payment for delivered products. Received bills of exchange can be presented to the issuing bank for payment or transferred to a supplier or contractor for raw materials received or work performed. In addition, the plant issues its own bills of exchange, which are transferred to suppliers and contractors, which allows for a certain deferment of obligations and increases working capital. When presented by the bill holders, the plant's bills are paid in cash or products.

| The finance department is responsible for issuing bills and registering their acceptance and transfer at the plant. At the same time, the functions of working with bills of exchange are distributed among several specialists of the department: they accept and check bank bills, draw up acceptance certificates, fill out forms for issuing their own bills, etc. Accounting and tax accounting of all transactions involving settlements using bills of exchange is carried out by the accounting department. Accounting checks the correctness and completeness of the preparation of primary documents and reflects transactions for accounting for settlements with bills of exchange in the accounting registers. Developed document flow and distribution of document processing functions among a large number of users were taken into account during automation. The developed electronic documents and directories ensured that the necessary business transactions were reflected in the program based on “1C:Enterprise 7.7”, the automatic filling of printed forms and the required differentiation of access rights. |

Accounting for bills of exchange: postings

Often, a promissory note in a buyer-seller relationship plays the role of a promissory note, since it arises in a situation where the buyer cannot pay for the goods with available funds, and the seller agrees to accept the bill. Such a commodity bill is not considered a security until it is transferred to a third party. To account for such bills, the buyer has an account. 60 open a subaccount 60/3 “Bills issued”, and the seller opens a subaccount 62/3 “Bills received”.

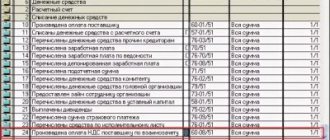

Transactions with it are recorded on both sides in the settlement accounts by postings:

| Operation | D/t | K/t |

| Accounting entries for bills issued | ||

| Reflected delivery debt | 60/1 | 60/3 |

| Security for future payment issued (behind balance) | 009 | |

| If the bill is interest-bearing, then the buyer’s debt will increase by the amount of accrued interest | 91 | 60/3 |

| Repayment of a debt | 60/3 | 51 |

| Writing off the bill after payment | 009 | |

| Accounting entries for bills received | ||

| The debt on the shipped goods is reflected | 62/ 3 | 62/1 |

| Payment security received | 008 | |

| Interest income from the bill | 62/3 | 91 |

| Received payment for goods secured by a bill of exchange | 51 | 62/3 |

| Writing off a bill after receiving payment | 008 | |

Example 1

Blitz LLC, to secure payment obligations under the supply agreement, Atrium LLC issued a promissory note in the amount of RUB 236,000. including VAT RUB 36,000. The accounting records of both organizations will reflect:

Operation D/t K/t Sum At Blitz LLC Debt to supplier for goods 41 60/1 200 000 VAT 19 60/1 36 000 A bill of exchange was issued 60/1 60/3 236 000 The bill is included in the balance sheet 009 236 000 Amortization 60/3 51 236 000 Writing off a bill 009 236 000 At Atrium LLC Revenue reflected 62/1 90/1 236 000 VAT charged 90/3 68 36 000 The cost of goods is written off 90/2 41 100 000 Bill received 62/3 62/1 236 000 The bill is included in the balance sheet 008 Payment for goods and materials received 51 62/3 236 000 Writing off a bill 008 236 000

Procedure for issuing a bill of exchange

The release should be considered carefully. The bill of exchange requires strict adherence to the statutory form. Otherwise, it will be a promissory note - the unconditionality of fulfillment of the specified obligation will be lost.

There is a developed form in Russian legislation. Its use is discretionary (free) in nature. There are also no additional requirements for payment of duties and registration of this security.

On the one hand, this is undoubtedly another advantage; on the other hand, it forces drafters to be more attentive to the procedure for issuing an obligation. Many people try to work on printed forms that correspond to the form developed by the legislator and are protected. This form is sold in banks and treasury organizations.

Published on paper, the content is written in or printed.

The following details are required for entry:

- Name

- obligation

- payment details

- amount of payment

- payment term

- place of fulfillment of the obligation

- date and place of creation of the paper

- drawer's signature.

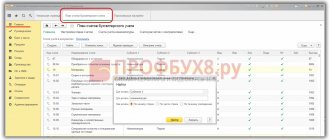

Bills of exchange in accounting as financial investments

If an enterprise, having free money, invests it in the purchase of bills issued by banks and capable of generating income, then we are talking about financial investments. Such bills are the object of purchase and sale, they are recorded in subaccount 58/2 “Debt securities”. Let's figure out how bills of exchange are accounted for in accounting. Postings:

| Operation | D/t | K/t |

| Purchase of a bill of exchange | 76 (60) | 51 |

| Acceptance for registration | 58/2 | 76 (60) |

| The difference between the purchase price and the face value is reflected | 58/2 | 91/1 |

Example 2

On January 25, 2018, the company acquired a bank bill with a face value of RUB 2,000,000, issued on January 25, 2018, with a payment due date at sight, but not earlier than May 5, 2018. Interest accrual is 8% per annum. On 04/05/2018, the company executed a compensation agreement with the condition of transferring the bill of exchange to the counterparty who performed the work worth RUB 2,000,000. without VAT. It was accepted as payment for the work. The transaction was formalized by an agreement for the transfer of a promissory note.

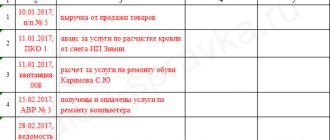

Accounting entries:

Operation D/t K/t Sum 25.01.2018 Bill paid 76 51 2 000 000 The bill is included in financial investments 58/2 76 2 000 000 31.01.2018 Accrual of interest on the bill for January 2,000,000 x 8% / 365 x 6 days. 76 91/1 2630 28.02.2018 Interest accrued for February (2,000,000 x 8% / 365 x 28) 76 91/1 12 274 31.03.2018 Interest accrued for March (2,000,000 x 8% / 365 x 31) 76 91/1 13 589 05.04.2018 The work performed was accepted for accounting 20 60 2 000 000 Interest accrued for April (2,000,000 x 8% / 365 x 5) 76 91/1 2192 The contractor was given a bill of exchange to repay the mortgage 60 91/1 2 000 000 The nominal value of the bill has been written off 91/2 58/2 2 000 000

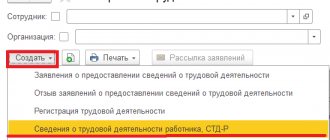

Own bills: simple and useful

A. Stunzhas, senior financial manager Procedure for issuing bills As is known, a bill is a document certifying an unconditional obligation to pay the amount specified in it upon maturity. The main documents regulating the issuance and circulation of bills of exchange are the Federal Law “On Bills of Exchange and Promissory Notes” dated March 11, 1997 N 48-FZ and the Regulations on Bills of Exchange and Promissory Notes, put into effect by a resolution of the Central Executive Committee and the Council of People's Commissars of the USSR dated August 7, 1937 . N 104/1341. It is there that the mandatory details are listed that allow you to call the document a bill of exchange.

If all these details are present, then the debt obligation will be valid, even if it is written on plain paper. But still, if you decide to issue a bill of exchange, it is better to draw it up on a printed form (you can order it at a printing house), or purchase ready-made forms issued by the Federal Treasury. However, keep in mind that the Treasury sells at least 100 forms at a time.

The content of the transaction in accordance with which the bill of exchange was issued must be reflected in the act of acceptance and transfer of bills of exchange, along with all the essential circumstances of the issue (date, series and number of the bill of exchange, its denomination, etc.). Please note that when transferring a bill of exchange as payment under a purchase and sale agreement for goods and materials, you must highlight the VAT amount in the act. Otherwise, the tax office will refuse you a deduction, since the payment order when paying on a bill of exchange indicates the purpose of payment “without VAT.”

Accounting for own bills

It is customary to distinguish between commodity bills, when the buyer issues a bill to the supplier in confirmation of his debt under an agreement for the purchase and sale of material assets, and financial bills, when the subject of the purchase and sale is the bill itself. Moreover, the bill of exchange can be either “our own production” or third parties.

Often, a bill of exchange is issued not at par, but at a discount (discount bills), or interest is charged on the amount of the bill (interest bills). There are no differences in accounting for these types of bills. In the first case, the holder’s income (and, accordingly, your expense) will be the difference between its face value and the purchase price, and in the other case, the amount of accrued interest.

In the case where a bill of exchange serves as security under a purchase and sale agreement, the amount of discount or interest for accounting purposes before the property is capitalized is included in its value (clause 15 of PBU 15/01). In tax accounting, such interest is included in non-operating expenses similar to interest on financial bills (subclause 2, clause 1, article 265 of the Tax Code of the Russian Federation). However, you must remember that the Tax Code limits the amount of interest that can be taken into account in costs when calculating income tax (Article 269 of the Tax Code of the Russian Federation).

Accounting for commodity and financial bills is different. First, let's take an example of a situation where a bill of exchange is issued to repay a debt for the supply of goods.

Example 1 Alpha LLC shipped goods to Beta CJSC under a supply agreement in the amount of 90,000 rubles. paid with her own bill at a discount. The deadline for presenting the bill for payment is no earlier than 10 months. The accountant of “Beta” (the drawer) made the following accounting entries: Debit 60 Credit 60 subaccount “Bills issued” - 90,000 rubles. — the debt under the supply agreement has been repaid; Debit 009 - 100,000 rubles. - the bill was issued at par; Debit 91-2 Credit 60 subaccount “Bills issued” - 10,000 rubles. — additional discount on the bill is accrued on the basis of the act of acceptance and transfer of the bill on the day of issue. Depending on the method chosen in the accounting policy, the last operation can be reflected in another way: Debit 97 Credit 60 “Bills issued” 10,000 rubles. — additional interest accrued on the discount bill; Debit 91-2 Credit 97 - 1000 rub. (RUB 10,000: 10 months) - part of the discount is written off monthly; Debit 60 “Bills issued” Credit 76 - 100,000 rubles. - a bill of exchange is presented for payment; Debit 76 Credit 51 - 100,000 rub. - the presented bill has been paid. The accountant of Alpha (the beneficiary) reflected the receipt of the bill with a discount as follows: Debit 62 “Bills received” Credit 62 - 90,000 rubles. — received a trade bill with a discount as payment; Debit 008 - 100,000 rub. — the received bill of exchange is taken into account at par; Debit 51 Credit 62 “Bills received” - 90,000 rubles. - the presented bill has been paid; Debit 51 Credit 91-1 - 10,000 rubles. — the discount on the presented bill has been paid; Loan 008 - 100,000 rub. - the bill is written off.

Closing a bill of exchange

Typically, bills of exchange are issued with a payment term “at sight” or “at sight, but not earlier” than a certain date. The bill of exchange is extinguished upon presentation of the security to the drawer (in the case of a promissory note). In this case, it is necessary to draw up an act of presenting bills of exchange, which indicates all the details of the bill, its denomination and the amount of payment on it. If the drawer accepts the bill, he makes payment.

After this, the original bill remains in the accounting archive of the drawer and is stored like other monetary documents. Do not forget that from this moment the bill must have external signs of repayment. The most common way to cancel bills is to cross out the bill in red ink and write the word “cancelled” on it.

For the holder of the bill, the receivables on the bill can be repaid by transferring it by endorsement. Endorsement is an endorsement on the reverse side of a bill. It can be blank, when the first bill holder puts his signature and seal, and in the future the bill can be transferred to any person without endorsement, or it can be registered, when the person to whom the bill is transferred is indicated.

Let us remind you that both the drawer and the entire chain of transfer of the bill must keep in the accounting department not only the acts of acceptance and transfer, but also copies of the bill, including the reverse side on which endorsements are placed.

Financial bill

Now let's look at how the issue and repayment of a financial bill is accounted for. The following example considers a situation where one company sells its own bill of exchange to another. In essence, this is similar to a loan agreement.

Example 2 Gamma LLC sold a bill of exchange to Delta CJSC at a discount. Its nominal value is 100,000 rubles, the discount is 10,000 rubles. The deadline for presenting the bill for payment is no earlier than 10 months. In accounting (by the drawer) this will be reflected as follows: Debit 51 Credit 66 subaccount “Bills issued” - 90,000 rubles. — a loan was received, formalized by a bill of exchange purchase and sale agreement. Then you need to take into account the discount. This may occur at a time (A), gradually over the period until the bill is presented (B), or gradually as deferred expenses (C). The method is established in the accounting policy. A) Debit 91-2 Credit 66 “Interest on bills issued” - 10,000 rubles. — the full amount of the discount is accrued upon presentation of the bill. B) Debit 91-2 Credit 66 “Interest on bills issued” - 1000 rubles. — interest on the bill is accrued monthly based on the period of its circulation based on the calculation. C) Debit 97 Credit 66 “Interest on bills issued” - 10,000 rubles. — a discount was accrued when issuing a bill; Debit 91-2 Credit 97 - 1000 - part of the discount is written off monthly based on the calculation; Debit 66 “Bills issued” Credit 51 - 90,000 rubles. — the debt on the presented bill has been paid; Debit 66 “Interest on bills issued” Credit 51 - 10,000 rubles. — the discount on the presented bill has been paid. The accountant of Delta CJSC (the payee) will make the following accounting entries: Debit 58-2 Credit 51 - 90,000 rubles. — a loan was issued, the debt on which was formalized by a financial bill; Debit 58-2 Credit 98 - 10,000 rub. — a discount was accrued on the bill of exchange based on the act of acceptance and transfer of securities; Debit 98 Credit 91-1 - 1000 rub. — operating income is accrued monthly; Debit 76 Credit 91-1 - 100,000 rubles. - a bill of exchange is presented for payment; Debit 91-2 Credit 58-2 - 100,000 rubles. — the book value of the bill is written off; Debit 51 Credit 76 - 100,000 rub. — funds received under the bill.

Prepayment by bill of exchange

Many suppliers are afraid to ship goods without prepayment. At the same time, buyers are also afraid to make an advance payment, since in this case they risk not receiving either the goods or the money. In addition, prepayment diverts funds from circulation, and VAT on it cannot be offset until the moment of delivery. In this case, the solution to the problem is to issue your own bill of exchange in payment for the delivery, that is, prepayment by bill of exchange.

For the seller, such a bill will be recorded as an advance, but until the bill is paid or transferred by endorsement, it will not be included in the taxable base. The buyer will have the bill listed on the balance sheet in account 009 “Securities for obligations and payments issued.”

Redistribution of funds

Issuing your own bills can help redistribute funds between companies that are controlled by the same owner. It is not uncommon for some companies to have a surplus of cash, while others have a shortage. In this case, an excellent way not only to attract funds, but also to close internal debts between money is a financial bill.

However, when issuing such a bill of exchange, it is necessary to remember that the tax inspectorate, during inspections, always assesses additional taxes on gratuitous loans, and the purchase and sale of one’s own bill of exchange at par will be considered by the inspectors in exactly this way. Therefore, we advise you to provide a small discount based on a rate of 1-2 percent per annum. At the same time, the amount of income tax will be minimal, and the possibilities for cavils of the tax inspector will be limited.

"Establishment" of profits for the company

Another convenient way for owners of several companies to use their own bills is to create artificial profits through interest income. The reason for this need may be a loss, for example, for a company specializing in exports.

Large exporters try to “split” supplies among several companies so that the monthly export package does not exceed 5,000,000 rubles. As practice shows, this greatly simplifies VAT returns. Another important factor is the profitability of the exporting company, which confirms the economic meaning of its activities. However, the reality is that even financial planning does not always make it possible to make a profit from export operations. In this case, an excellent solution is to receive interest (discount) income on bills.

But do not forget that the tax base for the sale of securities and for the main activity is determined separately and for income tax purposes, the loss from export does not reduce the profit on bills.

Bills of exchange in settlements with the commission agent

Own bills of exchange are also useful for settlements through a commission agent. Let us remind you that the commission agent’s taxable turnover for VAT is his revenue, that is, his commission. Therefore, if the commission agent receives the principal’s own bill of exchange as payment under the purchase commission agreement and then transfers it by endorsement to the supplier, these transactions will not have any tax consequences for the commission agent. At the same time, the principal will not include this bill of exchange in the VAT base until the moment of payment (when determining revenue “on payment”).

And the need for such a transfer may arise in the case where one of the “related” companies has a VAT refund from the budget, which, as is known, is a “red rag” for the tax inspectorate. There can be many reasons for this situation, but the most common of them is a loan, which is especially dangerous for organizations in the light of the well-known definition of the Constitutional Court of the Russian Federation N 169-O.

Such a company receives a bill of exchange from third parties and with it VAT for payment, and then, when the situation changes, presents the bill or transfers it under any agreement as payment to the drawer.

Pitfalls of own bills

The main problem with the use of bills of exchange is the requirement of the tax service to divide the input VAT between taxable and non-taxable activities, that is, in this case, between the main activity and the sale of bills of exchange. However, this problem only concerns the transfer of third party bills of exchange as payment, which is considered by inspectors as the sale of securities.

At the same time, when issuing their own bill of exchange, the drawer and the first bill holder do not have such a problem, since they do not dispose of the bill of exchange for sales accounts.

On the other hand, please note that when using the above and other schemes, for some companies in the chain the bill of exchange passes as a bill of exchange of third parties. In this situation, we recommend that you do not ignore the requirements of the tax department for separate accounting, since in the event of claims you will have to dispute a much larger amount of VAT. The most reasonable solution is to divide costs in such a way as to forfeit the minimum amount of VAT. Among such methods, one can note the division of the enterprise’s employees into those involved in securities and those who do not, the use of the “5 percent rule” (clause 4 of Article 170 of the Tax Code), etc.

attention When issuing a bill of exchange, a company faces a minimum of obstacles and restrictions. Firstly, even an unprofitable company can issue a bill. Secondly, the company will not require any permits or licenses. Thirdly, such an operation does not need to be registered anywhere and there is no need to pay a state fee for it. And finally, there is no need to place bills on the stock exchange or resort to the services of a depository. This is due to the fact that the bill of exchange is not an issue-grade security (Article 2 of the Federal Law of April 22, 1996 N 39-FZ “On the Securities Market”).